Market Overview

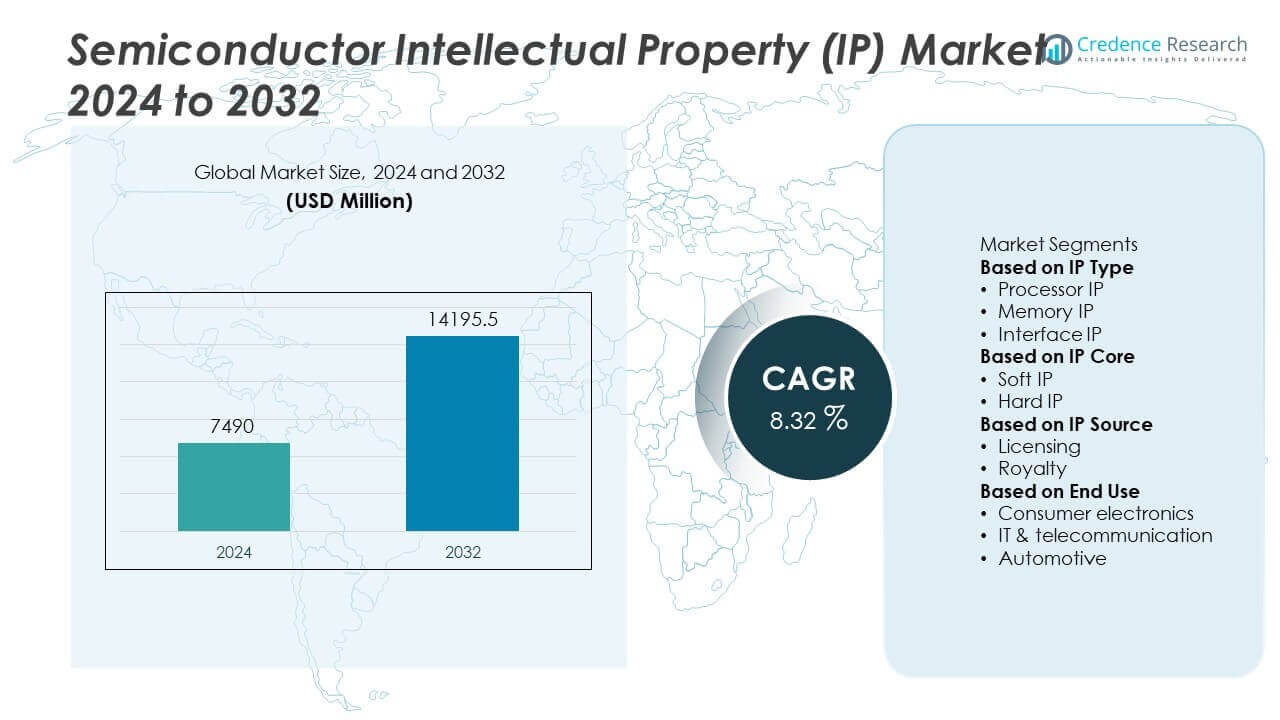

The Semiconductor Intellectual Property (IP) Market was valued at USD 7,490 million in 2024. It is expected to grow to USD 14,195.5 million by 2032, expanding at a CAGR of 8.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Semiconductor Intellectual Property (IP) Market Size 2024 |

USD 7,490 Million |

| Semiconductor Intellectual Property (IP) Market, CAGR |

8.32% |

| Semiconductor Intellectual Property (IP) Market Size 2032 |

USD 14,195.5 Million |

The Semiconductor Intellectual Property (IP) Market grows due to rising SoC complexity, shorter product cycles, and high demand for design reuse. Companies adopt licensed IP cores to reduce costs, accelerate development, and meet performance targets across AI, automotive, and IoT sectors.

Asia-Pacific leads the Semiconductor Intellectual Property (IP) Market due to its strong semiconductor manufacturing base and growing chip design capabilities. Countries like China, Taiwan, South Korea, and India drive demand across consumer electronics, automotive, and industrial applications. North America follows with major contributions from the United States, supported by innovation hubs and large R&D investments in AI and advanced node development. Europe maintains steady demand through its automotive and industrial sectors, focusing on functional safety and compliance. Latin America and the Middle East & Africa represent emerging regions with expanding infrastructure and digital adoption. Key players shaping the global market include Arm Limited, known for its processor IP leadership, Synopsys, Inc., a major provider of interface and security IP, and Cadence Design Systems, Inc., offering comprehensive IP and design tools. Other notable participants include Imagination Technologies and VeriSilicon, both contributing to GPU, multimedia, and application-specific IP innovation across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Semiconductor Intellectual Property (IP) Market was valued at USD 7,490 million in 2024 and is projected to reach USD 14,195.5 million by 2032, growing at a CAGR of 8.32%.

- Increasing SoC complexity and shorter design cycles drive demand for licensed IP cores across end-use sectors.

- Trends show rising adoption of modular IP architectures, domain-specific cores for AI, and security-focused IP in connected systems.

- Arm Limited, Synopsys, and Cadence Design Systems lead the market with strong IP portfolios for processors, interfaces, and memory.

- High integration costs and interoperability issues across advanced process nodes limit seamless IP reuse in some applications.

- Asia-Pacific leads the market due to high semiconductor production and growing local chip design activity, while North America drives innovation in AI and high-performance computing.

- Europe sees steady growth from automotive and industrial sectors, while Latin America and the Middle East & Africa offer emerging opportunities through digital transformation and smart infrastructure.

Market Drivers

Rising SoC Complexity Accelerates IP Core Adoption Across Chip Design Cycles

The growing complexity of System-on-Chip (SoC) design drives higher demand for reusable IP cores. Modern SoCs integrate CPUs, GPUs, memory interfaces, and connectivity modules on a single die. This integration requires verified IP blocks to meet performance and reliability targets. Semiconductor companies depend on third-party IPs to reduce design risks and enable quicker prototyping. It allows design teams to focus on customization and differentiation. The Semiconductor Intellectual Property (IP) Market benefits from this shift toward modular and scalable chip architectures. Pre-verified IP blocks improve time-to-market and reduce testing burdens.

- For instance, Synopsys’ DesignWare ARC NPX Neural Processor IP supports significantly higher performance than 8 TOPS for vision and AI workloads, enabling real-time object detection in complex SoCs used in automotive ADAS systems. A more recent model, like the ARC NPX6 NPU IP, can deliver up to 250 TOPS in a single instance, and up to 3,500 TOPS when multiple instances are combined on a single SoC.

Surge in AI, IoT, and 5G Applications Increases Custom IP Requirements

Emerging applications in AI, IoT, and 5G demand custom and optimized semiconductor IP. These technologies require edge computing, low latency, and high throughput capabilities. Standard IPs fail to meet such tailored requirements, driving need for application-specific IP solutions. Vendors offering optimized IPs for neural networks, RF communication, and low-power processing see stronger traction. It enables device makers to deliver differentiated features and performance. The market supports these needs through scalable and configurable IP portfolios. This demand growth continues as connected devices and AI models become more advanced.

- For instance, CEVA’s NeuPro-M NPU IP is a highly scalable processor designed for both classic and generative AI inference workloads in edge devices across automotive, surveillance, and other markets. A single core of the NeuPro-M can deliver a processing range from 4 to 400 TOPS, and multi-core clusters can scale to thousands of TOPS.

Rising Design Costs and Shrinking Time-to-Market Push IP Licensing

Escalating design costs at advanced nodes make IP licensing economically attractive. Foundries and fabless players face pressure to deliver faster and cheaper chip iterations. Using licensed IPs reduces verification cycles, speeds up tape-out, and ensures compliance with industry standards. It becomes vital for startups and mid-sized players lacking in-house IP development capabilities. The model also benefits large firms by lowering R&D burden. The market sees greater adoption of licensing models such as royalty-based and subscription-based IP access. It supports cost control and agility in a competitive semiconductor environment.

Growth in Automotive and Consumer Electronics Expands IP Demand

Automotive electronics require functional safety, reliability, and performance across harsh conditions. Semiconductors in ADAS, infotainment, and EV systems need specialized IP cores. Consumer electronics demand multimedia, connectivity, and power efficiency through ready-to-integrate IP blocks. It helps OEMs accelerate innovation and manage component interoperability. The Semiconductor Intellectual Property (IP) Market leverages demand from both sectors to diversify revenue streams. IP providers continue to expand their portfolios to serve these high-volume and performance-sensitive applications.

Market Trends

Shift Toward Design Reuse and Modular IP Architectures Becomes Mainstream

Design reuse has become a core strategy across semiconductor product cycles. Companies increasingly adopt modular IP architectures to improve scalability, reduce errors, and shorten design time. Reusable IP cores lower development costs and enable faster integration across multiple chip generations. It supports flexibility in adding new features without changing the base architecture. This trend strengthens the role of IP vendors that offer configurable and silicon-proven blocks. The Semiconductor Intellectual Property (IP) Market aligns with this shift by delivering modular solutions that support various applications. This evolution enhances time efficiency and ensures predictable design outcomes.

- For instance, Cadence’s Tensilica Fusion G3 DSP is a configurable and extensible multi-purpose DSP core. It enables reuse across audio, radar, and AI signal processing subsystems, allowing designers to integrate the same IP core across multiple SoCs. A 2016 benchmark showed the G3 was approximately 5.3 times faster than a competitor’s DSP on one specific task, but this is not a universal TOPS rating.

Open-Source Hardware Gains Momentum in IP Development Ecosystem

Open-source hardware is gaining attention as companies seek collaborative development and lower licensing costs. RISC-V is a key example, offering an open instruction set architecture used in processors, AI chips, and microcontrollers. Startups and research institutes benefit from reduced entry barriers and strong community support. It pushes traditional IP vendors to innovate and improve proprietary offerings. The market sees a balance between open IP and secure, optimized commercial solutions. The trend drives adoption in academic, industrial, and government projects where flexibility and transparency are priorities. Open hardware expands access while reshaping commercial IP strategies.

- For instance, Imagination Technologies did launch RISC-V-based Catapult CPUs for edge-AI and microcontrollers in December 2021. However, the company exited the standalone RISC-V CPU business in January 2025 to focus on its GPU and AI products.

Growing Integration of Security IP in Connected Devices and Edge Systems

Rising cyber threats and growing device connectivity drive demand for embedded security IP. Industries focus on securing firmware, hardware root of trust, and encryption features in the design phase. It ensures compliance with safety and privacy standards across critical sectors like automotive, healthcare, and IoT. Vendors integrate tamper detection, secure boot, and authentication modules into IP libraries. The market reflects this trend by expanding security-focused portfolios and offering turnkey compliance support. The Semiconductor Intellectual Property (IP) Market plays a vital role in enabling trust in connected systems. Security IP becomes essential rather than optional in design flows.

AI and ML Workloads Drive Demand for Domain-Specific IP Cores

AI and machine learning models require fast, efficient processing across edge and data center environments. This trend fuels growth in domain-specific IP cores designed for parallel computation, memory access, and acceleration. Chipmakers seek IP blocks optimized for convolution, vector processing, and model inference. It helps reduce power use and boost performance in real-time applications. IP vendors develop cores tailored for AI frameworks and software stacks. The market supports this trend through continuous R&D and close collaboration with AI solution providers. The Semiconductor Intellectual Property (IP) Market evolves to serve new workloads that demand precision and speed.

Market Challenges Analysis

Rising IP Infringement and Licensing Disputes Increase Legal and Operational Risks

The global expansion of semiconductor design has led to a surge in IP infringement cases. Unauthorized use, duplication, or modification of IP cores creates legal complexities and slows development timelines. Smaller firms struggle to protect their designs in regions with weak enforcement. Cross-border disputes delay product launches and increase legal spending for both licensors and licensees. The Semiconductor Intellectual Property (IP) Market must address these risks through stronger licensing frameworks and compliance tools. It requires ongoing investment in digital rights management and monitoring systems to safeguard innovation. Disputes over ownership and royalty terms also complicate partnerships and joint development.

Complex Integration of IP Cores Across Advanced Nodes Creates Validation Bottlenecks

Shrinking process nodes demand precise integration and verification of IP blocks to meet performance targets. As designs move below 5nm, timing closure, power optimization, and signal integrity grow more difficult. Variations in foundry standards and EDA tools often affect IP interoperability. This creates challenges in reuse, especially for analog and mixed-signal IPs. It forces vendors to provide extensive support during customization and post-silicon validation. The Semiconductor Intellectual Property (IP) Market faces delays when IP cores fail to meet new design rule requirements. Solving these challenges requires deeper collaboration among IP providers, foundries, and EDA vendors.

Market Opportunities

Emerging Demand in Edge AI and Wearable Devices Expands IP Scope

Edge AI and wearable devices present strong opportunities for specialized IP development. These applications require low-power, high-efficiency cores that support real-time processing and compact designs. IP vendors can create value by offering configurable, lightweight cores for vision, audio, and biometric processing. The Semiconductor Intellectual Property (IP) Market supports innovation in these segments by enabling rapid prototyping and flexible integration. It opens pathways for growth in consumer electronics, smart health, and industrial IoT. Vendors that deliver optimized IP for low-latency and low-energy use cases can capture new design wins. This shift helps IP providers enter untapped, fast-growing device categories.

Automotive and Industrial Digitalization Fuels Long-Term IP Licensing Demand

The automotive sector’s move toward electrification, automation, and connectivity creates strong demand for domain-specific IP. Industrial digitalization also drives adoption of advanced semiconductors with embedded security, safety, and communication capabilities. IP vendors that provide ASIL-certified cores, functional safety modules, and robust analog IP see stronger traction. The Semiconductor Intellectual Property (IP) Market aligns with this trend by delivering IP portfolios that meet stringent compliance and reliability standards. It enables OEMs and Tier 1 suppliers to reduce development risks and accelerate product launches. This opportunity spans infotainment, EV control systems, and industrial automation platforms. Demand continues to rise with increasing deployment of intelligent systems.

Market Segmentation Analysis:

By IP Type

The market is segmented into processor IP, interface IP, memory IP, and others. Processor IP holds a major share due to strong demand from consumer electronics, smartphones, and automotive segments. It supports integration of CPUs, GPUs, and AI accelerators into SoCs. Interface IP sees rising adoption driven by high-speed protocols like PCIe, USB, HDMI, and MIPI. Memory IP supports SRAM, DRAM controllers, and non-volatile memory blocks across embedded systems. Each type serves a critical role in performance, power efficiency, and system compatibility. The Semiconductor Intellectual Property (IP) Market benefits from this diversified demand across IP categories.

- For instance, Synopsys’ DesignWare Interface IP portfolio includes PCIe 6.0 controller IP operating at 64 GT/s per lane, enabling efficient data throughput in AI and networking SoCs.

By IP Core

IP cores are classified into soft cores, firm cores, and hard cores. Soft cores offer flexibility in synthesis and targeting across various foundries, making them suitable for FPGAs and early prototyping. Hard cores provide fixed layouts optimized for power and performance, ideal for production at advanced nodes. Firm cores balance flexibility and predictability, allowing customization with moderate design effort. Demand for hard IP cores grows in high-performance computing and automotive safety applications. Soft IP continues to dominate in AI, IoT, and academic use cases. It reflects how IP selection aligns with development goals and fabrication constraints.

- For instance, The Arm Cortex-A720 core was announced in 2023 for flagship mobile and automotive designs. However, it provides up to 20% better power efficiency over its predecessor, the Cortex-A715, not a 25% performance increase. The core’s focus was on improving efficiency for sustained high performance, with a much smaller performance uplift.

By IP Source

The market divides IP sources into licensing from third-party vendors and internal or in-house developed IP. Third-party licensing remains dominant due to time savings, design validation, and broad support from EDA tool vendors. Companies rely on external IPs to meet design targets quickly and reduce in-house engineering workload. In-house IP development holds relevance for firms with large R&D budgets or proprietary architecture requirements. It allows better control over design, security, and optimization. The Semiconductor Intellectual Property (IP) Market reflects a hybrid sourcing model where firms blend third-party IPs with internal assets to maximize performance and cost efficiency.

Segments:

Based on IP Type

- Processor IP

- Memory IP

- Interface IP

Based on IP Core

Based on IP Source

Based on End Use

- Consumer electronics

- IT & telecommunication

- Automotive

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for approximately 31% of the global Semiconductor Intellectual Property (IP) Market. The United States leads the region, backed by strong R&D investment, large semiconductor players, and a well-developed design ecosystem. Companies in this region actively license processor, interface, and memory IP to accelerate SoC development. Growth is also supported by demand from AI, cloud computing, defense, and automotive sectors. Licensing models are mature, with established players driving consistent adoption. It continues to focus on advanced node development, IP verification, and system integration. North America remains a vital region for innovation-led IP growth.

Asia-Pacific

Asia-Pacific holds the largest share of the global market, contributing more than 34%. Countries like China, Taiwan, South Korea, and Japan drive this growth through robust semiconductor manufacturing and increasing chip design capabilities. The region benefits from strong electronics demand, government support, and rapid expansion in consumer and automotive electronics. China remains a dominant force due to its investments in domestic chip design and IP independence. India shows rising activity through design services and startups, creating more demand for licensed IP cores. The Semiconductor Intellectual Property (IP) Market grows here due to flexible licensing needs, faster product cycles, and scaling of AI, IoT, and 5G. Asia-Pacific will likely sustain its lead through high-volume chip design and manufacturing expansion.

Europe

Europe holds close to 22% of the global market share. The region’s strength lies in its automotive and industrial base, where safety-critical and energy-efficient semiconductors require verified and compliant IP. Countries like Germany, France, and the UK support innovation in electric vehicles, industrial automation, and IoT infrastructure. Demand for functional safety IP, RF interfaces, and analog cores remains high. Firms seek reliable IP for compliance with strict regulatory standards. The region balances in-house IP development with third-party licensing. Growth is steady, fueled by digital transformation and mobility innovation across the continent.

Latin America

Latin America contributes around 7.4% to the global Semiconductor IP market. Brazil and Mexico are key contributors, supported by electronics manufacturing and telecom growth. Demand for IP rises in smartphones, set-top boxes, and smart appliances. Cost-effective and validated IP cores find demand among regional OEMs and integrators. Growth potential remains high in consumer electronics and industrial automation. Regional adoption is limited compared to Asia or North America but shows promise through infrastructure modernization and digital device proliferation.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of the total market. Countries in the Gulf Cooperation Council and parts of Africa are exploring IP-based solutions for telecom, healthcare, and industrial sectors. Governments promote digital transformation through smart cities and industrial hubs. Demand exists for secure, energy-efficient IP cores suited for local infrastructure needs. The market remains early-stage, but opportunities grow with expanding internet penetration and regional design activity. Vendors entering early may gain first-mover advantage in tailored IP offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- VeriSilicon

- CEVA, Inc.

- Synopsys, Inc.

- Achronix Semiconductor Corporation

- eMemory Technology Inc.

- Rambus

- Imagination Technologies

- Lattice Semiconductor

- Cadence Design Systems, Inc.

- Arm Limited

Competitive Analysis

The competitive analysis of the Semiconductor Intellectual Property (IP) Market highlights key players including Arm Limited, Synopsys, Inc., Cadence Design Systems, Inc., Imagination Technologies, CEVA, Inc., Lattice Semiconductor, Rambus, eMemory Technology Inc., VeriSilicon, and Achronix Semiconductor Corporation. These companies compete on the basis of portfolio breadth, IP quality, silicon validation, and support for emerging technologies. Processor, interface, and memory IP remain core focus areas, while demand grows for AI-optimized, low-power, and security-integrated cores. Leading firms leverage strategic acquisitions, licensing agreements, and R&D investments to strengthen market presence and address evolving design needs. Integration with advanced EDA tools and compatibility across multiple foundry processes serve as key differentiators. Competitive pressure increases as open-source hardware and regional IP providers expand, challenging established players to maintain innovation pace and customer engagement. Flexibility, compliance readiness, and proven performance continue to shape long-term positioning across global applications.

Recent Developments

- In August 2025, CEVA, Inc. surpassed 20 billion Ceva-powered devices shipped globally, highlighting its dominance in smart edge IP and fueling ongoing innovation in AIoT, automotive, and mobile markets.

- In June 2025, VeriSilicon launched high-performance, scalable GPGPU-AI computing IP tailored for automotive and edge server AI applications.

- In June 2025, VeriSilicon also introduced an ultra‑low‑energy Neural Network Processing Unit (NPU) IP delivering over 40 TOPS for large language model inference on mobile devices.

- In April 2025, Cadence Design Systems, Inc. signed a definitive agreement to acquire Arm’s Artisan foundation IP business, including standard cell libraries and memory compilers for advanced process nodes.

Report Coverage

The research report offers an in-depth analysis based on IP Type, IP Core, IP Source, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily, supported by rising semiconductor demand across sectors.

- Processor IP designs will remain in high demand due to their flexibility and broad use cases.

- Adoption of soft-core IP will increase, offering easier integration across multiple foundry platforms.

- Royalty-based licensing models will dominate, offering scalable revenue for IP vendors.

- Specialized IP for AI, automotive, 5G, and IoT will drive next-phase growth.

- Asia-Pacific will maintain its lead due to strong chip production and expanding design hubs.

- North America will stay competitive through innovation, R&D strength, and ecosystem maturity.

- Demand for IP supporting sub-5nm nodes and integration with advanced EDA tools will rise.

- Open-source IP initiatives will gain traction, encouraging broader collaboration and access.

- New applications in industrial automation, smart healthcare, and edge AI will open fresh IP opportunities.