Market Overview:

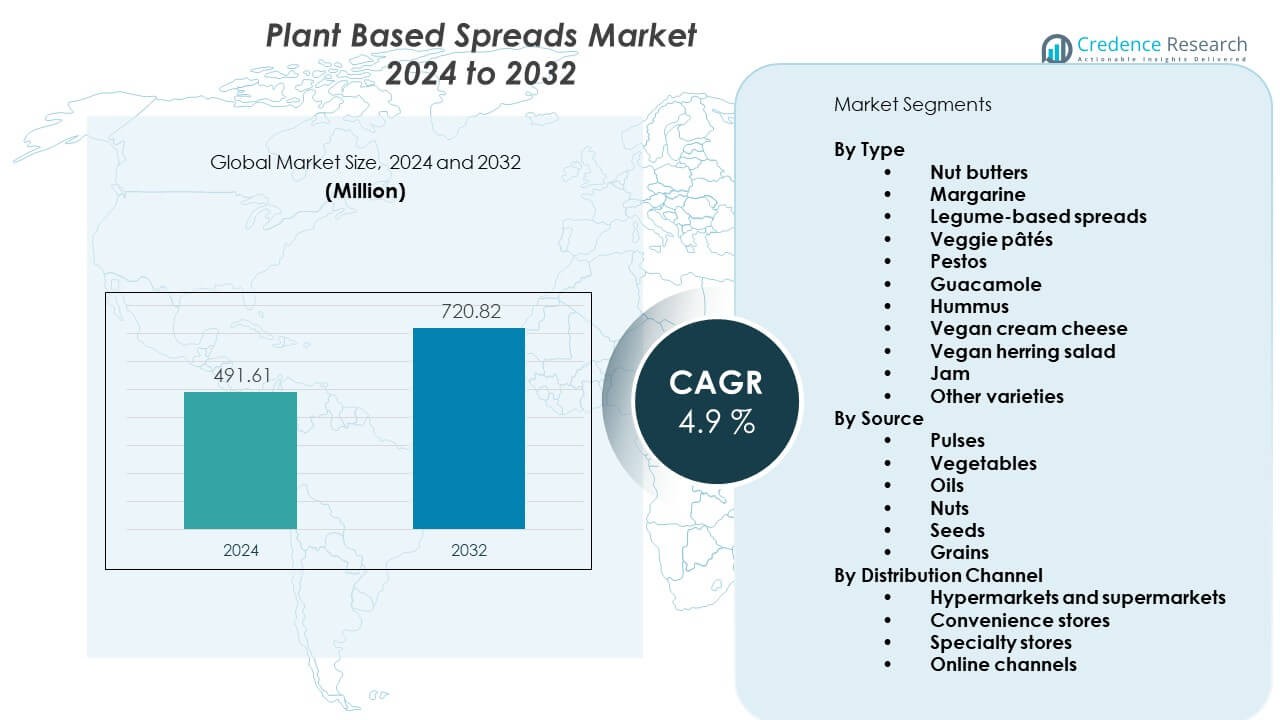

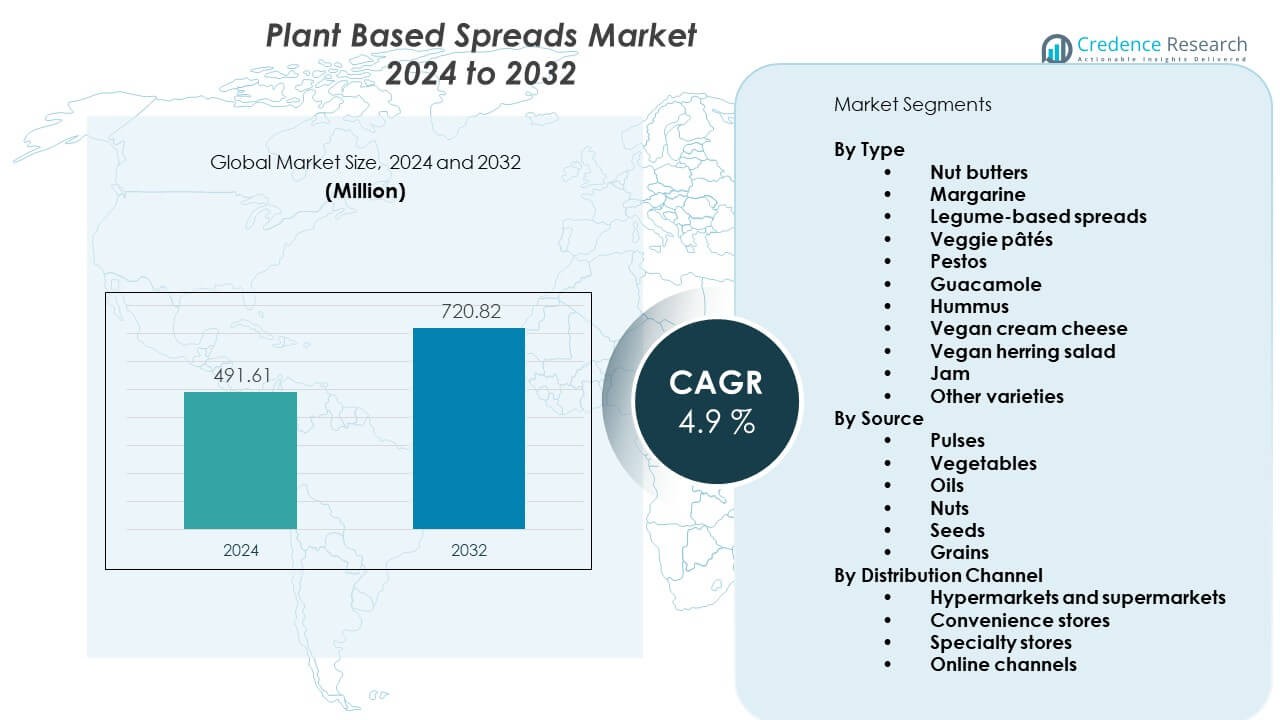

The Plant based spreads market is projected to grow from USD 491.61 million in 2024 to USD 720.82 million by 2032, reflecting a CAGR of 4.9% from 2024 to 2032. Demand rises due to clean-label trends and wider use in daily meals.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plant based spreads market Size 2024 |

USD 491.61 Million |

| Plant based spreads market, CAGR |

4.9% |

| Plant based spreads market Size 2032 |

USD 720.82 Million |

The market grows due to strong interest in dairy-free diets and rising concern over animal-based fat intake. Brands introduce new blends that use nuts, seeds, and plant oils for better taste. Many buyers choose vegan options for health goals and easier digestion. Food makers use plant fats to reduce cholesterol levels in common meals. Retailers expand shelf space for vegan choices in busy urban stores. Restaurants add dairy-free spreads to support flexible menus. Social media awareness also drives steady interest across young buyers.

North America leads due to strong vegan adoption and wide brand availability. Europe follows due to strict sustainability rules and long interest in plant foods. Germany and the U.K. show high demand due to rising lactose-free diets. Asia Pacific emerges fast as buyers shift toward healthier breakfast habits. China and India expand use of plant spreads in bakery and home meals. Latin America grows as supermarkets add more dairy-free choices in large cities. Middle East & Africa show early growth supported by rising health awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Plant based spreads market is valued at USD 491.61 million in 2024 and is projected to reach USD 720.82 million by 2032, growing at a 9% CAGR driven by clean-label demand and dairy-free adoption.

- North America (38%), Europe (34%), and Asia Pacific (20%) lead due to strong vegan acceptance, wide retail availability, and rising health awareness.

- Asia Pacific, with a 20% share, is the fastest-growing region supported by expanding retail networks and increasing interest in dairy alternatives.

- By type, nut butters hold the largest share due to strong breakfast usage and protein appeal.

- By distribution channel, hypermarkets and supermarkets command the highest share due to strong visibility and frequent household purchases.

Market Drivers:

Rising Shift Toward Plant-Based Nutrition and Better Everyday Health Choices

The Plant based spreads market gains steady support from consumers who prefer clean-label foods. Buyers choose plant oils, nuts, and seeds to reduce reliance on dairy fats. Many households adopt vegan or lactose-free diets for easier digestion and wellness goals. Brands launch new formulations that improve texture and flavor without synthetic additives. Supermarkets highlight plant spreads in high-traffic aisles to meet rising demand. Restaurants add dairy-free choices to widen menu flexibility for diverse diners. It benefits from strong interest in cholesterol-conscious eating across major cities. Health-driven shoppers help sustain long-term momentum for new launches.

- For instance, almond butter delivers 3.4 grams of protein per tablespoon along with 3.87 milligrams of Vitamin E and 44.6 milligrams of magnesium. Brands launch new formulations that improve texture and flavor without synthetic additives.

Growing Retail Penetration Across Urban Stores and Expanding Foodservice Use

Retail chains increase shelf space for plant spreads to meet weekly purchase cycles. Urban supermarkets introduce multiple variants to support different meal habits. Foodservice operators use dairy-free spreads in bakery items and breakfast dishes. The Plant based spreads market gains visibility through private-label ranges targeting value-focused buyers. Many cafes rely on nut-based spreads to serve allergy-aware customers. Product makers enhance stability for warm-kitchen applications and wide batch production. Online grocery platforms push vegan items through bundled deals and fast delivery. It benefits from broader distribution partnerships that strengthen category presence.

- For instance, almond milk achieved 3.6 percent menu penetration with 41 percent growth over four years, while oat milk menu appearances rose from nearly zero to 1.9 percent penetration. Product makers enhance stability for warm-kitchen applications and wide batch production. Online grocery platforms push vegan items through bundled deals and fast delivery.

Continuous Product Innovation With Cleaner Ingredients and Improved Taste Profiles

Brands invest in new formulations that reduce saturated fat levels and improve spreadability. Many producers use cold-pressed oils to maintain natural flavor quality. The Plant based spreads market gains strength from better emulsification techniques that improve shelf life. Companies explore new bases such as cashew, almond, and sunflower to boost nutrition. Research teams work on creamier textures for direct bread use and cooking needs. It grows due to recipes that match familiar dairy mouthfeel with lower fat. Labels promote non-GMO status to appeal to premium buyers. Wider innovation encourages cross-category use in snacks and home baking.

Growing Awareness of Environmental Impact Linked to Dairy Alternatives Adoption

Shoppers turn toward plant options to reduce environmental strain from dairy supply chains. Many consumers view plant spreads as a lower-impact choice for daily meals. The Plant based spreads market benefits from strong interest in sustainable fats sourced from plants. Producers use eco-friendly packaging to attract environmentally aware buyers. It receives attention from climate-focused groups encouraging reduced dairy use. Governments promote plant-based choices through wellness education programs. Supply chains adopt sustainable farming practices for nuts and oilseeds. Rising visibility of climate messaging supports higher product adoption.

Market Trends

Rising Demand for Premium Flavors and Global Culinary Influence

The Plant based spreads market sees higher interest in gourmet flavors inspired by global cuisines. Consumers select chili-infused, herb-blended, or roasted nut variants for meal diversity. Brands introduce richer textures to support premium breakfast formats. It gains traction through spreads designed for pairing with artisanal bread. Many buyers experiment with bold and fusion flavors at home. Food influencers promote specialty plant spreads in recipe videos. Retailers use flavor-led assortments to lift impulse purchases. Evolving taste preferences support premium-tier product launches.

- For instance, Litehouse introduced two new product lines in the summer of 2024: the Litehouse Loadedsavory dips and the Litehouse Kids line. The Loaded varieties—which include Fry Sauce, Taco Sauce, and Buffalo Sauce—feature bold flavor profiles and are designed to elevate meals and snacks, not with pretzel bits and chocolate chunks, but with savory ingredients. This launch aligns with broader industry practices, as retailers use flavor-led assortments to boost impulse purchases, and evolving consumer taste preferences support premium product launches.

Expansion of High-Protein and Functional Spread Formulations

Producers develop high-protein spreads that support active lifestyle needs. Many launches highlight added vitamins, omega oils, and fiber. The Plant based spreads market benefits from strong interest in functional foods that support wellness goals. Brands use pea protein and seed blends to raise nutritional value. It attracts fitness-oriented consumers seeking dairy-free protein sources. Formulations position plant spreads as nutrient-dense meal add-ons. Retailers feature functional choices near health-food sections. Growing focus on fortified spreads helps widen audience reach.

- For instance, Nuts ‘N More offers high-protein peanut butter with 9 grams of protein per serving, enhanced with added omega fatty acids from flax. It attracts fitness-oriented consumers seeking dairy-free protein sources.

Shift Toward Minimal-Ingredient and Ultra-Clean Label Products

Consumers look for simple ingredients with clear sourcing information. Many shoppers avoid additives and artificial stabilizers. The Plant based spreads market gains visibility through labeling that highlights purity and transparency. Producers shorten ingredient lists to reassure label-sensitive buyers. It benefits from rising demand for natural flavors and cold-processed oils. Brands emphasize allergen-friendly claims to attract new users. Retailers promote clean-label assortments through health-focused store zones. This trend pushes companies toward natural emulsifiers and simpler formulations.

Growing Adoption of Sustainable Packaging and Ethical Sourcing Models

Brands invest in biodegradable or recyclable containers to reduce waste. Many producers highlight ethical sourcing of nuts and seeds. The Plant based spreads market benefits from sustainability messaging across retail channels. Companies partner with certified farms to strengthen supply transparency. It appeals to buyers who prioritize responsible agricultural practices. Packaging innovations support longer shelf life with lower impact. Retailers reward sustainable brands with better shelf placement. Trendlines show steady growth in eco-conscious product ranges.

Market Challenges Analysis:

High Production Costs and Limited Raw Material Stability Across Regions

The Plant based spreads market faces cost pressure from nuts, seeds, and plant oils. Many of these ingredients experience price swings due to climate risks. Producers struggle to maintain stable formulations during raw material shortages. It requires careful sourcing strategies to handle seasonal volatility. Brands must balance cleaner recipes with rising ingredient expenses. Smaller firms face difficulty competing with large manufacturers on sourcing. Retailers push for competitive pricing even during cost spikes. This creates margin stress across distribution networks.

Taste Familiarity Gaps and Slower Conversion Among Traditional Dairy Consumers

Many buyers still prefer the taste and texture of dairy-based spreads. The Plant based spreads market works to narrow this gap with better formulations. Brands invest in sensory research to match dairy-like performance. It needs strong marketing efforts to convince first-time users. Older consumers adopt plant spreads at a slower pace due to habit loyalty. Some regions lack awareness of plant-based alternatives. Retail trials sometimes face low repeat purchases due to unfamiliar taste. Firms must improve flavor consistency to support wider household adoption.

Market Opportunities:

Expansion Into Foodservice, Bakery Chains, and Ready-Meal Manufacturers

The Plant based spreads market can scale through strong partnerships with bakery outlets and cafes. Many chains need dairy-free options to meet rising dietary requests. It can support multiple menu uses, including breakfast toppings and sandwich fillings. Producers can supply bulk packs tailored for high-volume kitchens. Brands can also develop cooking-friendly variants for ready-meal makers. Retail meal kits offer another opportunity for plant-based flavor bases. Wider foodservice integration strengthens category visibility and trial rates. Growth in fast-casual dining supports new placement opportunities.

Innovation in Premium, Organic, and Allergen-Free Formulations Across Retail Channels

The Plant based spreads market can grow through organic lines that attract health-driven buyers. Many consumers seek allergen-free choices due to rising sensitivity concerns. It can introduce new blends made from seeds, oats, and legumes. Retailers favor premium plant spreads for wellness-focused aisles. Companies can highlight ethical sourcing to support brand loyalty. Improved flavor engineering can attract traditional dairy users. Product diversification helps brands enter new demographic groups. Strengthening innovation pipelines unlocks long-term category expansion.

Market Segmentation Analysis:

By Type

The Plant based spreads market includes a wide range of products that cater to varied taste and nutrition needs. Nut butters hold strong adoption due to their protein content and daily breakfast use. Margarine maintains steady demand among buyers shifting from dairy fats. Legume-based spreads, veggie pâtés, and pestos attract consumers seeking clean-label options. Guacamole and hummus show strong traction in snacks and meal-prep formats. Vegan cream cheese and vegan herring salad support growth in alternative dairy sections. Jam and other varieties offer flexibility across sweet and savory applications. It benefits from wide product diversity that supports repeat purchases.

By Source

Producers rely on pulses, vegetables, oils, nuts, seeds, and grains to meet varied formulation needs. Nuts and seeds dominate due to strong flavor, natural fats, and nutritional value. Oils support smooth textures suitable for bread spreads and cooking uses. Pulses and vegetables help brands create lower-fat options for health-driven buyers. Grains appear in new recipes designed for mild flavor profiles. Each source supports different functional goals in product design. It gains strength from clear sourcing transparency that appeals to label-conscious shoppers.

By Distribution Channel

Hypermarkets and supermarkets lead due to strong visibility and frequent household purchases. Convenience stores support impulse buying of small packs. Specialty stores attract premium buyers who seek organic and vegan lines. Online channels grow fast due to wider assortment and subscription models. Retail expansion improves brand reach across urban and semi-urban zones. It benefits from strong placement strategies that lift overall category exposure.

Segmentation:

By Type

- Nut butters

- Margarine

- Legume-based spreads

- Veggie pâtés

- Pestos

- Guacamole

- Hummus

- Vegan cream cheese

- Vegan herring salad

- Jam

- Other varieties

By Source

- Pulses

- Vegetables

- Oils

- Nuts

- Seeds

- Grains

By Distribution Channel

- Hypermarkets and supermarkets

- Convenience stores

- Specialty stores

- Online channels

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The plant based spreads market holds its largest share in North America at 38%, supported by high adoption of dairy-free diets and strong penetration of premium vegan brands. Consumers choose plant spreads for health goals and flexible meal habits. Retail chains support wide product visibility through diverse assortments. It benefits from strong demand in the U.S. driven by wellness trends and high purchasing power. Canada strengthens regional growth with rising interest in natural fats sourced from nuts and seeds. Foodservice operators increase menu integration to meet changing dietary needs. Strong brand presence helps maintain market leadership across major cities.

Europe

Europe contributes 34% of global demand, driven by sustainability awareness and long-standing interest in plant-forward nutrition. Buyers prefer nut butters, hummus, and clean-label spreads that fit daily meal routines. It grows through strong regulations that encourage transparent sourcing and low-fat alternatives. Germany, the U.K., and France show high household penetration due to diverse vegan offerings. Retailers highlight organic and allergen-friendly options to support health-focused shoppers. Mediterranean regions lift demand for pestos and vegetable-based spreads. Strong cultural acceptance of plant foods supports steady expansion.

Asia Pacific, Latin America, and Middle East & Africa

Asia Pacific holds 20% share and emerges fast due to rising awareness of dairy-free diets. Buyers in China and India adopt plant spreads for breakfast and bakery use. It benefits from expanding retail networks that introduce new flavors and pack formats. Latin America accounts for 5%, supported by new product availability in urban supermarkets. Middle East & Africa hold 3%, driven by rising interest in clean-label foods among younger consumers. Growth across these regions improves due to wider online access and greater exposure to global food trends. Increasing health focus supports long-term adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Upfield (Flora, Becel, Country Crock)

- Unilever (The Vegetarian Butcher)

- Conagra Brands (Earth Balance)

- Miyoko’s Creamery

- Violife

- Forager Project

- Kite Hill

- Nutiva

- Daiya Foods Inc.

- Amy’s Kitchen Inc.

- Meridian Foods Limited

- B&G Foods, Inc.

- Litehouse Inc.

- Good Foods Group LLC

- Majestic Garlic

- Bear Pond Farm

- Frito-Lay North America, Inc.

- Galaxy Nutritional Foods, Inc.

- Wayfare Health Foods

Competitive Analysis:

The Plant based spreads market features strong competition among global and regional brands that focus on clean-label recipes and dairy-free alternatives. Upfield, Unilever, Conagra Brands, Miyoko’s Creamery, and Violife lead through broad portfolios and wide retail access. It gains intensity from new entrants that promote organic and allergen-free options. Established brands use advanced formulations to improve texture and flavor performance. Private-label ranges expand rapidly in supermarkets and challenge premium brands. Companies invest in sourcing transparency to strengthen consumer trust. Digital campaigns help brands increase engagement with younger buyers. Market players focus on product innovation to maintain visibility in crowded retail shelves.

Recent Developments:

- In November 2025, Miyoko’s Creamery entered the assignment for the benefit of creditors process (a bankruptcy alternative), opening a bidding process for interested parties. Founder Miyoko Schinner mobilized over $100,000 from crowd investors to mount a bid to buy back the vegan cheese company she founded 11 years ago, though she ultimately was not successful in her acquisition attempt.

- In November 2025, Daiya Foods Inc. announced a new strategic relationship with MicroSalt plc, receiving an initial order of $50,000 with projected 2026 volume of approximately $500,000. MicroSalt expects to be integrated into Daiya Foods’ portfolio of product lines, with an initial focus on cheese and pizza dough, supporting Daiya’s mission to provide delicious, accessible, and healthier plant-based alternatives.

- In November 2025, Good Foods Group revealed a refresh of its brand identity with updated packaging across the brand’s portfolio of products hitting shelves at retailers nationwide, including Target, Costco, Kroger, Sprouts, and Publix. The refresh includes a sunny new logo, playful typography, ingredient photography, and updated packaging that allows consumers to better view the product’s color and texture.

- In October 2025, B&G Foods announced an agreement to sell its Green Giant and Le Sieur brands in Canada to Nortera Foods for an undisclosed amount, with the transaction expected to close by Q1 2026. The divestiture is another milestone in B&G’s ongoing effort to divest non-core brands, sharpen its focus, and reduce long-term debt.

Report Coverage:

The research report offers an in-depth analysis based on covering type, source, and distribution channels. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising focus on dairy-free diets will support long-term product diversification.

- Premium flavors and gourmet variants will see higher household adoption.

- Online retail channels will expand category reach across new consumer groups.

- Clean-label and minimal-ingredient spreads will continue to dominate launches.

- Foodservice integration will rise due to demand for vegan menu additions.

- Brands will adopt sustainable packaging to strengthen consumer trust.

- Emerging markets will drive demand through growing health awareness.

- Innovation in seed- and pulse-based formulations will gain momentum.

- Nut- and oil-based spreads will retain strong traction among urban buyers.

- Product reformulation will enhance taste profiles to attract dairy users.