Market Overview

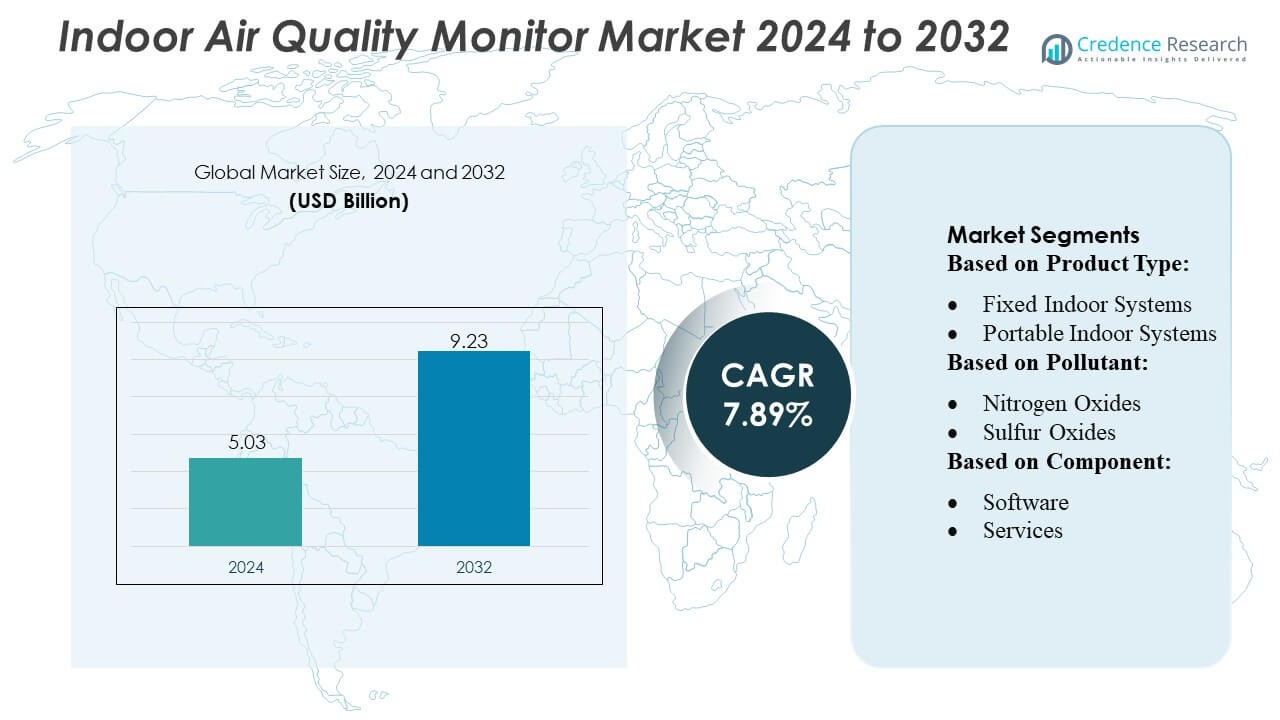

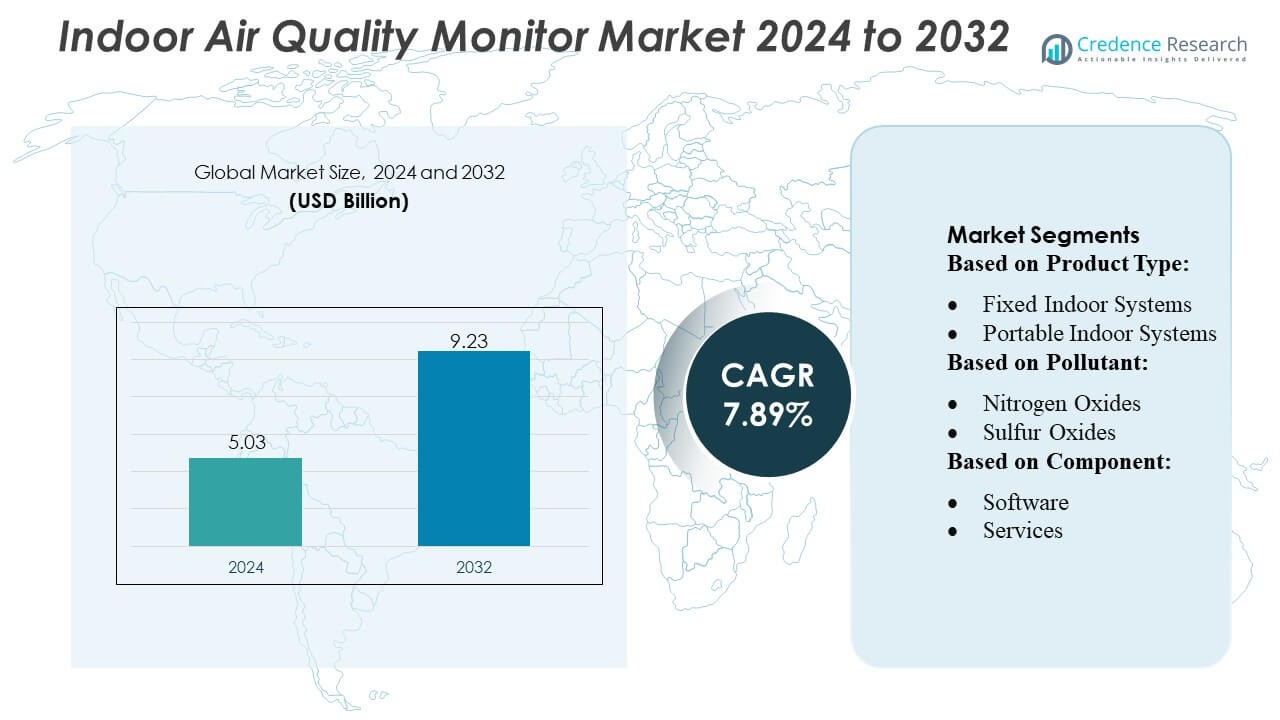

Indoor Air Quality Monitor Market size was valued USD 5.03 billion in 2024 and is anticipated to reach USD 9.23 billion by 2032, at a CAGR of 7.89% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indoor Air Quality Monitor Market Size 2024 |

USD 5.03 Billion |

| Indoor Air Quality Monitor Market, CAGR |

7.89% |

| Indoor Air Quality Monitor Market Size 2032 |

USD 9.23 Billion |

The Indoor Air Quality Monitor Market is shaped by a diverse group of global manufacturers that focus on advanced sensing technologies, multi-pollutant detection, and integration with smart building platforms. Leading companies strengthen competitiveness through continuous innovation in optical, electrochemical, and laser-based sensors, along with expanded offerings in connected and cloud-enabled monitoring systems. Strategic collaborations with HVAC providers and building automation firms further enhance product adoption across residential, commercial, and industrial settings. Asia-Pacific remains the leading regional market with approximately 30–32% share, supported by rapid urbanization, rising pollution levels, and strong investments in smart infrastructure and environmental compliance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Indoor Air Quality Monitor Market reached USD 5.03 billion in 2024 and is projected to attain USD 9.23 billion by 2032 at a 89% CAGR, reflecting growing demand for accurate and connected indoor monitoring solutions.

- Rising health concerns, stricter IAQ regulations, and increasing adoption of smart building technologies drive strong demand across residential, commercial, and industrial segments, with indoor monitoring systems holding the dominant share.

- Advanced trends such as IoT integration, AI-based analytics, multi-pollutant detection, and compact consumer-grade sensors continue to transform product capabilities and broaden market penetration.

- The competitive landscape is defined by continuous innovation in sensing technologies, cloud-enabled platforms, and strategic partnerships with HVAC and automation providers, though high device cost and calibration challenges restrain adoption in price-sensitive regions.

- Asia-Pacific leads with 30–32% share, supported by rapid urbanization and pollution concerns, while North America and Europe follow with significant adoption driven by regulatory compliance and advanced building automation ecosystems.

Market Segmentation Analysis:

By Product Type

Indoor air quality monitoring systems represent the dominant product category with approximately 48–50% market share, driven by rising demand for continuous pollutant tracking in residential, commercial, and institutional facilities. Within this category, fixed indoor systems outperform portable models due to their higher measurement accuracy, integration with HVAC networks, and suitability for long-term compliance monitoring. Portable indoor systems continue to grow steadily as consumers adopt compact devices for personal health assessment. Outdoor air quality monitors, both fixed and portable, gain traction in urban centers, but remain secondary to indoor-focused deployments.

- For instance, Thermo Fisher’s Series 1400i indoor air quality monitors can detect particulate matter down to 0.3 µm, measuring flows of up to 1 m³/min, and integrate with building management systems for real-time HVAC control.

By Pollutant

The chemical pollutant segment accounts for the largest share at nearly 55–58%, supported by the need to monitor nitrogen oxides, sulfur oxides, carbon oxides, VOCs, and other hazardous gases linked to respiratory disorders and workplace safety risks. Among these, volatile organic compounds (VOCs) emerge as the most widely monitored due to their prevalence in household products, paints, furnishings, and industrial emissions. Physical pollutant monitoring—covering particulates, humidity, and temperature—records growing adoption as regulatory agencies emphasize PM2.5 and PM10 thresholds, but chemical monitoring continues to dominate due to broader industrial and indoor exposure concerns.

- For instance, Aeroqual’s Series 500 portable gas monitors detect VOCs with sensitivity down to 1 ppb and measure gases at flow rates up to 0.5 L/min, enabling real-time exposure monitoring in industrial and indoor environments.

By Component

Hardware leads the component segment with approximately 62–65% market share, supported by continuous advancements in sensor modules, processors, and output interfaces that enhance detection accuracy and real-time reporting. Sensors form the largest hardware sub-component, driven by demand for multi-parameter gas, particulate, and VOC sensing technologies integrated into residential and commercial systems. Processors and output devices expand steadily as manufacturers incorporate edge analytics, wireless connectivity, and user-friendly digital dashboards. Software and analytics layers grow in importance, yet hardware remains dominant due to its essential role in pollutant detection and environmental data acquisition.

Key Growth Drivers

1. Rising Health Awareness and Indoor Pollution Concerns

Growing awareness of indoor pollutants such as VOCs, carbon oxides, and particulate matter significantly accelerates adoption of indoor air quality monitors. Rising cases of asthma, allergies, and chronic respiratory diseases make households, commercial buildings, and healthcare facilities prioritize air quality assessment. Increased time spent indoors—exceeding 85–90% for most populations—amplifies the need for continuous monitoring. Public health campaigns, improved access to information, and consumer inclination toward preventive wellness further strengthen market growth across both residential and workplace environments.

- For instance, Siemens’ Desigo Air Quality Sensor integrates VOC, CO₂, temperature, and humidity measurement in a single device, with sampling rates of 1 measurement per second and a detection range of 0–2,000 ppm for CO₂, supporting real-time indoor air quality management in commercial buildings.

2. Regulatory Standards and Building Compliance Requirements

Stricter air quality regulations introduced by environmental and occupational safety agencies fuel strong uptake of advanced monitoring systems. Commercial buildings, industrial units, educational institutions, and hospitals must comply with guidelines covering PM2.5, PM10, CO₂ limits, VOC thresholds, and ventilation efficiency. Green building certifications such as LEED and WELL also mandate routine air quality tracking, pushing businesses toward fixed and networked monitoring systems. As governments increase enforcement of IAQ norms in both developed and emerging markets, demand for accurate, integrated monitoring technologies continues to expand.

- For instance, Teledyne’s API T640 particulate monitors measure PM1, PM2.5, and PM10 concentrations, enabling compliance monitoring in commercial and industrial environments. The monitors offer a wide detection range, typically from 0.1 to 10,000 µg/m³, and usually provide measurements as a 1-minute (or longer) average to ensure stable, high-quality data suitable for regulatory reporting.

3. Technological Advancements in Sensors and Connected Devices

Rapid innovations in sensor miniaturization, multi-pollutant detection, and IoT connectivity play a major role in market expansion. Modern systems incorporate high-precision electrochemical, optical, and laser-based sensors that improve accuracy while reducing power consumption. Integration with smart home platforms, HVAC controls, and cloud analytics enhances real-time visibility and automated responses. Manufacturers increasingly embed AI-driven algorithms for predictive maintenance and pollution pattern analysis. These advancements lower costs, improve usability, and broaden adoption across residential, commercial, and industrial segments.

Key Trends & Opportunities

1. Expansion of Smart Home Ecosystems and Consumer IoT Adoption

The growing penetration of smart home solutions creates significant opportunities for compact and connected indoor air quality monitors. Integration with devices such as thermostats, purifiers, and ventilation systems enhances automated control of indoor environments. Voice-enabled assistants and mobile dashboards make monitoring more accessible and actionable for consumers. As IoT adoption rises, manufacturers increasingly offer subscription-based analytics, multi-room sensing, and remote diagnostics. This trend positions air quality monitors as essential components of comprehensive home wellness ecosystems.

- For instance, Testo’s Indoor Air Quality Monitor 435 can measure CO₂ concentrations from 0–5,000 ppm, VOC levels from 0–10 ppm, and temperature/humidity, with a data logging interval of every 1 second, providing precise environmental control for offices and classrooms.

2. Increased Demand from Commercial and Industrial Facilities

Enterprises increasingly deploy fixed monitoring networks to ensure compliance with workplace safety regulations and maintain productive indoor environments. Office buildings, data centers, factories, warehouses, hospitals, and educational institutions demand continuous IAQ measurement for employee well-being and operational efficiency. Markets such as pharmaceuticals, semiconductors, and food processing require high-precision pollutant tracking to protect product quality. Growing investments in building automation and facility management platforms further expand opportunities for integrated, large-scale monitoring systems.

- For instance, Merck’s AEROSOLsense fixed IAQ monitors can measure PM1, PM2.5, and PM10 concentrations from 0–1,000 µg/m³, along with VOCs from 0–10 ppm and CO₂ from 0–5,000 ppm, enabling high-precision air quality monitoring in factories and laboratories.

3. Rising Adoption of Sustainability and Green Building Initiatives

Global momentum toward sustainable construction drives the use of IAQ monitors as part of energy-efficient building design. Governments and developers increasingly adopt green building standards that mandate tracking of CO₂, humidity, and pollutant levels to optimize ventilation performance. Real-time indoor environmental quality (IEQ) dashboards enhance decision-making for energy conservation and occupant comfort. As corporate ESG initiatives strengthen, demand for IAQ-linked reporting and environmental transparency continues to grow, creating strong opportunities for advanced, connected systems.

Key Challenges

1. High Cost of Advanced Monitoring Systems

Cost remains a significant barrier, particularly in price-sensitive residential and small commercial markets. Multi-pollutant sensors, advanced processors, and wireless connectivity features raise overall device costs, limiting adoption in developing regions. Long-term maintenance, calibration requirements, and replacement components add to operational expenses. While low-cost consumer IAQ devices exist, they often compromise accuracy, creating a performance gap that restrains broader uptake. Manufacturers must balance affordability and precision to expand penetration across all user categories.

2. Sensor Accuracy Limitations and Data Reliability Issues

Ensuring consistent and accurate pollutant detection poses a major challenge for both low-end and mid-range monitors. Environmental factors such as humidity, temperature variation, chemical interference, and sensor drift affect measurement precision. Many consumer-grade devices lack standardized calibration protocols and struggle to meet regulatory-grade accuracy. Data variability reduces user trust and affects decision-making for building automation systems. Improving sensor durability, establishing certification standards, and integrating AI-based calibration will be essential to overcoming reliability concerns.

Regional Analysis

North America

North America leads the Indoor Air Quality Monitor Market with an estimated 32–34% share, supported by strong regulatory enforcement from agencies such as the EPA and OSHA, which mandate continuous monitoring of indoor pollutants. High consumer awareness, extensive HVAC integration, and early adoption of smart home technologies drive widespread deployment across residential, commercial, and industrial environments. Rapid uptake of connected IAQ systems, presence of advanced sensor manufacturers, and increasing concerns over wildfire smoke infiltration further strengthen market demand. Corporations and institutions increasingly adopt high-precision, real-time monitoring solutions to meet sustainability and building performance standards.

Europe

Europe holds approximately 28–30% market share, driven by stringent indoor air quality standards and widespread adoption of energy-efficient, green-certified buildings. EU directives promoting workplace safety, ventilation performance, and low-emission construction materials push demand for advanced IAQ monitoring systems across offices, schools, and healthcare facilities. Growing focus on reducing exposure to VOCs, particulate matter, and carbon oxides enhances uptake of fixed and integrated monitoring networks. Countries such as Germany, the U.K., France, and the Nordic region demonstrate strong adoption due to mature building automation ecosystems and rising emphasis on occupant health and environmental transparency.

Asia-Pacific

Asia-Pacific represents the fastest-growing region, accounting for 30–32% market share, driven by rapid urbanization, industrial expansion, and widespread concern over indoor and outdoor pollution levels. High population density, rising construction of commercial complexes, and increasing awareness of pollution-related health risks fuel demand across both residential and institutional segments. Government initiatives addressing PM2.5 and PM10 risks, combined with expanding smart city programs, encourage adoption of connected IAQ systems. China, India, Japan, and South Korea lead installations, supported by growing middle-class awareness and investments in ventilation optimization and building automation technologies.

Latin America

Latin America accounts for roughly 6–8% market share, with demand gradually rising as public health agencies emphasize the risks associated with poor indoor ventilation and urban pollution. Commercial buildings, educational institutions, and healthcare facilities increasingly adopt IAQ monitors to comply with emerging regional standards. Economic recovery, modernization of building infrastructure, and heightened awareness of respiratory illnesses support steady uptake in major markets such as Brazil, Mexico, Chile, and Colombia. Growth remains moderate due to cost constraints, yet improving availability of affordable portable devices strengthens penetration across residential users.

Middle East & Africa

The Middle East & Africa region holds an estimated 4–6% market share, influenced by rising urban development, expanding commercial infrastructure, and increasing concern over indoor pollutants linked to HVAC inefficiencies and sealed building designs. GCC nations, particularly the UAE and Saudi Arabia, lead adoption as part of investment in smart buildings, hospitals, and high-performance commercial facilities. Awareness of IAQ’s role in occupant comfort and productivity is growing, although adoption in Africa remains limited by price sensitivity and lack of regulatory frameworks. Gradual investment in air-quality compliance and sustainability initiatives supports long-term growth.

Market Segmentations:

By Product Type:

- Fixed Indoor Systems

- Portable Indoor Systems

By Pollutant:

- Nitrogen Oxides

- Sulfur Oxides

By Component:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Indoor Air Quality Monitor Market features leading global companies such as Thermo Fisher Scientific Inc., Aeroqual, Siemens, Teledyne Technologies Incorporated, HORIBA Scientific, Testo SE & Co. KGaA, Merck KGaA, General Electric, 3M, and Emerson Electric Co. the Indoor Air Quality Monitor Market is defined by continuous innovation, expanding product portfolios, and strong integration with connected building ecosystems. Companies focus on developing high-precision, multi-pollutant detection systems equipped with advanced electrochemical, optical, and laser-based sensors that deliver real-time, accurate measurements. The market is increasingly shaped by IoT-enabled platforms that link monitoring devices with HVAC systems, smart home networks, and cloud analytics for automated ventilation control and predictive insights. Vendors strengthen competitiveness through investments in miniaturized sensors, AI-driven diagnostics, and wireless technologies that enhance usability and performance. Strategic collaborations with building automation firms, regulatory compliance pressures, and rising demand across residential, commercial, and industrial sectors further intensify competition and drive technological differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thermo Fisher Scientific Inc.

- Aeroqual

- Siemens

- Teledyne Technologies Incorporated

- HORIBA Scientific

- Testo SE & Co. KGaA

- Merck KGaA

- General Electric

- 3M

- Emerson Electric Co.

Recent Developments

- In April 2025, BD launched the HemoSphere Alta, an advanced hemodynamic monitoring platform featuring AI-driven predictive algorithms like the Cerebral Autoregulation Index (CAI) and Hypotension Prediction Index (HPI) along with a 15″ touchscreen and hands-free voice/gesture controls to help clinicians proactively manage blood pressure and blood flow in critical care settings.

- In June 2024, ASUS announced new displays and computers at Computex, including the ProArt line of 5K and 8K professional monitors, the wellness-focused ASUS VU displays, and the flexible ZenScreen monitors.

- In February 2024, Honeywell International Inc. was designated the Official Sustainable Building Technology Partner for the Atlanta Hawks and the State Farm Arena. Through this multi-year partnership, Honeywell International Inc. will introduce a range of advanced upgrades to the building operations systems at State Farm Arena.

- In February 2024, Lenovo announced the launch of software, purpose-built AI devices, infrastructure solutions, and introduced two proof-of-concept devices, which stand out as challenging to the traditional PC and smartphone form factors.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Pollutant, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady expansion as indoor air quality becomes a core component of healthy building standards.

- Adoption of smart, connected monitoring systems will accelerate with wider integration into HVAC and building automation networks.

- Sensor technologies will advance toward higher accuracy, lower power consumption, and multi-pollutant detection capabilities.

- AI- and cloud-based analytics will gain prominence for predictive alerts, trend analysis, and automated ventilation control.

- Residential demand will strengthen as consumers prioritize health, wellness, and real-time environmental insights.

- Commercial and industrial facilities will increasingly deploy networked monitoring platforms to support compliance and operational efficiency.

- Portable and wearable IAQ monitors will gain traction among health-conscious users and field professionals.

- Green building certifications will continue to drive mandatory adoption of indoor air quality monitoring solutions.

- Manufacturers will expand offerings with more compact, affordable, and user-friendly models to increase market penetration.

- Emerging markets will witness faster growth as awareness improves and governments implement clearer IAQ regulations.