Market Overview

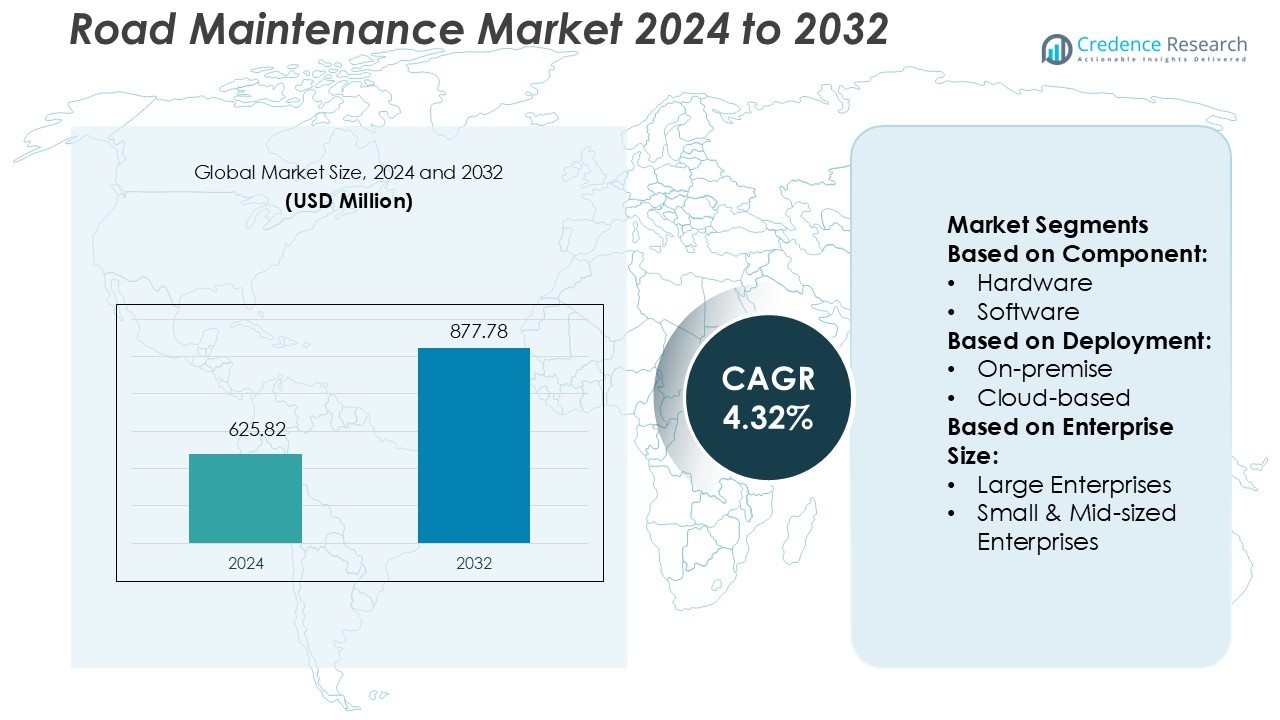

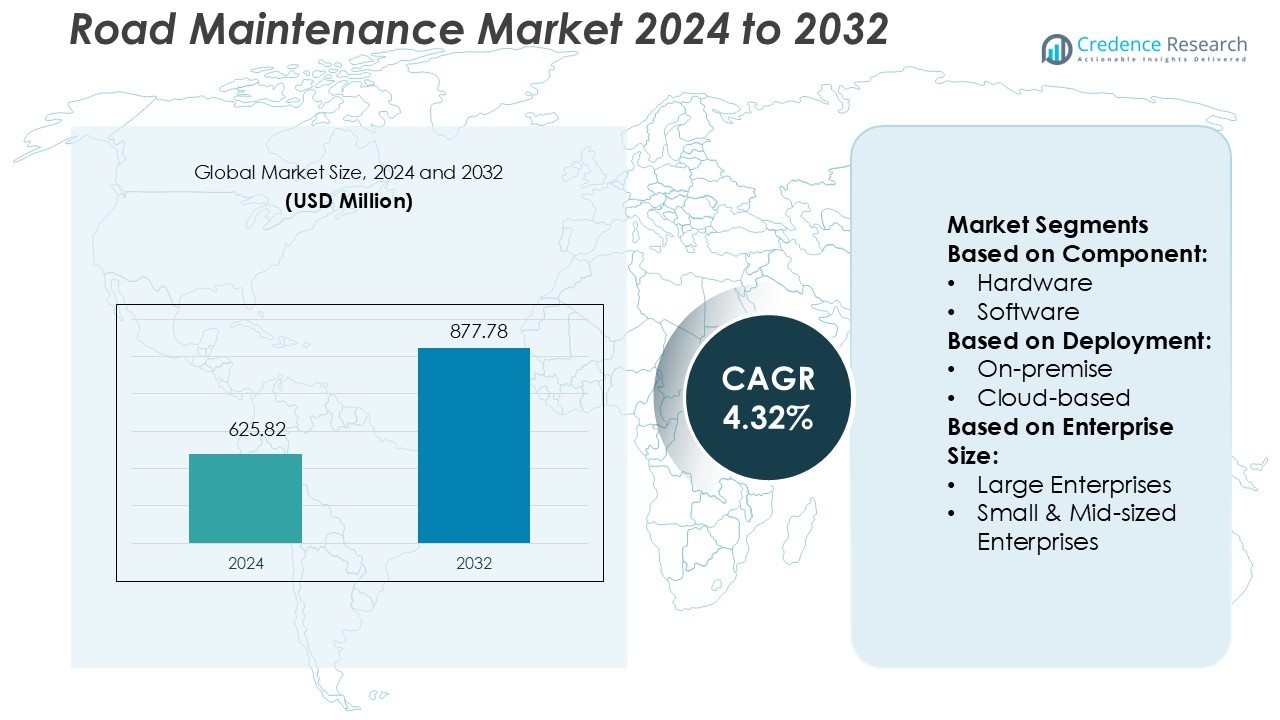

Road Maintenance Market size was valued USD 625.82 million in 2024 and is anticipated to reach USD 877.78 million by 2032, at a CAGR of 4.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Road Maintenance Market Size 2024 |

USD 625.82 Million |

| Road Maintenance Market, CAGR |

4.32% |

| Road Maintenance Market Size 2032 |

USD 877.78 Million |

The road maintenance market is driven by top players including Hitachi, Ltd., Rockwell Automation, Accenture plc, Robert Bosch GmbH, IBM Corporation, PTC, Honeywell International Inc., Microsoft, Cisco Systems, Inc., and General Electric. These companies focus on integrating AI, IoT, and cloud platforms to enhance real-time monitoring, predictive maintenance, and automated repair operations. Their strong investment in innovation and partnerships with infrastructure agencies strengthens global market competitiveness. North America leads the market with a 34% share, supported by advanced infrastructure, early adoption of smart technologies, and high government spending on modernization programs. This leadership is reinforced by strong R&D capabilities and scalable deployment models.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Road Maintenance Market size was valued at USD 625.82 million in 2024 and is projected to reach USD 877.78 million by 2032, at a CAGR of 4.32% during the forecast period.

- Predictive maintenance and smart infrastructure initiatives are driving consistent demand across urban and rural networks.

- Advanced IoT, AI, and automation technologies are shaping operational efficiency and boosting competitiveness.

- High initial investment costs and workforce skill gaps remain major restraints for several regions.

- North America leads with a 34% share, supported by early technology adoption, while the hardware segment holds the largest component share, driven by increased use of connected monitoring systems.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Component

The hardware segment holds the dominant market position with a 62% share in the road maintenance market. Hardware solutions such as sensors, IoT devices, GPS units, and automated inspection tools drive operational efficiency. These technologies enable real-time monitoring of road conditions, asset performance, and equipment maintenance. Increased investment in smart infrastructure projects and predictive maintenance systems further supports hardware adoption. Governments and private contractors rely on advanced machinery and connected devices to reduce downtime and extend road life cycles, which strengthens the segment’s leadership position.

- For instance, Rockwell’s Allen-Bradley Smart Sensors provide advanced diagnostics including sensor health and communication status, enabling real-time event timestamping that can reduce issue-resolution time by up to 90%.

By Deployment

Cloud-based deployment leads the market with a 58% share. The growing need for scalable, cost-effective solutions is driving this dominance. Cloud platforms offer centralized data storage, real-time analytics, and remote access, which enhance decision-making and maintenance planning. Cloud systems also support predictive modeling, automated scheduling, and AI-driven optimization, improving resource allocation. Their ease of integration with other smart infrastructure systems is increasing adoption among public agencies and private operators. This flexibility makes cloud deployment a preferred choice over traditional on-premise solutions.

- For instance, Accenture deployed its “Azure AI Foundry” platform with 75+ use-cases across industries and delivered 16 into production, reducing AI-app build time by 50 %.

By Enterprise Type

Large enterprises dominate the market with a 65% share. Their higher budget capacity and focus on infrastructure modernization fuel technology investments. Large players deploy advanced maintenance fleets, real-time monitoring systems, and AI-based platforms to manage large-scale projects efficiently. Their ability to invest in integrated asset management solutions improves operational visibility and maintenance outcomes. These enterprises also benefit from strategic collaborations and public-private partnerships, further boosting their market presence. Meanwhile, small and mid-sized enterprises are gradually adopting cost-efficient solutions but remain secondary in market share.

Key Growth Drivers

Rising Investment in Smart Infrastructure

Governments and private sectors are increasing investments in smart infrastructure to improve road quality and safety. Advanced monitoring systems and automated maintenance tools help detect cracks, potholes, and wear early. This reduces repair costs and enhances road durability. The integration of IoT sensors, drones, and GPS units allows authorities to make data-driven decisions. These investments accelerate modernization efforts, driving stronger demand for advanced road maintenance solutions across both urban and rural regions.

- For instance, IBM Research in Zurich developed an AI-model that analyzes over 10,000 high-resolution drone images to detect cracks on runways and road surfaces, achieving a detection accuracy of 94%.

Growing Focus on Road Safety and Durability

The growing number of road accidents is pushing authorities to prioritize preventive maintenance. Regular monitoring and timely repairs help minimize structural failures and improve traffic safety. New technologies enable real-time condition assessment, helping teams address potential issues before they escalate. Countries are also strengthening regulations and safety standards to ensure high-quality road infrastructure. This increased focus on durability and compliance is creating steady demand for modern road maintenance equipment and software.

- For instance, PTC’s “ThingWorx” industrial IoT platform now supports connectivity to over 1 000 different industrial protocols via its Kepware component, enabling real-time condition monitoring of assets in infrastructure-heavy deployments.

Expansion of Urbanization and Mobility Projects

Rapid urbanization is placing pressure on existing road infrastructure. Expanding cities require durable, efficient, and well-maintained roads to support mobility and logistics. Governments are implementing large-scale maintenance programs to sustain road networks and meet future traffic demands. Digital maintenance platforms and predictive models are becoming essential tools for urban planners. These initiatives support long-term infrastructure goals and boost demand for automated and connected road maintenance solutions.

Key Trends & Opportunities

Adoption of Predictive Maintenance Technologies

Predictive maintenance is emerging as a key trend in the market. IoT sensors, drones, and AI algorithms enable early detection of surface damage and structural issues. This approach reduces emergency repair costs and extends asset lifespan. Many municipalities are shifting from reactive to predictive models, improving planning and resource allocation. The growing use of digital twins and cloud-based analytics is expanding opportunities for technology providers in this space.

- For instance, Cisco’s Mass-Scale IoT solution supports deployment and onboarding of wireless IoT-compliant devices at global scale, managing “over 200 million connected devices today.”

Integration of Automation and Robotics

Automation and robotics are transforming road maintenance operations. Robotic systems and automated repair machines help minimize manual intervention, improving efficiency and safety. Self-driving inspection vehicles and AI-enabled tools can identify and repair small defects faster than traditional crews. This shift is creating opportunities for manufacturers and service providers offering advanced maintenance technologies. Automation also aligns with smart city goals, making it a key investment area.

- For instance, VINCI Construction, a core business of VINCI SA, reports that in 2024 it employed over 117,000 staff globally in its construction business as it deploys robot, virtual reality and AI solutions on-site.

Public-Private Partnerships in Infrastructure Development

Public-private partnerships (PPPs) are increasing in road maintenance projects. These collaborations provide funding support and enable the deployment of modern technologies at scale. PPPs help governments meet infrastructure demands while ensuring operational efficiency. Private players benefit from long-term contracts and opportunities to showcase innovation. This model is strengthening global market growth, especially in developing economies.

Key Challenges

High Initial Investment Costs

The adoption of advanced road maintenance technologies requires significant upfront investment. Hardware such as sensors, automated equipment, and drones can be costly for smaller municipalities and contractors. Limited budgets delay technology adoption and restrict large-scale implementation. Although these solutions reduce long-term costs, the lack of immediate financial flexibility remains a key barrier for many regions, especially in developing countries.

Lack of Skilled Workforce and Standardization

Many regions face a shortage of skilled personnel trained to operate advanced maintenance technologies. The lack of standardized procedures and technical knowledge limits efficient implementation. Without proper training, automation and digital systems may not deliver expected outcomes. Inconsistent standards across regions also affect interoperability and scalability. Addressing workforce training and regulatory alignment is crucial for the market to achieve sustainable growth.

Regional Analysis

North America

North America leads the road maintenance market with a 34% share. The region benefits from advanced infrastructure, high government spending, and early adoption of digital maintenance systems. The U.S. invests heavily in road rehabilitation programs, focusing on sensor networks, predictive maintenance, and automated equipment. Canada’s infrastructure modernization initiatives also support market expansion. The presence of strong technology providers and robust public-private partnerships further accelerates adoption. Growing traffic volumes and aging road networks increase the need for efficient maintenance solutions. These factors position North America as a dominant and mature market for road maintenance technologies and services.

Europe

Europe holds a 28% share in the road maintenance market. The region’s strong regulatory frameworks and sustainable infrastructure initiatives drive consistent demand for modern maintenance solutions. Countries like Germany, France, and the U.K. are implementing predictive maintenance programs supported by smart sensors and AI-driven monitoring systems. The European Union’s climate goals also push for energy-efficient and eco-friendly repair methods. Widespread investments in highway upgrades and cross-border transportation networks further boost market growth. Strategic collaborations between public authorities and private technology firms strengthen innovation, making Europe a key hub for sustainable and digital road maintenance solutions.

Asia Pacific

Asia Pacific accounts for a 25% share of the road maintenance market. Rapid urbanization, large-scale infrastructure projects, and rising vehicle traffic are major growth drivers. China, India, and Japan are increasing investments in smart road monitoring systems and automated repair technologies. Governments are integrating IoT and cloud platforms to improve asset tracking and predictive maintenance. Public infrastructure programs like smart city development further enhance adoption. Cost-effective solutions and expanding road networks support strong regional demand. The region’s diverse markets present significant opportunities for technology providers, especially in fast-developing economies with growing transportation infrastructure.

Latin America

Latin America captures a 6% share of the road maintenance market. The region is witnessing gradual adoption of smart road management technologies driven by infrastructure reforms. Brazil, Mexico, and Chile are investing in road repair programs to improve transportation efficiency. Limited budgets encourage governments to explore cost-effective predictive maintenance solutions. International funding and PPP models are supporting modernization efforts in major cities. While the market is still developing, the increasing need to upgrade aging infrastructure is driving steady demand. Over the forecast period, technology adoption and infrastructure investments are expected to strengthen the region’s market position.

Middle East & Africa

The Middle East & Africa region holds a 7% market share. Gulf countries like the UAE and Saudi Arabia are investing in road modernization to support their economic diversification goals. The region focuses on adopting advanced road monitoring tools and durable materials to withstand harsh climates. Infrastructure development programs, especially under national vision strategies, drive new projects and maintenance activities. Africa’s market remains at an early stage but is expanding through foreign investments and regional connectivity projects. Growing emphasis on urban development and trade route upgrades positions the region as an emerging market with future growth potential.

Market Segmentations:

By Component:

By Deployment:

By Enterprise Size:

- Large Enterprises

- Small & Mid-sized Enterprises

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The road maintenance market is shaped by leading players including Hitachi, Ltd., Rockwell Automation, Accenture plc, Robert Bosch GmbH, IBM Corporation, PTC, Honeywell International Inc., Microsoft, Cisco Systems, Inc., and General Electric. The road maintenance market is characterized by strong competition driven by innovation, technology integration, and strategic collaborations. Companies are focusing on smart maintenance solutions that leverage IoT, AI, and predictive analytics to enhance operational efficiency. Many players are investing in automation tools and advanced monitoring systems to reduce downtime and extend road lifecycles. Public-private partnerships play a key role in expanding project reach and scaling technology adoption. Sustainability is becoming a core strategy, with increased emphasis on eco-friendly materials and energy-efficient repair methods. Continuous R&D efforts, service diversification, and digital transformation are shaping the competitive dynamics of the global market.

Key Player Analysis

- Hitachi, Ltd.

- Rockwell Automation

- Accenture plc

- Robert Bosch GmbH

- IBM Corporation

- PTC

- Honeywell International Inc.

- Microsoft

- Cisco Systems, Inc.

- General Electric

Recent Developments

- In September 2024, Siemens engaged in a strategic partnership with Merck, a science and technology company. Through this collaboration, the company aims to drive digital transformation and take smart manufacturing to the next level.

- In June 2024, C3.ai, Inc. delivers its C3 AI Reliability solution to Holcim, a provider of sustainable building solutions. Holcim will integrate C3 AI Reliability, a novel PdM solution, across its plants globally for their digital transformation and a net-zero future.

- In March 2024, General Electric Vernova announced that it will provide its novel predictive analytics software to National Industrialization Company (TASNEE), a petrochemical company based in Saudi Arabia. Through this software, the company aims to avoid equipment downtime by detecting, forecasting, and preventing critical failures in industrial companies.

- In January 2024, Rockwell Automation engaged in a strategic partnership with MakinaRocks, a provider of advanced solutions for the manufacturing industry. Through this collaboration, the company aims to boost the integration of AI solutions in automation. It will help the manufacturers to increase productivity and reduce unplanned shutdowns through the PdM solution.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, Enterprise Size and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Predictive maintenance technologies will become central to reducing infrastructure repair costs.

- Smart sensors and IoT systems will enable real-time monitoring of road conditions.

- Governments will increase investments in digital infrastructure modernization programs.

- Cloud-based platforms will dominate road asset management and planning operations.

- Automation and robotics will improve operational speed and safety in maintenance work.

- Public-private partnerships will accelerate large-scale infrastructure upgrades.

- AI-driven analytics will support data-based decision-making for resource allocation.

- Eco-friendly and sustainable road materials will gain higher adoption rates.

- Emerging economies will expand investments to strengthen transportation networks.

- Workforce upskilling programs will support the transition to technology-enabled maintenance models.

Market Segmentation Analysis:

Market Segmentation Analysis: