Market Overview:

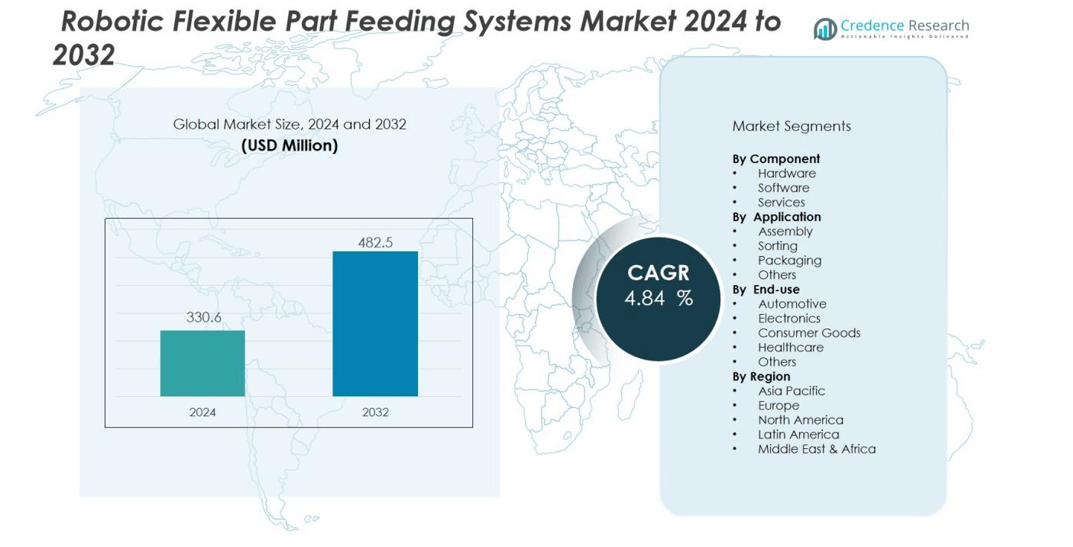

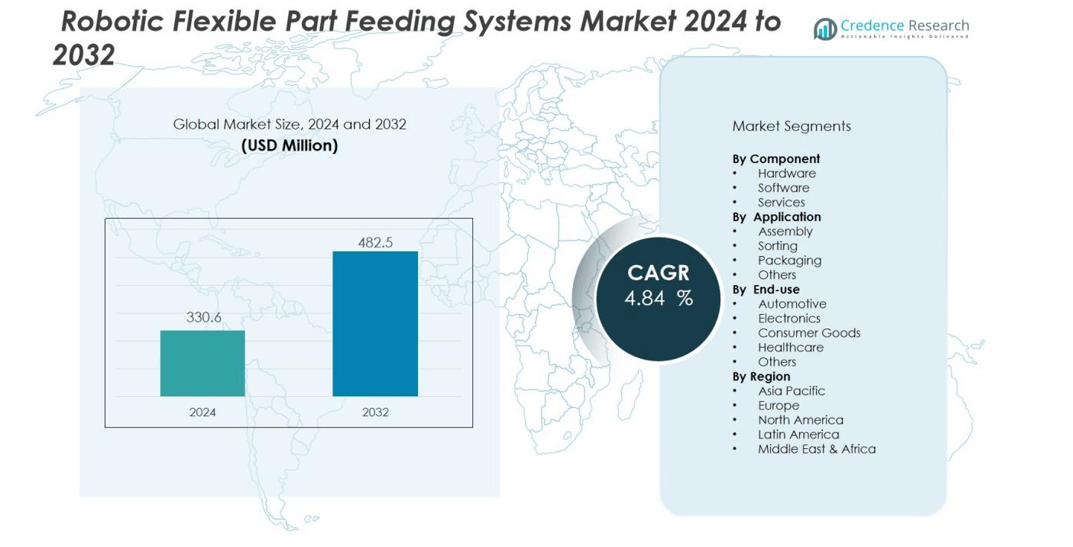

The robotic flexible part feeding systems market size was valued at USD 330.6 million in 2024 and is anticipated to reach USD 482.5 million by 2032, at a CAGR of 4.84 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Robotic Flexible Part Feeding Systems Market Size 2024 |

USD 330.6 million |

| Robotic Flexible Part Feeding Systems Market, CAGR |

4.84% |

| Robotic Flexible Part Feeding Systems Market Size 2032 |

USD 482.5 million |

Growth in this market is fueled by several factors. The shift toward Industry 4.0, demand for collaborative robots, and rising labor costs are accelerating adoption. Flexible feeding systems reduce reliance on traditional bowl feeders, enabling manufacturers to handle multiple parts with minimal retooling. Industries such as automotive, electronics, and consumer goods are investing heavily in these systems to meet growing customization needs and improve throughput. Advancements in machine vision, AI, and sensor technologies further enhance precision and adaptability, strengthening their value proposition.

Regionally, North America and Europe lead the market, supported by strong automation adoption and high investments in industrial robotics. Asia-Pacific is expected to witness the fastest growth, driven by rapid industrialization, expansion of electronics manufacturing, and government incentives for smart factories in China, Japan, and South Korea. Emerging economies in Latin America and the Middle East are also showing rising interest, backed by growing industrial automation projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The robotic flexible part feeding systems market was valued at USD 330.6 million in 2024 and is projected to reach USD 482.5 million by 2032.

- Rising demand for high-mix, low-volume production drives adoption, enabling quick part changeovers and reduced downtime.

- Industry 4.0 initiatives and smart factory investments fuel integration of robotics, sensors, and AI-driven feeding systems.

- Growing labor costs and shortages of skilled workers accelerate the shift toward automated and error-free part handling.

- Advancements in vision systems and artificial intelligence enhance precision, allowing reliable handling of complex and delicate components.

- North America held 35% market share in 2024, supported by advanced manufacturing, aerospace, and electronics investments.

- Asia-Pacific recorded 25% market share in 2024 and is the fastest-growing region, led by China, Japan, and South Korea.

Market Drivers:

Rising Demand for High-Mix, Low-Volume Production:

Manufacturers are shifting toward production models that require handling diverse components in smaller batches. The robotic flexible part feeding systems market benefits from this trend, as these solutions enable quick changeovers without extensive retooling. Companies in automotive, electronics, and consumer goods sectors rely on flexibility to meet changing customer preferences. It provides efficiency by reducing downtime and improving throughput in dynamic manufacturing setups.

- For instance, Samsung Electronics achieved significant efficiency improvements through their SLIM (Short Cycle Time and Low Inventory in Manufacturing) system, reducing manufacturing cycle times for dynamic random access memory devices from more than 80 days to less than 30 days, enabling them to capture an additional $1 billion in sales revenue.

Growing Adoption of Industry 4.0 and Smart Manufacturing:

The move toward Industry 4.0 accelerates the adoption of advanced feeding technologies. The robotic flexible part feeding systems market supports smart factories by integrating robotics, sensors, and AI for adaptive production processes. It aligns with digital manufacturing strategies, ensuring real-time adjustments in part orientation and supply. Companies implement these systems to achieve seamless automation and data-driven decision-making.

- For instance, ABB offers the FlexFeeder system, which can sort components ranging from 3 to 30 mm. This system, which can work with integrated vision and control systems, allows manufacturers to quickly change component types without having to change the feeder itself.

Rising Labor Costs and Shortage of Skilled Workforce:

Increasing labor costs and shortages of skilled workers push industries toward automation. The robotic flexible part feeding systems market addresses these challenges by reducing dependency on manual operators. It enables consistent, error-free part handling, ensuring quality and productivity. Businesses adopt these systems to offset rising operational expenses and maintain competitiveness in global markets.

Technological Advancements in Vision Systems and Artificial Intelligence:

Machine vision and AI technologies significantly enhance the accuracy of robotic feeding systems. The robotic flexible part feeding systems market leverages these innovations to deliver higher precision in sorting and orientation. It allows manufacturers to automate complex assembly lines that require handling irregular or delicate parts. These advancements ensure that flexible feeding systems remain vital for industries pursuing greater efficiency and adaptability.

Market Trends:

Integration of Advanced Vision Technology and Artificial Intelligence:

The robotic flexible part feeding systems market is witnessing a strong shift toward advanced vision and AI-enabled solutions. Manufacturers deploy machine vision to enhance part recognition, orientation, and sorting accuracy across varied components. It ensures greater adaptability for high-mix production, where traditional feeders fall short. AI-driven algorithms further optimize feeding by learning part variations and reducing system errors. These innovations enable consistent performance in industries like electronics and medical devices, where precision is critical. The trend supports manufacturers’ need for smarter, scalable, and efficient automation solutions.

- For Instance, FlexiBowl 650 C/CC systems can handle entire part ranges measuring 10-110mm and weighing up to 170g with multiple feeding modes achieving simultaneous bulk feeder dropping and robot picking operations.

Expansion of Collaborative Robotics and Modular Feeding Solutions:

Collaborative robots, or cobots, are driving demand for flexible feeding systems across small and medium-sized enterprises. The robotic flexible part feeding systems market benefits from modular designs that integrate seamlessly with cobots for diverse applications. It allows manufacturers to achieve fast deployments and minimize setup costs. The use of modular platforms also provides scalability, enabling easy upgrades as production needs evolve. Industries adopt these systems to enhance safety, efficiency, and workforce collaboration on assembly lines. This trend highlights the move toward cost-efficient, adaptable automation suited to dynamic manufacturing environments.

- For instance, FANUC’s CR-35iA collaborative robot enabled STIHL to complete production setup in 3 days through intensive preparation, while the robot operates at a speed of 250 mm/s to relieve workers from handling 8-ton daily loads of 10 kg gasoline cut-off saws.

Market Challenges Analysis:

High Initial Investment and Integration Complexity:

The robotic flexible part feeding systems market faces challenges due to high upfront costs and complex integration requirements. Small and medium-sized enterprises often hesitate to adopt these systems because of budget constraints. It requires advanced infrastructure, skilled technicians, and tailored system design, which raise overall expenses. Integration with existing assembly lines can also lead to compatibility issues, delaying deployment. Many companies struggle to justify the investment without clear short-term returns. These factors slow adoption in cost-sensitive industries, limiting wider market penetration.

Technical Limitations and Maintenance Concerns:

Despite advancements, flexible part feeding systems still encounter technical constraints in handling highly irregular or delicate components. The robotic flexible part feeding systems market must address these performance issues to ensure consistent reliability. It demands frequent calibration, monitoring, and maintenance, which increase operational costs. System downtime during maintenance impacts production efficiency, especially in continuous manufacturing setups. Manufacturers also face challenges in training workers to manage advanced software and hardware. These hurdles restrict scalability and create hesitation among potential adopters in competitive markets.

Market Opportunities:

Expanding Applications in Emerging Industries:

The robotic flexible part feeding systems market is positioned to benefit from rising demand in emerging industries such as medical devices, renewable energy, and advanced electronics. Manufacturers in these sectors require high precision, customization, and adaptability, which flexible feeding systems deliver effectively. It enables efficient handling of complex and delicate parts that traditional feeders cannot manage. The growing push for automation in cleanroom environments and precision assembly lines creates new growth avenues. Companies exploring automation in healthcare and semiconductor manufacturing are expected to drive adoption further. These applications expand the market’s role beyond conventional automotive and consumer goods sectors.

Growing Demand in Small and Medium Enterprises through Modular Solutions:

Small and medium enterprises present a significant opportunity for market expansion with modular and cost-efficient solutions. The robotic flexible part feeding systems market can cater to this segment by offering scalable systems that reduce setup time and investment. It allows SMEs to adopt automation without heavy infrastructure costs, making advanced feeding accessible. Modular platforms also support phased implementation, aligning with evolving production needs. The rising trend of cobot integration strengthens this opportunity, as SMEs increasingly adopt collaborative robotics. By addressing cost and adaptability, vendors can unlock strong demand from this underpenetrated market segment.

Market Segmentation Analysis:

By Component:

The robotic flexible part feeding systems market by component is segmented into hardware, software, and services. Hardware dominates due to the demand for advanced feeders, robotic arms, and vision systems. It ensures precise part handling and supports integration with various automation platforms. Software is gaining momentum with AI-driven recognition, error detection, and process optimization capabilities. Services, including installation, training, and maintenance, also hold significant value in supporting system longevity.

- For instance, KUKA’s KR DELTA robots demonstrate exceptional performance with pose repeatability of ±0.05 mm while handling payloads up to 3 kg in a 1,200 mm diameter workspace.

By Application:

By application, the market is divided into assembly, sorting, packaging, and others. Assembly applications lead the segment, supported by rising demand in automotive and electronics production. It provides manufacturers with reliable solutions for high-mix, low-volume environments. Sorting is growing rapidly, driven by the need for precision and efficiency in complex manufacturing lines. Packaging applications are expanding across consumer goods and healthcare industries. Other applications highlight adoption in specialized industrial processes.

- For instance, Specialized industrial robots in pharmaceutical manufacturing achieve precision handling of components as small as 0201 packages (0.6mm x 0.3mm) with sub-millimeter accuracy.

By End-use:

The end-use segment includes automotive, electronics, consumer goods, healthcare, and others. Automotive holds the largest share, supported by automation in part handling and assembly operations. The robotic flexible part feeding systems market is expanding in electronics, where miniaturized and delicate components require high accuracy. Consumer goods manufacturers adopt these systems to increase flexibility and efficiency. Healthcare demonstrates growing adoption in medical device assembly and pharmaceutical packaging. Other industries also explore opportunities to improve productivity through automation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentations:

By Component:

- Hardware

- Software

- Services

By Application:

- Assembly

- Sorting

- Packaging

- Others

By End-use:

- Automotive

- Electronics

- Consumer Goods

- Healthcare

- Others

By Region:

North America

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America:

North America accounted for 35% market share in 2024, making it the leading region. The robotic flexible part feeding systems market in this region benefits from advanced manufacturing infrastructure and high adoption of Industry 4.0 technologies. It is driven by strong investments in automotive, aerospace, and electronics sectors, which demand precision and flexible automation. The presence of leading robotics companies and integrators further strengthens market penetration. Government initiatives to enhance smart manufacturing and reduce labor dependency support wider adoption. Continuous innovation and early adoption trends ensure the region maintains its leadership position.

Europe:

Europe recorded 30% market share in 2024, supported by robust demand from automotive and industrial automation sectors. The robotic flexible part feeding systems market in this region thrives due to the presence of key automotive hubs in Germany, France, and Italy. It benefits from strong R&D investments and a skilled workforce that accelerates system integration. The region focuses heavily on sustainability and efficient manufacturing, driving adoption of flexible feeding technologies. Collaborative robotics adoption is growing, particularly in SMEs aiming to improve productivity. Government support for digital transformation in manufacturing enhances long-term growth potential.

Asia-Pacific:

Asia-Pacific held 25% market share in 2024, establishing itself as the fastest-growing regional market. The robotic flexible part feeding systems market is expanding rapidly in China, Japan, and South Korea, driven by rising electronics and semiconductor production. It gains momentum from government incentives promoting smart factories and advanced robotics adoption. India’s growing manufacturing base also supports long-term market opportunities. Local and international companies invest in automation to meet high-volume and diversified production demands. The increasing push for industrial modernization positions Asia-Pacific as a key growth engine for the global market.

Key Player Analysis:

- ABB Ltd.

- Daifuku Co. Ltd.

- ARS Srl Socio Unico

- FANUC Corp.

- Keyence Corp.

- ISRA VISION AG

- OMRON Corp.

- Seiko Epson Corp.

- RNA Automation Ltd.

- Teradyne Inc.

Competitive Analysis:

The robotic flexible part feeding systems market is highly competitive, shaped by global technology leaders and specialized solution providers. Key players include ABB Ltd., Daifuku Co. Ltd., ARS Srl Socio Unico, FANUC Corp., Keyence Corp., ISRA VISION AG, and OMRON Corp. It is defined by continuous innovation in vision technology, AI integration, and modular hardware design. Companies strengthen their positions by offering flexible, scalable, and efficient feeding solutions that meet the requirements of diverse industries. Strategic collaborations with system integrators and manufacturers support expansion into high-growth sectors such as automotive, electronics, and healthcare. Market leaders focus on enhancing product portfolios while investing in software capabilities to provide adaptive, data-driven automation. The competitive landscape emphasizes reliability, precision, and customization, making technology differentiation a core strategy for growth and long-term sustainability.

Recent Developments:

- In June 2025, ABB expanded its robot product line for the Chinese market with the introduction of the IRB 6730S, IRB 6750S, and IRB 6760 robots, aiming to target mid-sized customers and the large-industrial sector.

- In April 2025, Daifuku launched a new manufacturing plant in Hyderabad, India, to increase capacity for its intralogistics and material handling systems in response to rapid demand growth.

- In Feb 2025, ARS TECH participated in JEC World 2025 in Paris, strengthening its presence in the innovative composite materials market.

Report Coverage:

The research report offers an in-depth analysis based on Component, Application, End-use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The robotic flexible part feeding systems market will witness strong adoption in high-mix production environments.

- It will benefit from growing demand in precision-driven industries such as electronics and medical devices.

- Advancements in AI and vision technologies will continue to enhance system accuracy and adaptability.

- Integration with collaborative robots will expand applications across small and medium enterprises.

- Modular and scalable platforms will support cost-efficient adoption and phased implementation strategies.

- It will gain momentum from global Industry 4.0 initiatives and smart factory development.

- The market will see rising adoption in emerging regions driven by manufacturing expansion and government incentives.

- Vendors will focus on improving system reliability, reducing maintenance needs, and enhancing software usability.

- Partnerships between robotics manufacturers and system integrators will strengthen competitive positioning.

- Sustainability-focused industries will favor flexible feeders that reduce waste and optimize resource use.