Market Overview

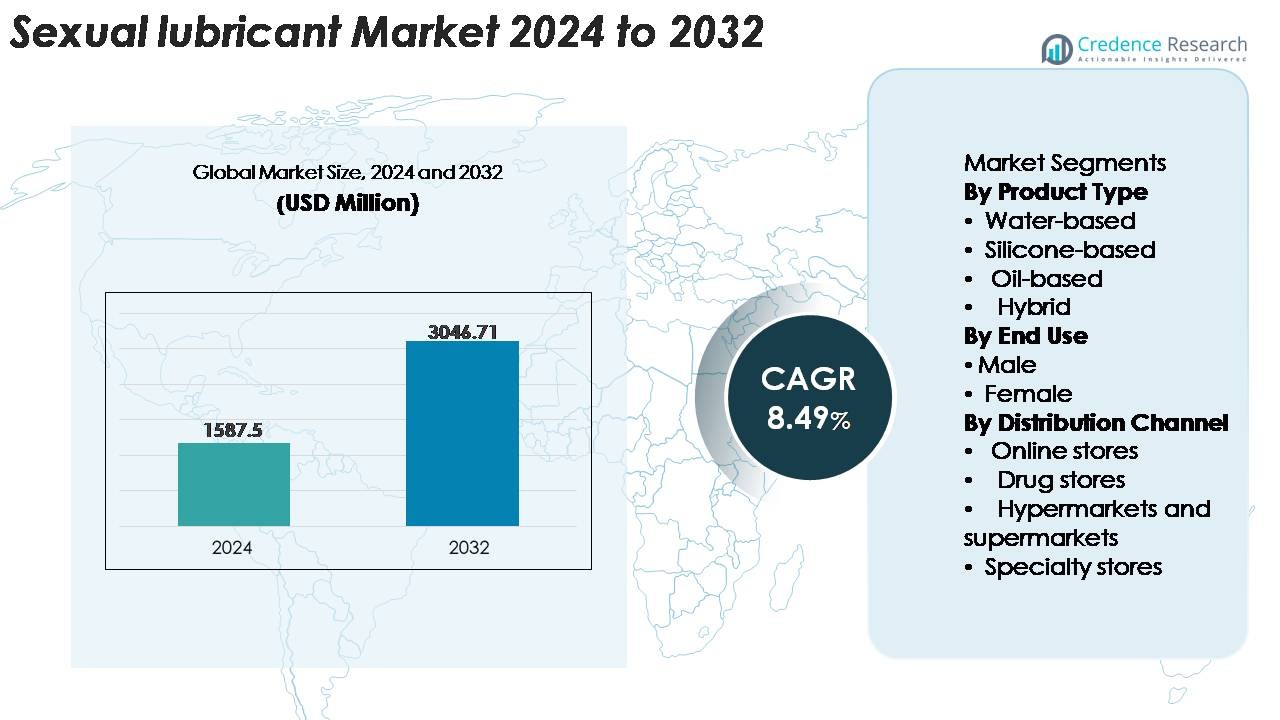

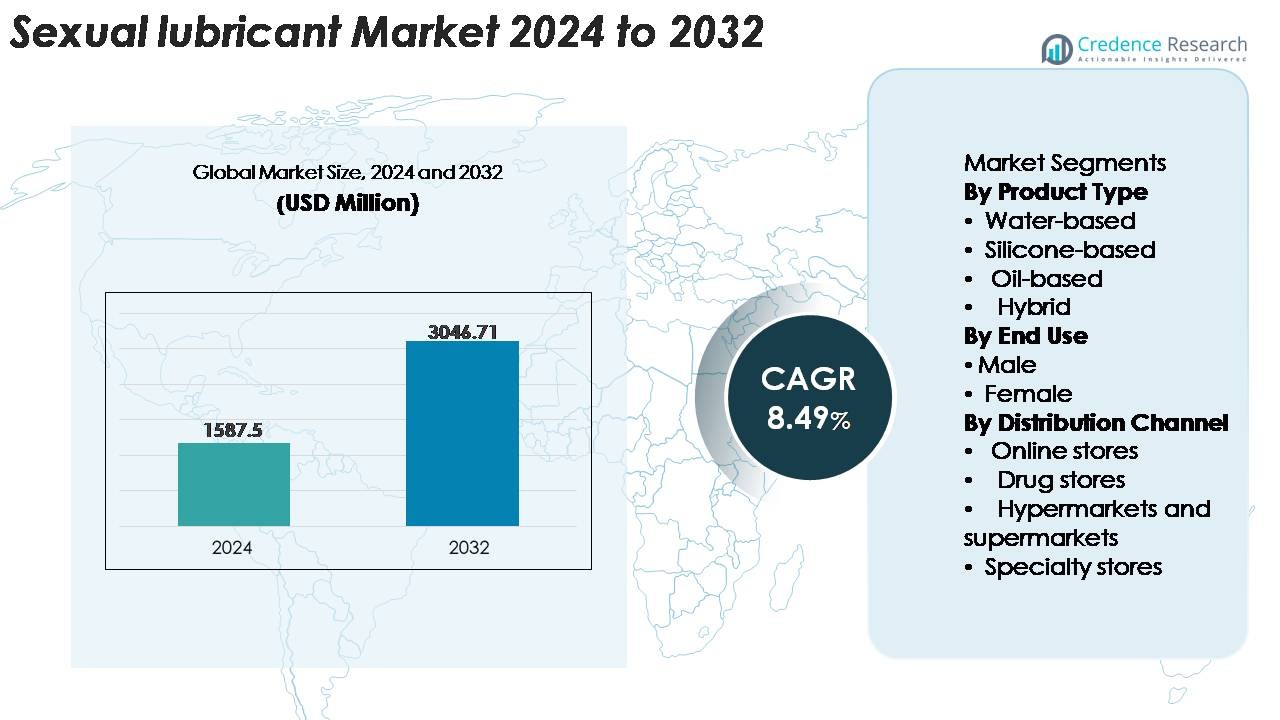

The global Sexual Lubricant Market size was valued at USD 1,587.5 million in 2024 and is anticipated to reach USD 3,046.71 million by 2032, at a CAGR of 8.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sexual Lubricant Market Size 2024 |

USD 1,587.5 Million |

| Sexual Lubricant Market, CAGR |

8.49% |

| Sexual Lubricant Market Size 2032 |

USD 1,587.5 Million |

The sexual lubricant market is shaped by a competitive mix of established global brands and specialized wellness companies, including Lovehoney Group, Peptonic Medical, Mayer Laboratories, BioFilm, SASMAR, LifeStyles Healthcare, Cupid, Good Clean Love, Reckitt Benckiser Group, and Church & Dwight. These players compete through advanced formulations, expanded distribution across retail and e-commerce, and growing investments in clean-label and dermatologically tested products. North America remains the leading region, accounting for approximately 40% of the global market share, driven by strong consumer awareness, mature retail networks, and high adoption of sexual-wellness products. Europe follows with roughly 30%, supported by progressive attitudes and stringent quality standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global sexual lubricant market was valued at USD 1,587.5 million in 2024 and is projected to reach USD 3,046.71 million by 2032, advancing at a CAGR of 8.49% during the forecast period.

- Rising sexual-wellness awareness, increasing acceptance of intimacy products, and expanding therapeutic use for issues such as dryness and discomfort are driving steady demand, with water-based lubricants holding the dominant 45%+ product-type share.

- Clean-label, organic, and premium sensory formulations continue to shape market trends as consumers seek safer, long-lasting, and dermatologically tested options, supported by rapid e-commerce penetration enabling discreet access.

- Competitive activity intensifies as major players such as Reckitt Benckiser Group, Lovehoney Group, and Church & Dwight expand portfolios while smaller brands differentiate through natural ingredients, though stigma in conservative regions remains a key restraint.

- Regionally, North America leads with ~40% share, followed by Europe at ~30%, while Asia-Pacific holds ~20% and grows fastest due to rising urbanization and digital retail adoption.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The water-based segment stands out as the dominant sub-segment in the global sexual lubricants market, capturing well over 45% of market share in 2024 thanks to its compatibility with latex condoms, ease of cleanup and broad consumer acceptance. It is driven by hygiene and safety concerns, convenience usage trends, and its appeal across age and gender demographics. Meanwhile, the silicone-based and hybrid formulations are growing rapidly due to their longer lasting performance and premium positioning consumers seeking enhanced experience are shifting toward these variants. Oil-based lubricants remain a smaller niche, constrained by latex incompatibility and residue concerns, yet continue to persist where natural or alternative-ingredient positioning is valued.

- For instance, Cupid Limited in India operates a dedicated production line capable of manufacturing 210 million sachets of water-based lubricant jelly annually, supporting large-scale distribution across institutional and retail channels.

By End Use

Within the end-use segmentation, the male sub-segment holds the predominant share of the market, accounting for more than 80% of revenues in 2022. This dominance is underpinned by widespread male usage patterns, product familiarity and targeted marketing toward male sexual wellness. The female sub-segment is emerging as the fastest growing, stimulated by increasing awareness of female sexual health issues (such as vaginal dryness), rising demand for tailored products, and a growing cultural shift toward openness and inclusivity. Brands are innovating with formulations and packaging aimed specifically at women, which is expanding that sub-segment’s momentum.

- For instance, Cupid Limited (India) maintains an annual manufacturing capacity of 480 million male latex condoms and 210 million lubricant-jelly sachets, enabling large-scale distribution of male-targeted lubricant formats across domestic and international markets.

By Distribution Channel

In terms of distribution channels, offline retail (inclusive of drug stores, hypermarkets/supermarkets and specialty stores) has historically dominated the market, benefitting from established shelf-space, consumer trust and visibility. However, the online stores channel is emerging as the fastest-growing route, propelled by greater consumer comfort with discreet purchase of sexual wellness products, convenience, and wider product selection. Within online sales, direct-to-consumer, subscription models and e-commerce platforms are increasingly prominent. Drug stores maintain strength in the offline channel due to accessibility and perceived legitimacy, while hypermarkets and supermarkets offer broad reach, and specialty stores cater to niche/enthusiast segments with premium branding and experience-oriented retailing.

Key Growth Drivers

Rising Sexual Wellness Awareness and Normalization of Intimacy Products

Growing global awareness of sexual wellness is a primary driver accelerating demand for sexual lubricants. Increased public discourse on sexual health, broader acceptance of intimacy products, and educational initiatives by healthcare professionals are encouraging more consumers to adopt lubricants as part of routine intimate care. The widespread use of digital platforms has made conversations about sexual comfort, pleasure enhancement, and safety more accessible, reducing stigma and boosting product visibility. Pharmaceutical companies and wellness brands are also expanding retail footprints and running targeted campaigns highlighting the importance of lubrication for comfort and reduced friction-related irritation. This has created a more informed and receptive consumer base. The normalization of these products across age groups especially young adults and middle-aged consumers continues to strengthen category penetration. As sexual wellness transitions from taboo to mainstream, the market benefits from increasing first-time buyers, repeat purchases, and expanding product diversification.

- For instance, Good Clean Love leverages its Bio-Match® technology, engineered to maintain a vaginal-healthy osmolality of 250–400 mOsm/kg, in educational materials that emphasize bio-compatibility and the role of balanced lubrication in reducing discomfort.

Growth of E-Commerce and Discreet Online Purchasing Behavior

The rapid rise of e-commerce is a strong catalyst for sexual lubricant market expansion, as digital platforms overcome traditional barriers associated with in-store purchasing. Many consumers, especially in conservative regions, prefer online channels due to enhanced privacy, discreet packaging, and broader product visibility. E-commerce giants, direct-to-consumer brands, and specialized wellness stores offer extensive assortments including water-based, silicone-based, hybrid, natural/organic, and flavored variants. Subscription models further promote recurring purchases, while personalized recommendation algorithms help users select products tailored to sensitivity levels, ingredient preferences, and usage occasions. Online reviews and influencer-driven content improve consumer confidence and accelerate trial. Additionally, mobile-first markets benefit from simplified checkout, digital wallets, and same-day delivery services. Together, these factors make e-commerce the fastest-growing distribution channel, reshaping consumer behavior and enabling manufacturers to target niche segments more effectively.

- For instance, Lovehoney operates one of the largest dedicated sexual-wellness e-commerce platforms worldwide, dispatching more than 1 million orders per year through its global fulfillment centers. The company uses unbranded, discreet packaging across all lubricant shipments, a policy stated in its customer service standards.

Expanding Applications in Medical, Therapeutic, and Women’s Health Segments

The use of sexual lubricants has expanded beyond recreational contexts into medical and therapeutic domains, making it an important driver of market growth. Healthcare providers increasingly recommend lubricants for managing vaginal dryness, menopausal discomfort, post-partum recovery, and conditions such as dyspareunia. Rising diagnosis and treatment of sexual dysfunctions, along with increased adoption of lubricants during gynecological procedures, have broadened the product’s clinical relevance. Women’s health companies are also formulating pH-balanced, hypoallergenic, and fertility-safe lubricants tailored to sensitive users. Growing availability of silicone-free and preservative-free variants further aligns with dermatological safety standards. With aging populations worldwide and heightened focus on reproductive and intimate wellness, the therapeutic use of lubricants is becoming routine. This expansion into healthcare-supported applications not only increases product legitimacy but also strengthens long-term demand across diverse demographics.

Key Trends & Opportunities

Surge in Natural, Organic, and Clean-Label Formulations

One of the most prominent trends shaping the sexual lubricant market is the strong shift toward natural, plant-derived, and clean-label formulations. Consumers increasingly seek products free from parabens, glycerin, petrochemicals, and artificial fragrances, particularly those with sensitive skin or medical conditions. Brands are responding with botanical blends, aloe-based lubricants, pH-optimized formulations, and dermatologist-tested alternatives. The rise of the “clean beauty” movement has extended into sexual wellness, creating opportunities for premium positioning and innovative ingredient sourcing. Manufacturers developing lubricants with transparent labeling, FSC-certified packaging, and eco-certifications gain a competitive edge. As consumer scrutiny of ingredient safety intensifies, clean-label lubricants will continue to capture higher market share, especially in North America and Europe where regulatory compliance and personal care standards are more rigorous.

· For instance, YES® WB water-based lubricant holds a Soil Association Organic certification and maintains a pH of 4.0–5.5, matching normal vaginal acidity to reduce irritation.

Product Premiumization and Innovation in Texture, Longevity, and Sensory Appeal

Innovation in formulation science presents major opportunities for market differentiation as brands compete to offer enhanced sensory experiences. Advanced silicone-based and hybrid lubricants with extended glide time, improved viscosity control, and multi-purpose compatibility are gaining traction. Manufacturers are also experimenting with temperature-response gels, warming/cooling sensations, flavored formulations, and specialized products for sensitive skin or specific sexual activities. The rise of couples-focused intimacy kits, multi-variant bundles, and premium packaging elevates the perceived value of lubricants. Additionally, innovation in long-lasting micro-emulsion technologies and pH-adaptive formulations is creating new performance benchmarks. The shift toward premium, experience-driven offerings allows brands to target high-income consumers and expand penetration into lifestyle-oriented sexual wellness markets.

· For instance, Sliquid Naturals Swirl flavored lubricants maintain a verified pH of 4.0–4.4, ensuring texture stability and sensory appeal while remaining aligned with normal vaginal acidity.

Growing Market Penetration in Emerging Economies

Developing regions such as Asia-Pacific, Latin America, and parts of Africa are experiencing rising adoption of sexual lubricants, driven by improving access to healthcare, increasing urbanization, and exposure to global sexual wellness trends. Younger populations in these regions are more open to exploring intimate products, supported by expanding retail networks and online marketplaces. Governments and NGOs promoting sexual health education also indirectly support product demand. As cultural taboos gradually soften and purchasing power increases, manufacturers see significant growth potential in affordable, mass-market products. Localization strategies such as regional formulation preferences, culturally aligned branding, and multilingual packaging further enhance success in emerging markets.

Key Challenges

Persistent Cultural Stigma and Limited Awareness in Conservative Regions

Despite global progress in sexual wellness acceptance, cultural stigma remains a major barrier in several countries where discussions about intimacy are still socially restricted. Consumers in these regions may avoid purchasing lubricants due to embarrassment, fear of judgment, or misconceptions about product purpose. Limited sex education in schools and societal norms discouraging open communication about sexual health further restrict awareness. Even when retailers stock products, they may be placed in less visible or discreet sections, reducing consumer exposure. These cultural constraints hinder category penetration and limit opportunities for innovation and brand expansion. Overcoming stigma requires long-term efforts through awareness campaigns, discreet retail solutions, and normalized messaging that reframes lubricants as part of everyday wellness rather than taboo products.

Ingredient Sensitivity Issues and Increasing Regulatory Scrutiny

Growing consumer sensitivity toward chemical ingredients poses a challenge, as certain additives such as parabens, glycerin, petroleum derivatives, or artificial preservatives may cause irritation for some users. Negative reactions can reduce consumer trust and prompt shifts toward competing natural formulations. At the same time, regulatory bodies in key markets are tightening requirements for labeling, safety testing, and manufacturing standards for intimate-area products. Meeting stricter compliance expectations increases production complexity and costs for manufacturers, especially those operating across multiple regions with varying regulations. Companies must invest in R&D, dermatological testing, and transparent documentation to avoid product rejections. Maintaining consistent quality while adapting to evolving regulatory landscapes remains a significant challenge for global brands.

Regional Analysis

North America

The North American market dominates global sales of sexual lubricants, accounting for approximately 40 % of the total. High disposable income levels, broad consumer awareness of sexual wellness, and mature e-commerce and retail infrastructures support this leadership. Manufacturers focus on product innovation including premium formulations, clean-label ingredients, and direct-to-consumer channels to cater to demanding U.S. and Canadian consumers. Online purchase convenience, strong regulatory frameworks, and well-developed marketing also drive adoption. As lifestyles evolve and intimate wellness becomes increasingly mainstream, North America maintains its stronghold, though growth gradually slows as market maturation sets in.

Europe

Europe represents roughly 30 % of the global sexual lubricant market, backed by progressive social attitudes, high penetration of retail channels, and sophisticated consumer preferences. Countries such as the UK, Germany and France lead product uptake, with major brand presence and advanced distribution networks. European consumers increasingly demand premium and natural formulations, and regulatory oversight ensures high safety standards. Online retail continues to expand alongside established drug-stores and supermarkets. The combination of rising sexual wellness awareness, shifting demographics (including ageing populations facing dryness/comfort issues), and strong brand equity positions Europe as a key region for strategic product launches and portfolio diversification.

Asia-Pacific

The Asia-Pacific region holds an estimated 20 % share of the global sexual lubricant market and is among the fastest-growing regions. Rising disposable incomes, rapid urbanisation, wider internet and mobile adoption, and evolving cultural openness toward sexual wellness all fuel growth. Markets such as Japan, Australia, India, China and Southeast Asia are witnessing growing demand especially via e-commerce platforms that offer privacy and product variety. Domestic and international brands tailor formulations and marketing to regional sensitivities (e.g., warm/cool lubricants, local flavours). While penetration remains lower than in the West, the region’s high growth potential and large population base make it a strategic target for expansion.

Latin America

Latin America contributes around 5 % of the global sexual lubricant market share. Growth is supported by increasing public awareness campaigns around sexual health, improving retail infrastructure and rising middle-class affluence in countries such as Brazil, Mexico and Argentina. However, societal taboos, limited shelf visibility in certain markets, and variable regulatory landscapes moderate adoption rates. E-commerce uptake is accelerating, particularly among younger consumers seeking discreet purchase options. As brands localise product portfolios and marketing to culturally aligned narratives and regional consumer needs, Latin America’s share is expected to slowly increase, offering opportunistic potential for targeted mid-price and value brands.

Middle East & Africa

The Middle East & Africa region also accounts for about 5 % of the global sexual lubricant market. Market growth hinges on gradually shifting cultural attitudes, increasing urban-consumer openness and expanding online retail channels that provide privacy. Key countries such as the UAE, South Africa and Saudi Arabia are early adopters, supported by rising healthcare awareness and premium-segment interest. Nonetheless, regulatory complexities, social conservatism and inconsistent retail availability pose challenges to widespread penetration. Brands that address local language marketing, discreet packaging and education-driven outreach will unlock greater growth. The region remains relatively under-penetrated, creating opportunity for growth over the medium-term as barriers relax.

Market Segmentations:

By Product Type

- Water-based

- Silicone-based

- Oil-based

- Hybrid

By End Use

By Distribution Channel

- Online stores

- Drug stores

- Hypermarkets and supermarkets

- Specialty stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the sexual lubricant market is characterized by a mix of established personal-care brands, pharmaceutical companies, and emerging specialty wellness manufacturers competing through innovation, formulation diversity, and strong distribution capabilities. Leading players focus heavily on expanding product portfolios that include water-based, silicone-based, organic, and hybrid lubricants to address varied consumer needs such as sensitivity, longevity, and pH balance. Companies invest in dermatologically tested, clean-label, and hypoallergenic formulations to strengthen trust and appeal to health-conscious users. E-commerce has intensified competition, enabling direct-to-consumer brands to gain market visibility through subscription models, influencer collaborations, and discreet delivery services. Retail placement in drug stores, supermarkets, and specialty wellness outlets remains critical for mainstream brands. Many competitors pursue partnerships with healthcare providers and sexual-wellness clinics to build legitimacy, while others differentiate through premium packaging, sensory variants, and niche targeting. As consumer openness toward sexual wellness grows, competitive activity continues to accelerate across price tiers and geographies.

Key Player Analysis

Recent Developments

- In January 2025, Peptonic Medical AB launched VagiVital Active Glide, a fragrance-free water-based sexual lubricant that sold nearly 1,000 units shortly after release. The company plans U.S. market entry following regulatory clearance

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product type, End use, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for sexual lubricants will continue to rise as sexual-wellness awareness strengthens across all age groups and becomes further normalized.

- Clean-label, natural, and hypoallergenic formulations will gain momentum as consumers prioritize ingredient safety and skin compatibility.

- E-commerce and direct-to-consumer channels will expand their share, driven by discreet delivery and broader product visibility.

- Premium and sensory-enhancing lubricants will grow as consumers seek enhanced experiences and differentiated textures.

- Clinically endorsed and pH-balanced formulations will see increasing adoption for therapeutic and women’s health applications.

- Brands will invest more in personalization, offering tailored products for sensitivity levels, usage occasions, and ingredient preferences.

- Hybrid formulations combining benefits of water-based and silicone-based technologies will gain stronger traction.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will accelerate growth through rising openness and digital retail access.

- Strategic collaborations between wellness brands, healthcare providers, and personal-care companies will increase product credibility.

- Sustainability-driven packaging and ethical manufacturing practices will become a key competitive differentiator.

Market Segmentation Analysis:

Market Segmentation Analysis: