Market Overview

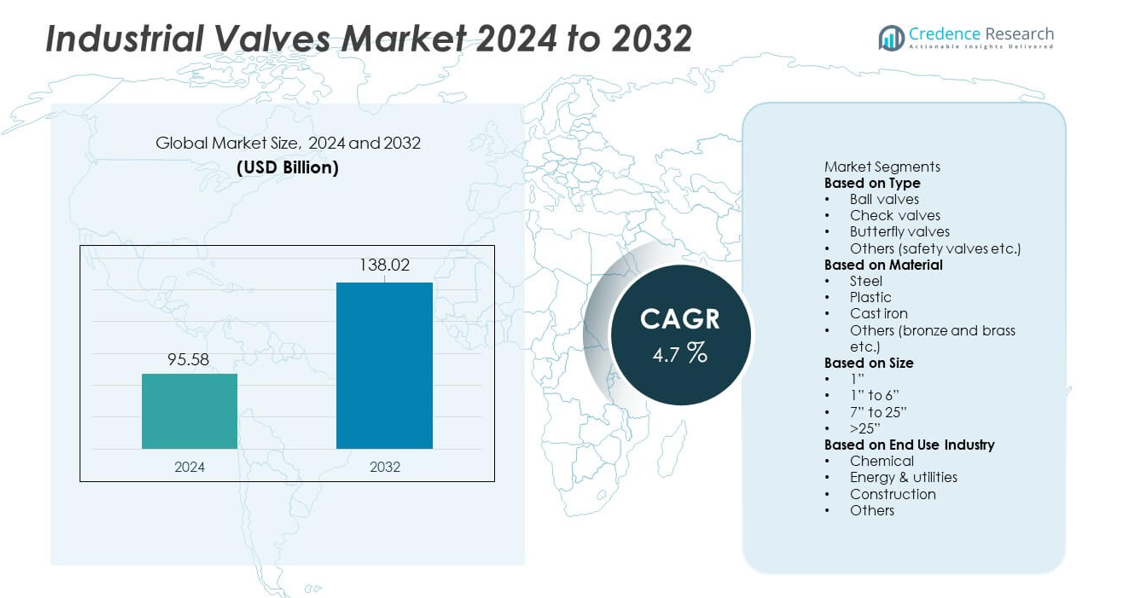

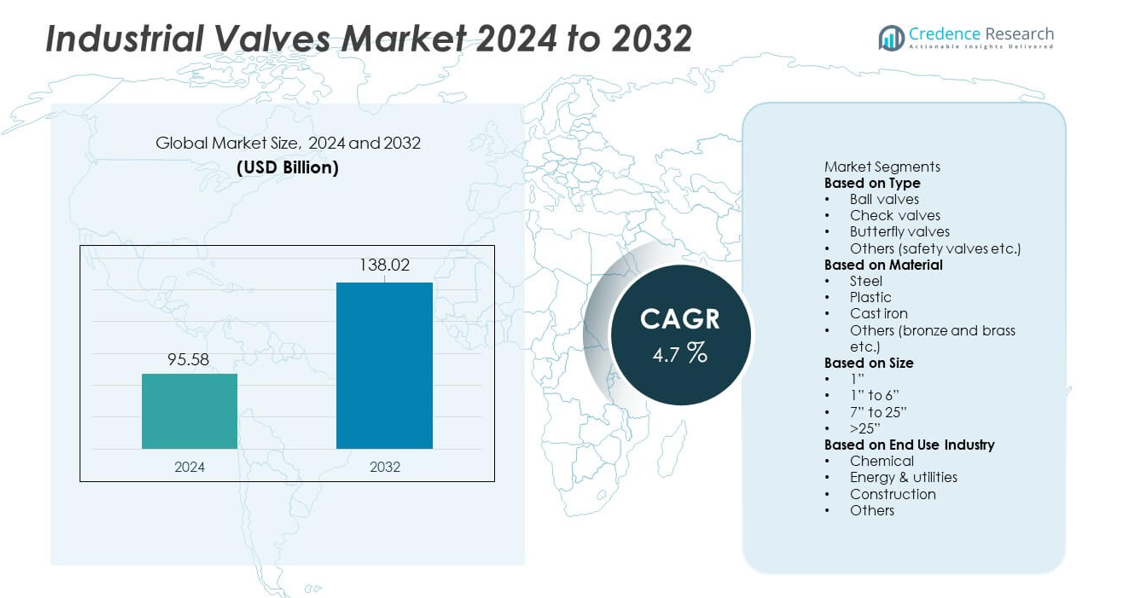

The Industrial Valves market size reached USD 95.58 billion in 2024. The market is projected to reach USD 138.02 billion by 2032, supported by a CAGR of 4.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Valves Market Size 2024 |

USD 95.58 billion |

| Industrial Valves Market, CAGR |

4.7% |

| Industrial Valves Market Size 2032 |

USD 138.02 billion |

Top players in the Industrial Valves market include Emerson Electric, Honeywell, Baker Hughes, Alfa Laval, CIRCOR, Danfoss, Crane Company, Curtiss-Wright, AVK Holding, and Hitachi, all of which strengthen their positions through advanced valve technologies, automation capabilities, and material innovations. These companies focus on smart monitoring, improved durability, and tailored designs for oil and gas, power, chemical, and water sectors. North America leads the market with a 33% share, driven by strong investments in pipeline upgrades and energy infrastructure. Asia Pacific follows closely as rapid industrialization, refinery expansions, and growing water treatment needs boost large-scale valve deployment across diverse industries.

Market Insights

- The Industrial Valves market reached USD 95.58 billion in 2024 and is set to grow at a 4.7% CAGR, supported by rising upgrades across process industries.

- Strong growth stems from expanding oil and gas activities, power generation upgrades, and rising water treatment investments that boost adoption of durable valve systems across major applications.

- Digital valve technologies, smart monitoring, and corrosion-resistant materials shape market trends, while leading players strengthen portfolios through automation and high-performance designs.

- Market restraints include high maintenance costs, raw material volatility, and operational downtime risks, especially across aging industrial infrastructure.

- North America leads with a 33% share, followed by Asia Pacific at 30% and Europe at 28%, while ball valves dominate the type segment with a 34% share, and the 1” to 6” size category leads with a 46% share, supported by widespread use in pipelines and industrial systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Ball valves hold the leading position with a 34% share due to strong use in oil and gas pipelines, chemical plants, and power facilities. Their tight shutoff ability and durability support steady demand across high-pressure and high-temperature systems. Check valves follow as industries adopt backflow prevention systems to protect pumps and compressors. Butterfly valves gain traction in water treatment and HVAC due to compact size and easy operation. Safety valves and other types support niche applications in steam and process industries. Rising industrial automation and flow control upgrades help expand adoption across all valve categories.

- For instance, Emerson expanded its ball valve line with designs tested to handle 1,500 psi and 260°C in pipeline service. The company also validated cycle life above 100,000 operations during endurance trials.

By Material

Steel dominates the material segment with a 41% share, driven by its strength, corrosion resistance, and suitability for extreme operating environments. Refineries, offshore platforms, and thermal power plants widely use steel valves for high-stress operations. Cast iron remains preferred in water supply, wastewater systems, and low-pressure industrial settings due to cost efficiency. Plastic valves gain steady adoption in chemical handling, desalination, and food processing thanks to lightweight structure and chemical resistance. Bronze and brass serve specialized marine and HVAC applications. Growth in heavy engineering and fluid handling infrastructure keeps steel-based designs in strong demand.

- For instance, Velan manufactured forged steel valves certified for service up to 425 bar and 620°C. The company also produced more than 60,000 steel gate and globe valves in a single year for global power projects. Velan’s tests confirmed leak rates approaching zero across high-cycle steam applications.

By Size

Valves sized 1” to 6” lead with a 46% share, supported by broad deployment in pipeline networks, industrial machinery, and utility systems. These mid-range sizes offer flexibility, easy installation, and strong compatibility with standard process equipment. The 7” to 25” segment sees increased use in power plants, desalination units, and municipal water systems requiring high-capacity flow control. Valves above 25” serve large transmission pipelines and heavy industrial projects. The 1” segment supports compact equipment and precision flow management. Expansion in water infrastructure and oil and gas transmission drives higher demand for mid- and large-diameter valves.

Key Growth Drivers

Rising Demand from Oil, Gas, and Power Industries

Oil and gas exploration, refinery expansions, and pipeline upgrades create strong demand for advanced flow control systems. Power generation plants, including thermal, nuclear, and renewable facilities, rely on durable valves for high-pressure and high-temperature operations. Industrial operators invest in enhanced safety systems and leak-prevention mechanisms to support regulatory compliance. The shift toward automated valve assemblies and predictive maintenance increases adoption in large processing units. These factors strengthen the need for reliable valves across upstream, midstream, and downstream environments, supporting steady market expansion.

- For instance, Baker Hughes deploys high-performance control valves in global LNG and refinery projects, including severe-service models designed for demanding high pressure applications that can exceed typical industrial ratings.

Growth in Water Treatment and Wastewater Management Projects

Global investment in water infrastructure boosts demand for valves used in distribution networks, desalination units, and sewage plants. Urban expansion increases pressure on water supply systems, prompting governments to upgrade pipelines and control mechanisms. Water scarcity accelerates deployment of reverse osmosis and membrane-based treatment units that rely on corrosion-resistant valve designs. Wastewater recycling and stormwater management further increase usage across municipal projects. Rising sustainability goals drive adoption of energy-efficient flow control components, supporting long-term demand from environmental and utility sectors.

- For instance, companies like Xylem and others supply corrosion-resistant valves and related products made from specialist materials like duplex and super duplex stainless steels to desalination plants. These materials are designed and tested to withstand high salinity levels and the harsh conditions of seawater environments.

Expansion of Chemical, Pharmaceutical, and Food Processing Industries

Chemical plants and pharmaceutical facilities require precise flow regulation and contamination-free operation, boosting adoption of high-performance valves. Growth in specialty chemicals and advanced materials increases deployment of corrosion-resistant and automated valve systems. Food and beverage processing lines adopt hygienic valve designs that support easy cleaning and safe handling of liquid products. Rising global manufacturing output drives investments in new production facilities with modern flow control equipment. These industry expansions help widen the market base for specialized valves across diverse applications.

Key Trends & Opportunities

Automation, Smart Valves, and IIoT Integration

Industrial plants adopt automated and sensor-enabled valves to improve safety, accuracy, and productivity. Smart valves equipped with real-time monitoring, position sensing, and diagnostics support predictive maintenance strategies. IIoT platforms enable remote operation and faster troubleshooting for complex flow networks. Industries transition from manual to electric and pneumatic actuators to enhance operational responsiveness. This shift creates new opportunities for digital valve solutions that reduce downtime and optimize system efficiency across process manufacturing and energy sectors.

- For instance, Siemens deployed digital valve automation modules capable of processing extensive status readings across large process plants. Their SIPART PS2 system is designed for high reliability and a long product lifetime, utilizing features such as advanced diagnostics and integrated pressure sensors to perform routine Partial Stroke Tests (PSTs) to ensure operational integrity and prevent valve sticking without performance degradation.

Rising Need for Corrosion-Resistant and Advanced Materials

Growth in harsh-environment applications increases demand for valves made from stainless steel, duplex alloys, and specialty coatings. Offshore platforms, chemical plants, and high-salinity water treatment units require materials that withstand aggressive conditions. Manufacturers invest in new alloys and surface engineering technologies to extend valve life and reduce maintenance cycles. Plastic and composite valves gain traction in industries seeking lightweight, corrosion-proof options. These material innovations offer strong opportunities for product differentiation and long-term reliability across heavy industrial operations.

- For instance, Flowserve produces robust valves using duplex and super duplex alloys, which offer superior resistance to various corrosive fluids including seawater and chlorides, making them ideal for aggressive offshore systems.

Key Challenges

High Maintenance Costs and Operational Downtime

Valves operating in high-pressure, abrasive, or corrosive environments face frequent wear and leakage issues. Unplanned shutdowns increase repair expenses and disrupt production schedules. Many industries struggle to manage aging pipeline networks that require constant inspection and servicing. Limited availability of skilled technicians further raises maintenance-related risks. These operational pressures push companies to adopt predictive maintenance tools, although upfront costs remain a challenge for smaller facilities.

Supply Chain Constraints and Raw Material Volatility

Fluctuating prices of steel, alloys, and industrial coatings affect production costs for valve manufacturers. Supply disruptions caused by geopolitical issues, shipping delays, or trade restrictions slow project execution. Lead time extensions make it harder for industrial sectors to plan equipment upgrades and replacements. Manufacturers face pressure to maintain competitive pricing while dealing with unstable input costs. These constraints create procurement challenges across major end-use industries, especially in large-scale infrastructure and energy projects.

Regional Analysis

North America

North America leads the Industrial Valves market with a 33% share, driven by strong demand from oil and gas, pipeline modernization, and power generation projects. The region benefits from steady shale development, refinery upgrades, and investment in LNG terminals. Water and wastewater utilities expand valve installations to support urban population growth and stricter environmental regulations. Industrial automation adoption further boosts the use of smart and automated valve systems. The United States accounts for the largest share due to extensive petrochemical capacity and replacement cycles across aging infrastructure. Canada adds steady demand through ongoing midstream expansions.

Europe

Europe holds a 28% share, supported by advanced manufacturing, strict emission norms, and strong investments in chemical processing and district heating networks. Countries like Germany, Italy, and the UK drive demand through energy transition projects and modernization of industrial facilities. The shift toward hydrogen production and carbon-capture systems increases usage of corrosion-resistant valve materials. Water treatment upgrades across Eastern Europe add further momentum. The region also adopts digital valve monitoring solutions to improve efficiency and reduce maintenance costs. Ongoing infrastructure renewal and sustainability-focused policies continue to shape long-term demand.

Asia Pacific

Asia Pacific accounts for a 30% share, backed by rapid industrialization, expanding petrochemical capacity, and major investments in power generation. China and India lead growth through refinery construction, pipeline expansion, and large-scale water treatment projects. Southeast Asian countries contribute through LNG import terminals and manufacturing growth. The region’s strong focus on industrial automation drives wider use of advanced valve technologies. Rising urbanization increases demand for reliable water supply and wastewater systems. Large infrastructure spending and ongoing capacity expansions across energy and process industries reinforce the region’s dominant growth role.

Latin America

Latin America holds an 8% share, driven by oil and gas production in Brazil, Mexico, and Argentina. The region invests in offshore drilling, pipeline rehabilitation, and refinery modernization, supporting demand for high-performance valves. Water management projects grow as governments improve treatment and distribution systems. Mining operations in Chile and Peru increase the need for durable valves suitable for abrasive slurries and high-pressure applications. Industrial modernization across manufacturing and food processing also boosts adoption. Despite economic fluctuations, long-term energy projects and water infrastructure upgrades sustain steady valve demand.

Middle East & Africa

The Middle East & Africa region accounts for a 6% share, supported by strong oil and gas exploration, petrochemical development, and power generation expansion. Gulf countries invest heavily in refinery upgrades, LNG facilities, and desalination plants, driving use of corrosion-resistant and high-capacity valves. Africa contributes through mining growth, water treatment expansion, and industrial development in South Africa and Nigeria. Mega infrastructure projects in the Gulf Cooperation Council enhance adoption of advanced valve systems. Continued investment in energy diversification and industrial clusters supports stable demand across regional markets.

Market Segmentations:

By Type

- Ball valves

- Check valves

- Butterfly valves

- Others (safety valves etc.)

By Material

- Steel

- Plastic

- Cast iron

- Others (bronze and brass etc.)

By Size

- 1”

- 1” to 6”

- 7” to 25”

- >25”

By End Use Industry

- Chemical

- Energy & utilities

- Construction

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Major players in the Industrial Valves market include Emerson Electric, Honeywell, Baker Hughes, Alfa Laval, CIRCOR, Danfoss, Crane Company, Curtiss-Wright, AVK Holding, and Hitachi. These companies compete through product innovation, expanded portfolios, and advanced flow control technologies that address complex industrial requirements. Many manufacturers invest in smart and automated valve systems that integrate sensors, diagnostics, and IIoT capabilities to support predictive maintenance and reduce operational downtime. Strategic acquisitions strengthen market presence, while partnerships with EPC contractors and energy operators help secure long-term supply contracts. Leading firms also focus on developing corrosion-resistant materials and high-performance valves for harsh environments. Regional expansion remains a priority, especially in Asia Pacific and the Middle East, where large-scale industrial projects continue to drive procurement. Continuous R&D spending, digital upgrades, and customization capabilities shape the competitive edge across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Honeywell

- CIRCOR

- Danfoss

- Baker Hughes

- AVK Holding

- Hitachi

- Curtiss-Wright

- Emerson Electric

- Crane Company

- Alfa Laval

Recent Developments

- In June 2025, Crane Company announced an agreement to acquire the precision sensors & instrumentation (PSI) product line from Baker Hughes for about US$ 1.15 billion.

- In November 2024, Crane Company acquired Technifab Products, Inc. — a move noted among recent industrial-valve market developments.

- In February 2023, Emerson Electric launched its ASCO Series 262 and 263 biodiesel-compatible valves for U.S. industrial use.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, Size, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for smart and automated valves will rise as industries adopt digital monitoring.

- Oil and gas pipeline expansions will continue to drive high-pressure valve installations.

- Water and wastewater treatment upgrades will support long-term valve procurement.

- Power generation projects will increase adoption of durable, high-temperature valve designs.

- Chemical and pharmaceutical capacity growth will boost use of corrosion-resistant materials.

- Manufacturers will invest more in predictive maintenance and IIoT-enabled valve systems.

- Sustainability goals will push development of energy-efficient and low-emission valve solutions.

- Urban infrastructure expansion will strengthen demand for mid-size valves in utilities.

- Global refinery modernization will create steady opportunities for advanced flow control systems.

- Regional industrialization, especially in Asia and the Middle East, will accelerate large-scale valve deployments.