Market Overview

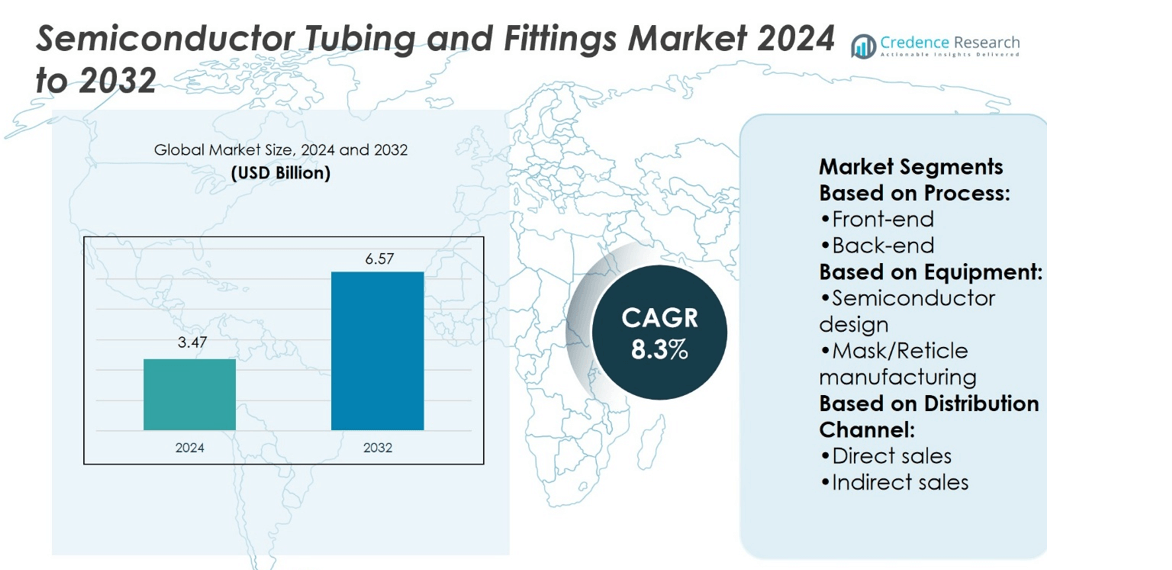

Semiconductor Tubing and Fittings Market size was valued at USD 3.47 billion in 2024 and is anticipated to reach USD 6.57 billion by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Semiconductor Tubing and Fittings Market Size 2024 |

USD 3.47 billion |

| Semiconductor Tubing and Fittings Market, CAGR |

8.37% |

| Semiconductor Tubing and Fittings Market Size 2032 |

USD 6.57 billion |

The Semiconductor Tubing and Fittings Market grows through rising demand for high-purity components in advanced fabrication facilities, driven by expanding global chip production. It benefits from strict contamination control requirements, supporting adoption of fluoropolymer, stainless steel, and specialty polymer tubing in front-end and back-end processes. Trends such as miniaturization of chips, growing complexity of semiconductor nodes, and rapid expansion of 5G, AI, and electric vehicles create new opportunities. The market advances with innovations in material science, smart monitoring solutions, and cleanroom infrastructure. Strong regional investments and supportive government initiatives further strengthen long-term growth across major semiconductor hubs.

The Semiconductor Tubing and Fittings Market shows strong geographical distribution, with Asia-Pacific leading due to extensive fabrication capacity in China, Taiwan, Japan, and South Korea. North America follows with advanced cleanroom infrastructure and government-backed semiconductor initiatives, while Europe emphasizes sustainable production and strict compliance standards. Emerging growth in Latin America and the Middle East & Africa reflects industrial modernization. Key players shaping the market include FITOK Group Co Ltd, FUJIKIN, Nippon Steel Corp, Masterflex Group, and Ihara Science Corporation.

Market Insights

- The Semiconductor Tubing and Fittings Market was valued at USD 3.47 billion in 2024 and is expected to reach USD 6.57 billion by 2032, at a CAGR of 8.3%.

- Rising demand for high-purity tubing and fittings in semiconductor fabs drives market growth.

- Miniaturization of chips, 5G expansion, AI, and electric vehicles create strong growth trends.

- Competition is defined by product innovation, quality standards, and expansion of global supply networks.

- High production costs and raw material price fluctuations remain key restraints for the market.

- Asia-Pacific leads with strong fabrication capacity, followed by North America and Europe with advanced infrastructure.

- Latin America and the Middle East & Africa show smaller but growing opportunities through industrial modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Semiconductor Manufacturing Equipment

The Semiconductor Tubing and Fittings Market benefits from strong demand in advanced semiconductor fabrication facilities. It supports precision fluid and gas handling essential for chip production. Rising investments in wafer fabrication plants across Asia and North America drive the need for reliable tubing and fittings. The market grows as companies expand capacity to meet demand for consumer electronics and data centers. It relies on highly engineered components that ensure contamination-free environments. This factor strengthens adoption across both new and upgraded semiconductor facilities.

- For instance, Novoplast Schlauchtechnik operates cleanrooms meeting ISO 14644‑1 Class 6 and Class 8 standards to manufacture ultra‑clean tubes for semiconductor use.

Emphasis on Cleanroom and Contamination Control

The Semiconductor Tubing and Fittings Market gains momentum from stricter contamination control standards. It supports the semiconductor industry’s focus on ultra-clean manufacturing environments. Growth in miniaturized chips requires defect-free production processes, which tubing and fittings enable. The market benefits from growing deployment of high-purity polymer and stainless-steel components. It delivers solutions that withstand aggressive chemicals used in fabrication processes. Demand rises as cleanroom infrastructure expands globally to maintain higher process yields.

- For instance, Advance Fittings Corp produces ASME-BPE fittings for the biopharmaceutical industry in welded and clamp styles, with sizes from 1/8″ up to 12″. The company offers custom fabrication services, having produced components up to 20″ and larger to meet unique fabrication specifications.

Technological Advancements in Material Engineering

The Semiconductor Tubing and Fittings Market is driven by innovation in material science. It relies on advanced polymers, fluoropolymers, and stainless steel for high-purity performance. Enhanced corrosion resistance and durability improve long-term reliability in harsh processing conditions. The market benefits from tubing solutions that meet extreme temperature and chemical resistance requirements. Companies focus on R&D to supply components with tighter dimensional tolerances. These advancements create competitive differentiation and increase adoption across semiconductor manufacturing hubs.

Expansion of Semiconductor Applications Across Industries

The Semiconductor Tubing and Fittings Market expands with rising semiconductor use in multiple sectors. It supports growth in automotive, healthcare, telecommunications, and industrial electronics. Electric vehicles and 5G infrastructure accelerate demand for chips, fueling higher production volumes. This trend boosts investments in advanced fabs, which require reliable tubing and fittings. The market plays a critical role in supporting supply chains for critical industries. Continuous expansion of end-use applications ensures sustained demand over the forecast period.

Market Trends

Shift Toward High-Purity Materials

The Semiconductor Tubing and Fittings Market experiences a steady trend toward high-purity materials. It increasingly uses fluoropolymers and specialty stainless steels for critical applications. Demand grows because these materials ensure chemical resistance and minimize contamination risks. The market responds to stricter quality standards in semiconductor production processes. It delivers products that meet advanced cleanroom requirements and withstand harsh fabrication environments. This trend enhances overall reliability and boosts manufacturing efficiency across fabs.

- For instance, Orion manufactures high-purity piping and fittings using Type I homopolymer polypropylene (PPI) and PVDF, delivering components in 10 ft lengths that withstand 150 psi at 73 °F pressure in socket-fusion fittings.

Integration of Advanced Manufacturing Technologies

The Semiconductor Tubing and Fittings Market benefits from integration of advanced manufacturing technologies. It includes precision extrusion, 3D printing, and automated quality control systems. These processes improve dimensional accuracy and consistency in component performance. The market adopts digital tools to optimize production lines and reduce operational costs. It increasingly emphasizes automated inspection for detecting defects at micro-levels. This trend strengthens supply reliability and supports large-scale semiconductor manufacturing projects.

- For instance, Canon commercialized the FPA-1200NZ2C nanoimprint lithography (NIL) system, shipping. It achieves patterning with minimum linewidths of 14 nm, equivalent to the 5 nm logic semiconductor node, and does so without optical projection—offering both high fidelity and lowered energy use.

Rising Demand from Next-Generation Semiconductors

The Semiconductor Tubing and Fittings Market expands with rising demand for next-generation semiconductors. It aligns with trends in AI, IoT, and 5G-driven devices that need advanced chips. The production of smaller, more complex nodes creates higher requirements for contamination-free environments. The market supports this transition by providing fittings and tubing tailored for precision handling. It adapts to changing chemical usage and stricter yield targets in fabrication plants. This trend reinforces the importance of advanced fluid management systems.

Regional Manufacturing Shifts and Capacity Expansion

The Semiconductor Tubing and Fittings Market reflects regional shifts in semiconductor production. It grows with large-scale investments in Asia-Pacific, North America, and Europe. Companies expand facilities to secure supply chains and meet rising global chip demand. The market supports this growth by supplying tubing and fittings tailored to regional regulations. It adapts product portfolios for local standards and customer needs. This trend ensures steady demand across diverse geographies and strengthens long-term industry presence.

Market Challenges Analysis

High Production Costs and Supply Chain Constraints

The Semiconductor Tubing and Fittings Market faces challenges from high production costs and supply chain volatility. It relies on specialized raw materials such as high-purity fluoropolymers and stainless steel, which remain expensive. Disruptions in global logistics and fluctuating raw material prices put pressure on manufacturers. The market struggles to balance cost control with meeting strict performance and purity standards. It requires continuous investments in advanced production technologies to maintain consistency. These financial pressures make it difficult for smaller players to compete against established global suppliers.

Stringent Quality Standards and Technical Complexity

The Semiconductor Tubing and Fittings Market is challenged by stringent quality standards and complex technical requirements. It must meet strict regulations governing contamination control and chemical compatibility in semiconductor fabrication. Manufacturers face difficulties in developing tubing and fittings that consistently perform under extreme operating conditions. The market demands components with high durability, precise tolerances, and resistance to aggressive chemicals. It forces companies to invest heavily in R&D and compliance testing, which lengthens development cycles. This complexity creates barriers to entry and slows product innovation in certain regions.

Market Opportunities

Growing Investments in Semiconductor Manufacturing Expansion

The Semiconductor Tubing and Fittings Market holds strong opportunities from global investments in semiconductor manufacturing. It benefits from new fabrication plants across Asia-Pacific, North America, and Europe, driven by rising chip demand. Government initiatives to strengthen domestic chip production further support expansion of cleanroom infrastructure. The market can capture growth by supplying advanced tubing and fittings that ensure process purity. It also gains momentum from the increasing shift toward miniaturized chips requiring ultra-clean production. These dynamics create a favorable landscape for suppliers offering high-performance, contamination-resistant components.

Innovation in Materials and Smart Manufacturing Solutions

The Semiconductor Tubing and Fittings Market presents opportunities through innovation in materials and smart technologies. It advances with the development of tubing that withstands extreme conditions while reducing maintenance costs. Opportunities emerge from integrating sensors and monitoring features for predictive maintenance in semiconductor plants. The market can expand by offering solutions tailored to new processes such as advanced lithography and chemical handling. It benefits from demand for components that improve energy efficiency and operational reliability. This creates room for companies to differentiate through product innovation and value-added services.

Market Segmentation Analysis:

By Process

The market is divided into front-end and back-end processes, each requiring precise tubing and fittings solutions. Front-end processes such as wafer manufacturing, surface conditioning, deposition, and thermal processing demand high-purity tubing to handle gases and chemicals. It ensures accuracy and stability in critical fabrication steps. Back-end processes including assembly, packaging, and test/inspection also rely on fittings that maintain reliability under high-volume production. Fabrication facilities adopt both tubing and fittings to ensure smooth integration with advanced semiconductor equipment.

- For instance, Teradyne J750Ex-HD microcontroller test solution has over 6,000 units installed across more than 50 OSAT (Outsourced Semiconductor Assembly and Test) sites globally, making it the high-volume test standard for low-cost devices.

By Equipment

Semiconductor tubing and fittings are used across multiple equipment categories, including semiconductor design, mask/reticle manufacturing, wafer processing, assembly and packaging, test/inspection, and fabrication facilities. The market also supports surface conditioning, thermal processing, deposition, and other specialized systems. It ensures efficiency by enabling precise fluid and gas flow across these stages. Equipment manufacturers require tubing and fittings with consistent quality and durability to meet stringent performance standards. This creates strong demand across both new equipment installations and upgrades in existing facilities.

- For instance, ULVAC’s ENTRON-EX2 multi-chamber sputtering system is engineered for the 300 mm wafer segment, enabling advanced PVD (physical vapor deposition) processing on larger diameters.

By Distribution Channel

The market operates through direct and indirect sales channels, meeting diverse customer preferences. Direct sales dominate in large contracts with foundries and integrated device manufacturers, where high-volume supply and custom specifications are required. Indirect sales channels, including distributors and suppliers, play a key role in reaching smaller semiconductor facilities and research institutions. It balances both models to ensure wide accessibility and timely delivery of specialized tubing and fittings. This dual approach supports long-term growth across different market tiers and geographies.

Segments:

Based on Process:

Based on Equipment:

- Semiconductor design

- Mask/Reticle manufacturing

Based on Distribution Channel:

- Direct sales

- Indirect sales

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for about 32 % of the Semiconductor Tubing and Fittings Market, making it one of the most influential regions. The United States dominates with its advanced semiconductor ecosystem and significant investments in new fabrication facilities. Government-backed initiatives to boost domestic chip production strengthen market demand for high-purity tubing and fittings. The region benefits from strong R&D activities, digital integration in fabs, and established cleanroom infrastructure. Leading manufacturers supply contamination-free components to meet stringent quality standards. Growing demand from data centers, automotive electronics, and defense sectors ensures steady adoption across the region.

Europe

Europe contributes nearly 26 % of the market, supported by a strong industrial and technology base. Germany, France, and the Netherlands play leading roles in advancing semiconductor manufacturing and cleanroom technologies. The European Union’s focus on self-sufficiency in chip production adds momentum to tubing and fittings demand. The market benefits from strict environmental standards that encourage the use of sustainable materials in production. European companies emphasize durability, technical precision, and compliance with global quality benchmarks. This focus helps the region remain competitive while supporting advanced applications in automotive, aerospace, and industrial automation.

Asia-Pacific

Asia-Pacific leads with the largest share of about 34 %, driven by the region’s position as the global hub for semiconductor manufacturing. Taiwan, South Korea, China, and Japan dominate with advanced wafer fabrication and packaging capabilities. Rapid expansion of foundries such as TSMC and Samsung generates strong demand for ultra-high purity tubing and fittings. Governments in the region actively support semiconductor production through funding and favorable policies. Asia-Pacific also benefits from cost-efficient supply chains and a skilled workforce. Continuous investments in 5G, artificial intelligence, and consumer electronics further reinforce its dominant market position.

Latin America

Latin America represents approximately 5 % of the global market, with demand steadily growing through industrial modernization. Countries such as Brazil and Mexico are gradually adopting advanced cleanroom technologies to support electronics and semiconductor-related industries. The region focuses on upgrading its industrial base to align with global supply chain requirements. While the semiconductor ecosystem is still emerging, investments in automation, healthcare, and energy sectors create opportunities. Suppliers targeting this region must adapt solutions to local regulations and infrastructure needs. This segment remains smaller but demonstrates long-term potential for high-purity tubing and fittings adoption.

Middle East & Africa

The Middle East & Africa hold nearly 3 % of the Semiconductor Tubing and Fittings Market, contributing the smallest regional share. The region experiences growth from expanding industrial sectors such as chemicals, oil refining, and healthcare, which support semiconductor-related applications. Governments invest in clean technology and research infrastructure to diversify beyond traditional industries. While semiconductor production capacity is limited, demand for contamination-free tubing and fittings is gradually rising. Suppliers view the region as a niche but growing market for high-performance components. This growth is expected to accelerate with technology transfer and infrastructure development in key economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Semiconductor Tubing and Fittings Market features such as FITOK Group Co Ltd, Masterflex Group, Advance Fittings Corp, Orion, Ihara Science Corporation, Nippon Steel Corp, FUJIKIN, APT, Heraeus Covantics, and Dibert Valve & Fitting Co Inc. The Semiconductor Tubing and Fittings Market is shaped by innovation, quality standards, and global supply capabilities. Companies focus on delivering ultra-high purity solutions that ensure contamination control and withstand aggressive chemicals used in semiconductor fabrication. The market sees strong investment in research and development to create advanced materials such as specialty polymers, fluoropolymers, and stainless steel for extreme processing conditions. Competition is influenced by the ability to provide consistent product performance, meet regulatory compliance, and adapt to regional customer requirements. Firms also strengthen their positions through partnerships with semiconductor foundries, expansion of production facilities, and adoption of automated manufacturing technologies. This competition fosters continuous improvement in product reliability, process efficiency, and customer service, ensuring long-term growth opportunities across the industry.

Recent Developments

- In April 2025, Atomera Incorporated, a semiconductor materials and technology licensing firm, announced a strategic marketing alliance with a leading chip fabrication company. The agreement is aimed at driving the adoption of Atomera’s Mears Silicon Technology™ (MST®) across cutting-edge electronics, including AI, 5G, and other next-gen platforms.

- In January 2025, Bengaluru-based UHP Technologies is set to inaugurate semiconductor equipment factory near the international airport. Its subsidiary, KASFAB Tools, has initially invested Rs 20 crore into the Doddaballapur facility.

- In August 2024, Birla HIL Pipes, a subordinate of CK Birla group, launched a new leak-proof solution in the pipe and fittings segment to add more value to the products that added price volatility and premiumise the portfolio.

- In August 2024, Aliaxis SA, a leading player that offers access to water and energy via fluid management solutions, announced the strategic deal for acquiring manufacturing assets of Johnson Controls’ CPVC pipe and fittings business for light commercial sprinkler systems and the residential sector.

Report Coverage

The research report offers an in-depth analysis based on Process, Equipment, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising semiconductor fabrication plant investments worldwide.

- High-purity tubing and fittings will remain critical for contamination-free production.

- Asia-Pacific will sustain dominance due to strong foundry and packaging capacity.

- North America will grow with government-backed semiconductor manufacturing initiatives.

- Europe will emphasize sustainable materials and compliance with strict regulations.

- Advanced polymers and alloys will gain preference for extreme process conditions.

- Integration of smart monitoring features will support predictive maintenance in fabs.

- Demand will rise from emerging applications in AI, 5G, and electric vehicles.

- Suppliers will focus on regional customization to meet diverse quality standards.

- Innovation in cleanroom infrastructure will create long-term opportunities for manufacturers.