Market Overview

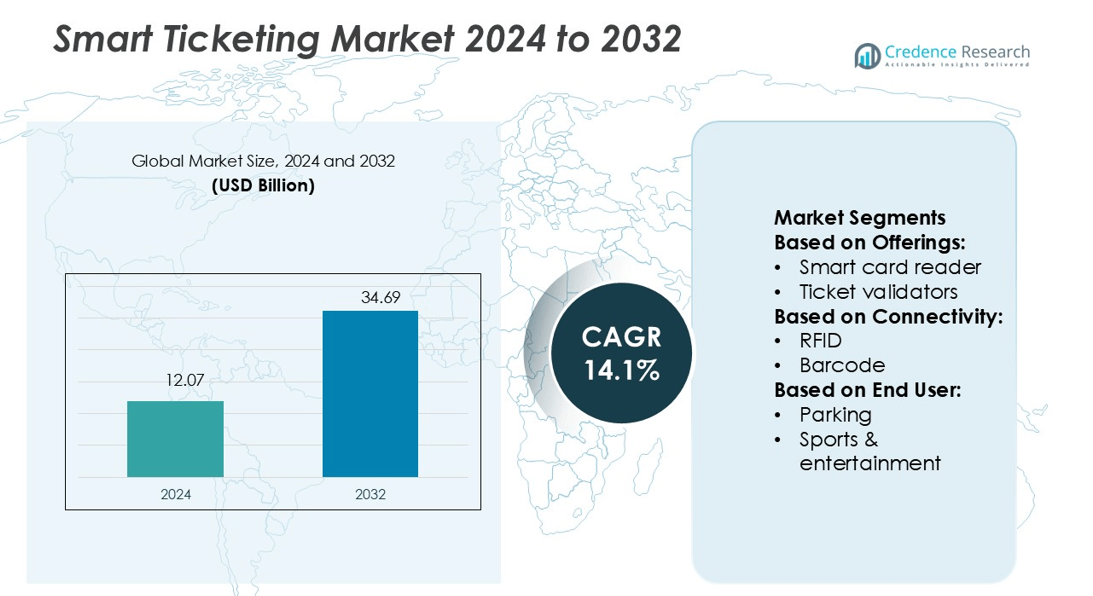

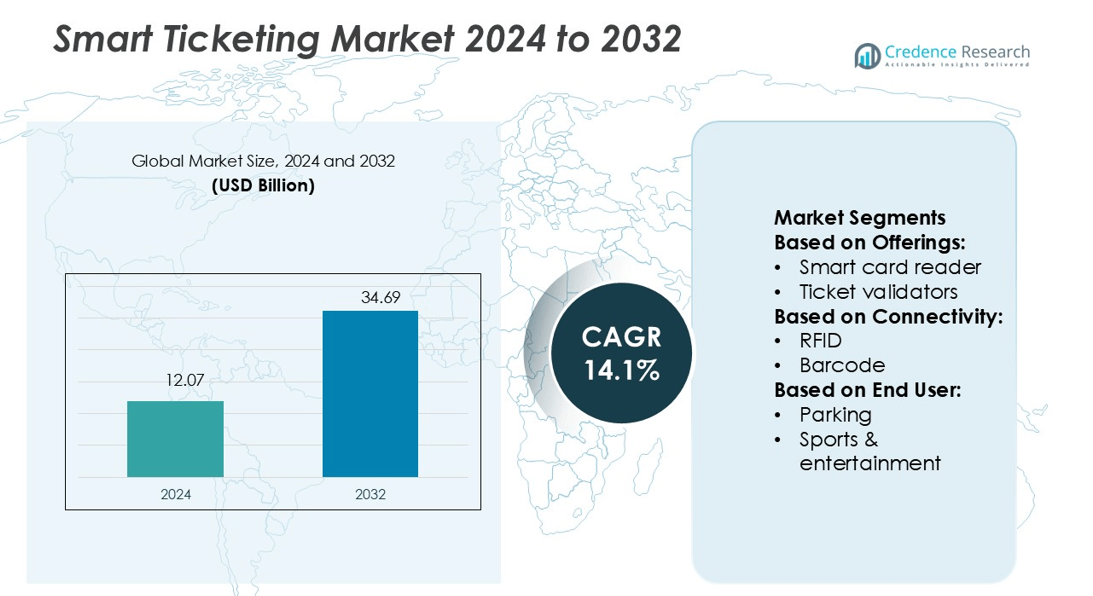

Smart Ticketing Market size was valued USD 12.07 billion in 2024 and is anticipated to reach USD 34.69 billion by 2032, at a CAGR of 14.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Ticketing Market Size 2024 |

USD 12.07 billion |

| Smart Ticketing Market, CAGR |

14.1% |

| Smart Ticketing Market Size 2032 |

USD 34.69 billion |

The smart ticketing market is shaped by top players including Giesecke + Devrient, CPI Card Group, Infineon Technologies, Thales Group (formerly Gemalto), Cubic Corporation, HID Global (Assa Abloy), Siemens, NXP Semiconductors, Conduent, and Confidex. These companies focus on delivering secure, efficient, and scalable solutions by leveraging NFC, RFID, and mobile technologies across transportation, parking, and entertainment sectors. They invest in R&D, partnerships, and large-scale deployments to strengthen global presence. Regionally, Asia-Pacific leads the market with a 33% share, supported by rapid urbanization, government-backed smart city initiatives, and widespread adoption of mobile ticketing systems in metro and rail networks.

Market Insights

- The smart ticketing market size was valued at USD 12.07 billion in 2024 and is projected to reach USD 34.69 billion by 2032, growing at a CAGR of 14.1% during the forecast period.

- Growing demand for contactless payments, mobile ticketing, and e-toll systems drives adoption across transportation, parking, and entertainment sectors, with kiosks and smart machines holding the largest segment share.

- Key players such as Giesecke + Devrient, Infineon Technologies, Thales Group, and Cubic Corporation compete by advancing NFC and RFID technologies, expanding mobile integration, and forming strategic partnerships.

- High implementation costs and data security concerns remain significant restraints, limiting adoption in cost-sensitive markets and raising compliance challenges for operators.

- Asia-Pacific leads with 33% market share due to smart city projects and rapid digitalization, while North America holds 29% and Europe 27%, reflecting mature infrastructure and sustained investment in secure ticketing systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Offerings

In the smart ticketing market, ticketing machines and smart kiosks hold the largest share at 28%. Their dominance comes from widespread adoption in metro stations, airports, and bus terminals, ensuring quick ticketing and reduced manual operations. Rising investments in digital infrastructure and passenger demand for self-service options drive growth. Kiosks also support integrated payment systems and multilingual interfaces, enhancing accessibility and convenience. Vendors continue to innovate with biometric authentication and QR-based services, strengthening adoption across transportation and entertainment hubs.

- For instance, CPI Card Group’s Card@Once platform supports instant issuance across thousands of financial institutions and locations. A 2023 press release from the company noted it was trusted by over 2,000 financial institutions across nearly 15,000 locations.

By Connectivity

Near-field communication (NFC) dominates the connectivity segment with a 34% share. Its strong growth is driven by the rise of contactless payments and smartphone integration, enabling fast and secure ticketing. NFC-based systems reduce transaction times and minimize queues, boosting customer experience in high-traffic areas. Transportation authorities and event organizers increasingly deploy NFC-enabled gates and readers to streamline access. Support from banks and fintech firms for mobile wallets further strengthens demand. Ongoing expansions in smart transit and parking ecosystems continue to push NFC ahead of barcode and RFID solutions.

- For instance, Infineon’s security IC portfolio for transport ticketing includes the SLE 77CLF601P, which supports multi-application loads with 60 kByte of SOLID FLASH™. The IC is certified for use in transport ticketing and supports high-speed contactless communication, including protocols like ISO/IEC 14443-4.

By End User

Transportation leads the end-user segment with a commanding 41% market share. Railways, metros, and bus networks rely heavily on smart ticketing systems to handle large passenger volumes efficiently. Government-backed initiatives for digital transit systems and reduced cash handling reinforce adoption. Transportation operators invest in integrated e-toll and mobile ticketing platforms to improve revenue assurance and reduce fraud. Smart ticketing also supports multimodal travel by linking buses, trains, and metros under unified payment solutions. Growing urbanization and congestion management policies make transportation the strongest driver of market expansion.

Market Overview

Rising Adoption of Contactless Payment Systems

The adoption of contactless payment systems is a major growth driver in the smart ticketing market. Consumers prefer faster, secure, and convenient payment methods for daily commutes, entertainment, and parking. The integration of NFC-enabled smartphones, wearables, and smart cards enhances ticketing efficiency while reducing physical contact. Transportation operators, supported by government cashless initiatives, invest heavily in modern infrastructure to accommodate these technologies. This shift also reduces operational costs by minimizing manual cash handling. As cashless transactions grow globally, demand for contactless ticketing solutions continues to accelerate.

- For instance, Thales’ Biometric Sensor Payment Card (BSPC) embeds a fingerprint sensor that operates without a battery. It wirelessly harvests all its energy from an ISO 14443-compliant POS terminal’s magnetic field when the card is held within 4 cm.

Government Initiatives for Smart Transit Systems

Government initiatives to modernize transportation systems drive smart ticketing adoption worldwide. Public transport agencies invest in integrated ticketing platforms to enhance passenger convenience and streamline revenue collection. Smart city projects prioritize digital ticketing for buses, metros, and rail networks, aligning with sustainability and congestion management goals. Subsidies and regulatory frameworks encourage deployment of kiosks, e-toll solutions, and mobile ticketing applications. Such initiatives not only support seamless travel experiences but also reduce fraud and improve operational transparency. This government backing strengthens market growth across urban and intercity transit networks.

- For instance, HID’s Seos 16K credential holds 16,384 bytes of secure memory and supports over 12 distinct application partitions within one card, allowing both fare payment and access control on the same medium. ([HID Global credential specs].

Growing Demand for Seamless Multimodal Travel

The need for unified ticketing solutions across multiple transportation modes significantly fuels market expansion. Passengers expect a single digital platform for buses, trains, metros, and parking services. Smart ticketing systems provide interoperability, reducing the complexity of carrying multiple tickets or cards. Integrated systems also improve data-driven decision-making for operators, enabling optimized scheduling and resource allocation. The growing focus on multimodal transport efficiency, coupled with digitalization trends, encourages authorities to adopt advanced ticketing platforms. This demand for seamless travel experiences ensures steady growth in the global smart ticketing industry.

Key Trends & Opportunities

Integration of Mobile Ticketing Applications

Mobile ticketing applications are emerging as a strong trend, reshaping the passenger experience. The convenience of purchasing and storing tickets on smartphones reduces dependency on physical kiosks and cards. Event organizers and transportation operators leverage mobile apps to expand digital ticketing ecosystems with features like QR validation and real-time journey updates. Integration with mobile wallets enhances accessibility, while push notifications improve customer engagement. As smartphone penetration grows, mobile ticketing adoption provides operators with opportunities to reduce infrastructure costs and enhance user satisfaction.

- For instance, NXP’s PN7150 controller embeds an Arm Cortex-M0 core and supports I²C-host interface while handling all NFC Forum modes with wake-on-RF and low-power polling modes.

Expansion of E-Toll and Smart Parking Systems

E-tolling and smart parking present significant opportunities for market players. With rising urban congestion, governments and private operators adopt automated toll and parking systems to improve traffic flow and reduce waiting times. These solutions integrate RFID and NFC technologies, allowing seamless payment and reducing cash dependency. E-toll platforms also enhance revenue collection accuracy and minimize fraud risks. The growing number of vehicles globally accelerates demand for automated solutions, creating opportunities for vendors to expand offerings beyond public transport ticketing into road infrastructure and parking management.

- For instance, Confidex offers a range of rugged RFID vehicle labels that operate in temperatures from approximately −20 °C to 80 °C, with some hard tags designed for even more extreme temperatures.

Key Challenges

High Implementation and Maintenance Costs

The deployment of smart ticketing systems involves substantial infrastructure investments. Operators must procure ticketing kiosks, validators, and advanced communication networks, which significantly increase upfront costs. Additionally, system integration across legacy platforms and ongoing maintenance require continuous spending. Smaller operators and developing regions face financial barriers in adopting these systems, slowing widespread implementation. These high costs restrict scalability, especially in markets where return on investment depends heavily on passenger volumes. Vendors must develop cost-efficient solutions to address this challenge and encourage broader adoption.

Data Security and Privacy Concerns

Smart ticketing systems rely heavily on digital transactions and user data, raising concerns over cybersecurity and privacy. Sensitive passenger information, including payment credentials and travel history, becomes a target for cyberattacks. Breaches can lead to financial losses, legal liabilities, and damage to consumer trust. Stricter regulatory frameworks require operators to implement advanced encryption and secure authentication measures, which increase compliance costs. Managing these security risks remains a critical challenge for operators and vendors, as system vulnerabilities could slow adoption of digital ticketing solutions.

Regional Analysis

North America

North America holds a 29% share of the smart ticketing market, supported by strong adoption in transportation and entertainment sectors. The United States leads with extensive deployment of NFC-based ticketing in metro and bus networks, along with mobile ticketing for sports and concerts. Government emphasis on digital infrastructure and cashless payments further accelerates adoption. Canada follows with investments in smart parking and e-toll systems to ease urban congestion. High smartphone penetration, combined with consumer demand for contactless solutions, positions North America as a mature and technology-driven market with steady long-term growth prospects.

Europe

Europe accounts for 27% of the smart ticketing market, driven by integrated transit systems across countries like the UK, Germany, and France. Extensive use of smart cards and validators in public transport strengthens its position. European Union initiatives promoting sustainable mobility and cashless systems further expand opportunities. Rail operators and city transport agencies are adopting multimodal ticketing platforms to improve travel convenience. NFC and mobile-based solutions gain traction, particularly in urban hubs. Strong regulatory support, coupled with established public transport infrastructure, makes Europe a frontrunner in adopting innovative smart ticketing technologies for passenger convenience.

Asia-Pacific

Asia-Pacific dominates the global market with a commanding 33% share, led by China, Japan, and India. Rapid urbanization and high population density drive the adoption of smart ticketing in metro, bus, and rail systems. Governments actively invest in smart city projects that integrate mobile ticketing, RFID, and e-toll systems to streamline travel. Rising smartphone usage fuels demand for app-based ticketing platforms, while large-scale transport networks require scalable solutions. Japan and South Korea pioneer NFC and contactless systems, while India accelerates metro ticketing digitalization. Asia-Pacific’s growth is sustained by expanding infrastructure and strong consumer acceptance of digital payments.

Latin America

Latin America contributes 6% of the smart ticketing market, with growing adoption in Brazil, Mexico, and Argentina. The expansion of metro networks and investments in smart parking solutions strengthen regional growth. Brazil drives demand through contactless ticketing in public buses and stadiums, while Mexico focuses on integrating mobile ticketing applications for urban mobility. Despite budgetary constraints, government efforts to modernize transport infrastructure push adoption forward. Rising smartphone penetration supports mobile-based solutions, though limited digital infrastructure in rural areas remains a challenge. Latin America’s market is evolving steadily, with opportunities tied to ongoing transport modernization programs.

Middle East & Africa

The Middle East & Africa region holds a 5% share of the smart ticketing market, driven by infrastructure development in the Gulf Cooperation Council (GCC) countries and South Africa. The UAE and Saudi Arabia invest in smart transit solutions as part of broader smart city initiatives, including metro ticketing, parking systems, and e-toll platforms. South Africa leads African adoption, particularly in bus rapid transit networks. Growing tourism also fuels ticketing adoption in entertainment and transport hubs. However, limited affordability and infrastructure gaps in parts of Africa constrain expansion, keeping growth slower compared to other global regions.

Market Segmentations:

By Offerings:

- Smart card reader

- Ticket validators

By Connectivity:

By End User:

- Parking

- Sports & entertainment

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The smart ticketing market is highly competitive, featuring leading players such as Giesecke + Devrient, CPI Card Group, Infineon Technologies, Thales Group (formerly Gemalto), Cubic Corporation, HID Global (Assa Abloy), Siemens, NXP Semiconductors, Conduent, and Confidex. The smart ticketing market is characterized by rapid innovation, strong adoption across transportation networks, and growing reliance on digital platforms. Companies compete by offering advanced solutions that integrate NFC, RFID, and mobile technologies to ensure faster transactions and enhanced security. Market players prioritize seamless multimodal travel experiences, enabling passengers to use a single platform for buses, trains, metros, and parking services. Investments in mobile ticketing applications, e-toll systems, and smart kiosks reflect the shift toward contactless and cashless ecosystems. Strategic collaborations with governments and transport authorities, along with continuous R&D, remain central to strengthening market competitiveness and global reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Giesecke + Devrient

- CPI Card Group

- Infineon Technologies

- Thales Group (formerly Gemalto)

- Cubic Corporation

- HID Global (Assa Abloy)

- Siemens

- NXP Semiconductors

- Conduent

- Confidex

Recent Developments

- In October 2024, the Tasmanian government and its ITS (Intelligent Transport Systems) supplier Cubic Transportation Systems (CTS), a division of Cubic Corporation entered into an agreement for the provision of a safe and efficient smart ticketing system throughout the state.

- In October 2024, Infineon Technologies AG, CPI has designed All-in-One technology with Secora Pay Green, a technology not only minimizing its impact on the environment but even offering new and flexible structures for credit, debit, and prepaid cards for issuers.

- In July 2024, Conduent Transportation signed a major deal with Saint-Étienne Métropole (SEM), which is the public transit authority taking care of over 400,000 inhabitants in Saint-Étienne. Conduent will be the head of the STAR bus and tram network in the three-phase improving process, thereby, providing eco-friendly, cost-effective service to the area.

- In January 2024, Goodyear partnered with TDK for advanced next-generation tire solutions. By integrating TDK’s software, sensors, and electrical component experience with Goodyear’s tire development, intelligent solutions, and industry knowledge, the companies are planning to launch an effective tire sensing system with a collaborative approach.

Report Coverage

The research report offers an in-depth analysis based on Offerings, Connectivity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of contactless and mobile payment solutions.

- Governments will continue to promote smart transit systems through digital infrastructure investments.

- Integration of multimodal travel platforms will improve passenger convenience and operational efficiency.

- Mobile ticketing applications will dominate due to increasing smartphone penetration worldwide.

- E-toll and smart parking solutions will witness higher adoption in urban mobility ecosystems.

- Biometric authentication will enhance security and streamline passenger identification in ticketing systems.

- Partnerships between technology providers and transport operators will accelerate innovation.

- Data analytics integration will enable operators to optimize routes and manage revenues effectively.

- Growth in smart city projects will drive large-scale deployments of smart ticketing systems.

- Cloud-based ticketing platforms will gain traction for scalability, flexibility, and cost efficiency.