Market Overview

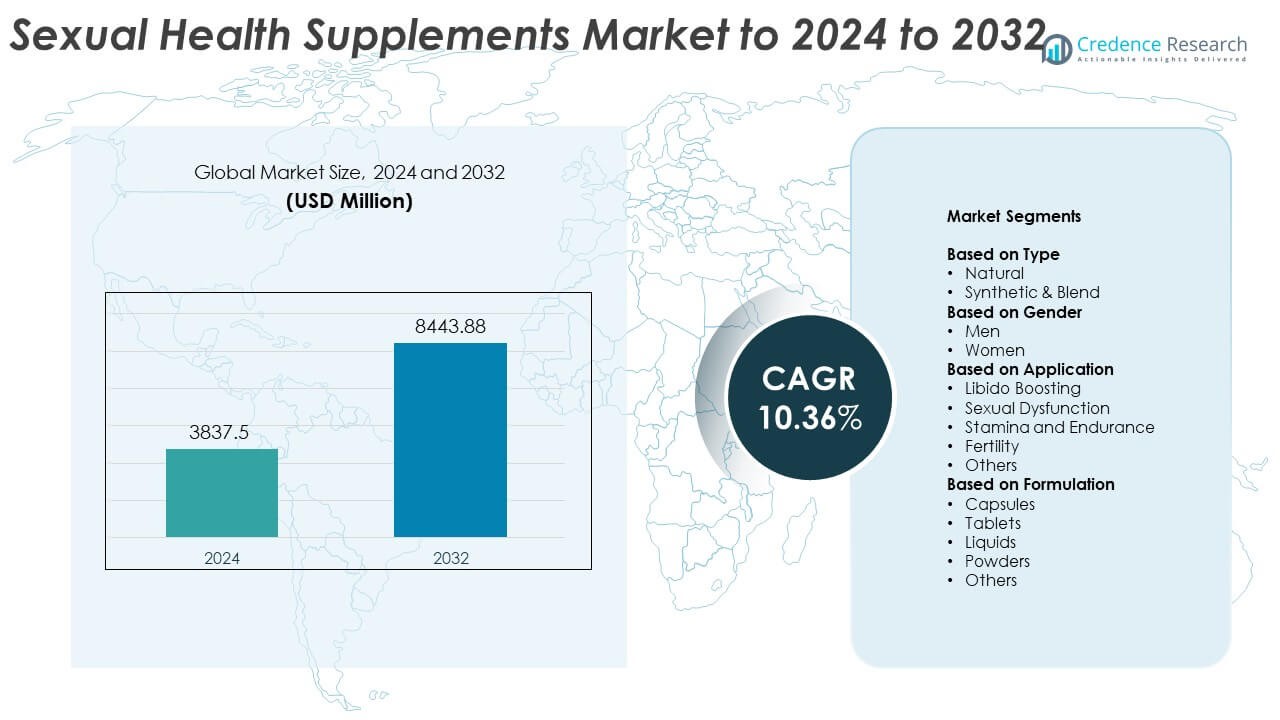

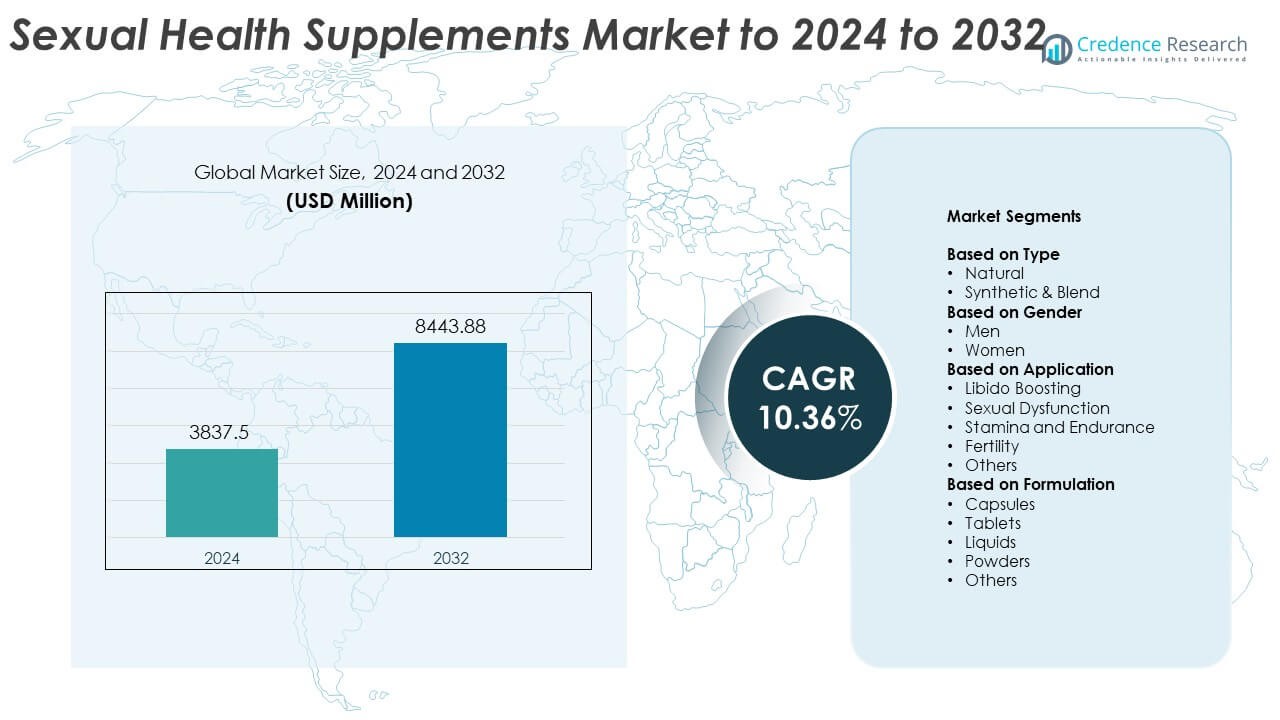

Sexual Health Supplements Market size was valued at USD 3837.5 million in 2024 and is anticipated to reach USD 8443.88 million by 2032, at a CAGR of 10.36% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sexual Health Supplements Market Size 2024 |

USD 3837.5 Million |

| Sexual Health Supplements Market , CAGR |

10.36% |

| Sexual Health Supplements Market Size 2032 |

USD 8443.88 Million |

The Sexual Health Supplements Market is shaped by major companies including Nature’s Bounty, BioXgenic, Swisse Wellness, Life Extension, GNC, Amway, Metagenics, Himalaya Drug Company, and NOW Foods. These players strengthen their position through natural formulations, research-backed blends, and strong multichannel distribution. North America leads the market with about 36% share due to high spending on wellness and strong retail and online penetration. Europe follows with nearly 29% share supported by clean-label demand, while Asia Pacific holds around 24% share driven by rising awareness and preference for herbal products. These regions collectively shape global market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sexual Health Supplements Market reached USD 3837.5 million in 2024 and is projected to hit USD 8443.88 million by 2032, growing at a CAGR of 10.36%.

- Strong demand for natural formulations drives market growth, with the natural segment holding about 61% share and gaining traction as consumers prefer clean-label and plant-based blends.

- Key trends include rising adoption of personalized nutrition, growing female-focused product development, and expansion of online and subscription-based models that support consistent product usage.

- Competition intensifies as leading brands enhance clinical validation, improve ingredient transparency, and strengthen digital marketing to stand out in a crowded marketplace with similar offerings.

- North America leads with 36% share, Europe follows with 29%, and Asia Pacific accounts for 24%, while the men’s segment dominates gender demand with about 68% share and libido boosting remains the top application with around 42% share.

Market Segmentation Analysis:

By Type

Natural supplements lead the category with about 61% share in 2024. Buyers prefer natural formulas due to safer profiles, growing consumer trust in plant-based extracts, and wider adoption in preventive health routines. Brands expand natural lines with herbal mixes that support libido, hormonal balance, and stamina. Synthetic and blend products grow steadily as they offer targeted ingredients with faster action, but demand remains lower due to rising clean-label awareness and stricter scrutiny of chemical additives. The shift toward botanical and organic formulations continues to anchor segment leadership.

- For instance, Bayer’s Supradyn Naturals Ginseng product for men includes a clinically backed Panax ginseng extract as a key ingredient, alongside 12 vitamins and 5 minerals.

By Gender

Men dominate the segment with nearly 68% share in 2024. Higher demand arises from growing awareness of erectile health, age-related decline in testosterone levels, and rising use of supplements for performance improvement. Marketing strategies focus heavily on male enhancement, leading to wider product availability and stronger brand penetration. Women’s supplements show steady momentum driven by interest in hormonal balance, fertility support, and reproductive wellness, but uptake remains lower due to fewer targeted formulations. Expanding female-focused product lines is expected to reduce this gap over time.

- For instance, clinical studies on L-arginine for ED have used daily dosages ranging from 1,500 to 6,000 milligrams (1.5 to 6 grams), often in combination with other ingredients like Pycnogenol.

By Application

Libido boosting holds the dominant position with about 42% share in 2024. Demand rises as consumers seek quick-acting solutions for desire enhancement, improved mood, and stress reduction. The category benefits from broad marketing reach and a large range of herbal formulations. Sexual dysfunction support follows with steady growth due to high prevalence of performance-related issues. Stamina and endurance, fertility, and other applications expand as users adopt supplements for overall sexual wellness and long-term reproductive health. The rising normalization of supplement-based sexual health aids continues to drive growth across applications.

Key Growth Drivers

Rising Demand for Natural and Herbal Formulations

Consumers increasingly choose natural sexual health supplements due to safer profiles, clean-label preferences, and rising trust in botanical ingredients. This shift supports strong demand for plant-based blends that address libido, vitality, and hormonal balance. Marketing efforts highlight purity, sustainability, and long-term wellness benefits, which strengthens adoption across both genders. The expansion of organic supply chains also helps brands launch broader portfolios. This factor remains a major growth driver as buyers move away from synthetic or chemically processed alternatives.

- For instance, Gaia Herbs’ Maca Root capsules contain 500 milligrams of organic gelatinized maca root powder per capsule.

Growing Awareness of Sexual Wellness and Preventive Health

Public awareness campaigns and digital health platforms have made sexual wellness a mainstream topic. Users now treat sexual health as an essential part of overall wellbeing, driving interest in supplements that enhance stamina, mood, and performance. Younger consumers adopt these products for preventive purposes, while older buyers seek support for age-related changes. Widespread use of e-commerce and telehealth consultations further accelerates accessibility. This continued rise in awareness stands as a key growth driver for the market.

- For instance, Haleon’s 2024 Annual Report cites the “Ipsos Global Trends Report (2024), study conducted across 50 markets” to understand the evolving definitions of everyday health among consumers.

Increasing Prevalence of Sexual Dysfunction and Lifestyle-Related Issues

Rising cases of stress, obesity, sedentary habits, and chronic health conditions contribute to higher rates of sexual dysfunction. This creates strong demand for supplements that support erectile strength, libido enhancement, and hormonal balance. Men’s health brands benefit the most, but targeted solutions for women are also gaining traction. Many consumers prefer supplements as a non-invasive alternative to prescription treatments. This expanding need for functional support marks another key growth driver for the industry.

Key Trends and Opportunities

Expansion of Female-Focused Sexual Wellness Products

Women’s sexual health supplements gain momentum as brands introduce solutions for hormonal balance, fertility support, and libido enhancement. Social acceptance of female sexual wellness continues to rise, creating a large untapped market. Companies are also designing formulations tailored to women’s nutritional and hormonal needs. This shift opens new growth opportunities and helps diversify product portfolios. Wider availability of female-focused lines represents a major trend and opportunity.

- For instance, DSM-Firmenich offers geniVida®, a unique, proven genistein-based ingredient to support women’s health. The effective daily dosage of geniVida® is generally recognized in clinical studies to be around 54 milligrams of genistein to provide benefits such as supporting healthy bone density and relieving menopausal symptoms.

Growth of Personalized and Functional Nutrition Solutions

Brands invest in personalized supplement programs that match user-specific needs such as stress levels, hormonal profiles, or age-related decline. Functional blends combining adaptogens, vitamins, and amino acids gain popularity for delivering targeted benefits. Digital platforms that offer customized recommendations also help boost consumer engagement. This broader move toward personalization signals a key industry trend and a high-value opportunity for manufacturers.

- For instance, the Lonza Capsugel Vcaps® and Vcaps® Plus HPMC capsules are available in various standard sizes. The fill capacity for a specific capsule size, such as size 1, can be around 300 milligrams for a powder with a bulk density of 0.6 g/mL.

Rising Adoption of E-commerce and Subscription-Based Models

Online platforms play a major role in expanding market reach. Subscription plans offer convenience, privacy, and consistent product access, encouraging long-term usage. Digital channels allow brands to target specific demographics with tailored marketing. Growing online penetration represents a strong opportunity and an important trend shaping future demand.

Key Challenges

Regulatory Variability and Quality Control Issues

Sexual health supplements face inconsistent regulatory frameworks across regions, creating challenges in product claims, ingredient approvals, and safety standards. Lack of uniform oversight can lead to quality concerns, reducing consumer confidence. Manufacturers must invest heavily in rigorous testing and transparent labeling to meet evolving regulations. This remains a major challenge that impacts market stability and brand credibility.

High Competition and Product Differentiation Barriers

The market is crowded with numerous brands offering similar formulations, making differentiation difficult. Price competition intensifies pressure on profit margins, while aggressive marketing by established players limits the visibility of smaller companies. Consumers often struggle to identify clinically supported products, leading to slower trust-building. This competitive saturation stands as another significant challenge for sustained market growth.

Regional Analysis

North America

North America holds about 36% share in 2024, driven by strong consumer spending on wellness products and high awareness of sexual health. The region benefits from widespread retail penetration, strong e-commerce activity, and large male-focused supplement demand. Brands introduce advanced natural formulations supported by clinical claims, which further boosts adoption. Rising cases of stress-related dysfunction and age-related decline also support long-term consumption. The presence of established manufacturers and subscription-based delivery models strengthens overall growth in the region.

Europe

Europe accounts for nearly 29% share in 2024, supported by growing acceptance of sexual wellness as part of preventive healthcare. Consumers show strong interest in herbal and clean-label formulations due to stricter regulations on synthetic ingredients. Demand increases among both men and women, driven by rising lifestyle-related issues and wider product distribution across pharmacies and online platforms. Expanding fertility-focused supplements and broader wellness campaigns also support category expansion. The region continues to benefit from high product quality standards and increased spending on natural health solutions.

Asia Pacific

Asia Pacific holds about 24% share in 2024 and emerges as the fastest-growing region due to rising awareness of sexual wellness, increasing urbanization, and expanding middle-class spending. Herbal and traditional ingredient-based supplements dominate, driven by strong cultural acceptance of natural remedies. Growing stress levels, lifestyle changes, and higher infertility rates contribute to rising demand. E-commerce platforms help brands reach younger buyers seeking discreet purchasing options. Rapid product innovation and wider availability across emerging markets continue to strengthen regional momentum.

Latin America

Latin America captures around 6% share in 2024, supported by rising interest in sexual performance enhancers and increasing adoption of natural supplements. Awareness improves as local brands promote herbal ingredients and affordable formulations. Economic recovery in several countries boosts discretionary spending, allowing consumers to explore wellness categories. Growing male-focused demand and increasing visibility of e-commerce channels support higher penetration. Despite slower uptake compared to larger regions, rising youth population and shifting social attitudes contribute to steady market growth.

Middle East and Africa

Middle East and Africa hold close to 5% share in 2024, driven by gradual lifestyle modernization and rising online access to wellness products. Demand grows primarily in urban areas where awareness of sexual health supplements is higher. Male enhancement products see the strongest adoption due to cultural preferences and increasing stress-related issues. However, limited product availability and stricter regulatory environments restrict faster expansion. As awareness campaigns expand and digital retail spreads, the region is expected to experience consistent but moderate growth.

Market Segmentations:

By Type

- Natural

- Synthetic & Blend

By Gender

By Application

- Libido Boosting

- Sexual Dysfunction

- Stamina and Endurance

- Fertility

- Others

By Formulation

- Capsules

- Tablets

- Liquids

- Powders

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Sexual Health Supplements Market is shaped by leading players such as Nature’s Bounty, BioXgenic, Swisse Wellness, Life Extension, GNC (General Nutrition Centers), Amway, Metagenics, Himalaya Drug Company, and NOW Foods. These companies compete by expanding natural product lines, improving clinical validation, and enhancing ingredient quality to meet rising consumer expectations. Many brands focus on research-backed formulations to strengthen trust and differentiate their offerings in a crowded marketplace. Digital marketing, influencer partnerships, and targeted campaigns support stronger visibility across key demographics. Firms also invest in e-commerce platforms and subscription programs to secure long-term customer engagement. Premium formulations with botanical blends and multibenefit features gain traction as consumers seek comprehensive wellness support. Competitive pressure drives continuous innovation in dosage forms, flavor options, and fast-acting solutions. Regulatory compliance, clean-label positioning, and transparent sourcing remain critical as companies work to sustain credibility in a rapidly growing and highly competitive market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Himalaya promotes its Ayurvedic sexual health product “Confido Tablet,” designed to regulate testosterone, improve libido, strengthen tissue in the male sexual organ, increase sperm count, and treat erectile dysfunction using natural ingredients like Kapikachhu and Gokshura.

- In 2025, Life Extension offers “Sexual Health for Her,” a plant-based supplement formulated for female libido, arousal, lubrication, and satisfaction.

- In 2022, GNC continued to offer and support its established sexual health supplement “GNC Men’s ArginMax,” which combines L-arginine, ginseng, and ginkgo biloba to enhance sexual desire and performance by supporting nitric oxide production and improving blood flow.

Report Coverage

The research report offers an in-depth analysis based on Type, Gender, Application, Formulation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as awareness of sexual wellness continues to rise.

- Natural and herbal formulations will gain stronger dominance across key demographic groups.

- Personalized supplement programs will grow with wider adoption of digital health tools.

- Female-focused products will see faster development as brands target unmet needs.

- E-commerce and subscription models will strengthen long-term customer retention.

- Clinical validation and transparent labeling will become essential for brand credibility.

- Innovation in multibenefit blends will increase demand for holistic sexual wellness solutions.

- Regulatory tightening will improve product quality and reduce low-grade offerings.

- Emerging markets in Asia Pacific and Latin America will contribute heavily to growth.

- Collaboration between nutraceutical brands and telehealth platforms will shape future consumer engagement.