Market Overview

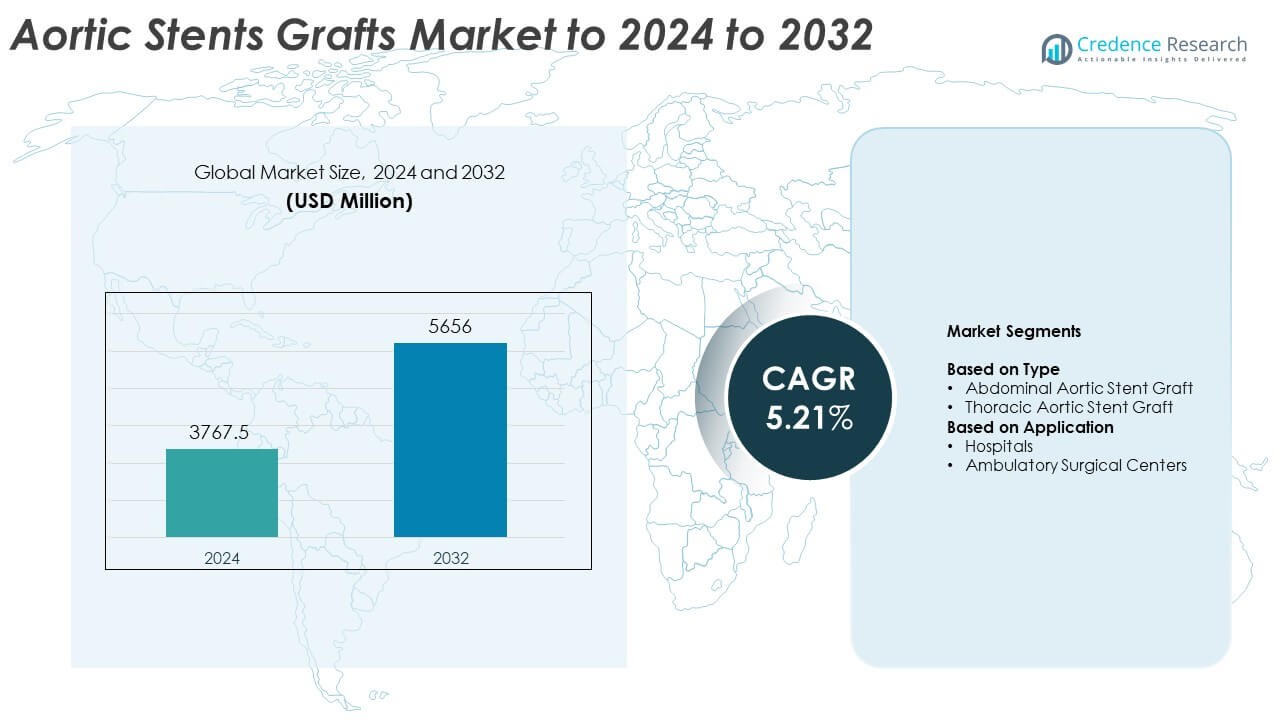

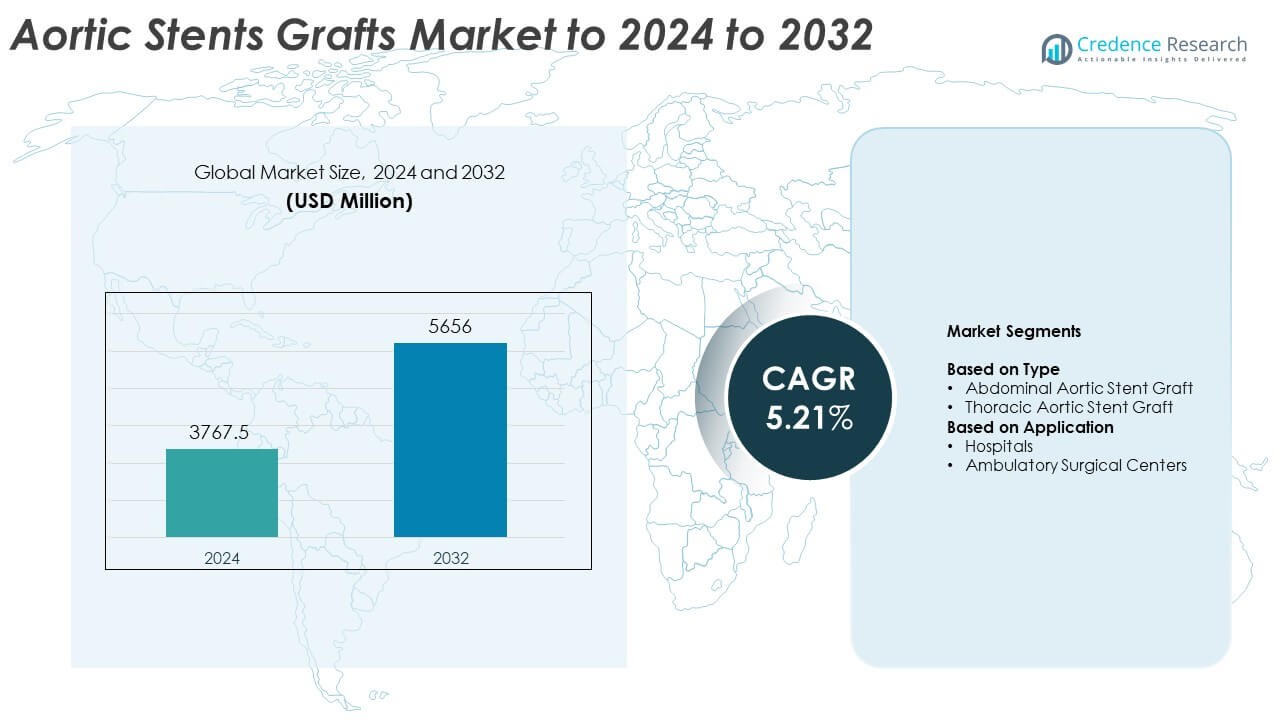

Aortic Stents Grafts Market size was valued at USD 3767.5 Million in 2024 and is anticipated to reach USD 5656 Million by 2032, at a CAGR of 5.21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aortic Stents Grafts Market Size 2024 |

USD 3767.5 Million |

| Aortic Stents Grafts Market, CAGR |

5.21% |

| Aortic Stents Grafts Market Size 2032 |

USD 5656 Million |

The Aortic Stents Grafts Market is shaped by leading companies including Terumo Corporation Inc., Cook Medical Inc., W.L. Gore & Associates Inc., Medtronic, MicroPort Scientific Corporation, ENDOLOGIX, INC., Lombard Medical, Inc., Cardinal Health, Becton, Dickinson and Company, and CryoLife, Inc. (Artivion Inc.). These players compete through advanced graft designs, expanded endovascular portfolios, and strong clinical evidence supporting safety and durability. North America leads the market with about 38% share in 2024 due to high EVAR and TEVAR adoption, strong screening programs, and robust vascular care infrastructure. Europe follows with around 31% share, supported by well-established vascular networks and wide use of minimally invasive repair.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Aortic Stents Grafts Market reached USD 3767.5 Million in 2024 and is projected to reach USD 5656 Million by 2032, advancing at a CAGR of 5.21%.

- Market growth is driven by rising aortic aneurysm cases, strong adoption of minimally invasive EVAR and TEVAR procedures, and wider use of advanced imaging that supports early diagnosis and precise graft placement.

- Key trends include rapid development of flexible, durable graft materials, expansion of personalized graft designs for complex anatomies, and increasing investments in hybrid operating rooms across major hospitals.

- The market features strong competition among global players focusing on improved sealing performance, reduced endoleak risks, and wider regulatory approvals, with abdominal aortic stent grafts leading the type segment at about 58% share in 2024.

- North America leads with nearly 38% share in 2024 due to advanced vascular infrastructure, followed by Europe at about 31%, while Asia Pacific grows fastest with expanding endovascular capabilities and rising screening programs.

Market Segmentation Analysis:

By Type

Abdominal Aortic Stent Graft leads this segment with about 58% share in 2024. Adoption rises due to the high global prevalence of abdominal aortic aneurysms and strong clinical preference for minimally invasive endovascular repair. Surgeons choose abdominal grafts because these devices reduce operative risks, shorten recovery time, and improve long-term patency. Thoracic Aortic Stent Grafts grow at a steady pace as hospitals expand thoracic endovascular aortic repair capabilities and invest in advanced imaging systems that support complex aortic interventions.

- For instance, Medtronic reports in its 2024 clinical evidence documentation that the Endurant stent graft system has been chosen by physicians to treat over half a million patients worldwide.

By Application

Hospitals dominate this segment with nearly 71% share in 2024. Large hospitals treat higher volumes of aneurysm cases due to better access to hybrid operating rooms, vascular surgery teams, and advanced diagnostic tools. Demand rises as hospital systems expand endovascular programs to reduce open-surgery rates and improve patient outcomes. Ambulatory Surgical Centers show gradual growth, supported by shorter procedure times and rising adoption of day-care endovascular procedures in select low-risk cases.

- For instance, the Cleveland Clinic’s Aortic Surgery Outcomes report for 2023 states that surgeons performed 853 elective open procedures to repair the ascending aorta and aortic arch.

Key Growth Drivers

Rising Burden of Aortic Aneurysms

Growing global cases of abdominal and thoracic aortic aneurysms drive strong demand for stent graft systems. Ageing populations, higher smoking rates, and rising hypertension levels increase aneurysm detection in both developed and emerging regions. Hospitals adopt endovascular repair more widely because these procedures offer lower mortality and faster recovery compared with open surgery. Continuous improvements in imaging technology also help clinicians diagnose aneurysms earlier, further supporting market expansion.

- For instance, the NHS Abdominal Aortic Aneurysm (AAA) screening annual standards report for the screening year 2023 to 2024 (1 April 2023 to 31 March 2024) indicates that 2,004 aneurysms (aorta measuring 3.0cm or greater) were detected through an initial scan in England.

Shift Toward Minimally Invasive Endovascular Repair

Healthcare providers prefer endovascular procedures because these treatments reduce complications, hospital stays, and overall recovery time. Surgeons increasingly choose stent grafts as patient outcomes improve with advanced device flexibility, better sealing performance, and lower reintervention rates. Governments and insurers support minimally invasive surgery due to its cost efficiency and reduced patient burden. The growth of hybrid operating rooms also strengthens adoption as hospitals integrate vascular and imaging capabilities.

- For instance, Boston Scientific develops technologies for vascular interventions, but the typical hospital stay depends heavily on the specific procedure. For many minimally invasive endovascular procedures (e.g., peripheral stenting), patients can often go home the same day or within 24 hours.

Technological Advancements in Stent Graft Design

Manufacturers invest in improved graft materials, enhanced radial strength, and better conformability to suit complex anatomies. Newer devices offer greater durability, reduced endoleak risk, and enhanced compatibility with varied vessel structures. R&D in custom-made stent grafts also expands options for patients with rare or irregular aortic structures. These innovations help clinicians manage more complex cases safely, leading to broader acceptance and wider adoption across major care centers.

Key Trends and Opportunities

Growth of Personalized and Custom-Fit Stent Grafts

Demand rises for personalized devices that match complex anatomical variations, especially in challenging aneurysm cases. Custom-fit grafts allow better sealing, improved long-term durability, and reduced procedure risks. Manufacturers gain new opportunities by offering patient-specific solutions supported by advanced imaging and 3D modeling. Adoption grows in high-volume medical centers that treat a larger share of complex aortic pathologies.

- For instance, Cook Medical reports that there have been approximately 8,500 Zenith Fenestrated AAA Endovascular Graft proximal components implanted in the U.S. since 2019, in addition to the many thousands of implants that occurred between the commercial approval in 2012 and 2019

Expansion of Endovascular Procedures in Emerging Markets

Healthcare systems in Asia and Latin America invest heavily in vascular surgery infrastructure and hybrid operating rooms. Growing awareness, improved screening programs, and expanding insurance coverage help increase procedure volumes. Local hospitals adopt modern endovascular techniques as training programs expand and device availability improves. These regions offer strong long-term growth potential as access to advanced vascular care continues to rise.

- For instance, Sir Ganga Ram Hospital in New Delhi completed 1000 vascular surgeries in its Siemens Healthineers Artis Q hybrid operating room after installing the system in November 2018.

Increasing Use of Imaging and Navigation Technologies

The integration of high-resolution CT, intravascular ultrasound, and real-time navigation tools supports more accurate placement of stent grafts. These technologies reduce complications and improve procedural success rates. Hospitals use advanced imaging to manage complex anatomies, driving broader adoption of EVAR and TEVAR procedures. The trend also opens opportunities for device makers to build more imaging-compatible graft solutions.

Key Challenges

High Cost of Stent Graft Procedures and Devices

Advanced stent grafts remain expensive due to specialized materials, regulatory requirements, and manufacturing complexity. Hospitals in low-income regions struggle to adopt these devices because reimbursement policies remain limited. Patients often face high out-of-pocket expenses, slowing wider accessibility. These cost barriers restrict adoption outside major tertiary care centers and limit market growth in developing regions.

Complexity of Procedures and Risk of Postoperative Complications

Endovascular repairs require skilled vascular teams and advanced imaging infrastructure, which are not available in all hospitals. Complex anatomies increase the risk of endoleaks, graft migration, and the need for reintervention. Surgeons require extensive training to manage difficult cases safely, creating challenges for small and mid-sized centers. These clinical limitations delay broader global expansion of advanced stent graft systems.

Regional Analysis

North America

North America holds the largest share at about 38% in 2024 due to strong adoption of endovascular repair, high aneurysm screening rates, and widespread availability of hybrid operating rooms. The United States leads the region as hospitals invest in advanced imaging, custom stent grafts, and minimally invasive vascular programs. Growing awareness of abdominal aortic aneurysm risks further supports procedure volumes. Favorable reimbursement frameworks and strong presence of global manufacturers strengthen market growth. Canada also expands endovascular capacity, driven by rising demand for less invasive treatment options and improved access to vascular specialists.

Europe

Europe accounts for nearly 31% share in 2024, supported by advanced clinical infrastructure and high adoption of EVAR and TEVAR procedures across major healthcare systems. Countries such as Germany, France, the U.K., and Italy lead usage due to strong vascular surgery networks and well-established aneurysm screening programs. Demand grows as hospitals adopt next-generation grafts suited for complex anatomies. Government support for early detection and access to specialized vascular centers enhances treatment rates. Continued clinical research and trials across European institutions also contribute to steady market expansion.

Asia Pacific

Asia Pacific holds around 22% market share in 2024 and represents the fastest-growing region due to rising healthcare investment and improving access to vascular care. China, Japan, South Korea, and India drive growth as hospitals expand endovascular capabilities and build modern hybrid operating suites. Increasing awareness of aortic aneurysm symptoms and broader imaging availability support earlier diagnosis. Expanding insurance coverage improves access to EVAR and TEVAR procedures. Regional manufacturers also enhance device availability, enabling wider adoption of advanced stent graft technologies across diverse patient populations.

Latin America

Latin America captures about 5% share in 2024, with growth supported by improving hospital infrastructure and gradual adoption of minimally invasive aortic repair. Brazil and Mexico lead the market as tertiary hospitals improve imaging capabilities and expand vascular surgery programs. Rising prevalence of hypertension and smoking increases aneurysm cases, creating greater demand for advanced treatment options. Training programs in major cities strengthen surgical expertise, supporting higher procedure volumes. Limited reimbursement and uneven access across rural areas remain constraints, but upgrades in private healthcare systems continue to push adoption.

Middle East and Africa

Middle East and Africa account for roughly 4% share in 2024, driven by increasing investments in specialized cardiovascular centers across Gulf nations. Countries such as Saudi Arabia, the UAE, and Qatar expand endovascular treatment capacity through modern imaging and hybrid operating rooms. Awareness of aneurysm risks improves as screening initiatives grow. Adoption remains slower in Africa due to limited specialist availability and cost barriers, but private hospitals in South Africa and Kenya show rising interest in advanced stent grafts. Gradual expansion of vascular care infrastructure supports long-term market potential across the region.

Market Segmentations:

By Type

- Abdominal Aortic Stent Graft

- Thoracic Aortic Stent Graft

By Application

- Hospitals

- Ambulatory Surgical Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Aortic Stents Grafts Market features key players such as Terumo Corporation Inc., Cook Medical Inc., W.L. Gore & Associates Inc., Medtronic, MicroPort Scientific Corporation, ENDOLOGIX, INC., Lombard Medical, Inc., Cardinal Health, Becton, Dickinson and Company, and CryoLife, Inc. (Artivion Inc.). Companies focus on expanding endovascular repair portfolios through advanced stent graft designs, improved sealing technologies, and enhanced durability for both abdominal and thoracic applications. Manufacturers invest in R&D to reduce endoleak risks, increase graft flexibility, and support treatment of complex anatomies. Strategic partnerships with hospitals and research centers strengthen clinical evidence and accelerate product adoption. Firms also prioritize regulatory approvals across major markets to expand geographic reach. Training programs for vascular specialists support safe deployment of next-generation grafts, while ongoing innovation in materials, imaging compatibility, and personalized graft solutions helps companies maintain strong competitive positioning.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Terumo Corporation Inc.

- Cook Medical Inc.

- W.L. Gore & Associates Inc.

- Medtronic

- MicroPort Scientific Corporation

- ENDOLOGIX, INC.

- Lombard Medical, Inc.

- Cardinal Health

- Becton, Dickinson and Company

- CryoLife, Inc. (Artivion Inc.)

Recent Developments

- In 2025, Dickinson and Company (Becton Dickinson) achieved a milestone with full enrollment of the iliac artery patient cohort in its pivotal AGILITY study of the Revello™ Vascular Covered Stent for treatment of peripheral artery disease.

- In 2025, Lombard Medical Limited (a subsidiary of MicroPort Scientific Corporation) continues to advance and support its established ALTURA™ stent graft system for the treatment of abdominal aortic and aorto-iliac aneurysms.

- In 2025, Medtronic received FDA labeling approval allowing the Endurant AAA Stent Graft System to be used for ruptured abdominal aortic aneurysms, after data showed acceptable outcomes in emergency EVAR for rAAA.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily as endovascular repair becomes the standard treatment for most aortic aneurysms.

- Advancements in stent graft materials will improve durability and reduce long-term complication risks.

- Custom-made and patient-specific grafts will gain wider adoption for complex anatomical cases.

- Imaging and navigation technologies will support higher procedural accuracy and better outcomes.

- Hybrid operating rooms will expand across hospitals, enabling more EVAR and TEVAR procedures.

- Emerging markets will see faster adoption as access to vascular specialists and screening programs improves.

- Next-generation grafts will focus on reducing endoleaks and enhancing long-term sealing performance.

- Reimbursement improvements in developing regions will expand patient access to minimally invasive repair.

- Clinical trials will drive innovation and introduce grafts tailored to rare and high-risk aneurysm profiles.

- Collaboration between device manufacturers and hospitals will accelerate training and expand advanced procedural capabilities.