Market Overview

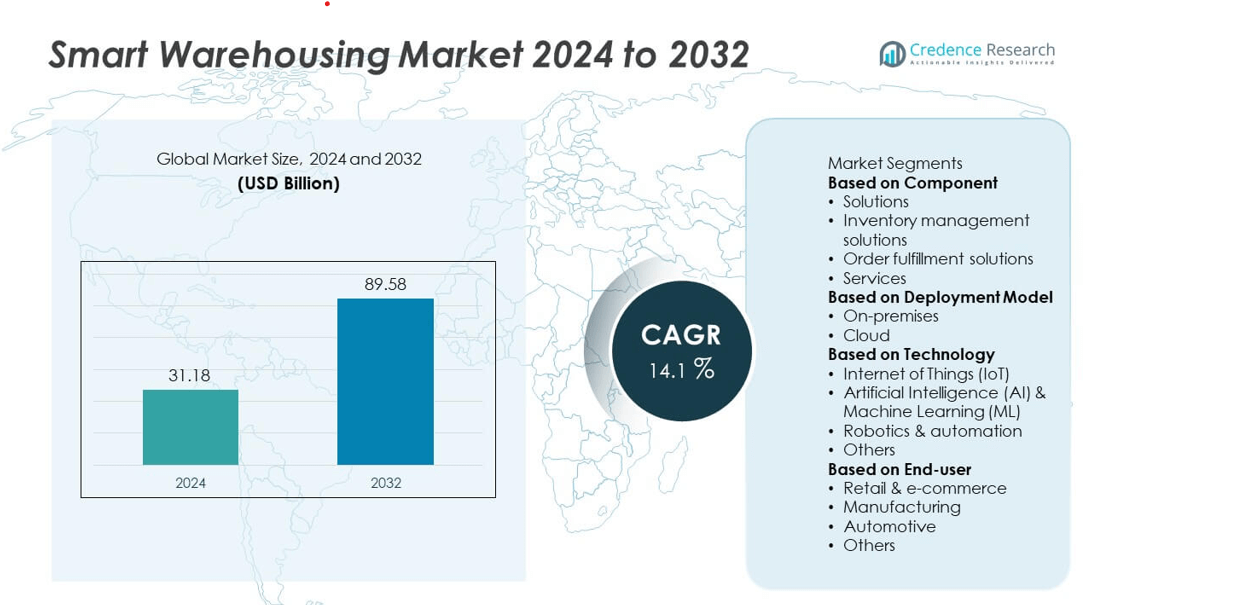

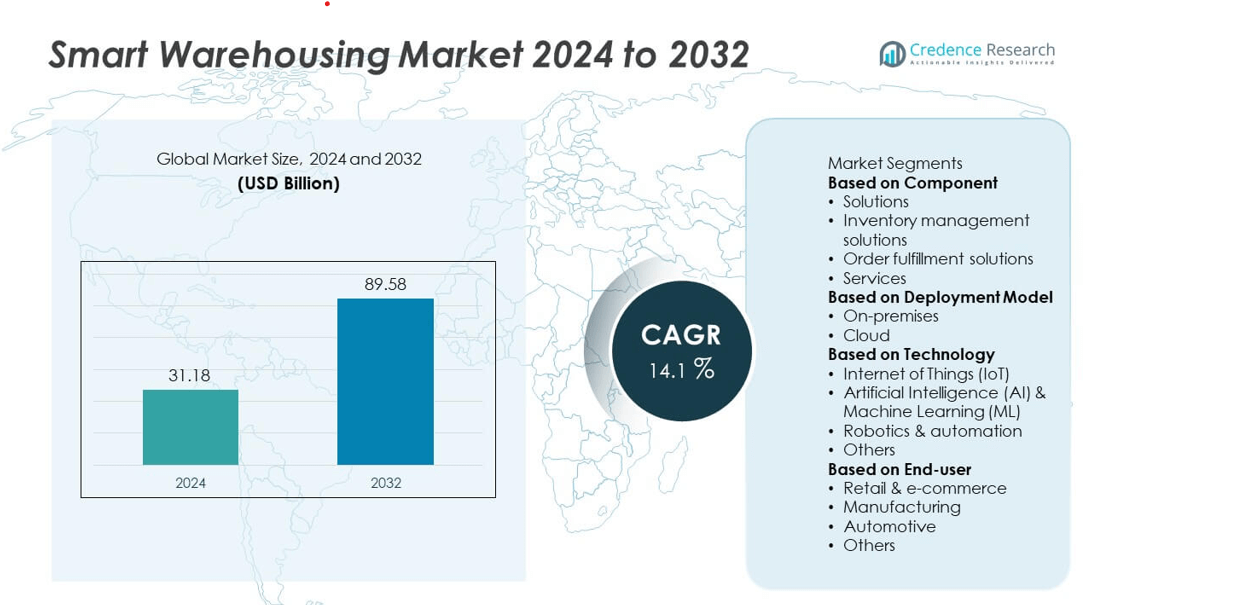

The Smart Warehousing market size was valued at USD 31.18 billion in 2024 and is projected to reach USD 89.58 billion by 2032, growing at a CAGR of 14.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Warehousing Market Size 2024 |

USD 31.18 billion |

| Smart Warehousing Market, CAGR |

14.1% |

| Smart Warehousing Market Size 2032 |

USD 89.58 billion |

The smart warehousing market is led by major players including Oracle Corporation, SAP SE, Infor, Blue Yonder Group, Inc., Korber AG, IBM Corporation, Microsoft Corporation, Manhattan Associates, Epicor Software Corporation, and Tecsys Inc. These companies drive innovation through AI-powered platforms, IoT integration, and robotics to streamline inventory management and order fulfillment. Regionally, North America held the largest share at 36% in 2024, supported by advanced automation adoption and strong e-commerce growth. Asia-Pacific followed with 33% share, fueled by rapid digitalization and expanding logistics networks, while Europe accounted for 25%, driven by regulatory focus on sustainable and efficient supply chains.

Market Insights

- The smart warehousing market was valued at USD 31.18 billion in 2024 and is projected to reach USD 89.58 billion by 2032, growing at a CAGR of 14.1% during the forecast period.

- Rising e-commerce growth and increasing demand for faster deliveries are driving adoption of AI, IoT, and robotics in smart warehousing systems.

- Key trends include the rise of cloud-based warehouse management, predictive analytics, and automation technologies that enhance real-time decision-making and efficiency.

- Competition is shaped by players such as Oracle, SAP SE, IBM, Microsoft, Blue Yonder, and Infor, focusing on scalable platforms and partnerships to expand their global reach.

- Regionally, North America led with 36% share in 2024, followed by Asia-Pacific at 33% driven by logistics investments, while Europe held 25% supported by sustainability-focused solutions, and Latin America and Middle East & Africa accounted for 4% and 2% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solutions segment dominated the smart warehousing market in 2024, holding over 55% share. Within this category, inventory management solutions led adoption, driven by rising demand for real-time tracking, reduced stockouts, and improved operational accuracy. Order fulfillment solutions also gained traction due to the expansion of e-commerce and need for faster deliveries. Services complemented adoption by providing system integration and maintenance, but solutions remained the primary contributor. The shift toward digitalized, automated inventory processes continues to strengthen this segment’s position as companies prioritize efficiency and accuracy in warehouse operations.

- For instance, Manhattan Associates’ warehouse management system (WMS), including the Manhattan Active® Warehouse Management system implemented by clients such as WSI Supply Chain Solutions in 2024, is designed to optimize order workflows.

By Deployment Model

Cloud deployment led the smart warehousing market in 2024 with more than 60% share, reflecting its scalability, flexibility, and cost-effectiveness. Businesses increasingly prefer cloud platforms to manage distributed warehouse networks, enable real-time collaboration, and support data-driven decision-making. Cloud solutions also facilitate integration with IoT and AI technologies, ensuring seamless upgrades and reducing reliance on physical infrastructure. On-premises deployment remains relevant in industries with strict security and compliance needs, such as defense and healthcare. However, the rapid adoption of cloud-driven models underlines their dominance, supported by global digital transformation initiatives.

- For instance, SAP’s cloud-based logistics platform, including SAP Extended Warehouse Management (EWM) cloud, offers scalable real-time analytics and remote system updates to multinational clients across manufacturing and e-commerce.

By Technology

Robotics and automation dominated the smart warehousing market in 2024, accounting for over 40% share. Automated guided vehicles, robotic picking systems, and conveyor technologies are increasingly adopted to reduce labor costs and enhance efficiency. The Internet of Things (IoT) followed closely, enabling real-time monitoring of assets, predictive maintenance, and connected workflows. Artificial Intelligence (AI) and Machine Learning (ML) are growing rapidly, supporting demand forecasting, intelligent routing, and process optimization. While other technologies contribute to niche applications, robotics and automation remain the key driver, supported by rising labor shortages and the global push for faster, error-free warehousing.

Market Overview

Rising E-commerce and Omnichannel Retail

The expansion of e-commerce and omnichannel retail is a major driver for the smart warehousing market. Growing consumer expectations for faster deliveries and accurate order fulfillment are pushing companies to adopt automated solutions. Technologies such as robotics, IoT, and real-time inventory management systems streamline warehouse operations and minimize errors. Retailers and logistics providers increasingly invest in smart systems to manage large product volumes and seasonal demand spikes. This shift enhances efficiency, reduces costs, and positions smart warehouses as critical enablers of modern supply chains.

- For instance, as of mid-2025, Amazon had deployed more than 1 million robotics units across its operations. In late 2024, the company announced its newest generation of facilities, which are designed to achieve a 25% improvement in productivity compared to older sites.

Adoption of Robotics and Automation

The rising adoption of robotics and automation is driving smart warehousing growth. Automated guided vehicles, robotic picking systems, and conveyor automation improve efficiency, reduce human dependency, and address rising labor costs. Robotics support 24/7 operations, allowing warehouses to handle higher volumes without compromising accuracy. Increasing use of autonomous mobile robots (AMRs) enhances flexibility in handling diverse workflows. With businesses focusing on productivity and scalability, automation strengthens competitive advantage, fueling widespread integration of robotics in warehouses across retail, manufacturing, and third-party logistics.

- For instance, Autonomous Mobile Robots (AMRs) are proven to increase warehouse efficiency. For instance, in deployments with various clients, AMRs integrated through Zebra Technologies’ solutions have helped increase warehouse throughput and operate with high uptime.

Advancements in IoT and AI Technologies

Integration of IoT and artificial intelligence is transforming warehouse operations and serving as a key growth driver. IoT sensors enable real-time asset tracking, condition monitoring, and predictive maintenance, reducing downtime and enhancing visibility. AI and machine learning optimize inventory management, forecast demand, and automate decision-making processes. Combined, these technologies help minimize errors, improve energy efficiency, and enhance customer service levels. Growing investment in digital transformation across industries ensures that IoT and AI remain central to the adoption of next-generation smart warehousing solutions worldwide.

Key Trends & Opportunities

Expansion of Cloud-Based Platforms

The growing use of cloud-based warehousing solutions is a notable trend creating strong opportunities. Cloud deployment provides scalability, cost efficiency, and easier integration with advanced technologies like IoT and AI. It enables global companies to manage distributed warehouses with centralized data access, real-time visibility, and predictive insights. As supply chains become more complex, cloud adoption enhances collaboration between stakeholders and supports flexible operations. The increasing shift from on-premises systems to cloud platforms will continue to reshape the smart warehousing landscape during the forecast period.

- For instance, DHL’s GoGreen program has integrated smart energy management, including intelligent building systems, across its facilities worldwide, with all new buildings designed to be carbon-neutral

Emergence of Sustainable and Green Warehousing

Sustainability is becoming a key opportunity in the smart warehousing market. Companies are adopting energy-efficient lighting, solar-powered systems, and smart energy management solutions to reduce carbon footprints. Automated solutions also improve space utilization, lowering energy consumption and operating costs. Growing regulatory pressures and consumer demand for eco-friendly operations are pushing warehouses to align with green building standards. This trend highlights the role of smart technologies in enabling sustainable operations, creating long-term growth opportunities for eco-conscious logistics and warehousing providers globally.

- For instance, Blue Yonder’s warehouse management system, known for its AI-embedded supply chain execution platform, aims to deliver near 100% inventory visibility and accuracy through cycle counting capabilities.

Key Challenges

High Initial Investment and Integration Costs

One of the main challenges in the smart warehousing market is the high cost of implementation. Deploying robotics, IoT systems, and AI platforms requires significant capital investment and specialized expertise. Integration with legacy systems further increases expenses, posing a barrier for small and medium-sized enterprises. Although smart warehouses provide long-term cost savings and efficiency, upfront costs limit adoption in price-sensitive markets. This challenge continues to slow penetration in developing regions, requiring affordable and scalable solutions to bridge the gap.

Cybersecurity and Data Privacy Risks

The reliance on IoT, cloud platforms, and connected systems in smart warehouses raises significant cybersecurity concerns. Warehouses generate large volumes of sensitive data related to supply chains, customer information, and operational performance. Any breach or cyberattack can disrupt operations, cause financial losses, and erode trust. Compliance with global data protection regulations adds further complexity. As digital adoption expands, securing networks, devices, and platforms remains a critical challenge, requiring continuous investment in encryption, monitoring, and robust cybersecurity frameworks.

Regional Analysis

North America

North America accounted for 33% share of the smart warehousing market in 2024, driven by strong adoption of automation, robotics, and IoT solutions in logistics and retail. The U.S. leads with heavy investments in digital supply chain transformation and advanced e-commerce operations. Canada contributes with increased adoption of AI-driven platforms for inventory and order management. The region’s focus on efficiency, coupled with labor shortages, accelerates demand for automation. Supportive government policies and well-established infrastructure make North America a key hub for innovation, sustaining its leadership in the smart warehousing market.

Europe

Europe held 28% share in 2024, supported by stringent regulations promoting digitalization, sustainability, and efficient supply chain management. Germany, the U.K., and France lead adoption, leveraging robotics, AI, and cloud-based systems to modernize warehousing operations. The rise of cross-border e-commerce within the EU further drives demand for smart solutions. Focus on green warehousing practices, including energy-efficient systems and automation, strengthens growth. Strong partnerships between logistics providers and technology firms are enabling integration of advanced platforms. Europe’s emphasis on compliance, sustainability, and efficiency ensures steady expansion in the smart warehousing market.

Asia-Pacific

Asia-Pacific dominated the smart warehousing market with 30% share in 2024, fueled by rapid e-commerce growth, expanding manufacturing bases, and rising investments in automation. China leads regional demand with large-scale deployment of robotics and IoT-enabled warehouses, while India shows significant growth through government-backed digital initiatives. Japan and South Korea contribute with advanced AI and robotics solutions for efficient inventory management. Rising urbanization and demand for fast deliveries accelerate adoption of cloud-based and automated systems. With increasing focus on logistics optimization, Asia-Pacific remains both the largest and fastest-growing market for smart warehousing globally.

Latin America

Latin America captured 5% share of the smart warehousing market in 2024, led by Brazil and Mexico, where e-commerce expansion and logistics modernization are boosting adoption. Demand is growing for portable and cloud-enabled warehousing systems that improve efficiency in retail and manufacturing sectors. Government-backed digital transformation initiatives and rising consumer preference for online shopping further support growth. However, cost constraints and limited infrastructure remain key challenges. Despite these hurdles, regional partnerships with global technology providers and rising investments in automation are creating steady opportunities for smart warehousing adoption in Latin America.

Middle East & Africa

The Middle East and Africa accounted for 4% share in 2024, reflecting gradual but rising adoption of smart warehousing technologies. The UAE and Saudi Arabia lead with large-scale investments in logistics infrastructure and smart city projects, incorporating IoT-enabled and automated systems. South Africa contributes with increased demand for digital solutions in retail and manufacturing supply chains. Affordability issues and infrastructure gaps restrain adoption across several African nations. However, government support for digital transformation and growing e-commerce activity are expected to fuel long-term opportunities, making the region an emerging market for smart warehousing solutions.

Market Segmentations:

By Component

- Solutions

- Inventory management solutions

- Order fulfillment solutions

- Services

By Deployment Model

By Technology

- Internet of Things (IoT)

- Artificial Intelligence (AI) & Machine Learning (ML)

- Robotics & automation

- Others

By End-user

- Retail & e-commerce

- Manufacturing

- Automotive

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

Competitive landscape in the smart warehousing market is defined by the presence of major players such as Oracle Corporation, SAP SE, Infor, Blue Yonder Group, Inc., Korber AG, IBM Corporation, Microsoft Corporation, Manhattan Associates, Epicor Software Corporation, and Tecsys Inc. These companies focus on offering advanced warehouse management solutions, robotics integration, and cloud-based platforms to optimize efficiency and scalability. Strategic initiatives include investments in AI- and IoT-enabled systems, partnerships with logistics providers, and acquisitions to expand global reach. Competition is intensifying as vendors enhance automation, predictive analytics, and real-time visibility features to address rising e-commerce demands. Key players are also aligning solutions with sustainability goals by improving energy efficiency and reducing carbon footprints in warehouse operations. With growing reliance on robotics, cloud deployments, and digital platforms, the competitive environment emphasizes innovation, scalability, and integration, ensuring that market leaders maintain their edge while new entrants capture niche opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Oracle added Advanced Inventory Management capabilities in Oracle Cloud SCM, to streamline warehouse operations using embedded AI.

- In May 2025, Blue Yonder was named a Leader in the 2025 Gartner Magic Quadrant for Warehouse Management Systems, for the 14th consecutive year.

- In May 2025, Blue Yonder acquired Pledge Earth Technologies Ltd. to expand its end-to-end supply chain and sustainability capabilities.

- In March 2025, Microsoft published insights urging retailers to digitalize warehouses using AI, cloud platforms, and simulation (e.g., with NVIDIA Omniverse) to boost agility.

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment Model, Technology, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly with rising adoption of AI and IoT in warehouses.

- Robotics and automation will improve efficiency, accuracy, and labor productivity in operations.

- Cloud-based warehouse management systems will dominate due to scalability and cost-effectiveness.

- Predictive analytics will play a key role in optimizing inventory and demand forecasting.

- Integration with e-commerce platforms will drive strong adoption across global retail supply chains.

- Sustainability initiatives will push adoption of energy-efficient and green warehouse solutions.

- North America will maintain dominance, while Asia-Pacific will remain the fastest-growing region.

- Partnerships between tech firms and logistics providers will accelerate innovation in solutions.

- High implementation costs and cybersecurity concerns will remain challenges to adoption.

- Future warehouses will evolve into fully connected, automated, and data-driven ecosystems.