Market Overview:

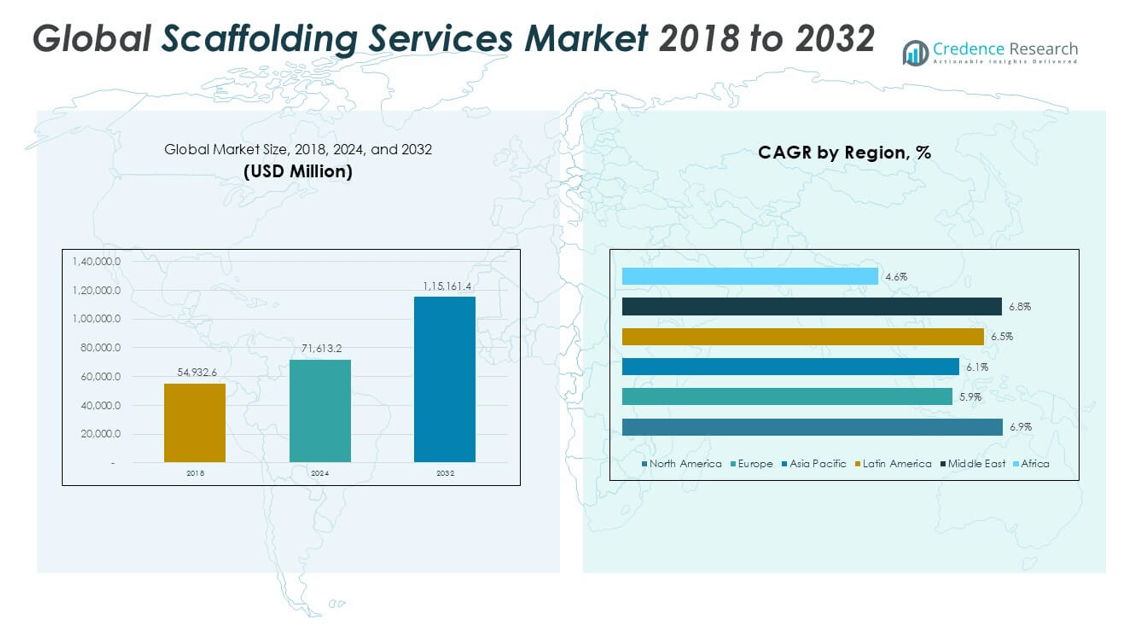

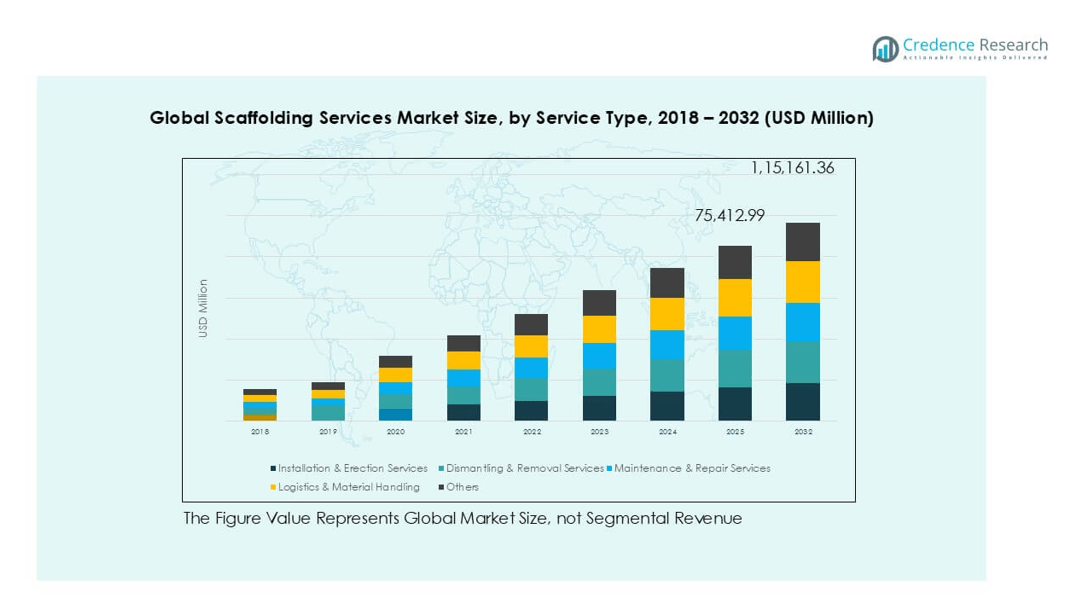

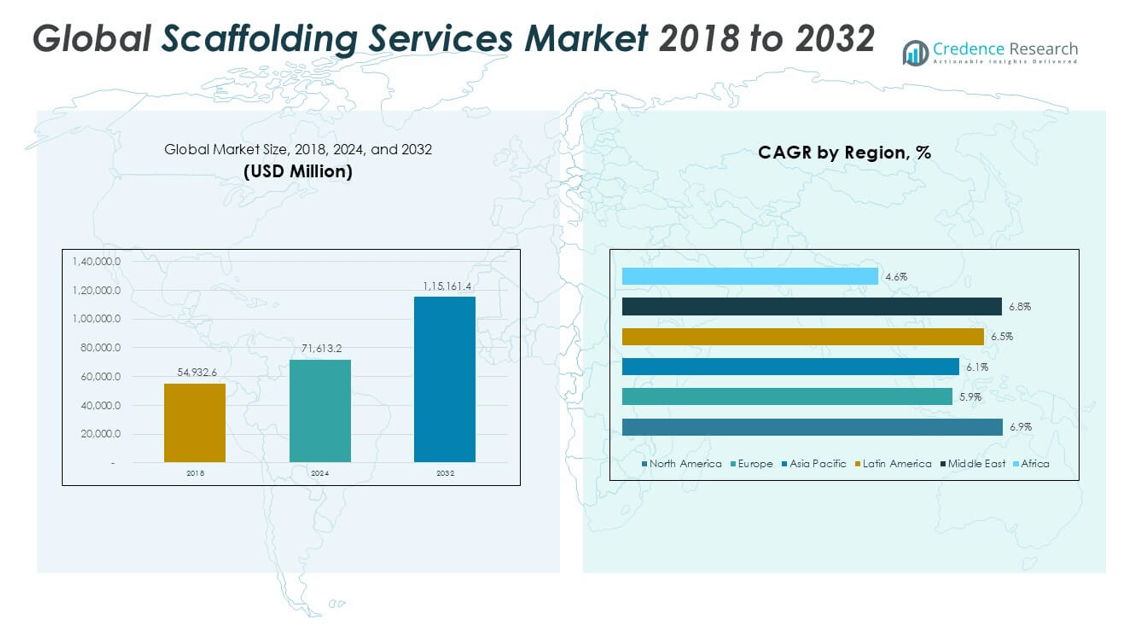

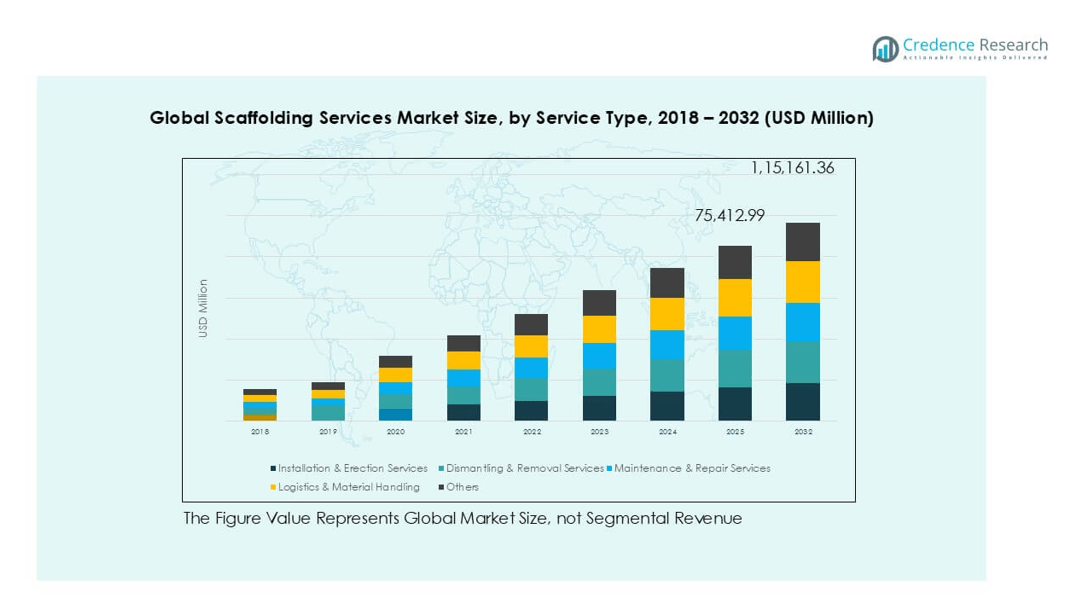

The Scaffolding Market size was valued at USD 54,932.6 million in 2018 and increased to USD 71,613.2 million in 2024. It is anticipated to reach USD 115,161.4 million by 2032, growing at a CAGR of 6.23% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Scaffolding Market Size 2024 |

USD 71,613.2 million |

| Scaffolding Market , CAGR |

6.23% |

| Scaffolding Market Size 2032 |

USD 115,161.4 million |

The Scaffolding Market is highly competitive, led by prominent players such as BrandSafway, Layher, ULMA C y E, Waco Equipment, ADTO Group, and Wellmade Scaffold. These companies dominate through comprehensive service offerings, advanced modular scaffolding systems, and adherence to stringent safety standards. Regional specialists like Saudi Scaffolding Factory, Nassaco, and C J Scaffold Service Inc strengthen their presence through localized expertise and project-specific solutions. Asia Pacific emerged as the leading region, accounting for 35.34% of the global market share in 2024, driven by rapid urbanization, infrastructure expansion, and high construction activity in China and India.

Market Insights

- The global Scaffolding Market was valued at USD 54,932.6 million in 2018 and reached USD 71,613.2 million in 2024; it is projected to reach USD 115,161.4 million by 2032, growing at a CAGR of 6.23% during the forecast period.

- Market growth is driven by rising global construction activities, increasing infrastructure development projects, and stringent safety regulations across sectors such as industrial, residential, and civil engineering.

- The adoption of modular and prefabricated scaffolding systems, along with digital tools like BIM and automated tracking, is transforming project efficiency and safety compliance.

- Asia Pacific leads the market with a 35.34% share in 2024, followed by Europe at 26.36% and North America at 19.38%; by service type, installation & erection services hold the dominant share due to high construction project volume.

- Market restraints include fluctuating raw material costs, regulatory complexity across regions, and a shortage of certified scaffolding professionals.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

The Installation & Erection Services segment dominates the Scaffolding Market, accounting for the largest revenue share in 2024. This dominance is attributed to the extensive demand for scaffolding setup during new construction, repair, and renovation projects across residential, commercial, and industrial sectors. The growth in large-scale infrastructure development and high-rise building projects continues to drive demand for skilled erection services. Moreover, stringent safety regulations and the need for efficient project execution have boosted the preference for professional scaffolding installation over in-house or informal alternatives. The Dismantling & Removal Services, Maintenance & Repair Services, and Logistics & Material Handling segments collectively contribute a significant share, with dismantling services following installation in terms of demand. Increasing project completion rates and the need for safe removal of temporary structures drive this segment’s growth. Meanwhile, maintenance and repair services are essential for long-duration projects where scaffold integrity must be ensured over time. Logistics and material handling services are also gaining traction due to the complexity of managing heavy scaffolding components across multiple sites.

- For instance, BrandSafway has installed over 2.5 million linear feet of scaffolding annually across more than 1,200 projects in North America, supported by its 8,000+ certified field service professionals.

By End User

The Infrastructure & Civil Construction segment holds the largest share of the Scaffolding Market, supported by massive government and private sector investments in roads, bridges, airports, and public buildings. This segment’s demand is amplified by urbanization and industrial corridor development initiatives worldwide. The use of scaffolding is critical in such projects to ensure structural safety and efficiency during complex construction processes. The Industrial & Energy and Residential Construction segments also contribute significantly to market revenue. Industrial facilities such as refineries and power plants require scaffolding during both construction and routine maintenance, driving sustained demand. Residential construction is fueled by increasing urban housing needs and renovation activities. The Shipbuilding & Marine segment sees moderate growth, with demand driven by dockyard maintenance and vessel construction.

- For instance, EK Scaffolding supplied over 100,000 steel scaffold frames for dockside works in the Hyundai Heavy Industries shipyard.

Market Overview

Key Growth Drivers

Surge in Global Infrastructure and Urban Development

The ongoing expansion of global infrastructure—particularly in emerging economies—acts as a key driver for the Scaffolding Market. Large-scale projects involving roads, bridges, railways, airports, and smart cities require robust scaffolding solutions for safe and efficient construction. Governments and private developers are investing heavily in urbanization initiatives, thereby fueling demand for both temporary and long-term scaffolding structures. This growth is further accelerated by strategic infrastructure programs such as China’s Belt and Road Initiative and India’s Smart Cities Mission, creating long-term opportunities for scaffolding service providers.

- For instance, ADTO Group supplied 380,000 tons of scaffolding materials for over 65 Belt and Road Initiative-linked projects across Asia and Africa.

Increased Safety Regulations and Compliance Standards

Rising emphasis on worker safety and regulatory compliance across the construction and industrial sectors significantly boosts demand for professional scaffolding services. Governments and regulatory bodies are implementing stricter guidelines regarding scaffold design, erection, maintenance, and dismantling to reduce workplace accidents. As a result, contractors are increasingly outsourcing these tasks to certified service providers. This shift not only enhances safety but also ensures accountability, fostering a more structured and regulated scaffolding services industry globally.

- For instance, Wellmade Scaffold’s entire ringlock system complies with OSHA 1926.451 and has passed SGS load testing for over 24.5 kN vertical bearing capacity, qualifying it for federal contracts in the U.S.

Growing Industrial Maintenance and Repair Activities

The growing number of industrial facilities, including oil & gas plants, power stations, and manufacturing units, has led to increased demand for scaffolding during maintenance, retrofitting, and shutdown operations. These projects often require specialized scaffolding for safe access to complex and elevated structures. As industries focus on reducing downtime and improving operational efficiency, the need for quick, reliable, and compliant scaffolding services becomes essential, creating recurring revenue streams for service providers.

Key Trends & Opportunities

Adoption of Modular and Prefabricated Scaffolding Systems

Technological advancements have introduced modular and prefabricated scaffolding systems that offer faster assembly, enhanced safety, and reduced labor requirements. These systems are gaining popularity in large-scale and time-sensitive projects. Their versatility and adaptability to different construction environments present a major opportunity for market players. Additionally, modular systems support sustainability goals by enabling reusability, further appealing to eco-conscious developers and contractors.

- For instance, Layher’s Allround Lightweight scaffolding system reduces setup time by 35% compared to traditional tube-and-coupler systems and is designed to support over 200 kN/m² of load with fewer components.

Digital Integration and Automation in Scaffolding Operations

The integration of digital tools such as Building Information Modeling (BIM), drone inspections, and automated inventory tracking is transforming scaffolding services. These technologies improve planning accuracy, reduce resource waste, and enhance on-site safety. Companies leveraging digital solutions gain a competitive edge by offering value-added services to clients, including real-time project monitoring and predictive maintenance. This digital transformation presents a promising avenue for operational efficiency and market differentiation.

Key Challenges

High Labor Dependency and Skilled Workforce Shortage

Scaffolding services remain labor-intensive, requiring skilled professionals for installation, supervision, and dismantling. However, the industry faces a persistent shortage of trained and certified scaffolders, especially in developing regions. This labor gap can lead to project delays, increased costs, and safety risks. Addressing this challenge requires significant investment in training programs and partnerships with vocational institutions to build a qualified workforce pipeline.

- For instance, Saudi Scaffolding Factory has partnered with the Technical and Vocational Training Corporation (TVTC) in Saudi Arabia to train over 1,500 scaffolders annually, addressing national workforce gaps in oil and gas construction projects.

Fluctuating Raw Material Costs

Scaffolding systems rely heavily on raw materials like steel and aluminum, which are subject to price volatility driven by global supply-demand dynamics, trade policies, and geopolitical factors. Sudden cost escalations can erode profit margins for scaffolding service providers, particularly in highly competitive markets. This unpredictability poses a challenge for long-term project pricing and financial planning, prompting companies to seek more cost-stable material sourcing strategies.

Regulatory Variability Across Regions

The scaffolding services industry operates within a highly fragmented regulatory landscape, with varying safety and compliance standards across countries and even regions within countries. This variability complicates operations for multinational or cross-regional service providers, who must adapt to different certification, labor, and safety requirements. Navigating these diverse regulatory frameworks demands significant administrative resources and local expertise, increasing operational complexity and compliance risks.

Regional Analysis

North America

North America held a notable position in the Scaffolding Market, valued at USD 10,255.92 million in 2018 and growing to USD 13,873.53 million in 2024. It is projected to reach USD 23,389.27 million by 2032, expanding at a CAGR of 6.9%. In 2024, the region accounted for approximately 19.38% of the global market share. Growth is driven by robust commercial infrastructure, renovation projects, and stringent safety regulations in the U.S. and Canada. The increasing focus on high-rise residential construction and energy infrastructure upgrades further fuels the demand for specialized scaffolding services across this region.

- For instance, BrandSafway completed over 24,000 scaffold projects annually across North America and deployed more than 4 billion cubic feet of scaffolding in a single year, demonstrating its scale and execution capacity.

Europe

Europe’s Scaffolding Market was valued at USD 14,710.96 million in 2018 and rose to USD 18,871.11 million in 2024. It is forecasted to reach USD 29,688.60 million by 2032, growing at a CAGR of 5.9%. The region represented around 26.36% of the global market share in 2024. Growth is supported by consistent investments in sustainable infrastructure, renovation of historical buildings, and industrial maintenance, particularly in Germany, the UK, and France. Strict EU construction regulations and the rise in urban renewal projects further contribute to the increasing demand for professional and safety-compliant scaffolding services.

- For instance, Layher has deployed its Allround Scaffolding system in over 140 countries and manufactures more than 90,000 metric tons of scaffolding annually at its facility in Güglingen-Eibensbach, Germany, emphasizing its engineering innovation and production strength.

Asia Pacific

Asia Pacific emerged as the largest regional market, valued at USD 19,594.47 million in 2018 and reaching USD 25,305.05 million in 2024, with projections of USD 40,179.80 million by 2032. The region is growing at a CAGR of 6.1% and held the highest market share of approximately 35.34% in 2024. Rapid urbanization, mega infrastructure projects, and expanding residential construction in China, India, and Southeast Asia are the major drivers. Additionally, growing foreign investment in real estate and manufacturing sectors is propelling demand for both temporary and modular scaffolding solutions across the region.

Latin America

Latin America’s Scaffolding Market was worth USD 4,641.81 million in 2018 and increased to USD 6,152.60 million in 2024. It is expected to reach USD 10,111.17 million by 2032, registering a CAGR of 6.5%. The region accounted for 8.34% of the global market share in 2024. Growth is mainly driven by infrastructure development programs, urban housing projects, and expansion in industrial and energy sectors, especially in Brazil and Mexico. Increasing government investments in transport and utilities infrastructure are also supporting the market’s upward trajectory, along with a gradual shift toward formal scaffolding services.

Middle East

The Middle East Scaffolding Market grew from USD 3,543.16 million in 2018 to USD 4,787.86 million in 2024 and is forecasted to reach USD 8,061.30 million by 2032, at a CAGR of 6.8%. The region held a 6.70% market share in 2024. Major growth contributors include ongoing megaprojects such as Saudi Vision 2030 and UAE’s urban expansion. The oil & gas sector also plays a critical role in scaffolding demand for facility maintenance and upgrades. Despite political and economic volatility, investment in tourism infrastructure and commercial construction continues to stimulate demand for scaffolding services.

Africa

Africa’s Scaffolding Market stood at USD 2,186.32 million in 2018 and increased to USD 2,623.09 million in 2024. It is projected to reach USD 3,731.23 million by 2032, growing at a comparatively slower CAGR of 4.6%. The region accounted for just 3.66% of the global market share in 2024. Growth is limited by underdeveloped infrastructure and lower investment levels; however, urban population growth, government-backed infrastructure projects, and improvements in construction safety standards offer emerging opportunities. Countries like South Africa, Nigeria, and Kenya are gradually adopting modern scaffolding services, particularly in urban centers and industrial zones.

Market Segmentations:

By Service Type

- Installation & Erection Services

- Dismantling & Removal Services

- Maintenance & Repair Services

- Logistics & Material Handling

- Others

By End User

- Infrastructure & Civil Construction

- Industrial & Energy

- Residential Construction

- Shipbuilding & Marine

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Scaffolding Market is characterized by the presence of a mix of global and regional players competing based on service quality, safety compliance, geographic reach, and project capabilities. Key industry leaders such as BrandSafway, Layher, ULMA C y E, and Waco Equipment maintain strong market positions through integrated service offerings, innovative scaffolding systems, and large-scale project execution capabilities. Companies like ADTO Group, Wellmade Scaffold, and EK Scaffolding leverage their manufacturing strength and cost-effective services to cater to emerging markets. Regional firms such as Saudi Scaffolding Factory and Nassaco serve niche markets with localized expertise. Competitive intensity is further driven by increasing demand for safety-certified scaffolding, digital project management tools, and modular systems. Strategic collaborations, mergers, and geographic expansions are commonly adopted to strengthen market share. With growing infrastructure investment and safety regulations, service providers that can deliver efficient, compliant, and scalable solutions are expected to gain a long-term competitive edge.

- For instance, Wellmade Scaffold exports over 500 containers monthly and serves 49 global markets through its 260,000-square-meter manufacturing plant.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ADTO Group

- BrandSafway

- Saudi Scaffolding Factory

- Layher

- C J Scaffold Service Inc

- Nassaco

- Wellmade Scaffold

- Qingdao Scaffolding

- Guangzhou AJ Building End User Co., Ltd

- EK Scaffolding

- ULMA C y E, S. Coop

- Waco Equipment

Recent Developments

- In January 2025, AJ Building continued its expansion, bolstering both its manufacturing capacity and global footprint. The company’s operations now support engineering projects in over 160 countries, demonstrating a strong international presence. A key aspect of their business is customization, offering tailored solutions in size, thickness, and finishing. Furthermore, AJ Building is committed to continuous improvement, regularly updating its factory automation and research and development efforts based on evolving client needs. This includes incorporating technologies like AI, blockchain, cloud computing, IoT, and big data analytics to enhance operational efficiency and decision-making in their global operations.

- In June 2024, Saudi Arabia’s ratification of ILO Convention 187 is expected to significantly impact the scaffolding industry by necessitating stricter safety standards and promoting the adoption of advanced, engineered scaffolding solutions. This shift will likely favor companies like Saudi Scaffolding Factory, which already provides premium, engineered products, as the market moves towards higher safety and quality standards.

- In July 2022, StepUp Scaffold UK, a Glasgow-based subsidiary of the StepUp Scaffold Group in Memphis (US), which offers scaffolding and access equipment in the UK market, has finalized the acquisition of MP House ApS, which is located just outside Copenhagen. MP House is a market leader in the supply of tools, equipment, and accessories to Danish scaffolding operators.

- In July 2022, Doka, a provider of formwork, solutions, and services to the construction industry, has reinforced its existing partnership with renowned American scaffolding manufacturer AT-PAC by acquiring a significant investment in the US-based company. Doka and AT-PAC developed an initial relationship in 2020 to provide comprehensive building site solutions, and the partnership has been increasing ever since.

Market Concentration & Characteristics

The Scaffolding Market demonstrates moderate concentration, with a mix of global leaders and numerous regional players competing across varied construction sectors. Key multinational firms such as BrandSafway, Layher, and ULMA C y E hold significant market share due to their extensive service portfolios, safety certifications, and operational scale. It features a fragmented landscape in developing regions, where small and mid-sized firms serve local demand through cost-effective and customized solutions. The market is project-driven, influenced by infrastructure investment cycles, industrial maintenance schedules, and residential construction trends. Entry barriers remain moderate due to relatively low capital requirements but high regulatory and safety compliance standards. It relies heavily on skilled labor and operational efficiency, making workforce availability and productivity critical to service quality. Customers prioritize service providers with proven safety records, equipment reliability, and the capacity to manage complex or large-scale projects. Price competition remains intense in emerging economies, while developed markets emphasize compliance and long-term service partnerships.

Report Coverage

The research report offers an in-depth analysis based on Service Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Scaffolding Market will continue to grow steadily due to increasing global infrastructure and construction activities.

- Demand for modular and prefabricated scaffolding systems will rise as contractors seek faster and safer installation methods.

- Digital integration such as BIM and drone-assisted inspections will enhance operational efficiency and safety compliance.

- Emerging economies in Asia Pacific and Latin America will offer strong growth opportunities driven by urbanization and industrial development.

- Regulatory frameworks will become more stringent, increasing demand for certified and professional scaffolding services.

- The industrial maintenance segment will expand as aging facilities require frequent inspections and structural upgrades.

- Skilled labor shortages may challenge service providers, increasing the need for training and workforce development.

- Strategic partnerships and regional expansions will become key growth strategies among leading players.

- Sustainability will gain importance, with increased adoption of reusable and recyclable scaffolding materials.

- Technological advancements will support customized solutions, improving safety and cost-effectiveness for complex projects.