Market Overview

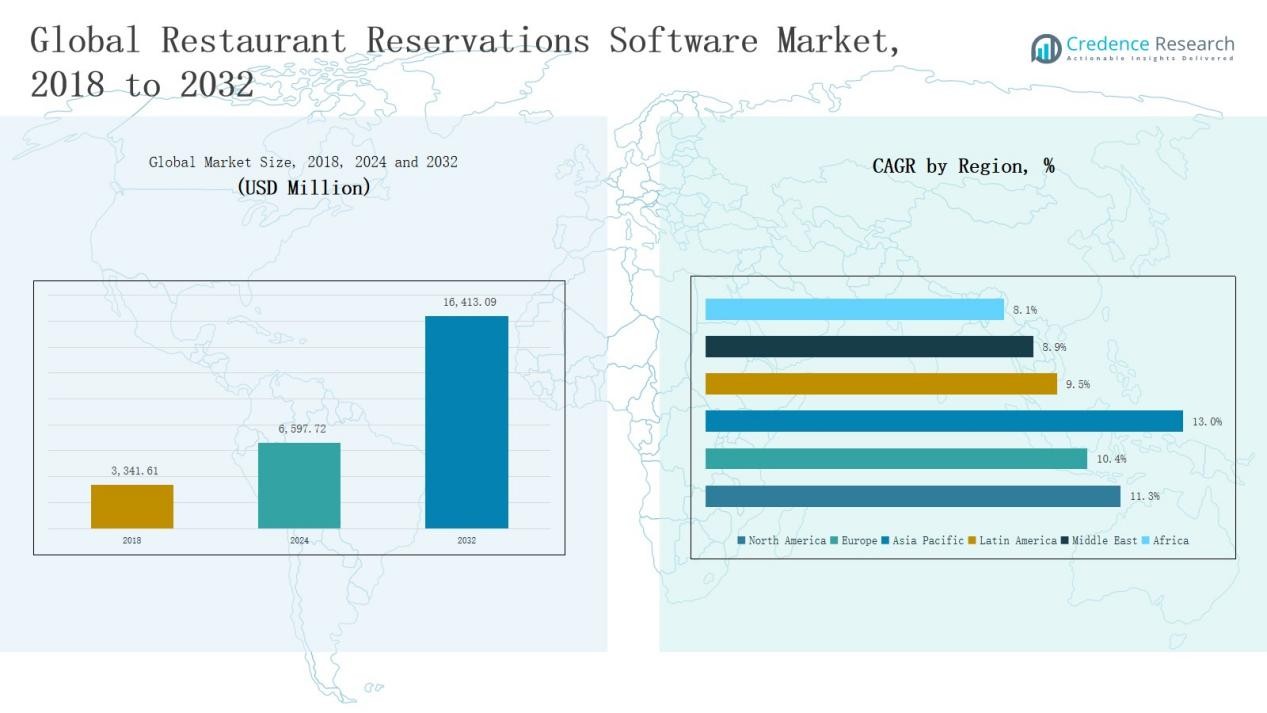

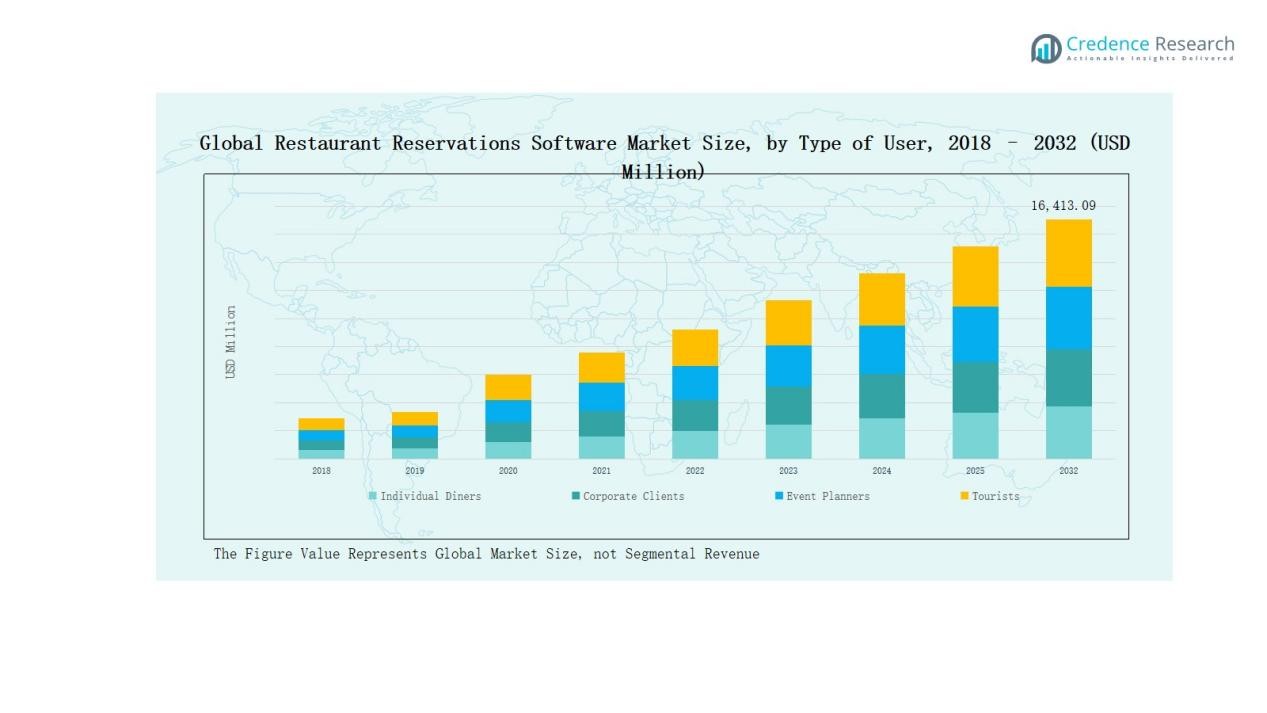

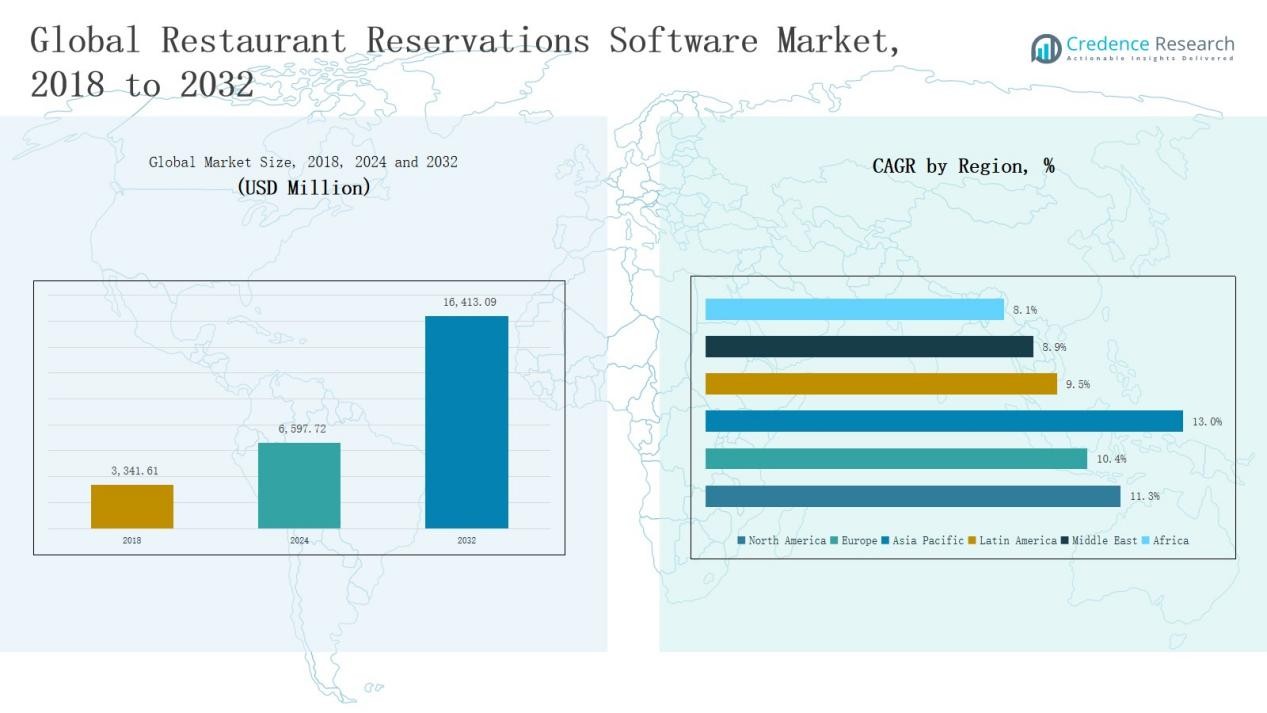

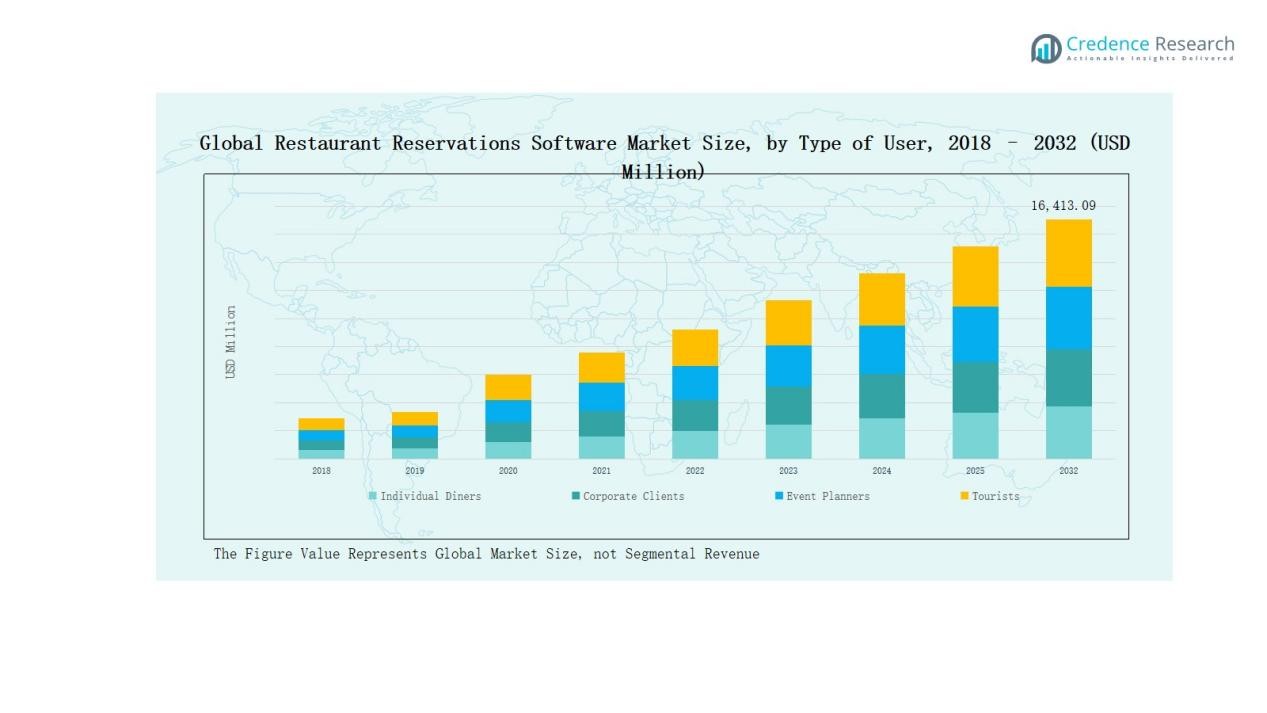

Global Restaurant Reservations Software Market size was valued at USD 3,341.61 million in 2018, grew to USD 6,597.72 million in 2024, and is anticipated to reach USD 16,413.09 million by 2032, expanding at a CAGR of 11.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Restaurant Reservations Software Market Size 2024 |

USD 6,597.72 Million |

| Restaurant Reservations Software Market, CAGR |

11.24% |

| Restaurant Reservations Software Market Size 2032 |

USD 16,413.09 Million |

The Global Restaurant Reservations Software Market is led by prominent companies such as OpenTable, Tock, Resy Network Inc., Eveve, Hostme, Nowbookit, easyTableBooking, SevenRooms, and Yelp Reservations. These players maintain a strong competitive edge through advanced digital booking solutions, AI integration, and mobile app connectivity that enhance user experience and restaurant efficiency. Strategic collaborations, product innovation, and cloud-based deployment models further strengthen their market positions. North America emerged as the leading region in 2024 with a 44% market share, driven by high digital adoption, mature restaurant infrastructure, and widespread use of online reservation systems across premium and casual dining segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Restaurant Reservations Software Market grew from USD 3,341.61 million in 2018 to USD 6,597.72 million in 2024, and is expected to reach USD 16,413.09 million by 2032, expanding at a CAGR of 11.24%.

- Individual Diners led the user segment with a 42% share in 2024, driven by smartphone use, digital convenience, and loyalty integrations enhancing personalized booking experiences.

- Fine Dining restaurants dominated the restaurant segment with a 36% share, relying on reservation systems to optimize service, manage premium guests, and maintain exclusivity

- Online Reservations accounted for the largest 48% share in 2024, fueled by growing internet access, aggregator integration, and demand for real-time, automated booking platforms.

- North America remained the leading regional market with a 44% share, supported by high digital adoption, advanced restaurant infrastructure, and widespread use of AI-powered reservation platforms.

Market Segment Insights

By Type of User:

Individual Diners dominated the Global Restaurant Reservations Software Market in 2024 with a 42% share. This segment leads due to the growing adoption of digital reservation platforms among urban consumers seeking convenience and quick table access. Rising smartphone penetration, user-friendly booking interfaces, and integration with loyalty programs strengthen engagement. Personalized dining experiences and instant confirmation options also attract more frequent users, driving consistent platform traffic and subscription-based growth across restaurants worldwide.

By Type of Restaurant:

Fine Dining restaurants accounted for the largest 36% market share in 2024. The dominance stems from high reliance on reservation management systems to optimize guest turnover and maintain premium service standards. These establishments focus on seamless booking, table customization, and VIP management tools to enhance customer satisfaction. Increasing global tourism and luxury dining trends further boost software adoption, allowing restaurants to manage exclusive events and reduce operational inefficiencies effectively.

- For instance, Resy offers flexible bookings, event management, and advanced analytics tailored for upscale dining, allowing these restaurants to efficiently manage private events and VIP guests.

By Reservation Method:

Online Reservations emerged as the leading sub-segment, holding a 48% share in 2024. Growth is driven by expanding internet accessibility, integration with third-party aggregators, and preference for web-based booking convenience. Restaurants leverage online systems for real-time updates, reduced no-shows, and improved customer data analytics. Enhanced user interfaces, cloud synchronization, and automated confirmation systems further support adoption, especially across global chains and high-volume dining outlets.

- For instance, SevenRooms partnered with Marriott International in mid-2024 to expand its reservation and guest management software, enabling personalized dining experiences integrated with hotel loyalty programs.

Key Growth Drivers

Rising Demand for Contactless and Digital Dining Solutions

The growing preference for contactless dining and digital engagement drives strong adoption of restaurant reservation software. Customers increasingly use online platforms to avoid waiting and ensure safe, seamless service. Restaurants benefit from reduced operational friction, better crowd management, and enhanced hygiene control. Integration of QR-based menus and digital check-ins also supports efficiency. These factors collectively accelerate market growth, particularly among urban, tech-driven populations emphasizing convenience and digital interaction.

- For instance, Shake Shack utilizes QR codes combined with personalized digital survey links enabling efficient ordering and real-time customer feedback collection.

Expansion of Cloud-Based and SaaS Platforms

The increasing use of cloud and Software-as-a-Service (SaaS) models enhances flexibility and scalability in restaurant operations. Cloud-based reservation systems allow multi-location access, real-time synchronization, and data analytics, helping restaurants manage dynamic demand patterns. Cost-effective subscription plans attract both small and large operators. Easy integration with POS, CRM, and payment systems strengthens overall restaurant automation. These advantages promote widespread adoption across global chains and independent outlets, supporting long-term market expansion.

- For instance, Resy provides a cloud platform integrating reservation, waitlist, and customer messaging management with features like POS integration and advanced analytics, supporting operators in optimizing guest experience and operational control.

Integration of AI and Data Analytics

Artificial intelligence (AI) and analytics integration enables restaurants to improve personalization and operational forecasting. Smart systems analyze booking patterns, peak hours, and customer preferences, allowing better staffing and inventory management. Predictive analytics enhance user engagement through personalized recommendations and loyalty offers. Restaurants adopting AI-driven tools experience higher retention and optimized seat utilization. The increasing shift toward data-driven decision-making remains a major factor boosting competitiveness and profitability across the industry.

Key Trends & Opportunities

Mobile-First Booking Experience

The growing dominance of mobile-based reservations is reshaping customer interaction models. Mobile apps now feature quick booking, digital payment, and in-app notifications, enhancing user convenience. Restaurants increasingly design mobile-friendly interfaces to improve customer retention and engagement. With smartphones driving over 60% of global online bookings, mobile optimization offers a major opportunity for software providers. Enhanced features such as push reminders and location-based offers further strengthen this trend’s impact on user acquisition.

- For instance, SimplyBook.me’s mobile app in 2025 offers features like calendar synchronization, auto-reminders, and instant payments, which significantly reduce no-shows and boost customer retention.

Growth of Integrated Ecosystems and Cross-Platform Connectivity

Reservation software is evolving toward unified ecosystems combining POS, CRM, and digital marketing functions. Restaurants use integrated systems to centralize operations, improve data insights, and strengthen brand consistency. Cross-platform compatibility across delivery, feedback, and loyalty programs increases customer satisfaction. This integration opportunity supports the shift toward end-to-end hospitality management. Vendors investing in open APIs and seamless integration capabilities are positioned to gain a competitive advantage in a rapidly consolidating market.

- For instance, Little Hotelier’s integrated booking system automatically syncs room availability and pricing across booking platforms like Booking.com and Airbnb, reducing double bookings and maximizing revenue.

Key Challenges

High Initial Setup and Integration Costs

Implementation costs for advanced reservation systems remain a barrier for small and mid-sized restaurants. Expenses related to software customization, employee training, and hardware upgrades often deter adoption. Many operators prefer low-cost or manual booking alternatives, limiting digital penetration. Vendors face pressure to offer scalable, affordable packages. Addressing this challenge through flexible pricing and modular solutions is crucial for improving accessibility and market reach, particularly in emerging regions.

Data Privacy and Cybersecurity Risks

Handling customer data, including payment details and personal information, poses serious privacy concerns. Increasing cyberattacks and system breaches threaten trust between restaurants and customers. Compliance with regional data protection laws such as GDPR adds operational complexity. Failure to ensure robust encryption and secure authentication can lead to reputational and financial damage. Continuous investment in cybersecurity measures and transparent data governance is essential to maintain user confidence and regulatory compliance.

Dependence on Internet and Technical Infrastructure

Reservation platforms rely heavily on stable internet connectivity and reliable digital infrastructure. Outages or technical disruptions can cause booking errors, lost revenue, and customer dissatisfaction. In developing markets, weak connectivity limits system efficiency and adoption. Restaurants with limited IT support face difficulties in maintaining software performance. This dependence highlights the need for offline functionality, responsive technical support, and consistent system upgrades to sustain smooth operations and customer reliability.

Regional Analysis

North America

North America dominated the Global Restaurant Reservations Software Market in 2024 with a 44% share, reaching USD 2,881.22 million, up from USD 1,474.43 million in 2018. The region is expected to achieve USD 7,187.28 million by 2032, expanding at a CAGR of 11.3%. High digital adoption, strong restaurant infrastructure, and advanced online booking systems drive market growth. Leading providers such as OpenTable and Resy capitalize on integrated payment, analytics, and loyalty features, ensuring convenience and efficiency for diners and operators across the U.S., Canada, and Mexico.

Europe

Europe held a 29% market share in 2024, with revenue rising from USD 919.73 million in 2018 to USD 1,748.44 million in 2024, and projected to reach USD 4,086.97 million by 2032 at a CAGR of 10.4%. Growth is fueled by rising adoption of digital dining platforms across key markets such as the UK, Germany, France, and Italy. Strong tourism, evolving dining culture, and the shift toward AI-enabled reservation systems strengthen market performance. Increasing partnerships between restaurants and software providers enhance customer retention and streamline operations.

Asia Pacific

Asia Pacific is the fastest-growing region, capturing a 21% share in 2024, valued at USD 1,376.22 million, up from USD 643.11 million in 2018, and expected to reach USD 3,877.28 million by 2032, at a CAGR of 13.0%. Rapid urbanization, smartphone penetration, and expansion of online food services boost adoption. Markets such as China, Japan, India, and Australia drive regional demand through tech-savvy consumers and emerging restaurant chains. Cloud-based platforms and integrated mobile apps are accelerating market maturity across both premium and casual dining sectors.

Latin America

Latin America accounted for a 5% share in 2024, generating USD 307.77 million, up from USD 157.84 million in 2018, and projected to reach USD 677.65 million by 2032, expanding at a CAGR of 9.5%. Growing restaurant digitization and consumer preference for online booking support regional development. Brazil and Mexico lead in adoption, driven by expanding middle-class populations and improving connectivity. Increased software localization and integration with delivery services enhance usability, while investments in restaurant technology strengthen competitiveness across urban centers.

Middle East

The Middle East held a 3% market share in 2024, valued at USD 170.40 million, compared to USD 94.35 million in 2018, and forecasted to reach USD 358.26 million by 2032, growing at a CAGR of 8.9%. Growth is supported by expanding tourism, high-end dining culture, and smart city initiatives across Gulf countries. Hotels and fine dining establishments increasingly rely on integrated reservation and CRM systems. Cloud-based solutions and mobile booking trends are enhancing guest management efficiency, particularly in the UAE, Saudi Arabia, and Israel.

Africa

Africa captured a 2% market share in 2024, with market value increasing from USD 52.15 million in 2018 to USD 113.67 million in 2024, and expected to reach USD 225.66 million by 2032, at a CAGR of 8.1%. Growth is driven by urban expansion, smartphone adoption, and the rising presence of restaurant chains in South Africa and Egypt. Although infrastructure limitations persist, digital payment integration and mobile app-based reservations are improving accessibility. Local startups focusing on affordable SaaS solutions are helping accelerate market penetration across emerging economies.

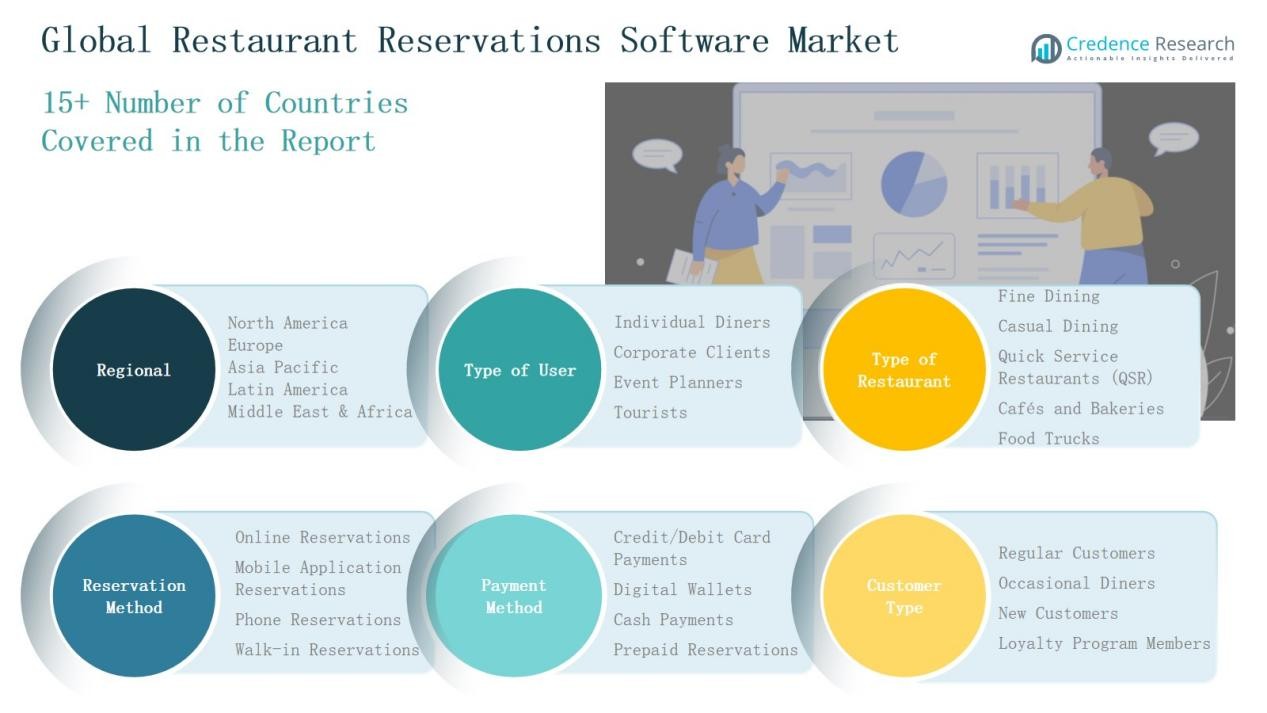

Market Segmentations:

By Type of User:

- Individual Diners

- Corporate Clients

- Event Planners

- Tourists

By Type of Restaurant:

- Fine Dining

- Casual Dining

- Quick Service Restaurants (QSR)

- Cafés and Bakeries

- Food Trucks

By Reservation Method:

- Online Reservations

- Mobile Application Reservations

- Phone Reservations

- Walk-in Reservations

By Payment Method:

- Credit/Debit Card Payments

- Digital Wallets

- Cash Payments

- Prepaid Reservations

By Customer Type:

- Regular Customers

- Occasional Diners

- New Customers

- Loyalty Program Members

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Global Restaurant Reservations Software Market is highly competitive, featuring a blend of established players and emerging technology providers. Leading companies such as OpenTable, Tock, Resy Network Inc., Eveve, Hostme, Nowbookit, and easyTableBooking dominate through strong brand recognition, extensive restaurant partnerships, and advanced platform functionalities. These players focus on enhancing user experience with features like real-time availability tracking, AI-driven recommendations, mobile app integration, and secure payment processing. Strategic alliances, acquisitions, and technological upgrades remain key competitive strategies. Smaller firms and regional startups are leveraging cloud-based SaaS models and affordability to attract independent and mid-sized restaurants. The competitive environment emphasizes innovation in analytics, loyalty management, and multi-language support to strengthen global reach. As consumer expectations evolve toward convenience, personalization, and seamless digital interaction, market leaders continue investing in automation, cross-platform integration, and data-driven insights to sustain growth and maintain leadership in this fast-evolving digital hospitality ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Eveve

- Nowbookit

- Tock

- OpenTable

- Wisely

- Hostme

- easyTableBooking

- Resy Network Inc.

- TableAgent

- Yelp Reservations

- Quandoo GmbH

- GuestBridge

- Eat App

- SevenRooms

- DinePlan

- ResDiary Ltd.

- SimpleERB Ltd.

- Bookatable (by Michelin)

- Formitable

- Upserve (Lightspeed)

Recent Developments

- In July 2025, OpenTable launched its generative AI-powered “Concierge” tool to help diners find and book tables instantly across 60,000 global restaurants.

- In September 2025, Thoma Bravo completed the acquisition of Olo in a deal valued at around USD 2 billion, strengthening its restaurant technology portfolio.

- In September 2025, Sadie partnered with Libro to enhance restaurant guest booking and communication features.

- In early 2025, Tock extended its partnership with Google, enabling paid reservations directly through Google Search and Maps.

Report Coverage

The research report offers an in-depth analysis based on Type of User, Type od Restaurant, Reservation Method, Payment Method, Customer Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing demand for AI-powered reservation systems will improve personalization and operational efficiency.

- Integration of voice assistants and chatbots will simplify real-time booking management.

- Mobile-first platforms will dominate as smartphone reservations continue to rise globally.

- Cloud-based and subscription models will attract small and mid-sized restaurant operators.

- Expansion into emerging markets will create new growth opportunities for software providers.

- Data analytics and customer insights will become central to enhancing loyalty programs.

- Partnerships between software vendors and POS or CRM providers will strengthen ecosystem connectivity.

- Increased focus on cybersecurity and data privacy will shape future software compliance standards.

- Hybrid reservation models combining dine-in, pickup, and delivery scheduling will gain traction.

- Sustainability-focused dining and digital transformation initiatives will influence long-term market evolution.