Market Overview

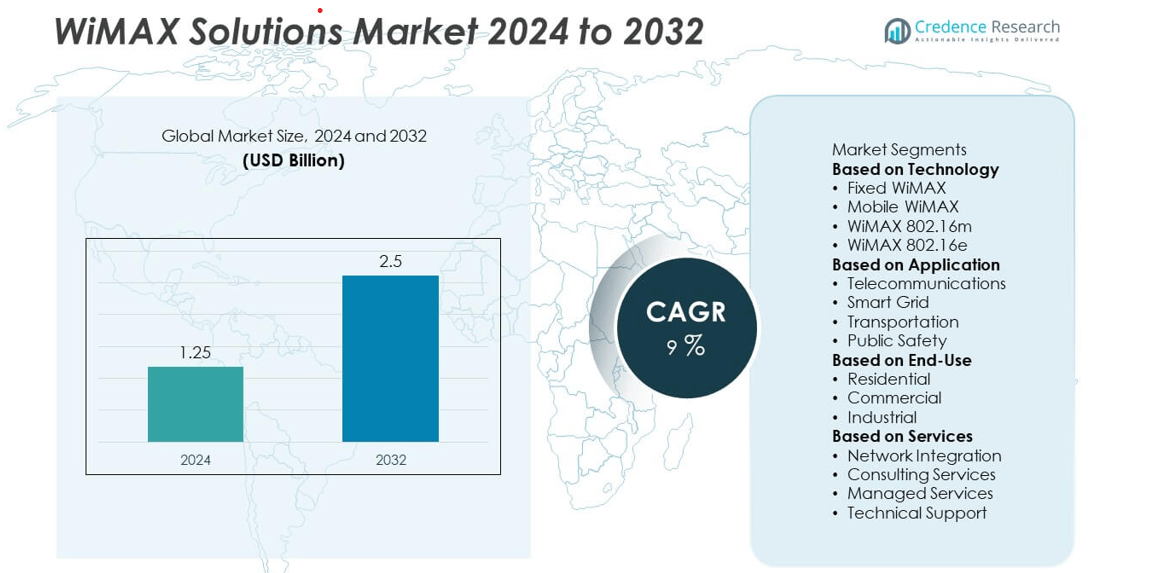

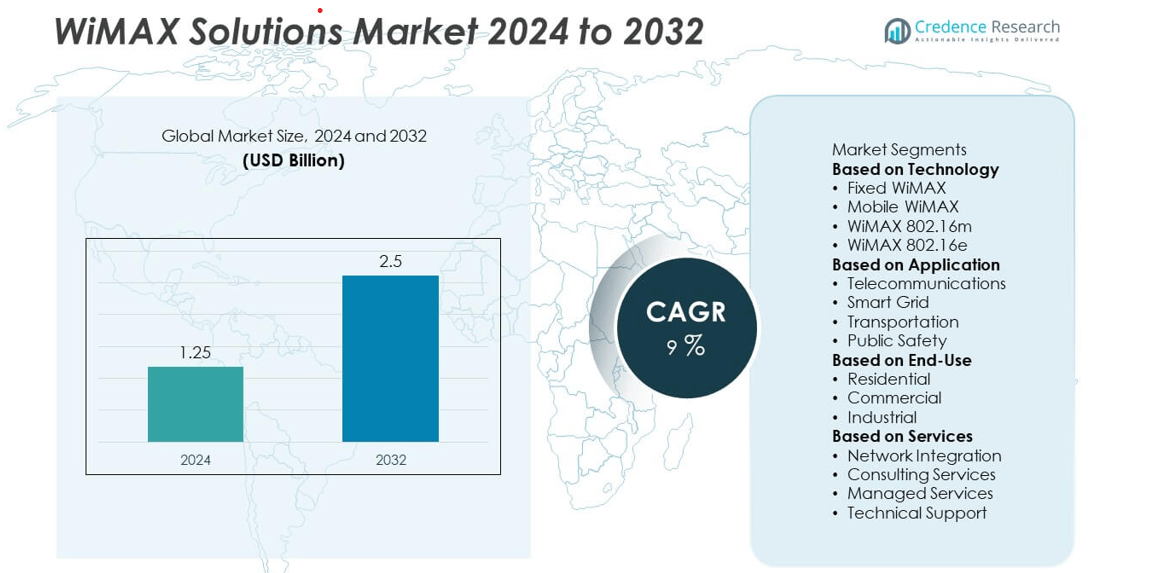

The WiMAX Solutions market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.5 billion by 2032, registering a CAGR of 9 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| WiMAX Solutions Market Size 2024 |

USD 1.25 billion |

| WiMAX Solutions Market, CAGR |

9% |

| WiMAX Solutions Market Size 2032 |

USD 2.5 billion |

The WiMAX solutions market is led by key players including Clearwire, Huawei Technologies, Nokia, TE Connectivity, Ruckus Wireless, and Motorola Solutions, who focus on providing cost-effective broadband infrastructure and next-generation WiMAX 802.16m solutions. These companies are enhancing network performance through spectrum optimization, IoT integration, and partnerships with telecom operators for rural broadband deployment. North America leads the market with over 36% share in 2024, driven by government-supported digital inclusion programs and strong enterprise adoption. Europe follows with 28% share supported by rural connectivity projects, while Asia-Pacific holds 25% and is the fastest-growing region, driven by rapid urbanization and national broadband initiatives.

Market Insights

- The WiMAX solutions market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.5 billion by 2032, growing at a CAGR of 9% during the forecast period.

- Rising demand for rural broadband connectivity and low-cost network deployment drives adoption, with mobile WiMAX holding over 40% share in 2024 due to its ability to support high-speed mobile internet access.

- Key trends include the transition toward WiMAX 802.16m for higher spectral efficiency, integration with IoT and smart grid applications, and focus on low-latency solutions for mission-critical networks.

- The market is competitive with leading players such as Huawei Technologies, Nokia, Clearwire, and Motorola Solutions investing in partnerships, network upgrades, and cost-optimized solutions to compete with LTE and 5G alternatives.

- North America leads with over 36% share, followed by Europe with 28%, while Asia-Pacific holds 25% and remains the fastest-growing region due to government-backed broadband expansion programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Mobile WiMAX leads the market with over 40% share in 2024, driven by its flexibility and ability to support high-speed internet access for mobile users. The growing demand for broadband connectivity in remote and underserved areas further fuels adoption. Fixed WiMAX holds a significant share, serving rural broadband and enterprise connectivity applications. WiMAX 802.16e remains widely deployed due to its cost-effectiveness and compatibility with existing infrastructure, while WiMAX 802.16m is gradually gaining traction for next-generation networks offering improved spectral efficiency and higher data rates to meet rising bandwidth requirements.

- For instance, while the IEEE 802.16m standard targeted peak data rates of up to 1 Gbps for fixed stations and supported robust, long-distance wireless links, actual commercial deployments for mobile and rural broadband access from the era saw significantly lower real-world speeds. Instead of WiMAX, Huawei was a major developer of the competing LTE technology. Its LTE base stations have been demonstrated to provide coverage over 10 km in rural areas and offer high spectral efficiency, with the DBS3900 eLTE station

By Application

Telecommunications dominate the WiMAX solutions market with over 50% share in 2024, as operators leverage WiMAX for last-mile connectivity and broadband expansion in underserved regions. The technology’s ability to deliver reliable, high-speed internet with low infrastructure cost makes it a preferred option for rural deployment. Smart grid applications are growing steadily, supporting real-time data transmission for energy distribution networks. Transportation and public safety sectors are adopting WiMAX for secure communication and monitoring systems, enabling better coordination and reliability for mission-critical operations across large coverage areas.

- For instance, Motorola Solutions has deployed various communication technologies, including private LTE networks, radio systems like MOTOTRBO and TETRA, and fixed wireless solutions, to support critical infrastructure and smart grid operations for utilities. These deployments aim to enable secure and reliable communication for applications such as real-time monitoring and control of substations, improving operational efficiency and safety.

By End-Use

The commercial segment accounts for over 45% share in 2024, driven by enterprises seeking cost-effective and scalable broadband connectivity solutions. Businesses use WiMAX to connect remote offices, support VoIP services, and enable cloud-based applications. Residential adoption continues to grow, particularly in rural areas where wired broadband infrastructure is limited. Industrial users are integrating WiMAX for machine-to-machine communication, remote monitoring, and automation systems. Rising demand for wireless connectivity across all end-use segments ensures steady market growth, with commercial applications remaining the most significant contributor to global revenue generation.

Market Overview

Rising Demand for Rural Broadband Connectivity

The growing need for reliable internet in underserved and remote areas is driving WiMAX adoption. Governments and telecom operators are deploying WiMAX as a cost-effective solution for last-mile connectivity. Its ability to cover large areas with fewer base stations makes it ideal for rural broadband projects. This demand is supported by digital inclusion programs and public-private partnerships that aim to bridge the connectivity gap. Increasing internet penetration in developing countries will continue to fuel growth for fixed and mobile WiMAX networks through the forecast period.

- For instance, state-owned operator BSNL deployed WiMAX networks in rural districts across India as part of government digital inclusion initiatives. The WiMAX rollout aimed to connect thousands of rural Common Service Centres (CSCs) and village panchayats. A 2012 report on a BSNL deployment in Chennai noted demonstrated download speeds of around 2 Mbps, illustrating the actual performance levels achieved by WiMAX technology in the field.

Expansion of Mobile Data Usage

Rapid growth in smartphone adoption and rising consumption of data-heavy applications are boosting demand for high-speed wireless networks. Mobile WiMAX is well-suited for providing broadband connectivity with lower deployment costs compared to traditional cellular networks. Operators are leveraging WiMAX to deliver 4G-level speeds in areas where LTE infrastructure is limited. The rising need for seamless video streaming, VoIP, and cloud-based services is further strengthening mobile WiMAX adoption, especially in emerging markets with growing mobile-first user bases.

- For instance, Sprint Corporation, through its US subsidiary Clearwire, operated a WiMAX network. In its commercial rollout, this network provided average download speeds of 3–6 Mbps, with peak speeds reaching over 10 Mbps. It achieved lower latencies compared to older 3G networks, though typical mobile WiMAX latency ranged from 50 to 100 milliseconds rather than the much lower figure previously claimed. This capacity helped support growing mobile-first user bases in regions of the U.S. with seamless video streaming, VoIP, and cloud service access, before the technology was superseded by LTE.

Supportive Government Initiatives and Investments

Government-backed broadband expansion projects and funding programs are accelerating WiMAX deployment worldwide. Many countries are focusing on rural digitalization and affordable broadband access, creating opportunities for WiMAX solution providers. Spectrum allocations for WiMAX and incentives for network expansion are helping operators reach unserved communities. Development banks and international agencies are also supporting connectivity projects in low-income regions, which directly contributes to WiMAX infrastructure growth. These initiatives ensure a steady market demand while supporting global goals for digital inclusion and economic development.

Key Trends & Opportunities

Integration with Smart Grid and IoT Applications

WiMAX technology is increasingly being used in smart grid communications for real-time monitoring and control of energy distribution. Its low latency and wide coverage make it suitable for connecting smart meters, substations, and control centers. The rise of IoT is creating new opportunities for WiMAX to support large-scale device connectivity in industrial and utility sectors. This trend is encouraging vendors to develop optimized solutions for machine-to-machine communication, enabling greater automation, predictive maintenance, and improved operational efficiency across critical infrastructure.

- For instance, Motorola Solutions helped a utility in the Northeastern United States deploy a private wireless network for distribution automation. An initial 2,000-site network was equipped with Motorola MOSCAD-L Remote Terminal Units (RTUs) for secure and reliable wireless communication.

Migration Toward Next-Generation WiMAX (802.16m)

The adoption of WiMAX 802.16m is gaining traction as operators upgrade networks for higher capacity and spectral efficiency. This standard enables improved data throughput and supports applications requiring real-time performance such as telemedicine and public safety communication. Migration to advanced WiMAX networks also positions operators to compete with LTE and 5G services in specific markets. This transition opens opportunities for equipment manufacturers and service providers to supply upgraded hardware, software, and managed services, expanding revenue potential in the coming years.

- For instance, UQ Communications incorporated elements of the WiMAX 2 (802.16m) standard into its network around 2011, which provided faster data speeds and improved network efficiency over the prior Mobile WiMAX standard. A 2013 plan involved upgrading over 20,000 base station sites to WiMAX 2+, a technology compatible with TD-LTE, with the goal of increasing peak data rates and user capacity.

Key Challenges

Competition from LTE and 5G Networks

The growing penetration of LTE and emerging 5G networks presents a major challenge for WiMAX solutions. Many operators are shifting investments toward 5G due to its faster speeds and broader ecosystem support. This competition limits WiMAX adoption in urban and high-density areas. Vendors must differentiate by focusing on cost efficiency, rural coverage, and niche applications such as smart grids to remain competitive. The challenge lies in sustaining market relevance as next-generation cellular technologies dominate global wireless infrastructure investments.

High Deployment and Maintenance Costs

Initial capital investment for WiMAX infrastructure, including base stations and spectrum licenses, remains a barrier for small operators. Ongoing maintenance and upgrades to keep pace with rising data demand further add to operational expenses. In cost-sensitive markets, these factors can delay deployments and reduce return on investment. Solution providers are focusing on developing cost-effective, modular systems and offering managed services to lower financial burdens for operators and accelerate adoption of WiMAX technology.

Regional Analysis

North America

North America leads the WiMAX solutions market with over 36% share in 2024, driven by strong demand for rural broadband connectivity and enterprise wireless solutions. The United States accounts for the majority of deployments, supported by federal programs focused on bridging the digital divide in underserved areas. Telecom operators leverage WiMAX to provide last-mile connectivity in regions lacking fiber infrastructure. The presence of leading technology vendors and early adoption of advanced wireless standards further strengthen market growth. Rising mobile data traffic and expansion of public safety communication networks will continue to support regional adoption through 2032.

Europe

Europe holds around 28% share in 2024, supported by widespread deployment of WiMAX networks in rural and semi-urban areas. Countries such as Germany, the UK, and France are investing in cost-effective wireless technologies to extend broadband coverage. The region’s focus on smart grid development and industrial automation supports adoption of fixed WiMAX solutions for reliable, low-latency data transmission. European Union initiatives to expand digital infrastructure and ensure universal connectivity provide significant opportunities for solution providers. Upgrades to WiMAX 802.16m networks are also contributing to steady growth and enhanced service delivery across key European markets.

Asia-Pacific

Asia-Pacific accounts for over 25% share in 2024 and is the fastest-growing region for WiMAX solutions. Rapid urbanization, increasing internet penetration, and government-backed digitalization initiatives drive adoption across China, India, and Southeast Asia. National broadband programs encourage operators to deploy WiMAX to reach remote areas where fiber rollouts are challenging. Mobile WiMAX is gaining traction due to rising smartphone usage and demand for affordable wireless broadband. The region’s expanding smart city projects and industrial IoT applications are expected to create additional opportunities, making Asia-Pacific a key contributor to global market expansion during the forecast period.

Latin America

Latin America captures around 7% share in 2024, with Brazil, Mexico, and Argentina leading adoption. WiMAX is widely used to provide connectivity in underserved rural areas and to support enterprise networks in remote locations. Governments and telecom operators are collaborating to expand broadband coverage under universal service programs. Demand for reliable communication networks in industries such as mining, oil, and energy is further driving uptake. While competition from LTE is growing, WiMAX remains an attractive solution for cost-sensitive deployments where quick rollout and large-area coverage are priorities, supporting steady market growth across the region.

Middle East & Africa

The Middle East & Africa hold around 4% share in 2024, with demand focused on connecting remote areas and industrial sites. Gulf countries are adopting WiMAX to support smart city initiatives, energy grid modernization, and public safety communications. African nations are using WiMAX as a cost-effective alternative to fixed-line broadband, particularly in rural and peri-urban areas. The region’s growing interest in digital transformation and e-governance projects is driving adoption, though limited funding and competition from mobile broadband present challenges. International partnerships and infrastructure investments are expected to improve coverage and accelerate growth through 2032.

Market Segmentations:

By Technology

- Fixed WiMAX

- Mobile WiMAX

- WiMAX 802.16m

- WiMAX 802.16e

By Application

- Telecommunications

- Smart Grid

- Transportation

- Public Safety

By End-Use

- Residential

- Commercial

- Industrial

By Services

- Network Integration

- Consulting Services

- Managed Services

- Technical Support

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the WiMAX solutions market features key players such as Clearwire, Huawei Technologies, Nokia, TE Connectivity, Ruckus Wireless, Motorola Solutions, Sprint Corporation, Alcatel-Lucent, Aviat Networks, and ZTE Corporation. These companies focus on delivering robust WiMAX infrastructure, including base stations, CPEs, and network management solutions to enable high-speed broadband connectivity. Strategic efforts include upgrading networks to WiMAX 802.16m, integrating IoT capabilities, and supporting rural broadband initiatives. Leading vendors are investing in partnerships with telecom operators and governments to expand coverage in underserved areas and enhance service quality. Many players are working on cost-efficient deployment models to compete with LTE and 5G technologies, ensuring relevance in niche applications such as smart grid, enterprise connectivity, and public safety communications. Continuous innovation and expansion into emerging markets remain key strategies to strengthen market presence and capture growth opportunities through 2032.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Clearwire

- Huawei Technologies

- Nokia

- TE Connectivity

- Ruckus Wireless

- Motorola Solutions

- Sprint Corporation

- Alcatel-Lucent

- Aviat Networks

- ZTE Corporation

Recent Developments

- In September 2025, Motorola Solutions and Nokia partnered to deliver a next-generation, containerized tactical communications network for UK defense agencies.

- In August 2025, Motorola Solutions completed the acquisition of Silvus Technologies, integrating their high-speed mobile ad-hoc network (MANET) technology designed for mission-critical applications.

- In December 2023, Motorola Solutions acquired IPVideo, creator of the HALO Smart Sensor that monitors air quality and detects gunshots with emergency keyword detection. This tehnology enhances situational awareness for security personnel in critical infrastructure.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-Use, Services and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The WiMAX solutions market will grow steadily with demand for rural and underserved broadband connectivity.

- Mobile WiMAX will continue to dominate due to its flexibility and cost-effective deployment.

- Migration to WiMAX 802.16m will improve network capacity and enhance service quality.

- Integration with IoT and smart grid applications will create new growth opportunities.

- Governments will support WiMAX adoption through digital inclusion and broadband expansion programs.

- Vendors will focus on cost-optimized deployment models to compete with LTE and 5G networks.

- Enterprise demand for private wireless networks will boost commercial segment growth.

- Emerging markets will drive adoption as operators seek quick and scalable broadband solutions.

- Public safety and transportation sectors will expand use of WiMAX for secure communication.

- Asia-Pacific will remain the fastest-growing region due to rapid urbanization and strong national connectivity initiatives.