Market Overview:

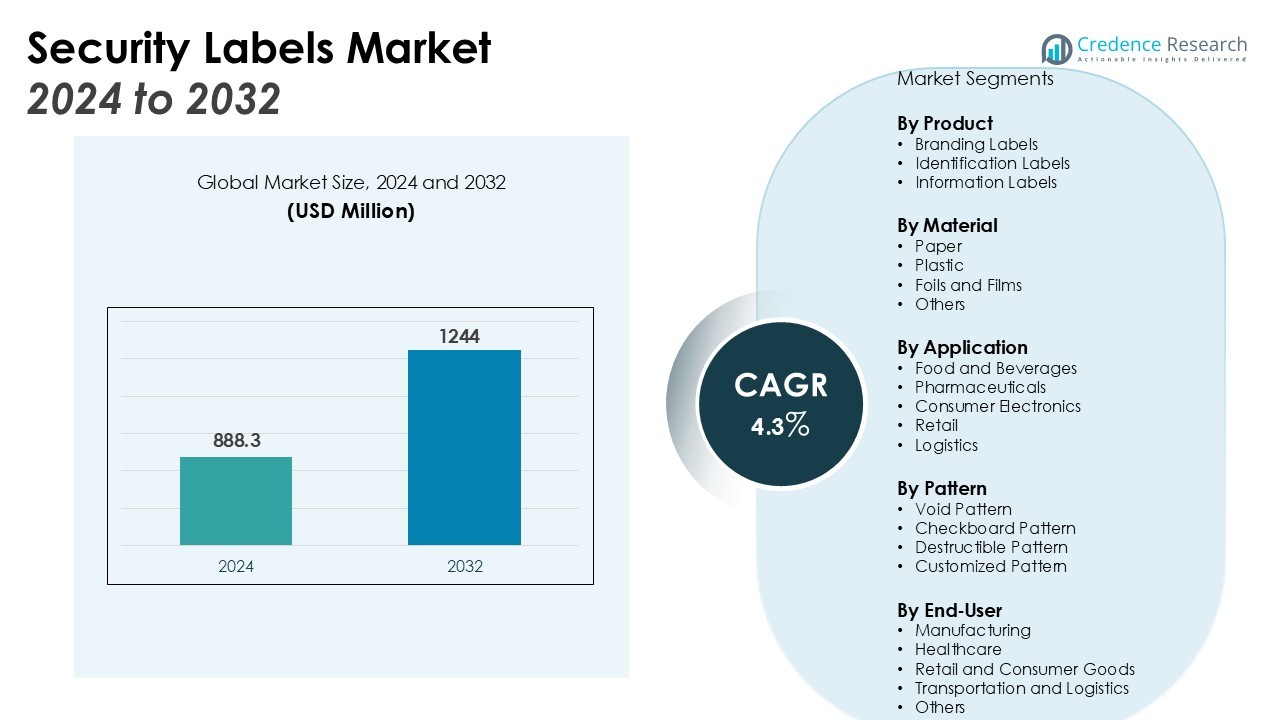

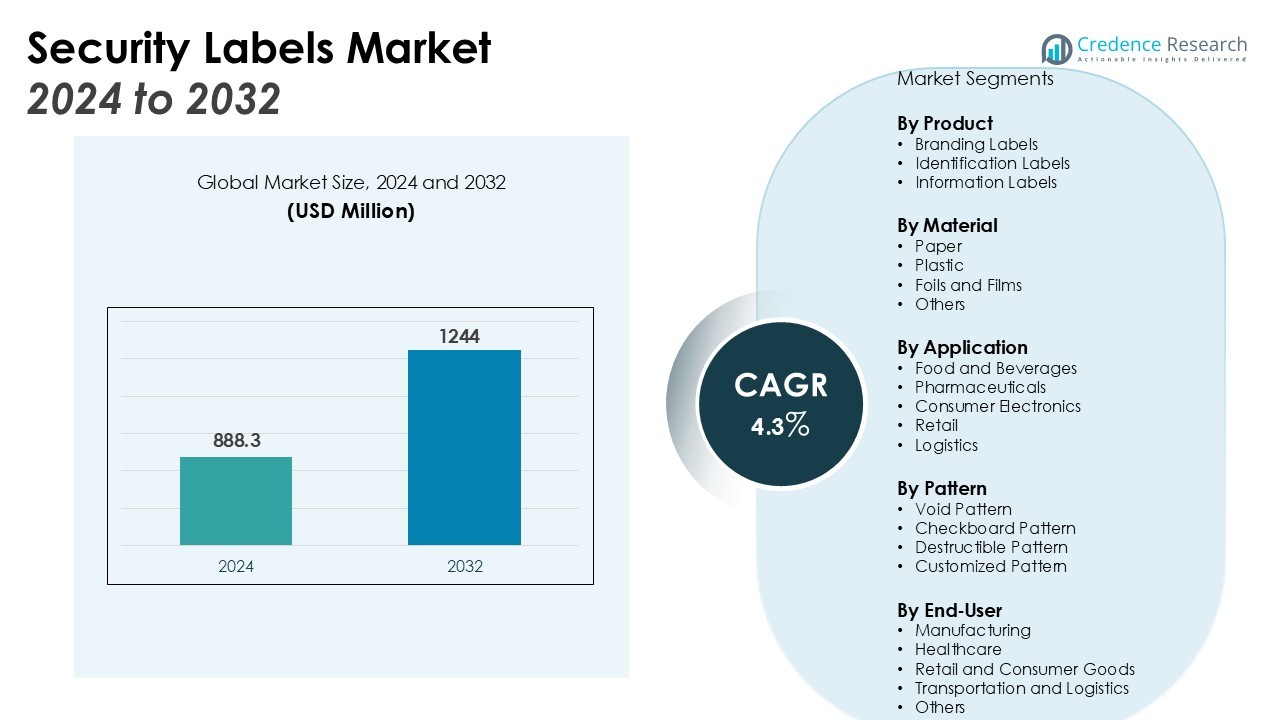

The Security Labels Market size was valued at USD 888.3 million in 2024 and is anticipated to reach USD 1244 million by 2032, at a CAGR of 4.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Security Labels Market Size 2024 |

USD 888.3 Million |

| Security Labels Market, CAGR |

4.3% |

| Security Labels Market Size 2032 |

USD 1244 Million |

The security labels market is experiencing steady expansion, supported by strong industry-wide adoption. Growth is driven by rising concerns over counterfeiting and theft, which encourage companies in pharmaceuticals, food and beverages, electronics, and luxury goods to use tamper-evident and authentication solutions. Regulatory frameworks, including serialization and traceability requirements, further strengthen demand. Continuous innovation in RFID, QR codes, holograms, and digital printing enhances label effectiveness, while the rapid rise of e-commerce fuels greater use of secure packaging across supply chains.

North America holds a dominant position due to strict regulatory standards, high consumer awareness, and widespread use of advanced labeling technologies. Asia-Pacific is emerging as the fastest-growing market, supported by rapid industrialization, expansion of e-commerce platforms, and growing compliance needs across exports. Europe continues to remain an important region, benefiting from established regulatory frameworks and demand for premium security packaging solutions. Latin America and the Middle East & Africa are also developing steadily, with growth underpinned by expanding retail networks, rising manufacturing activity, and increasing focus on brand protection.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Security Labels Market reached USD 888.3 million in 2024 and is forecast to hit USD 1244 million by 2032, registering a CAGR of 4.3%.

- Rising counterfeiting and theft risks in pharmaceuticals, food and beverages, electronics, and luxury goods continue to drive adoption of tamper-evident and authentication labels.

- Government regulations mandating serialization, traceability, and compliance frameworks are reinforcing demand and creating strong entry barriers for non-compliant players.

- Technological advancements such as RFID, QR codes, holograms, and digital printing are enhancing label effectiveness, improving verification, and expanding supply chain transparency.

- The rapid growth of e-commerce and global trade is fueling demand for secure, tamper-evident packaging solutions that protect brand trust across distribution channels.

- North America accounted for 35% of market share, Asia-Pacific held 39%, and Europe represented 22%, reflecting a balanced but regionally diverse growth pattern.

- Despite high production costs and regulatory complexity, opportunities lie in sustainable materials, digital authentication, and expanding adoption across emerging economies.

Market Drivers:

Growing Threat of Counterfeiting and Product Theft

The Security Labels Market benefits from rising awareness of counterfeiting and theft across industries. Pharmaceuticals, food and beverages, electronics, and luxury goods face increasing risks, creating strong demand for tamper-evident and authentication labels. These solutions act as a first layer of protection for products during distribution and retail handling. Companies view them as essential tools for safeguarding brand reputation and consumer trust. Security labels now form a critical element of modern packaging strategies.

- For instance, Pfizer introduced RFID-embedded security labels on its Viagra packaging in 2006, enabling real-time authentication by supply chain partners, which improved counterfeit detection during distribution.

Regulatory Mandates and Compliance Requirements

Government regulations play a decisive role in shaping the Security Labels Market. Serialization laws, pharmaceutical traceability requirements, and compliance standards in various sectors require adoption of secure labeling practices. It ensures transparent product identification while reducing illegal trade activities. Businesses that fail to comply risk severe penalties and reputational damage. Regulatory enforcement continues to accelerate adoption across both developed and emerging markets.

- For instance, to meet global regulations like the U.S. Drug Supply Chain Security Act (DSCSA), Johnson & Johnson successfully implemented a serialization strategy for several thousand of its pharmaceutical products, ensuring full compliance and traceability.

Technological Advancements in Labeling Solutions

Innovation drives adoption in the Security Labels Market through the introduction of advanced features. RFID, QR codes, holograms, and digital printing are enhancing the scope and reliability of security labeling. These technologies improve product verification, support supply chain tracking, and strengthen authentication. It also provides manufacturers with flexible design options while reducing counterfeiting risks. Continuous investment in research is expanding the effectiveness and efficiency of security solutions.

Rising Impact of E-commerce and Global Supply Chains

The growth of e-commerce has created new demand patterns in the Security Labels Market. Online retail requires packaging that demonstrates integrity from dispatch to delivery. Secure and tamper-evident labels are increasingly viewed as vital for ensuring consumer confidence. It allows companies to protect shipments across complex supply networks where risks of diversion or tampering are high. The expansion of global trade further reinforces the need for reliable label-based protection.

Market Trends:

Adoption of Smart Labeling Technologies and Digital Integration

The Security Labels Market is witnessing strong adoption of smart technologies such as RFID, QR codes, and NFC-enabled solutions. These innovations allow real-time product authentication, improve traceability, and enhance supply chain transparency. It helps companies meet rising consumer expectations for secure, verified purchases across retail and online platforms. Integration of digital printing techniques also allows cost-effective customization, brand protection, and rapid scalability. Businesses are increasingly deploying labels with interactive features to engage customers and safeguard against counterfeiting. The shift toward digitally integrated security labeling reflects a broader industry trend toward combining protection with data-driven insights.

- For instance, Zebra Technologies projects that nearly six in 10 warehouse leaders plan to deploy RFID by 2028 to significantly enhance inventory visibility and reduce out-of-stock situations.

Sustainability Focus and Expansion Across Global Trade

Sustainability is shaping the Security Labels Market, with manufacturers emphasizing recyclable, biodegradable, and eco-friendly materials. It supports corporate commitments to reduce environmental impact while meeting regulatory pressures for sustainable packaging practices. Companies are focusing on lightweight label materials that lower costs without compromising durability or security. At the same time, growth in e-commerce and cross-border trade is expanding the demand for tamper-evident and authentication labels. International brands require solutions that ensure consistent product integrity across diverse regulatory environments. The combination of sustainable innovation and globalization is positioning security labels as essential components of modern packaging strategies.

- For instance, Cognosos launched the RT-270 finished vehicle logistics tag that integrates 900MHz wireless and Bluetooth Low Energy technology with an LED light, enabling real-time precise location tracking and operational efficiency improvements in automotive logistics.

Market Challenges Analysis:

High Production Costs and Complex Technology Integration

The Security Labels Market faces the challenge of balancing advanced technology with cost efficiency. Incorporating features such as RFID, holograms, and digital printing raises production expenses, which limits adoption among small and medium enterprises. It requires significant investment in specialized equipment and skilled labor to maintain quality standards. Companies often struggle to justify higher costs in price-sensitive markets, slowing overall penetration. Integration with existing supply chain systems also creates technical hurdles, demanding upgrades that not all businesses can afford. These barriers make scaling secure labeling solutions more complex across diverse industries.

Counterfeit Adaptation and Regulatory Variability

The Security Labels Market also contends with counterfeiters who quickly adapt to new technologies. It forces continuous innovation, which increases research and development costs for manufacturers. Inconsistent regulatory frameworks across countries add further complexity, creating compliance challenges for global brands. Companies must navigate differing requirements for serialization, traceability, and labeling formats, raising operational risks. The lack of standardization reduces efficiency and slows international adoption. These factors combine to create ongoing challenges that demand strategic investment and flexible solutions.

Market Opportunities:

Expansion Through Smart Packaging and Digital Authentication

The Security Labels Market holds strong opportunities through integration with smart packaging and digital authentication systems. Demand for interactive labels that link to mobile applications or online verification platforms is rising rapidly. It allows consumers to validate product authenticity and strengthens trust in global brands. Companies are leveraging QR codes, NFC, and RFID to combine brand engagement with protection. Growth of digital commerce is further fueling adoption, as online shoppers expect clear evidence of product safety. This convergence of technology and consumer trust positions secure labeling as a key enabler of modern retail strategies.

Sustainable Materials and Emerging Market Growth

The Security Labels Market is also well-positioned to benefit from the shift toward sustainable materials. Recyclable and biodegradable security labels align with corporate commitments to reduce environmental impact and meet regulatory targets. It opens new opportunities in regions where eco-friendly packaging adoption is accelerating. Expansion of retail and manufacturing in emerging economies further increases demand for tamper-evident and authentication solutions. Companies entering these markets can strengthen brand protection while complying with evolving regulatory standards. This combination of sustainability and geographic expansion creates long-term growth avenues for security label providers.

Market Segmentation Analysis:

By Product

The Security Labels Market is segmented by product into branding labels, identification labels, and information labels. Each type serves a distinct role in ensuring product safety and authenticity. Branding labels protect brand image by integrating logos and holograms, while identification labels focus on serialization and tracking. Information labels provide regulatory and handling details that support compliance and consumer safety. It reflects the wide adoption of labels as multi-functional security tools across industries.

- For instance, to enhance its brand protection offerings, All4Labels operates under the high-security certification ISO 14298, one of the key standards which ensures a secure manufacturing process for its advanced holographic labels.

By Material

Segmentation by material includes paper, plastic, and others such as foils and films. Paper labels dominate sectors requiring cost efficiency and flexibility, particularly in food and beverages. Plastic labels deliver durability, water resistance, and tamper protection, making them suitable for electronics and pharmaceuticals. Specialty foils and films offer advanced barriers and anti-counterfeit properties for high-value goods. It demonstrates how material choice is aligned with product type and regulatory requirements.

- For instance, Avery Dennison provides high-performance plastic solutions like its 2 Mil White PET label, a durable material engineered to withstand challenging conditions in specialized applications.

By Application

The Security Labels Market by application spans food and beverages, pharmaceuticals, consumer electronics, and retail. Food and beverages lead adoption due to strict safety regulations and brand protection needs. Pharmaceuticals rely on serialized and tamper-evident labels for compliance with traceability standards. Electronics and retail segments use secure labels to combat counterfeit products and safeguard customer trust. It highlights the essential role of security labels in protecting product integrity and meeting diverse industry demands.

Segmentations:

By Product

- Branding Labels

- Identification Labels

- Information Labels

By Material

- Paper

- Plastic

- Foils and Films

- Others

By Application

- Food and Beverages

- Pharmaceuticals

- Consumer Electronics

- Retail

- Logistics

By Pattern

- Void Pattern

- Checkboard Pattern

- Destructible Pattern

- Customized Pattern

By End-User

- Manufacturing

- Healthcare

- Retail and Consumer Goods

- Transportation and Logistics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Strong Presence in North America with Regulatory Support

North America accounted for 35% of the Security Labels Market in recent assessments. It is driven by strict compliance requirements and high consumer awareness. Companies across pharmaceuticals, food and beverage, and luxury goods sectors rely heavily on tamper-evident and authentication labels. It benefits from advanced printing technologies and established supply chain systems that ensure reliable deployment. Strong intellectual property laws and brand protection strategies further reinforce adoption. North America continues to act as a hub for innovation and early implementation of digital security features in packaging.

Rapid Expansion Across Asia-Pacific with Industrial Growth

Asia-Pacific captured 39% of the Security Labels Market in recent evaluations. It is supported by manufacturing expansion, urbanization, and the rise of e-commerce. Countries such as China, India, and Southeast Asian economies are investing in secure labeling to strengthen exports and protect brands in international trade. It benefits from growing retail demand and heightened awareness of counterfeit risks among consumers. The region is also witnessing increased adoption of smart packaging technologies integrated with QR codes and RFID. Rising government focus on regulatory compliance and product traceability further accelerates adoption.

Stable Growth in Europe with Emerging Opportunities in Other Regions

Europe represented 22% of the Security Labels Market in recent studies. It is supported by stringent regulatory frameworks and emphasis on premium product protection. Companies in the region are adopting sustainable and recyclable security labels to align with environmental policies. It reflects a strong balance between technological adoption and regulatory alignment. Emerging markets in Latin America and the Middle East & Africa are also displaying promising demand, driven by expanding retail networks and industrial sectors. These regions are increasingly turning to security labeling as a tool to combat counterfeiting and strengthen consumer trust.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Zebra Technologies Corp.

- Brady Worldwide, Inc.

- 3M

- AVERY DENNISON CORPORATION.

- CCL Industries

- UPM-Kymmene Corporation

- MEGA FORTRIS GROUP

- Honeywell International, Inc.

- Invengo Information Technology Co., Ltd.

- tesa Tapes (India) Private Limited

Competitive Analysis:

The Security Labels Market is defined by strong competition among global and regional players focusing on innovation, compliance, and scalability. Leading companies invest heavily in research to enhance tamper-evident features, integrate RFID and QR technologies, and deliver cost-effective solutions that address rising counterfeiting threats. It benefits from continuous advancements in digital printing and sustainable materials that appeal to both regulatory bodies and environmentally conscious consumers. Market participants also compete through strategic mergers, acquisitions, and partnerships that expand their presence in emerging economies and strengthen product portfolios. Firms prioritize customization and supply chain integration to serve industries such as pharmaceuticals, food and beverages, electronics, and retail. The competitive landscape reflects a balance between established leaders with strong technological expertise and new entrants offering niche, eco-friendly solutions. This dynamic creates sustained pressure to innovate, improve operational efficiency, and meet evolving global standards in product authentication and brand protection.

Recent Developments:

- In March 2025, 3M formed a partnership with the European hydrogen innovation platform H2UB, contributing its expertise in materials science.

- In August 2025, Avery Dennison announced it signed a definitive agreement to acquire the U.S. flooring adhesives business of Meridian Adhesives Group for $390 million.

- In August 2024, CCL Industries announced record results for its second quarter, with a significant improvement in sales and net earnings for the six-month period ending June 30, 2024.

Report Coverage:

The research report offers an in-depth analysis based on Product, Material, Application, Pattern, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Security Labels Market will witness steady expansion supported by demand for anti-counterfeit solutions.

- Pharmaceutical and healthcare sectors will continue to adopt serialization and traceability labels at scale.

- Food and beverage industries will drive strong usage of tamper-evident labels to ensure safety and regulatory compliance.

- It will see wider deployment of RFID, NFC, and QR-enabled labels that improve authentication and supply chain transparency.

- Sustainability will emerge as a key focus, with recyclable and biodegradable security labels gaining wider acceptance.

- E-commerce growth will increase demand for secure packaging that safeguards brand trust and consumer confidence.

- Regional growth in Asia-Pacific will strengthen further, supported by industrialization, exports, and e-commerce expansion.

- North America and Europe will maintain strong positions due to advanced regulations and established brand protection strategies.

- It will create opportunities for manufacturers investing in cost-efficient production and digital integration.

- Strategic collaborations, mergers, and investments in innovation will shape the competitive dynamics and accelerate adoption across industries.