Market Overview

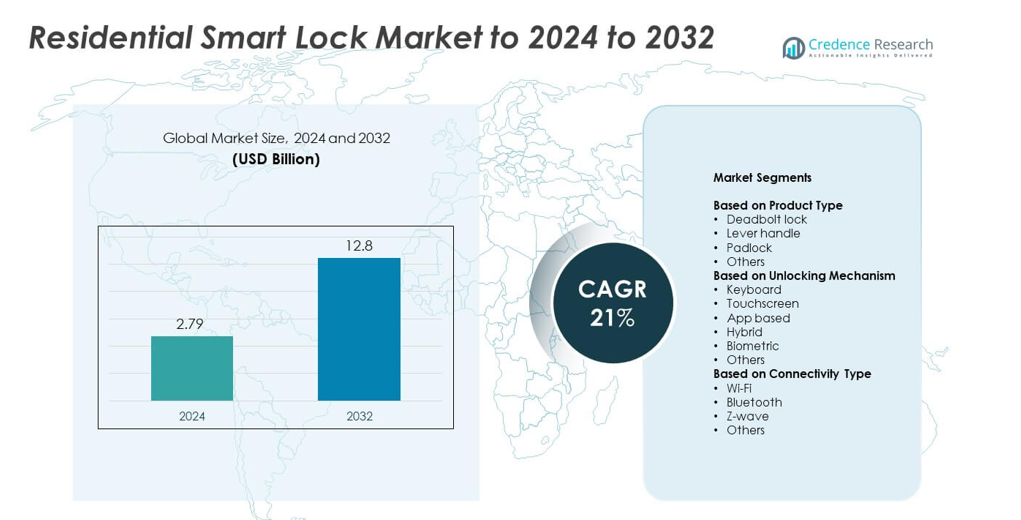

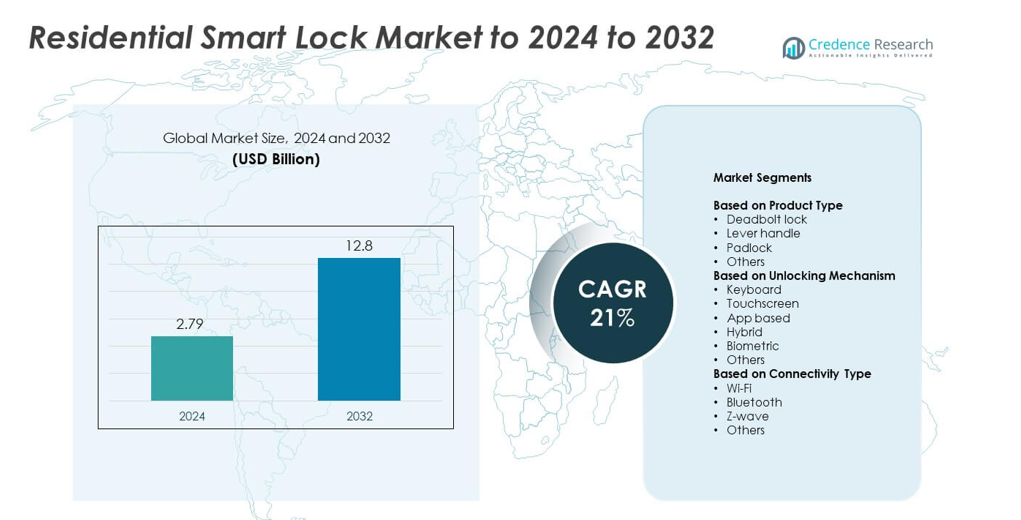

Residential Smart Lock Market size was valued at USD 2.79 Billion in 2024 and is anticipated to reach USD 12.8 Billion by 2032, at a CAGR of 21% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Residential Smart Lock Market Size 2024 |

USD 2.79 Billion |

| Residential Smart Lock Market, CAGR |

21% |

| Residential Smart Lock Market Size 2032 |

USD 12.8 Billion |

The Residential Smart Lock Market is led by companies such as Assa Abloy AB, Allegion Plc, Yale, August Home Inc., Samsung Electronics Co. Ltd., and Honeywell International Inc. These players focus on integrating AI, biometrics, and IoT connectivity to enhance product functionality and user convenience. Innovations in Wi-Fi and Bluetooth-enabled locks are driving competitive differentiation, supported by strategic partnerships with smart home ecosystem providers. North America dominated the market in 2024 with a 38% share, driven by high smart home adoption and advanced infrastructure, while Asia Pacific is emerging rapidly due to rising urbanization and affordable smart technologies.

Market Insights

- The Residential Smart Lock Market was valued at USD 2.79 Billion in 2024 and is projected to reach USD 12.8 Billion by 2032, growing at a CAGR of 21%.

- Rising smart home adoption and growing security awareness are driving demand for advanced smart lock systems across residential spaces.

- App-based unlocking and Wi-Fi connectivity trends are gaining momentum, supported by AI and biometric integration for improved access control.

- The market is highly competitive, with major players focusing on innovation, product diversification, and partnerships with smart home ecosystem providers.

- North America held a 38% share in 2024, followed by Europe at 27% and Asia Pacific at 25%, while the deadbolt lock segment led globally with 46% share, supported by widespread installation in modern and retrofit housing projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Deadbolt locks dominated the residential smart lock market in 2024 with a 46% share. Their robust structure, easy installation, and compatibility with existing door setups make them the preferred choice for homeowners. Increasing integration of Wi-Fi and biometric features in smart deadbolts enhances both convenience and security. Lever handle and padlock types are also gaining traction due to smart home expansion and rental property applications. The growing consumer demand for reliable and tamper-proof home security systems continues to drive adoption of advanced deadbolt smart locks globally.

- For instance, Nuki reports 300,000+ Smart Locks in use and 560,000+ active users

By Unlocking Mechanism

App-based unlocking mechanisms held the largest share at 38% in 2024. These systems enable remote access, activity monitoring, and integration with digital assistants like Alexa and Google Home. Growing smartphone penetration and preference for app-controlled home automation drive this segment’s growth. Biometric and hybrid mechanisms are also expanding as consumers seek higher security and touchless access. The demand for convenience, coupled with enhanced cybersecurity and encryption standards, further strengthens the adoption of app-based smart lock technologies in modern residential settings.

- For instance, Schlage Encode lets you manage up to 100 access codes per lock.

By Connectivity Type

Wi-Fi-based smart locks accounted for a 41% share in 2024, emerging as the dominant connectivity segment. Their ability to support real-time remote management, access history tracking, and multi-user control boosts demand among homeowners. Integration with cloud-based smart home ecosystems allows seamless operation with voice assistants and security cameras. Bluetooth and Z-wave segments are growing steadily due to their low-power consumption and local connectivity advantages. Rising adoption of connected home solutions and strong emphasis on security automation are driving the expansion of Wi-Fi-enabled smart lock systems.

Key Growth Drivers

Rising Smart Home Adoption

The growing penetration of smart home technologies is a major driver for residential smart locks. Increasing consumer preference for automation and IoT-based devices enhances security, comfort, and remote accessibility. Integration with voice assistants and home ecosystems such as Alexa, Google Home, and Apple HomeKit accelerates adoption. As urban populations expand, smart locks are becoming essential components of modern housing projects, supported by the rising number of tech-savvy homeowners seeking advanced digital security solutions.

- For instance, Aqara reported having more than 12 million users worldwide as of February 2024

Increasing Security Awareness

Heightened awareness regarding home safety and the limitations of traditional locks fuel smart lock adoption. Advanced authentication options like biometrics and mobile app controls provide superior protection against unauthorized access. Smart locks with real-time alerts, audit trails, and encryption-based access management enhance security confidence. Growing incidents of break-ins and thefts in urban areas push households to upgrade to smart locking systems offering tamper detection and emergency override features.

- For instance, Eufy smart locks recognize a fingerprint in 0.3 seconds and unlock in ~1 second.

Technological Advancements in Connectivity

Ongoing innovations in Wi-Fi, Bluetooth, and cloud connectivity are strengthening market growth. Enhanced interoperability among smart home devices enables users to control multiple systems through a single interface. Manufacturers are focusing on longer battery life, remote diagnostics, and firmware updates through cloud platforms. The rise of 5G and edge computing also facilitates faster data transmission, ensuring seamless operation and improved user experience. These advancements are transforming smart locks into highly connected, intelligent security solutions.

Key Trends & Opportunities

Integration with AI and Biometrics

Artificial intelligence and biometric authentication are transforming smart lock functionality. AI enables predictive access control, while biometrics like fingerprint or facial recognition enhance personalization and safety. These technologies reduce dependency on physical keys and prevent data breaches. As demand for intelligent home ecosystems grows, AI-powered smart locks are being increasingly integrated into connected platforms to offer real-time monitoring and behavior-based access customization.

- For instance, Eufy FamiLock S3 Max carries ANSI Grade 1, supports palm-vein biometrics, and stores up to 100 PIN codes.

Expansion of Cloud and App-Based Ecosystems

Cloud connectivity and app-based access are opening new opportunities for service-based smart lock models. Users can remotely control, monitor, and share access credentials securely via mobile applications. The growth of subscription-based models for maintenance and software upgrades strengthens recurring revenue for manufacturers. Integration with home security systems, surveillance, and IoT-enabled devices further enhances operational flexibility and system intelligence.

- For instance, Lockly’s access-code capacity varies by model and firmware. The company lists model limits of 33, 37, 49, or up to 999 codes. The Vision Elite manual specifies 33 codes, while some models are listed with 49 codes.

Rising Demand in Multi-Family Residences

Urbanization and the rise in apartment complexes are driving smart lock installations in multi-dwelling units. Property managers benefit from centralized access control and tenant management features. Cloud-based access sharing, time-bound entry codes, and contactless unlocking support modern rental operations. This trend aligns with the increasing use of property automation systems and energy-efficient infrastructure in smart housing projects.

Key Challenges

High Installation and Product Costs

Despite technological benefits, the high initial cost of smart locks limits adoption in price-sensitive markets. Integration with existing doors, Wi-Fi modules, and professional installation adds to expenses. Consumers in developing regions often prefer traditional locks due to affordability. Manufacturers are addressing this challenge by introducing cost-effective models and expanding DIY-friendly products, but cost remains a major barrier for widespread adoption.

Data Privacy and Cybersecurity Concerns

Smart locks connected via Wi-Fi or Bluetooth face risks of hacking and data breaches. Unauthorized access or manipulation of connected devices raises privacy concerns among consumers. Weak encryption or outdated firmware increases vulnerability to cyberattacks. Addressing this challenge requires continuous software updates, stronger encryption algorithms, and multi-layer authentication. Ensuring user trust through transparent data policies and robust cybersecurity standards remains critical for long-term market growth.

Regional Analysis

North America

North America dominated the residential smart lock market in 2024 with a 38% share. The region’s leadership stems from strong smart home adoption, high disposable income, and widespread integration of IoT-based security devices. The United States accounts for the majority of demand, driven by growing preference for app-controlled and Wi-Fi-enabled locks. Major players such as August, Schlage, and Yale strengthen their market presence through advanced connectivity and voice-assistant integrations. The increasing need for secure and automated access systems across single-family and multi-unit residences continues to drive consistent market expansion.

Europe

Europe held a 27% share of the residential smart lock market in 2024. Growth is supported by rising adoption of home automation, data security standards, and energy-efficient smart housing. The United Kingdom, Germany, and France lead the regional demand, driven by strong smart home penetration and retrofit installations. Government initiatives promoting smart living technologies further boost adoption. European consumers show a strong preference for hybrid and biometric smart locks with enhanced encryption and user privacy features. Collaborations among technology firms and door manufacturers are helping standardize product reliability and performance across the region.

Asia Pacific

Asia Pacific accounted for a 25% share of the global residential smart lock market in 2024. Rapid urbanization, expanding middle-class populations, and increased smartphone usage are fueling growth. China, Japan, and South Korea dominate the market due to fast-paced adoption of connected home technologies. Local manufacturers such as Xiaomi, Samsung, and Panasonic are introducing affordable and AI-integrated products. Growing awareness of home security and government-backed smart city projects further accelerate market development. Rising e-commerce availability and digital payment adoption are also contributing to faster regional deployment of smart locking systems.

Middle East & Africa

The Middle East and Africa region represented a 6% share of the residential smart lock market in 2024. The market benefits from increasing investment in smart infrastructure and luxury housing developments, especially in the UAE and Saudi Arabia. Growing demand for contactless access systems in high-end apartments and villas supports product adoption. Integration with building management systems enhances convenience and security. However, high installation costs and limited consumer awareness in some African countries restrict growth. Continuous digital transformation initiatives across GCC nations are expected to improve adoption over the forecast period.

Latin America

Latin America captured a 4% share of the residential smart lock market in 2024. The region’s growth is driven by rising security awareness, smartphone adoption, and expansion of connected home ecosystems. Brazil and Mexico are key markets where increasing smart city initiatives and retail availability of smart devices stimulate demand. Affordability remains a challenge, but emerging local brands and online distribution are helping bridge the gap. As digital lifestyles expand, consumers increasingly prefer app-based and Bluetooth-enabled locks for convenience, boosting gradual adoption across residential properties in major urban centers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type

- Deadbolt lock

- Lever handle

- Padlock

- Others

By Unlocking Mechanism

- Keyboard

- Touchscreen

- App based

- Hybrid

- Biometric

- Others

By Connectivity Type

- Wi-Fi

- Bluetooth

- Z-wave

- Others

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The residential smart lock market is highly competitive, with leading players such as Assa Abloy AB, Allegion Plc, Yale, August Home Inc., Samsung Electronics Co. Ltd., Xiaomi Corporation, Honeywell International Inc., Spectrum Brands, Inc., Onity Inc., Salto Systems S.L., Gantner Electronic GmbH, ZKTeco USA, Kwikset, Avent Security, HavenLock Inc., Amadas Inc., Megadoorlock Technology Co., Ltd., and Nord-Lock International AB. The competition is driven by continuous innovation, product diversification, and integration with smart home ecosystems. Companies are focusing on Wi-Fi and Bluetooth-enabled designs to enhance connectivity and user convenience. Emphasis on AI-driven security, biometric access, and voice control integration is shaping product differentiation. Manufacturers are expanding distribution networks through online platforms and home automation partnerships to reach broader consumer bases. Strategic collaborations, R&D investments, and focus on cybersecurity are key to maintaining brand loyalty. Global players are also strengthening regional production and after-sales service capabilities to enhance market presence.

Key Player Analysis

- Assa Abloy AB

- Allegion Plc

- Yale

- August Home Inc.

- Xiaomi Corporation

- Honeywell International Inc.

- Spectrum Brands, Inc.

- Onity Inc.

- Salto Systems S.L.

- Gantner Electronic GmbH

- ZKTeco USA

- Kwikset

- Avent Security

- HavenLock Inc.

- Amadas Inc.

- Megadoorlock Technology Co., Ltd.

- Nord-Lock International AB

Recent Developments

- In 2025, Kwikset Presented new smart locks at CES 2025 in Las Vegas, showcasing ongoing innovation and commitment to the residential market.

- In 2024, Yale launched the Approach Lock, a retrofit smart lock designed for easy installation with just a screwdriver.

- In 2023, HavenLock Inc. released a PowerG version of its smart locking system, designed for commercial and school environments

Report Coverage

The research report offers an in-depth analysis based on Product Type, Unlocking Mechanism, Connectivity Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to expand with growing adoption of smart home technologies.

- Integration of AI and biometrics will enhance personalized and secure access solutions.

- Cloud-based and app-controlled systems will dominate future installations.

- Affordable product lines will increase adoption in emerging economies.

- Partnerships between lock manufacturers and home automation firms will strengthen market reach.

- Enhanced cybersecurity measures will improve consumer trust and reliability.

- Demand for energy-efficient and connected housing projects will boost product deployment.

- Multi-family housing developments will increasingly adopt centralized access management systems.

- Voice-controlled and 5G-enabled locks will redefine user convenience and automation.

- Continuous innovation in design and connectivity will shape long-term market competitiveness.