Market Overview

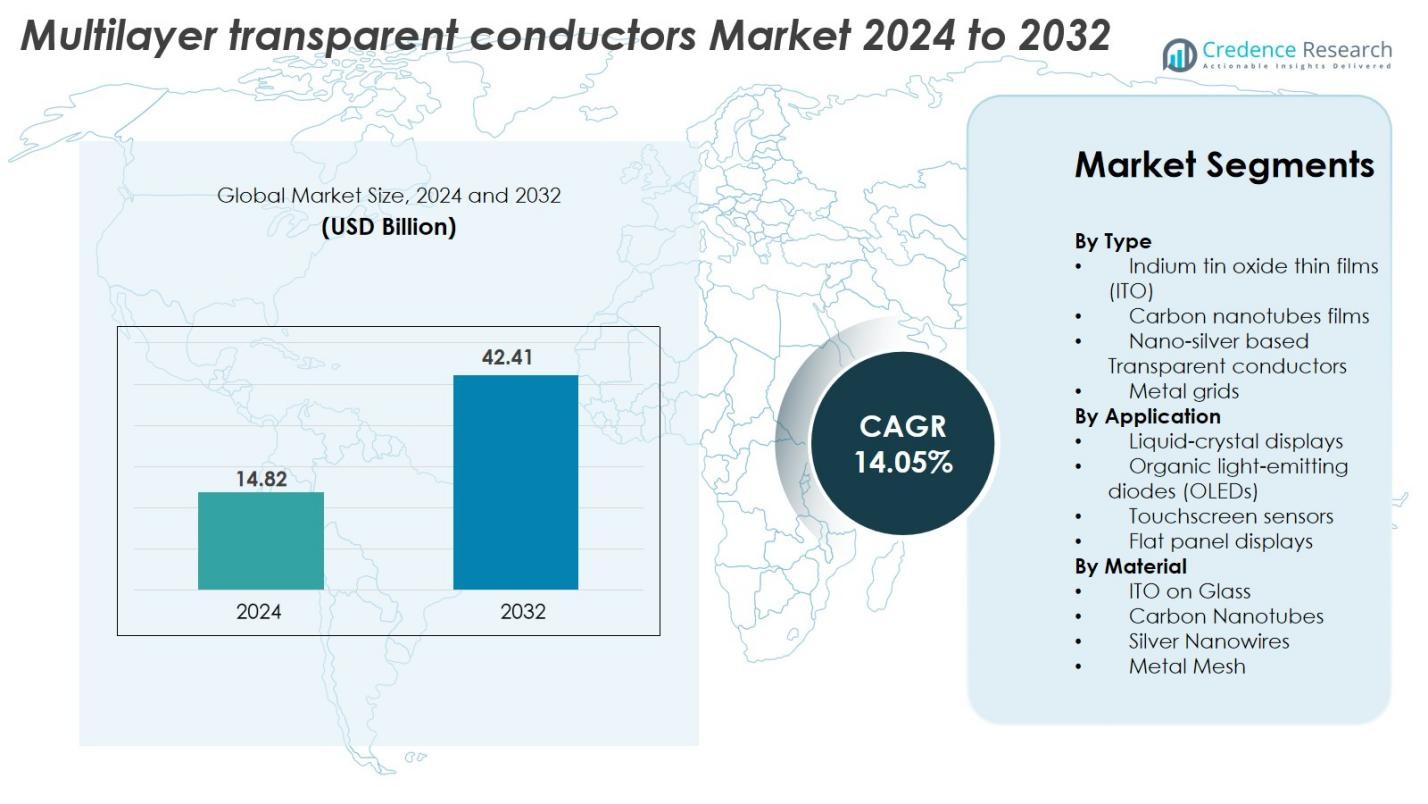

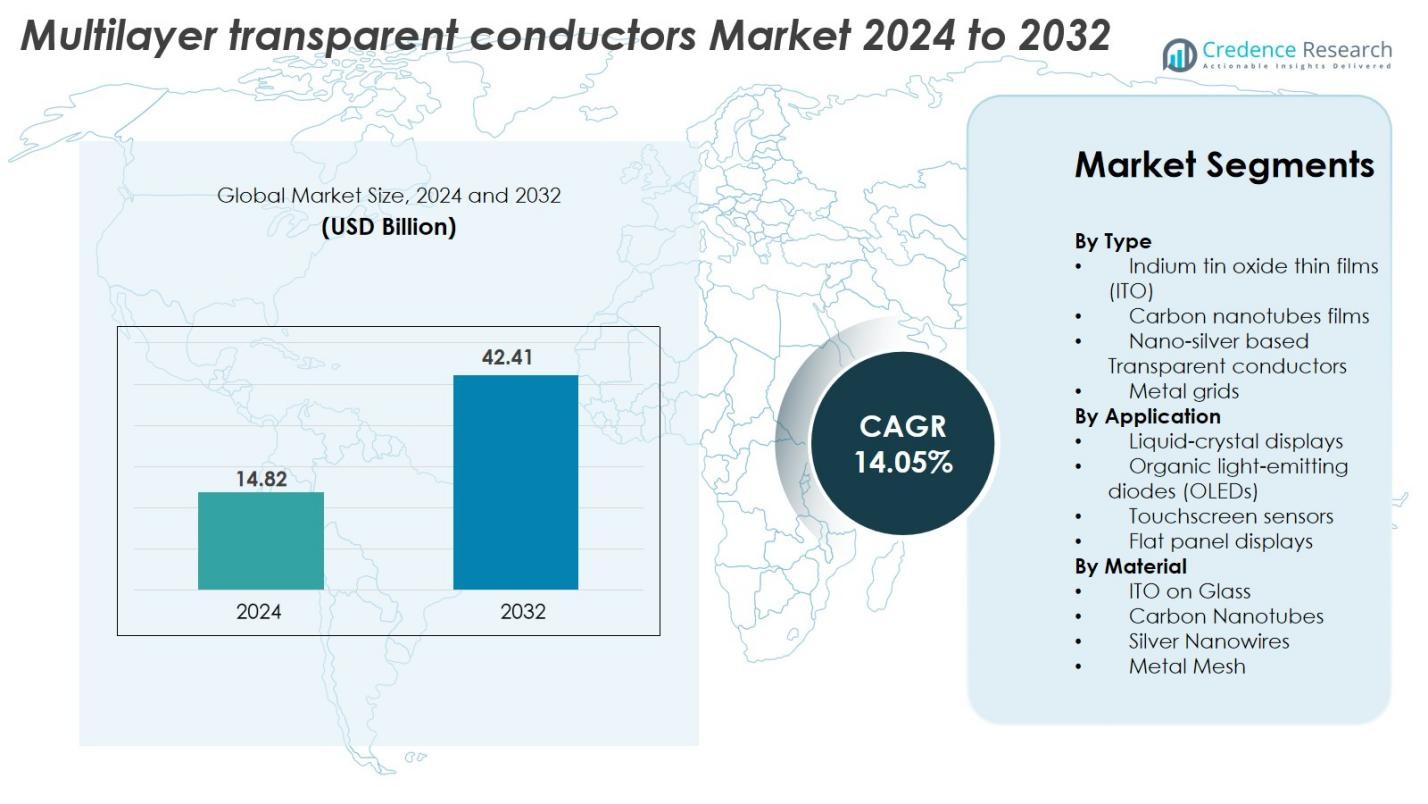

Multilayer Transparent Conductors Market size was valued at USD 14.82 Billion in 2024 and is anticipated to reach USD 42.41 Billion by 2032, at a CAGR of 14.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Multilayer Transparent Conductors Market Size 2024 |

USD 14.82 Billion |

| Multilayer Transparent Conductors Market, CAGR |

14.05% |

| Multilayer Transparent Conductors Market Size 2032 |

USD 42.41 Billion |

Multilayer Transparent Conductors Market is shaped by the presence of major global players such as 3M Company, Canatu Oy, Nitto Denko Corporation, DuPont Teijin Films, Toyobo Corporation, Fujifilm Holdings Corporation, Thin Film Devices Inc., DONTECH Inc., Abrisa Technologies, Eastman Kodak, Acree Technologies Inc., Cambrios Technologies Corporation, Apple Inc., Quantum Coating Inc., and Cima Nanotech. These companies compete through innovations in nanomaterials, flexible conductive films, and high-performance multilayer structures. Asia-Pacific leads the market with a 39.8% share, driven by its strong electronics manufacturing ecosystem, followed by North America at 27.4% and Europe at 22.1%, reflecting robust demand for advanced display and touch technologies across these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Multilayer Transparent Conductors Market was valued at USD 14.82 Billion in 2024 and is projected to reach USD 42.41 Billion by 2032, growing at a CAGR of 14.05% during the forecast period.

- Market growth is driven by rising demand for advanced displays, touch sensors, OLED panels, and flexible electronics, with ITO thin films holding a 41.6% share as the leading segment due to their strong transparency–conductivity balance.

- Key trends include rapid adoption of nanomaterial-based conductors such as silver nanowires, carbon nanotubes, and metal mesh structures, supporting the shift toward foldable, stretchable, and ultra-thin devices.

- The competitive landscape features companies like 3M, Canatu Oy, Nitto Denko, DuPont Teijin Films, Fujifilm, and Cambrios, all focusing on R&D and partnerships to enhance performance and scalability while addressing cost and durability restraints.

- Regionally, Asia-Pacific leads with 39.8%, supported by strong electronics manufacturing; followed by North America at 27.4% and Europe at 22.1%, reflecting growing adoption of advanced display technologies.

Market Segmentation Analysis

By Type

Indium Tin Oxide (ITO) thin films dominated the Multilayer Transparent Conductors Market in 2024 with a 41.6% share, driven by their high optical transparency, excellent electrical conductivity, and mature production infrastructure. ITO remains the preferred material for high-resolution displays and touch interfaces due to its stable performance and wide compatibility with existing manufacturing lines. Meanwhile, nano-silver transparent conductors and metal grids are gaining momentum for flexible and foldable devices. Carbon nanotube films continue to grow gradually, supported by rising demand for durable, sustainable, and mechanically resilient alternatives.

- For instance, LG Display integrated ITO-based electrodes with sheet resistance levels below 10 Ω/sq in its OLED TV panels, enabling mass production of displays exceeding 77 inches.

By Application

The touchscreen sensors segment led the market in 2024 with a 38.4% share, fueled by the rapid adoption of smartphones, industrial touch interfaces, and automotive infotainment systems. Rising demand for precise, high-sensitivity touch performance continues to strengthen this segment’s position. OLEDs and flat-panel displays are expanding steadily as manufacturers shift toward ultra-thin, energy-efficient display technologies. Liquid-crystal displays maintain significant usage in TVs, monitors, and instrumentation panels, though the overall market is gradually transitioning toward OLED-based solutions driven by superior visual performance.

- For instance, AU Optronics (AUO) developed on-cell and in-cell touch integrated AMOLED panels for various devices, including a 1.6-inch panel for wearable devices noted for its exceptionally thin, 0.5 mm profile.

By Material

ITO on Glass held the largest share in 2024 at 43.2%, supported by its excellent clarity, strong mechanical stability, and wide integration across LCDs, touchscreens, and flat-panel displays. Silver nanowires are experiencing strong growth due to their superior flexibility, low sheet resistance, and suitability for foldable and wearable electronics. Metal mesh materials are increasingly used in large-format displays and high-brightness panels where lower resistance is crucial. Carbon nanotubes continue to gain attention as eco-friendly, durable, and highly flexible alternatives aligned with the shift toward next-generation transparent conductor technologies.

Key Growth Drivers

Expanding Adoption of Advanced Display Technologies

The rapid expansion of advanced display technologies, including OLEDs, micro-LEDs, and high-resolution touch interfaces, serves as a primary growth driver for the multilayer transparent conductors market. Manufacturers increasingly demand materials that deliver superior optical clarity, lower sheet resistance, and mechanical flexibility to support next-generation display designs. As consumer electronics move toward bezel-less, ultra-thin, curved, and foldable screens, the need for advanced transparent conductors continues to escalate. ITO alternatives such as silver nanowires, metal meshes, and carbon nanotubes are gaining prominence as they address performance gaps related to flexibility and conductivity. Furthermore, rising investments in smart TVs, automotive digital clusters, AR/VR devices, and industrial touch panels amplify the requirement for transparent conductor solutions with higher durability and improved electrical efficiency. This trend is reinforced by strong production capacity expansions across Asia-Pacific, particularly China, Japan, and South Korea, where display manufacturing remains highly concentrated.

- For instance, BOE Technology’s Gen 10.5 factories in Hefei and Wuhan have a designed monthly production capacity of 120,000 glass substrates each, primarily for manufacturing large-sized LCD panels (65-inch and above).

Growth of Smart Devices, Wearables, and IoT Interfaces

The accelerating adoption of smart devices, wearable electronics, and IoT-based human–machine interfaces significantly boosts the demand for multilayer transparent conductors. These applications require thin, flexible, high-conductivity materials that can withstand repeated bending and environmental exposure. Silver nanowires, CNTs, and hybrid multilayer films have emerged as preferred choices for smartwatches, fitness trackers, connected home devices, and biomedical wearables that demand lightweight, highly responsive touch or sensing surfaces. With consumers increasingly prioritizing compact form factors and extended device lifecycles, transparent conductors that offer low power consumption and enhanced durability continue to gain traction. The proliferation of smart homes, connected healthcare devices, and industrial IoT interfaces further strengthens market expansion. Moreover, the surge in digitalization across transportation, retail automation, and factory operations reinforces the need for advanced touch-enabled systems, positioning multilayer transparent conductors as a critical enabling component.

- For instance, Cambrios Advanced Materials supplies its ClearOhm® silver-nanowire films, which are used in touch sensors with sheet resistance as low as 30 Ω/sq at over 90% transparency

Shift Toward Flexible, Foldable, and Sustainable Electronics

The global transition toward flexible, foldable, and sustainable electronics acts as a powerful growth driver for the multilayer transparent conductors market. Traditional ITO films suffer from brittleness and limited bending performance, creating strong demand for alternative materials such as metal mesh, silver nanowires, and carbon nanotubes that offer exceptional flexibility and high conductivity. As brands focus on eco-friendly and recyclable materials, CNT-based and hybrid nanomaterial transparent conductors gain wider adoption across consumer electronics and industrial applications. The rise of foldable smartphones, rollable displays, electronic paper, and smart textiles drives rapid commercialization of multilayer transparent conductor architectures designed for mechanical resilience. In addition, stricter environmental regulations and corporate sustainability commitments encourage manufacturers to adopt low-energy deposition processes and non-rare-earth materials. These shifts collectively create substantial opportunities for innovative multilayer structures optimized for performance, sustainability, and long-term reliability.

Key Trends & Opportunities

Rising Commercialization of Nanomaterial-Based Transparent Conductors

A key trend reshaping the multilayer transparent conductors market is the increasing commercialization of nanomaterial-based solutions, including silver nanowires, graphene, CNTs, and hybrid nano-metallic grids. These materials offer superior flexibility, lower sheet resistance, improved optical performance, and high mechanical robustness, making them ideal for flexible displays, next-generation wearables, and automotive interfaces. As R&D investments accelerate, manufacturers are scaling production and developing cost-efficient coating and printing technologies that enhance uniformity and durability. Graphene and CNT films, in particular, offer opportunities to reduce reliance on scarce materials such as indium. This trend is further supported by strong demand for conformable, lightweight, and stretchable electronics. With governments and private organizations funding nanomaterial innovation, commercial deployment is expected to expand significantly across consumer electronics, digital signage, AR/VR devices, and smart home products, creating substantial long-term growth potential.

- For instance, Samsung Electronics’ graphene research has resulted in breakthrough synthesis methods for commercializing graphene-based electrodes, with flexible AMOLED screens showing mechanical reliability superior to traditional materials, supporting development of next-generation wearable devices and flexible display technologies.

Expanding Opportunities in Automotive Displays and Smart Surfaces

Automotive digitization presents a major growth opportunity as vehicles increasingly integrate digital dashboards, head-up displays, infotainment systems, and touch-enabled smart surfaces. Multilayer transparent conductors play a critical role in enabling high-brightness, low-reflection, and temperature-resistant display interfaces required for automotive environments. The shift toward electric and autonomous vehicles accelerates this demand as manufacturers incorporate larger, curved, and integrated displays into cockpits. Additionally, smart windows, interior control panels, gesture sensors, and augmented reality overlays provide new application avenues for advanced transparent conductors. The need for materials that withstand vibration, UV exposure, and thermal fluctuations creates opportunities for metal mesh, silver nanowires, and hybrid transparent conductor technologies. With global automakers investing heavily in digital cockpit ecosystems and HMI innovation, the automotive sector is emerging as one of the most attractive long-term application markets.

- For instance, Continental develops various curved automotive displays designed for vehicle cockpits, which are built to withstand rigorous automotive testing standards, including extensive vibration and shock tests

Key Challenges

High Manufacturing Costs and Material Limitations

Despite strong growth prospects, the multilayer transparent conductors market faces significant challenges related to high manufacturing costs and material constraints. ITO production requires vacuum deposition and expensive indium, leading to fluctuating raw material prices and cost volatility. Alternatives like silver nanowires offer performance benefits but also introduce concerns regarding oxidation, migration, and long-term stability. Graphene and CNT films, though promising, remain expensive due to complex synthesis and processing requirements. Achieving uniformity, adhesion, and defect-free multilayer coatings across large substrates is technologically demanding, limiting cost-effective scalability. These issues create pricing pressure, particularly in cost-sensitive display and consumer electronics segments. Manufacturers must balance performance requirements with affordability, highlighting the need for innovation in deposition methods, material optimization, and supply chain diversification.

Integration Complexity and Performance Trade-offs

Integrating multilayer transparent conductors into diverse electronic systems presents another major challenge due to performance trade-offs and compatibility issues. Different applications require tailored combinations of optical transparency, conductivity, flexibility, surface hardness, and environmental resistance. Achieving an optimal balance often requires multi-step fabrication involving metal layers, nanomaterials, and oxide films, increasing process complexity. Additionally, integrating advanced transparent conductors into existing manufacturing lines demands significant capital investment and equipment reconfiguration. Issues such as haze formation, surface roughness, and adhesion failures can impair display quality or degrade touch responsiveness. Environmental durability—particularly resistance to heat, moisture, and UV exposure—also limits application in automotive and outdoor environments. These integration challenges create barriers to widespread adoption and require continuous advancements in materials engineering and multilayer design architectures.

Regional Analysis

North America

North America accounted for 27.4% of the Multilayer Transparent Conductors Market in 2024, driven by strong adoption of advanced display technologies across consumer electronics, automotive infotainment systems, and industrial touch interfaces. The region benefits from high R&D investments, particularly in nanomaterials and flexible electronics, led by the U.S. technology ecosystem. Growing demand for premium OLED TVs, smart wearables, and digital signage further supports market expansion. Additionally, rising integration of touch-enabled clusters and augmented displays in electric vehicles strengthens opportunities, positioning North America as a key innovation hub.

Europe

Europe held 22.1% of the market in 2024, supported by strong growth in automotive digitalization, industrial automation, and next-generation display technologies. Germany, France, and the UK contribute significantly due to the increasing adoption of smart surfaces, high-brightness automotive displays, and energy-efficient OLED lighting. The region’s emphasis on sustainability accelerates interest in eco-friendly materials such as carbon nanotubes and metal mesh structures. Moreover, investments in flexible electronics manufacturing and regulatory pressure for low-emission production processes help strengthen Europe’s position as a leading transparent conductor consumer.

Asia-Pacific

Asia-Pacific dominated the market with a 39.8% share in 2024, fueled by its leadership in consumer electronics, display manufacturing, and semiconductor production. China, Japan, and South Korea host major display panel producers, driving substantial demand for high-performance transparent conductors. The rapid rise in smartphone, smart TV, tablet, and flexible display production significantly boosts growth. Increasing investments in electric vehicles, battery systems, and smart industrial technologies also support adoption. Additionally, the region’s cost-efficient manufacturing capabilities and expanding nanomaterial production capacity solidify its role as the global growth engine.

Latin America

Latin America captured 5.9% of the market in 2024, driven by rising demand for smartphones, smart TVs, and digital signage across Brazil, Mexico, and Chile. Expanding retail digitalization and increasing adoption of mid-range consumer electronics contribute to regional growth. Integration of touch-enabled systems in automotive infotainment and industrial equipment is also gaining traction. Although the region lacks large-scale manufacturing facilities, strong imports of advanced display components support market momentum. Economic improvements and expanding telecom infrastructure are expected to further accelerate demand for multilayer transparent conductor technologies.

Middle East & Africa (MEA)

The Middle East & Africa accounted for 4.8% of the market in 2024, supported by growing adoption of digital signage, smart city technologies, and next-generation communication devices. Countries such as the UAE and Saudi Arabia are leading investments in modern display infrastructure, boosting demand for multilayer transparent conductors. The expansion of hospitality, transportation, and retail industries drives installation of high-brightness displays and touchscreen kiosks. While regional manufacturing remains limited, increasing import activity and rising consumption of smart consumer electronics contribute to steady market growth.

Market Segmentations

By Type

- Indium tin oxide thin films (ITO)

- Carbon nanotubes films

- Nano-silver based Transparent conductors

- Metal grids

By Application

- Liquid-crystal displays

- Organic light-emitting diodes (OLEDs)

- Touchscreen sensors

- Flat panel displays

By Material

- ITO on Glass

- Carbon Nanotubes

- Silver Nanowires

- Metal Mesh

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Multilayer Transparent Conductors Market is characterized by a mix of established material manufacturers, advanced nanotechnology developers, and display component suppliers competing to deliver high-performance, flexible, and cost-efficient conductive solutions. Leading companies such as 3M Company, Canatu Oy, Nitto Denko Corporation, DuPont Teijin Films, Toyobo Corporation, Fujifilm Holdings Corporation, Thin Film Devices Inc., DONTECH Inc., Abrisa Technologies, Eastman Kodak, Acree Technologies Inc., Cambrios Technologies Corporation, Apple Inc., Quantum Coating Inc., and Cima Nanotech actively invest in R&D to enhance conductivity, optical clarity, and mechanical durability. Many players focus on scaling nanomaterials such as silver nanowires, carbon nanotubes, and metal mesh structures to address the growing demand for flexible and foldable displays. Strategic partnerships between material suppliers and electronics OEMs are increasing as companies aim to accelerate product development, optimize multilayer coating processes, and strengthen their presence in high-growth sectors such as OLED displays, automotive touch systems, and wearable electronics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fujifilm Holdings Corporation

- Cima Nanotech

- Apple Inc.

- DuPont Teijin Films

- Canatu Oy

- Cambrios Technologies Corporation

- Acree Technologies Inc.

- Eastman Kodak

- DONTECH Inc.

- Abrisa Technologies

Recent Developments

- In December 2024, DENSO signed a Memorandum of Understanding (MOU) with Canatu to deepen their collaboration on carbon nanotube-based transparent conductive films, transparent heaters for vehicle cameras and windshields, and mass-production technologies.

- In April 2024, Canatu Oy and DENSO Corporation commissioned a jointly-developed carbon-nanotube reactor at Canatu’s Finnish facility to scale up transparent-conductive film (CNT film) manufacturing targeting automotive ADAS applications.

- In October 2023, Dai Nippon Printing Co., Ltd. (DNP) and Microwave Chemical Co., Ltd. announced a partnership to develop a new transparent-conductive film employing microwave-irradiated 11 nm silver nanowires for high transparency and conductivity.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth driven by rising adoption of flexible, foldable, and wearable electronics.

- Advanced nanomaterials like silver nanowires, carbon nanotubes, and graphene will gain wider commercial acceptance.

- Demand for high-performance conductive films in OLEDs, micro-LEDs, and next-generation displays will continue to accelerate.

- Automotive digitalization will boost the use of transparent conductors in infotainment systems, smart surfaces, and HUD displays.

- Manufacturers will increasingly shift toward sustainable materials and low-energy production technologies.

- Innovations in multilayer coating techniques will improve conductivity, durability, and optical clarity.

- Expansion of smart home devices and IoT ecosystems will create new opportunities for touch and sensing applications.

- Partnerships between material suppliers and electronics OEMs will intensify to support large-scale integration.

- Asia-Pacific will maintain its dominance due to strong electronics manufacturing capacity and rapid technological advancements.

- Competitive pressure will rise as companies focus on cost reduction, performance optimization, and large-area production scalability.