Market Overview

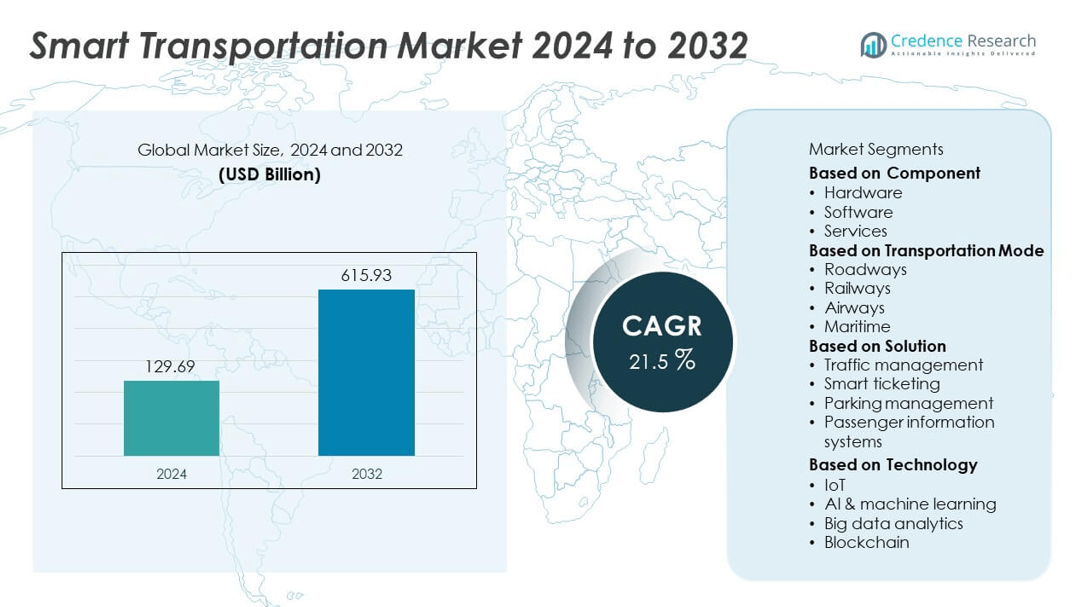

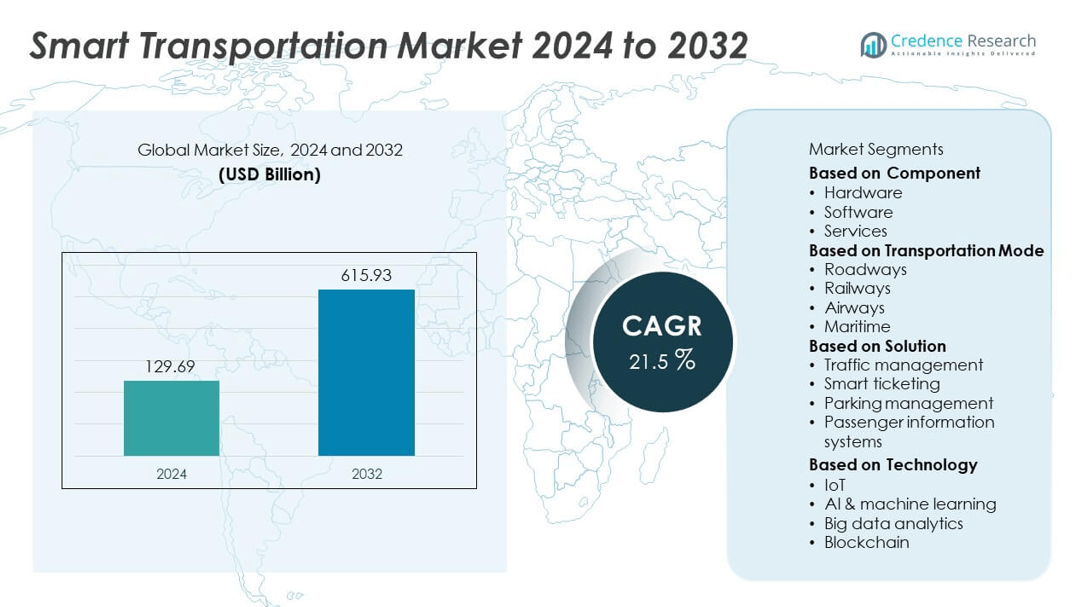

The Smart Transportation market size was valued at USD 129.69 billion in 2024 and is projected to reach USD 615.93 billion by 2032, expanding at a CAGR of 21.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Transportation Market Size 2024 |

USD 129.69 billion |

| Smart Transportation Market, CAGR |

21.5% |

| Smart Transportation Market Size 2032 |

USD 615.93 billion |

The smart transportation market is driven by top players including Hitachi, Cisco Systems, Thales Group, Huawei Technologies, Siemens Mobility, NEC Corporation, Alstom SA, IBM, Cubic, and Bentley Systems. These companies compete through advanced portfolios in traffic management, smart ticketing, and intelligent mobility solutions, leveraging IoT, AI, and cloud technologies to enhance efficiency and safety. Regionally, Asia-Pacific led the market with 34% share in 2024, supported by large-scale smart city projects and rapid urbanization. North America followed with 32% share, driven by strong government initiatives and adoption of connected vehicle infrastructure, while Europe accounted for 28% share, fueled by sustainability policies and integrated public transit systems.

Market Insights

- The smart transportation market was valued at USD 129.69 billion in 2024 and is projected to reach USD 615.93 billion by 2032, growing at a CAGR of 21.5% during the forecast period.

- Rising urbanization and traffic congestion drive demand, with the roadways segment leading by transportation mode at over 50% share in 2024, supported by heavy investments in intelligent traffic systems and connected infrastructure.

- Key trends include adoption of IoT, AI, and cloud-based platforms, along with growing opportunities in electric and connected vehicle integration, smart ticketing, and contactless payment systems.

- The market is highly competitive with players such as Hitachi, Cisco Systems, Thales Group, Huawei Technologies, Siemens Mobility, NEC Corporation, Alstom SA, IBM, Cubic, and Bentley Systems focusing on smart city partnerships, digital platforms, and sustainable mobility solutions.

- Regionally, Asia-Pacific led with 34% share in 2024, followed by North America at 32%, Europe at 28%, while Latin America and the Middle East & Africa accounted for 4% and 2% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The software segment dominated the smart transportation market in 2024 with over 45% share, supported by the growing adoption of advanced platforms for traffic management, predictive analytics, and mobility-as-a-service applications. Cities worldwide are investing in integrated software solutions to optimize traffic flow, reduce congestion, and enhance safety. Cloud-based systems and AI-driven platforms further improve efficiency by enabling real-time monitoring and data-driven decision-making. While hardware such as sensors and cameras remains essential, and services such as consulting and maintenance are expanding, software continues to drive the largest share due to its scalability and flexibility.

- For instance, Microsoft Azure provides services and partnerships that enable cities to build intelligent traffic management solutions using cloud computing, AI, and IoT technologies. These systems can process large volumes of data from various sources like traffic sensors and cameras to optimize traffic flow, improve commuter experiences, and enhance safety.

By Transportation Mode

Roadways accounted for the largest share of over 50% in 2024, driven by increasing deployment of intelligent traffic management, smart tolling, and connected vehicle systems. Governments and municipalities are investing heavily in roadway infrastructure upgrades to address congestion, improve safety, and reduce emissions. Smart mobility solutions such as vehicle-to-infrastructure (V2I) systems and electronic toll collection further strengthen this segment’s dominance. Railways are witnessing growth through investments in smart signaling and ticketing systems, while airways and maritime modes adopt digital platforms for enhanced efficiency. However, roadways remain the backbone of smart transportation investments worldwide.

- For instance, Cisco Systems provides connectivity solutions for intelligent transportation systems in Europe, which are designed to enable V2I communication. For example, a project involving Austria’s highway operator ASFiNAG utilized Cisco’s Connected Roadways solution to deploy a sensor network along 2,200 km of highway more than a decade ago, which helps with traffic monitoring and can improve overall traffic flow.

By Solution

Traffic management held the dominant share of over 40% in 2024, supported by rising urban congestion and the need for efficient mobility solutions in metropolitan areas. Deployment of smart traffic lights, surveillance systems, and real-time data platforms ensures improved flow and safety across road networks. Smart ticketing solutions are growing rapidly due to rising demand for digital and contactless payments in public transit systems. Parking management and passenger information systems are also expanding, especially in smart city projects, but traffic management continues to lead due to its critical role in easing congestion and enabling sustainable urban mobility.

Market Overview

Rising Urbanization and Traffic Congestion

Rapid urbanization is creating significant challenges in traffic flow and urban mobility, pushing governments to adopt smart transportation systems. Increasing vehicle ownership and population density intensify congestion, resulting in demand for intelligent traffic management and smart mobility solutions. Real-time monitoring, adaptive traffic signals, and predictive analytics are being deployed to optimize road use and reduce delays. With urban centers expanding globally, investments in digital infrastructure for transportation are accelerating, making congestion control one of the primary drivers for smart transportation adoption.

- For instance, Los Angeles drivers experienced an average of 87 hours stuck in traffic in 2024, spurring the city to implement AI-powered adaptive traffic signal systems which reduced average delay times by approximately 8 minutes per trip in pilot zones.

Government Initiatives and Smart City Investments

Strong government support through smart city initiatives is fueling smart transportation adoption. Investments in digital mobility infrastructure, intelligent public transit, and integrated ticketing systems are rising across developed and emerging economies. Programs such as Europe’s Green Deal and the U.S. Smart City Challenge highlight the importance of sustainable mobility solutions. Financial incentives, policy frameworks, and public-private partnerships are strengthening large-scale deployments. This regulatory push ensures the integration of smart technologies in transportation systems, accelerating long-term market growth and creating opportunities for global solution providers.

- For instance, Newcastle, a noted smart city leader in the UK, has used connected sensors and data analytics to improve traffic management and public transit efficiency. This includes real-time tracking and dynamic traffic adjustments to enhance the overall transport network.

Advancements in IoT, AI, and Cloud Technologies

The growing use of IoT devices, AI-driven platforms, and cloud solutions is transforming the transportation ecosystem. Connected sensors, GPS systems, and data analytics tools allow for real-time vehicle and infrastructure monitoring. AI algorithms enhance predictive traffic management, while cloud platforms improve system scalability and interoperability. These technologies are also enabling mobility-as-a-service models, offering integrated travel solutions. The continuous evolution of digital technologies is driving efficiency, improving safety, and reducing operational costs, positioning technological innovation as a central driver for smart transportation growth worldwide.

Key Trends & Opportunities

Expansion of Electric and Connected Vehicles

The rise of electric and connected vehicles offers strong opportunities for smart transportation integration. EVs require charging networks connected to digital platforms, while connected cars support vehicle-to-infrastructure (V2I) and vehicle-to-vehicle (V2V) communication. Automakers and governments are investing in these technologies to improve safety, reduce emissions, and create seamless travel experiences. The growth of EV adoption, combined with smart charging infrastructure and real-time connectivity, positions connected mobility as a major opportunity for the smart transportation ecosystem.

- For instance, OPTRAFFIC introduced advanced features and updates in 2024 to their Variable Message Signs (VMS) and Web System for smart traffic control, leveraging AI and IoT technologies.

Adoption of Digital and Contactless Solutions

Digital ticketing, mobile payments, and contactless systems are rapidly expanding within smart transportation. Public transit systems increasingly adopt QR codes, NFC-based solutions, and mobile apps for seamless passenger experiences. The COVID-19 pandemic accelerated demand for contactless technologies, which continue to grow due to convenience and safety. Integration with multimodal transport platforms ensures travelers can plan, book, and pay through unified digital interfaces. This trend creates opportunities for technology providers and strengthens consumer adoption of modernized mobility services.

- For instance, Masabi, a leading contactless ticketing solution provider with offices in London and New York, processed more than 10 million mobile barcode validations in 2024 for its NEORide service alone.

Key Challenges

High Implementation Costs

The deployment of smart transportation systems requires significant capital investments in infrastructure, hardware, and software integration. Costs related to sensors, data centers, and cloud platforms limit adoption, particularly in developing regions with budget constraints. Public-private partnerships help ease financial burdens, but high upfront costs remain a major barrier for widespread implementation. Smaller municipalities often delay or scale back projects due to limited funding, slowing overall market penetration despite strong long-term benefits.

Cybersecurity and Data Privacy Concerns

Smart transportation systems depend heavily on data collection, storage, and real-time connectivity, which makes them vulnerable to cyberattacks. Unauthorized access to traffic management systems or passenger data could result in safety risks and public distrust. Strict regulations such as GDPR and rising consumer concerns about data privacy challenge companies to implement robust cybersecurity frameworks. Balancing innovation with security compliance increases costs and operational complexity, posing an ongoing challenge for smart transportation operators and technology providers.

Regional Analysis

North America

North America held 32% share in 2024, driven by strong adoption of intelligent traffic management, smart ticketing, and connected vehicle technologies. The U.S. leads the region with heavy investments in smart city projects and advanced roadway infrastructure, while Canada follows with growing deployment of sustainable mobility solutions. High penetration of IoT and AI-based platforms enhances system efficiency and safety. Public-private partnerships, coupled with supportive policies, strengthen large-scale implementations. Increasing demand for electric vehicles and connected infrastructure further accelerates adoption, making North America a key market for innovation in the smart transportation ecosystem.

Europe

Europe accounted for 28% share in 2024, supported by government-led initiatives such as the EU Green Deal and investments in sustainable transportation. Countries including Germany, France, and the U.K. drive adoption with integrated public transport systems, smart ticketing, and advanced traffic management platforms. Strong regulatory focus on reducing emissions and promoting eco-friendly mobility strengthens the region’s role in driving innovation. The expansion of electric vehicle infrastructure and connected rail systems further supports growth. With established urban centers and rising adoption of contactless ticketing, Europe remains a leading hub for smart and sustainable transportation development.

Asia-Pacific

Asia-Pacific dominated the global market with 34% share in 2024, led by extensive investments in smart city infrastructure, digital mobility platforms, and intelligent traffic systems. China, Japan, India, and South Korea drive adoption, supported by government-backed programs and rising urbanization. The region benefits from high demand for real-time traffic management and smart ticketing in megacities. Growing deployment of connected and electric vehicles adds further momentum. Rapid advancements in AI, IoT, and cloud technologies strengthen market penetration, making Asia-Pacific not only the largest but also the fastest-growing region in the smart transportation market.

Latin America

Latin America captured 4% share in 2024, with Brazil and Mexico leading adoption of smart mobility systems. Growing urbanization and rising congestion in metropolitan areas are fueling investments in traffic monitoring, public transit upgrades, and parking management systems. Regional governments are gradually deploying digital ticketing and real-time passenger information platforms to modernize infrastructure. While financial constraints and limited funding slow widespread adoption, public-private partnerships are emerging as key enablers. The region’s demand for sustainable transport solutions and expanding smart city initiatives are expected to strengthen growth in the coming years.

Middle East & Africa

The Middle East and Africa accounted for 2% share in 2024, reflecting smaller but growing adoption of smart transportation systems. The Gulf states, led by the UAE and Saudi Arabia, are investing in intelligent mobility solutions as part of broader smart city initiatives. Projects include advanced traffic management systems, digital ticketing platforms, and smart public transit upgrades. South Africa also contributes to regional adoption through urban transport modernization. Despite infrastructure gaps and budgetary challenges, increasing focus on sustainable mobility and ongoing urban development programs provide growth opportunities in the smart transportation market.

Market Segmentations:

By Component

- Hardware

- Software

- Services

By Transportation Mode

- Roadways

- Railways

- Airways

- Maritime

By Solution

- Traffic management

- Smart ticketing

- Parking management

- Passenger information systems

By Technology

- IoT

- AI & machine learning

- Big data analytics

- Blockchain

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the smart transportation market is defined by leading players such as Hitachi, Cisco Systems, Thales Group, Huawei Technologies, Siemens Mobility, NEC Corporation, Alstom SA, IBM, Cubic, and Bentley Systems. These companies drive growth through advanced solutions in traffic management, smart ticketing, connected infrastructure, and intelligent mobility platforms. Their strategies focus on leveraging IoT, AI, and cloud technologies to deliver real-time monitoring, predictive analytics, and seamless passenger services. Partnerships with governments and municipalities play a vital role in expanding large-scale smart city projects, particularly in Asia-Pacific, North America, and Europe. Sustainability and safety remain central themes, with companies investing in green mobility initiatives, energy-efficient systems, and cybersecurity frameworks. By enhancing global distribution, forging strategic alliances, and innovating across transport modes—roadways, railways, airways, and maritime—these players strengthen their competitive edge and ensure the long-term transformation of urban mobility ecosystems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hitachi

- Cisco Systems

- Thales Group

- Huawei Technologies

- Siemens Mobility

- NEC Corporation

- Alstom SA

- IBM

- Cubic

- Bentley Systems

Recent Developments

- In August 2025, Cubic showcased new Intelligent Transportation Systems software at ITS World Congress, including AI analytics, real-time optimization, and V2X capability.

- In August 2025, Alstom secured a contract to supply 234 Metropolis metro cars and signaling solutions for urban systems worldwide.

- In June 2025, Alstom unveiled AI-driven maintenance and predictive health monitoring via its HealthHub fleet management solution, along with retrofit options for emission-free shunting locomotives.

- In 2025, Siemens Mobility presented Smart Asset Suite (powered by Railigent X) and a Vectron AC locomotive with battery module at Transport Logistic 2025 in Munich

Report Coverage

The research report offers an in-depth analysis based on Component, Transportation Mode, Solution, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow rapidly, supported by expanding smart city initiatives worldwide.

- Roadways will continue to dominate due to heavy investments in intelligent traffic systems.

- Software solutions will lead growth as cities adopt AI and cloud-based platforms.

- Electric and connected vehicles will drive integration with smart transportation infrastructure.

- Contactless ticketing and digital payment systems will expand across public transit networks.

- Asia-Pacific will remain the largest and fastest-growing regional market.

- North America will sustain strong adoption through government funding and policy support.

- Europe will strengthen its position with sustainability-driven mobility projects.

- Emerging regions will adopt smart systems gradually through public-private partnerships.

- Competition will intensify as global players invest in innovation and regional expansion.