Market Overview

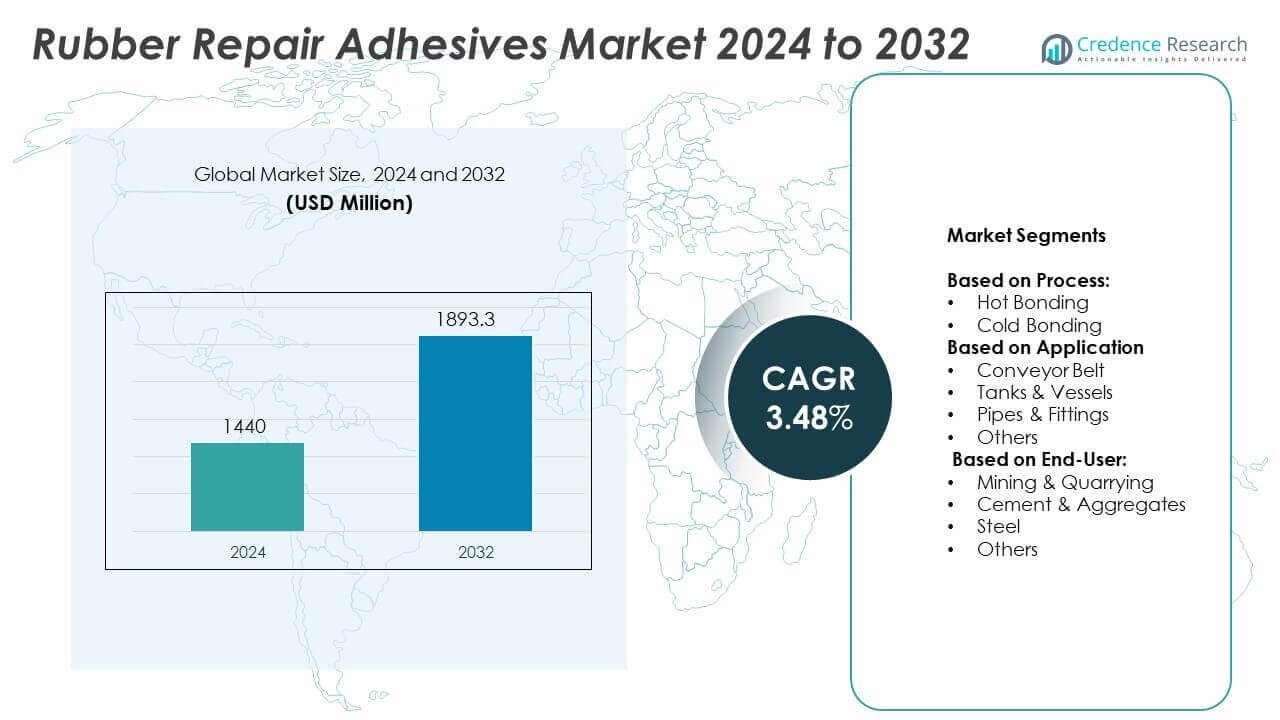

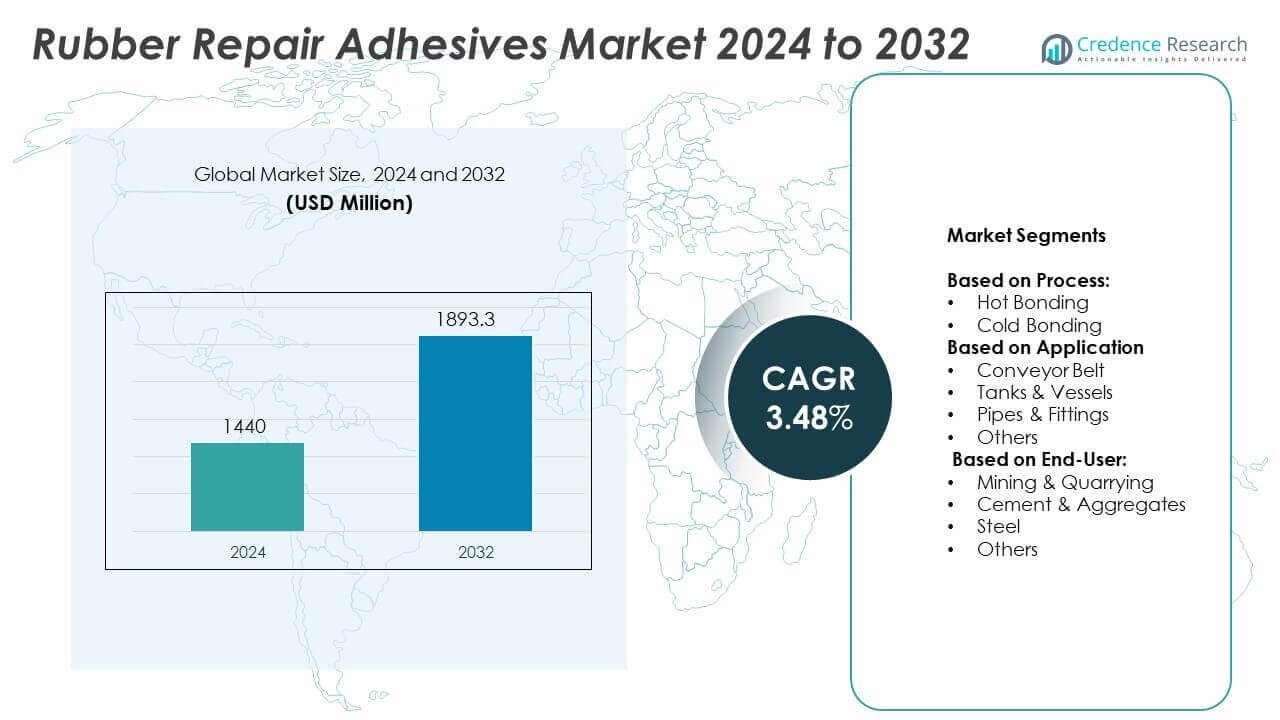

The Rubber Tired Gantry Crane Market size was valued at USD 1520 million in 2024 and is expected to reach USD 1986.1 million by 2032, growing at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rubber Tired Gantry Crane Market Size 2024 |

USD 1520 Million |

| Rubber Tired Gantry Crane Market, CAGR |

3.4% |

| Rubber Tired Gantry Crane Market Size 2032 |

USD 1986.1 Million |

The Rubber Tired Gantry Crane market is driven by the growing global trade and port expansions. Advancements in automation and energy-efficient technologies, such as hybrid and electric cranes, are key trends. Sustainability concerns are pushing ports to adopt greener solutions, while increasing demand for higher-capacity cranes reflects the need for more efficient container handling. The focus on reducing operational costs and enhancing productivity further accelerates the adoption of modern RTG systems in major ports worldwide.

The Rubber Tired Gantry Crane market is dominated by regions such as Asia-Pacific, North America, and Europe. Asia-Pacific leads in demand, driven by major ports in China, Japan, and India. North America and Europe follow with growing adoption of automated and eco-friendly cranes. Key players shaping the market include Konecranes, Liebherr Group, ZPMC, and Cargotec (Kalmar), each innovating to meet the rising need for efficient, sustainable, and high-capacity cranes in port operations globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Rubber Tired Gantry Crane market was valued at USD 1520 million in 2024 and is projected to reach USD 1986.1 million by 2032, growing at a CAGR of 3.4% during the forecast period.

- The primary drivers of the market include increasing global trade, port expansions, and a growing need for efficient container handling solutions.

- Key trends influencing the market are the shift towards automation, the adoption of hybrid and electric cranes, and the focus on energy-efficient and environmentally sustainable solutions.

- The competitive landscape is marked by major players such as Konecranes, Liebherr Group, ZPMC, and Cargotec (Kalmar), all of whom focus on technological advancements and enhancing crane performance.

- One of the key restraints is the high initial investment and maintenance costs associated with RTGs, particularly in emerging markets.

- Regional growth is driven by Asia-Pacific, which dominates port infrastructure development, followed by North America and Europe, where sustainability and automation are top priorities.

- Market opportunities lie in the continued modernization of ports, particularly in emerging markets, and the growing trend of integrating RTGs with digital technologies for enhanced operational efficiency.

Market Drivers

Increasing Demand for Containerized Cargo Handling

The growth in global trade has led to a higher demand for containerized cargo handling. Rubber Tired Gantry Cranes (RTGs) are essential for efficiently managing containerized goods at ports. Their flexibility and mobility make them ideal for handling large volumes of containers across various terminal settings. This demand continues to rise as logistics companies and port operators seek solutions to enhance productivity and minimize operational delays. The need for faster loading and unloading times at container terminals strengthens the demand for RTGs.

- For instance, Konecranes developed an RTG that is capable of lifting containers up to 65 tons with a height clearance of 20 meters, providing increased capacity and efficiency for high-volume terminals.

Technological Advancements in Crane Design

Ongoing advancements in RTG technology drive the market forward. The introduction of automation and improved control systems enhances crane performance and reduces human intervention. These innovations improve operational efficiency, reduce maintenance costs, and ensure greater safety. With better precision and automation, RTGs can handle complex operations, increasing their appeal to modern ports and terminals looking to enhance productivity.

- For instance, Liebherr introduced a new RTG lineup with travel speeds significantly faster than 35 meters per minute, with some models reaching speeds of up to 130 meters per minute when unladen. This speed, combined with other innovations like electric and hybrid drives, contributes to greater efficiency and reduced operational time at busy ports.

Expansion of Port Infrastructure

The expansion and modernization of port infrastructure are key factors driving the market. As trade volumes increase globally, many ports are investing in expanding their capacity. RTGs offer an efficient solution to accommodate growing container throughput. They are highly adaptable to the evolving needs of port operations, allowing them to scale and provide high levels of productivity in busy shipping terminals.

Environmental Regulations and Sustainability Focus

Growing concerns over the environmental impact of port operations contribute to the adoption of more energy-efficient equipment. RTGs, particularly those powered by electricity or hybrid solutions, help reduce carbon emissions and fuel consumption. Ports are increasingly prioritizing eco-friendly solutions, and RTGs meet these demands while maintaining performance. The push for sustainability encourages investment in advanced crane technologies that support green initiatives in the maritime industry.

Market Trends

Growth in Automation and Remote Control Systems

Automation is a prominent trend in the Rubber Tired Gantry Crane market. Ports are increasingly adopting automated systems to improve operational efficiency and reduce human errors. RTGs equipped with remote control systems allow operators to manage cranes from a distance, improving safety and productivity. These advanced systems offer enhanced precision, enabling cranes to perform more complex tasks while minimizing downtime. Automated RTGs also allow for 24/7 operations, further increasing throughput and optimizing terminal performance.

- For instance, Qingdao Port’s automated terminal, which uses ZPMC equipment and its own control systems, handled over 1.5 million TEUs in 2023, achieving a high equipment availability of 99.8%.

Integration of Hybrid and Electric Power Solutions

Environmental sustainability is a growing trend in the Rubber Tired Gantry Crane market. The shift towards hybrid and fully electric RTGs is gaining traction due to their reduced environmental impact. These energy-efficient cranes help ports meet stricter emissions standards while maintaining high performance. The adoption of electric power in RTGs also lowers fuel costs and reduces maintenance requirements. As environmental concerns become more significant, these eco-friendly solutions are increasingly favored by port operators aiming to improve their sustainability credentials.

- For instance, Liebherr introduced an automated RTG system with enhanced precision, utilizing features like an eight-rope reeving system and advanced drive controls for excellent stability and anti-sway performance. This enables precise handling and positioning of containers, reducing human errors and downtime compared to manual operations.

Focus on Digitalization and Data Analytics

The digitalization trend continues to influence the Rubber Tired Gantry Crane market. Ports are integrating data analytics tools to optimize crane performance and manage operations more effectively. By collecting and analyzing real-time data, port operators can monitor crane health, predict maintenance needs, and improve efficiency. The use of digital systems allows for better coordination between cranes and other port equipment, minimizing delays and maximizing cargo handling. This trend of digital transformation is helping ports streamline their operations and reduce operational costs.

Customization and Flexibility in Crane Solutions

Customization has become a significant trend in the Rubber Tired Gantry Crane market. As ports handle varying types of cargo, there is a growing demand for cranes tailored to specific operational needs. RTGs can now be customized to work in different environments, such as high-temperature or corrosive settings. The flexibility of these cranes allows operators to adapt to different workloads, making them ideal for a range of terminal operations. This trend towards customizable crane solutions helps ports increase efficiency while meeting diverse operational requirements.

Market Challenges Analysis

High Initial Investment and Maintenance Costs

The Rubber Tired Gantry Crane market faces challenges related to the high initial investment required for purchasing and installing these cranes. While RTGs offer significant long-term benefits, their upfront cost can be a barrier for smaller ports or terminals with limited budgets. The need for specialized infrastructure and the cost of installation further increase the overall expenditure. Maintenance costs also contribute to the financial burden, especially for older cranes that require frequent repairs and part replacements. These factors can deter port operators from making investments, slowing the adoption rate of RTGs in certain regions.

Operational Limitations in Harsh Environments

Rubber Tired Gantry Cranes can face operational difficulties in harsh or extreme environments, such as areas with high humidity, corrosive substances, or rough terrains. These conditions can shorten the lifespan of the equipment, increase the frequency of maintenance, and reduce operational efficiency. The need for specialized materials and design modifications to ensure durability further adds to the cost and complexity. This poses a challenge for ports located in such environments, limiting the widespread adoption of RTGs in these regions and affecting their market growth.

Market Opportunities

Expansion of Port Infrastructure and Global Trade

The ongoing expansion of global trade presents significant opportunities for the Rubber Tired Gantry Crane market. As ports modernize and increase their capacity to handle higher volumes of cargo, the demand for efficient material handling equipment rises. RTGs offer an ideal solution for ports seeking to improve container handling efficiency while optimizing space. Ports in emerging markets, particularly in Asia-Pacific and Africa, are undergoing significant infrastructure development, providing ample opportunities for RTG adoption. This trend reflects a growing need for advanced cranes that can operate flexibly and handle large cargo volumes efficiently.

Shift Towards Sustainable and Energy-Efficient Solutions

The growing focus on sustainability in the maritime industry provides opportunities for the Rubber Tired Gantry Crane market to expand. Ports and terminals are increasingly seeking eco-friendly alternatives to reduce their carbon footprint and comply with stringent environmental regulations. RTGs, especially those with hybrid or fully electric power options, align with this shift towards greener solutions. Their ability to reduce emissions and lower fuel consumption appeals to ports aiming to meet environmental standards while improving operational efficiency. This focus on sustainability presents a valuable opportunity for RTG manufacturers to innovate and cater to the increasing demand for energy-efficient equipment.

Market Segmentation Analysis:

By Wheels:

Wheels into 8-wheelers and 16-wheelers. The 8-wheeler segment holds a larger share due to its cost-effectiveness and ability to handle moderate lifting capacities in smaller or less complex port operations. These cranes are more suitable for handling lighter loads or smaller terminal spaces where maneuverability and flexibility are key. On the other hand, 16-wheelers are used in high-capacity operations that require more robust lifting capabilities. They offer improved load distribution, which is vital for handling heavier containers and working in larger terminals with higher throughput. The 16-wheeler segment is expected to grow in response to the increasing demand for larger cranes capable of supporting the growth of global trade and the expansion of port infrastructure.

- For instance, ZPMC implemented fully electric RTGs in several major ports, utilizing lithium battery power systems or sourcing power from the electric grid. While these electric RTGs significantly lower carbon emissions compared to their diesel counterparts, with some estimates suggesting up to 100 tons of CO2 reduction annually per crane.

By Power Supply:

Diesel, electric, and hybrid models. Diesel-powered RTGs remain popular due to their high mobility and ability to operate without dependence on external electrical infrastructure. These cranes are ideal for regions where electricity supply is inconsistent or where mobility across large terminals is essential. Electric-powered RTGs are gaining traction due to their lower operating costs and environmental benefits. They offer reduced emissions, lower fuel consumption, and less maintenance, which aligns with the growing emphasis on sustainability in the maritime industry. Electric RTGs are mainly deployed in environmentally-conscious ports that prioritize reducing their carbon footprint. Hybrid RTGs combine both diesel and electric power, providing flexibility for operations in various environments. These cranes offer the benefits of both systems, ensuring greater energy efficiency while still maintaining the versatility and power of diesel engines when necessary. As sustainability concerns continue to grow, the hybrid and electric segments are expected to expand, as ports increasingly adopt greener technologies.

- For instance, The 1,200 kWh battery capacity and 10-hour operational time are not associated with Trelleborg. Publicly documented battery capacities for RTG systems are typically much lower, with operational times dependent on the work cycle. All battery-powered RTGs, operational time is highly dependent on the specific work cycle, load, and terminal infrastructure. A universal 10-hour continuous operation figure is unrealistic.

Segments:

Based on Wheels:

Based on Power Supply:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant share in the Rubber Tired Gantry Crane market, accounting for 28% of the global market. The region’s strong demand for advanced container handling systems is driven by the growth in international trade and port expansion projects. Major ports like the Port of Los Angeles and the Port of Long Beach continue to modernize their infrastructure, contributing to the increasing adoption of RTGs. The growing focus on automation and sustainability in these ports also drives the demand for electric and hybrid RTGs. North America’s market growth is further supported by stringent environmental regulations, which encourage the shift towards more energy-efficient and eco-friendly crane solutions. Ports across this region are actively investing in modernizing equipment, and RTGs remain a preferred choice due to their versatility and productivity.

Europe

Europe accounts for 23% of the global Rubber Tired Gantry Crane market. The region’s focus on sustainability and environmental regulations significantly impacts the growth of the market. European ports, including Rotterdam, Hamburg, and Antwerp, are expanding and upgrading their infrastructure, with a strong emphasis on green technologies. Electric and hybrid RTGs are particularly in demand as ports strive to meet stringent carbon emission standards. Additionally, the growing trend of digitalization and automation across European terminals contributes to the market’s expansion. The region’s advanced technology adoption and eco-conscious mindset offer opportunities for growth in both hybrid and electric crane segments. The continuous development of port capacity and improved efficiency in container handling further drive the demand for RTGs.

Asia-Pacific

The Asia-Pacific region holds the largest share of the Rubber Tired Gantry Crane market, accounting for 35% of the global market. The region’s dominance is driven by the rapid expansion of port infrastructure, particularly in China, India, Japan, and South Korea. As the largest global trade hub, Asia-Pacific sees a significant increase in container traffic, fueling the demand for high-capacity cranes. China remains the leading country in the production and usage of RTGs, with numerous port development projects underway. With a growing focus on automation, ports in this region are increasingly adopting advanced RTG models equipped with electric and hybrid systems. The large-scale infrastructure projects across the region ensure continued growth in the Rubber Tired Gantry Crane market.

Middle East & Africa

The Middle East and Africa collectively account for 9% of the global Rubber Tired Gantry Crane market. The market in this region is growing steadily, driven by the expansion of major ports such as the Port of Dubai and the Port of Tanger Med in Morocco. These regions are witnessing significant investments in port infrastructure, which are expected to drive demand for efficient container handling solutions like RTGs. The growth in trade activities, particularly with Africa’s emerging markets, contributes to this upward trajectory. However, despite the growth, the market share remains relatively smaller compared to other regions due to the ongoing development phase in many Middle Eastern and African countries.

Latin America

Latin America holds 5% of the global Rubber Tired Gantry Crane market share. The market in this region is smaller due to less-developed port infrastructure compared to other regions. However, Latin American countries like Brazil, Argentina, and Mexico are investing in port modernization, with the goal of improving operational efficiency and handling larger volumes of containers. The increasing adoption of eco-friendly crane technologies, particularly hybrid and electric RTGs, is expected to drive growth in the future. The gradual increase in international trade and the growing importance of efficient port operations are factors contributing to the potential growth of the RTG market in Latin America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ZPMC (Shanghai Zhenhua Heavy Industries Co., Ltd.)

- Konecranes

- Liebherr Group

- Doosan Heavy Industries & Construction

- Cavotec SA

- Cargotec (Kalmar)

- Gantrex

- Hutchinson Industries

- Terex Corporation

- Engineered Material Handling (EMH)

- Gunter-Winkelmann GmbH

- Anupam Industries Limited

- Conductix-Wampfler

Competitive Analysis

The Rubber Tired Gantry Crane market is highly competitive, with key players such as Anupam Industries Limited, Cargotec (Kalmar), Doosan Heavy Industries & Construction, Konecranes, Liebherr Group, Terex Corporation, ZPMC (Shanghai Zhenhua Heavy Industries Co., Ltd.), Cavotec SA, Conductix-Wampfler, Engineered Material Handling (EMH), Gantrex, Gunter-Winkelmann GmbH, and Hutchinson Industries leading the industry. These companies are continuously innovating to offer advanced RTG solutions that improve efficiency, reduce environmental impact, and enhance container handling capacity. Market players are focusing on technology integration, including automation and electric power systems, to meet the growing demand for energy-efficient and sustainable solutions. Additionally, the competition is fueled by ongoing product development efforts, such as hybrid RTGs that combine the benefits of both diesel and electric power. As sustainability becomes a priority, key players are increasingly investing in environmentally friendly technologies that align with global emission reduction goals. The market is also witnessing increased collaboration between manufacturers and port operators to enhance crane performance through customized solutions. With the growing demand for high-capacity cranes, leading players are focusing on expanding their presence in emerging markets and modernizing their existing product lines. Strategic acquisitions, partnerships, and expansion in key regional markets further intensify competition.

Recent Developments

- In 2025, Konecranes introduced its E-Hybrid Rubber-Tired Gantry (RTG) crane and electric empty container handler at TOC Europe in Rotterdam aiming for a fully electric port equipment portfolio by 2026

- In 2025, Liebherr Group marked 25 years of RTG innovation, introducing a next-gen range with electric, hybrid, and variable speed genset options, backed by advanced modeling software

- In June 2022, Konecranes introduced a lineup of container handling equipment powered by batteries including a battery-operated rubber-tired gantry (RTG) crane, a battery-driven straddle carrier, and an entirely electric mobile harbor crane (MHC).

Report Coverage

The research report offers an in-depth analysis based on Wheels, Power Supply and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for Rubber Tired Gantry Cranes is expected to rise due to global trade expansion.

- Ports will increasingly focus on automation and advanced technologies to improve operational efficiency.

- Environmental concerns will drive the adoption of electric and hybrid RTGs to reduce emissions.

- Increased infrastructure investment in emerging markets will contribute to the market’s growth.

- The shift toward sustainability and eco-friendly solutions will be a key market driver.

- Technological advancements will lead to more precise and efficient RTG operations.

- Ports are likely to invest in modernizing their existing RTG fleets to meet growing demands.

- Demand for high-capacity cranes capable of handling large volumes of containers will continue to rise.

- The trend towards digitalization and data analytics will help improve RTG performance and management.

- Manufacturers will focus on designing cost-effective, energy-efficient cranes to cater to the evolving market needs.