Market Overview

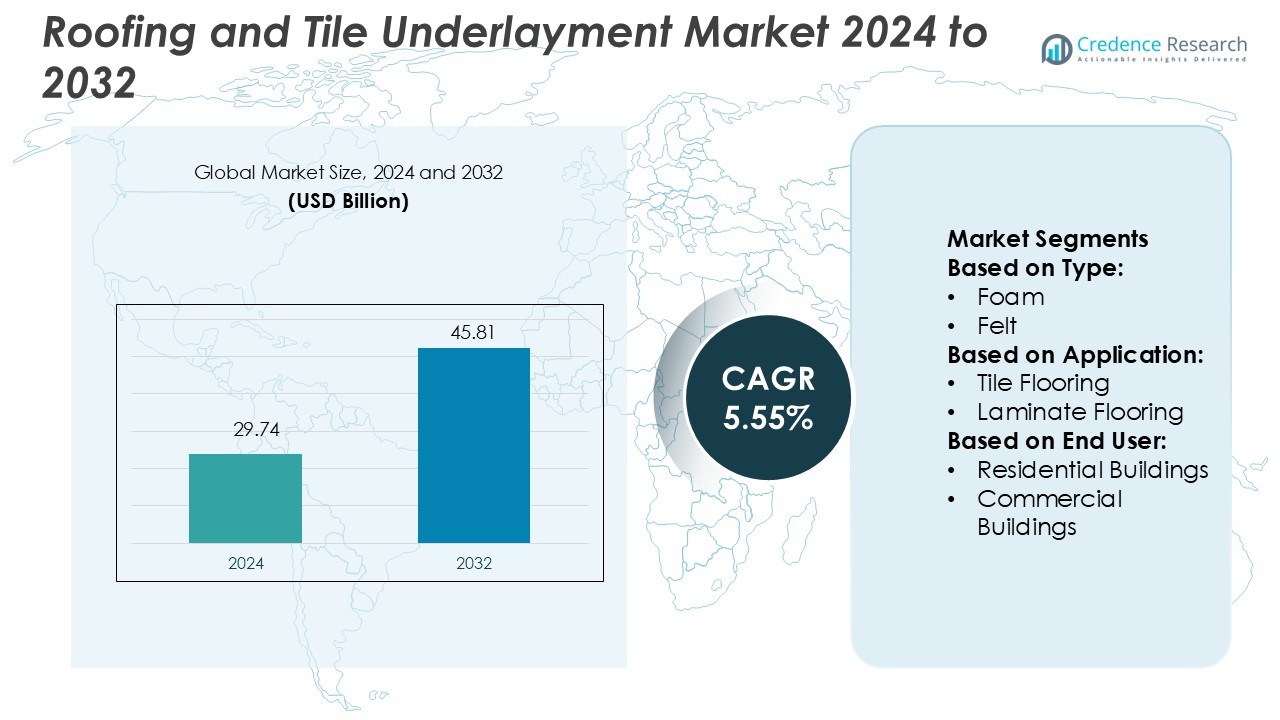

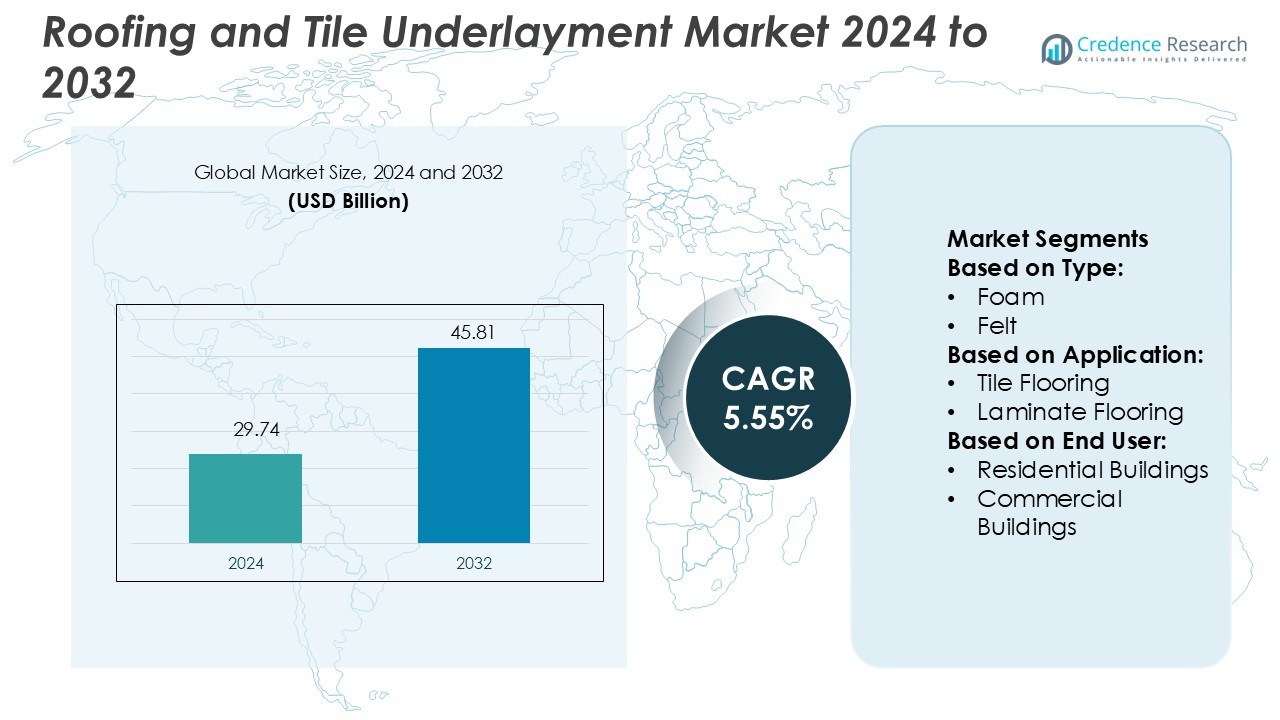

Roofing and Tile Underlayment Market size was valued USD 29.74 billion in 2024 and is anticipated to reach USD 45.81 billion by 2032, at a CAGR of 5.55% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Roofing and Tile Underlayment Market Size 2024 |

USD 29.74 Billion |

| Roofing and Tile Underlayment Market, CAGR |

5.55% |

| Roofing and Tile Underlayment Market Size 2032 |

USD 45.81 Billion |

The Roofing and Tile Underlayment Market is driven by major players including Eagle Roofing, Hongbo Roof Tiles, Brava Roof Tile, Ecostar LLC, Atlas Roofing Corporation, IKO Industries Ltd., Ross Roof Group, Etex, Crown Roof Tiles, and Entegra Roof Tiles. These companies focus on developing high-performance, moisture-resistant, and energy-efficient underlayment solutions to meet evolving construction demands. Strategic expansion, advanced material innovation, and sustainable product offerings strengthen their global competitiveness. North America leads the market with a 34% share, supported by strong residential construction activity, stringent building codes, and early adoption of energy-efficient and eco-friendly building materials, ensuring continued market leadership.

Market Insights

- The Roofing and Tile Underlayment Market size was valued at USD 29.74 billion in 2024 and is projected to reach USD 45.81 billion by 2032, growing at a CAGR of 5.55%.

- Rising demand for energy-efficient and moisture-resistant materials is driving adoption across residential and commercial construction projects.

- Foam underlayment leads the type segment with a 32% share, supported by strong insulation and soundproofing performance.

- North America holds a 34% regional share, driven by strict building codes, renovation trends, and early adoption of sustainable products.

- Leading players focus on innovation, global expansion, and eco-friendly product development, while high installation costs and labor shortages remain key restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Foam underlayment dominates the Roofing and Tile Underlayment Market with a 32% market share in 2024. Its popularity stems from excellent sound absorption, moisture resistance, and ease of installation. Foam’s lightweight nature and superior insulation performance make it a preferred choice for residential and commercial flooring. Polyethylene and rubber follow closely, supported by their durability and thermal benefits. Rising demand for energy-efficient and sustainable construction materials is further driving foam adoption. Product innovations that enhance strength and comfort also strengthen its position in both new construction and renovation projects.

- For instance, Eagle Roofing offers Secure Guard 60, a self-adhering polymer-modified bituminous underlayment. The product was launched in 2024 to provide a high-quality leak barrier and enhance moisture protection for roofing systems.

By Application

Tile flooring holds the leading position in the market with a 36% share. Its dominance is driven by strong structural stability and resistance to moisture, which make it suitable for high-traffic areas. Tile underlayment improves surface leveling, extending floor life and performance. Laminate and vinyl flooring are also growing rapidly due to their lower maintenance requirements and cost benefits. Expanding residential and commercial construction activities, along with consumer preference for durable flooring solutions, support the rising use of tile flooring underlayment in both developed and emerging regions.

- For instance, Brava Roof Tile’s composite slate product (Old World Slate) installs at a weight of approximately 311 lbs per 100 sq ft at 10-inch exposure (≈16.5 kg per m²). The Spanish Barrel variant installs at 281 lbs per 100 sq ft at 13-inch exposure (≈12.6 kg per m²), making both products significantly lighter than traditional slate or clay tiles.

By End-User

Residential buildings account for a 58% share of the market, making it the largest end-user segment. The segment benefits from growing urbanization, increasing home renovations, and demand for noise insulation and moisture control solutions. Homeowners prefer underlayment that improves comfort, durability, and energy efficiency, boosting adoption in flooring upgrades and new housing projects. Commercial buildings are also witnessing steady growth as developers prioritize durable, long-lasting flooring in offices, retail spaces, and hospitality. Regulatory focus on energy-efficient construction materials further accelerates residential segment expansion.

Key Growth Drivers

Key Growth Drivers

Rising Demand for Energy-Efficient Construction Materials

The growing focus on energy conservation strongly drives the Roofing and Tile Underlayment Market. Builders and homeowners increasingly prefer underlayment materials that provide superior insulation and reduce heating and cooling costs. Foam and polyethylene options are gaining traction for their ability to regulate indoor temperatures effectively. Governments are introducing stricter energy codes and green building certifications, further accelerating adoption. The emphasis on sustainable, low-maintenance construction materials is pushing manufacturers to invest in high-performance products that support long-term energy savings.

- For instance, EcoStar’s synthetic roofing line is manufactured with up to 80% recycled polymers (rubber and plastics) in many profiles, enhancing sustainability and thermal insulation performance.

Rapid Expansion of Residential and Commercial Construction

Urbanization and infrastructure development significantly contribute to market expansion. Residential projects lead demand due to the rise in new housing developments and renovation activities. Commercial spaces, such as offices, retail outlets, and hospitality facilities, are also expanding, increasing the use of underlayment solutions for durability and noise insulation. Tile and laminate flooring underlayment are preferred for their strength and comfort. Increasing real estate investments and favorable government housing schemes further support the adoption of modern underlayment materials in diverse construction applications.

- For instance, Atlas Roofing’s Summit® 60 synthetic roof underlayment is offered in 10-square rolls (1,000 sq ft) with dimensions of 48″ × 250′ and supports 60-day UV exposure during installation.

Advancements in Material Technology and Product Innovation

Manufacturers are focusing on advanced underlayment technologies that enhance strength, moisture protection, and acoustic performance. Modern materials like foam and rubber offer better compression resistance and longer lifespans compared to traditional felt. New waterproof and vapor-barrier technologies address common flooring issues, improving installation quality and durability. Innovations in lightweight, eco-friendly materials also meet growing sustainability goals. These technological advancements drive product differentiation and help manufacturers target both residential and commercial sectors more effectively.

Key Trends & Opportunities

Growing Preference for Sustainable and Recyclable Materials

Sustainability is becoming a central trend shaping market strategies. Builders and consumers prefer recyclable and low-VOC underlayment to meet green building certifications and environmental standards. Manufacturers are introducing biodegradable and energy-efficient materials that align with carbon reduction goals. This trend creates new opportunities for companies investing in sustainable product development and circular economy practices. Green construction incentives and increasing consumer awareness are further accelerating this shift toward eco-friendly underlayment solutions.

- For instance, IKO’s “IKO Hyload Original Roll” high-performance moisture barrier features a roll size of 20 m × 1 m (≈65.6 ft × 3.3 ft). The total area of a 20 m x 1 m roll is 20 square meters, which correctly converts to approximately 215 square feet (20 x 10.764).

Increasing Adoption of Advanced Waterproofing and Soundproofing Solutions

Waterproof and sound-absorbing underlayment solutions are gaining strong market traction. Rising demand for noise reduction in residential and commercial spaces drives the adoption of rubber and foam-based materials. These products offer enhanced comfort, durability, and protection against moisture damage, making them suitable for high-traffic flooring applications. The integration of vapor barriers and sound control features in a single product creates added value for end users. This trend opens new growth avenues for manufacturers with specialized, high-performance solutions.

- For instance, Ross Roof Group’s metal tile system supports a roof underlay requirement that allows a clear ventilated air-gap of at least 25 mm beneath the tile finish to control internal moisture and temperature.

Key Challenges

High Initial Costs and Price Sensitivity

The cost of advanced underlayment materials remains a key restraint, particularly in price-sensitive markets. High-performance foam, rubber, and cork options require larger upfront investments compared to traditional alternatives. Budget-conscious builders often choose lower-cost materials, limiting market penetration of premium products. Fluctuations in raw material prices also impact final product costs, making affordability a challenge for large-scale adoption in developing regions.

Installation Complexity and Lack of Skilled Labor

Proper installation is essential to achieve the full performance benefits of advanced underlayment. However, complex installation processes and a shortage of skilled labor can lead to improper application, reducing durability and effectiveness. Training gaps among installers also result in inconsistent quality across projects. This challenge highlights the need for better training programs, simplified installation systems, and clear product guidelines to support wider adoption.

Regional Analysis

North America

North America leads the Roofing and Tile Underlayment Market with a 34% share in 2024. The region benefits from well-established residential construction, advanced building codes, and strong demand for energy-efficient flooring solutions. Homeowners and developers favor foam and polyethylene underlayment for their insulation and moisture protection. Rising renovation activities and strict green building standards further strengthen market growth. The U.S. accounts for the majority of demand due to widespread use in both residential and commercial spaces. Increasing adoption of sustainable materials and advanced waterproofing technologies continues to drive product innovation across the region.

Europe

Europe holds a 27% market share, supported by strong environmental regulations and a high adoption of eco-friendly construction materials. Countries such as Germany, France, and the UK are key markets with significant renovation and retrofitting activity. Foam and rubber underlayment are widely used to meet insulation and noise control standards in residential and commercial buildings. The region’s commitment to green building certifications encourages the use of recyclable materials. Growing consumer preference for durable and sustainable flooring solutions drives steady demand, while advancements in moisture control technologies strengthen product performance and market competitiveness.

Asia Pacific

Asia Pacific captures a 29% market share and represents the fastest-growing regional market. Rapid urbanization, large-scale residential construction, and infrastructure expansion in China, India, and Southeast Asia drive strong demand for underlayment products. Tile flooring underlayment dominates due to its durability and suitability for humid climates. Government housing schemes and investments in commercial projects further accelerate growth. Rising awareness of energy efficiency and indoor comfort supports the adoption of foam and polyethylene products. Local manufacturers are expanding production capacities, making the region a key growth hub for both domestic and international players.

Latin America

Latin America accounts for an 8% share of the Roofing and Tile Underlayment Market. Market growth is supported by increasing urbanization and a steady rise in residential construction projects, particularly in Brazil and Mexico. Developers are gradually adopting foam and felt underlayment to improve moisture resistance and acoustic insulation. Economic development and infrastructure investments are boosting demand for affordable, durable flooring solutions. Although adoption of advanced underlayment remains lower than in developed regions, government housing initiatives and private sector investments present significant opportunities for market expansion over the coming years.

Middle East & Africa

The Middle East & Africa region holds a 6% market share, driven by growing construction activities in commercial and residential sectors. Rapid urban development in the UAE, Saudi Arabia, and South Africa is increasing the demand for durable flooring solutions. Underlayment materials like rubber and foam are gaining traction due to their thermal insulation and moisture control properties, which suit the region’s climate. Large-scale infrastructure and real estate projects further support market growth. While price sensitivity remains a challenge, rising investments in modern building technologies are expected to boost underlayment adoption across the region.

Market Segmentations:

By Type:

By Application:

- Tile Flooring

- Laminate Flooring

By End User:

- Residential Buildings

- Commercial Buildings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Roofing and Tile Underlayment Market is shaped by leading players such as Eagle Roofing, Hongbo Roof Tiles, Brava Roof Tile, Ecostar LLC, Atlas Roofing Corporation, IKO Industries Ltd., Ross Roof Group, Etex, Crown Roof Tiles, and Entegra Roof Tiles. The Roofing and Tile Underlayment Market is defined by strong innovation, product diversification, and expanding global footprints. Companies focus on developing advanced underlayment solutions with improved moisture resistance, sound insulation, and energy efficiency to meet evolving construction standards. Investments in sustainable materials and eco-friendly production processes are increasing as green building regulations gain traction. Strategic partnerships and R&D initiatives enhance product durability and performance, supporting greater market penetration. Manufacturers also prioritize expanding distribution networks in high-growth regions, particularly Asia Pacific and Latin America. This dynamic environment fosters continuous technological advancement and drives long-term industry growth.

Key Player Analysis

- Eagle Roofing

- Hongbo Roof Tiles

- Brava Roof Tile

- Ecostar LLC

- Atlas Roofing Corporation

- IKO Industries Ltd.

- Ross Roof Group

- Etex

- Crown Roof Tiles

- Entegra Roof Tiles

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In July 2025, Mohawk Industries, Inc. continues to expand globally with manufacturing facilities in 19 countries, providing luxury vinyl products under brands like Quick-Step, Pergo, and IVC Resilient Design. The company emphasizes product innovation to meet residential and commercial demand worldwide, especially in North America and Asia.

- In April 2025, Shaw Industries Group, Inc.’s EcoWorx™ resilient flooring received a bronze Edison Award for circular design innovation, highlighting advances in sustainability and eco-friendly product lines within the vinyl flooring sector.

- In September 2024, IMETCO introduced IntelliWrap PR, a self-adhering, breathable roof underlayment for providing water- and air-tight, vapor-permeable protection. It is versatile for use on various roofing systems, such as standing seam metal, slate tile, clay tile, and cedar shingle roofs.

- In June 2024, Transom Capital Group acquired Virginia Tile Company, merging it with Galleher to form a leading flooring and tile products distributor with enhanced product development and fulfillment capabilities.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for energy-efficient and sustainable underlayment solutions will continue to grow.

- Foam and polyethylene materials will gain wider adoption for moisture control and insulation.

- The residential sector will remain the dominant end-user segment.

- Renovation and retrofitting activities will boost product demand in mature markets.

- Green building certifications will influence material choices and product innovation.

- Asia Pacific will experience the fastest regional growth due to rapid urbanization.

- Technological advancements will improve product performance and durability.

- Waterproofing and soundproofing features will become standard in premium solutions.

- Manufacturers will expand their presence in emerging markets.

- Strategic partnerships and R&D investments will drive market competitiveness.

Key Growth Drivers

Key Growth Drivers