Market Overview

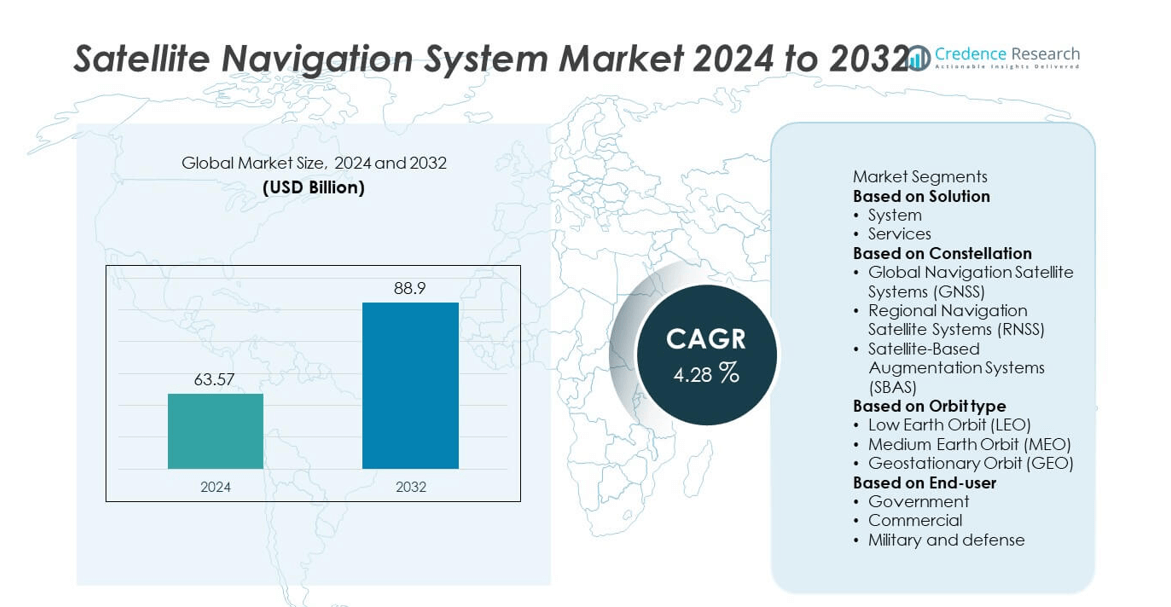

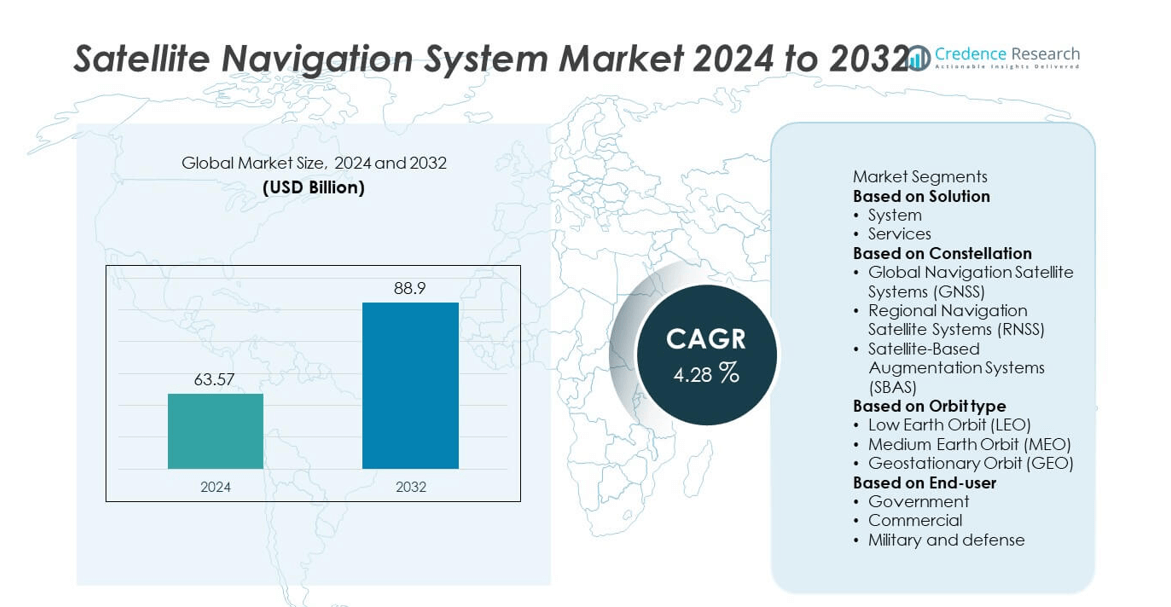

The Satellite Navigation System market size was valued at USD 63.57 billion in 2024 and is projected to reach USD 88.9 billion by 2032, growing at a CAGR of 4.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Satellite Navigation System Market Size 2024 |

USD 63.57 billion |

| Satellite Navigation System Market, CAGR |

4.28% |

| Satellite Navigation System Market Size 2032 |

USD 88.9 billion |

The Satellite Navigation System market is driven by major players including Broadcom Inc., Airbus, RTX Corporation, Northrop Grumman, Garmin Ltd., Thales Group, u-blox Holding AG, Lockheed Martin Corporation, Hexagon AB, and Qualcomm Technologies, Inc. These companies focus on advancing GNSS constellations, precision receivers, and augmentation services to strengthen applications across aviation, defense, automotive, and consumer electronics. In 2024, Asia-Pacific led the market with 35% share, supported by BeiDou expansion and rising automotive demand. North America followed with 32% share, driven by strong defense investments and GPS modernization, while Europe accounted for 27%, supported by Galileo’s advancements and regulatory focus on secure navigation systems.

Market Insights

- The Satellite Navigation System market was valued at USD 63.57 billion in 2024 and is projected to reach USD 88.9 billion by 2032, growing at a CAGR of 4.28%.

- Rising demand for real-time positioning, autonomous vehicles, and aviation safety systems is driving market expansion, with services leading by solution type at over 60% share in 2024.

- Trends highlight increased integration of GNSS with IoT, AI, and 5G technologies, while opportunities emerge from precision agriculture, smart city projects, and defense modernization programs worldwide.

- Competition is shaped by players such as Broadcom Inc., Airbus, RTX Corporation, Northrop Grumman, Garmin Ltd., Thales Group, u-blox Holding AG, Lockheed Martin Corporation, Hexagon AB, and Qualcomm Technologies, Inc., who focus on advanced chipsets, satellite modernization, and resilient navigation services.

- Regionally, Asia-Pacific led with 35% share in 2024, followed by North America at 32% and Europe at 27%, while Latin America and the Middle East & Africa accounted for 4% and 2% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solution

The services segment dominated the satellite navigation system market in 2024, holding over 60% share, driven by growing demand for navigation, timing, and positioning services across automotive, aviation, and defense applications. Increasing reliance on real-time data for logistics, fleet management, and autonomous vehicle technologies has further boosted adoption. Governments and private operators are expanding service offerings such as location-based services, precision agriculture, and smart city applications. While system development continues to attract investment, the recurring demand for navigation services ensures this segment’s long-term leadership.

- For instance, Trimble announced that its real-time correction service was actively supporting over 750,000 connected devices worldwide, enabling centimeter-level positioning in precision agriculture and construction equipment fleets managed by leading OEMs such as John Deere and Caterpillar.

By Constellation

Global Navigation Satellite Systems (GNSS) accounted for the largest share of over 70% in 2024, supported by widespread use of systems such as GPS, GLONASS, Galileo, and BeiDou. Their global coverage and integration with consumer electronics, automotive applications, and aviation navigation make GNSS the backbone of satellite-based services. Expanding smartphone penetration and increasing deployment of GNSS receivers in vehicles drive further growth. While Regional Navigation Satellite Systems (RNSS) and Satellite-Based Augmentation Systems (SBAS) play important complementary roles, GNSS dominance is sustained by its universal availability and broad technological adoption.

- For instance, Qualcomm reported shipment of over 2 billion Snapdragon mobile chipsets with multi-constellation GNSS support, enabling fast time-to-first-fix and meter-level horizontal accuracy for leading smartphone OEMs worldwide.

By Orbit Type

Medium Earth Orbit (MEO) dominated the satellite navigation system market with over 65% share in 2024, as most GNSS constellations, including GPS and Galileo, operate in this orbit. MEO satellites provide wide coverage, stable signal transmission, and optimal altitude for global navigation, making them essential for high-accuracy applications. Increasing modernization initiatives for existing constellations and expansion of new systems support this dominance. While Low Earth Orbit (LEO) satellites are gaining traction for enhanced positioning accuracy, and Geostationary Orbit (GEO) supports augmentation services, MEO continues to hold the largest share due to its proven reliability and efficiency.

Market Overview

Rising Adoption in Automotive and Transportation

The automotive sector is a major driver of the satellite navigation system market, with increasing integration of GNSS-based technologies in connected and autonomous vehicles. In 2024, over 60% of passenger and commercial vehicles featured navigation-enabled systems, supporting route optimization, fleet management, and safety applications. Intelligent transportation systems further accelerate adoption by requiring precise positioning. The push for smart mobility solutions, ride-hailing services, and logistics efficiency strengthens demand, positioning the automotive industry as a critical contributor to market expansion during the forecast period.

- For instance, Qualcomm has reported that its Snapdragon Digital Chassis platforms enable advanced GNSS-based capabilities, lane-level accuracy through partner services, and vehicle-to-everything (V2X) communication across leading OEM fleets, with its technologies used in over 350 million vehicles globally

Growing Demand for Precision in Defense and Aviation

Defense and aviation sectors significantly drive market growth due to their reliance on accurate and resilient navigation solutions. Satellite navigation systems provide critical support for surveillance, reconnaissance, and precision targeting in defense applications. Aviation uses GNSS for route optimization, fuel savings, and safety improvements in air traffic management. Increasing global defense budgets and civil aviation expansion create strong opportunities. With air passenger numbers expected to double by 2040, navigation systems will continue to play a pivotal role in ensuring operational efficiency and safety standards.

- For instance, BAE Systems has delivered thousands of its advanced M-Code GPS receivers, including the ultra-small MicroGRAM-M, to the United States military and its allies, providing enhanced resistance to jamming and supporting precision guidance for military applications like aviation and unmanned aerial systems. The company has a long heritage in military GPS and announced full-rate production for the MicroGRAM-M in 2022.

Expansion of Location-Based Services (LBS) and IoT Applications

The rising use of smartphones, wearables, and IoT devices is driving demand for satellite navigation services in everyday applications. Location-based services now support e-commerce, emergency response, smart cities, and precision agriculture. In 2024, over 5 billion smartphone users worldwide utilized GNSS-enabled applications, highlighting its mass adoption. The expansion of 5G connectivity further enhances real-time tracking and positioning accuracy. As industries integrate IoT-driven solutions for asset monitoring and logistics, the demand for GNSS services will rise sharply, making LBS and IoT integration a long-term growth driver.

Key Trends & Opportunities

Integration with Emerging Technologies

The satellite navigation system market is witnessing strong opportunities from integration with AI, 5G, and blockchain technologies. AI-powered analytics enhance accuracy and reliability of navigation signals, while 5G ensures faster and seamless data transfer. Blockchain is being explored for improving cybersecurity in navigation services. This convergence supports advanced applications in autonomous driving, drone operations, and smart infrastructure. The ability of satellite navigation systems to combine with disruptive technologies makes them central to next-generation digital ecosystems, creating long-term opportunities for innovation and adoption.

- For instance, Eutelsat Group, in partnership with MediaTek and Airbus, conducted the world’s first successful trial of 5G Non-Terrestrial Network (NTN) technology using its OneWeb low Earth orbit (LEO) satellites in February 2025, laying the groundwork for satellite and terrestrial network interoperability.

Development of Regional Navigation and Augmentation Systems

Countries are investing in regional systems and augmentation networks to enhance sovereignty and reduce dependence on foreign GNSS. Programs such as India’s NavIC, Japan’s QZSS, and Europe’s EGNOS highlight this trend. These systems improve regional accuracy, resilience, and security, addressing growing concerns about global system vulnerabilities. The expansion of Satellite-Based Augmentation Systems (SBAS) further supports aviation and maritime safety. This localized approach not only improves navigation reliability but also creates opportunities for domestic industries and technology providers, ensuring stronger regional competitiveness in the market.

- For instance, Europe’s EGNOS achieved the milestone of 1,000 operational approach procedures with its SBAS technology, directly supporting precision aviation landings and safety at over 400 airports throughout the continent

Key Challenges

Signal Vulnerability and Security Risks

Satellite navigation systems face significant risks from signal interference, jamming, and spoofing attacks, which compromise reliability and safety. These challenges are particularly critical in defense, aviation, and autonomous driving applications where precision is vital. For instance, GNSS-dependent drones and vehicles are vulnerable to malicious disruptions, raising security concerns. Governments and companies are investing in encryption and resilient signal technologies, but ensuring robust protection remains costly. Without effective countermeasures, security vulnerabilities could limit adoption in safety-critical sectors, slowing overall market growth.

High Costs of Deployment and Modernization

Building and maintaining satellite constellations involves substantial investment, often exceeding billions of dollars. Continuous modernization of systems such as GPS, Galileo, and BeiDou adds further financial burden. Smaller economies face challenges in developing regional navigation systems due to high capital and operational costs. Moreover, integrating GNSS services with next-generation technologies such as AI and 5G requires additional infrastructure investment. These costs hinder widespread adoption in developing regions, where budget constraints limit the ability to scale navigation technologies effectively.

Regional Analysis

North America

North America accounted for 33% share of the satellite navigation system market in 2024, driven by high adoption in defense, aviation, and automotive sectors. The U.S. leads with advanced GPS infrastructure supporting military, civil, and commercial applications, while Canada contributes with strong investments in aviation and logistics. Expansion of autonomous vehicle testing and integration of GNSS into smart city projects further strengthen regional demand. Government programs to modernize GPS signals and adoption of precision agriculture technologies enhance growth, making North America a critical hub for innovation and deployment in the satellite navigation market.

Europe

Europe held 28% share in 2024, supported by the widespread use of the Galileo satellite navigation system. Countries such as Germany, France, and the U.K. drive adoption through applications in automotive, aviation, and maritime industries. Strong emphasis on data security and sovereignty fuels investments in regional navigation and augmentation systems like EGNOS. The region benefits from EU-led initiatives that integrate GNSS into transportation, logistics, and emergency response. Rising demand for autonomous vehicles and smart infrastructure further strengthens adoption, positioning Europe as a key market for satellite-based navigation and precision services across multiple industries.

Asia-Pacific

Asia-Pacific dominated the satellite navigation system market with 30% share in 2024, led by China’s BeiDou system, India’s NavIC, and Japan’s QZSS. Strong growth in automotive, agriculture, and consumer electronics sectors drives demand for GNSS-based applications. China leads global expansion of navigation services, integrating BeiDou into logistics, aviation, and defense. India is expanding NavIC adoption in smartphones, vehicles, and fisheries, while Japan focuses on disaster management and urban mobility. Rising investment in satellite infrastructure and large-scale smart city initiatives make Asia-Pacific both the largest and fastest-growing market for satellite navigation technologies.

Latin America

Latin America captured 5% share of the market in 2024, with demand concentrated in Brazil and Mexico. Adoption is fueled by applications in logistics, agriculture, and public safety, where GNSS improves fleet management and crop monitoring. Governments are integrating satellite navigation into aviation safety and emergency response systems. Although infrastructure challenges and limited funding restrain widespread adoption, regional collaborations with global providers enhance access to navigation services. Growing interest in precision agriculture and urban mobility solutions continues to drive gradual expansion, positioning Latin America as an emerging but promising market for satellite navigation systems.

Middle East & Africa

The Middle East and Africa accounted for 4% share in 2024, reflecting gradual adoption of satellite navigation technologies. Gulf countries such as the UAE and Saudi Arabia lead with investments in aviation safety, defense, and smart transportation projects, often relying on GPS and Galileo services. South Africa is adopting GNSS solutions in mining, agriculture, and logistics to improve efficiency. Limited infrastructure and high costs pose challenges across several nations, but growing demand for urban mobility, disaster management, and precision farming solutions create opportunities for future expansion of satellite navigation systems in the region.

Market Segmentations:

By Solution

By Constellation

- Global Navigation Satellite Systems (GNSS)

- Regional Navigation Satellite Systems (RNSS)

- Satellite-Based Augmentation Systems (SBAS)

By Orbit type

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Orbit (GEO)

By End-user

- Government

- Commercial

- Military and defense

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Satellite Navigation System market is shaped by leading players such as Broadcom Inc., Airbus, RTX Corporation, Northrop Grumman, Garmin Ltd., Thales Group, u-blox Holding AG, Lockheed Martin Corporation, Hexagon AB, and Qualcomm Technologies, Inc. These companies are advancing GNSS constellations, multi-frequency chipsets, and high-precision receivers to serve applications in defense, aviation, automotive, and consumer electronics. Strategic collaborations with governments and space agencies are central to expanding satellite networks and improving service reliability. Many players are investing in resilient navigation technologies to counter spoofing and jamming threats while enhancing accuracy for autonomous vehicles and smart city infrastructure. Service diversification, including navigation-as-a-service and integration with IoT ecosystems, is gaining momentum. With rising global demand for real-time navigation, these companies focus on balancing technological innovation, affordability, and cybersecurity, consolidating their leadership positions in the competitive satellite navigation system market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Broadcom Inc.

- Airbus

- RTX Corporation

- Northrop Grumman

- Garmin Ltd.

- Thales Group

- u-blox Holding AG

- Lockheed Martin Corporation

- Hexagon AB

- Qualcomm Technologies, Inc.

Recent Developments

- In July 2025, Garmin raised its full-year revenue forecast citing strong sales of its GPS-enabled fitness and smartwatch products.

- In May 2025, u-blox introduced PointPerfect Global, its global GNSS correction service for high-precision use in agriculture, UAVs, robotics.

- In January 2025, u-blox announced it would phase out its cellular business and focus more on GNSS / positioning technologies.

- In 2025, Lockheed Martin delivered its built GPS III satellite SV08 to operational control for improved PNT services.

Report Coverage

The research report offers an in-depth analysis based on Solution, Constellation, Orbit type, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising use of GNSS in autonomous vehicles and drones.

- Services will dominate as demand for navigation, mapping, and tracking continues to grow.

- Integration of satellite navigation with IoT and 5G will enhance accuracy and connectivity.

- Defense and aerospace sectors will increase reliance on secure navigation systems.

- Precision agriculture will drive adoption of satellite-based solutions in emerging economies.

- Regional navigation systems will strengthen as countries invest in independent constellations.

- Smart city development will boost demand for real-time navigation applications.

- North America and Asia-Pacific will remain the largest markets with strong government support.

- Cybersecurity and resilience against jamming will be critical for future system reliability.

- Innovation in chipsets and multi-constellation receivers will shape next-generation applications.