Market Overview

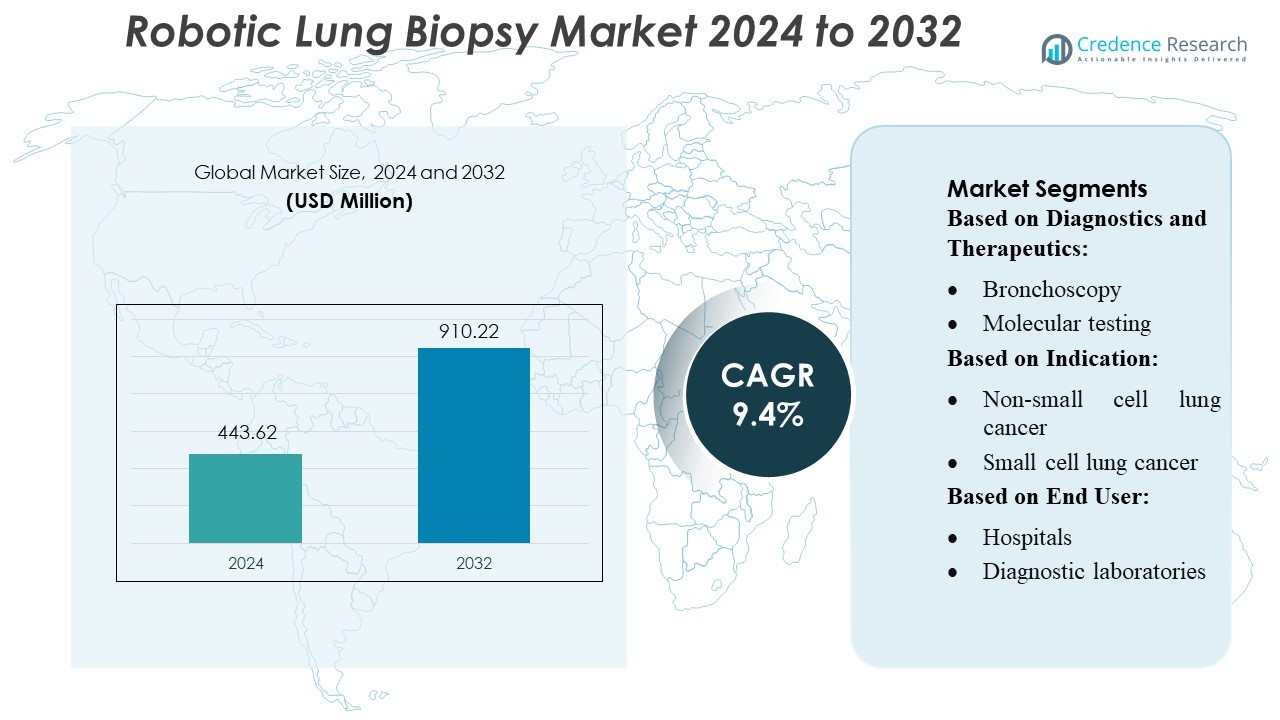

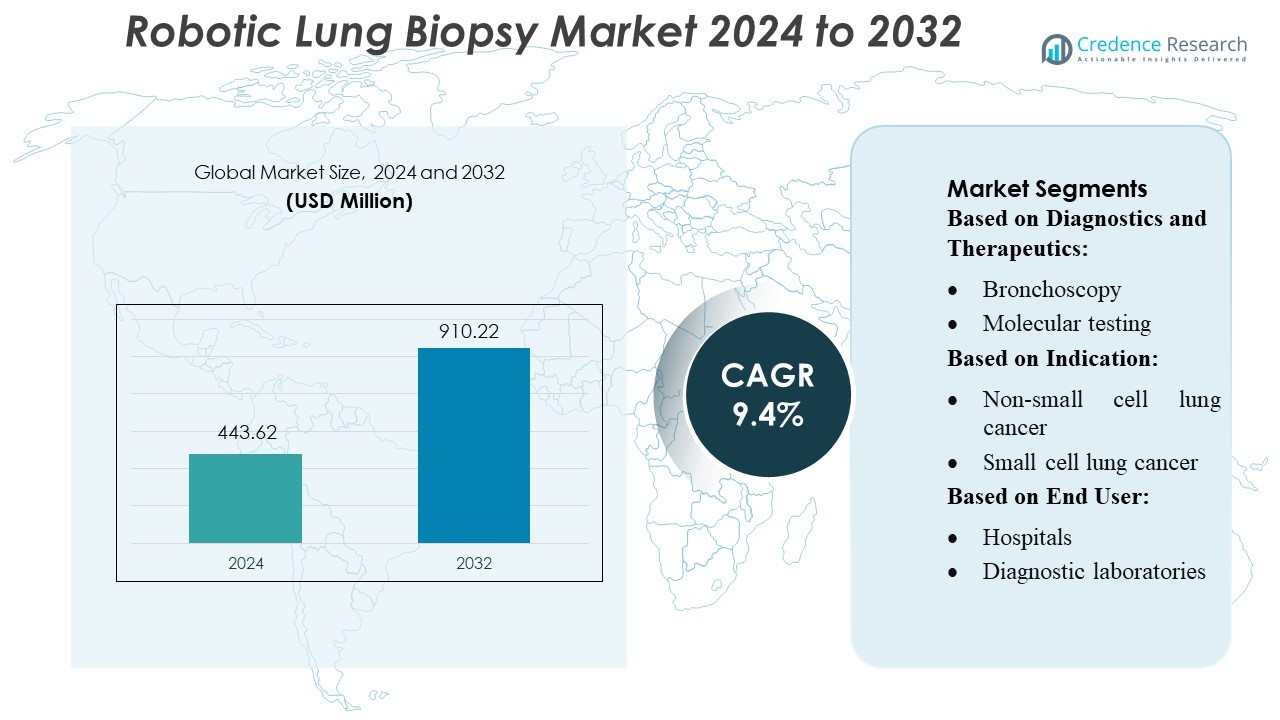

Robotic Lung Biopsy Market size was valued USD 443.62 million in 2024 and is anticipated to reach USD 910.22 million by 2032, at a CAGR of 9.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Robotic Lung Biopsy Market Size 2024 |

USD 443.62 Million |

| Robotic Lung Biopsy Market, CAGR |

9.4% |

| Robotic Lung Biopsy Market Size 2032 |

USD 910.22 Million |

The Robotic Lung Biopsy Market features strong competition among global medical-technology innovators, with top players focusing on advanced robotic bronchoscopy systems, integrated imaging platforms, and AI-supported navigation technologies to improve diagnostic accuracy. These companies continue to strengthen their portfolios through clinical collaborations, product enhancements, and global expansion initiatives aimed at increasing adoption of minimally invasive lung biopsy solutions. North America leads the market with an exact market share of 40%, driven by early technology adoption, well-established healthcare infrastructure, and a high volume of lung cancer screening procedures. This regional dominance is reinforced by continuous investments in robotics, digital health integration, and precision oncology diagnostics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Robotic Lung Biopsy Market was valued at USD 443.62 million in 2024 and is projected to reach USD 910.22 million by 2032, registering a 4% CAGR, supported by rising demand for minimally invasive and precision-based diagnostic procedures.

- Growing adoption of robotic bronchoscopy, expanding lung cancer screening programs, and technological advancements in AI-enabled navigation systems continue to drive market growth across key end-user segments.

- Increasing integration of real-time imaging, robotics–software fusion, and enhanced workflow automation defines major market trends, strengthening clinical accuracy and procedural efficiency.

- High equipment costs, limited reimbursement in developing economies, and the need for specialized training remain major restraints, slowing adoption across smaller healthcare facilities.

- North America holds a 40% share, leading global adoption, while diagnostics remain the dominant segment with over 55% share, driven by growing use of robotic systems for accurate sampling of peripheral pulmonary nodules.

Market Segmentation Analysis:

By Diagnostics and Therapeutics:

The diagnostics segment dominates the robotic lung biopsy market, led by bronchoscopy, which accounts for an estimated 42–45% market share owing to its high procedural accuracy and compatibility with robotic navigation systems. Molecular testing continues to expand rapidly as robotics enables more precise sample acquisition for genomic profiling. Imaging technologies, including real-time 3D mapping, support improved lesion localization and have strengthened adoption among centers performing complex biopsies. Other diagnostic methods remain niche but benefit from increasing integration of AI-assisted robotic tools that enhance workflow efficiency and reduce sampling errors.

- For instance, Acumed LLC has developed implant systems manufactured to tolerances as tight as 0.02 mm in its orthopedic portfolio, demonstrating engineering precision capabilities that are increasingly relevant as the company explores opportunities to support advanced robotic procedural tools requiring sub-millimeter accuracy.

By Indication:

Non-small cell lung cancer (NSCLC) represents the dominant indication, contributing nearly 70% of total procedural volume, driven by the high global prevalence of NSCLC and the need for early, minimally invasive biopsy of small peripheral nodules. Robotic platforms enhance reach and stability, enabling higher diagnostic yield in NSCLC cases compared to conventional bronchoscopy. Small cell lung cancer (SCLC) accounts for a smaller share but is steadily growing as robotic systems improve access to hard-to-reach lesions and support more accurate tissue retrieval for molecular characterization and treatment planning.

- For instance, Zimmer Biomet’s ROSA robotic platform has been installed in nearly 2,000 centers globally, positioning the company as a robotics leader.

By End User:

Hospitals lead the end-user segment with over 60% market share, supported by higher adoption of integrated robotic bronchoscopy suites, strong reimbursement capabilities, and availability of skilled pulmonologists. Diagnostic laboratories show increasing uptake as demand rises for precise robotic-assisted tissue sampling compatible with advanced pathology and genomic assays. Specialty clinics demonstrate moderate growth, benefiting from compact robotic systems and outpatient-friendly workflows. Other end-use settings remain limited but are expanding gradually as technology costs decline and portable robotic solutions broaden accessibility.

Key Growth Drivers

- Rising Prevalence of Lung Cancer and Need for Earlier, More Accurate Diagnosis

The increasing global incidence of lung cancer is driving demand for precise diagnostic solutions, positioning robotic lung biopsy systems as critical tools. Hospitals are adopting these systems to improve early detection by enabling enhanced navigation, stable needle positioning, and higher sampling accuracy for small nodules. Their ability to reach peripheral lesions—where conventional bronchoscopy often fails—supports improved diagnostic confidence. As clinicians emphasize minimally invasive methods that reduce complications, robotic biopsy platforms gain strong traction across high-burden regions.

- For instance, MedGenome Labs has processed over 60,000 NIPT samples since 2017, validating its proprietary Claria NIPT (based on Illumina’s VeriSeq) with 100% concordance in sex-chromosome aneuploidy detection across 51 high-risk cases.

- Technological Advancements in Robotic Navigation and Imaging Integration

Advances in robotic-assisted bronchoscopy, including real-time 3D imaging, augmented navigation, and AI-enhanced lesion targeting, significantly strengthen market growth. These technologies improve procedural precision, increase diagnostic yield, and reduce variability across operators. The integration of CT-to-body divergence correction, electromagnetic guidance, and robotic articulation enhances access to deep pulmonary pathways. Manufacturers are also developing compact systems with intuitive interfaces, enabling greater adoption among mid-sized hospitals. Continuous R&D toward automation and cloud-based analytics further elevates system performance and clinical confidence.

- For instance, Smith+Nephew’s installed base of CORI systems now exceeds 1,000 units, underscoring rapid adoption of its compact, data-driven robotics platform.

- Growing Preference for Minimally Invasive, Outpatient Diagnostic Pathways

Healthcare providers are increasingly prioritizing minimally invasive procedures that reduce hospital stays, complications, and overall diagnostic delays. Robotic lung biopsy systems support this shift by offering safer, outpatient-compatible approaches with improved patient recovery profiles. The capability to lower pneumothorax risk compared to CT-guided percutaneous biopsies strengthens their value proposition. Payers and health systems favor technologies that reduce downstream costs associated with repeat diagnostic procedures. As patient volumes rise, outpatient pulmonary centers adopt robotic systems to enhance efficiency and standardize biopsy workflows.

Key Trends & Opportunities

- Integration of Artificial Intelligence for Predictive Targeting and Workflow Optimization

AI integration is emerging as a major opportunity, enabling more accurate lesion identification, automated pathway planning, and improved real-time decision support. Machine learning models enhance targeting precision by predicting anatomical movement and compensating for CT-to-body divergence. Vendors are incorporating AI-driven analytics to reduce procedure time and support operator training. As datasets expand across health networks, AI-powered platforms can standardize diagnostic outcomes, reduce variability, and drive widespread adoption in high-volume centers seeking consistent, high-quality biopsy results.

- For instance, PROPHECY® patient-specific guides, which use CT-based 3D modeling with over 25,000 preoperative planning datasets validated for reproducible alignment accuracy.

- Expansion of Robotic Biopsy Adoption in Ambulatory and Mid-Sized Healthcare Facilities

As robotic systems become more compact, cost-efficient, and easier to use, opportunities emerge in outpatient centers and regional hospitals that previously relied on manual bronchoscopy. Lower operating costs, modular system designs, and simplified workflow integration enable broader market penetration. Ambulatory settings benefit from reduced procedure time, fewer complications, and higher patient throughput. This trend aligns with global healthcare shifts toward decentralized diagnostics, creating strong demand for scalable robotic biopsy platforms tailored to medium-volume facilities.

- For instance, Bioretec is developing specialized coatings for the RemeOs™ alloy to better control degradation rates, backed by a publicly funded 0.97 million R&D grant from Business Finland.

- Increasing Collaboration Between Imaging, Robotics, and Tele-Navigation Technology Providers

Strategic partnerships among robotics manufacturers, imaging companies, and digital health platforms are accelerating innovation. Collaborative ecosystems enable unified imaging-navigation interfaces, improved interoperability, and remote procedural support. These integrated solutions optimize biopsy planning, enhance user experience, and reduce training barriers. Vendors leveraging tele-navigation and cloud-based data sharing create competitive advantages in multi-site hospital networks. Such collaborations unlock opportunities for next-generation robotic platforms capable of delivering standardized, high-precision diagnostics across diverse clinical environments.

Key Challenges

- High Capital and Maintenance Costs Limiting Adoption in Resource-Constrained Settings

The substantial upfront investment required for robotic biopsy systems remains a significant barrier, particularly for smaller hospitals and emerging markets. Costs associated with installation, maintenance, disposable tools, and operator training further compound financial challenges. Budget-constrained facilities often prioritize essential diagnostic equipment over advanced robotics, slowing market penetration. Reimbursement limitations for robotic procedures in certain regions also deter adoption. Vendors must address affordability through flexible financing models, cost-optimized platforms, and subscription-based service models to expand global reach.

- Technical Complexity and Need for Specialized Training Impact Workflow Adoption

Despite technological advancements, system complexity and the need for skilled operators create adoption hurdles. Effective use of robotic platforms requires structured training, familiarity with navigation software, and proficiency in handling challenging anatomical variations. Hospitals may experience extended onboarding periods and workflow disruptions during early implementation. Variability in clinician learning curves can affect diagnostic accuracy and procedure time. Without standardized training programs and user-friendly interfaces, healthcare facilities may struggle to fully realize the value of robotic biopsy systems.

Regional Analysis

North America

North America dominates the robotic lung biopsy market with an estimated 38–42% share, driven by early adoption of robotic-assisted bronchoscopy systems and strong reimbursement frameworks. The U.S. leads regional demand due to high lung cancer prevalence, rapid integration of platforms such as robotic navigation bronchoscopy, and increasing preference for minimally invasive diagnostic procedures. Growth is further supported by the presence of major device manufacturers, continuous technological advancements, and a well-established clinical ecosystem. Canada contributes steadily to regional expansion as investments in advanced oncology diagnostics rise across major healthcare networks, strengthening overall market penetration.

Europe

Europe accounts for approximately 26–30% of the global robotic lung biopsy market, supported by widespread deployment of advanced endoscopic robotics across Germany, the U.K., France, and the Nordics. Demand is driven by the region’s strong regulatory emphasis on early lung cancer detection and hospital investments in precision diagnostic technologies. Germany remains the leading market due to high procedural volumes and robust technology adoption, while the U.K. accelerates adoption through national cancer screening initiatives. Increasing clinical validation studies conducted across European academic centers continue to strengthen acceptance of robotic navigation tools, contributing to steady regional growth.

Asia-Pacific

Asia-Pacific represents a rapidly expanding market with an estimated 20–24% share, fueled by rising lung cancer incidence, expanding healthcare infrastructure, and increasing adoption of next-generation robotic bronchoscopy platforms. China and Japan lead regional demand, driven by government-supported diagnostic upgrades and growing acceptance of minimally invasive procedures. India and South Korea demonstrate strong growth potential as tertiary hospitals integrate robotic-assisted diagnostics to improve accuracy in peripheral pulmonary lesion sampling. Favorable economic growth, expanding private healthcare networks, and investments in advanced oncology technologies position Asia-Pacific as the fastest-growing region in the forecast period.

Latin America

Latin America holds around 6–8% of the global market, with growth supported by rising awareness of early lung cancer detection and gradual modernization of diagnostic infrastructure. Brazil dominates regional adoption due to increasing deployment of robotic systems in premium hospitals and rising investments in advanced oncology care. Mexico, Argentina, and Chile show growing interest in robotic-assisted biopsy solutions as clinical outcomes improve and access to minimally invasive diagnostics expands. Although cost constraints and limited reimbursement slow broader penetration, strategic partnerships with global device manufacturers are helping strengthen regional capability and market expansion.

Middle East & Africa

The Middle East & Africa region captures approximately 4–6% of the robotic lung biopsy market, driven primarily by high-value healthcare investments across the Gulf Cooperation Council (GCC) countries. The UAE and Saudi Arabia lead adoption as tertiary hospitals integrate robotic platforms to enhance diagnostic accuracy and reduce procedural risks. Africa remains in an early stage of adoption due to cost barriers, limited specialized facilities, and lower awareness of robotic diagnostics. However, expanding oncology centers, improving healthcare expenditure, and strategic collaborations with international technology providers are gradually improving access and supporting long-term market growth.

Market Segmentations:

By Diagnostics and Therapeutics:

- Bronchoscopy

- Molecular testing

By Indication:

- Non-small cell lung cancer

- Small cell lung cancer

By End User:

- Hospitals

- Diagnostic laboratories

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Robotic Lung Biopsy Market players such as Acumed LLC, Zimmer Biomet, Cardinal Health, Medtronic, Smith+Nephew, Wright Medical Group N.V., Integra LifeSciences Corporation, Bioretec GmbH, Stryker, and Medical Device Business Services, Inc. The Robotic Lung Biopsy Market is defined by rapid technological advancement and increasing investments in precision diagnostics. Companies prioritize the development of robotic-assisted bronchoscopy systems, AI-enabled navigation platforms, and real-time imaging technologies to enhance accuracy in sampling peripheral pulmonary lesions. Competition intensifies as firms expand clinical validation studies, strengthen global distribution networks, and pursue regulatory approvals across major markets. The industry also sees rising collaboration between hospitals, technology developers, and research institutions to improve workflow efficiency and reduce procedural complications. Continuous innovations in robotics, software integration, and minimally invasive biopsy tools shape the market’s long-term growth trajectory.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Acumed LLC

- Zimmer Biomet

- Cardinal Health

- Medtronic

- Smith+Nephew

- Wright Medical Group N.V.

- Integra LifeSciences Corporation

- Bioretec GmbH

- Stryker

- Medical Device Business Services, Inc.

Recent Developments

- In June 2025, King’s College London unveiled nanoneedle patches that perform painless real-time tissue sampling, signaling a potential shift away from conventional biopsy needles.

- In August 2024, Illumina, Inc. received approval for in vitro diagnostic (IVD) TruSight Oncology (TSO), cancer biomarker tests with its two companion diagnostic indications to rapidly match patients to targeted therapies.

- In June 2024, RevelAi Health and Zimmer Biomet entered into a multi-year partnership focused on co-marketing generative artificial intelligence (AI) solutions aimed at enhancing value-based orthopedic care and promoting health equity. As part of this collaboration, Zimmer Biomet is expected to market RevelAi Health’s patient care management platform, which includes a dashboard for care teams and other forthcoming products.

- In June 2024, Guardant Health, Inc. announced the launch of an updated version of the Guardant360 TissueNext test with an expanded identification of genes in tissue samples to 498. This helps enable oncologists to identify treatment strategies and targeted therapies for patients with advanced cancer.

Report Coverage

The research report offers an in-depth analysis based on Diagnostics and Therapeutics, Indication, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance as robotic platforms achieve higher precision for sampling small and hard-to-reach pulmonary nodules.

- AI integration will enhance navigation accuracy, real-time lesion localization, and clinical decision support.

- Hospitals will increasingly adopt robotic bronchoscopy to improve diagnostic yield and reduce complication rates.

- Expanding lung cancer screening programs will drive a higher volume of early-stage diagnostic procedures.

- Manufacturers will focus on developing compact, cost-effective robotic systems to enable wider global adoption.

- Strategic collaborations between technology firms and healthcare institutions will accelerate innovation and clinical validation.

- Regulatory approvals for next-generation robotic tools will improve market penetration across emerging regions.

- Workflow automation and software-driven guidance will shorten procedure times and improve physician efficiency.

- Training programs and simulation-based learning will expand, supporting faster clinical integration of robotic systems.

- Enhanced imaging-robotics fusion technologies will elevate diagnostic confidence and support personalized treatment planning.