Market Overview:

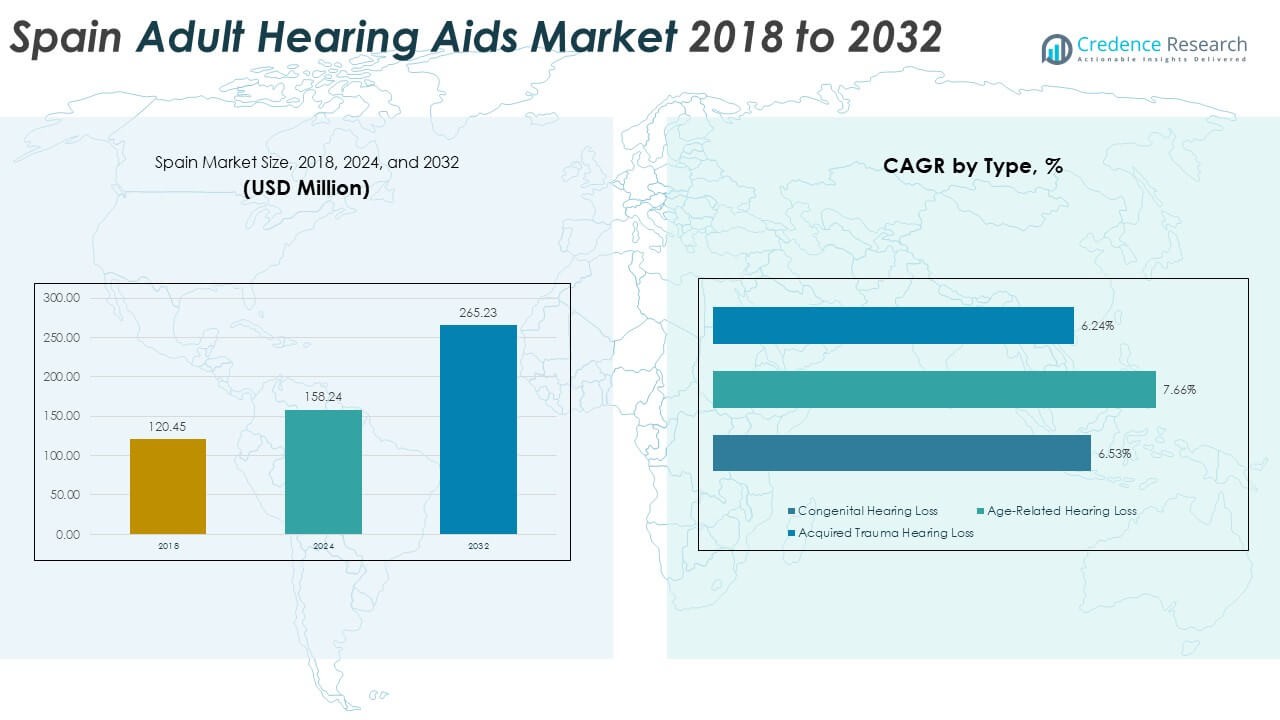

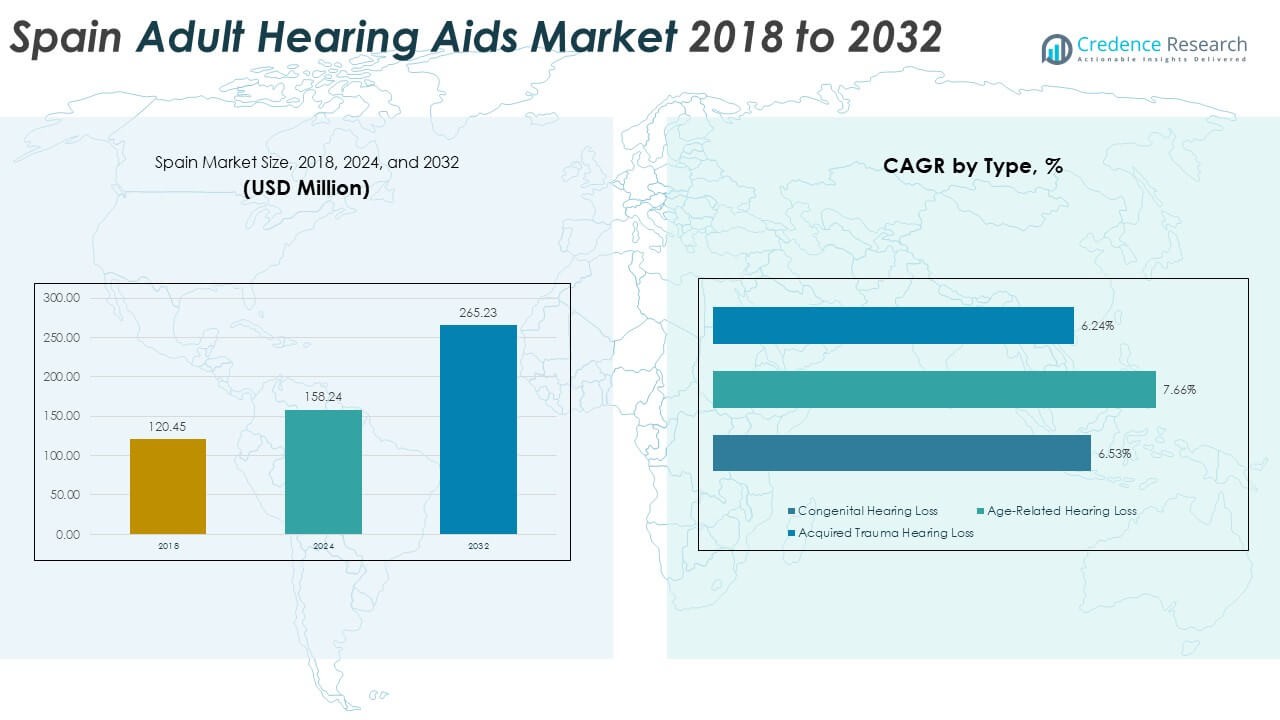

The Spain Adult Hearing Aids Market size was valued at USD 120.45 million in 2018 to USD 158.24 million in 2024 and is anticipated to reach USD 265.23 million by 2032, at a CAGR of 6.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Adult Hearing Aids Market Size 2024 |

USD 158.24 Million |

| Spain Adult Hearing Aids Market, CAGR |

6.67% |

| Spain Adult Hearing Aids Market Size 2032 |

USD 265.23 Million |

The Spain Adult Hearing Aids Market is experiencing strong growth due to rising cases of age-related hearing loss and higher awareness of hearing health. Advancements in digital technology, such as Bluetooth-enabled and rechargeable devices, are increasing adoption among elderly users. Supportive government healthcare programs and reimbursement policies further encourage patients to seek treatment. Additionally, increasing penetration of teleaudiology services and online hearing tests improves accessibility. Growing focus on user-friendly designs and discreet devices also strengthens consumer confidence, driving greater demand across Spain.

Within the Spain Adult Hearing Aids Market, Western Europe leads due to its advanced healthcare infrastructure and higher adoption rates of innovative devices. Countries such as Germany and France set benchmarks in technology integration and reimbursement systems. Spain benefits from these trends, with expanding awareness campaigns boosting uptake. Meanwhile, Eastern European regions are emerging as promising markets, driven by gradual improvements in healthcare systems and growing disposable income. This geographic spread highlights the importance of both established and evolving markets in shaping overall growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Spain Adult Hearing Aids Market size was valued at USD 120.45 million in 2018 to USD 158.24 million in 2024 and is anticipated to reach USD 265.23 million by 2032, at a CAGR of 6.67% during the forecast period.

- Central Spain led with 41% share in 2024, supported by Madrid’s healthcare infrastructure and retail penetration, while Northern Spain held 34% due to strong awareness and reimbursement programs.

- Southern Spain accounted for 25% and is the fastest-growing subregion, driven by improving healthcare facilities and rising disposable incomes in Andalusia and nearby provinces.

- Age-Related Hearing Loss holds the largest share at 45%, showing dominance in the Spain Adult Hearing Aids Market.

- Congenital Hearing Loss and Acquired Trauma Hearing Loss together account for 55%, with congenital at 30% and acquired trauma at 25%.

Market Drivers:

Growing Prevalence of Age-Related Hearing Loss and Rising Elderly Population

The Spain Adult Hearing Aids Market is expanding due to a rapid increase in elderly citizens facing hearing impairment. Rising life expectancy is pushing the demand for advanced hearing solutions across major Spanish cities and rural regions alike. A larger elderly base is directly influencing demand levels and increasing device adoption in clinical settings. It is becoming more evident that untreated hearing loss leads to isolation and reduced quality of life. Health institutions are actively stressing early diagnosis to prevent cognitive decline risks. Government initiatives are encouraging people to seek professional treatment with awareness campaigns. Elderly individuals are becoming more open to adopting digital and rechargeable models for daily use. This shift is setting a long-term foundation for steady growth.

- For instance, Widex offers the Moment hearing aids with rechargeable technology that provides up to 29 hours of battery life on a single charge, enhancing daily usability for elderly users worldwide including Spain.

Technological Advancements and Integration of Smart Features in Hearing Aids

Innovations in design and performance are pushing adoption across various user segments. The Spain Adult Hearing Aids Market is benefitting from the arrival of Bluetooth-enabled, rechargeable, and AI-supported devices. It is clear that digital platforms with remote adjustments are creating more convenience for users. Integration with smartphones is making hearing aids multifunctional and attractive for younger adult patients as well. Spanish clinics are adopting advanced fitting technologies that improve precision and comfort. Hearing aid manufacturers are introducing smaller, discreet models designed to reduce stigma and boost confidence. Audiologists are reporting rising satisfaction rates among patients due to these improvements. The technological edge is making the market more competitive and sustainable.

- For instance, Widex Moment hearing aids feature PureSound technology with a ZeroDelay™ processing pathway that handles sound in under 0.5 milliseconds. This reduces echo and distortion for a more natural listening experience, particularly for users with mild-to-moderate hearing loss.

Expanding Government Support and Reimbursement Policies Encouraging Wider Adoption

Public health programs are addressing accessibility gaps and promoting affordability of hearing aids. The Spain Adult Hearing Aids Market is strengthened by reimbursement initiatives that encourage more patients to seek treatment. It is evident that financial support is vital in removing cost barriers for middle-income groups. Local authorities are cooperating with hospitals to run free screening campaigns across urban and rural areas. This approach is increasing the diagnosis rate and stimulating higher device penetration. Healthcare professionals are observing greater acceptance when patients are assured of financial aid. National frameworks are aligning with EU health strategies to strengthen access for all citizens. Reimbursement efforts are reinforcing the market’s long-term expansion.

Rising Awareness and Shift Toward Early Diagnosis and Preventive Hearing Health

Awareness campaigns are shaping consumer attitudes toward timely intervention. The Spain Adult Hearing Aids Market is gaining traction as more adults understand the benefits of early treatment. It is evident that untreated hearing loss impacts productivity, safety, and social relationships. Hospitals are emphasizing the role of early screening in preventing severe complications. Patients are more motivated to act when they receive professional guidance about risks of neglecting symptoms. Market players are partnering with community organizations to enhance outreach efforts. Media coverage and health programs are improving public knowledge and reducing stigma around device use. The focus on prevention is accelerating adoption at earlier stages of hearing decline.

Market Trends:

Integration of Teleaudiology and Remote Care Platforms for Wider Accessibility

The rise of teleaudiology services is changing the delivery of hearing care. The Spain Adult Hearing Aids Market is increasingly supported by remote consultation platforms and digital monitoring. It is helping patients in rural areas access care without visiting specialized clinics. Mobile applications are enabling real-time adjustments, offering flexibility and faster troubleshooting. Telecare adoption is gaining strong acceptance due to its convenience and cost savings. Audiologists are leveraging these tools to expand patient engagement beyond hospital visits. Manufacturers are investing in telehealth-friendly devices to stay competitive. Remote

Growth of Personalized and Custom-Fit Hearing Solutions Targeting Consumer Comfort

Personalization is becoming a strong trend shaping product adoption across adult users. The Spain Adult Hearing Aids Market is observing an increase in custom-fit solutions designed for individual ear anatomy. It is clear that consumers prefer products offering both comfort and discretion. Companies are investing in 3D printing and digital modeling to provide tailored fittings. Audiologists are encouraging patients by highlighting the comfort and natural sound of personalized aids. The trend is also reducing device rejection rates among hesitant users. Younger patients are more willing to accept aids when they are less visible and more comfortable. The customization wave is reinforcing long-term loyalty to premium brands.

Adoption of Eco-Friendly and Sustainable Hearing Aid Components Supporting Green Growth

Environmental awareness is influencing medical device manufacturing across Europe. The Spain Adult Hearing Aids Market is witnessing the introduction of eco-friendly components in design and packaging. It is being driven by consumer preference for sustainability and regulatory requirements. Companies are using recyclable materials and promoting energy-efficient rechargeable batteries. Spanish consumers are gradually embracing green devices due to heightened awareness of climate goals. Hospitals are also supporting sustainable procurement practices across medical devices. The adoption of rechargeable models reduces waste from disposable batteries. Sustainability-driven innovation is becoming a clear trend shaping industry differentiation.

- For example, Starkey Hearing Technologies features a portfolio of lithium-ion rechargeable hearing aids, including the smallest and most powerful rechargeable BTE models. The lithium-ion batteries deliver up to 22 hours of use per charge, support fast charging, and are compatible with Apple and Android streaming technology. These rechargeable devices reduce dependence on disposable batteries, supporting sustainability in hearing aid use.

Rising Retail Partnerships and Expansion of Distribution Networks Across Spain

Distribution channels are expanding to make devices accessible beyond hospitals. The Spain Adult Hearing Aids Market is observing an increasing presence of hearing aids in retail chains and pharmacies. It is bridging the gap between specialist clinics and broader consumer reach. Companies are partnering with optical retailers and general health providers to increase exposure. Direct-to-consumer models are gaining traction, offering faster access for patients. Retail partnerships are reducing barriers by simplifying the purchase journey for adults. Online platforms are further broadening sales opportunities across urban and semi-urban areas. The rise of diverse distribution networks is accelerating adoption across demographic groups.

- For example, Amplifon’s GAES brand acquired 31 hearing centers from OirT in 2024, expanding its presence primarily in Andalusia. This acquisition added about 60 hearing care professionals to the GAES network, which operates more than 700 centers in Spain.

Market Challenges Analysis:

High Cost of Advanced Hearing Devices and Limited Affordability for Patients

The Spain Adult Hearing Aids Market faces challenges linked to affordability and access inequality. It is evident that high prices of premium digital devices prevent many adults from purchasing them. Patients from lower-income backgrounds often delay or avoid treatment due to financial constraints. Hospitals and clinics report that a significant portion of patients rely heavily on reimbursement or discounts. Even with government programs, advanced models remain inaccessible for large segments of the population. Cost-sensitive buyers are more likely to purchase outdated models, slowing the adoption of innovations. Manufacturers must find strategies to balance profit with affordability. Without solutions, market penetration may remain uneven across different income groups.

Social Stigma, Lack of Awareness, and Unequal Healthcare Access Across Regions

The Spain Adult Hearing Aids Market is hindered by cultural perceptions and healthcare gaps. It is often observed that social stigma discourages adults from using hearing aids openly. Fear of visible disability leads to underutilization despite clinical needs. Rural regions face limited access to specialized audiology services, leaving patients untreated for long periods. Awareness campaigns are not reaching all demographics with equal intensity. Healthcare providers highlight that late diagnosis increases the severity of untreated hearing loss. Unequal access across geographic locations weakens overall adoption rates. Addressing stigma and expanding healthcare infrastructure remain critical for overcoming these barriers.

Market Opportunities:

Expansion of Digital Health Ecosystem and Adoption of AI-Powered Hearing Solutions

Growing investments in digital health are opening new pathways for innovation. The Spain Adult Hearing Aids Market is well-positioned to benefit from AI-powered solutions that enhance sound quality and user control. It is creating opportunities for manufacturers to launch products that adapt automatically to changing environments. AI-driven features improve patient satisfaction and encourage higher device usage. Integration with digital ecosystems such as smartphones and telecare platforms ensures greater convenience. Health institutions are supporting the adoption of AI-enabled solutions to raise care standards. Continuous technological progress is expanding opportunities for local and international players. The future scope aligns with digital transformation goals in healthcare.

Rising Potential in Untapped Rural Areas and Growing Retail Expansion Strategies

Untapped demand across rural regions presents a strong opportunity for growth. The Spain Adult Hearing Aids Market is expected to benefit from improved awareness and wider retail penetration. It is becoming clear that direct-to-consumer distribution and retail tie-ups can close accessibility gaps. Pharmacies and health stores provide easier access for adults who avoid hospital visits. Companies adopting hybrid retail and digital sales strategies are reaching underserved groups effectively. Awareness programs targeting smaller towns can further enhance demand. Rising disposable income in rural areas is improving purchasing power for healthcare products. Retail expansion is opening a pathway for wider adoption and stronger growth potential.

Market Segmentation Analysis:

The Spain Adult Hearing Aids Market is segmented

By type

Into congenital hearing loss, age-related hearing loss, and acquired trauma hearing loss. Age-related hearing loss dominates demand due to the growing elderly population and rising awareness of early treatment. Congenital hearing loss contributes steadily, supported by improved neonatal screening and early intervention programs. Acquired trauma hearing loss also creates demand, with rising cases linked to accidents and occupational hazards. This segmentation highlights the diverse clinical needs driving product adoption across patient groups.

- For instance, age-related hearing loss is the dominant form of hearing loss globally. As a result, hearing aid manufacturers like GN Hearing experience a strong sales emphasis on devices targeting adults aged 65 and older in the European market, which aligns with market trends driven by the aging population.

By application

The market covers behind-the-ear (BTE), in-the-ear (ITE), in-the-canal (ITC), and completely-in-canal (CIC) hearing aids. BTE devices lead usage due to their advanced features, durability, and suitability for severe hearing loss. ITE and ITC models are gaining attention from adults seeking comfort and discretion, while CIC devices attract users preferring near-invisible designs. It is evident that rising innovation in miniaturization and sound clarity is strengthening demand for smaller form factors, creating opportunities across multiple application areas.

- For example, Oticon’s More BTE uses an open-fit design with AI-driven sound processing for severe hearing loss. The Opn S CIC offers a discreet, nearly invisible design with wireless connectivity, showing how Oticon addresses multiple user needs.

By sales channel

The Spain Adult Hearing Aids Market is divided into direct and distribution channels. Direct channels, including clinics and hospitals, remain vital due to personalized fitting and professional consultation. Distribution channels are expanding, supported by retail outlets and online platforms offering wider accessibility. It is driving greater convenience for patients who prefer simpler purchasing options. The blend of clinical and retail distribution ensures broad coverage, enabling manufacturers to target both urban and semi-urban populations effectively.

Segmentation:

By Type

- Congenital Hearing Loss

- Age-Related Hearing Loss

- Acquired Trauma Hearing Loss

By Application

- Behind-the-Ear (BTE) Hearing Aids

- In-the-Ear (ITE) Hearing Aids

- In-the-Canal (ITC) Hearing Aids

- Completely-In-Canal (CIC) Hearing Aids

By Sales Channel

- Direct Channel

- Distribution Channel

Regional Analysis:

Northern Spain holds a market share of 34% in the Spain Adult Hearing Aids Market. The region benefits from advanced healthcare infrastructure and high awareness of hearing health among the aging population. Urban centers such as Bilbao and San Sebastián support strong adoption due to access to specialized audiology clinics. Public healthcare programs in the Basque Country and Navarra promote early screening, increasing penetration of modern hearing solutions. Private sector initiatives also support the distribution of digital hearing aids, making Northern Spain a strong contributor. It continues to drive growth through high adoption of premium models and effective reimbursement systems.

Central Spain accounts for 41% of the Spain Adult Hearing Aids Market, making it the leading subregion. Madrid dominates this share with its concentration of hospitals, clinics, and hearing aid retailers. The urban lifestyle and dense elderly population create consistent demand for advanced devices. It benefits from strong public-private partnerships that focus on early diagnosis and hearing health awareness. Clinics across Castilla-La Mancha and Castilla y León are expanding access to rural populations, strengthening market growth. Central Spain maintains its lead due to high consumer spending, broad product availability, and strong government engagement in healthcare delivery.

Southern Spain, including Andalusia, holds 25% of the Spain Adult Hearing Aids Market. The region is expanding due to rising disposable incomes and improved awareness of hearing health. It is experiencing higher adoption in cities such as Seville, Málaga, and Granada, where healthcare infrastructure is improving. Rural populations are gradually gaining access through distribution channels and awareness programs. Retail expansion and pharmacy-led sales models are bridging gaps in availability across smaller towns. Southern Spain is expected to grow steadily as both healthcare access and consumer acceptance improve, positioning it as a promising subregion for future investments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- GAES

- Horentek

- GrandAudition

- WSA

- GN ReSound

- Hansaton Hearing Aids

- Sebotek Hearing Systems

- Audina Hearing Instruments

- Microson

- Amplifon

- Phonak

- Others

Competitive Analysis:

The Spain Adult Hearing Aids Market features a mix of global leaders and strong domestic players competing across technology, pricing, and distribution. Key companies such as Amplifon, Phonak, and GN ReSound dominate with advanced product portfolios, extensive retail presence, and strong R&D pipelines. Local firms including GAES and Microson hold a significant role in addressing regional needs and tailoring solutions to Spanish consumers. It benefits from their deep market knowledge and strong distribution networks across urban and semi-urban regions. International players are focusing on product innovation with AI integration, Bluetooth connectivity, and rechargeable batteries to differentiate themselves. Competition is intensifying through mergers, acquisitions, and partnerships designed to expand footprints and strengthen brand visibility. Direct-to-consumer models and retail partnerships are increasing pressure on traditional clinical sales channels. The Spain Adult Hearing Aids Market is also shaped by the ability of companies to offer discreet designs, high sound quality, and personalized fitting. Price sensitivity among consumers continues to influence competitive positioning, driving firms to balance innovation with affordability. It is evident that strategic investment in technology, accessibility, and customer experience will determine long-term leadership in the Spanish market.

Recent Developments:

- In August 2025, William Demant Invest entered a three-year research collaboration with Lineage Cell Therapeutics to develop ReSonance (ANP1), an auditory neuronal cell transplant targeting hearing loss. William Demant will fund up to $12 million for preclinical development in this pioneering initiative.

- In June 2025, Starkey announced a partnership with MED-EL, introducing DualSync, a bimodal streaming technology that allows seamless audio from Apple devices to both Starkey hearing aids (Edge AI and Genesis AI) and MED-EL cochlear implants, launching July 1, 2025. This collaboration aims to unify wireless connectivity for users requiring both technologies.

- In August 2024, Sonova Holding AG launched the Phonak Audéo Infinio Sphere, a new receiver-in-canal (RIC) hearing aid featuring advanced Bluetooth connectivity, IP68+ water resistance, and next-generation fitness tracking capabilities, further establishing their innovation leadership in the adult hearing aids market.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Spain Adult Hearing Aids Market will expand steadily, driven by rising elderly populations seeking advanced solutions.

- Growing preference for discreet, comfortable, and personalized hearing devices will shape product innovation.

- Integration of AI-enabled features and smartphone compatibility will strengthen consumer adoption and satisfaction.

- Teleaudiology and remote care platforms will expand access in underserved and rural regions.

- Eco-friendly rechargeable models will gain traction, aligning with sustainability goals and reducing waste.

- Direct-to-consumer sales and retail partnerships will broaden accessibility beyond hospital-based distribution.

- Government reimbursement initiatives and public health campaigns will continue to encourage early adoption.

- Domestic players will leverage regional knowledge to compete with international brands in niche markets.

- Awareness about preventive hearing care will increase adoption among middle-aged adults.

- Expanding investment in research and technology will reinforce the long-term competitiveness of the industry.