Market Overview

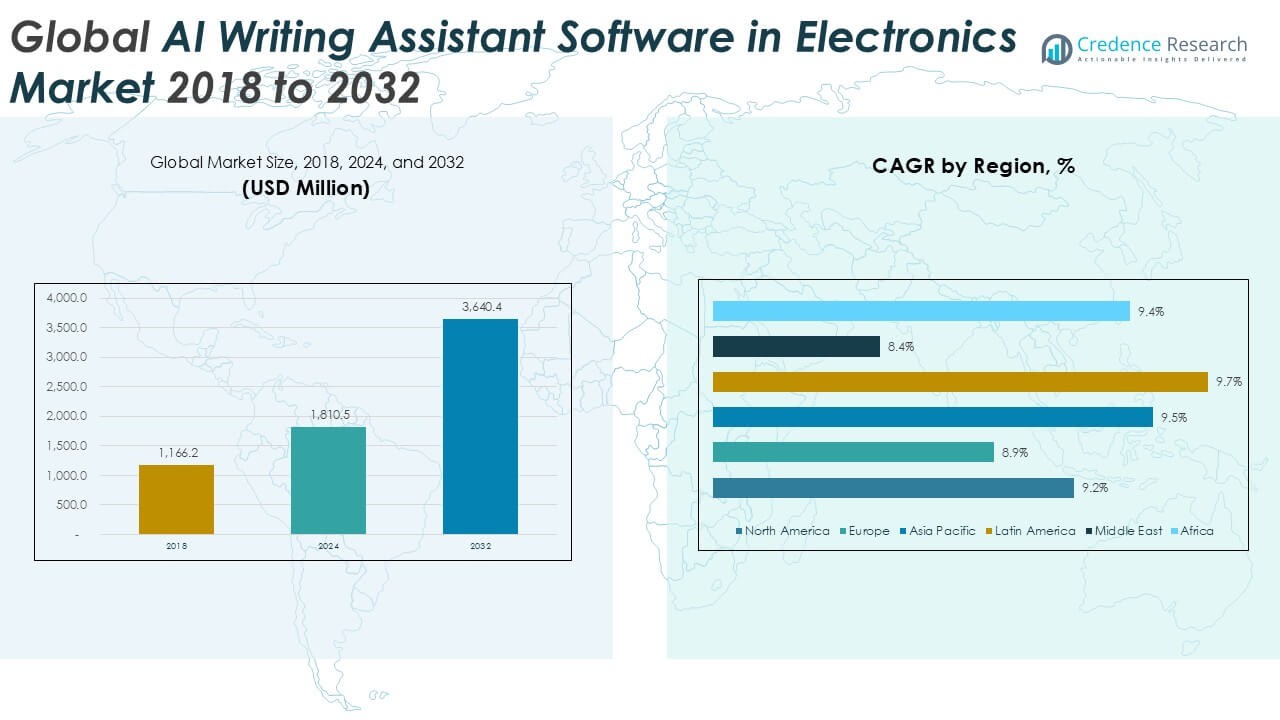

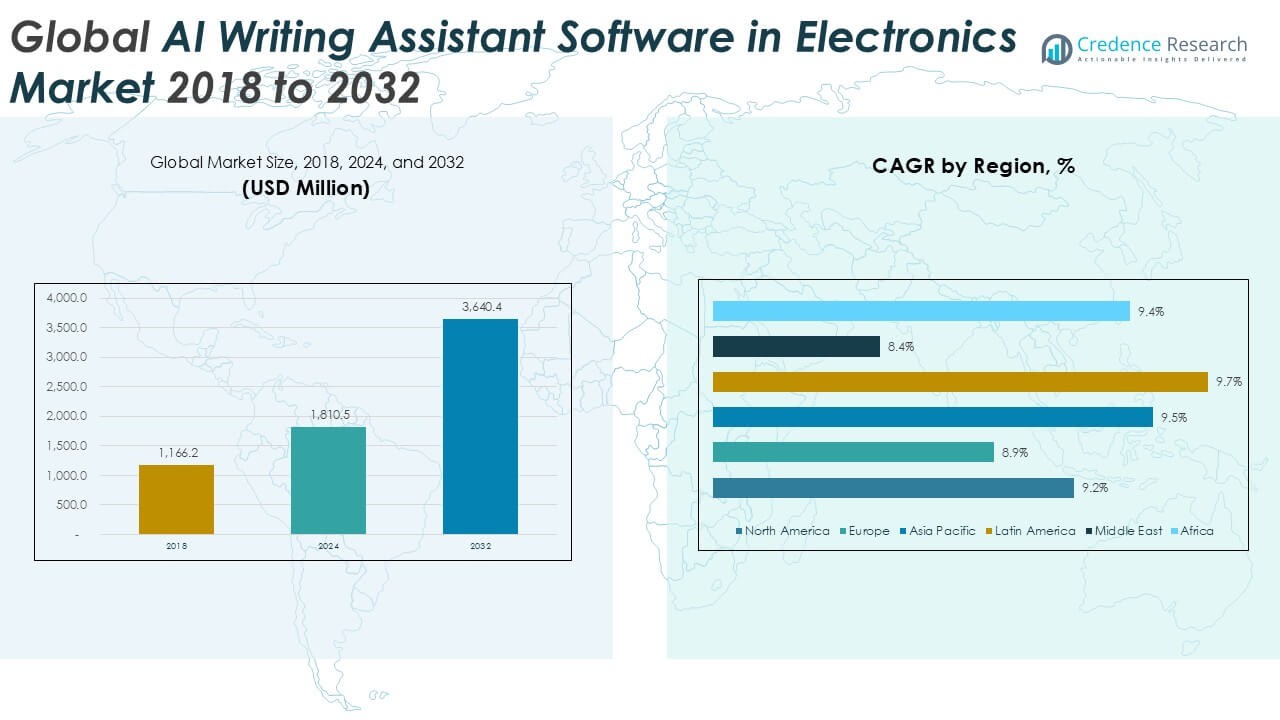

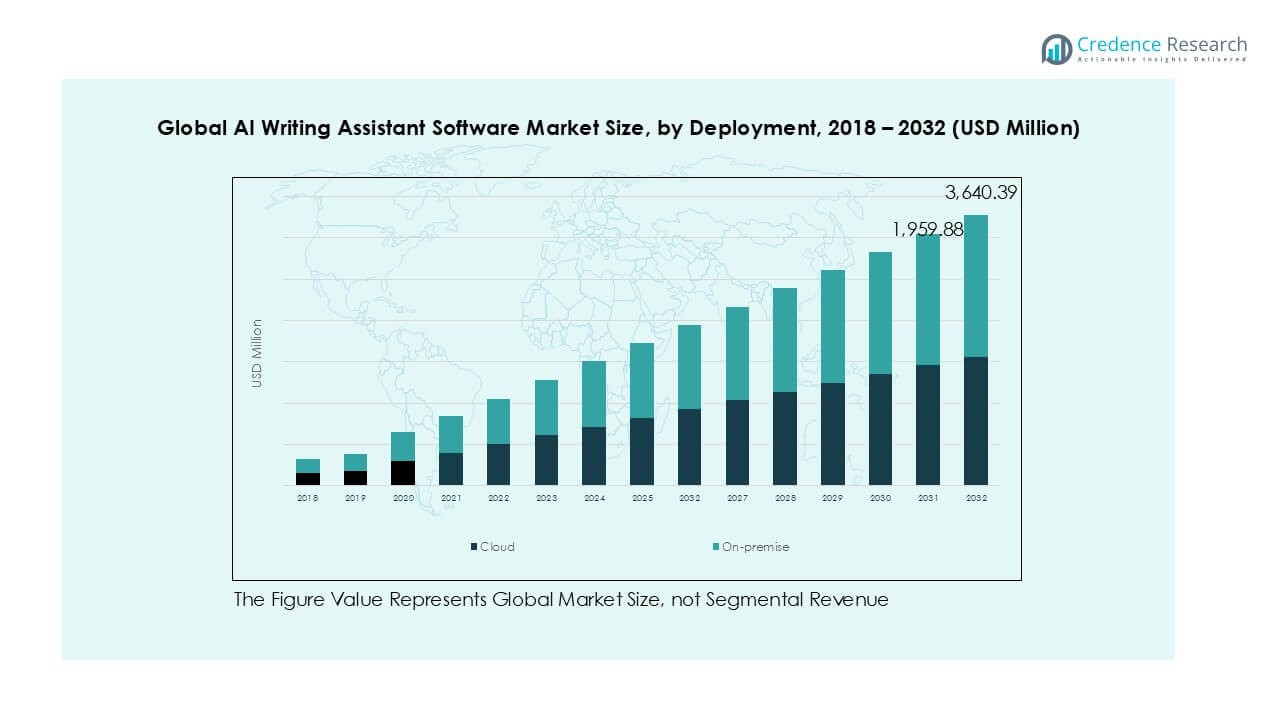

AI Writing Assistant Software market size was valued at USD 1,166.2 million in 2018, growing to USD 1,810.5 million in 2024, and is anticipated to reach USD 3,640.4 million by 2032, at a CAGR of 9.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| AI Writing Assistant Software Market Size 2024 |

USD 1,810.5 Million |

| AI Writing Assistant Software Market, CAGR |

9.25% |

| AI Writing Assistant Software Market Size 2032 |

USD 3,640.4 Million |

The AI writing assistant software market is led by major players including Grammarly Inc., Semrush, Jasper AI Inc., ProWritingAid, and DeepL, supported by emerging providers such as Rytr, Frase Inc., and AI Writer. These companies drive growth through advanced features like contextual recommendations, grammar and spelling checks, and style adjustments, increasingly integrated into cloud-based platforms for global reach. Asia Pacific emerged as the leading region with a 34.8% share in 2018, supported by rapid digitalization and growing e-learning adoption, followed by North America with 27.3% and Europe with 22.1%. Together, these regions account for the bulk of the market’s revenue, reflecting strong adoption among enterprises, individuals, and academic institutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The AI Writing Assistant Software market was valued at USD 1,810.5 million in 2024 and is projected to reach USD 3,640.4 million by 2032, growing at a CAGR of 9.25%.

- Rising demand for error-free, efficient communication in business, academia, and publishing is a key driver boosting adoption, with grammar and spelling checking tools holding the largest feature-based share.

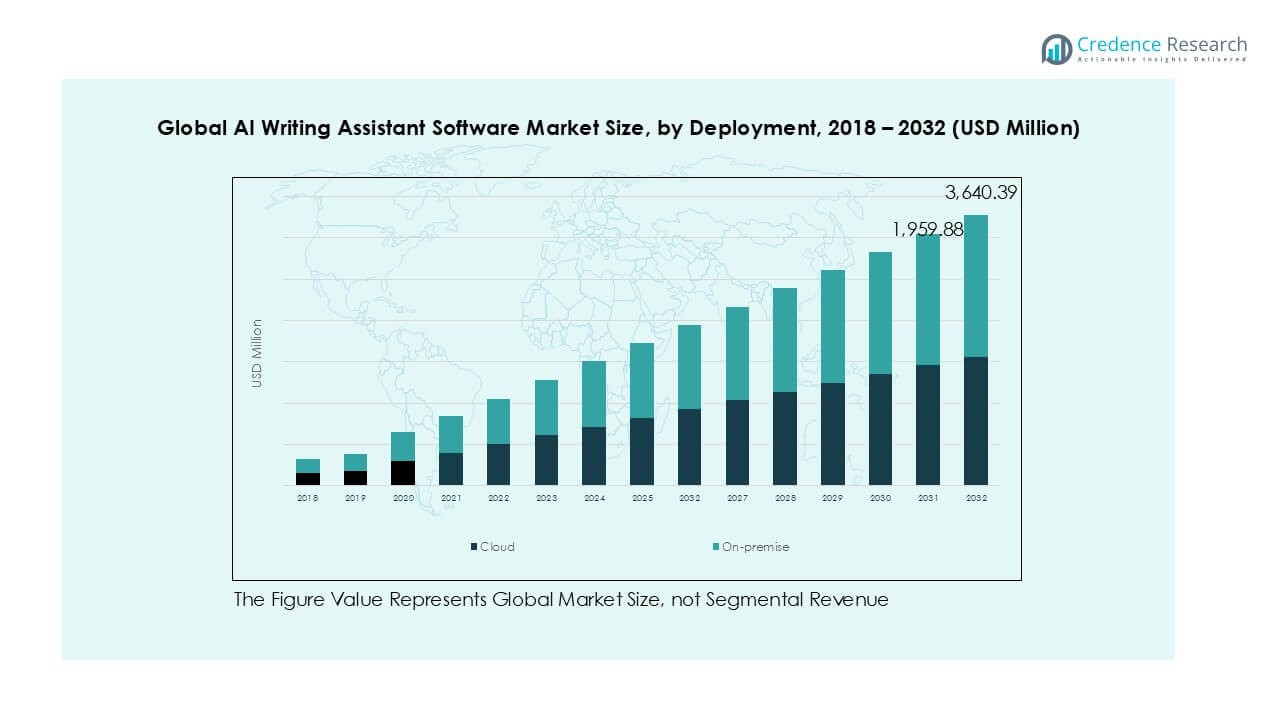

- Cloud deployment leads the market with nearly 70% share, supported by scalability and remote accessibility, while on-premise remains relevant in regulated industries requiring strict data security.

- The competitive landscape includes global leaders like Grammarly, Semrush, Jasper AI, and DeepL, alongside emerging players such as Rytr and Frase Inc., focusing on affordability and niche user segments.

- Regionally, Asia Pacific dominates with 34.8% share in 2018, followed by North America at 27.3% and Europe at 22.1%; Latin America, Middle East, and Africa show high growth potential with CAGRs above 9%.

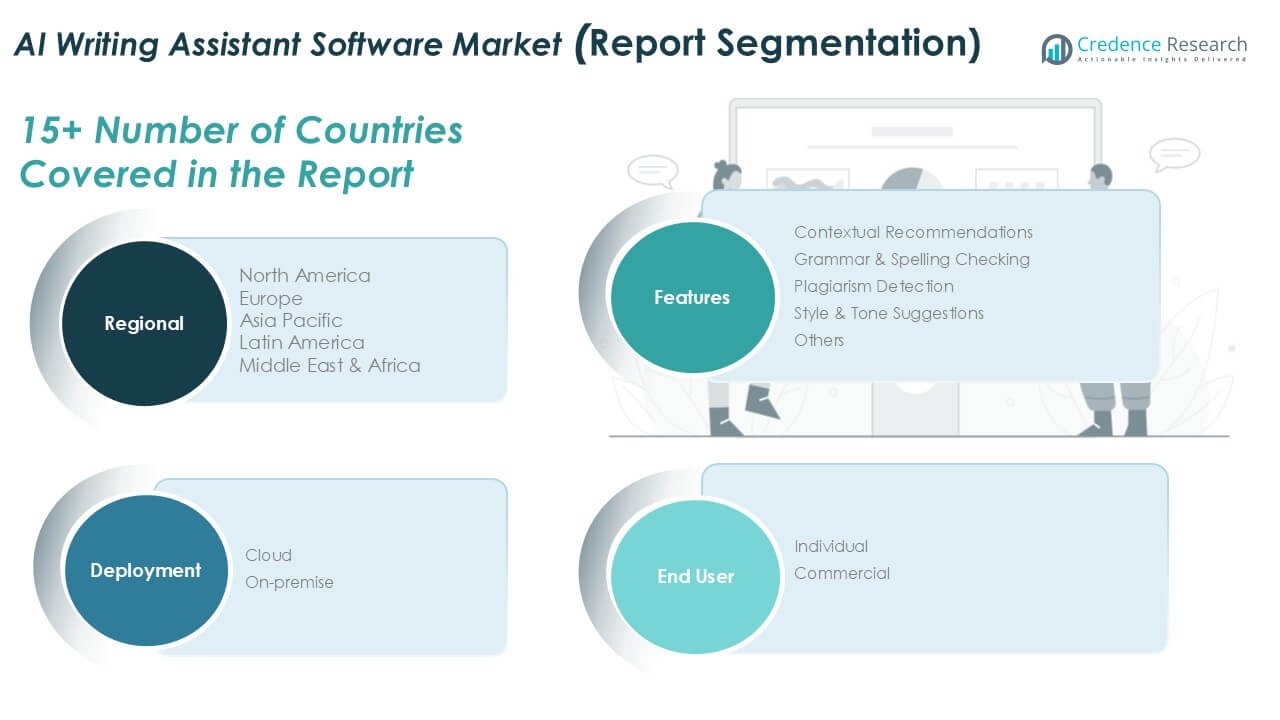

Market Segmentation Analysis:

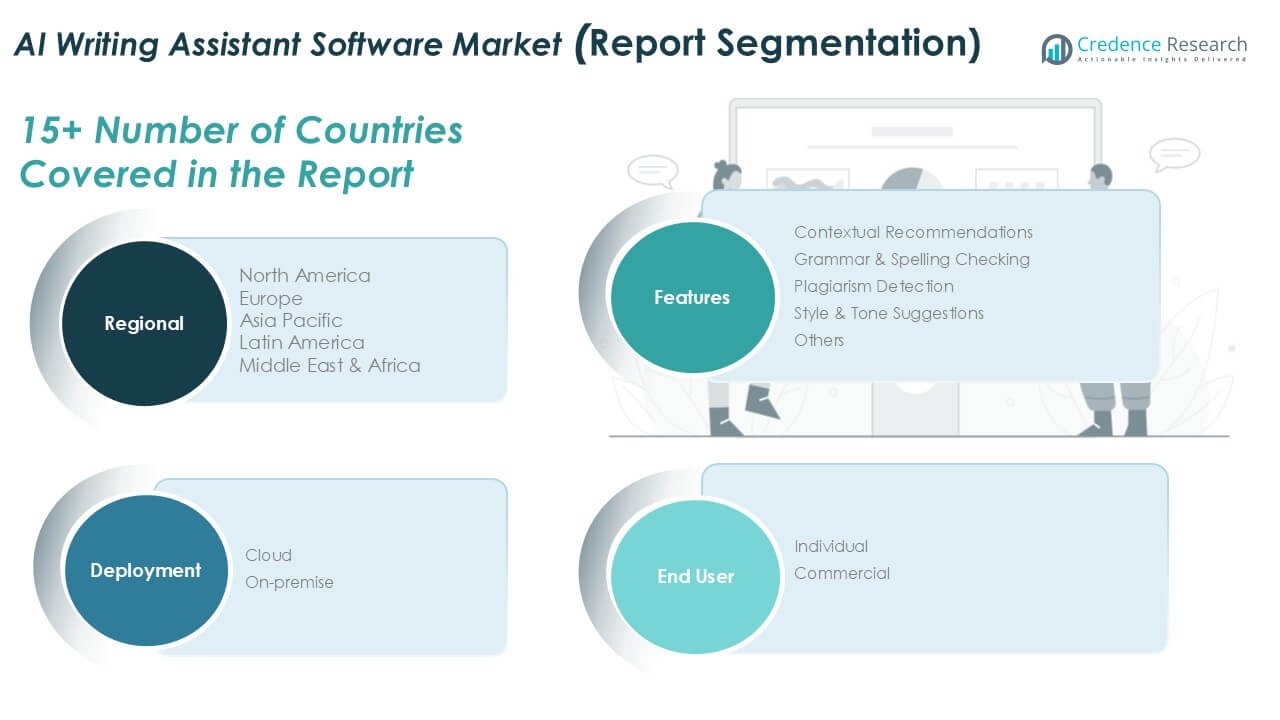

By Feature

The AI writing assistant software market by feature is led by grammar and spelling checking, which accounted for over 35% of revenue share in 2024. This dominance is driven by its wide adoption across individual and professional users seeking error-free content in real-time. Contextual recommendations and style & tone suggestions are also gaining traction as enterprises focus on brand consistency and personalized communication. Meanwhile, plagiarism detection tools see rising demand in academia and publishing, supported by stricter content originality policies. The “others” category includes niche features like translation support and formatting aids.

- For instance, Turnitin has published other usage statistics, such as its AI writing detection feature reviewing over 159 million submissions since its April 2023 launch.

By Deployment

Cloud-based deployment dominated the AI writing assistant software market, holding nearly 70% of the share in 2024. The preference for cloud solutions stems from their scalability, cost-effectiveness, and ability to support remote collaboration across global teams. Enterprises favor cloud platforms for integrating AI into digital workflows, while individuals value the accessibility of subscription-based models. On-premise deployment continues to serve organizations with stricter data security and compliance requirements, particularly in regulated industries. However, the growing emphasis on flexibility and seamless updates ensures cloud remains the preferred model for most users.

- For instance, Grammarly reported surpassing 30 million daily active users in 2023 through its cloud-based platform, highlighting the widespread adoption of subscription-driven AI writing assistants.

By End User

Commercial users led the AI writing assistant software market, capturing about 65% of the share in 2024. Businesses across marketing, publishing, legal, and customer service rely on AI-driven tools to enhance productivity, reduce manual editing, and maintain brand tone consistency. Demand from individuals, although smaller, is expanding due to rising freelance writing, academic needs, and professional communication tasks. The growth in commercial adoption is further supported by enterprises investing in multilingual content generation and real-time assistance to improve engagement. Increasing focus on operational efficiency ensures commercial applications continue as the dominant end-user segment.

Key Growth Drivers

Rising Demand for Error-Free and Efficient Communication

The growing importance of clear, accurate, and fast communication is driving the AI writing assistant software market. Businesses across industries are prioritizing polished content to engage customers, build brand credibility, and maintain professionalism in customer-facing documents. Grammar and spelling checking tools remain the most widely used features, as they reduce manual editing time and ensure error-free outputs. In addition, organizations are integrating these tools into internal communication platforms and customer service workflows to improve efficiency. The surge in remote and hybrid work has further accelerated adoption, as professionals seek real-time assistance to deliver consistent, high-quality content without additional editorial resources. This strong need for accuracy and productivity underpins steady market growth.

- For instance, Microsoft reported that more than 400 million users engaged with Editor in 2023, its AI-powered writing assistant integrated into Office 365 and Teams.

Expansion of Content Marketing and Digital Engagement

The rise of digital platforms and content-driven strategies is a major growth driver for AI writing assistant software. Companies are producing blogs, whitepapers, marketing emails, and social media posts at an unprecedented scale. AI tools offering contextual recommendations, style suggestions, and tone adjustments support marketers in tailoring content for diverse audiences while ensuring consistency with brand guidelines. Plagiarism detection has also gained traction, especially for publishers and marketing agencies handling large volumes of content. The demand for multilingual support further widens opportunities, as businesses expand into global markets. As digital engagement becomes central to customer acquisition and retention, AI-powered writing assistants play a crucial role in delivering personalized and persuasive content efficiently.

- For instance, Jasper AI reported generating over 80,000 pieces of marketing content per day in 2023 across blogs, ads, and social media posts for enterprise clients.

Integration with Advanced AI and Natural Language Processing (NLP)

The evolution of AI and NLP technologies is enhancing the capabilities of writing assistant tools. Modern platforms now deliver context-aware recommendations, detect subtle style variations, and even provide tone modifications aligned with the writer’s intent. These innovations are fueling broader adoption among enterprises seeking advanced, human-like writing support. Cloud-based models also leverage continuous updates to refine accuracy and expand functionality, offering users access to cutting-edge features. Furthermore, the integration of AI writing assistants into enterprise software ecosystems, such as customer relationship management (CRM) systems and productivity suites, has increased usability and relevance. As organizations embrace digital transformation and automation, the sophistication of NLP-driven solutions acts as a significant catalyst for long-term market growth.

Key Trends & Opportunities

Growing Adoption of Cloud-Based Writing Platforms

Cloud deployment is a strong trend shaping the AI writing assistant software market. Businesses and individuals increasingly prefer cloud-based solutions due to their scalability, low upfront cost, and ease of integration with existing digital tools. Subscription models also make advanced AI features accessible to freelancers, students, and small businesses, broadening the user base. The shift toward cloud platforms further allows real-time collaboration across geographies, supporting global teams and remote work environments. Vendors offering multilingual support and seamless integration with productivity tools like email, word processors, and customer engagement platforms are well positioned to capture new opportunities. This trend not only strengthens market penetration but also ensures recurring revenue streams for providers.

- For instance, Grammarly’s cloud-based platform surpassed 30 million daily active users in 2023, with support for over 500,000 enterprise teams globally.

Increasing Use Cases in Education and Academia

The education sector represents a growing opportunity for AI writing assistant software. Students and academic institutions are adopting tools for grammar correction, plagiarism detection, and structured writing assistance. These solutions help improve learning outcomes by enabling students to refine their writing skills while ensuring academic integrity. Universities and online learning platforms are also incorporating AI assistants into coursework and learning management systems to support non-native English speakers and enhance accessibility. The adoption is expected to grow with the rise of e-learning and remote education models. This trend positions AI writing assistants as essential academic tools, further diversifying market applications beyond business and personal use.

Key Challenges

Data Privacy and Security Concerns

One of the main challenges in the AI writing assistant software market is data privacy. Writing assistants often process sensitive information such as business communication, legal documents, or academic submissions. Concerns arise over how this data is stored, analyzed, and protected, especially with cloud-based deployments. Enterprises in regulated industries such as healthcare and finance are hesitant to adopt these solutions due to potential compliance risks. Vendors must ensure robust encryption, compliance with regulations like GDPR, and transparent data usage policies to address these concerns. Without proper safeguards, trust issues could slow adoption rates, particularly among large organizations handling confidential content.

Limitations in Accuracy and Context Understanding

Despite advancements in NLP, AI writing assistants still face challenges in delivering perfect contextual understanding. Complex sentences, domain-specific terminology, and nuanced language often result in misinterpretations or inaccurate suggestions. These limitations can lead to over-reliance on AI and potential errors in critical business or academic documents. While tools continue to improve, users often require human oversight to ensure final content quality. This challenge highlights the need for hybrid solutions that combine automation with editorial control. Failure to address accuracy and contextual gaps could hinder adoption among professionals demanding precise, industry-specific outputs.

Regional Analysis

North America

North America held a 27.3% market share in 2018, valued at USD 319.77 million, and grew to USD 494.74 million in 2024. The region is projected to reach USD 990.19 million by 2032, expanding at a CAGR of 9.2%. Strong adoption of AI in enterprises, widespread use of digital platforms, and high demand for advanced grammar and contextual recommendation tools support growth. The U.S. dominates the regional market with a focus on AI integration in business communication, academic institutions, and publishing. The region remains a leader due to advanced technology adoption and established software ecosystems.

Europe

Europe captured a 22.1% share in 2018, with the market valued at USD 257.85 million, rising to USD 392.47 million in 2024. It is forecast to reach USD 768.12 million by 2032 at a CAGR of 8.9%. The region benefits from increasing adoption of AI-powered writing tools across corporate, academic, and publishing sectors. Stringent compliance standards also drive interest in secure on-premise deployments. Countries like Germany, the UK, and France lead adoption, supported by growing demand for multilingual content creation. Europe’s digital transformation strategies and e-learning expansion further strengthen the regional outlook.

Asia Pacific

Asia Pacific led the market with a 34.8% share in 2018, valued at USD 405.61 million, growing to USD 638.31 million in 2024. The market is projected to reach USD 1,306.54 million by 2032, with the fastest CAGR of 9.5%. Growth is fueled by rapid digitalization, strong e-learning demand, and increasing use of AI tools by freelancers and enterprises. China, India, and Japan drive the expansion, supported by rising smartphone penetration and large-scale adoption of cloud solutions. The region benefits from a fast-growing content creation ecosystem, positioning Asia Pacific as the leading global market in the forecast period.

Latin America

Latin America accounted for a 9% market share in 2018, valued at USD 103.91 million, and increased to USD 165.51 million in 2024. It is projected to reach USD 344.02 million by 2032, advancing at a CAGR of 9.7%, the highest among all regions. Growth is driven by the rise of digital businesses, expanding e-learning platforms, and increased focus on professional communication quality. Brazil and Mexico dominate adoption, supported by growing awareness of AI-powered writing tools. The market’s expansion is also linked to SMEs adopting cost-effective cloud-based writing solutions to enhance productivity and competitiveness.

Middle East

The Middle East represented a 4.8% share in 2018, valued at USD 55.74 million, growing to USD 82.97 million in 2024. The region is expected to reach USD 157.26 million by 2032, registering a CAGR of 8.4%. Adoption is primarily driven by enterprises in the UAE and Saudi Arabia investing in AI-based solutions for corporate communication and education. Government-led digital transformation programs also support demand. However, slower technological penetration compared to developed regions limits growth pace. Increasing integration of AI into workplace productivity tools is expected to boost market uptake over the forecast period.

Africa

Africa held a 2% share in 2018, with the market valued at USD 23.32 million, increasing to USD 36.52 million in 2024. It is forecast to reach USD 74.26 million by 2032, growing at a strong CAGR of 9.4%. Rising internet penetration, expansion of digital education, and the increasing freelance workforce drive adoption. South Africa and Nigeria are leading contributors, while smaller economies are gradually embracing cloud-based writing assistants. Limited awareness and infrastructure challenges remain barriers, but opportunities from e-learning platforms and mobile-first users position Africa as an emerging growth market with promising potential.

Market Segmentations:

By Feature

- Contextual Recommendations

- Grammar & Spelling Checking

- Plagiarism Detection

- Style & Tone Suggestions

- Others

By Deployment

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the AI writing assistant software market is highly dynamic, with established technology firms and emerging startups competing to enhance their offerings. Leading players such as Semrush, Grammarly Inc., ProWritingAid, Jasper AI Inc., and DeepL dominate due to their strong brand presence, diversified portfolios, and integration with productivity platforms. Startups like Rytr, AI Writer, and Frase Inc. are gaining traction with cost-effective solutions tailored for freelancers and SMEs. Vendors are focusing on expanding feature sets, such as contextual recommendations and plagiarism detection, while investing in cloud-based delivery models to reach wider audiences. Strategic partnerships, product innovations, and AI-driven advancements in natural language processing are common growth strategies. Companies are also emphasizing multilingual support and enterprise-focused solutions to strengthen adoption across global markets. Intense competition is expected to push continuous innovation, driving user-centric solutions that combine accuracy, security, and efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Semrush

- ProWritingAid (Orpheus Technology)

- Jasper AI Inc.

- DeepL

- Grammarly Inc.

- AI Writer

- Rytr

- Keywee Inc.

- Cvent

- Frase Inc.

- Other Key Players

Recent Developments

- In July 2024, Proton, a privacy app developer, launched Proton Scribe, an AI writing assistant. This tool helps users write, redraft, and proofread emails with simple prompts. Proton Scribe uses Mistral 7B, an open-source language model from the French AI startup, Mistral. This new feature aims to make email communication more efficient and secure for users.

- In March 2024, GetResponse, a global email marketing platform, introduced an AI email writing assistant. This tool helps users save time, overcome writer’s block, and create engaging email content faster. The AI assistant is built into GetResponse’s drag-and-drop email editor and uses an OpenAI-powered text generator. With ready-to-use prompts and text optimization options, users can quickly generate compelling email copy tailored to their audience.

- In 2023, Google started working on a new AI product called ‘Genesis’. The main goal of Genesis AI, which functions as a writing assistant, is to make journalistic tasks easier and more efficient, allowing reporters to dedicate their time to more intricate challenges.

- In 2023, Springer Nature introduced Curie, a scientific writing assistant powered by AI, created to aid researchers, particularly those who are not native English speakers, in enhancing their scientific writing. Curie has been taught using academic papers from over 447 different fields and over 1 million revisions.

Report Coverage

The research report offers an in-depth analysis based on Feature, Deployment, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as businesses and individuals adopt AI-driven writing solutions.

- Demand will grow due to the rising need for error-free communication across industries.

- Integration with advanced natural language processing will make tools more context-aware and accurate.

- Cloud-based platforms will remain dominant as users prefer flexible and scalable models.

- Grammar and spelling checking will continue as the leading feature segment by share.

- Commercial end users will drive adoption, supported by strong enterprise content needs.

- Asia Pacific will maintain leadership, fueled by digitalization and e-learning expansion.

- North America will remain a major hub, supported by early technology adoption.

- Data privacy concerns and accuracy limitations will challenge providers to improve solutions.

- Vendors will compete on innovation, multilingual support, and integration with productivity ecosystems.