Market Overview:

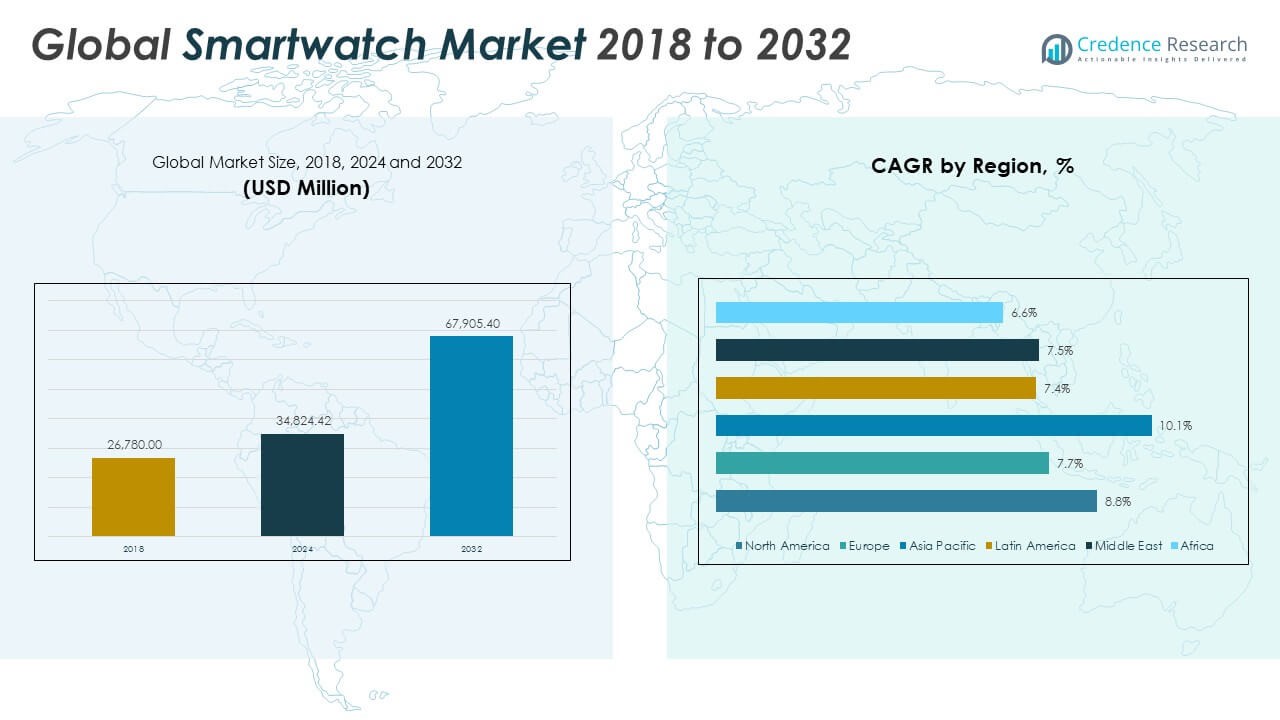

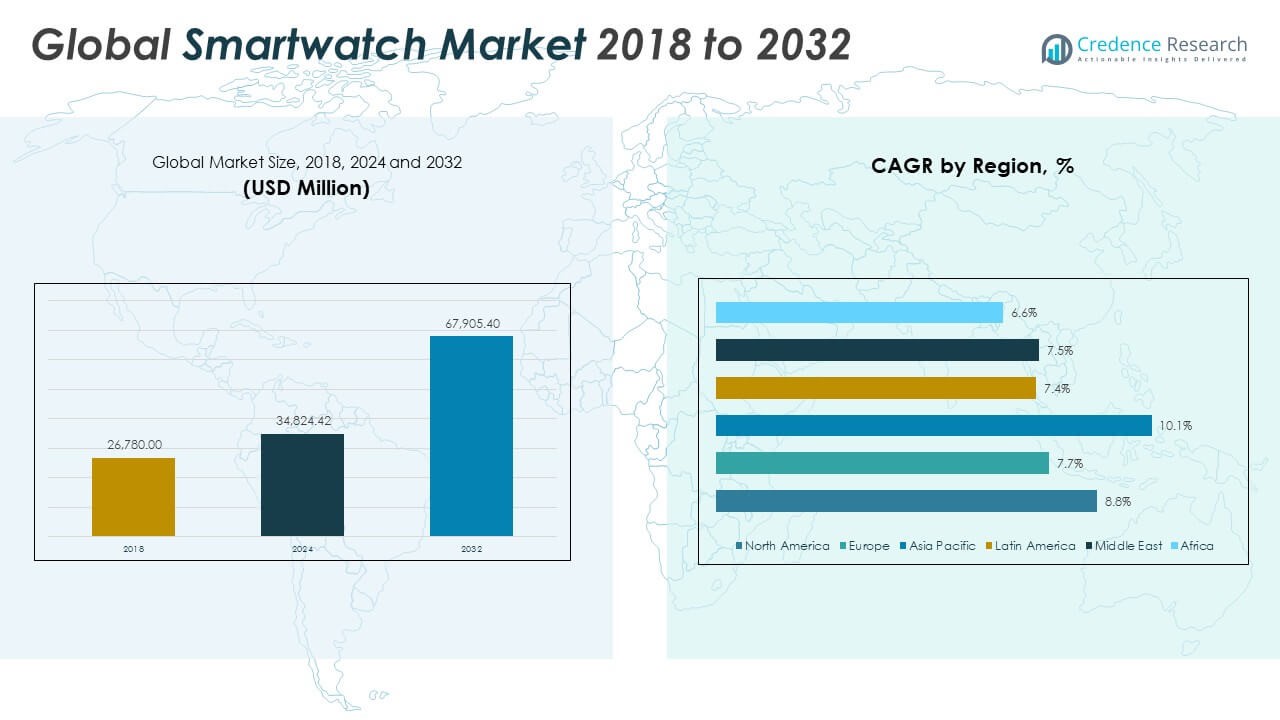

The Global Smartwatch Market size was valued at USD 26,780.00 million in 2018 to USD 34,824.42 million in 2024 and is anticipated to reach USD 67,905.40 million by 2032, at a CAGR of 8.78% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smartwatch Market Size 2024 |

USD 34,824.42 Million |

| Smartwatch Market, CAGR |

8.78% |

| Smartwatch Market Size 2032 |

USD 67,905.40 Million |

The market is primarily driven by rising demand for health and wellness monitoring, which has elevated the smartwatch from a lifestyle gadget to a core health companion. Smartwatches now offer capabilities such as heart rate tracking, ECG recording, blood oxygen sensing, stress analysis, and sleep monitoring. Several models have received medical-grade certification and regulatory clearance, making them suitable for chronic disease management and early detection. Improvements in semiconductor technology, AI algorithms, and compact sensors have enhanced device performance, accuracy, and battery efficiency. AI-based features such as personalized coaching, automated alerts, and voice interactions are also enhancing user experience. Furthermore, the convenience of synchronizing notifications, calls, messages, and apps from smartphones contributes to increased everyday use. As consumers embrace digital health, fitness routines, and connected living, smartwatches are becoming an integral part of daily life across both consumer and professional segments.

Geographically, North America continues to lead the market in terms of revenue, supported by a strong base of premium smartwatch users, advanced healthcare infrastructure, and widespread adoption of digital technologies. Europe also contributes significantly, with steady demand for both functional and fashion-driven wearables. Asia-Pacific represents the fastest-growing region by shipment volume, led by China, which recorded notable year-on-year gains in early 2025. Domestic brands such as Huawei and Xiaomi have significantly expanded their user base through competitively priced models with advanced features. Latin America and the Middle East & Africa are emerging as promising markets, driven by growing urbanization, rising health awareness, and increasing availability of mid-range smartwatch offerings. While high-end models dominate developed economies, mid- and low-tier segments are gaining momentum in emerging regions, offering manufacturers multiple growth avenues across global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Smartwatch Market was valued at USD 26,780.00 million in 2018, reached USD 34,824.42 million in 2024, and is projected to reach USD 67,905.40 million by 2032, growing at a CAGR of 8.78% during the forecast period.

- The market is driven by rising demand for health monitoring features including heart rate tracking, ECG, blood oxygen sensing, stress analysis, and sleep monitoring, making smartwatches critical tools in chronic disease management.

- Technological advancements in semiconductors, compact sensors, and AI have enhanced smartwatch performance, enabling faster processing speeds, longer battery life, and real-time predictive health alerts.

- Strong demand for smartphone integration is boosting adoption as users benefit from calls, texts, navigation, music playback, contactless payments, and voice control directly from their smartwatch.

- Fashion-focused innovations including customizable watch faces, interchangeable bands, and luxury brand collaborations are driving demand among users seeking a blend of style and functionality.

- Price sensitivity in regions like Latin America, Southeast Asia, and Africa is limiting high-end adoption; mid- and low-tier smartwatches are gaining traction with retail prices under USD 150–200.

- Asia-Pacific is the fastest-growing region by shipment volume, led by China, where brands like Huawei and Xiaomi have expanded significantly through advanced feature sets at price points below USD 100–150.

Market Drivers:

Rising Focus on Health Monitoring and Preventive Wellness:

One of the most significant drivers of the Global Smartwatch Market is the increasing consumer focus on health monitoring and preventive care. Consumers are seeking devices that can track vital health parameters such as heart rate, blood oxygen levels, ECG, sleep patterns, and stress indicators. Many smartwatch models now support medical-grade features and have received regulatory clearance for health applications. This has made them valuable tools for managing chronic conditions, detecting irregularities early, and promoting fitness goals. The growing adoption of healthy lifestyles and personalized wellness routines further fuels demand for advanced smartwatches. It has become common for individuals to rely on these devices for continuous health insights throughout the day.

- For instance, the Apple Watch can measure heart rate, respiratory rate, wrist temperature, blood oxygen saturation (SpO2), and sleep duration, and it provides high and low heart rate notifications, irregular rhythm alerts, and an ECG app that can help detect atrial fibrillation. Similarly, the Fitbit Sense offers on-wrist ECG, blood oxygen monitoring, and the first electrodermal activity (EDA) sensor for stress management, along with heart rate variability and skin temperature tracking.

Advancements in Semiconductor, Sensor, and AI Technology:

The integration of improved semiconductor components, compact sensors, and artificial intelligence has played a crucial role in advancing smartwatch functionality. These technological upgrades have allowed manufacturers to offer devices with better accuracy, faster processing speeds, and extended battery life. AI capabilities now enable features such as predictive health alerts, real-time feedback, and intelligent voice assistance. Compact sensor designs support more lightweight and comfortable form factors without sacrificing functionality. The Global Smartwatch Market benefits from these innovations by offering users an efficient and highly responsive wearable experience. It continues to evolve with faster chips, thinner displays, and smarter interfaces.

- For instance, Qualcomm’s Snapdragon Wear 4100+ platform, built on a 12-nm process, enables up to 64K color displays, faster tilt-to-wake responsiveness, and up to 15 hours of continuous GPS and heart rate monitoring, while reducing GPS power consumption by 50% and keyword detection by 43% compared to previous generations.

Strong Demand for Smartphone Integration and Digital Convenience:

The ability to pair seamlessly with smartphones and perform essential tasks independently has made smartwatches increasingly attractive. Users value the convenience of receiving calls, texts, calendar alerts, and navigation on their wrist, especially during exercise or commuting. Features such as contactless payments, music playback, and voice control strengthen the smartwatch’s role as a versatile companion device. It allows users to stay connected while reducing dependency on their phones. This demand for digital convenience and multitasking is particularly strong among working professionals, fitness enthusiasts, and tech-savvy consumers. The Global Smartwatch Market continues to grow as manufacturers enhance compatibility across operating systems and introduce more standalone functions.

Shift Toward Lifestyle Personalization and Fashion-Tech Appeal:

Smartwatches are no longer viewed only as fitness tools but also as lifestyle and fashion accessories. Consumers seek customizable watch faces, interchangeable bands, and slim profiles that match personal style preferences. Brands are responding with a wide range of designs that combine performance and aesthetics. It enables users to wear their devices comfortably in casual, business, and formal settings. Luxury fashion brands are also entering the market, creating premium collaborations that attract a wider audience. This fusion of technology and personal expression is expanding the user base and further propelling demand in the Global Smartwatch Market.

Market Trends:

Integration of Satellite Connectivity and Emergency Communication Features:

A key trend gaining momentum in the Global Smartwatch Market is the integration of satellite connectivity for emergency communication. Brands are now embedding satellite-based SOS messaging and location sharing into smartwatches to improve user safety in remote or disconnected areas. This feature appeals to outdoor adventurers, travellers, and professionals operating in unpredictable environments. Satellite capabilities enable communication in places without cellular coverage, expanding the smartwatch’s utility beyond fitness and lifestyle use cases. It transforms the device into a critical safety tool for users in off-grid or high-risk locations. The Global Smartwatch Market is embracing this shift as brands differentiate with robust emergency response and navigation capabilities.

- For instance, Garmin smartwatches offer multi-band satellite systems, including GPS, GLONASS, and Galileo, and feature SatIQ™ technology for dynamic selection of the best satellite system, improving positioning accuracy and enabling SOS features for users in challenging environments.

Growth of Subscription-Based Services and Ecosystem Lock-In:

Smartwatch manufacturers are increasingly introducing subscription-based services to build recurring revenue and deepen user engagement. These services often include personalized fitness coaching, advanced health analytics, guided meditation, and exclusive content. It encourages consumers to remain within a brand’s ecosystem by offering continual value beyond the hardware. Apple, Samsung, Fitbit, and others are investing heavily in software platforms that pair with their devices to enhance loyalty and retention. This trend is shaping purchasing decisions, as users evaluate the long-term service value rather than just device specifications. The Global Smartwatch Market is moving toward an ecosystem-driven model that prioritizes engagement and monetization through bundled services.

- For instance, Apple Fitness+ service offers guided workouts and personalized health insights, which are tightly integrated with the Apple Watch and iOS ecosystem, while Fitbit Premium provides advanced analytics, wellness reports, and stress management tools, driving higher user engagement and retention.

Expansion of Child-Friendly and Senior-Centric Smartwatches:

Manufacturers are now developing smartwatches tailored specifically for children and older adults. These devices focus on features such as real-time GPS tracking, geofencing, simplified interfaces, and emergency calling. It allows parents and caregivers to monitor and communicate with dependents easily while promoting digital independence. Senior-centric models often include fall detection, medication reminders, and large displays to address aging-related needs. These demographic-specific products represent a growing subsegment within the Global Smartwatch Market, driven by family safety concerns and aging populations. It broadens the customer base and opens new growth channels for brands focused on accessibility and care support.

Rise of Sustainable Materials and Circular Design Approaches:

Sustainability has emerged as a critical trend in smartwatch design and production. Brands are incorporating recycled metals, bioplastics, and low-impact packaging to appeal to environmentally conscious consumers. Circular design approaches, including modular components and repairability, are gaining traction as users demand more responsible product lifecycles. It reflects a shift toward ethical manufacturing practices and long-term durability over frequent replacements. Some companies are also offering trade-in programs and second-life initiatives to reduce electronic waste. The Global Smartwatch Market is responding to regulatory pressures and consumer expectations by aligning with sustainability standards in materials and production processes.

Market Challenges Analysis:

High Price Sensitivity and Limited Affordability Across Price-Conscious Markets:

One of the major challenges facing the Global Smartwatch Market is the high price sensitivity in emerging and price-conscious regions. Premium smartwatches from established brands often come with high retail prices, making them inaccessible to a large segment of potential users. This creates a barrier to adoption in markets where disposable incomes remain limited or purchasing decisions are driven by necessity over lifestyle. Budget-conscious consumers may opt for basic fitness bands or unbranded alternatives that offer limited functionality but at a lower cost. It restricts market penetration in countries where affordability plays a decisive role in technology purchases. The Global Smartwatch Market must address this gap through localized pricing, cost-effective models, and flexible financing options to maintain consistent growth momentum.

Short Product Lifecycles and Growing Electronic Waste Concerns:

The rapid pace of technological updates and feature enhancements has led to shorter product lifecycles, creating environmental and logistical challenges. Frequent model releases pressure consumers to upgrade regularly, contributing to increased electronic waste and disposal issues. Smartwatches often lack modularity or repairability, making them difficult to refurbish or recycle efficiently. It raises sustainability concerns and exposes manufacturers to regulatory scrutiny over product end-of-life practices. Brands must strike a balance between innovation and long-term usability to address growing demands for sustainable consumption. The Global Smartwatch Market faces mounting pressure to adopt circular design principles and improve product longevity to align with evolving consumer and environmental expectations.

Market Opportunities:

Expansion into Untapped Demographics and Emerging Economies:

The Global Smartwatch Market holds strong growth potential in untapped consumer segments such as children, seniors, and first-time wearable users in emerging economies. Demand is rising for age-specific models that offer simplified interfaces, safety features, and wellness monitoring tailored to distinct needs. Manufacturers have an opportunity to develop localized offerings that address regional affordability, language preferences, and cultural usage patterns. It allows brands to diversify product portfolios and reach a broader customer base beyond traditional tech-savvy users. Government-led digital health initiatives and increasing smartphone penetration further support expansion into developing regions. The Global Smartwatch Market can leverage these factors to unlock new adoption cycles and increase market share.

Integration with Healthcare, Insurance, and Enterprise Applications:

Smartwatches are gaining strategic relevance in healthcare, insurance, and enterprise ecosystems. Opportunities exist to partner with healthcare providers for remote patient monitoring, chronic disease tracking, and post-surgical recovery support. Insurance firms are exploring smartwatch-based wellness programs that incentivize physical activity through premium discounts. Enterprises are adopting wearables for employee safety, productivity tracking, and biometric access control. It creates pathways for B2B growth and long-term service revenue beyond direct-to-consumer sales. The Global Smartwatch Market stands to benefit by aligning with institutional needs and integrating into critical business and health infrastructures.

Market Segmentation Analysis:

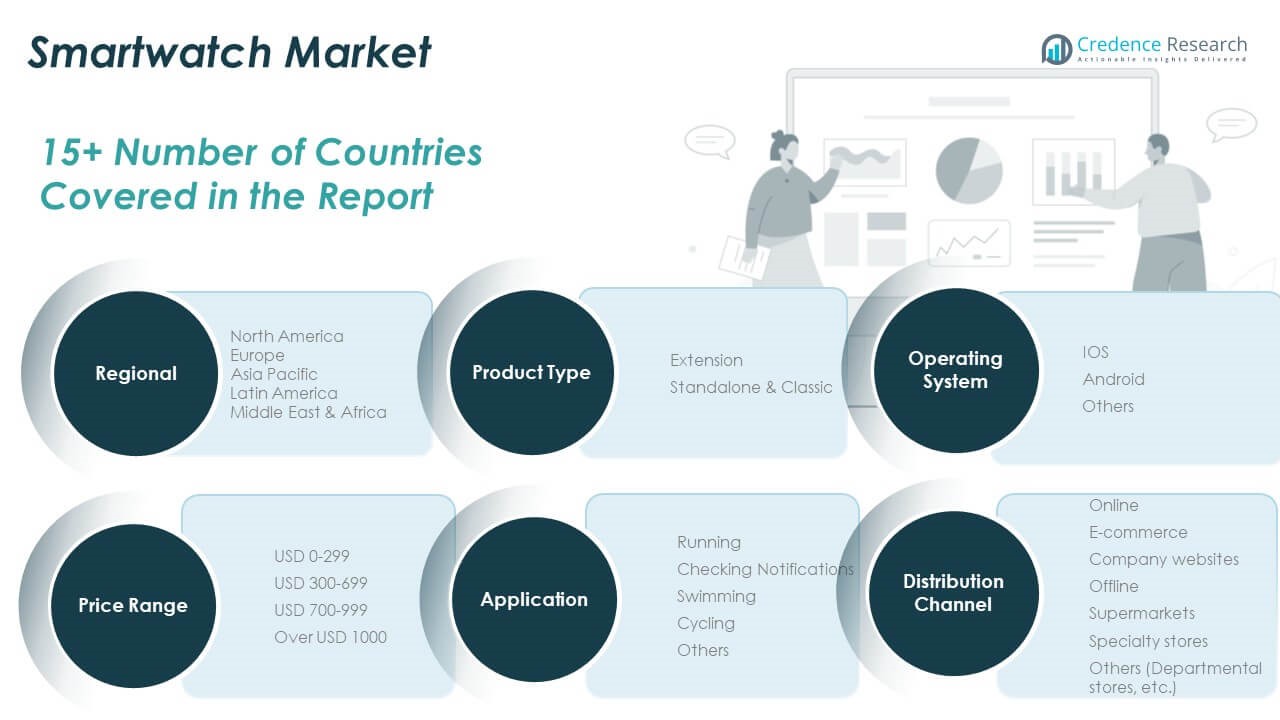

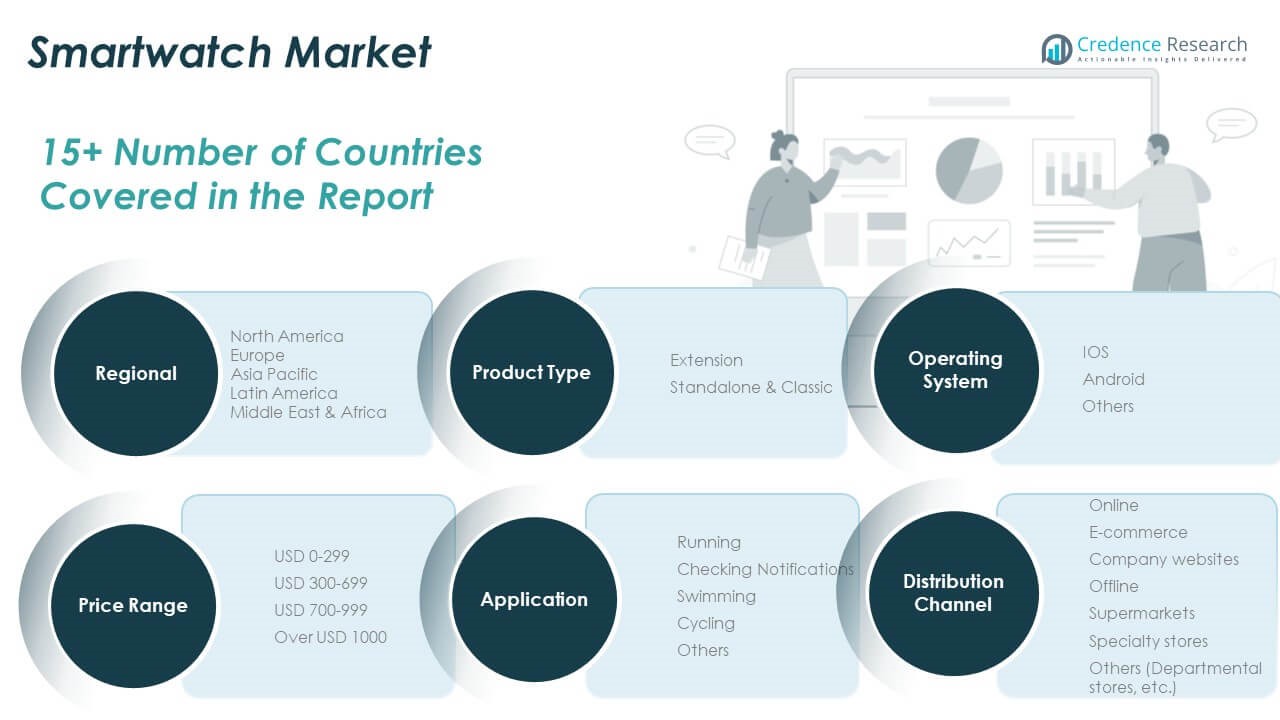

By Product Type

The market is categorized into Extension and Standalone & Classic smartwatches. Standalone & Classic models hold a dominant position due to their ability to operate independently with features like LTE connectivity, app usage, and music streaming. Extension models remain relevant among budget-conscious users seeking essential functions without high cost.

- For instance, Samsung’s Galaxy Watch series supports standalone LTE connectivity, allowing users to make calls, stream music, and use apps independently of their smartphones, which has contributed to their popularity among users seeking full-featured wearables.

By Operating System

The operating system segment includes iOS, Android, and Others. iOS leads in terms of revenue share, supported by strong brand loyalty and seamless integration within Apple’s ecosystem. Android-based smartwatches offer wider brand options and price flexibility, attracting a broad user base. Other platforms maintain limited presence, serving select markets.

- For instance, Wear OS by Google powers a variety of smartwatches from brands such as Fossil, Mobvoi, Montblanc, Xiaomi, OnePlus, and Samsung, offering flexibility and compatibility with Android devices.

By Price Range

Smartwatches are segmented into USD 0–299, USD 300–699, USD 700–999, and Over USD 1000. The USD 300–699 range drives the highest demand by offering advanced capabilities at mid-range prices. High-end models above USD 700 appeal to consumers prioritizing premium design and comprehensive health features.

By Application

Key applications include Running, Checking Notifications, Swimming, Cycling, and Others. Running and notification-checking dominate daily usage, while swimming and cycling are preferred by fitness-oriented consumers. Broader applications are emerging in health and productivity tracking.

By Distribution Channel

The market is divided into Online and Offline channels. E-commerce and Company Websites under the online segment are expanding reach with ease of access and frequent promotions. Offline channels, including Supermarkets, Specialty Stores, and Departmental Stores, support in-person experience and brand discovery.

Segmentation:

By Product Type

- Extension

- Standalone & Classic

By Operating System

By Price Range

- USD 0–299

- USD 300–699

- USD 700–999

- Over USD 1000

By Application

- Running

- Checking Notifications

- Swimming

- Cycling

- Others

By Distribution Channel

- Online

- E-commerce

- Company Websites

- Offline

- Supermarkets

- Specialty Stores

- Others (Departmental Stores, etc.)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Smartwatch Market size was valued at USD 11,933.17 million in 2018 to USD 15,364.32 million in 2024 and is anticipated to reach USD 29,926.03 million by 2032, at a CAGR of 8.8% during the forecast period. North America accounts for the largest share of the Global Smartwatch Market, driven by a high concentration of premium users, early technology adoption, and strong brand presence. The region benefits from robust healthcare infrastructure, rising awareness of digital health, and integration with fitness platforms. Leading companies like Apple and Fitbit have cemented their dominance by offering feature-rich models aligned with consumer expectations. Demand continues to grow across both consumer and enterprise applications, including health monitoring, productivity tracking, and communication. Retail and e-commerce channels maintain a balanced distribution mix, supporting consistent market growth.

Europe

The Europe Smartwatch Market size was valued at USD 5,023.93 million in 2018 to USD 6,176.90 million in 2024 and is anticipated to reach USD 11,092.53 million by 2032, at a CAGR of 7.7% during the forecast period. Europe holds the second-largest share in the Global Smartwatch Market, supported by growing demand for hybrid smartwatches, connected healthcare, and lifestyle wearables. Consumers in major economies such as Germany, the UK, and France value both functionality and design. The region is witnessing rising adoption of wearables for sleep analysis, stress tracking, and chronic disease monitoring. Regulatory support for digital health innovation is encouraging smartwatch usage in preventive care. Fashion-tech collaborations also enhance appeal among urban professionals and younger demographics.

Asia Pacific

The Asia Pacific Smartwatch Market size was valued at USD 6,874.43 million in 2018 to USD 9,317.13 million in 2024 and is anticipated to reach USD 19,964.24 million by 2032, at a CAGR of 10.1% during the forecast period. Asia Pacific represents the fastest-growing region in the Global Smartwatch Market, led by countries like China, India, South Korea, and Japan. Affordable models from Xiaomi, Huawei, and other regional brands are capturing mass-market demand. Rising disposable incomes, urbanization, and smartphone penetration are key contributors to growth. Consumer interest in health tracking, sports features, and digital connectivity is expanding rapidly. The youth population is highly engaged with fitness tech, driving high-volume sales through online channels.

Latin America

The Latin America Smartwatch Market size was valued at USD 1,226.52 million in 2018 to USD 1,573.72 million in 2024 and is anticipated to reach USD 2,761.71 million by 2032, at a CAGR of 7.4% during the forecast period. Latin America is an emerging market in the Global Smartwatch Market, driven by growing health awareness and increasing tech adoption in urban centers. Countries such as Brazil and Mexico lead regional sales, supported by mid-range offerings and expanding digital infrastructure. Consumers are embracing smartwatches for fitness tracking and communication, with affordability playing a critical role in purchasing behavior. Localized marketing strategies and e-commerce platforms are helping brands gain visibility. Market penetration remains moderate but shows strong upward momentum.

Middle East

The Middle East Smartwatch Market size was valued at USD 1,049.78 million in 2018 to USD 1,281.31 million in 2024 and is anticipated to reach USD 2,261.62 million by 2032, at a CAGR of 7.5% during the forecast period. The region contributes a growing share to the Global Smartwatch Market, with demand rising across the UAE, Saudi Arabia, and Israel. Consumers are adopting smartwatches for both personal health monitoring and productivity enhancement. Interest in luxury and fashion-tech combinations is strong, especially in affluent urban segments. Online retail platforms are playing a central role in product accessibility. Brands are targeting high-income users with premium models, while mid-tier offerings expand reach among younger demographics.

Africa

The Africa Smartwatch Market size was valued at USD 672.18 million in 2018 to USD 1,111.04 million in 2024 and is anticipated to reach USD 1,899.26 million by 2032, at a CAGR of 6.6% during the forecast period. Africa represents a nascent but expanding opportunity in the Global Smartwatch Market. Growth is supported by increasing mobile connectivity, health awareness, and urbanization in key economies such as South Africa, Nigeria, and Egypt. Consumers show interest in basic fitness features and smartphone pairing at accessible price points. Affordability and distribution remain challenges, but progress in digital retail and local partnerships is improving availability. The market is expected to grow steadily as wearable technology becomes more affordable and visible in regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Apple

- ASUS

- Fitbit

- Fossil

- Garmin

- Google

- Huawei

- Michael Kors

- Motorola

- Polar

- Samsung

- Sony

- TomTom

- Virtual-Realties

- Xiaomi

Competitive Analysis:

The Global Smartwatch Market features intense competition driven by continuous innovation, strong brand presence, and evolving consumer preferences. Leading players such as Apple, Samsung, Huawei, Garmin, and Fitbit dominate the market with diverse portfolios, proprietary ecosystems, and advanced health-tracking features. It sees increasing competition from regional brands like Xiaomi and Noise, which target budget-conscious consumers with feature-rich yet affordable models. Companies focus on integrating AI, medical-grade sensors, and personalized interfaces to enhance user engagement. Strategic partnerships, product launches, and software updates are central to gaining competitive advantage. Premium brands leverage design, brand equity, and ecosystem integration, while mid-tier players emphasize value and accessibility. The market remains highly dynamic, with emerging players entering through niche offerings or localized distribution strategies. Price segmentation and platform compatibility continue to shape brand positioning and customer loyalty. The Global Smartwatch Market rewards innovation, speed to market, and the ability to address diverse user needs across geographies.

Recent Developments:

- In July 2025, Apple announced the upcoming launch of the Apple Watch Series 11, expected to debut in late 2025 alongside the iPhone 17. The new model is anticipated to feature the S11 chip and incremental improvements, following the significant design overhaul introduced with Series 10 last year.

- In June 2025, Google released a major software update for the Pixel Watch series, introducing new features based on Wear OS 5.1 and Android 15. Notably, users can now use transit passes with Google Wallet directly from the watch, and the update brings improved security and device shortcuts through the Google Home app.

- In May 2025, ASUS unveiled its latest healthcare AI innovation at Computex: the HealthAI Genie for the ASUS VivoWatch. This AI-powered feature provides real-time health insights and personalized recommendations, transforming the VivoWatch into a 24/7 personal health coach with advanced risk prediction and actionable health plans.

- In May 2025, Garmin rolled out a significant feature update for its smartwatch lineup. New additions include a weighted hiking feature for more accurate tracking, breathing variation analysis during sleep, enhanced security with passcodes and wrist detection, and improved mapping tools for outdoor activities. These updates are designed to enhance both fitness and safety functionalities across Garmin’s fitness and outdoor products.

Market Concentration & Characteristics:

The Global Smartwatch Market is moderately concentrated, with a few dominant players holding significant market share. Apple leads with strong ecosystem integration and consistent product upgrades, followed by Samsung, Huawei, and Garmin. It features high entry barriers due to advanced technology requirements, brand recognition, and software compatibility. The market is characterized by rapid innovation cycles, short product lifespans, and strong emphasis on design, health tracking, and seamless connectivity. Consumer demand varies by region, with premium models driving growth in developed markets and mid-range offerings expanding reach in emerging economies. It shows strong alignment with trends in digital health, AI integration, and lifestyle personalization.

Report Coverage:

The research report offers an in-depth analysis based on product type, operating system, Price Range, application and Distribution channels. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for health monitoring will drive adoption of smartwatches with medical-grade features.

- AI integration will enhance personalized insights, predictive alerts, and real-time feedback.

- Standalone smartwatches will gain traction with improvements in battery life and cellular connectivity.

- Fashion-tech collaborations will expand consumer appeal across lifestyle and luxury segments.

- Affordable models will penetrate deeper into emerging markets, increasing overall shipment volumes.

- Online sales channels will continue to grow, supported by e-commerce expansion and digital marketing.

- Advanced sensors will support new applications in stress, hydration, and blood pressure tracking.

- Compatibility with multiple operating systems will remain a key differentiator for market players.

- Regional brands will challenge global leaders by offering localized features and aggressive pricing.

- Sustainability concerns will push manufacturers toward modular design and recyclable materials.