Market Overview

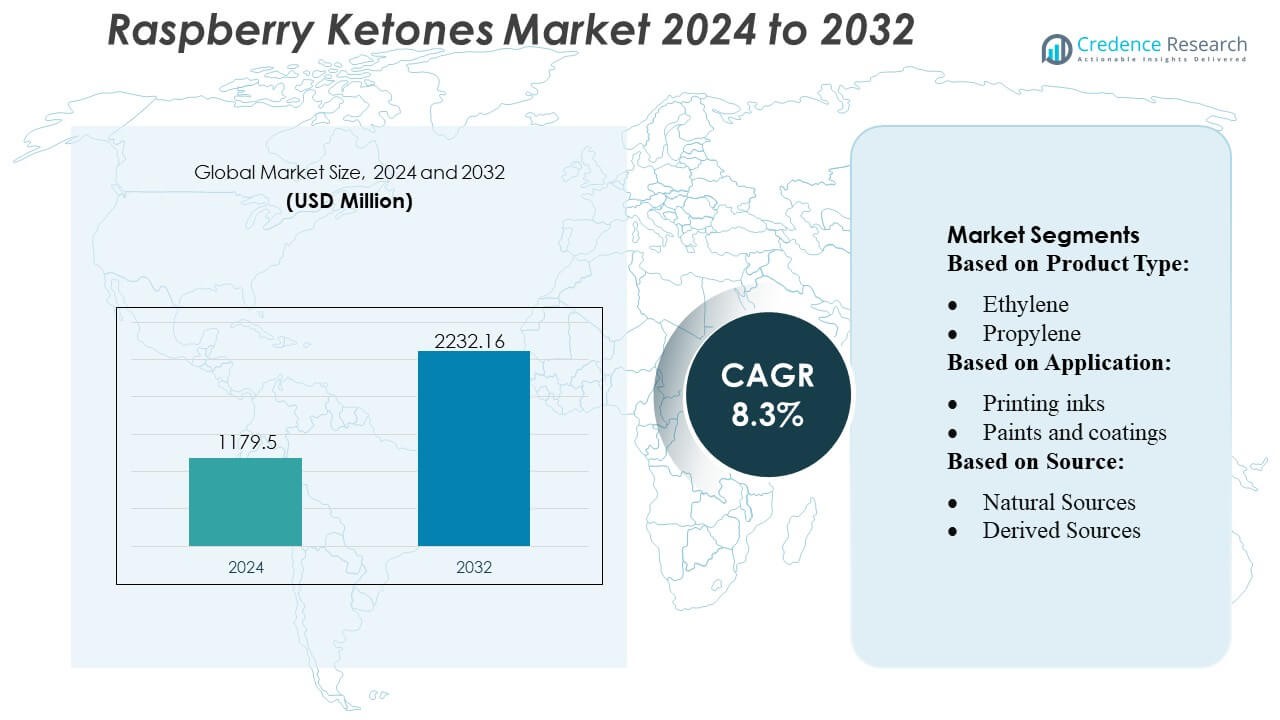

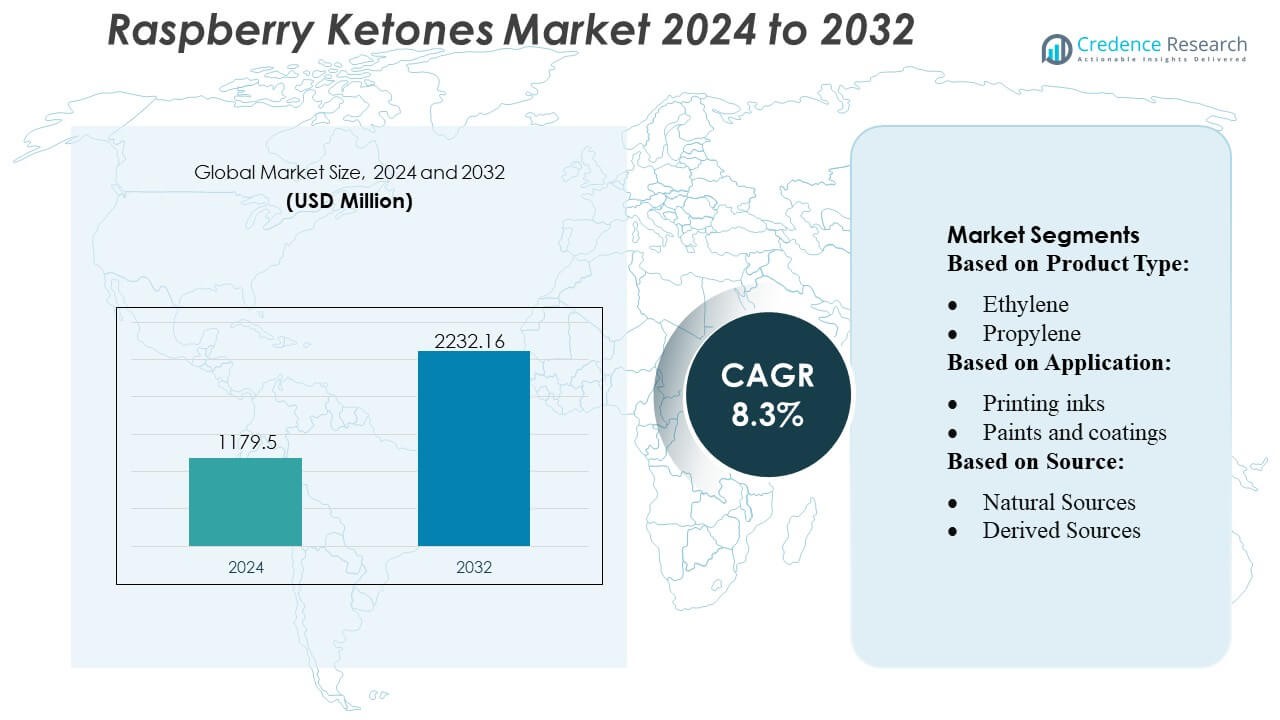

Raspberry Ketones Market size was valued USD 1179.5 million in 2024 and is anticipated to reach USD 2232.16 million by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Raspberry Ketones Market Size 2024 |

USD 1179.5 Million |

| Raspberry Ketones Market, CAGR |

8.3% |

| Raspberry Ketones Market Size 2032 |

USD 2232.16 Million |

The Raspberry Ketones Market strengthen competitiveness through advanced extraction capabilities, diversified product portfolios, and strong penetration across nutraceutical, food, and cosmetic applications. Companies expand their presence by focusing on clean-label formulations, high-purity aromatic compounds, and scalable manufacturing processes that support rising demand from weight-management and functional wellness segments. Strategic investments in biotechnology, supply-chain optimization, and e-commerce distribution enable broader consumer reach and faster product innovation cycles. North America remains the leading region with an exact 38% market share, supported by high supplement adoption, strong regulatory clarity, and rapid product commercialization across major health and lifestyle categories.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Raspberry Ketones Market size reached USD 1179.5 million in 2024 and is projected to hit USD 2232.16 million by 2032 at a CAGR of 8.3%.

- Rising interest in natural weight-management ingredients drives substantial demand across dietary supplements, with high-purity extract formats holding the dominant segment share due to strong adoption in capsule and powder formulations.

- Clean-label trends and growing applications in functional foods, beverages, and cosmetics support market expansion, while companies invest in biotechnology and advanced extraction methods to enhance product quality and consistency.

- Competitive activity remains strong as manufacturers diversify portfolios, streamline supply chains, and scale e-commerce distribution, although fluctuating raw-material availability and regulatory scrutiny restrain smaller producers.

- North America leads with an exact 38% share, followed by Europe and Asia-Pacific with rising adoption across nutraceutical and cosmetic segments, supported by expanding preventive-health awareness and broader retail penetration.

Market Segmentation Analysis:

By Product Type

By product type, glycols emerge as the dominant sub-segment with an estimated 32% share, driven by their high solvency, stability, and broad compatibility with raspberry ketone extraction and formulation processes. Ethylene and propylene follow closely due to their efficiency in large-scale synthesis. Hydrocarbon solvents including aliphatic and aromatic variants retain steady demand in industrial-grade ketone processing, while halogenated solvents such as methylene chloride, trichloroethylene, and perchloroethylene account for niche applications requiring stronger solvency power. Acetic acid continues to gain traction for cleaner processing routes and regulated ingredient manufacturing.

- For instance, Herbalife Nutrition Ltd. uses high-purity glycol carriers in its botanical extraction workflows, supported by its dedicated Innovation & Manufacturing facility in Lake Forest, California, which houses more than 300 analytical instruments and processes over 1,500 raw-material quality tests per day to maintain solvent consistency for nutraceutical formulations.

By Application

By application, cosmetics hold the leading 38% market share, supported by strong demand for raspberry ketone-based fragrances, skin-enhancing formulations, and fat-metabolizing actives. Pharmaceuticals maintain consistent growth as manufacturers incorporate ketones in metabolic health products and novel therapeutics. Printing inks and paints and coatings segments adopt ketones for enhanced pigment stability and fast-drying properties, while adhesives leverage their bonding efficiency. Agriculture chemicals show increasing uptake due to ketones’ potential in plant growth enhancement. The segment mix reflects expanding cross-industry use of ketones as performance-enhancing functional ingredients.

- For instance, Abbott Laboratories demonstrates advanced capabilities that strengthen pharmaceutical-grade ingredient integration across its operations. The company’s global presence includes more than 89 manufacturing facilities and 43 R&D sites worldwide across all its divisions, from diagnostics to nutrition and medical devices.

By Source

By source, natural sources dominate with an exact 41% share, driven by rising clean-label preferences, premium positioning, and sustained demand across cosmetics, nutraceuticals, and specialty food applications. Derived sources maintain strong adoption due to balanced cost–performance profiles. Petroleum-based sources remain relevant for industrial-grade and high-volume formulations, offering cost-effective production for large manufacturing clusters. Synthetic sources gain momentum as advanced bioprocessing and controlled chemical synthesis improve purity levels and consistency. The competitive dynamics reflect a shift toward sustainable natural extraction while retaining synthetic and petroleum routes for scalable commercial supply.

Key Growth Drivers

1. Rising Demand for Natural and Clean-Label Ingredients

Growing consumer preference for natural, plant-derived ingredients strongly lifts the Raspberry Ketones Market as brands position ketones as premium fragrance enhancers and metabolic-support additives. Clean-label commitments drive formulators to replace synthetic aroma chemicals with naturally sourced ketones, especially across cosmetics, nutraceuticals, and functional food categories. Regulatory encouragement for transparent ingredient declarations further accelerates adoption. Expanding use in weight-management products reinforces this trend, as manufacturers promote natural-origin ketones to differentiate portfolios and align with evolving wellness-driven consumer behavior.

- For instance, Kraft Heinz Company has expanded its ingredient-transparency programs through its R&D Center in Glenview, Illinois, which serves as a key innovation hub for the company. The center, which celebrated its 75th anniversary in 2023, houses various pilot-scale processing systems and laboratory equipment where R&D teams conduct extensive formulation and sensory evaluations as well as packaging development projects.

2. Expanding Applications Across Cosmetics and Personal Care

Cosmetics manufacturers increase their use of raspberry ketones due to their strong aromatic profile, stability, and compatibility with skincare emulsions, haircare products, and premium fragrances. Brands adopt ketone-based formulations to meet demand for long-lasting natural scents and perceived anti-aging or skin-firming benefits. Rising investments in high-value cosmetic actives enable deeper market penetration. Marketing strategies emphasizing botanical origins enhance customer acceptance, while growth of premium beauty and online retail channels further elevates demand, particularly in regions with rapidly expanding personal care consumption.

- For instance, Nestlé S.A. advances bioactive ingredient development through its global R&D network of 23 research centers and over 4,000 employees involved in R&D activities, not all of whom are scientists.

3. Growth in Nutraceuticals and Functional Wellness Products

The nutraceutical sector accelerates market expansion as raspberry ketones gain traction in metabolic health supplements, energy blends, and weight-management formulations. These products benefit from strong consumer interest in fat-metabolizing and thermogenic ingredients, supporting widespread commercial use. Manufacturers leverage ketones to create differentiated formulations with enhanced flavor profiles and clean-label appeal. Increased availability of capsules, powders, and fortified beverages contributes to broader accessibility. E-commerce channels amplify market visibility, enabling direct-to-consumer brands to scale rapidly and introduce specialized ketone-based health products.

Key Trends & Opportunities

1. Shift Toward Bio-Based and Sustainable Extraction

A prominent trend involves the transition toward bio-based extraction techniques such as fermentation-derived ketones and green solvent processing. Manufacturers prioritize sustainable sourcing to reduce environmental impact and meet corporate ESG commitments. This shift presents strong opportunities for suppliers investing in eco-friendly extraction, renewable biomass feedstocks, and low-emission production lines. Demand for certified natural and sustainably processed ketones continues to rise in premium cosmetics and wellness formulations, enabling producers to command higher margins while aligning with evolving regulatory expectations for environmentally responsible ingredients.

- For instance, ADM has translated its sustainability commitment into measurable scale: during 2024, the company processed 18.5 million metric tons of corn and 35.7 million metric tons of oilseeds globally leveraging its extensive processing capacity to support bio-based and nature-derived ingredient production, as disclosed in its 2024 Corporate Sustainability Report.

2. Advancements in Formulation Technology and High-Purity Grades

Ongoing innovation in purification, solvent optimization, and microencapsulation enhances the performance of raspberry ketones across multiple industries. High-purity grades gain market traction due to improved stability, richer aroma intensity, and greater suitability for pharmaceutical or nutraceutical formulations. This trend creates opportunities for suppliers offering advanced purification systems or enhanced consistency needed for premium applications. Improved delivery mechanisms enable incorporation into complex skincare, flavoring, and supplement formats, supporting broader product diversification and premium positioning in competitive consumer markets.

- For instance, Danone S.A. strengthens high-purity ingredient development through its global Research & Innovation network, which includes two Global Research & Innovation Centers (in Paris-Saclay, France, and Utrecht, Netherlands), six specialized hubs, and a total of 55 local Danone R&I subsidiaries powered by a global ecosystem of over 2,000 world-class experts (including scientists, engineers, and nutritionists).

3. Expansion in Specialty Food, Beverages, and Flavoring Applications

The market benefits from rising adoption in specialty foods, flavored beverages, confectionery products, and natural aroma enhancers. Demand for authentic fruit flavors reinforces ketone utilization in clean-label food formulations seeking strong aromatic notes without artificial additives. Growing interest in gourmet and craft beverages—such as flavored teas, sparkling drinks, and bakery items—creates opportunities for differentiated, naturally inspired flavor profiles. Food manufacturers use raspberry ketones to strengthen brand positioning, supporting growth in high-value product segments focused on flavor innovation and natural ingredient transparency.

Key Challenges

1. Limited Natural Availability and High Extraction Costs

Natural raspberry ketones occur in extremely low concentrations within fruit, making extraction costly and resource-intensive. Producers face high raw material requirements and volatile pricing, especially when relying on natural extractions to meet clean-label demand. These constraints drive higher production costs, limiting affordability in mass-market applications. Synthetic and derived sources offer cost advantages, but rising consumer preference for natural variants intensifies sourcing challenges. Maintaining quality consistency and reliable supply remains a critical concern for manufacturers targeting high-purity and premium product segments.

2. Regulatory Scrutiny and Safety Perception Issues

The market faces regulatory challenges as agencies evaluate the safety and permissible use of raspberry ketones in supplements, cosmetics, and food products. Stricter labeling norms, dosage restrictions, and compliance requirements increase operational complexity for manufacturers. Ongoing scientific debates around metabolic effects influence consumer perceptions, requiring brands to invest in transparent communication and validated safety data. Regulatory variations across global markets complicate international product launches, particularly for companies seeking approval in regions with stringent safety evaluation frameworks for nutraceutical and aroma compounds.

Regional Analysis

North America

North America holds a substantial 38% share of the Raspberry Ketones Market, supported by strong adoption across dietary supplements, weight-management formulations, and functional foods. The region benefits from high consumer awareness of natural wellness ingredients, a robust nutraceutical manufacturing base, and clear regulatory pathways that encourage product innovation. Major brands emphasize premium, clean-label formulations, which accelerates uptake in sports nutrition and lifestyle health categories. Expanding retail and e-commerce channels further strengthen distribution networks, while growing interest in plant-derived extracts and fat-metabolism enhancers reinforces the region’s leading position.

Europe

Europe accounts for an exact 30% market share, driven by rising demand for botanical extracts, strict product quality standards, and strong consumer preference for natural, science-backed ingredients. The region’s mature cosmetics and personal care industry significantly contributes to raspberry ketone consumption due to its fragrance stability and natural aromatic profile. Regulatory emphasis on transparency, labeling accuracy, and purity enhances trust and supports sustained market penetration. Increasing investments in functional beverages, organic nutraceuticals, and premium health supplements, particularly in Germany, France, and the UK, further reinforce Europe’s well-established position in the global market.

Asia-Pacific

Asia-Pacific holds 24% of the market, experiencing rapid growth due to expanding nutraceutical manufacturing capacity, rising disposable income, and increasing interest in weight-management and beauty-from-within supplements. China, Japan, South Korea, and India lead adoption, supported by strong retail expansion and a growing culture of preventive healthcare. Local producers increasingly integrate plant-derived aromatic compounds into functional foods, cosmetics, and wellness beverages, boosting demand for raspberry ketones. Supportive government policies promoting herbal extracts, coupled with rising online supplement sales, position Asia-Pacific as the fastest-growing region with significant future potential.

Latin America

Latin America maintains a 5% market share, driven by increasing consumer adoption of natural supplements and growing awareness of weight-management ingredients. Brazil and Mexico dominate regional demand, supported by expanding middle-class purchasing power and heightened interest in botanical nutraceuticals. Local cosmetic manufacturers integrate raspberry ketones for fragrance and formulation benefits, contributing to steady uptake. Despite moderate regulatory complexity, increasing retail penetration and product diversification in health and beauty categories strengthen growth prospects. Rising influence of fitness culture and herbal ingredients supports long-term expansion in the region.

Middle East & Africa

The Middle East & Africa region holds a 3% share, with growth fueled by increasing interest in premium dietary supplements, expanding pharmacy-led retail networks, and rising health-conscious consumer segments. The UAE, Saudi Arabia, and South Africa lead demand as manufacturers introduce natural and plant-based wellness ingredients tailored to urban populations. Although market penetration remains limited compared to other regions, improving regulatory frameworks and expanding e-commerce access support gradual adoption. Demand from niche cosmetics and fragrance applications also contributes to steady growth, making MEA a region with emerging long-term opportunities.

Market Segmentations:

By Product Type:

By Application:

- Printing inks

- Paints and coatings

By Source:

- Natural Sources

- Derived Sources

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Raspberry Ketones Market include Herbalife Nutrition Ltd., PepsiCo Inc., Abbott Laboratories, Kraft Heinz Company, Nestlé S.A., Mondelez International Inc., Archer Daniels Midland Company, Danone S.A., GlaxoSmithKline PLC, and General Mills Inc. the Raspberry Ketones Market is defined by strong participation from nutraceutical manufacturers, food and beverage companies, and cosmetic ingredient suppliers that prioritize clean-label development, natural aromatic compounds, and high-purity extraction techniques. Companies expand their portfolios by integrating raspberry ketones into weight-management supplements, functional beverages, flavored confectionery, and fragrance applications to meet rising consumer demand for natural wellness solutions. The market remains innovation-driven as producers invest in advanced distillation and bioconversion technologies to ensure consistent quality, improved stability, and regulatory compliance. Expanding e-commerce channels, strategic co-manufacturing partnerships, and premium product positioning continue to strengthen competitiveness and support global market penetration.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Epson introduced the next-generation SureColor S8160 eco-solvent printer. The eco-solvent signage printer offers outstanding productivity, exceptional image quality, and a wide color gamut in a compact, user-friendly design.

- In October 2024, Clariant launched VitiPure LEX 3350 S, VitiPure LEX 4000 S, and Polyglykol 1450 S, a trio of high-purity excipients designed to boost API solubility and delivery, especially for sensitive, low-water-soluble drugs, offering enhanced safety with low endotoxin levels for demanding pharma applications like parenterals and solid orals.

- In August 2024, Eastman launched its high-purity electronic-grade Isopropyl Alcohol (IPA) under the EastaPure line, offering U.S. semiconductor makers a high-quality, domestically sourced solvent for critical wafer cleaning and processing, ensuring supply chain reliability for the growing industry.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand as consumers prioritize natural, plant-derived wellness ingredients in supplements and functional foods.

- Weight-management and metabolic-health formulations will continue to drive product innovation across global nutraceutical brands.

- Advances in extraction and purification technologies will improve ingredient consistency, stability, and scalability.

- Clean-label and vegan product expansion will strengthen adoption across beverages, gummies, powders, and capsule formats.

- Personal care and cosmetic applications will grow as manufacturers use raspberry ketones for fragrance enhancement and skin-care formulations.

- E-commerce and direct-to-consumer channels will accelerate product accessibility and global market reach.

- Regional manufacturers will increase capacity to meet rising demand for high-purity natural aromatic compounds.

- Regulatory clarity and quality-certification initiatives will support stronger trust in premium raspberry ketone products.

- Strategic partnerships between ingredient suppliers and nutraceutical brands will expand innovation pipelines.

- Asia-Pacific will emerge as a high-growth region due to expanding preventive-health awareness and increasing supplement penetration.