Market Overview

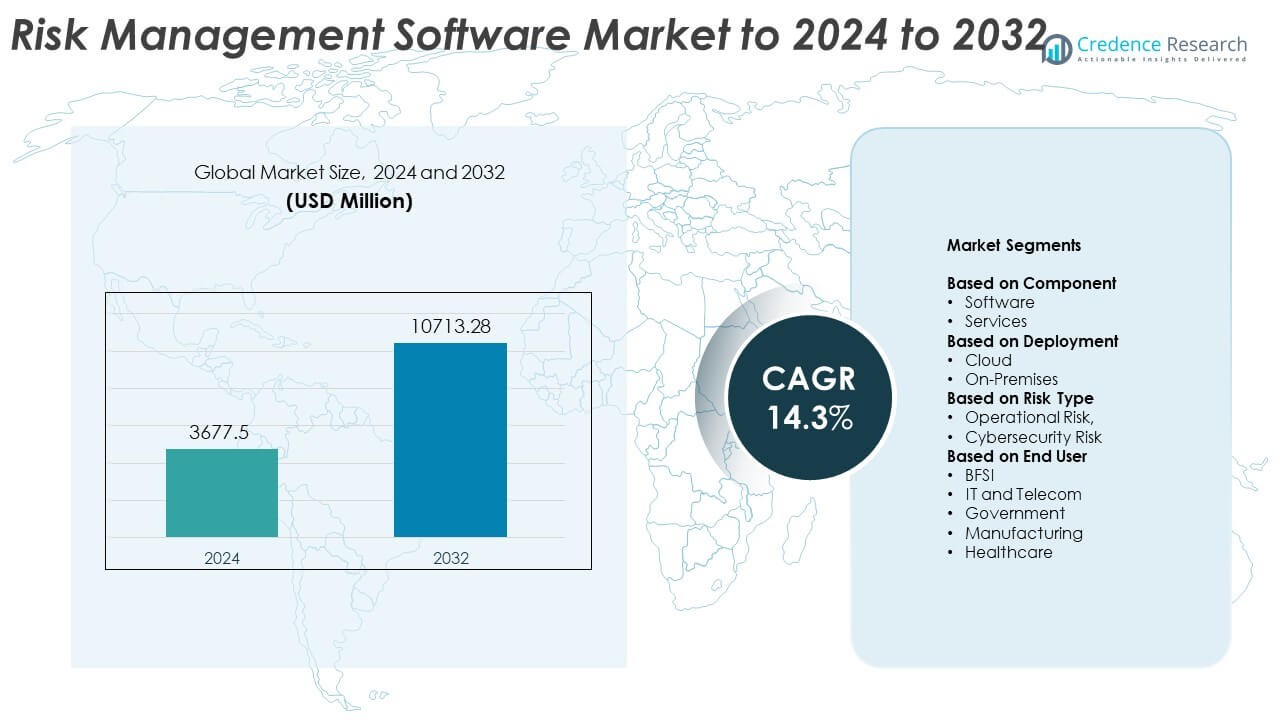

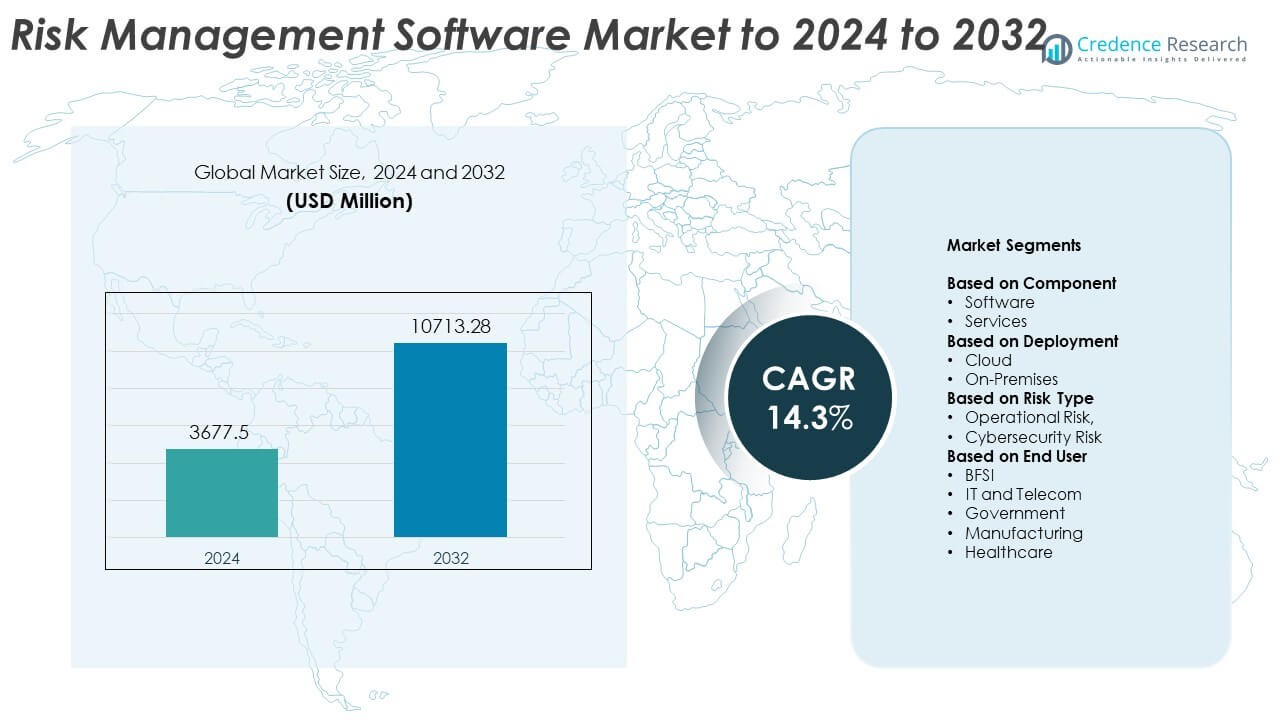

Risk Management Software Market size was valued USD 3677.5 Million in 2024 and is anticipated to reach USD 10713.28 Million by 2032, at a CAGR of 14.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Risk Management Software Market Size 2024 |

USD 3677.5 Million |

| Risk Management Software Market, CAGR |

14.3% |

| Risk Management Software Market Size 2032 |

USD 10713.28 Million |

The Risk Management Software Market is shaped by leading players such as Vendasta, SAS Institute Inc., SimplyCast, Adobe, Sailthru, HP Development Company, L.P., Act-On Marketing Automation, HubSpot, Oracle, and Infor. These companies strengthen portfolios with AI-based analytics, automated compliance tools, and integrated dashboards that support real-time risk visibility. Vendors focus on cloud platforms to offer scalable deployment and faster updates for global enterprises. North America leads the market with about 36% share in 2024, supported by strong digital maturity and strict regulatory frameworks, while Europe and Asia Pacific follow as adoption rises across finance, healthcare, and manufacturing sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Risk Management Software Market reached USD 3677.5 Million in 2024 and will hit USD 10713.28 Million by 2032 at a CAGR of 14.3%.

- Growth rises as firms adopt automated tools to handle cybersecurity threats, compliance needs, and operational risks across large and mid-sized enterprises.

- AI-driven analytics, predictive scoring, and cloud-native platforms shape major trends, while software holds about 63% share and cloud deployment leads with nearly 68% share.

- Competition strengthens as global vendors expand integrated dashboards, enhance workflow automation, and improve data security features to support digital governance.

- North America leads with about 36% share, followed by Europe at 28% and Asia Pacific at 22%, while cybersecurity risk solutions remain the top risk type with around 54% share.

Market Segmentation Analysis:

By Component

Software leads this segment with about 63% share in 2024. Demand grows as enterprises adopt integrated platforms that automate risk scoring, incident tracking, and compliance workflows. Firms choose software solutions because these tools offer real-time dashboards, advanced analytics, and seamless integration with ERP and security systems. Services continue steady growth as large organizations seek consulting, implementation, and managed support to handle complex governance structures and multi-region compliance needs.

- For instance, IBM confirmed in 2024 that the IBM Security platform processed more than 150 billion security events per day globally, as reported in IBM’s official Threat Intelligence Index.

By Deployment

Cloud dominates this segment with nearly 68% share in 2024. Adoption rises as companies shift to scalable platforms that support remote access, faster updates, and lower upfront costs. Cloud-based systems attract enterprises due to flexible subscription models and strong data recovery capabilities. On-premises solutions retain use in highly regulated sectors that control sensitive data and maintain strict security frameworks, but growth remains limited compared to cloud expansion.

- For instance, Microsoft disclosed that its cloud infrastructure analyzed over 78 trillion security signals each day in 2024, as stated in Microsoft’s Digital Defense Report 2024.

By Risk Type

Cybersecurity Risk leads this segment with about 54% share in 2024. Organizations prioritize cyber tools due to rising ransomware cases, identity breaches, and digital transformation across industries. Platforms supporting continuous monitoring, vulnerability assessment, and automated threat alerts gain rapid traction. Operational Risk maintains strong adoption as businesses enhance workflow controls, audit trails, and reporting functions to reduce process failures and improve governance maturity.

Key Growth Drivers

Rising Cyber Threats and Data Breaches

Escalating cyberattacks push companies to adopt advanced risk management software that supports threat detection, vulnerability monitoring, and rapid response workflows. Enterprises rely on these systems to protect cloud assets, strengthen identity controls, and meet stricter security rules. The rise of remote work and interconnected systems increases exposure, prompting higher investment in cybersecurity-linked risk platforms. Growing awareness among mid-sized firms also boosts adoption as digital operations expand across all sectors.

- For instance, Palo Alto Networks’ threat intelligence processes data at a massive scale. The company detects 1.5 million novel attacks daily and reported recording 6.06 billion malware attacks globally in the entire year of 2023.

Expansion of Regulatory Compliance Requirements

Global compliance rules become more complex, leading firms to use automated platforms that reduce manual effort and improve audit accuracy. Financial services, healthcare, and manufacturing sectors rely on digital tools to track obligations, map controls, and generate real-time compliance reports. Companies adopt software to avoid penalties and maintain transparency across their governance processes. Regulatory updates across data protection, environmental management, and financial reporting continue to drive market demand.

- For instance, Thomson Reuters Regulatory Intelligence tracks a significant number of regulatory changes daily and annually. A 2016 report noted an average of 200 international regulatory changes and announcements were captured daily.

Growth in Enterprise Digital Transformation

Enterprises modernize workflows and move core operations to the cloud, creating a higher need for integrated risk visibility. Digital transformation increases operational complexity, encouraging organizations to use platforms that unify risk scoring, incident reporting, and performance metrics. Automated dashboards help managers assess uncertainties across supply chains, IT systems, and business processes. Investments rise as companies seek scalable tools that support rapid decision-making and reduce downtime.

Key Trends & Opportunities

AI-Driven Risk Analytics Expansion

AI and machine learning reshape risk management by supporting predictive modeling, anomaly detection, and automated mitigation decisions. Companies deploy intelligent engines that scan large datasets and flag early warning signals with higher accuracy. Vendors integrate AI features to strengthen real-time scoring, improve investigation workflows, and reduce human error. This shift creates new opportunities for providers offering adaptive algorithms and self-learning tools that improve risk forecasting.

- For instance, Microsoft stated in its 2025 Digital Defense Report that it processes more than 100 trillion security signals every day across endpoints, cloud services, and identity systems, using AI-driven analytics to detect threats and support risk decisions.

Growing Adoption of Cloud-Native Governance Tools

Cloud-native platforms attract strong interest as enterprises prioritize scalable, flexible, and cost-efficient risk operations. Continuous updates, remote access, and stronger resilience make cloud systems ideal for global teams with distributed workflows. Vendors launch modular and API-friendly architectures that link risk, compliance, and audit functions into unified dashboards. This trend creates opportunities for subscription-based models and industry-specific cloud packages.

- For instance, Diligent reports that its cloud-based modern governance and GRC platform is used by about 1 million users at over 25,000 customer organizations worldwide, showing large-scale adoption of cloud-native governance and risk solutions.

Key Challenges

High Implementation and Integration Complexity

Enterprises face difficulties when linking risk software with legacy ERPs, cybersecurity tools, and operational systems. Integration delays increase the overall project timeline and raise cost burdens for large organizations. Complex governance structures in regulated sectors add more effort during setup. Many firms require skilled specialists to customize workflows, which slows adoption and raises dependency on external consultants.

Data Privacy and Security Concerns

Organizations hesitate to store sensitive risk data on external servers due to strict privacy rules and rising breach incidents. Cloud adoption faces scrutiny in sectors handling financial records, patient information, and confidential intellectual property. Vendors must provide strong encryption, access controls, and compliance certifications to gain trust. Concerns about cross-border data transfers and third-party exposure further challenge market penetration.

Regional Analysis

North America

North America leads the Risk Management Software Market with about 36% share in 2024. Strong adoption comes from financial services, healthcare, and technology firms that prioritize compliance automation and cybersecurity oversight. Enterprises invest heavily in cloud-based platforms that support real-time analytics and integrated governance frameworks. Regulatory pressure from data protection laws and industry-specific standards drives wider deployment across mid-sized and large companies. The region benefits from high digital maturity, strong vendor presence, and rapid integration of AI-enabled tools that enhance threat detection and operational visibility.

Europe

Europe holds nearly 28% share in 2024, driven by strict data protection rules and strong governance culture across major economies. Companies adopt digital tools to strengthen audit readiness, meet GDPR requirements, and manage cross-border compliance obligations. Financial institutions, manufacturing groups, and energy firms lead adoption as supply chain risks and cybersecurity incidents rise. Cloud-based platforms gain traction, though several sectors retain hybrid models due to privacy concerns. The region sees sustained demand due to evolving ESG reporting needs and the push for stronger operational resilience frameworks.

Asia Pacific

Asia Pacific accounts for around 22% share in 2024 and shows the fastest growth due to rapid digitalization across banking, telecom, and e-commerce industries. Expanding cyber threats and rising cloud usage encourage firms to invest in automated risk monitoring systems. Governments strengthen cybersecurity laws and compliance norms, prompting higher adoption among regulated enterprises. Large organizations focus on operational transparency, while small and mid-sized firms adopt cost-efficient cloud platforms. Growing digital payments, supply chain complexity, and increasing data exposure boost demand across regional markets.

South America

South America captures roughly 8% share in 2024, supported by rising digital adoption in banking, retail, and public sectors. Organizations invest in risk software to improve fraud management, meet reporting requirements, and address cybersecurity gaps. Economic instability and growing cyberattacks push enterprises to prioritize integrated governance tools. Cloud platforms gain acceptance due to lower upfront cost and easier deployment for distributed teams. However, limited digital infrastructure and budget constraints slow widespread adoption, though demand continues to rise among large enterprises and multinational firms.

Middle East and Africa

Middle East and Africa hold about 6% share in 2024, with growth driven by modernization programs in finance, energy, and government sectors. Countries invest in digital transformation and cybersecurity frameworks, boosting demand for risk monitoring platforms. Large enterprises adopt advanced tools to strengthen regulatory compliance, secure cloud environments, and enhance operational continuity. Cloud deployment expands as regional data centers grow, though adoption remains slower among small firms. Increasing cyber incidents and stricter national security regulations support steady market expansion across the region.

Market Segmentations:

By Component

By Deployment

By Risk Type

- Operational Risk,

- Cybersecurity Risk

By End User

- BFSI

- IT and Telecom

- Government

- Manufacturing

- Healthcare

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Risk Management Software Market features key players such as Vendasta, SAS Institute Inc., SimplyCast, Adobe, Sailthru, HP Development Company, L.P., Act-On Marketing Automation, HubSpot, Oracle, and Infor. Global vendors compete by improving real-time dashboards, faster automation, and stronger data security tools. Many providers invest in AI to improve threat detection and support quick decisions. Cloud platforms grow as buyers prefer flexible models and low setup effort. Vendors focus on smooth integration with ERP, CRM, and security systems to raise adoption. Several firms expand industry-specific tools for finance, healthcare, and manufacturing. Providers also improve mobile access to support remote teams. Partnerships with consulting firms help reach large enterprises. Strong demand pushes vendors to add better reports and simpler layouts. Competition stays intense as firms upgrade old systems and move toward unified governance tools.

Key Player Analysis

- Vendasta (U.S.)

- SAS Institute Inc. (U.S.)

- SimplyCast (Canada)

- Adobe (U.S.)

- Sailthru (U.S.)

- HP Development Company, L.P. (U.S.)

- Act-On Marketing Automation (U.S.)

- HubSpot, Inc. (U.S.)

- Oracle (U.S.)

- Infor (U.S.)

Recent Developments

- In 2025, Adobe released a comprehensive security update addressing multiple vulnerabilities across its major creative and enterprise software products, including those related to enterprise risk such as Adobe Commerce.

- In 2025, Oracle Risk Management Cloud (RMC) gained significant momentum as a cloud-native solution that automates segregation of duties, continuously monitors access and configurations, automates control testing workflows, and generates real-time audit-ready reports.

- In 2025, HubSpot’s CRM platforms enhanced compliance tracking with built-in rules, approval processes, robust audit trails, and fine-tuned permissions to reduce regulatory risk and ensure compliance logging.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, Risk Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as companies expand digital operations and require stronger risk visibility.

- AI-driven analytics will become standard for predictive assessments and automated alerts.

- Cloud-native platforms will gain wider adoption as firms prioritize scalability and lower costs.

- Integrated governance systems will replace standalone tools across compliance, audit, and risk functions.

- Cybersecurity modules will strengthen as ransomware and identity attacks continue rising.

- Mid-sized enterprises will adopt advanced platforms due to simpler deployment and subscription models.

- ESG and operational resilience regulations will push firms toward unified reporting frameworks.

- Real-time monitoring tools will expand across supply chains and third-party networks.

- Vendors will invest in industry-specific solutions tailored to finance, healthcare, and manufacturing.

- Global demand will rise as organizations aim to reduce downtime and improve decision-making accuracy.