Market Overview

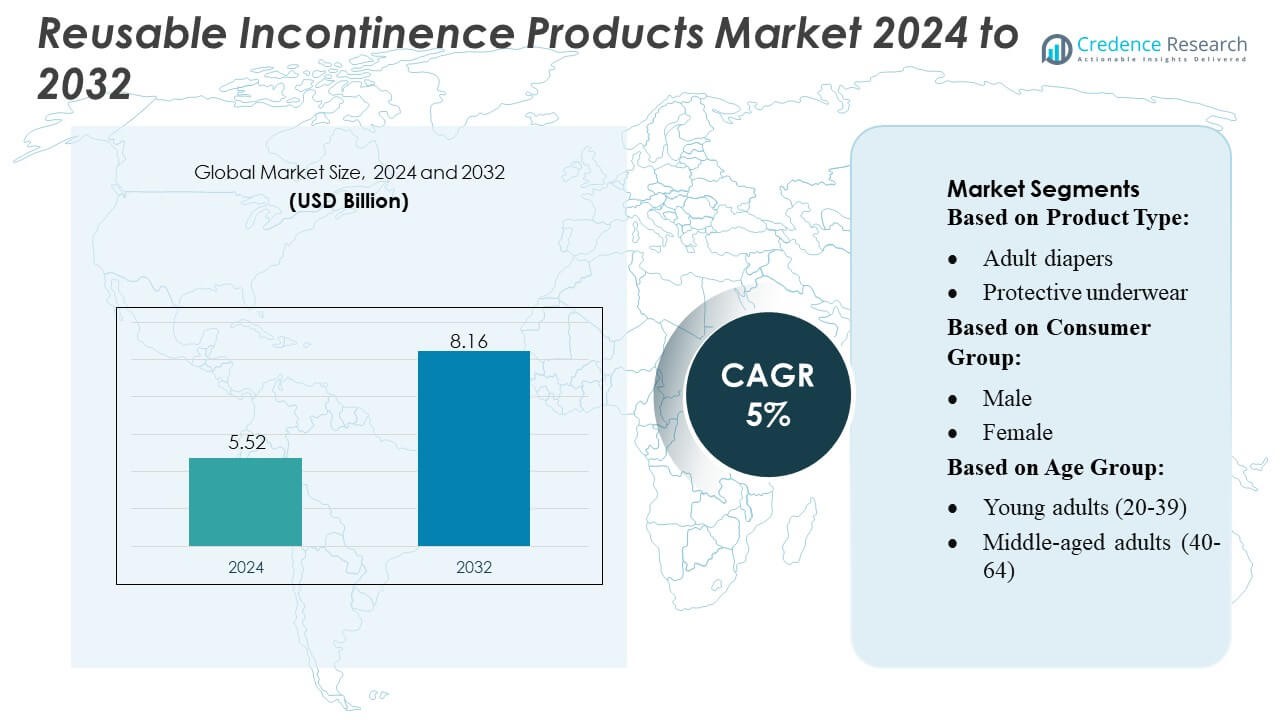

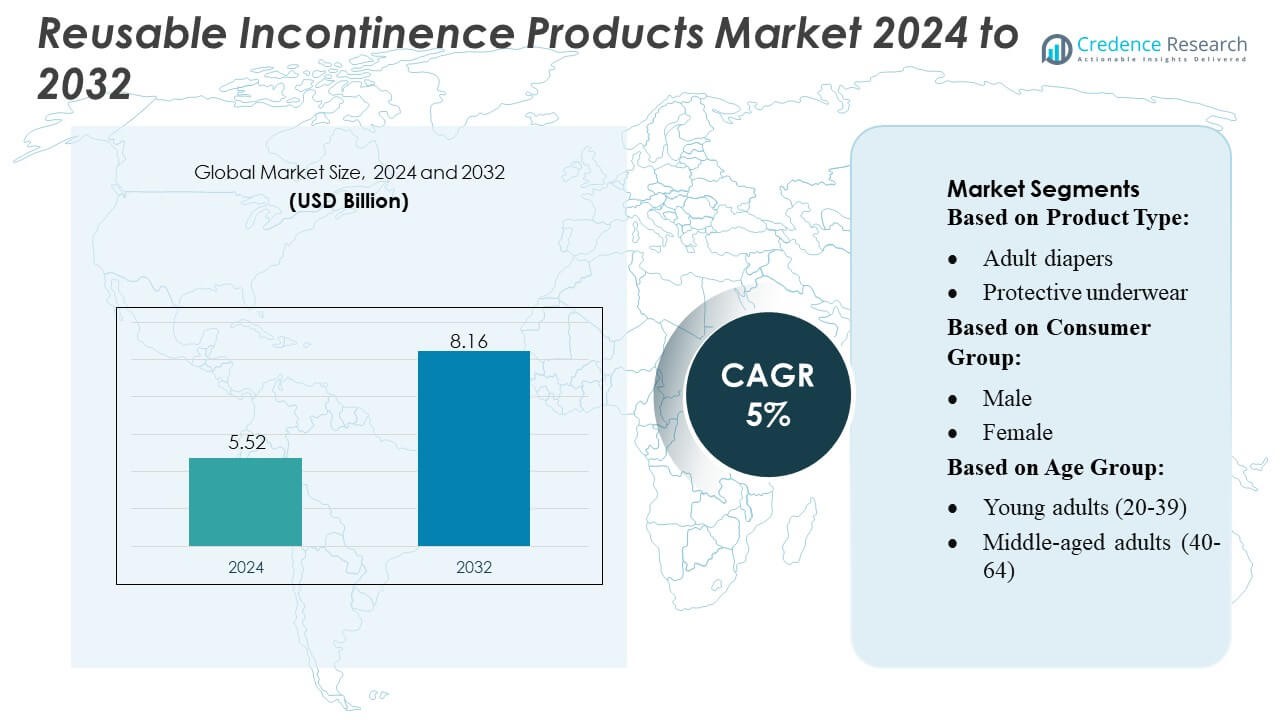

Reusable Incontinence Products Market size was valued USD 5.52 billion in 2024 and is anticipated to reach USD 8.16 billion by 2032, at a CAGR of 5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Reusable Incontinence Products Market Size 2024 |

USD 5.52 Billion |

| Reusable Incontinence Products Market, CAGR |

5% |

| Reusable Incontinence Products Market Size 2032 |

USD 8.16 Billion |

The reusable incontinence products market is shaped by a mix of global hygiene and medical care manufacturers that focus on advanced absorbent technologies, sustainable materials, and improved comfort features to strengthen product adoption across home-care and institutional settings. Leading companies continually expand their portfolios with washable diapers, protective underwear, and reusable pads designed for long-term durability and cost efficiency, supported by strong retail and e-commerce distribution channels. Regionally, North America leads the market with approximately 32–34% share, driven by high awareness, strong healthcare infrastructure, and rising adoption of eco-friendly incontinence solutions among aging populations and active adult users.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Reusable Incontinence Products Market was valued at USD 5.52 billion in 2024 and is expected to reach USD 8.16 billion by 2032 at a 5% CAGR, supported by rising long-term incontinence management needs and growing demand for sustainable hygiene solutions.

- Increasing awareness of reusable, cost-efficient products and advancements in absorbent textiles, odor-control layers, and ergonomic fits drive strong adoption across home-care and healthcare environments.

- The market experiences notable trends such as the shift toward eco-friendly materials, rapid e-commerce expansion, and rising demand for gender-specific and customized reusable underwear and pads.

- Competitive intensity grows as manufacturers innovate in comfort, durability, and washability, though restraints include maintenance concerns, stigma associated with incontinence, and limited product awareness in emerging markets.

- North America leads with 32–34% share, while adult diapers remain the dominant segment with around 45–48% share, supported by strong institutional usage and high acceptance among seniors.

Market Segmentation Analysis:

By Product Type

Adult diapers hold the dominant share of the reusable incontinence products market, accounting for nearly 45–48% of total demand due to their high absorbency, comfort upgrades, and suitability for moderate-to-severe incontinence. Their adoption increases with rising elderly populations, higher awareness of reusable hygiene solutions, and cost efficiency over disposables. Protective underwear follows as a fast-growing sub-segment driven by improved fit, discreet designs, and washable materials that appeal to active users. Pads & liners gain traction in mild-incontinence cases, while other products such as reusable briefs and pants expand through innovations in breathable fabrics and eco-friendly materials.

- For instance, First Quality offers adult briefs under its own brand and private‑label lines, manufactured in facilities such as its McElhattan, PA plant — which spans about 930,000 square feet — reflecting the company’s capacity to produce high‑volume, high‑absorbency adult diapers at scale.

By Consumer Group

Female consumers represent the leading segment with an estimated 50–52% market share, supported by higher prevalence of stress and urge incontinence, postpartum bladder control issues, and rising adoption of reusable pads and underwear specifically designed for anatomical comfort. Product manufacturers increasingly introduce soft-fabric, odor-control, and leak-proof options tailored for women, strengthening segment dominance. The male category grows steadily as awareness increases around prostate-related conditions and availability of gender-specific reusable briefs. Unisex products gain demand across hospitals, long-term care centers, and home-care settings due to versatility, easy sizing, and simplified inventory management.

- For instance, Attends’ “Sleep Comfort™ Premium Overnight Underwear” is engineered to provide up to 12 hours of continuous protection by using a “Dry‑Lock® Containment Core,” combined with soft, cloth‑like and breathable materials to maintain dryness and comfort over long periods.

By Age Group

Seniors (65 & above) hold the dominant market share of about 55–58%, driven by higher incidence of chronic urinary conditions, mobility limitations, and long-term care needs. Reusable incontinence products in this group benefit from durability, cost savings, and enhanced comfort from modern textile technologies. Middle-aged adults form a rising segment as lifestyle factors, obesity, and post-surgical recovery cases increase mild-to-moderate incontinence occurrences. Young adults represent a smaller but expanding group influenced by postpartum needs, sports-related pelvic issues, and preference for sustainable hygiene solutions supported by discreet, fashion-oriented reusable products.

Key Growth Drivers

Rising Geriatric Population

The expanding geriatric population significantly drives demand for reusable incontinence products, as seniors experience higher prevalence of chronic urinary conditions, mobility limitations, and age-related bladder control issues. Healthcare systems across developed and emerging markets increasingly promote reusable solutions because they reduce long-term costs and provide superior comfort through breathable, skin-friendly fabrics. Growing adoption in long-term care facilities and home care strengthens market penetration, while improvements in product absorbency, washability, and odor control further encourage seniors and caregivers to shift from disposables to durable, eco-efficient alternatives.

- For instance, MoliCare Absorbent Underwear is washable at 60 °C, dryer‑safe, and made from materials free of biocides, parabens, perfumes, latex and silver chloride (per their 2025 sustainability recognition).

Shift Toward Sustainability and Cost Efficiency

Heightened consumer awareness around environmental sustainability and rising concerns over disposable waste generation accelerate the shift toward reusable incontinence products. Households and healthcare providers increasingly recognize the long-term cost benefits of washable diapers, underwear, and liners, which offer extended usability compared to single-use items. Manufacturers invest in eco-friendly fabrics, biodegradable components, and water-efficient cleaning technologies, making reusable products more appealing. This sustainability-focus, combined with rising regulatory pressure on disposable hygiene waste, strengthens market growth across both developed and emerging economies.

- For instance, Ontex reports that raw materials (such as SAP and nonwoven plastics) constitute roughly 80% of its total greenhouse‑gas footprint (Scope 3) across sourcing, production and end-of-life waste.

Product Innovation and Material Advancements

Continuous improvements in textile engineering, moisture-wicking technologies, and ergonomic design strongly support market expansion. The availability of more discreet, lightweight, and comfortable reusable products—featuring leak-proof layers, odor-neutralizing materials, and enhanced absorbency—boosts consumer acceptance among active adults and younger demographics. Advancements in antimicrobial fabrics and quick-drying layers improve hygiene and convenience, widening usage beyond severe incontinence cases. Manufacturers introducing gender-specific fits, inclusive sizing, and fashionable designs further elevate adoption in retail, e-commerce, and healthcare distribution channels.

Key Trends & Opportunities

Growth of Gender-Specific and Customized Solutions

The market experiences rising demand for gender-specific reusable incontinence products offering improved fit, comfort, and leakage protection tailored to anatomical differences. Customized options such as adjustable waistbands, targeted absorbency zones, and premium fabric choices create strong differentiation. Brands also explore inclusive sizing, stylish designs, and hybrid models combining reusable layers with replaceable absorbent pads. This trend opens opportunities for premium pricing, expanded retail visibility, and improved consumer loyalty, particularly as younger users and postpartum women seek discreet and comfortable long-term solutions.

- For instance, Depend “Large” unisex briefs cater to waist/hip measurements between 35 and 49 inches and include features such as wetness‑indicator lines, side leakage barriers, and refastenable (EasyGrip) tabs, enabling a more secure, comfortable, and user‑friendly fit.

Expansion of E-Commerce and Direct-to-Consumer Channels

E-commerce continues to create major growth opportunities by improving accessibility, privacy, and affordability for users seeking reusable incontinence products. Subscription models, bundle packs, and trial kits help consumers experiment with new designs while reducing purchase barriers. Digital platforms also enable targeted marketing, user education, and personalization tools that match products to individual needs. The rise of social commerce and influencer-driven awareness further expands reach, especially among younger adults exploring sustainable hygiene options. Manufacturers leveraging online channels witness stronger brand recognition and recurring revenue streams.

- For instance, Cardinal Health’s own product catalog shows a full range of adult briefs and protective underwear (from small to X‑Large size), which institutions and individual consumers can purchase — with size bands covering waist/hip measurements from 20 to 64 inches.

Adoption in Healthcare and Institutional Settings

Hospitals, nursing homes, and rehabilitation centers increasingly integrate reusable incontinence products into their hygiene management systems due to long-term cost savings and reduced waste disposal requirements. Institutions benefit from improved durability, standardized sizing, and better skin health outcomes compared to disposables. Growing emphasis on sustainable procurement and budget optimization accelerates adoption, particularly in Europe and North America. This trend creates opportunities for large-volume contracts, product customization for clinical needs, and expansion of reusable product lines specifically designed for institutional workflows.

Key Challenges

Limited Awareness and Stigma Around Incontinence

Despite growing acceptance, social stigma surrounding incontinence remains a major barrier, particularly among younger and middle-aged adults who hesitate to discuss or seek solutions. Limited awareness of reusable alternatives, misconceptions about hygiene and maintenance, and cultural sensitivities reduce adoption in several regions. Marketing efforts often struggle to reach underserved demographics due to privacy concerns. Overcoming this challenge requires education campaigns, discreet packaging, and healthcare-provider engagement to normalize reusable products and build confidence among new users.

Maintenance Requirements and Hygiene Concerns

Reusable incontinence products face challenges related to washing, drying, and proper maintenance, which can deter potential users who prefer the convenience of disposables. Inadequate laundering practices may raise concerns about odor, bacterial buildup, and product durability, particularly in regions with limited access to efficient washing facilities. Consumers with mobility issues may find cleaning routines cumbersome, reducing overall adoption. Manufacturers must address these concerns through quick-dry fabrics, antimicrobial layers, and simplified care instructions to ensure long-term usability and hygiene compliance.

Regional Analysis

North America

North America holds a substantial share of approximately 32–34% in the reusable incontinence products market, supported by strong healthcare infrastructure, high product awareness, and widespread adoption among seniors and home-care users. The region benefits from rising preference for cost-efficient, eco-friendly alternatives to disposable incontinence items, particularly in the U.S. and Canada, where sustainability-driven consumer behavior continues to strengthen demand. Growth is further fueled by advanced product offerings featuring premium fabrics, superior absorbency, and enhanced comfort. Increasing prevalence of chronic conditions, expanding institutional use, and strong e-commerce penetration reinforce North America’s dominant market position.

Europe

Europe accounts for around 28–30% of the global market, driven by aging populations, well-established elder care systems, and strong regulatory emphasis on sustainable hygiene solutions. Countries such as Germany, the U.K., France, and the Nordic region show high adoption of reusable adult diapers, underwear, and liners due to rising environmental concerns and supportive reimbursement structures. Manufacturers in Europe lead innovations in breathable textiles, ergonomic design, and washable absorbent materials that improve comfort and long-term affordability. Growing acceptance in nursing homes, rehabilitation centers, and home-care settings further enhances the region’s steady market expansion.

Asia-Pacific

Asia-Pacific represents the fastest-growing region with approximately 24–26% market share, propelled by rapid population aging, increasing healthcare spending, and rising awareness of reusable hygiene products across China, Japan, India, South Korea, and Southeast Asia. Expanding urbanization and higher disposable incomes strengthen adoption, particularly among middle-aged adults seeking cost-effective and long-lasting solutions. Local manufacturers introduce affordable reusable products with improved fit and absorbency, expanding access across both premium and value segments. Institutional adoption in hospitals and senior care centers, combined with expanding online retail channels, positions Asia-Pacific as a key growth hub.

Latin America

Latin America holds an estimated 6–7% share of the reusable incontinence products market, supported by increasing awareness campaigns, improving healthcare access, and gradual acceptance of reusable hygiene options. Countries such as Brazil, Mexico, and Chile lead regional demand as aging populations rise and consumers shift toward cost-efficient solutions for long-term incontinence management. Economic constraints encourage adoption of washable underwear and pads that reduce recurring expenses. However, limited product variety and slower institutional uptake moderate growth. Expanding e-commerce platforms and entry of international brands create opportunities for broader market penetration.

Middle East & Africa

The Middle East & Africa region accounts for roughly 4–5% of the market, driven by increasing investments in healthcare infrastructure and rising demand among aging populations in the Gulf Cooperation Council (GCC) countries and South Africa. Adoption remains moderate due to limited awareness and cultural sensitivities surrounding incontinence, but growing acceptance of reusable products in hospitals and long-term care centers supports gradual expansion. International brands collaborate with local distributors to improve availability, while affordability concerns push demand for durable, washable solutions. Urbanization, improving retail networks, and targeted awareness efforts contribute to the region’s steady but slower growth trajectory.

Market Segmentations:

By Product Type:

- Adult diapers

- Protective underwear

By Consumer Group:

By Age Group:

- Young adults (20-39)

- Middle-aged adults (40-64)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The reusable incontinence products market features a competitive landscape led by major global and regional players such as First Quality Enterprises, Inc., Coloplast Corp, Attends Healthcare Products, Inc., Hollister Incorporated, PAUL HARTMANN AG, Ontex Group, Essity, Cardinal Health, Kimberly-Clark Corporation, and ABENA A/S. the reusable incontinence products market is shaped by companies focusing on product innovation, sustainability, and enhanced user comfort. Manufacturers invest heavily in advanced absorbent fabrics, leak-proof multilayer designs, and ergonomic fits that cater to varying levels of incontinence and diverse consumer groups. The market becomes increasingly dynamic as brands expand their portfolios across reusable diapers, protective underwear, and washable pads designed for both home-care and institutional use. Growing emphasis on eco-friendly materials, long-term cost savings, and discreet product aesthetics drives continuous R&D activity. Companies also strengthen their presence through e-commerce expansion, caregiver education initiatives, and strategic collaborations with healthcare providers, positioning themselves competitively in a rapidly evolving, sustainability-oriented market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- First Quality Enterprises, Inc.

- Coloplast Corp

- Attends Healthcare Products, Inc.

- Hollister Incorporated

- PAUL HARTMANN AG

- Ontex Group

- Essity

- Cardinal Health

- Kimberly-Clark Corporation

- ABENA A/S

Recent Developments

- In June 2025, Ontex launched its new iD Discreet incontinence product line across Europe to meet the growing demand for dignified and affordable continence care as the global population ages. The new collection includes breathable, absorbent pants for men and women, as well as night pads for both, designed to provide instant dryness, odor control, and a nearly invisible feel.

- In May 2024, Coloplast Corp. announced the expansion to its Luja Portfolio by introducing a next-generation catheter designed specifically for women. Compared to Coloplast’s existing SpeediCath Compact Eve, Luja Female features 28% less plastic and a 22% reduced carbon footprint.

- In April 2024, Medline and Consure Medical entered an exclusive distribution agreement for Consure Medical’s QiVi MEC male external urine management device, which helps prevent CAUTI and IAD by externally managing male urine.

- In October 2023, Unicharm released the revised versions of its LFREE ultra slim comfort pants. The adult disposable pants feature ultrasonic bonding technology in the waist band providing a better fit, less apparent form, soft fabric, additional comfort and ease of wearing.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Consumer Group, Age Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as sustainability-conscious consumers increasingly shift from disposable to reusable incontinence solutions.

- Advancements in absorbent textiles and antimicrobial fabrics will enhance product comfort, durability, and hygiene.

- Demand will rise among active adults and younger consumers as discreet, ergonomic, and fashion-oriented designs become more available.

- Healthcare institutions will adopt more reusable products to reduce long-term operational costs and support waste-reduction goals.

- E-commerce and subscription-based delivery models will accelerate product accessibility and recurring purchases.

- Gender-specific and customized fit options will strengthen consumer satisfaction and product loyalty.

- Manufacturers will invest in eco-friendly production processes to align with tightening environmental regulations.

- Emerging markets will experience faster growth due to rising awareness and improving access to reusable hygiene products.

- Collaborations with caregivers and medical professionals will drive better education and adoption among new users.

- Innovation in quick-dry, odor-control, and leak-resistant technologies will remain central to competitive differentiation.