Market Overview

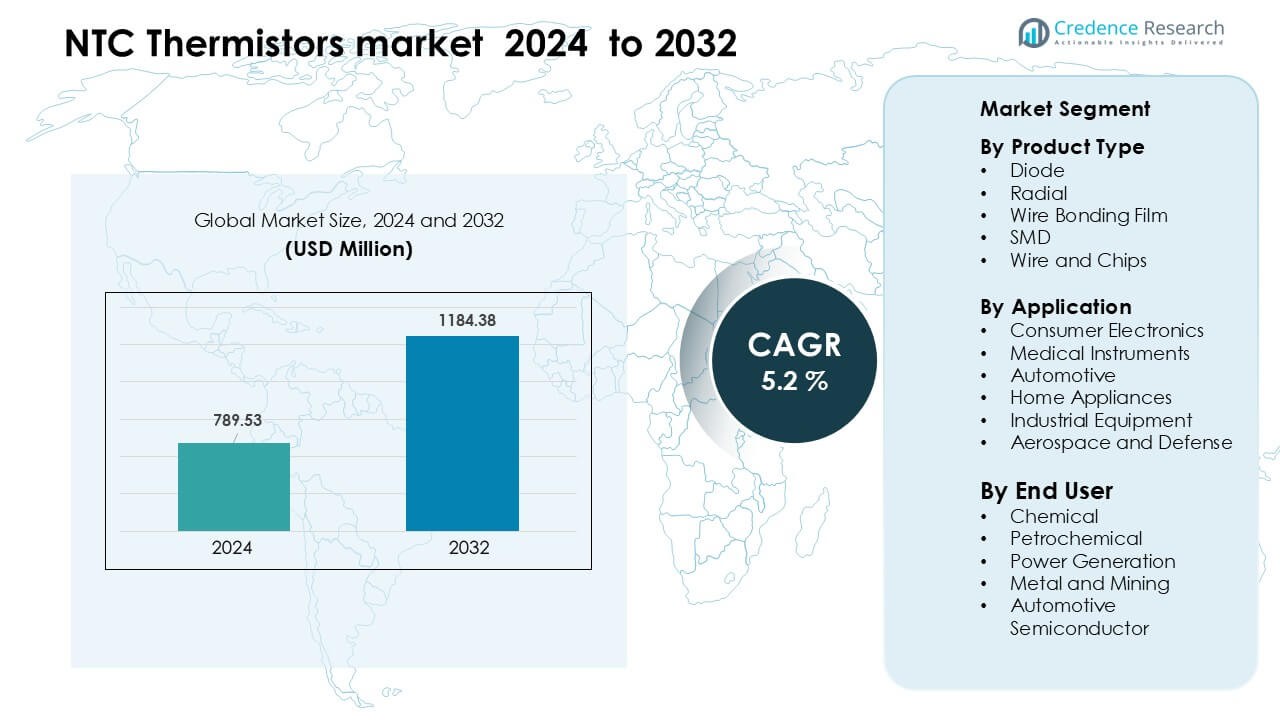

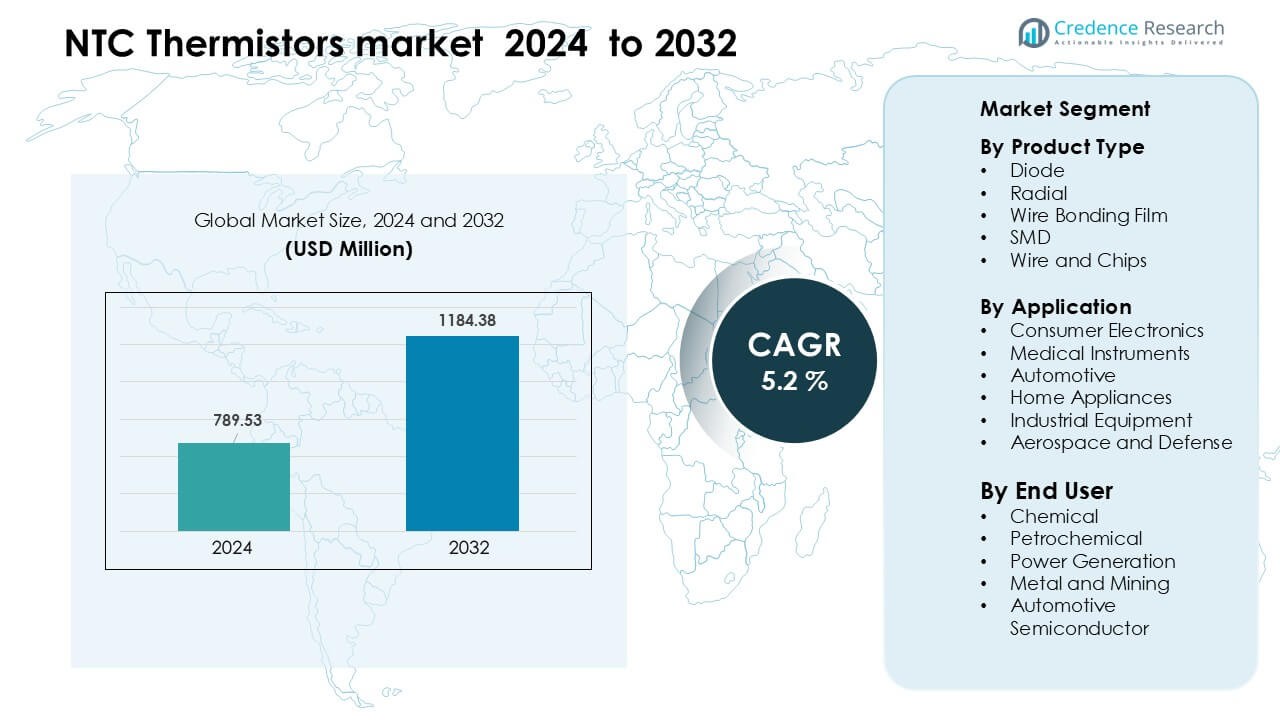

NTC Thermistors market was valued at USD 789.53 million in 2024 and is anticipated to reach USD 1184.38 million by 2032, growing at a CAGR of 5.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| NTC Thermistors Market Size 2024 |

USD 789.53 Million |

| NTC Thermistors Market, CAGR |

5.2 % |

| NTC Thermistors Market Size 2032 |

USD 1184.38 Million |

The NTC thermistors market includes major players such as STMicroelectronics, Emerson Electrical Company, Kongsberg, Panasonic Corporation, Honeywell International Inc., General Electric Company, Analog Devices Inc., ABB, Texas Instruments Incorporated, and other companies. These manufacturers focus on precise thermal sensing, compact SMD formats, and stable performance for consumer electronics, EV systems, medical tools, and industrial controls. Strong investment in automotive-grade thermistors and advanced production lines supports wider global adoption. Asia Pacific remained the leading region in 2024 with 38% share. The region held this position due to its strong electronics manufacturing base, high EV output, and large-scale semiconductor production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The NTC thermistors market was valued at USD 789.53 million in 2024 and is projected to reach USD 1184.38 million by 2032, growing at a CAGR of 5.2%.

- Growth is driven by rising demand from consumer electronics, EV battery systems, medical devices, and industrial automation, with SMD formats holding the largest segment share at 46% in 2024.

- Miniaturization, high-precision sensing, and strong adoption in smart appliances and IoT devices shape market trends, supported by expanding battery safety requirements and power-electronics investment.

- Competition intensifies as leading players improve thermal accuracy, expand automotive-grade portfolios, and enhance manufacturing efficiency while facing pressure from alternative sensors such as RTDs and digital ICs.

- Asia Pacific led the market in 2024 with 38% share due to strong electronics production, while North America and Europe followed, supported by EV programs and advanced medical and industrial equipment demand.

Market Segmentation Analysis:

By Product Type

SMD held the dominant share in 2024 with about 46% of the NTC thermistors market. Makers favored SMD designs because they support compact boards, fast surface-mount production, and stable thermal response for high-volume electronics. Radial and diode types gained steady use in power supplies and HVAC systems where higher dissipation is needed. Wire and chip formats supported custom assemblies in harsh sites, while wire-bonding films served thin medical and industrial devices. Demand rose as consumer brands pushed miniaturized circuits and tighter heat-control ranges.

- For instance, Vishay’s NTCS0805E3472JMT is a surface‑mount NTC thermistor in the 0805 package (2 × 1.25 × 0.8 mm) with a resistance of 4.7 kΩ at 25 °C, and a thermal time constant of 10 seconds, making it well suited to tightly packed consumer electronics.

By Application

Consumer electronics led the application segment in 2024 with nearly 41% share. Smartphone, wearables, and battery-management systems required precise thermal sensing, which pushed strong adoption from global device makers. Automotive and medical instruments expanded due to rising EV battery packs and regulated diagnostic tools. Home appliances and industrial equipment used NTC thermistors for overload protection and stable temperature loops. Aerospace and defense remained a niche but reliable user group that valued rugged sensing under wide temperature swings.

- For instance, Murata’s NCU15 series SMD NTC thermistors (used in mobile‑device battery sensing) offer a resistance of 10 kΩ at 25 °C and a B‑constant of about 3,380 K, enabling stable temperature compensation inside compact battery packs.

By End User

Automotive semiconductor users dominated the end-user segment in 2024 with about 38% share. EV traction systems, onboard chargers, ADAS modules, and power electronics relied on NTC thermistors for real-time thermal checks. Power generation and petrochemical plants adopted robust assemblies for motor windings, pipelines, and heat-exchange monitoring. Chemical and metal-mining operations used the sensors for process stability in corrosive and high-load settings. Growth increased as automakers scaled electrification and required high-accuracy thermal components across wider operating ranges.

Key Growth Drivers

Rising Demand from Consumer Electronics

Growing use of compact digital devices continues to boost NTC thermistor adoption. Global demand for smartphones, wearables, laptops, and smart home devices has increased the need for accurate and fast thermal sensing. Consumer brands integrate NTC thermistors into battery packs, charging units, display modules, and power-control circuits to maintain safe heat levels and improve device longevity. Miniaturized SMD thermistors support advanced designs that require tight thermal tolerance. Rising shipments of IoT devices further expand usage because each connected product requires reliable thermal monitoring. This broad consumer ecosystem keeps overall demand stable and helps manufacturers scale high-volume production for global electronics brands.

- For instance, Murata’s NCU15 series thermistors are explicitly designed for temperature sensing in rechargeable batteries, supporting stable temperature compensation inside lithium‑ion cells.

Expansion of Electric Vehicles and Automotive Electronics

Automotive OEMs rely on NTC thermistors to manage temperature across EV batteries, onboard chargers, traction inverters, ADAS electronics, cabin systems, and lighting units. Battery safety standards require real-time thermal checks, making NTC thermistors a preferred choice due to strong accuracy and fast response. Automakers also use these components in engine sensors, exhaust systems, and HVAC controls for thermal balance in hybrid and ICE vehicles. Growing EV production across Asia, Europe, and North America increases the need for robust, vibration-resistant sensors with wide temperature ranges. Government-led EV programs and stricter emission norms push automotive suppliers to expand high-temperature NTC designs.

- For instance, Vishay’s NTCAIMM66H immersion thermistor used in liquid‑cooled EV onboard chargers offers a resistance of 10 kΩ at 25 °C, a B‑constant of 3,984 K, and delivers a very fast response time of 1.5 seconds, making it highly effective for rapid temperature feedback in tight, fluid-cooled systems.

Increasing Use in Medical and Industrial Equipment

Medical device makers adopt NTC thermistors in patient monitoring systems, diagnostic tools, infusion pumps, and imaging platforms because the sensors deliver stable readings over narrow temperature bands. Hospitals depend on them for reliable thermal accuracy in critical devices. Industrial plants integrate NTC thermistors into automation machinery, drives, HVAC systems, and power electronics to protect circuits from overheating. The shift toward smart factories and predictive maintenance supports greater installation in motors, control boards, and energy systems. Strong demand from laboratory equipment, semiconductor lines, and industrial heating systems strengthens long-term growth in the medical and industrial sectors.

Key Trend & Opportunity

Miniaturization and High-Precision Sensing

Manufacturers are developing ultra-small SMD NTC thermistors that suit next-generation wearables, AR/VR devices, advanced medical tools, and high-density automotive electronics. Miniaturization enables compact designs without losing thermal accuracy, making it attractive for device designers facing space constraints. Thin-film and chip-level NTC thermistors offer fast response times for real-time monitoring in EVs and portable medical devices. This trend opens new opportunities in flexible electronics, smart patches, and implantable devices where lightweight and low-profile sensing components are essential. The push for smaller yet more reliable sensors will continue shaping competitive strategies among suppliers.

- For instance, Murata’s NCP03XH103F05RL is a 10 kΩ, 0201-size (0.6 × 0.3 mm) SMD NTC thermistor with a B‑constant of 3,380 K, enabling highly compact designs without sacrificing thermal sensitivity.

Growth of Smart Home, IoT, and Connected Appliances

Smart home ecosystems rely on accurate temperature control for energy efficiency, safety, and device automation. NTC thermistors support thermal management in smart thermostats, air purifiers, connected refrigerators, and heating systems. As IoT penetration expands in developing and developed markets, each connected appliance requires stable thermal sensing. Manufacturers benefit from strong replacement demand from smart HVAC upgrades and rising adoption of remote-controlled appliances. Opportunities also rise in building automation systems, where NTC thermistors help reduce energy waste and maintain environmental stability. This trend positions NTC sensors as essential components in the broader connected-home landscape.

- For instance, TDK’s B57862L (L862) NTC thermistors commonly used in HVAC and smart‑home temperature sensors offer resistance from 1 kΩ to 100 kΩ, operate over –40 °C to +155 °C, and are built to tolerate mechanical stress in connected devices.

Strong Demand from Battery Safety and Power Electronics

The global shift toward high-density lithium-ion and solid-state batteries increases the need for precise thermal sensors. Power electronics used in EVs, solar inverters, UPS units, and data center systems depend on thermal protection to prevent overheating. NTC thermistors offer the stability and cost efficiency required for large-scale deployment. As renewable energy storage, energy-efficient drives, and UPS installations rise, manufacturers gain opportunities to supply rugged, high-temperature NTC variants. The trend accelerates as companies expand backup power systems and renewable infrastructure worldwide.

Key Challenge

Performance Limitations in Extreme Environments

NTC thermistors show sensitivity loss or slower response when exposed to very high temperatures, corrosive chemicals, or long-term mechanical stress. Industrial, aerospace, and heavy-duty automotive applications often need components that maintain accuracy under intense heat or vibration. In such cases, companies may select platinum RTDs or digital sensors that offer more stable long-term drift performance. This limits NTC usage in some high-reliability systems. Manufacturers must develop enhanced materials and protective coatings to overcome these constraints and compete with alternative sensing technologies across demanding environments.

Strong Competition from Alternative Temperature Sensors

The market faces increased competition from RTDs, thermocouples, and digital temperature ICs, which offer higher precision, better stability, or lower drift depending on the application. Automotive and industrial users often switch to alternative sensors for extreme temperature zones, long-term reliability, or advanced diagnostics. Digital sensors also integrate easily with microcontrollers, which makes them attractive for IoT and smart devices. This forces NTC suppliers to innovate and improve tolerance, accuracy, and durability. The challenge intensifies as customers demand multi-function, self-calibrating, and integrated sensing solutions at competitive prices.

Regional Analysis

North America

North America held about 32% share in the NTC thermistors market in 2024. Broad demand came from advanced consumer electronics, EV platforms, medical devices, and HVAC systems supported by strong R&D activity in the United States. Automotive suppliers increased adoption for ADAS modules, battery packs, and cabin sensors, while hospitals expanded use in diagnostic and monitoring tools. Data centers and industrial automation also relied on NTC thermistors for thermal protection in power electronics. Ongoing EV incentives and rising smart appliance installations kept regional growth stable across major industries.

Europe

Europe accounted for nearly 27% share in 2024, driven by strong automotive production, strict safety norms, and growing EV penetration across Germany, France, and the UK. Medical equipment manufacturers used NTC thermistors for regulated sensing accuracy, while industrial plants adopted them for process control and energy systems. Consumer electronics and home appliance brands sustained steady demand, especially for compact SMD components. The region’s push for carbon-neutral transport and broader electrification continued to support NTC thermistor use in battery systems, renewable energy equipment, and smart building technologies.

Asia Pacific

Asia Pacific dominated the NTC thermistors market with about 38% share in 2024. Countries such as China, Japan, South Korea, and Taiwan served as major production hubs for smartphones, wearables, EV batteries, and semiconductor devices, creating strong demand for high-volume thermistor manufacturing. Local automotive and consumer electronics giants integrated NTC sensors across power modules, chargers, and heat-control circuits. Expanding EV output, growing medical equipment production, and rising smart appliance adoption continued to strengthen regional consumption. Strong supply chains and large-scale electronics exports kept Asia Pacific the global leader.

Latin America

Latin America held roughly 2% share in 2024, with demand concentrated in automotive parts, industrial machinery, and household appliances. Brazil and Mexico led adoption due to expanding electronics assembly units and rising automotive semiconductor needs. Industrial plants used NTC thermistors for motors, HVAC systems, and process heaters that require thermal stability. Growth increased as appliance makers incorporated more temperature-control components into refrigerators, air conditioners, and heaters. Gradual EV rollout and industrial automation upgrades supported steady but moderate market expansion across the region.

Middle East & Africa

The Middle East & Africa captured around 1% share in 2024, driven by rising installations in power generation systems, industrial automation, and HVAC equipment. Gulf countries adopted NTC thermistors for large-scale cooling systems and energy projects that depend on stable thermal monitoring. South Africa contributed through automotive components and medical device usage. Growing investments in smart buildings, renewable energy infrastructure, and healthcare modernization supported wider adoption. Although the market remained small compared to other regions, ongoing technology upgrades and import-driven electronics demand helped maintain positive growth momentum.

Market Segmentations:

By Product Type

- Diode

- Radial

- Wire Bonding Film

- SMD

- Wire and Chips

By Application

- Consumer Electronics

- Medical Instruments

- Automotive

- Home Appliances

- Industrial Equipment

- Aerospace and Defense

By End User

- Chemical

- Petrochemical

- Power Generation

- Metal and Mining

- Automotive Semiconductor

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the NTC thermistors market features players such as STMicroelectronics, Emerson Electrical Company, Kongsberg, Panasonic Corporation, Honeywell International Inc., General Electric Company, Analog Devices Inc., ABB, Texas Instruments Incorporated, and other manufacturers. These companies compete through advances in sensing accuracy, miniaturized SMD formats, and wider temperature-range stability for high-density electronics. Leading suppliers focus on expanding automotive-grade components for EV batteries, onboard chargers, and ADAS electronics, while also strengthening portfolios for medical devices, industrial controls, and smart appliances. Many firms invest in material enhancements, thin-film technologies, and automated production to improve long-term drift performance and reduce failure rates. Partnerships with automotive OEMs, consumer electronics brands, and industrial system integrators remain central to sustaining global demand and ensuring supply chain resilience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- STMicroelectronics

- Emerson Electrical Company

- Kongsberg

- Panasonic Corporation

- Honeywell International Inc.

- General Electric Company

- Analog Devices Inc.

- ABB

- Texas Instruments Incorporated

Recent Developments

- In June 2025, Kongsberg Maritime Kongsberg Maritime launched a Continuous Emissions Monitoring System (CEMS) and highlights a product portfolio of marine temperature sensors that explicitly includes thermistor elements (NTC) for engine/machinery instrumentation a direct product-line confirmation that Kongsberg supplies NTC thermistor elements for maritime and industrial applications.

- In December 2024, Kongsberg (Kongsberg Automotive) Kongsberg Automotive announced a significant contract win for thermal-management/coolant system assemblies for EVs (thermal management systems contract announced Dec 13, 2024), increasing its footprint in electrified-vehicle thermal solutions — a market context that raises demand for precision temperature sensing (including NTC elements) inside coolant and battery thermal assemblies.

- In June 2024, ABB launched an enhanced SIL2-certified NINVA™ TSP341-N non-invasive temperature sensor for process industries, improving safety and accuracy in temperature measurement and reinforcing ABB’s position in the broader thermistor and temperature-sensor market, where its relays work with NTC probes for motor and transformer protection.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as consumer electronics brands expand smart devices and wearables.

- EV growth will boost adoption in battery packs, onboard chargers, and power modules.

- Medical device makers will increase use in monitoring systems and diagnostic equipment.

- Industrial automation will push higher demand for thermal protection in motors and drives.

- Miniaturized SMD thermistors will gain strong traction across compact circuit designs.

- Advanced thin-film materials will improve accuracy and long-term stability.

- Smart home and IoT ecosystems will require more precise temperature-control components.

- Renewable energy systems and power electronics will drive wider thermal-sensing needs.

- Strong competition will push suppliers to enhance durability and extreme-temperature performance.

- Asia Pacific will continue leading global production due to strong electronics and EV supply chains.