Market Overview

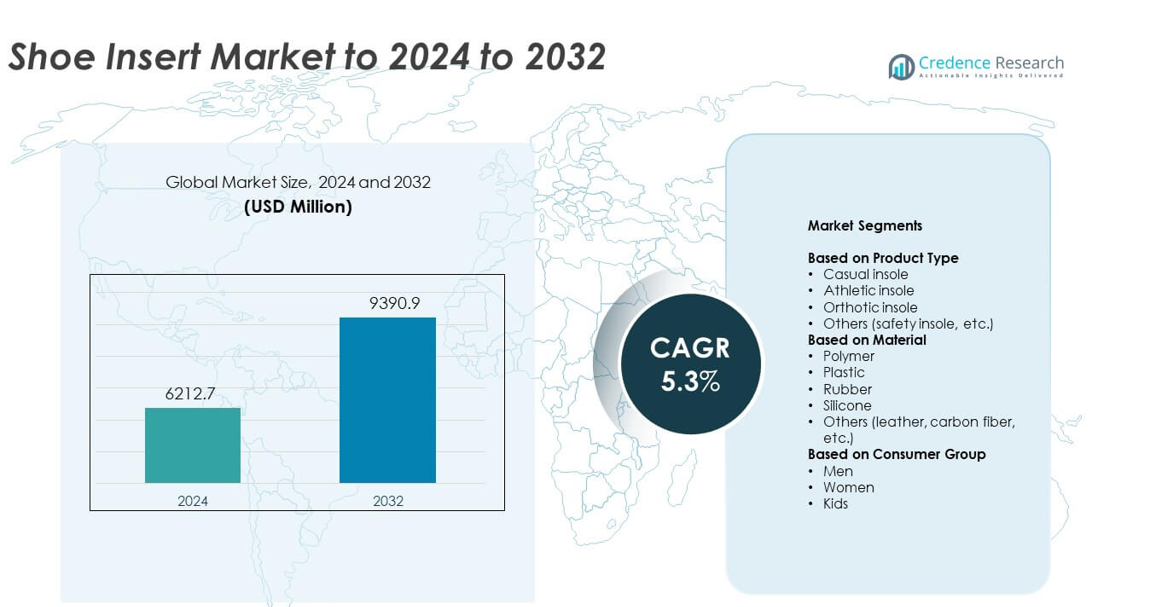

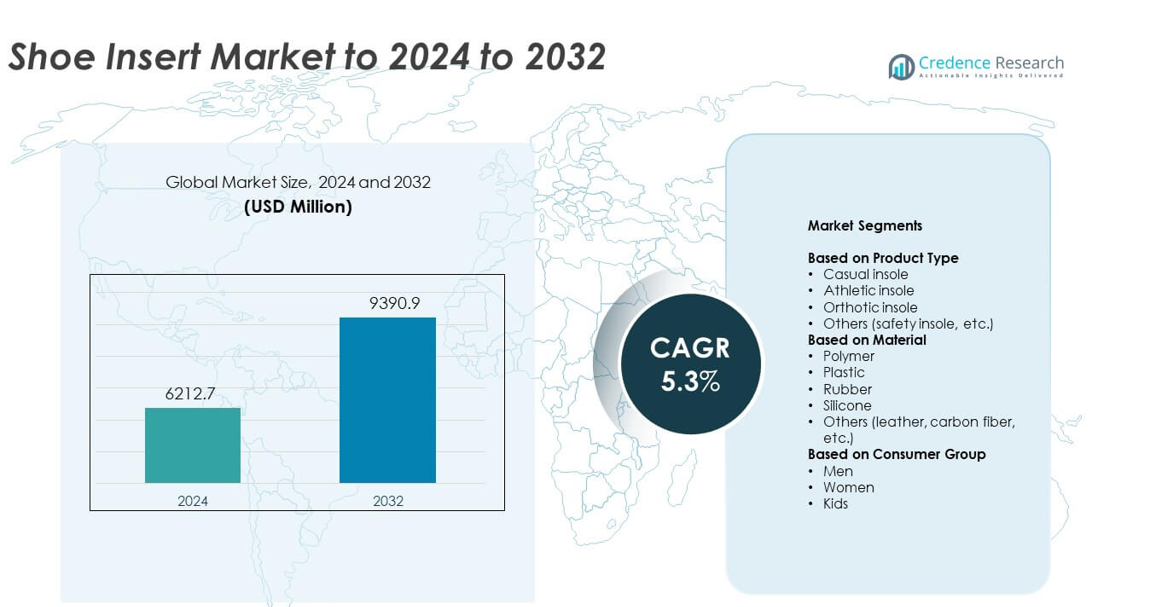

Shoe Insert Market size was valued at USD 6212.7 Million in 2024 and is anticipated to reach USD 9390.9 Million by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shoe Insert Market Size 2024 |

USD 6212.7 Million |

| Shoe Insert Market, CAGR |

5.3% |

| Shoe Insert Market Size 2032 |

USD 9390.9 Million |

The Shoe Insert Market is shaped by leading players such as ENERTOR, Puma, FootBalance System, Nike, Sidas, Bauerfeind, PROFOOT, PowerStep, Foot Science, and CURREX, each offering advanced comfort, performance, and orthotic solutions across global sales channels. These companies compete through material innovation, ergonomic design, and growing online distribution. North America led the market in 2024 with about 37% share, driven by strong sports usage and high awareness of foot health. Europe followed with nearly 28% share, supported by medical adoption and lifestyle demand, while Asia Pacific held roughly 23% and recorded the fastest growth.

Market Insights

- The Shoe Insert Market reached USD 6212.7 Million in 2024 and is projected to hit USD 9390.9 Million by 2032 with a CAGR of 5.3%.

- Strong demand rises from increasing foot health awareness, growing sports activity, and higher use of comfort-focused footwear across daily and work settings.

- Custom-fit solutions, sustainable materials, and digital fitting tools shape major trends as consumers seek more tailored and performance-oriented inserts.

- Competition remains intense as global brands invest in advanced cushioning, ergonomic design, and online expansion while facing pressure from low-cost alternatives.

- North America led with 37% share in 2024, followed by Europe with 28% and Asia Pacific with 23%, while casual insoles held the top segment position with 38% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Casual insoles held the dominant position in 2024 with about 38% share. Strong demand came from daily footwear users who seek comfort, pressure relief, and fatigue reduction during long walking hours. Brands expanded cushioning designs and breathable layers to support wider lifestyle use across work, travel, and leisure. Athletic insoles grew as sports participation increased, while orthotic insoles advanced due to rising foot pain cases. Safety insoles stayed smaller but gained traction in industrial settings that require impact protection and stable support.

- For instance, Superfeet’s Trailblazer Comfort insoles in a men’s size 10 (size E) weigh about 100 grams per pair. They are built for hiking and everyday walking on mixed terrain.

By Material

Polymer-based insoles led this segment in 2024 with nearly 41% share. Polymer materials offer strong durability, light weight, and steady shock absorption, which suits both casual and athletic footwear. Expanded use in memory foam and EVA blends supported higher adoption in mid-range and premium shoe lines. Rubber and silicone options grew due to strong grip and flexibility, while plastic-based units stayed common in low-cost models. Leather, carbon fiber, and other specialty materials captured a smaller base linked to niche comfort and performance needs.

- For instance, the PowerStep Pinnacle Original Full Length Orthotic Insoles have a forefoot thickness of approximately 6 mm and a heel thickness of approximately 10 mm, with an arch height of approximately 31 mm, according to multiple product specifications from online retailers.

By Consumer Group

Men accounted for the largest share in 2024 with around 46%. Demand rose due to higher use of work shoes, sports footwear, and protective boots where added cushioning and arch support improve comfort and long-hour stability. Women’s insoles grew with increasing interest in posture correction and pressure-relief designs suited to varied footwear styles. Kids remained a smaller group but gained momentum as parents focused on foot alignment and growth support. Improved materials and wider retail access strengthened uptake across all consumer categories.

Key Growth Drivers

Rising Foot Health Awareness

Growing concern about foot pain, plantar fasciitis, and posture issues increased demand for supportive shoe inserts. Consumers now seek products that reduce pressure, improve alignment, and enhance daily comfort. Clinics and sports therapists also recommend insoles more often, which boosts adoption across casual, athletic, and work footwear. Wider retail availability and digital customization tools further expand reach, making foot-care solutions accessible to a larger population.

- For instance, Dr. Scholl’s Custom Fit Orthotic Center uses around 2,200 pressure sensors to map each foot during a standing scan.

Expansion of Sports and Fitness Activities

Higher participation in running, gym training, and field sports drives need for shock-absorbing and performance-enhancing insoles. Athletes rely on inserts to reduce injury risk, stabilize the foot, and improve energy transfer during movement. Brands respond with advanced foam layers, impact zones, and heat-moldable materials. Growing interest in preventive care also supports steady demand among amateur and professional users who value long-term joint protection.

- For instance, Nike’s ZoomX Invincible Run 2 running shoe uses a ZoomX midsole with a brand-stated stack height of about 36.6 millimeters at the heel and 27.6 millimeters at the forefoot.

Growth in Workplace Safety and Comfort Demand

Industrial and service workers need added cushioning to handle long standing hours and high-impact environments. Companies now include supportive insoles in safety programs to reduce fatigue and lower injury claims. Rising use of protective boots and slip-resistant footwear also pushes adoption of inserts designed for stability and heel support. This trend strengthens uptake across manufacturing, logistics, healthcare, and retail sectors.

Key Trends and Opportunities

Rise of Custom and Semi-Custom Insoles

Consumers increasingly look for tailored comfort that matches arch height, gait pattern, and weight distribution. Digital scanning, mobile foot-mapping tools, and 3D-printed designs enable more precise fit and performance. Semi-custom inserts gain traction in retail stores due to lower cost and faster delivery. This shift opens new opportunities for brands to expand premium offerings and build stronger customer loyalty.

- For instance, FootBalance’s MyFootBalance 3D foot scanner unit measures roughly 72 by 96 by 144 centimeters and weighs about 70 kilograms.

Sustainable and Advanced Material Adoption

The market sees rising interest in eco-friendly foams, recycled plastics, and bio-based cushioning layers. These materials appeal to buyers who want comfort without added environmental impact. At the same time, brands explore graphene blends, gel compounds, and aerated foams that improve shock absorption and durability. This trend supports premium growth and helps companies stand out in competitive segments.

- For instance, Allbirds’ Tree Runner shoe uses a SweetFoam midsole and castor-bean–oil insole foam, and the model’s cradle-to-gate carbon footprint is listed as 4.99 kilograms of CO₂ equivalent per pair.

Growing Penetration in Online Channels

E-commerce platforms help consumers compare support levels, materials, and comfort features with ease. Online sales rise due to wider product availability, trial-friendly policies, and strong digital marketing. Brands leverage virtual fitting tools and subscription models to improve repeat purchases. This shift offers a key opportunity to reach global buyers without heavy retail investments.

Key Challenges

Limited Product Differentiation

Many brands offer similar cushioning, arch support, and material options, which reduces clear separation across categories. This overlap makes it harder for companies to command premium pricing or secure strong loyalty. Consumers often switch brands based on discounts rather than performance. Firms must invest in innovation, clinical testing, and clear value communication to overcome this challenge.

Counterfeit and Low-Quality Products

Online marketplaces face rising inflow of imitation insoles that use poor materials and deliver low durability. These products harm consumer trust and create pricing pressure for legitimate brands. Low-quality inserts may also cause discomfort or injury, reducing confidence in the overall category. Stronger quality checks, certifications, and brand-controlled distribution are essential to address this issue.

Regional Analysis

North America

North America held the leading position in 2024 with about 37% share. Strong adoption came from rising foot health awareness, higher sports participation, and widespread use of comfort-focused footwear. The region benefits from strong retail penetration, advanced product designs, and early uptake of custom-fit insoles. Demand remained high across both athletic and workwear categories due to growing preventive care habits. The United States drove most purchases, while Canada showed steady growth supported by expanding e-commerce sales and wellness spending.

Europe

Europe accounted for nearly 28% share in 2024. The region showed strong preference for orthotic and medically recommended inserts due to high attention toward posture correction and chronic foot issues. Demand rose across Germany, the United Kingdom, and France as consumers focused on comfort during daily commuting and work routines. Sports culture also supported athletic insole sales. Retailers expanded offerings in drugstores and specialty shops, strengthening overall access. Growing interest in sustainable materials further supported market traction.

Asia Pacific

Asia Pacific captured about 23% share in 2024 and recorded the fastest growth. Rising urbanization, long working hours, and increasing sports activity boosted demand for supportive insoles across major markets. China, India, Japan, and South Korea saw growing adoption of both casual and orthotic inserts. Expanding middle-class income and wider online availability helped shift consumers toward premium comfort products. Local brands also scaled production of affordable models, improving reach in value-driven segments.

Latin America

Latin America held roughly 7% share in 2024. Demand improved as more consumers sought low-cost comfort solutions for daily footwear and long work shifts. Brazil and Mexico led adoption due to growing sports interest and higher purchases of protective footwear. Awareness campaigns by clinics and pharmacies helped promote orthotic inserts, though adoption remained slower than in developed regions. E-commerce growth increased exposure to global brands and expanded product choices across urban areas.

Middle East and Africa

Middle East and Africa represented about 5% share in 2024. Growth came from rising use of safety footwear in construction, oil and gas, and industrial sectors. Comfort-driven inserts gained traction among workers who spend long hours on hard surfaces. Countries such as the UAE, Saudi Arabia, and South Africa showed higher uptake due to expanding retail networks and improved access to imported brands. Limited awareness in rural areas kept overall penetration lower, but urban markets continued to advance steadily.

Market Segmentations:

By Product Type

- Casual insole

- Athletic insole

- Orthotic insole

- Others (safety insole, etc.)

By Material

- Polymer

- Plastic

- Rubber

- Silicone

- Others (leather, carbon fiber, etc.)

By Consumer Group

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Shoe Insert Market features key players such as ENERTOR, Puma, FootBalance System, Nike, Sidas, Bauerfeind, PROFOOT, PowerStep, Foot Science, and CURREX operating in a highly competitive environment shaped by performance innovation and material advancement. Companies focus on enhanced cushioning, tailored arch profiles, and advanced shock absorption to meet rising comfort and wellness needs. Product lines expand across casual, athletic, and orthotic categories to reach broader consumer groups. Firms invest in research, digital fitting tools, and ergonomic testing to strengthen product differentiation. Sustainability also guides development as brands explore eco-friendly foams and recycled materials. Strong retail placement and digital visibility help maintain customer reach, while growing online channels create space for both global and emerging brands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ENERTOR

- Puma

- FootBalance System

- Nike

- Sidas

- Bauerfeind

- PROFOOT

- PowerStep

- Foot Science

- CURREX

Recent Developments

- In 2025, Nike unveiled the Mind 001 and Mind 002 “mind-body” shoes, which are scheduled for general release in January 2026.

- In 2024, Bauerfeind continued promoting Run Performance insoles for runners, highlighting targeted cushioning and arch support.

- In 2024, CURREX became official insole partner of Major League Pickleball, promoting pickleball-specific inserts

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, Consumer Group and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as foot health awareness increases across all age groups.

- Custom and semi-custom inserts will gain wider adoption through digital scanning tools.

- Sports and fitness expansion will drive steady demand for performance-focused insoles.

- Workplace safety programs will push companies to adopt supportive inserts for employees.

- Sustainable and advanced materials will shape new product development.

- Online channels will expand faster as brands improve virtual fitting and support tools.

- Medical recommendations for orthotic inserts will rise with growing foot-related issues.

- Premium comfort products will gain traction in both casual and athletic footwear.

- Local manufacturers will scale affordable options to meet value-driven demand.

- Product innovation will focus on durability, breathability, and shock absorption enhancements.