| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Industrial Fasteners Market Size 2024 |

USD 4208.84 Million |

| South Korea Industrial Fasteners Market, CAGR |

6.69% |

| South Korea Industrial Fasteners Market Size 2032 |

USD 7065.21 Million |

Market Overview:

The South Korea Industrial Fasteners Market is projected to grow from USD 4208.84 million in 2024 to an estimated USD 7065.21 million by 2032, with a compound annual growth rate (CAGR) of 6.69% from 2024 to 2032.

The growth of the South Korea industrial fasteners market is primarily driven by the expanding automotive industry, robust manufacturing sector, and significant infrastructure development. The automotive sector, led by major manufacturers like Hyundai and Kia Motors, remains a key driver, with fasteners being integral to vehicle assembly, ensuring safety and performance. Additionally, South Korea’s dominance in the electronics and consumer goods manufacturing sectors, with global giants such as Samsung and LG, increases the demand for specialized fasteners for assembling various electronic products. The country’s ongoing infrastructure projects, including the construction of highways, bridges, and energy facilities, also contribute to the rising need for durable and high-performance fasteners. Moreover, the adoption of new materials and coatings, such as corrosion-resistant and lightweight fasteners, is advancing manufacturing efficiency and longevity, further bolstering market demand.

Regionally, South Korea plays a dominant role in the industrial fasteners market within the Asia-Pacific region, benefiting from its advanced industrial ecosystem and technological innovations. The country’s strategic investments in sectors such as automotive, electronics, and infrastructure provide a solid foundation for the market’s growth. Furthermore, while South Korea’s industrial fastener market shows considerable potential, other rapidly developing markets in Asia, particularly China and India, are also witnessing significant growth. The increasing demand in these countries, driven by large-scale manufacturing and infrastructure development, adds a layer of regional competition, prompting South Korea to maintain its competitive edge in the fasteners market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The South Korea Industrial Fasteners Market is projected to grow from USD 4,208.84 million in 2024 to USD 7,065.21 million by 2032, at a CAGR of 6.69%.

- The Global Industrial Fasteners Market is projected to grow from USD 98,826 million in 2024 to USD 158,987.23 million by 2032, registering a robust CAGR of 6.12%.

- The growth is primarily driven by the expanding automotive industry, particularly with major manufacturers like Hyundai and Kia, which rely heavily on fasteners for vehicle assembly.

- South Korea’s dominance in the electronics and consumer goods sector, with companies such as Samsung and LG, increases demand for specialized fasteners for complex electronic products.

- Infrastructure development projects, including highways, bridges, and energy facilities, continue to drive demand for robust and high-performance fasteners in construction and urbanization efforts.

- Technological advancements in fastener production, including automation and precision manufacturing, are enabling the production of high-performance fasteners to meet industry needs.

- Fluctuations in raw material prices, such as steel and aluminum, create challenges for manufacturers by impacting production costs and profitability.

- Intense price competition within the South Korea market requires companies to balance high-quality fasteners with cost-effective solutions to maintain market share.

Market Drivers:

Growth in the Automotive Industry

The automotive industry is a key driver of the industrial fasteners market in South Korea, as it relies heavily on fasteners for vehicle assembly. Major manufacturers, including Hyundai, Kia, and other local producers, require a wide range of fastening solutions to ensure the structural integrity, safety, and performance of their vehicles. For instance, ARaymond, a leading global supplier of fastening solutions to the automotive industry, commenced production at its new plant in Hwaseong-si, South Korea, specifically to meet the growing demand from major automotive manufacturers such as Hyundai, Kia, GM Korea, and Renault Samsung. Fasteners are used extensively in engine components, body assemblies, interior fittings, and other critical automotive parts. The continued growth of the automotive industry, driven by technological advancements and the rise of electric vehicles (EVs), further fuels the demand for innovative fastening solutions that are lightweight, durable, and resistant to corrosion. This sector’s increasing reliance on high-quality fasteners will continue to stimulate the South Korean market.

Expansion of the Electronics and Consumer Goods Sector

South Korea’s position as a global leader in the electronics and consumer goods market significantly impacts the demand for industrial fasteners. For instance, Samsung and LG Electronics, both headquartered in South Korea, are major producers of smartphones, televisions, and home appliances that require high-precision, reliable fasteners for assembly. These products require specialized fasteners that can meet high precision and reliability standards, particularly in small-scale, complex electronic components. The continuous innovation in consumer electronics, coupled with the country’s role as a hub for technological advancements, has solidified the need for fasteners that can support the miniaturization and performance demands of modern devices.

Infrastructure Development and Urbanization

The South Korean government’s ongoing investment in infrastructure and urban development plays a pivotal role in driving the demand for industrial fasteners. The country’s ambitious plans for new transportation networks, including highways, railways, and airport expansions, as well as large-scale energy and residential construction projects, require robust fastening solutions. Fasteners ensure the safety and durability of structural components in buildings, bridges, and other critical infrastructure. With the increasing focus on enhancing urbanization and sustainability, the demand for high-strength, corrosion-resistant, and specialized fasteners is expected to rise in line with these projects, further boosting the market.

Technological Advancements in Fastener Production

Advancements in fastener manufacturing technologies are another important factor contributing to the growth of South Korea’s industrial fasteners market. The adoption of automation, precision manufacturing, and the development of advanced materials have led to the creation of high-performance fasteners that meet the rigorous demands of various industries. New materials such as lightweight alloys, titanium, and composites are being increasingly used to produce fasteners that offer superior strength, corrosion resistance, and weight reduction. These innovations cater to the evolving needs of industries like automotive, aerospace, and electronics, where performance and efficiency are paramount. As manufacturers continue to push for higher precision and faster production processes, the industrial fasteners market will benefit from continued growth driven by these technological advancements.

Market Trends:

Increasing Demand for Lightweight Fasteners

One of the notable trends in the South Korea industrial fasteners market is the growing demand for lightweight fasteners, particularly driven by advancements in the automotive and aerospace sectors. With the rise of electric vehicles (EVs) and the focus on improving fuel efficiency, manufacturers are increasingly using lightweight materials, such as aluminum and titanium, to reduce overall vehicle weight. These materials not only help improve energy efficiency but also enhance performance. Fasteners made from lightweight, high-strength materials are being adopted to meet the demands of these industries, thus contributing to the market’s growth. The push toward lightweight design is also becoming prevalent in aerospace applications, where the need for fasteners that are both durable and weight-efficient is crucial for aircraft performance.

Rise of Automation and Advanced Manufacturing Techniques

Automation in manufacturing has become a significant trend within South Korea’s industrial fasteners market. The adoption of robotic systems, artificial intelligence (AI), and smart manufacturing technologies has significantly improved production efficiency, precision, and scalability. Automated processes allow for the consistent production of high-quality fasteners at a faster rate, reducing human error and lowering costs. These technologies are increasingly being incorporated into the production of fasteners for critical sectors such as automotive and electronics, where precision and reliability are essential. As these industries demand faster turnaround times and more complex designs, automated manufacturing techniques are playing a vital role in meeting these needs, thereby driving the market forward.

Shift Towards Corrosion-Resistant Fasteners

The South Korean industrial fasteners market is witnessing a growing trend toward corrosion-resistant fasteners, especially in sectors where exposure to harsh environmental conditions is common. The demand for fasteners with enhanced corrosion resistance is being driven by the expanding construction, automotive, and marine sectors, which require durable and long-lasting components. For instance, companies like Hwaseung Corporation supply marine fenders equipped with corrosion-resistant wedge-locking washers from Nord-Lock, which have shown no corrosion issues even after 18 months in harsh coastal environments. Materials like stainless steel, coated fasteners, and surface-treated fasteners are increasingly being used to meet this demand. In construction, for example, fasteners used in bridges, roads, and buildings must be able to withstand exposure to moisture, chemicals, and extreme weather conditions. This trend is expected to continue as industries push for longer-lasting and more resilient fastening solutions to improve safety and reduce maintenance costs.

Sustainability and Eco-friendly Manufacturing

Sustainability is becoming an important trend in the South Korean industrial fasteners market, with a growing emphasis on eco-friendly manufacturing practices. Industries, including automotive and construction, are increasingly prioritizing sustainability in their production processes. The focus on reducing the environmental impact of fasteners is driving the demand for eco-friendly materials and coatings, as well as energy-efficient manufacturing practices. For instance, LG Electronics announced that by 2023, 35% of the fasteners used in its home appliance assembly lines were made from recycled steel, contributing to the company’s goal of reducing carbon emissions by 50% by 2030. Manufacturers are adopting more sustainable materials such as recyclable metals and exploring innovations in coatings that reduce environmental harm while maintaining high performance. As South Korea continues to align with global environmental standards and regulations, the industrial fasteners market is likely to see a continued shift toward more sustainable practices, with an emphasis on reducing waste and energy consumption during production.

Market Challenges Analysis:

Fluctuations in Raw Material Prices

One of the significant challenges facing the South Korea industrial fasteners market is the volatility in raw material prices. The cost of metals such as steel, aluminum, and titanium, which are commonly used in the production of fasteners, can fluctuate due to global supply chain disruptions, changes in demand, and geopolitical factors. These fluctuations can impact the overall production costs of fasteners, forcing manufacturers to adjust their pricing strategies or absorb the additional costs. The unpredictability of raw material prices can also hinder profitability, particularly for smaller manufacturers who may struggle to maintain competitive prices in a volatile market.

Intense Price Competition

The industrial fasteners market in South Korea is highly competitive, with numerous local and international players vying for market share. The intense price competition among manufacturers, especially in the automotive and construction sectors, presents a significant challenge. Companies are under constant pressure to offer high-quality products at competitive prices, which can strain profit margins. Additionally, price competition can sometimes lead to cost-cutting measures that affect product quality or customer service. Companies that fail to innovate or adapt to market demands risk losing their competitive edge in the face of lower-cost alternatives.

Regulatory Compliance and Standards

As industries increasingly prioritize quality and safety, adherence to stringent regulations and standards becomes a key challenge for fastener manufacturers. South Korea’s regulatory environment requires fasteners to meet various safety and performance standards, particularly in industries such as automotive, aerospace, and construction. For instance, KPF (Korea Parts & Fasteners) has achieved multiple certifications, including ISO 9001, ISO 14001, ISO/TS 16949, KS B1002, and CE, to ensure compliance with both domestic and international standards required by clients in automotive, construction, and infrastructure sectors. Complying with these standards often requires substantial investments in testing, certification, and quality control, which can be burdensome for smaller players. Moreover, as international markets also impose their own standards, manufacturers must ensure their products comply with both domestic and global regulations, adding an additional layer of complexity to operations.

Market Opportunities:

The South Korea industrial fasteners market presents significant growth opportunities driven by the expanding demand from the automotive, aerospace, and construction sectors. As South Korea continues to position itself as a leader in the global automotive industry, particularly with the rise of electric vehicles (EVs), the demand for advanced fasteners is expected to increase. EVs require lightweight, high-strength fasteners to optimize energy efficiency, creating a unique opportunity for manufacturers specializing in corrosion-resistant and lightweight fastening solutions. The aerospace industry, known for its rigorous performance standards, also presents substantial growth potential, particularly for high-precision and durable fasteners used in aircraft components. As South Korea continues to invest in infrastructure development, including major construction projects and energy facilities, the need for robust fastening solutions will continue to grow, providing long-term opportunities for manufacturers.

Additionally, the increasing trend toward automation and technological advancements in manufacturing presents another significant opportunity in the industrial fasteners market. The adoption of Industry 4.0 technologies, such as robotics and artificial intelligence, is improving production efficiency and precision, which allows fastener manufacturers to meet the growing demand for customized and high-performance fasteners. This technological shift presents an opportunity for companies to reduce production costs, improve product quality, and shorten lead times, enhancing their competitiveness in both domestic and international markets. As industries across South Korea embrace more sustainable practices, the demand for eco-friendly and recyclable fasteners is also poised to increase, further expanding the market’s growth prospects.

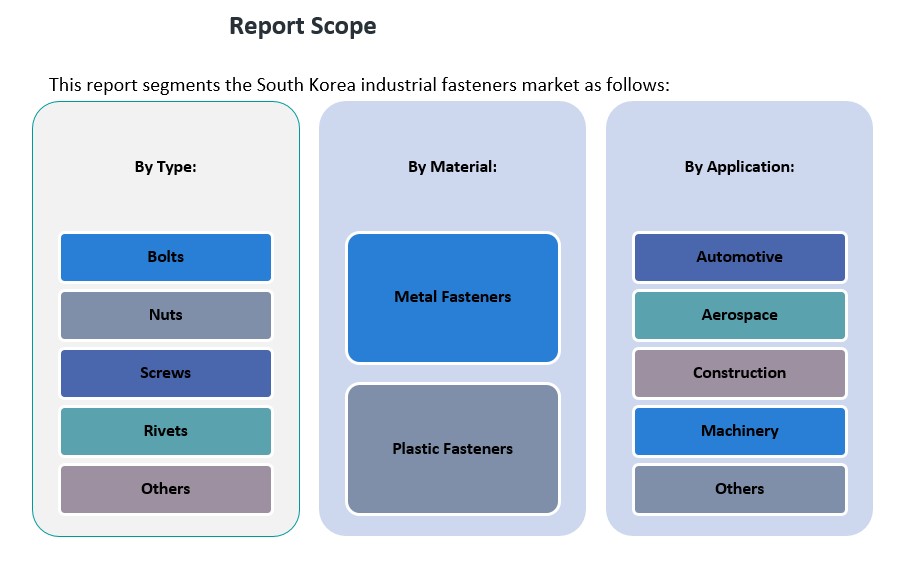

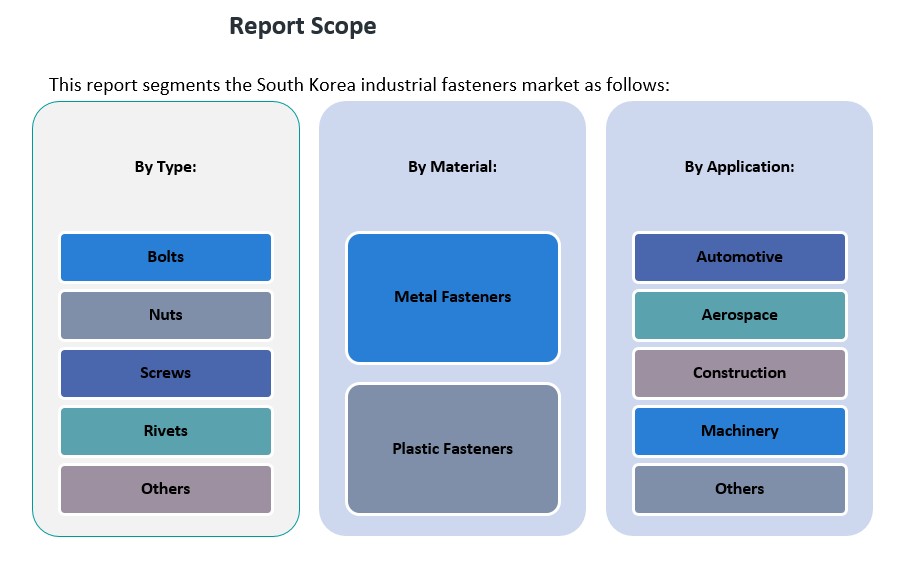

Market Segmentation Analysis:

The South Korea industrial fasteners market is segmented based on type, application, and material, with each segment demonstrating distinct trends and growth drivers.

By Type: The market is dominated by bolts, nuts, screws, and rivets, with bolts and screws being the most widely used fasteners across various industries. Bolts are essential in automotive and construction applications, providing secure fastening for structural components, while screws are commonly used in both machinery and electronics. Rivets are particularly prominent in aerospace applications due to their ability to provide strong, permanent fastenings in high-stress environments. Other types of fasteners, such as washers and pins, also contribute to the market but represent a smaller share.

By Application: The automotive sector is the largest consumer of industrial fasteners in South Korea, driven by the demand for lightweight, high-performance fasteners used in vehicle assembly, particularly with the rise of electric vehicles (EVs). The aerospace sector follows closely, with the need for specialized fasteners that can withstand extreme conditions. The construction industry also remains a key application segment, particularly for infrastructure projects such as bridges, highways, and residential buildings. Additionally, the machinery sector and other industries, including electronics, are contributing to the growing demand for industrial fasteners, as precision and durability become increasingly important.

By Material: Metal fasteners dominate the market, as materials like stainless steel, titanium, and aluminum provide strength and corrosion resistance needed in high-performance applications. Plastic fasteners, although a smaller segment, are gaining traction in industries requiring lightweight and non-corrosive fastening solutions, particularly in electronics and consumer goods manufacturing.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

The South Korea industrial fasteners market is characterized by significant regional variations, each driven by distinct industrial activities and infrastructure developments. The Seoul Capital Area, encompassing the capital city and its surrounding regions, holds the largest market share, accounting for approximately 45% of the national market. This dominance is attributed to the concentration of major manufacturing hubs, including automotive and electronics industries, which are primary consumers of industrial fasteners. The region’s robust infrastructure and technological advancements further bolster its leading position in the market.

Following the capital area, the Yeongnam region, which includes cities like Busan and Ulsan, contributes around 30% to the market. This southeastern region is a vital industrial base, particularly for shipbuilding, steel production, and automotive manufacturing. The presence of large-scale industrial complexes and ports enhances its role in the fasteners market, catering to both domestic and export demands.

The Honam region, comprising Gwangju and Jeollanam-do, holds a smaller yet significant share of approximately 15%. Known for its agricultural and light manufacturing sectors, Honam’s demand for industrial fasteners is primarily driven by machinery and construction applications. The Hoseo region, located in the central part of the country, contributes about 10% to the market. While less industrialized, Hoseo’s growing infrastructure projects and proximity to major industrial zones contribute to its increasing demand for fasteners.

Key Player Analysis:

- Nifco Inc.

- Shanghai Prime Machinery Co. Ltd.

- Meidoh Co. Ltd.

- Sundram Fasteners Limited

- Agrati Group

- HIL Ltd.

- Bhansali Fasteners

- Zhejiang Huantai Fastener Co., Ltd.

- Kyocera Corporation

Competitive Analysis:

The South Korea industrial fasteners market is highly competitive, with numerous local and international players striving for market share. Key domestic manufacturers such as Daewoo Shipbuilding & Marine Engineering, Hyundai Steel, and Samsung Precision are major suppliers in the automotive, aerospace, and construction sectors. These companies focus on producing high-quality fasteners that meet stringent industry standards, particularly in high-performance applications like aerospace and automotive manufacturing. Additionally, global players like Stanley Black & Decker and Bossard Group maintain a strong presence, offering a wide range of fasteners for various industrial applications. To remain competitive, these companies are increasingly focusing on innovation, particularly in advanced materials like corrosion-resistant coatings and lightweight alloys, to cater to the evolving needs of industries such as automotive and electronics. Moreover, the market is witnessing increased investments in automation and smart manufacturing technologies to enhance production efficiency and meet the growing demand for customized fastener solutions.

Recent Developments:

- On February 25, 2025, Miller Electric Mfg. LLC, a wholly-owned subsidiary of Illinois Tool Works (ITW), announced a strategic partnership with Novarc Technologies. This collaboration focuses on developing AI-powered welding solutions under the Miller® Copilot™ line, aiming to enhance productivity, address labor shortages, and improve precision in industries such as shipbuilding and heavy equipment manufacturing.

- In January 2023, Hilti North America announced the addition of more than 30 new cordless tools to its Nuron battery-powered platform, expanding its portfolio to over 100 tools. This expansion, showcased at the World of Concrete event, includes advanced tools such as a diamond core rig, rotating lasers, and cut-off saws, reinforcing Hilti’s leadership in cordless jobsite solutions

Market Concentration & Characteristics:

The South Korea industrial fasteners market exhibits a moderate level of concentration, characterized by a blend of established multinational corporations and specialized domestic manufacturers. In 2024, South Korea accounted for approximately 5.4% of the global industrial fasteners market share, underscoring its significant role in the Asia-Pacific region. Key players such as GS Bolt Co. Ltd., HASM Co. Ltd., Hilti Corporation, Hwashin Bolt Ind. Co. Ltd., and MISUMI Corporation dominate the market landscape. These companies leverage advanced manufacturing technologies and adhere to stringent quality standards to meet the diverse demands of sectors like automotive, aerospace, and construction. The market’s competitive dynamics are influenced by factors such as technological innovation, material advancements, and adherence to international certifications. The market’s fragmentation allows for opportunities in niche segments, particularly in high-performance fasteners tailored for specialized applications. This structure fosters innovation and responsiveness to industry-specific requirements, contributing to the market’s overall growth and resilience.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The South Korea industrial fasteners market is expected to experience substantial growth over the coming years, driven by increasing demand across key industries such as automotive, aerospace, and construction.

- Metal fasteners will continue to dominate the market due to their strength and durability, particularly in automotive and construction sectors.

- Plastic fasteners are expected to experience rapid growth, driven by demand in electronics and consumer goods manufacturing due to their lightweight and corrosion-resistant properties.

- The automotive industry will remain the largest consumer of fasteners, especially with the rise of electric vehicles (EVs), requiring lightweight and high-performance solutions.

- The aerospace sector will drive demand for specialized fasteners that meet stringent safety and performance standards.

- Infrastructure development projects, such as transportation networks and energy facilities, will continue to increase the need for durable and high-quality fasteners.

- Technological advancements, such as automation and smart manufacturing technologies, will improve production efficiency and precision.

- Customization in fastener design will become more important to meet specific industry requirements.

- Sustainability trends will influence the market, with a growing focus on eco-friendly materials and coatings for fastener production.

- The competitive landscape will evolve as both domestic and international players focus on innovation and quality to maintain their market positions.