Market Overview

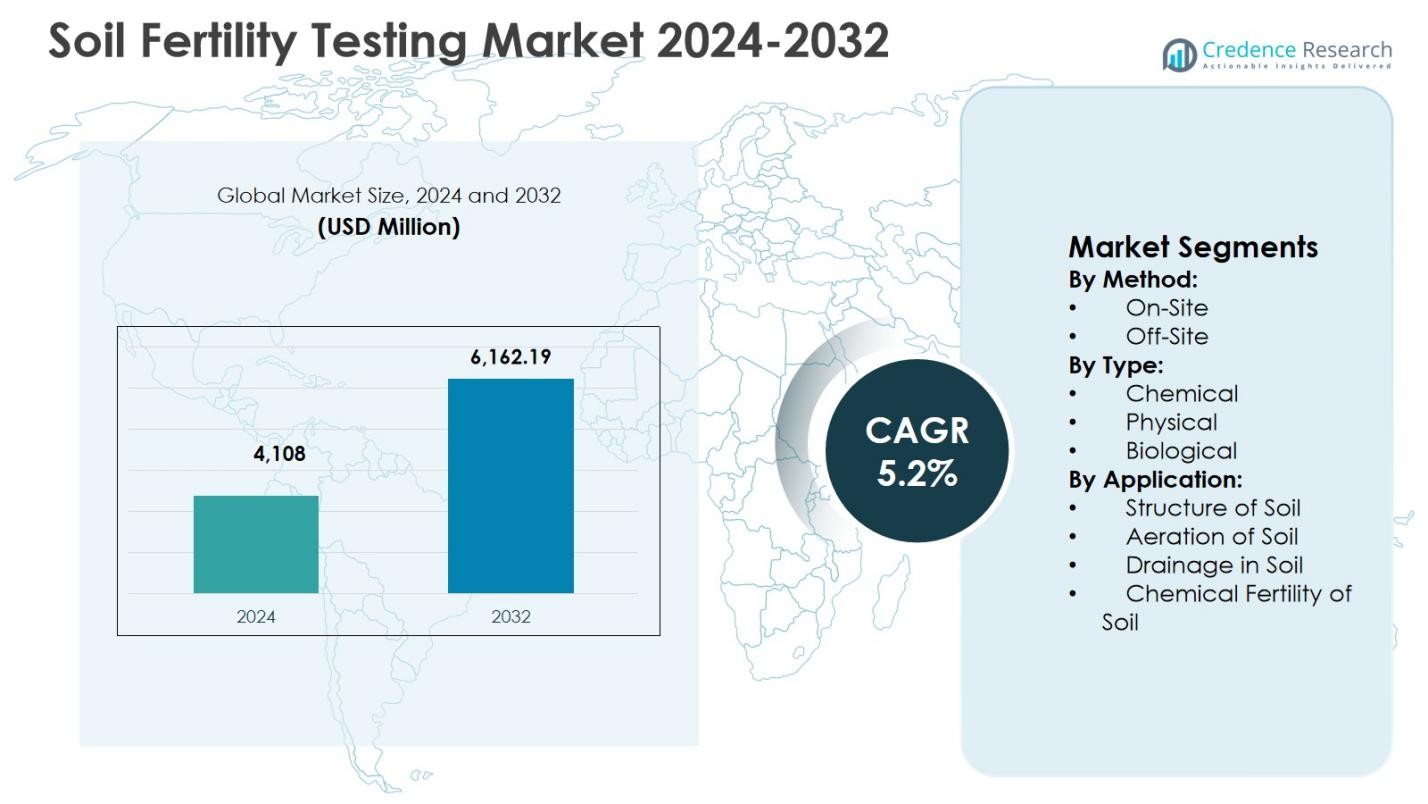

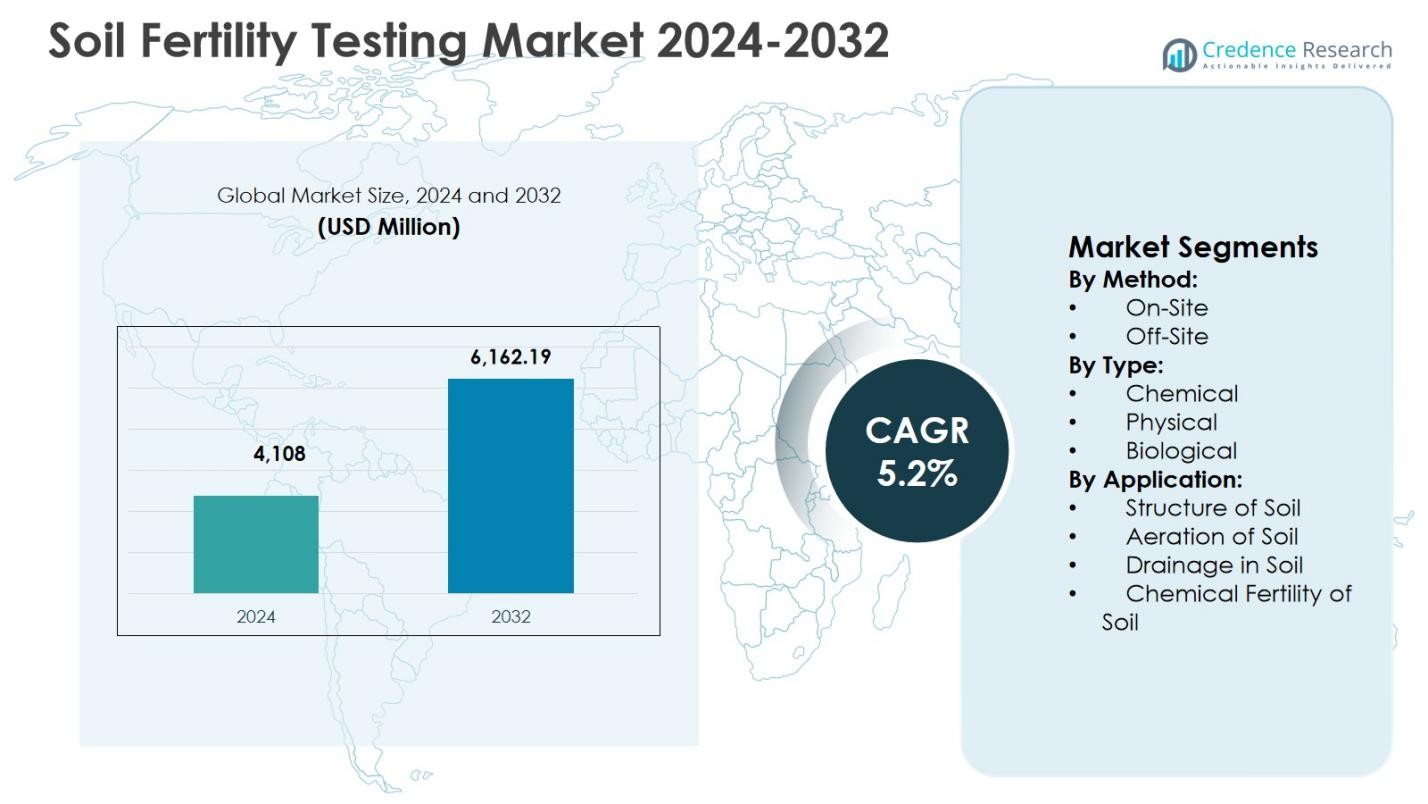

Soil Fertility Testing Market size was valued at USD 4,108 million in 2024 and is anticipated to reach USD 6,162.19 million by 2032, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Soil Fertility Testing Market Size 2024 |

USD 4,108 Million |

| Soil Fertility Testing Market , CAGR |

5.2% |

| Soil Fertility Testing Market Size 2032 |

USD 6,162.19 Million |

Soil Fertility Testing Market is characterized by the presence of well-established global testing service providers and specialized agricultural laboratories that focus on analytical accuracy, scale, and advisory capabilities. Key players such as Eurofins Agro, SGS Société Générale de Surveillance SA, ALS Ltd, Bureau Veritas, AgroLab, A&L Great Lakes Laboratories, Actlabs, Crop Nutrition Laboratory Services Ltd., Kinsey Ag Services, and Duraroot strengthen market development through expanded laboratory networks, advanced nutrient profiling, and integration of digital reporting tools. These companies support precision agriculture and sustainability initiatives by delivering reliable soil health insights. Regionally, North America leads the Soil Fertility Testing Market with a 32.8% market share, driven by high adoption of scientific farming practices, strong regulatory support, and widespread use of data-driven nutrient management across large commercial farms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Soil Fertility Testing Market was valued at USD 4,108 million in 2024 and is projected to reach USD 6,162.19 million by 2032, growing at a CAGR of 5.2%.

- The market growth is driven by rising adoption of precision agriculture, increased nutrient management focus, and government soil health initiatives that enhance soil productivity and sustainability.

- Key trends include integration of digital platforms with soil testing results, advanced analytics for predictive nutrient planning, and growing demand for sustainable and organic farming practices.

- Major players such as Eurofins Agro, SGS Société Générale de Surveillance SA, ALS Ltd, Bureau Veritas, AgroLab, and A&L Great Lakes Laboratories expand services through network growth, technological advancements, and digital reporting capabilities, while off-site testing holds 4% segment share and chemical testing accounts for 57.6% share in 2024.

- Regionally, North America leads with 8% market share, followed by Asia-Pacific with 29.6% and Europe at 27.4%, supported by commercial farming and precision agriculture adoption.

Market Segmentation Analysis:

By Method:

In the Soil Fertility Testing Market, the Off-Site testing segment dominated the By Method category, accounting for 68.4% market share in 2024. Off-site testing laboratories offer advanced analytical infrastructure, standardized testing protocols, and higher accuracy across large sample volumes, making them preferred by commercial farms, agribusinesses, and government soil programs. The segment benefits from increasing adoption of precision agriculture, rising soil health monitoring initiatives, and the need for multi-parameter analysis including macro- and micronutrients. Cost efficiency at scale, regulatory acceptance, and availability of expert interpretation continue to drive sustained demand for off-site soil testing services.

- For instance, SGS offers customizable off-site soil testing for pH, organic carbon, nematodes, and plant nutrients, using global labs with fast turnaround times to enable precision fertilizer programs via tools like Precision Gateway for optimized crop yields.

By Type:

By Type, Chemical soil testing led the Soil Fertility Testing Market with a 57.6% market share in 2024. Chemical analysis remains essential for evaluating nutrient availability, pH levels, salinity, and fertilizer requirements, which directly influence crop productivity. Strong demand is driven by intensive farming practices, rising fertilizer costs, and the need to optimize nutrient application. Government-backed soil health card programs and sustainability-focused nutrient management strategies further support adoption. The ability of chemical testing to deliver actionable, quantifiable results for immediate agronomic decisions reinforces its dominant position over physical and biological testing methods.

- For instance, Hanna Instruments’ HI3896 soil test kit performs colorimetric analysis for nitrogen (N), phosphorus (P), potassium (K), and pH, enabling over 25 tests per parameter to guide fertilizer use in farming.

By Application:

Within the By Application segment, Chemical Fertility of Soil emerged as the leading sub-segment, capturing 49.2% of the Soil Fertility Testing Market share in 2024. This dominance is driven by growing emphasis on nutrient balance, yield optimization, and soil degradation prevention. Farmers increasingly rely on fertility-focused testing to determine precise fertilizer blends, reduce input wastage, and comply with environmental regulations. Expansion of commercial agriculture, rising awareness of soil nutrient depletion, and integration of test results with digital farm management platforms continue to strengthen demand for chemical fertility assessment across both developed and emerging agricultural markets.

Key Growth Drivers

Rising Adoption of Precision Agriculture

The Soil Fertility Testing Market is strongly driven by the rising adoption of precision agriculture practices. Farmers increasingly depend on accurate soil data to optimize fertilizer application, enhance crop yields, and reduce input costs. Soil fertility testing supports site-specific nutrient management by identifying variability in soil composition across fields. Integration of soil test results with GPS-guided machinery, variable-rate technology, and farm management software further strengthens demand. Government support for resource-efficient farming and growing awareness of data-driven agriculture continue to accelerate adoption across large-scale and commercial farming operations.

- For instance, the University of Maryland Extension documents how grid and zone-based precision soil sampling, combined with GPS and variable-rate application equipment, enables farmers to apply nutrients only where needed, improving efficiency and reducing fertilizer use at the field scale.

Expansion of Commercial and Intensive Farming

Expansion of commercial and intensive farming systems significantly fuels the Soil Fertility Testing Market. High-input farming models require frequent monitoring of soil nutrients to sustain productivity and prevent long-term soil degradation. Agribusinesses, contract farming operations, and large growers increasingly rely on soil testing to improve fertilizer efficiency and minimize yield risks. Rising demand for food security, export-oriented crop production, and cultivation of high-value fruits and vegetables further reinforce the need for systematic soil fertility assessment across global agricultural regions.

- For instance, AgSource Laboratories offers agronomic soil testing packages like Basic (Potassium, Phosphorus, pH, Buffer pH, Organic Matter) and Basic Plus (adding CEC) to guide nutrient applications for commercial growers, helping optimize fertility decisions and reduce unnecessary inputs.

Government Soil Health and Sustainability Initiatives

Government soil health and sustainability initiatives remain a major driver for the Soil Fertility Testing Market. Programs promoting balanced fertilizer use, soil conservation, and reduced environmental impact encourage regular soil testing. National soil health card schemes, regulatory requirements, and subsidies for testing services expand adoption, particularly in developing economies. Increasing policy focus on sustainable land management, climate-resilient agriculture, and reduction of nutrient runoff strengthens long-term demand for certified and standardized soil fertility testing services.

Key Trends & Opportunities

Integration of Digital Platforms and Advanced Analytics

Integration of digital platforms and advanced analytics is a prominent trend in the Soil Fertility Testing Market. Service providers increasingly deliver test results through cloud-based dashboards, mobile applications, and decision-support systems. Advanced analytics enable predictive nutrient planning and long-term soil health tracking. This trend enhances service value, improves farmer engagement, and supports subscription-based and advisory-driven revenue models. It also creates opportunities for collaborations with agritech firms and precision farming solution providers.

- For instance, Cropnuts’ AgViza platform uses AI to analyze soil samples and deliver fertility management advice via interactive SMS. Local agronomists support the recommendations drawn from an Africa-wide geo-referenced soil database.

Growing Demand for Sustainable and Organic Farming

Growing demand for sustainable and organic farming presents significant opportunities in the Soil Fertility Testing Market. Organic and regenerative farming systems rely heavily on soil testing to maintain nutrient balance without synthetic inputs. Rising consumer demand for organic produce, stricter certification standards, and focus on soil biodiversity drive consistent testing requirements. This shift encourages laboratories to expand biological and nutrient-specific testing services aligned with environmentally responsible farming practices.

- For instance, Biome Makers’ BeCrop technology uses DNA soil testing to assess microbial metabolism and nutrient cycling in regenerative systems. In a collaboration with Bayer Crop Science on Idaho potato crops, BeCrop analysis predicted and delivered a 41% yield increase through targeted soil health adjustments.

Key Challenges

Limited Awareness and Adoption Among Smallholder Farmers

Limited awareness and adoption among smallholder farmers remain a key challenge for the Soil Fertility Testing Market. Many farmers continue to depend on traditional practices and lack understanding of the economic benefits of soil testing. Cost sensitivity, limited access to laboratories, and weak agricultural extension support restrict adoption, particularly in rural and developing regions. These factors slow market penetration despite the proven role of soil testing in improving yields and input efficiency.

Variability in Testing Standards and Result Interpretation

Variability in soil testing standards and interpretation challenges the Soil Fertility Testing Market. Differences in sampling techniques, analytical methods, and reporting formats across laboratories create inconsistencies in recommendations. Farmers may struggle to interpret results or compare data across seasons, reducing confidence in testing outcomes. Lack of harmonized standards and trained advisory support can limit repeat testing and slow broader adoption across diverse agricultural markets.

Regional Analysis

North America

North America held 32.8% market share in 2024 in the Soil Fertility Testing Market, driven by advanced agricultural practices and high adoption of precision farming technologies. The region benefits from strong awareness among farmers regarding soil health management, supported by well-established laboratory infrastructure and digital advisory platforms. Government programs promoting sustainable agriculture, nutrient management regulations, and environmental compliance further reinforce demand. High penetration of commercial farming, widespread use of variable-rate fertilization, and integration of soil data with farm management systems continue to support steady growth across the United States and Canada.

Europe

Europe accounted for 27.4% market share in 2024 in the Soil Fertility Testing Market, supported by stringent environmental regulations and sustainability-focused agricultural policies. The region emphasizes balanced fertilizer use, soil conservation, and reduction of nutrient runoff, driving consistent demand for soil testing services. Adoption is strong across Western and Northern Europe due to advanced agronomy practices and organic farming expansion. EU-backed soil health initiatives, precision agriculture adoption, and rising demand for certified testing services in compliance-driven farming systems continue to strengthen market penetration across the region.

Asia-Pacific

Asia-Pacific captured 29.6% market share in 2024 in the Soil Fertility Testing Market, supported by large agricultural land areas and growing focus on improving crop productivity. Government-led soil health programs, increasing fertilizer optimization efforts, and rising adoption of scientific farming practices drive demand. Countries such as China, India, and Australia show strong uptake due to national soil testing initiatives and food security priorities. Expansion of commercial farming, increasing awareness among farmers, and rapid development of testing infrastructure position Asia-Pacific as a high-growth regional market.

Latin America

Latin America held 6.4% market share in 2024 in the Soil Fertility Testing Market, driven by expansion of commercial agriculture and export-oriented crop production. Large-scale cultivation of cereals, oilseeds, and cash crops increases the need for nutrient management and soil productivity enhancement. Brazil and Argentina lead regional demand due to intensive farming systems and rising adoption of precision agriculture tools. Growing focus on yield optimization, soil sustainability, and agronomic advisory services continues to support gradual market expansion across the region.

Middle East & Africa

The Middle East & Africa region accounted for 3.8% market share in 2024 in the Soil Fertility Testing Market. Demand is driven by increasing efforts to improve agricultural productivity under challenging soil and climatic conditions. Governments focus on food security, land restoration, and efficient fertilizer use, encouraging soil testing adoption. Growth is supported by expanding commercial farming projects, irrigation-based agriculture, and international development initiatives. Although adoption remains uneven, rising awareness of soil management and gradual improvement in testing infrastructure support steady regional growth.

Market Segmentations:

By Method:

By Type:

- Chemical

- Physical

- Biological

By Application:

- Structure of Soil

- Aeration of Soil

- Drainage in Soil

- Chemical Fertility of Soil

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Soil Fertility Testing Market highlights a mix of global testing service providers and specialized agricultural laboratories, including Eurofins Agro, SGS Société Générale de Surveillance SA, ALS Ltd, Bureau Veritas, AgroLab, A&L Great Lakes Laboratories, Actlabs, Crop Nutrition Laboratory Services Ltd., Kinsey Ag Services, and Duraroot. These players focus on expanding laboratory networks, enhancing analytical accuracy, and offering comprehensive nutrient profiling services to strengthen market presence. Investment in advanced testing technologies, digital reporting platforms, and agronomic advisory services remains a key strategic priority. Companies increasingly align offerings with precision agriculture and sustainability requirements to meet evolving farmer and regulatory demands. Strategic partnerships with agritech firms, acquisitions of regional laboratories, and expansion into emerging agricultural markets support growth. Emphasis on standardized testing protocols, faster turnaround times, and value-added insights enables players to differentiate services and maintain strong client retention across commercial and government-supported agricultural programs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kinsey Ag Services

- SGS Société Générale de Surveillance SA

- AgroLab

- A&L Great Lakes Laboratories, Inc.

- Eurofins Agro

- ALS Ltd

- Actlabs

- BUREAU VERITAS

- Crop Nutrition Laboratory Services Ltd.

- Duraroot

Recent Developments

- In October 2024, Eurofins Agro Testing acquired soil sampling specialist FarmFacts from BayWa AG to strengthen its soil sampling and fertility testing capabilities in global agricultural markets.

- In July 2025, Miraterra acquired Trace Genomics, a soil DNA sequencing company specializing in biological soil fertility analysis, to enhance its soil health measurement capabilities with advanced IP and lab assets.

- In April 2025, EarthOptics launched its Total Farm subscription program at $4 per acre, integrating GroundOwl sensors, DNA soil testing, yield data, and satellite imagery for precise fertility recommendations.

- In December 2025, Bayer partnered with Elaniti to leverage soil microbiome insights from advanced testing, aiming to improve nutrient management and crop outcomes in sustainable farming.

Report Coverage

The research report offers an in-depth analysis based on Method, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Soil Fertility Testing Market will continue to gain importance as farmers prioritize yield optimization and input efficiency.

- Adoption of precision agriculture practices will increase demand for regular and site-specific soil testing services.

- Integration of digital platforms and data analytics will enhance interpretation and decision-making capabilities.

- Government-led soil health and sustainability programs will support long-term market expansion.

- Demand for off-site laboratory testing will remain strong due to accuracy and scalability advantages.

- Chemical soil testing will retain dominance as nutrient management becomes more critical.

- Growth in commercial and intensive farming systems will drive recurring testing requirements.

- Expansion of organic and sustainable farming practices will increase demand for specialized testing methods.

- Emerging economies will witness faster adoption due to improving agricultural infrastructure and awareness.

- Standardization of testing protocols and advisory services will improve farmer confidence and repeat usage.