Market Overview:

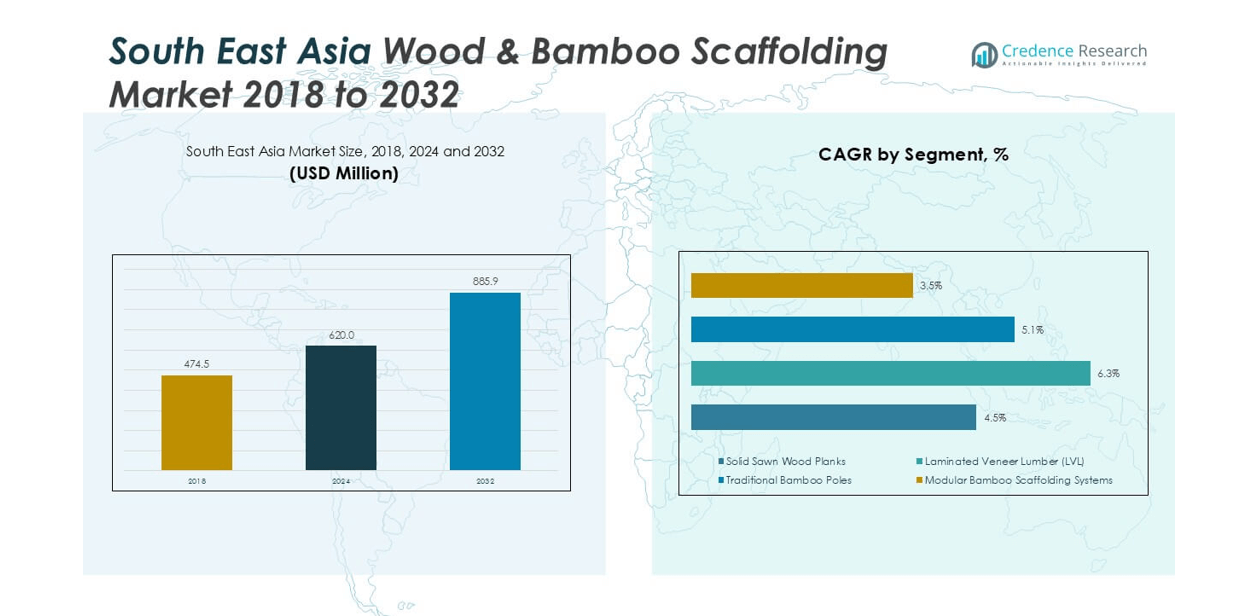

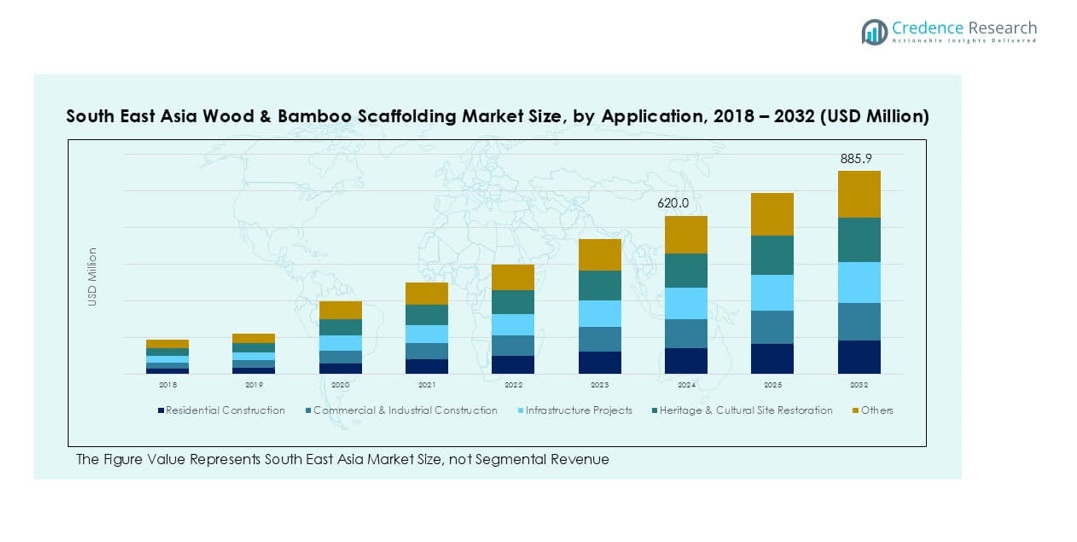

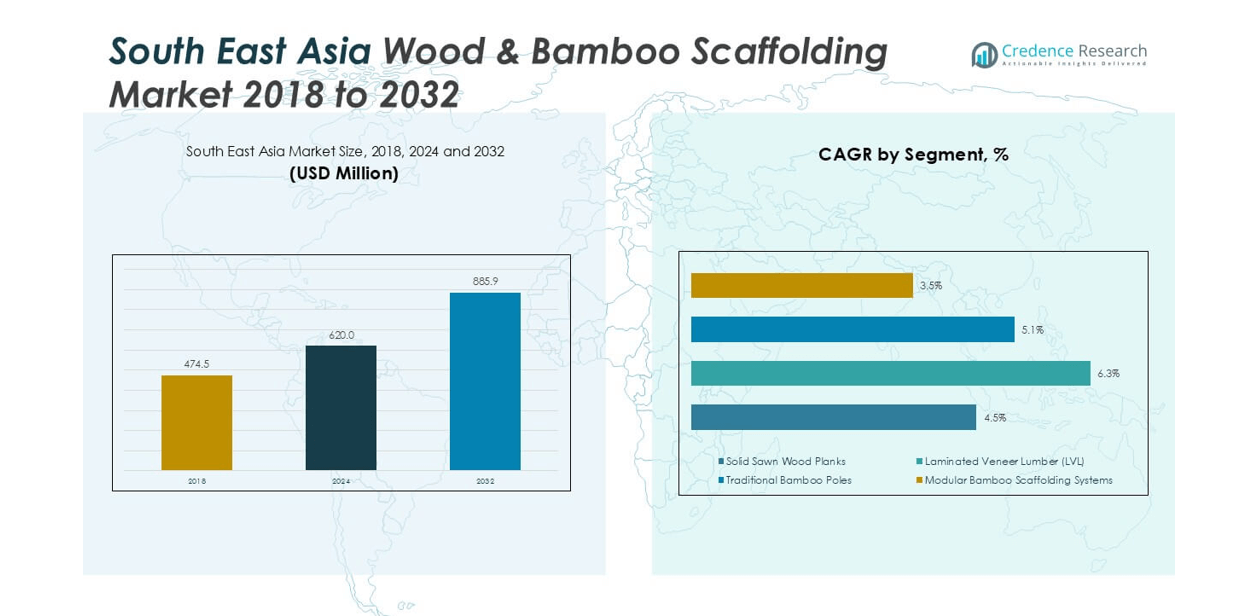

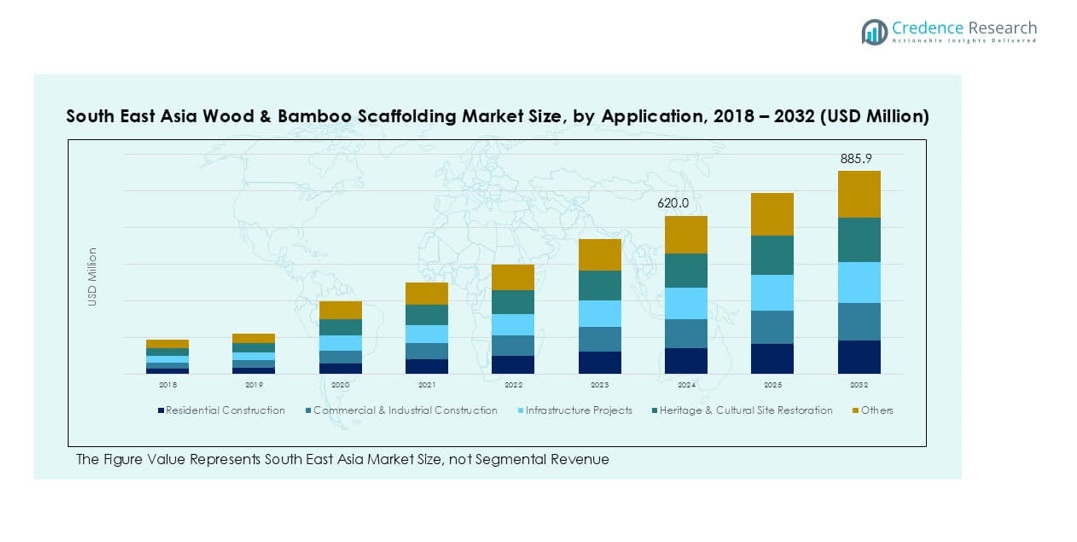

Southeast Asia Wood & Bamboo Scaffolding market size was valued at USD 474.5 million in 2018, grew to USD 620.0 million in 2024, and is anticipated to reach USD 885.9 million by 2032, registering a CAGR of 4.56% during the forecast period (2024–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Southeast Asia Wood & Bamboo Scaffolding Market Size 2024 |

USD 620.0 million |

| Southeast Asia Wood & Bamboo Scaffolding Market, CAGR |

4.56% |

| Southeast Asia Wood & Bamboo Scaffolding Market Size 2032 |

USD 885.9 million |

The Southeast Asia wood and bamboo scaffolding market is led by key players such as PERI SE, Layher Holding GmbH & Co. KG, Waco Kwikform, United Scaffolding Group, and Rizhao Fast & Fasten Scaffold Co., Ltd, along with regional firms like SS Group, Bamboooz, and GASSCO Scaffolding. These companies focus on modular bamboo systems, engineered wood solutions, and safety-certified scaffolding to meet rising demand. Indonesia dominates the market with over 30% share, driven by mega infrastructure projects and housing developments, followed by Vietnam at 20% and Thailand at 15%, supported by industrial growth and urbanization

Market Insights

- The Southeast Asia wood & bamboo scaffolding market was valued at USD 620.0 million in 2024 and is projected to reach USD 885.9 million by 2032, growing at a CAGR of 4.56%.

- Market growth is driven by rapid urbanization, government-backed infrastructure projects, and rising demand for cost-effective, eco-friendly scaffolding solutions such as bamboo and LVL systems.

- Modular scaffolding systems are a key trend, offering faster assembly, safety compliance, and reusability, making them attractive for commercial and industrial construction projects.

- Competition includes global leaders like PERI SE, Layher Holding GmbH & Co. KG, and Waco Kwikform, along with regional players such as SS Group and Bamboooz focusing on bamboo-based solutions.

- Indonesia holds over 30% share, followed by Vietnam at 20% and Thailand at 15%; by product type, solid sawn wood planks lead with over 40% share, followed by rising adoption of modular bamboo scaffolding systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

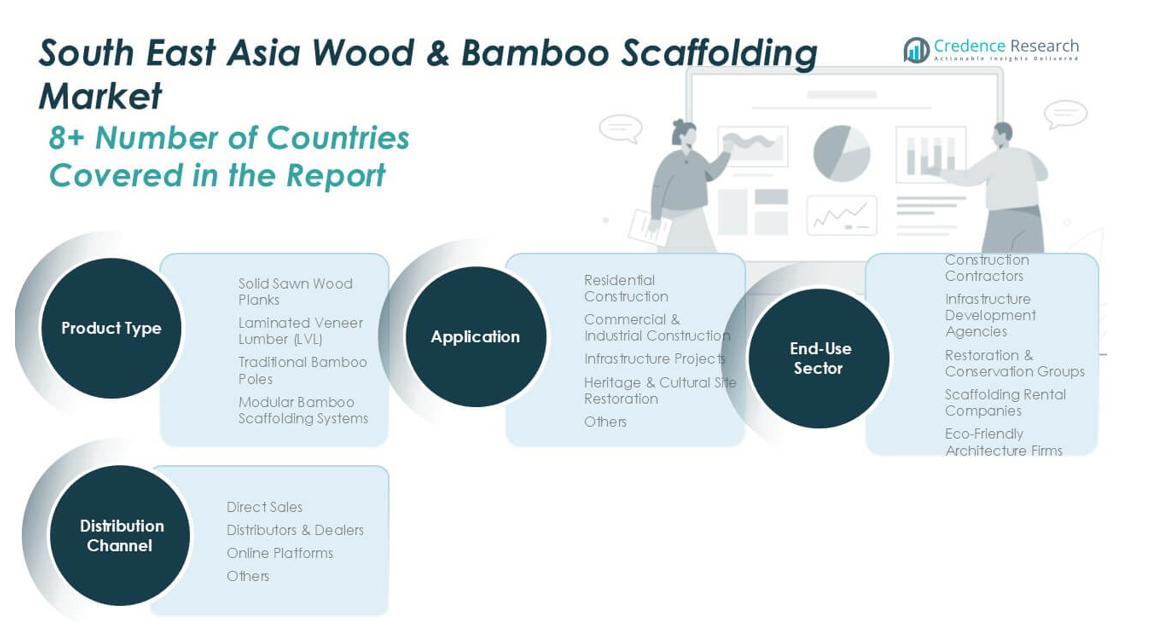

Market Segmentation Analysis:

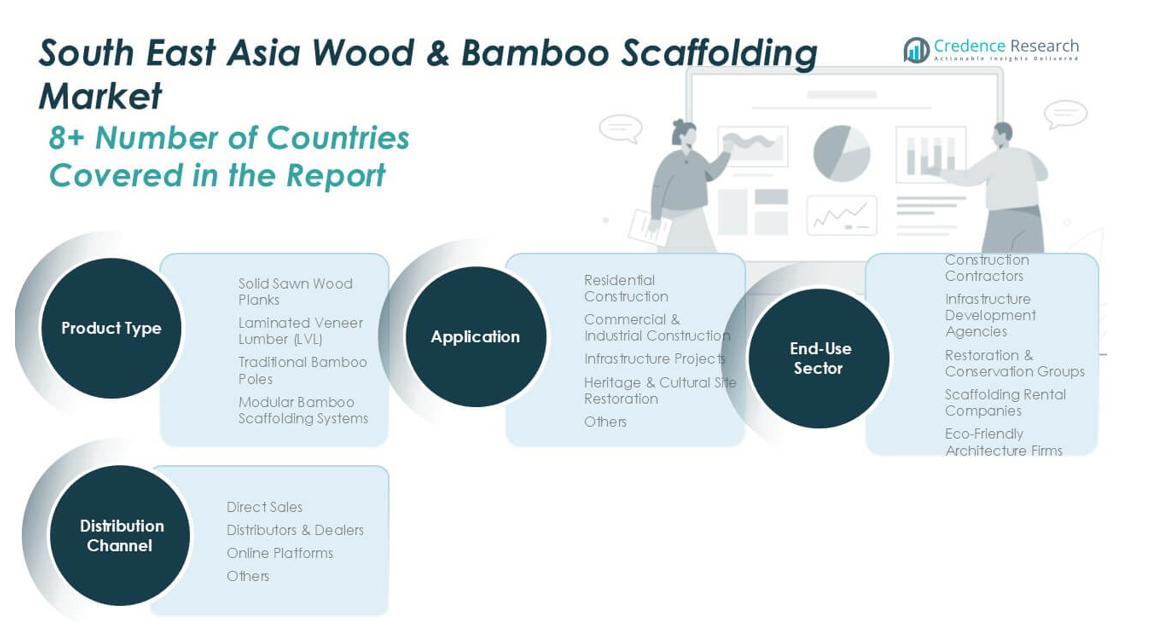

By Product Type

Solid sawn wood planks dominated the Southeast Asia wood and bamboo scaffolding market in 2024, holding over 40% share due to their strength, durability, and cost efficiency. These planks are widely used in large-scale construction projects where structural stability is critical. Laminated veneer lumber (LVL) is gaining momentum, driven by its consistent quality and ability to meet strict safety standards in urban projects. Traditional bamboo poles remain popular in rural areas because of their low cost and local availability. Modular bamboo scaffolding systems are expanding rapidly, driven by demand for faster assembly and compliance with green building codes.

- For instance, PT Sumatera Timber is a real company in Indonesia that manufactures and exports wooden doors and other finished wood products to international markets.

By Application

Commercial & industrial construction led the market with around 38% share in 2024, supported by growing factory expansions, logistics hubs, and real estate developments in key economies like Indonesia and Vietnam. Residential construction follows closely, driven by rapid urbanization and government-backed affordable housing schemes. Infrastructure projects, including highways, metro networks, and bridges, are a fast-growing segment as ASEAN countries ramp up public investment. Heritage and cultural site restoration, though a niche segment, is increasing steadily as nations invest in preserving temples and colonial-era structures. Other applications include small-scale renovations and event infrastructure.

- For instance, the Indonesian government has prioritized affordable and green housing initiatives, including the Indonesia Green Affordable Housing Programme (IGAHP). While these programs focus on sustainable building materials and energy-efficient design, modern large-scale residential construction generally relies on industrial-standard materials like steel.

By End-use Sector

Construction contractors accounted for the largest share of more than 45% in 2024, as they are the primary users of scaffolding systems for residential and commercial projects. Infrastructure development agencies drive demand through large public projects such as ports, railways, and airports, often requiring high-load scaffolding systems. Restoration and conservation groups contribute to specialized demand for bamboo scaffolding in heritage structures. Scaffolding rental companies are expanding rapidly, offering flexible rental solutions to smaller builders. Eco-friendly architecture firms are also adopting bamboo scaffolding to align with sustainable construction practices and reduce carbon footprint.

Market Overview

Rapid Urbanization and Construction Boom

Southeast Asia is experiencing a massive construction surge driven by rapid urbanization and rising infrastructure spending. Mega projects such as Indonesia’s new capital city Nusantara and metro rail expansions in Vietnam and Thailand are boosting demand for reliable scaffolding solutions. Residential housing demand is also increasing due to population growth and government-backed affordable housing initiatives, driving the need for large-scale construction projects. Solid sawn wood planks remain the preferred choice for these projects because of their strength and availability, while modular bamboo scaffolding is gaining adoption for faster assembly. This urban expansion is expected to sustain high scaffolding demand through 2032, with contractors and infrastructure agencies being the largest consumers.

- For instance, WIKA has secured multiple contracts for the construction of roads and infrastructure in Nusantara’s Central Government Core Area (KIPP).

Shift Toward Sustainable and Eco-Friendly Materials

The growing emphasis on sustainable construction is a major driver for bamboo scaffolding adoption across Southeast Asia. Bamboo is a renewable resource, easy to source locally, and has a significantly lower carbon footprint compared to steel scaffolding. Governments are increasingly mandating eco-friendly construction practices under green building codes, encouraging developers to adopt bamboo solutions. Modular bamboo scaffolding systems are becoming popular in urban areas due to their reusability, safety, and compliance with environmental regulations. Construction firms and eco-architecture practices are adopting bamboo scaffolding to meet ESG goals, reduce waste, and attract green project certifications like LEED. This sustainability focus is opening opportunities for bamboo product innovation and encouraging investment in engineered bamboo materials with enhanced durability and load capacity.

Rising Safety Standards and Regulatory Compliance

tringent workplace safety regulations are driving demand for certified scaffolding systems that meet international standards such as EN 12811 and OSHA guidelines. Governments in Southeast Asia are implementing stricter site safety protocols, pushing contractors to adopt high-quality scaffolding with strong load-bearing capacity and built-in safety features. Laminated veneer lumber (LVL) and modular bamboo scaffolding are gaining preference for their reliability, uniformity, and compliance with these standards. Training programs for workers on safe scaffolding use are also improving demand for engineered systems that minimize accidents. The focus on reducing workplace injuries and avoiding regulatory penalties is making safety-compliant scaffolding a priority investment, particularly for infrastructure and industrial projects, strengthening market growth prospects.

- For instance, Gamuda Berhad, a company committed to sustainable construction, utilizes its Digital Industrialised Building System (IBS) for residential towers. This modular approach is designed to increase productivity and reduce construction waste, with the company having a 20% waste-to-landfill reduction target by 2025 across all construction activities.

Key Trends & Opportunities

Adoption of Modular and Prefabricated Scaffolding

The shift toward modular scaffolding systems is a major trend in Southeast Asia, driven by demand for quick assembly, cost efficiency, and worker safety. Modular systems use standardized components that are easy to transport, reducing on-site labor time by up to 30%. This is particularly important for fast-paced urban projects where construction timelines are tight. Prefabricated bamboo scaffolding solutions are gaining popularity because they combine the strength of engineered bamboo with the convenience of modular design. Rental companies are expanding their inventory of modular systems, making them accessible to smaller contractors. This trend supports higher productivity, reduces downtime, and ensures compliance with evolving safety norms, which is crucial in competitive construction markets.

- For instance, in 2024, Singapore’s Yongnam Holdings and its subsidiary, Yongnam Engineering & Construction, were officially undergoing liquidation.The company’s shares were suspended from trading in 2022 and were set to be delisted from the Singapore Exchange (SGX) due to its financial situation.

Growth in Heritage Restoration and Tourism Projects

Southeast Asia’s rich cultural heritage and tourism sector create a strong opportunity for bamboo scaffolding applications. Countries like Cambodia, Thailand, and Myanmar are investing in temple restoration, palace renovation, and heritage site conservation to attract global tourists. Bamboo scaffolding is preferred in these projects because it is lightweight, flexible, and can be used without damaging fragile historical structures. Conservation agencies and UNESCO-backed projects are partnering with local scaffolding suppliers to meet project-specific requirements. This segment, though niche, is growing steadily and offers long-term opportunities for suppliers specializing in eco-friendly scaffolding. Developing custom bamboo solutions for sensitive restoration work can provide suppliers with a competitive edge and enhance their presence in this high-value market.

Key Challenges

Competition from Steel Scaffolding Systems

Steel scaffolding remains a major competitor, particularly in high-rise and heavy-load construction projects across urban centers. Its superior load capacity, durability, and ability to withstand extreme weather conditions make it the default choice for many large contractors. As urban skylines grow denser, developers often prefer steel scaffolding for projects requiring greater structural stability. However, steel systems are costlier and less sustainable, which can limit adoption in cost-sensitive or eco-conscious projects. The challenge for wood and bamboo scaffolding suppliers is to demonstrate comparable safety, reliability, and long-term cost efficiency to compete effectively. Manufacturers are investing in engineered bamboo and LVL solutions to address this gap, but widespread adoption still faces resistance from conservative contractors.

Quality Variability and Supply Chain Issues

One of the major hurdles for the market is the inconsistency in raw material quality and supply chain reliability. Locally sourced bamboo often varies in strength, diameter, and moisture content, leading to performance differences. Without proper treatment and quality control, bamboo scaffolding can be prone to degradation, reducing lifespan and safety. The supply chain for LVL and engineered bamboo is still underdeveloped in several Southeast Asian countries, causing delays and higher costs. Addressing these issues requires investment in modern processing facilities, standardization of material grades, and stronger distribution networks. Failure to resolve these bottlenecks can restrict market scalability and slow adoption among large construction firms seeking reliable and standardized solutions.

Regional Analysis

Indonesia

Indonesia led the Southeast Asia wood and bamboo scaffolding market in 2024 with over 30% share, supported by massive infrastructure development including the relocation of the national capital to Nusantara. Demand is driven by high-rise construction, new industrial parks, and urban housing projects. Bamboo scaffolding remains dominant in rural regions due to local availability, while modular systems are increasingly adopted for large-scale projects. Government-backed infrastructure spending and foreign investments in industrial manufacturing zones are expected to keep demand strong, positioning Indonesia as the fastest-growing market during the forecast period through 2032.

Vietnam

Vietnam accounted for around 20% market share in 2024, driven by rapid urbanization, industrial growth, and foreign direct investment in manufacturing sectors. Major cities like Ho Chi Minh City and Hanoi are witnessing a surge in high-rise residential and commercial projects, creating strong demand for durable scaffolding systems. Laminated veneer lumber (LVL) and modular bamboo scaffolding are preferred in urban construction due to strict safety compliance. Government initiatives like metro rail projects and export-oriented industrial zones further fuel market expansion. Vietnam is projected to maintain steady growth through 2032, supported by sustained infrastructure spending.

Thailand

Thailand held nearly 15% market share in 2024, supported by strong activity in commercial real estate, tourism-driven infrastructure, and industrial corridor development under the Eastern Economic Corridor (EEC) initiative. Bamboo scaffolding is commonly used for temple renovations and heritage projects, while wood planks dominate high-load applications in urban construction. The government’s focus on upgrading transport infrastructure, including airports and railways, is boosting demand for high-quality scaffolding. Adoption of modular systems is growing steadily as contractors prioritize faster assembly and improved site safety. Thailand is expected to remain a significant market with moderate but stable growth.

Philippines

The Philippines captured about 12% market share in 2024, driven by residential housing demand and large-scale government projects under the “Build, Build, Build” program. Metro Manila and surrounding urban centers are key demand hubs for scaffolding, particularly for high-rise condominiums and commercial developments. Traditional bamboo scaffolding remains widely used in semi-urban areas due to its cost-effectiveness, but modular bamboo systems are seeing rising adoption in modern projects. Infrastructure projects such as bridges, roads, and airports are expected to support consistent demand, making the Philippines a high-potential growth market during the forecast period.

Malaysia

Malaysia represented around 10% market share in 2024, supported by steady construction activity in Kuala Lumpur and other major cities. Demand is fueled by commercial real estate projects, industrial developments, and public infrastructure investments, including urban transit systems. Solid sawn wood planks are widely used due to their high strength, while modular bamboo scaffolding is gradually gaining traction in eco-friendly and green-certified projects. Growth is supported by the country’s commitment to sustainable construction practices under its Green Building Index (GBI), which encourages the use of renewable materials like bamboo in scaffolding solutions.

Other Southeast Asian Countries

Other Southeast Asian countries, including Myanmar, Cambodia, and Laos, together accounted for around 13% market share in 2024. Demand in these countries is primarily driven by public infrastructure projects, road construction, and restoration of cultural heritage sites. Bamboo scaffolding remains the preferred material due to its availability and low cost. However, rising foreign investments in industrial facilities and hospitality projects are slowly pushing the adoption of more standardized scaffolding solutions like LVL and modular systems. Market growth in these regions is expected to remain gradual but steady as construction activities expand and urban development accelerates.

Market Segmentations:

By Product Type

- Solid Sawn Wood Planks

- Laminated Veneer Lumber (LVL)

- Traditional Bamboo Poles

- Modular Bamboo Scaffolding Systems

By Application

- Residential Construction

- Commercial & Industrial Construction

- Infrastructure Projects

- Heritage & Cultural Site Restoration

- Others

By End-use Sector

- Construction Contractors

- Infrastructure Development Agencies

- Restoration & Conservation Groups

- Scaffolding Rental Companies

- Eco-Friendly Architecture Firms

By Distribution Channel

- Direct Sales

- Distributors & Dealers

- Online Platforms

- Others

By Geography

- Vietnam

- Indonesia

- Thailand

- Philippines

- Malaysia

- Myanmar

- Cambodia

- Others

Competitive Landscape

The Southeast Asia wood and bamboo scaffolding market is moderately fragmented, featuring a mix of global, regional, and local players competing on quality, price, and innovation. Leading companies such as PERI SE, Layher Holding GmbH & Co. KG, Waco Kwikform, and United Scaffolding Group dominate with advanced product portfolios, strong distribution networks, and focus on safety-compliant solutions. Manufacturers are investing in modular systems, engineered bamboo products, and worker safety training programs to capture market share. Partnerships with contractors and infrastructure agencies, along with rental service expansions, remain key strategies. Rising adoption of sustainable scaffolding materials is prompting companies to develop eco-friendly products that meet green building standards. The competitive environment is expected to intensify as infrastructure projects expand across Indonesia, Vietnam, and the Philippines, driving demand for standardized, certified scaffolding solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- PERI SE

- Layher Holding GmbH & Co. KG

- Waco Kwikform

- United Scaffolding Group

- Rizhao Fast & Fasten Scaffold Co., Ltd

- SS Group

- Bamboooz

- GASSCO Scaffolding

- NS BlueScope

- RMD Kwikform

Recent Developments

- In 2025, ULMA Construction’s innovation focus has been on engineering advancements and digital integration for scaffolding systems, especially for modular and steel variants. There is little emphasis from ULMA on wood or bamboo materials, as their recent solutions highlight sustainability efforts and technological enhancements more applicable to metal-based systems.

- In April 2025, at the bauma trade show in Munich, PERI showcased sustainable formwork innovations, including the introduction of a universal formwork system made from biopolymer. Their market direction is toward resource-saving solutions and modularity, with digital tools and even robotic assistance being trialed for assembly.

- In March 2025, the Hong Kong government announced plans to phase out bamboo scaffolding for most public projects, mandating a shift to modern metal alternatives for improved safety and fire resistance.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-use Sector, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily through 2032, driven by infrastructure and residential construction projects.

- Demand for modular bamboo scaffolding systems will rise due to faster assembly and safety compliance.

- Adoption of laminated veneer lumber will increase in urban projects requiring high structural consistency.

- Green building certifications will boost the use of eco-friendly bamboo scaffolding across the region.

- Rental scaffolding services will expand, supporting small and mid-sized contractors with flexible solutions.

- Government investment in metro networks, bridges, and smart cities will sustain long-term market growth.

- Technological innovations will improve bamboo treatment processes, enhancing durability and load capacity.

- Regional players will collaborate with global companies to offer standardized and certified scaffolding systems.

- Rising worker safety regulations will drive demand for engineered scaffolding with built-in safety features.

- Indonesia, Vietnam, and Thailand will remain the leading markets with strong construction pipelines.