Market Overview

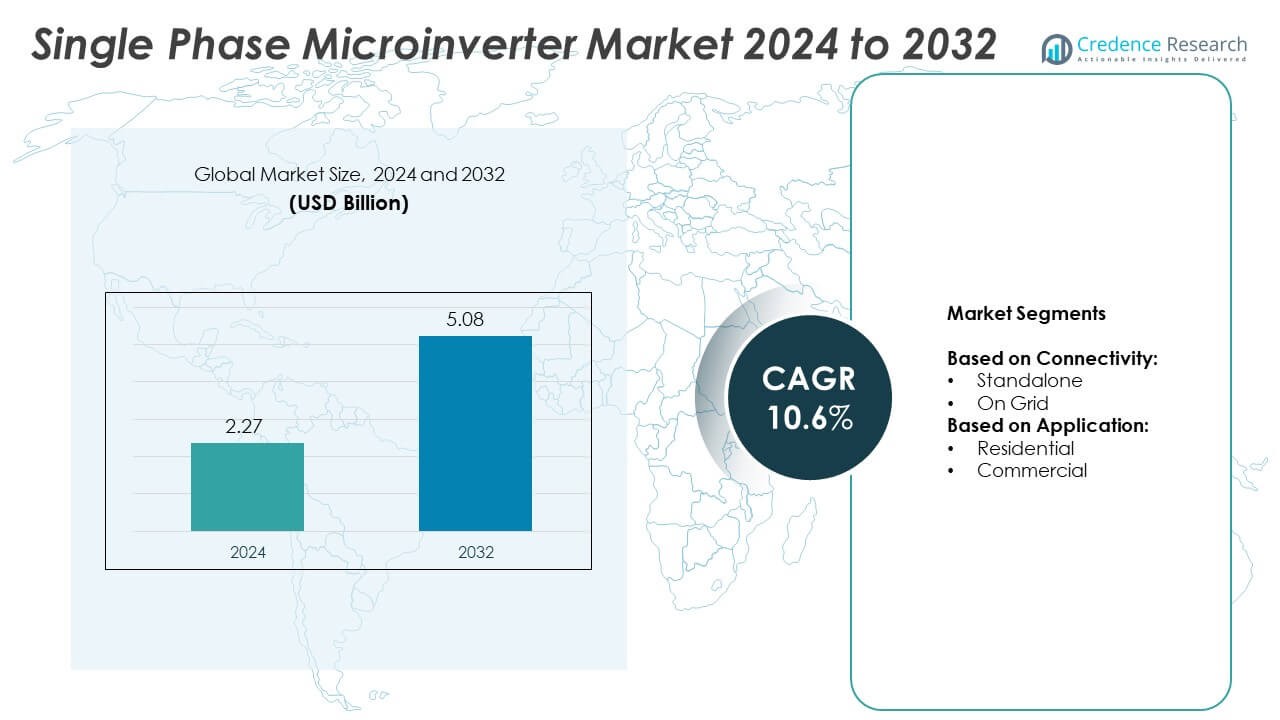

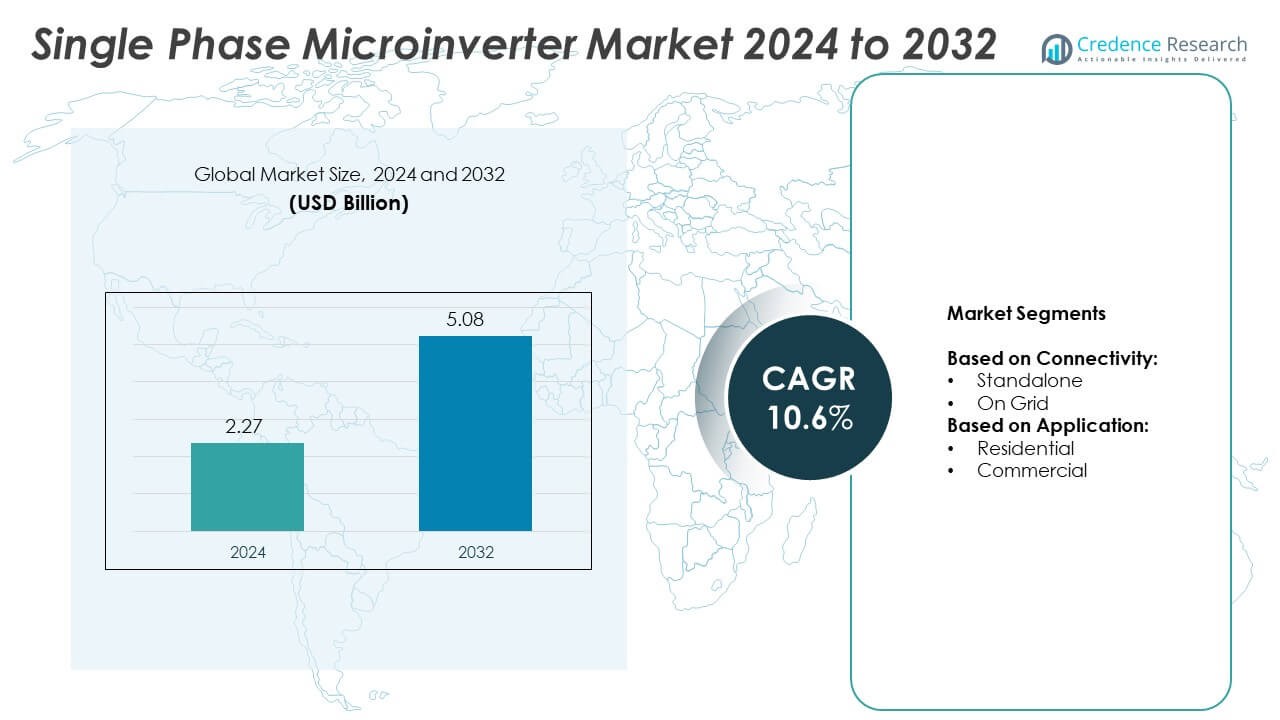

The Single Phase Microinverter Market size was valued at USD 2.27 billion in 2024 and is anticipated to reach USD 5.08 billion by 2032, at a CAGR of 10.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single Phase Microinverter Market Size 2024 |

USD 2.27 Billion |

| Single Phase Microinverter Market, CAGR |

10.6% |

| Single Phase Microinverter Market Size 2032 |

USD 5.08 Billion |

The Single Phase Microinverter market is driven by the rising adoption of residential solar energy systems, growing demand for panel-level optimization, and supportive government policies promoting renewable energy integration. It benefits from technological advancements, including IoT-enabled monitoring, AI-driven analytics, and compatibility with energy storage solutions, enhancing system efficiency and reliability. Increasing electricity costs and consumer preference for sustainable power solutions further accelerate market expansion. The trend toward decentralized energy generation, smart grid integration, and compact high-efficiency designs continues to reshape the industry, creating opportunities for manufacturers to deliver innovative, cost-effective, and scalable microinverter solutions for diverse applications.

The single-phase microinverter market shows robust demand across North America, Europe, and Asia Pacific, driven by residential solar adoption and supportive energy policies. Leading innovators in the field include Fimer Group, Enphase Energy, Hoymiles, and NingBo Deye Inverter Technology Co. Ltd. It benefits from efficient panel-level optimization, growing grid reconnection programs, and integration with storage solutions in urban and rural settings. Manufacturers respond by tailoring high-efficiency, compact designs for diverse climates and regulatory environments, enhancing uptake across global regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Single Phase Microinverter market size was valued at USD 2.27 billion in 2024 and is projected to reach USD 5.08 billion by 2032, growing at a CAGR of 10.6% during the forecast period.

- Growing residential solar installations, rising energy costs, and supportive government policies drive the adoption of high-performance microinverter systems globally.

- Advancements in IoT-enabled monitoring, AI-driven optimization, and energy storage integration are shaping market trends and enabling efficient, reliable, and scalable power conversion solutions.

- The competitive landscape includes established players focusing on innovation and cost optimization, with companies such as Enphase Energy, Fimer Group, Hoymiles, and NingBo Deye Inverter Technology investing in product advancements and global expansion strategies.

- High initial installation costs, complex system integration, and compatibility challenges with diverse panel technologies act as significant restraints for widespread adoption, especially in cost-sensitive regions.

- Asia Pacific leads the market with strong solar deployment programs, while North America shows steady growth supported by technological innovation, and Europe benefits from strict sustainability regulations and rapid renewable energy transitions.

- Emerging opportunities in Latin America and the Middle East & Africa are driven by expanding off-grid solar systems, increasing energy independence initiatives, and government-backed renewable energy projects.

Market Drivers

Rising Demand for Residential Solar Power Integration

The Single Phase Microinverter market experiences significant growth due to the increasing adoption of residential solar energy systems. Homeowners prefer microinverters because they enhance energy conversion efficiency and support panel-level optimization, making them ideal for smaller rooftop installations. It enables seamless integration of distributed solar generation into household grids while ensuring improved reliability and performance. Growing urbanization and rising electricity costs further encourage consumers to adopt efficient solar solutions. Governments are supporting clean energy projects through subsidies and tax incentives, creating a favorable ecosystem for product expansion. The rising preference for sustainable energy drives consistent investments in solar-based technologies.

- For instance, Enphase Energy shipped over 68 million microinverter units globally by 2023, powering more than 3.5 million residential solar systems with panel-level optimization.

Technological Advancements Enhancing Energy Efficiency

The market benefits from continuous innovations in inverter technology aimed at improving conversion efficiency and reducing operational losses. It allows users to maximize energy output by enabling independent functioning of each solar panel, which prevents power loss caused by shading or panel mismatches. Manufacturers are focusing on compact designs and advanced monitoring systems to provide real-time performance insights. Integration of AI-driven diagnostics and IoT-enabled solutions improves system reliability and simplifies maintenance. The trend toward adopting energy-efficient equipment drives investments in research and development. Growing emphasis on higher energy yields supports the adoption of advanced inverter architectures.

- For instance, Hoymiles launched its HMS series microinverters in 2022, achieving peak efficiencies of 96.7% while supporting up to 4 panels per device in distributed rooftop systems.

Supportive Government Policies and Renewable Energy Initiatives

Favorable regulatory frameworks accelerate the adoption of microinverters by encouraging renewable energy deployment. It benefits from net-metering policies, feed-in tariffs, and financial incentives offered to households and small businesses installing solar power systems. Governments in several regions are setting ambitious renewable energy targets, creating strong demand for efficient power conversion technologies. Manufacturers collaborate with energy agencies to develop solutions aligned with sustainability goals. Expanding renewable capacity worldwide pushes suppliers to innovate cost-effective, durable, and high-performing products. The policy-driven market structure supports long-term investments and technological upgrades.

Growing Shift Toward Decentralized Energy Generation

The rising focus on distributed energy resources drives a notable transformation in power generation models. It supports flexible and modular installations, making microinverters ideal for decentralized rooftop setups. Consumers are seeking energy independence by integrating small-scale solar systems for reduced reliance on traditional grids. Increasing adoption of electric vehicles and energy storage solutions further strengthens demand for efficient power management systems. Manufacturers are introducing scalable solutions to meet growing residential and commercial needs. The trend toward localized energy production creates lucrative opportunities for long-term market expansion.

Market Trends

Growing Integration of Smart Energy Management Systems

The Single Phase Microinverter market is witnessing an increased focus on integrating smart monitoring and control solutions. It enables users to track energy generation and consumption in real time through IoT-enabled platforms. Advanced data analytics tools support better performance optimization and faster fault detection, enhancing overall system efficiency. Manufacturers are embedding AI-powered algorithms to predict energy patterns and ensure maximum power utilization. The demand for intelligent microinverters is increasing among residential and small-scale commercial consumers seeking greater energy control. Rising consumer awareness about smart energy solutions drives wider adoption of connected technologies.

- For instance, Growatt supplied more than 2 million inverters across 180 countries, with its single-phase models supporting net-metered installations in Europe and Asia under regional solar subsidy programs.

Rising Preference for High-Efficiency and Compact Designs

Manufacturers are developing microinverters with improved efficiency, durability, and smaller form factors to meet evolving market demands. It enhances panel-level energy conversion by reducing losses caused by shading or mismatched panels. Compact architectures support easier installations and reduce maintenance complexity for residential and commercial users. High-efficiency designs are increasingly preferred to maximize power output in limited rooftop spaces. Integration of advanced cooling systems also improves long-term performance and product reliability. Continuous innovation in lightweight and space-saving technologies strengthens competitiveness among leading suppliers.

- For instance, APsystems deployed more than 3 GW of microinverter capacity worldwide, supporting decentralized solar adoption across over 120 countries.

Increasing Focus on Energy Storage Compatibility

The demand for hybrid energy systems is reshaping the design and functionality of microinverters. It supports seamless integration with energy storage units, enabling consumers to store excess solar power for later use. Manufacturers are introducing solutions compatible with lithium-ion and advanced battery technologies to improve energy flexibility. Rising adoption of electric vehicles further pushes the need for efficient solar-plus-storage systems. Flexible compatibility between solar panels, inverters, and storage batteries boosts consumer confidence in long-term investments. The trend toward self-sustained energy solutions accelerates demand for advanced storage-ready devices.

Expansion of Distributed and Grid-Independent Energy Models

Decentralized power generation models are influencing microinverter adoption across residential and commercial applications. It provides greater flexibility for managing rooftop solar installations and supports smooth integration into grid-independent systems. Consumers are increasingly seeking energy autonomy by relying on localized generation and storage solutions. Governments are promoting distributed energy frameworks to reduce grid dependency and ensure sustainable energy access. Emerging business models focused on peer-to-peer energy sharing are expanding the role of microinverters in energy distribution. This shift toward decentralization encourages product innovation and broader deployment across multiple regions.

Market Challenges Analysis

High Installation Costs and Complex System Integration

The Single Phase Microinverter market faces significant challenges due to the high upfront costs associated with installation and equipment procurement. It often requires more microinverters per system compared to traditional string inverters, which increases overall project expenses. Complex wiring and setup processes demand skilled technicians, creating additional labor costs for residential and small-scale users. Limited standardization across different manufacturers’ systems complicates integration and maintenance. Consumers with budget constraints often prefer cheaper alternatives, slowing adoption in certain regions. The need for cost-effective solutions continues to drive innovation in design and manufacturing processes.

Performance Limitations and Compatibility Issues

The market encounters challenges related to performance efficiency under extreme environmental conditions. It can be affected by overheating, voltage fluctuations, and panel mismatches, which reduce energy conversion efficiency over time. Compatibility with diverse panel technologies and energy storage systems also remains a concern for manufacturers and installers. Frequent technological upgrades in the solar industry require continuous redesigns, increasing development costs. Shorter product lifespans compared to centralized inverter systems pose reliability concerns among buyers. These performance and interoperability challenges influence purchasing decisions and limit widespread market penetration.

Market Opportunities

Growing Adoption of Residential Solar Power Solutions

The Single Phase Microinverter market presents significant opportunities driven by the rising demand for residential solar installations. It offers higher efficiency and panel-level optimization, making it suitable for households with limited rooftop space. Increasing awareness of sustainable energy solutions and supportive government policies encourage widespread adoption. Tax incentives, rebates, and financing schemes further enhance consumer affordability and accelerate market growth. The shift toward energy self-sufficiency creates strong demand for compact, durable, and high-performing systems. Expanding solar capacity worldwide continues to open new avenues for manufacturers and solution providers.

Integration with Energy Storage and Smart Technologies

The rising preference for energy independence creates opportunities for microinverters integrated with advanced storage and monitoring solutions. It supports seamless compatibility with battery systems, enabling efficient energy utilization and backup during outages. Manufacturers are developing smart-enabled devices with IoT connectivity and real-time performance tracking to enhance customer value. Growing adoption of electric vehicles boosts demand for solar-powered charging solutions, driving innovation in energy conversion technologies. Strategic partnerships between technology providers and utility companies are accelerating the deployment of integrated energy platforms. The convergence of storage, connectivity, and automation strengthens the long-term growth potential for market players.

Market Segmentation Analysis:

By Connectivity:

The Single Phase Microinverter market is segmented by connectivity into standalone and on-grid systems, each serving distinct energy needs. Standalone systems cater to areas with limited grid access, offering flexibility and independence for residential and small-scale commercial users. It enables consumers to generate and utilize solar energy without relying on centralized electricity supply. These systems are preferred in rural or remote locations where grid infrastructure is underdeveloped or unavailable. On-grid systems dominate the market due to their efficiency and ability to feed excess energy back into the main power grid. It supports net-metering policies and enhances cost savings, making them highly suitable for urban and suburban deployments where stable grid connectivity exists. The growing integration of smart energy platforms is further boosting the adoption of on-grid solutions among residential and small business users seeking seamless energy management.

- For instance, Tesla’s Powerwall systems integrated with microinverter-compatible solar setups achieved deployment in more than 500,000 homes globally, supporting efficient solar-plus-storage models.

By Application:

The market is classified into residential and commercial segments, with residential installations contributing significantly to overall demand. The rising adoption of rooftop solar systems in homes drives strong growth for this segment, supported by declining solar module prices and supportive government incentives. It allows homeowners to optimize energy output while ensuring panel-level performance monitoring and improved efficiency. Compact system design and ease of integration make microinverters ideal for small to medium-sized households with limited rooftop space. The commercial segment is also expanding steadily as businesses invest in renewable energy to reduce operational costs and meet sustainability targets. It supports scalable solar deployments across offices, retail facilities, and small enterprises seeking enhanced energy independence. Continuous advancements in monitoring systems and improved grid integration create further opportunities for both segments, driving market expansion globally.

- For instance, Chilicon Power microinverters have been deployed in over 25,000 residential systems in North America, supporting localized grid-independent solar generation.

Segments:

Based on Connectivity:

Based on Application:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 37.74% of the global Single Phase Microinverter market in 2024. The region leads due to strong residential solar adoption, advanced technological capabilities, and favorable policies such as net-metering and federal tax incentives. It benefits from the rising popularity of module-level power electronics, which enhance system efficiency and safety. The U.S. dominates the regional market, supported by increasing rooftop solar installations and integrated monitoring solutions. Canada contributes steadily with growing demand for standalone and hybrid installations in remote locations. It maintains a competitive edge with robust infrastructure, high innovation levels, and a strong focus on clean energy transition.

Asia Pacific

Asia Pacific holds the largest share at 43.6% in 2024, driven by rapid urbanization, strong government policies, and a growing shift toward renewable energy. China leads the region with large-scale manufacturing capacity, reducing production costs and boosting accessibility to affordable microinverters. It benefits from ambitious solar capacity expansion in India, Japan, and Australia, supported by subsidies and incentives. Rooftop solar deployment has increased significantly, especially in residential and small commercial applications. The region focuses on high-efficiency, durable, and adaptable technologies suitable for diverse climate conditions. It attracts strong investments from manufacturers and developers aiming to capitalize on the expanding energy infrastructure.

Europe

Europe secures a substantial position in the global market, holding an estimated 11.4% share in 2024. The region benefits from strict environmental regulations, growing renewable energy mandates, and strong consumer awareness. Germany, France, Italy, and the Netherlands lead in solar rooftop installations, driving the adoption of microinverters across residential and small commercial sectors. It focuses on maximizing energy efficiency, safety, and system monitoring capabilities. The integration of smart grids and decentralized power systems further supports market expansion. It continues to advance through supportive policies, sustainability targets, and the widespread use of high-performance solar technologies.

Latin America

Latin America represents a growing opportunity in the market with an approximate share of 4.2% in 2024. Countries like Brazil, Mexico, and Chile are experiencing rapid solar adoption due to high sunlight availability and rising electricity costs. It supports small-scale residential and commercial installations that demand reliable and cost-effective solutions. Microinverters appeal to the region due to their shading tolerance and scalable system design. The expansion of renewable energy programs and government-driven incentives further drives demand. It continues to strengthen as infrastructure improves and awareness of energy-efficient solutions rises.

Middle East and Africa

Middle East and Africa hold a combined market share of around 3% in 2024, with increasing adoption of off-grid and hybrid solar systems. The region benefits from high solar irradiance, making standalone microinverters a practical choice for energy generation in remote and rural areas. It is witnessing growing investments in renewable energy projects, particularly in the Gulf countries and South Africa. Rising demand for energy independence and decentralized power solutions drives adoption. Governments are promoting rural electrification programs, creating opportunities for microinverter suppliers. It shows strong potential for long-term growth as energy infrastructure continues to develop across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Fimer Group

- Sensata Technologies, Inc.

- LeadSolar Energy

- Hoymiles

- NingBo Deye Inverter Technology Co. Ltd.

- Enphase Energy

- Altenergy Power System Inc.

- TSUNESS Co., Ltd

- Growatt New Energy

- Sparq Systems

- Yotta Energy

- Chilicon Power, LLC

- SMA Solar Technology AG

- Darfon Electronics Corp

Competitive Analysis

The Single Phase Microinverter market features strong competition among leading players such as Fimer Group, Sensata Technologies, Inc., LeadSolar Energy, Hoymiles, NingBo Deye Inverter Technology Co. Ltd., Enphase Energy, Altenergy Power System Inc., TSUNESS Co., Ltd, Growatt New Energy, Sparq Systems, Yotta Energy, Chilicon Power, LLC, SMA Solar Technology AG, and Darfon Electronics Corp. These companies compete based on technological innovation, product efficiency, pricing strategies, and global reach.The market is driven by rising residential solar adoption, and players focus on developing high-efficiency, compact, and IoT-enabled microinverters to meet evolving customer demands. It emphasizes panel-level optimization, energy monitoring, and seamless integration with storage solutions. Several companies are expanding manufacturing capacities and strengthening distribution networks to meet increasing global demand. Partnerships with solar panel manufacturers and utility providers enhance market positioning. Continuous investment in research and development supports advancements in safety features, grid compatibility, and scalability. The competitive landscape remains dynamic, with established brands leveraging innovation to maintain dominance while emerging players focus on cost-effective solutions and regional expansion. Growing demand for smart, energy-efficient technologies continues to intensify competition among manufacturers.

Recent Developments

- In 2025, Fimer showcased its advanced photovoltaic solutions with McLaren Applied Group at Intersolar Europe, signaling a renewed strategic direction.

- In 2025, Enphase announced its financial results, reporting shipments of approximately 1.53 million microinverters and introducing its IQ Battery 5P with FlexPhase in key European markets

- In June 2024, Fimer introduced its new “Power” platform—PowerUNO, PowerTRIO (including the single-phase models), and PowerX storage system—at Intersolar 2024, highlighting simplified installation and energy monitoring capabilities; availability was slated for the second half of 2024

- In May 2023, Altenergy Power System Inc. introduced EZ1 Microinverter series with Wi-Fi & Bluetooth. It is a single-phase micro inverter addresses DIY PV and balcony systems and enables plug and play option with safe and reliable solutions. Furthermore, the product allows to connect solar systems with the mobile devices and operate it online. Therefore, the company will be able to showcase its capabilities and significantly drive the zero-carbon future.

Report Coverage

The research report offers an in-depth analysis based on Connectivity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Market growth will deepen in residential solar installations with increasing demand for panel-level optimization and efficiency.

- Developers will expand integration with energy storage systems to support energy independence and backup capabilities.

- Manufacturers will embed smart monitoring and IoT connectivity to enable real-time performance tracking and predictive maintenance.

- Innovation will target compact, high-efficiency designs suited to diverse rooftop form factors and varied climatic conditions.

- Companies will prioritize cost reduction through scale and manufacturing process optimization to enhance affordability.

- Microinverters will become essential components in smart grid ecosystems, improving grid resilience and distributed energy management.

- Adoption will rise in emerging markets driven by declining solar system costs and supportive regional renewable energy policies.

- Strategic partnerships with utilities, solar developers, and storage providers will drive broader product integration and market penetration.

- Expansion of electric vehicle charging infrastructure will increase demand for solar-plus-storage systems using microinverters.

- Regulatory emphasis on safety, system interoperability, and energy efficiency standards will foster further product refinement and market trust.