Market Overview

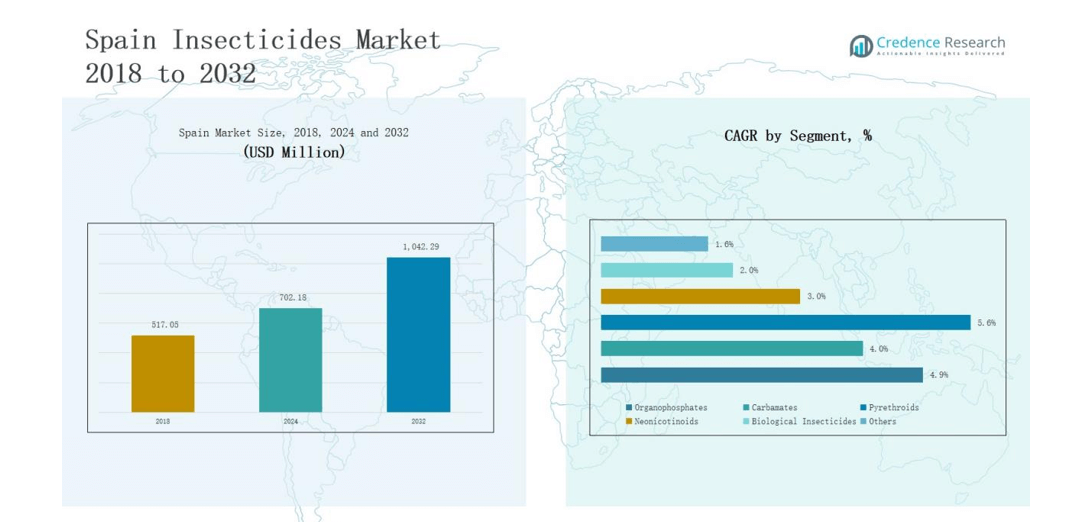

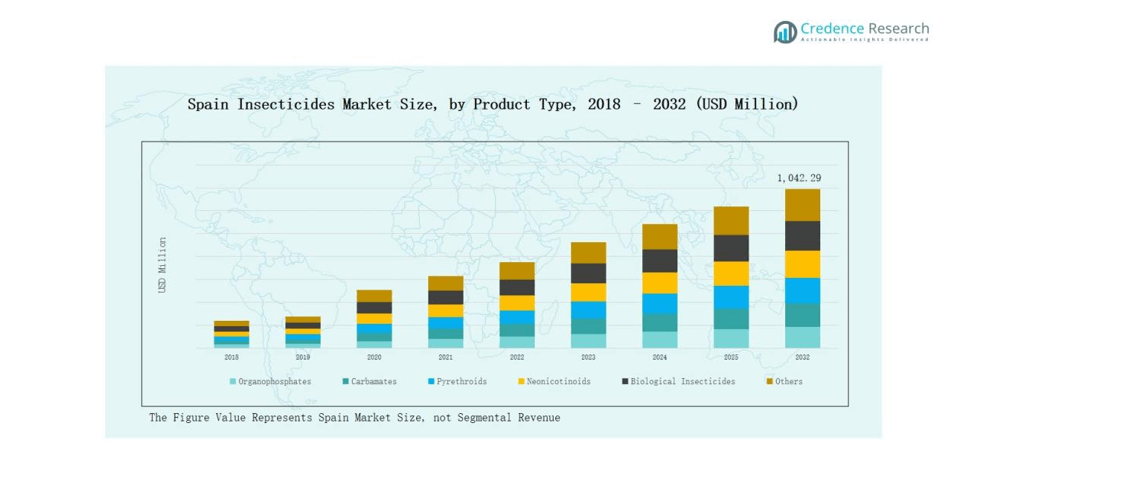

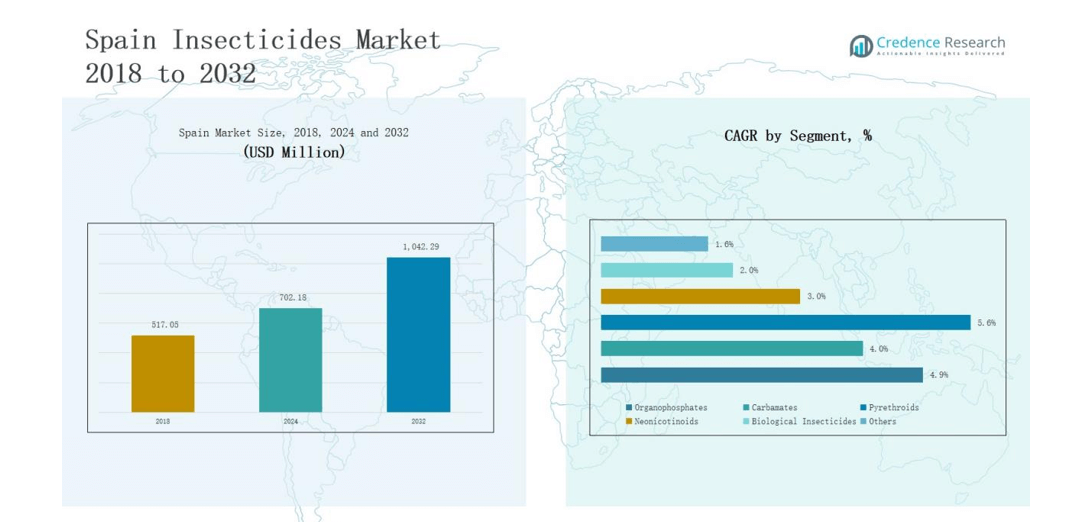

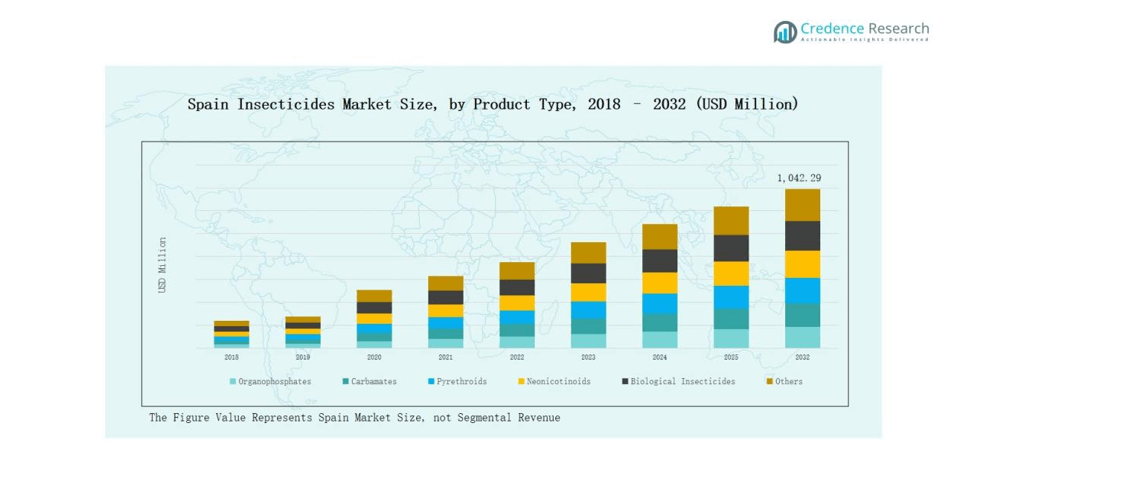

Spain Insecticides Market size was valued at USD 517.05 million in 2018 to USD 702.18 million in 2024 and is anticipated to reach USD 1,042.29 million by 2032, at a CAGR of 4.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Insecticides Market Size 2024 |

USD 702.18 million |

| Spain Insecticides Market, CAGR |

4.96% |

| Spain Insecticides Market Size 2032 |

USD 1,042.29 million |

The Spain Insecticides Market is shaped by the presence of global leaders and strong regional firms. Key players include Syngenta, Bayer CropScience, BASF SE, FMC Corporation, ADAMA, Nufarm, Dow AgroSciences, Sipcam Iberica, Atanor, and Indukern. These companies compete through diverse product portfolios, investments in biological insecticides, and compliance with stringent EU regulations. Their strategies focus on innovation, distribution partnerships, and sustainable solutions to address pest resistance and residue concerns. Regionally, Eastern Spain led the market with a 26% share in 2024, supported by greenhouse vegetable cultivation, citrus farming, and rapid adoption of eco-friendly formulations. This leadership highlights the region’s role in advancing both traditional and biological insecticide demand across Spain.

Market Insights

- The Spain Insecticides Market grew from USD 517.05 million in 2018 to USD 702.18 million in 2024 and will reach USD 1,042.29 million by 2032.

- Eastern Spain led with 26% share in 2024, driven by greenhouse vegetables, citrus farming, and adoption of sustainable insecticide solutions.

- Organophosphates dominated by product type with 32% share, followed by pyrethroids at 21% and neonicotinoids at 17% in 2024.

- Agriculture remained the leading application with 68% share in 2024, while forestry, turf, and public health accounted for smaller but steady shares.

- Key players include Syngenta, Bayer CropScience, BASF SE, FMC Corporation, ADAMA, Nufarm, Dow AgroSciences, Sipcam Iberica, Atanor, and Indukern.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Organophosphates led the Spain insecticides market with a 32% share in 2024, supported by their effectiveness across cereals, fruits, and vegetables. Pyrethroids followed with 21% share, benefiting from lower toxicity and strong application in orchards and vineyards. Neonicotinoids held 17% share, mainly in citrus and olive crops, though EU restrictions on pollinator safety are expected to slow their future growth. Carbamates accounted for 15% share, largely applied in horticulture, while biological insecticides gained 10% share, driven by rising demand for organic farming solutions and sustainable crop protection.

- For instance, Bayer Crop Science manufactures and markets various pyrethroid insecticides, including different formulations under the Decis brand, for pest control on a wide range of crops worldwide.

By Application

Agriculture dominated the Spain insecticides market with a 68% share in 2024, supported by intensive cultivation of cereals, citrus fruits, olives, and greenhouse vegetables. Forestry accounted for 12% share, reflecting pest management in pine plantations and forest reserves. Turf and landscape applications captured 8%, mainly in urban green spaces, while public health usage stood at 7%, focused on mosquito and vector control. The remaining 5% share came from other applications, including household and specialty uses.

- For instance, Syngenta España partnered with greenhouse growers in Almería to expand the use of its insecticide Minecto Alpha®, a chemical insecticide, for integrated pest management in tomatoes and peppers. Minecto Alpha® is not a biological-based product.

Market Overview

Expansion of High-Value Crops

Spain’s insecticides market benefits from the expansion of high-value crops such as citrus, olives, grapes, and greenhouse vegetables. These crops face significant pest pressure, driving strong demand for effective insect control solutions. Farmers increasingly invest in advanced insecticide formulations to protect yield and quality, which supports steady revenue growth. The export orientation of Spain’s fruit and vegetable sector further accelerates adoption, as compliance with global quality standards requires consistent pest management strategies across different product types.

- For instance, Bayer introduced its Vynyty Citrus® pheromone-based biological insecticide for Spanish citrus orchards, aimed at controlling the citrus fruit fly while reducing chemical residues in export-bound produce.

Rising Adoption of Integrated Pest Management (IPM)

The growing adoption of Integrated Pest Management (IPM) programs is boosting insecticide demand, especially biological and low-toxicity options. Farmers are aligning with EU sustainability regulations by using chemical and biological products in combination to reduce resistance and environmental impact. This shift has encouraged investments in bio-insecticides and targeted formulations that complement IPM systems. The approach not only enhances long-term crop protection efficiency but also supports Spain’s positioning as a leader in sustainable and eco-friendly agriculture within Europe.

- For instance, GreenField Biocontrol utilizes natural predator releases and habitat manipulation to support biodiversity and reduce chemical pesticide dependency, reinforcing sustainable IPM adoption in European farming.

Strong Government and EU Support for Agriculture

Government support and EU agricultural policies continue to shape insecticide demand in Spain. Subsidies for modernizing farming practices and strict crop protection standards create a market where advanced insecticides are essential. The Common Agricultural Policy (CAP) and local initiatives promote productivity, export competitiveness, and compliance with food safety requirements. These measures encourage both large-scale farms and smallholders to adopt innovative insect control products, ensuring consistent demand across segments despite increasing regulatory scrutiny on chemical formulations.

Key Trends & Opportunities

Shift Toward Biological Insecticides

A major trend is the accelerating shift toward biological insecticides, which accounted for 10% of Spain’s market in 2024. Rising consumer demand for organic produce and EU restrictions on harmful chemicals are driving this transition. Companies are introducing biopesticides based on natural extracts, microbial formulations, and pheromone-based traps. Greenhouse farming, particularly in Almería and Murcia, is a hotspot for adoption, as growers seek eco-friendly solutions that maintain yields while reducing chemical residues. This creates strong opportunities for global and local players.

- For instance, Government subsidy programs under Spain’s CAP Strategic Plan (2023–2027) have facilitated wider use of biofungicides, especially for high-value crops such as grapes and citrus fruits, reflecting increased investment in eco-friendly pest control solutions by local and global players.

Digitalization and Precision Agriculture

Spain’s insecticides market is also witnessing opportunities through digital farming and precision agriculture. Tools like drone spraying, remote sensing, and AI-based pest monitoring are improving the efficiency of insecticide application. These technologies reduce wastage, improve targeting, and align with sustainability goals. The adoption of smart farming practices among large agricultural cooperatives is creating demand for specialized insecticide formulations tailored for precision delivery. This trend is expected to accelerate as digital infrastructure and farm management technologies expand in Spain.

- For instance, in January 2024, the Spanish Agrarian Guarantee Fund (FEGA) launched the SIEX platform, enabling 800,000 farms to digitally report crop treatments and optimize pesticide application through data integration.

Key Challenges

Stringent EU Regulatory Restrictions

A major challenge for Spain’s insecticides market is the tightening EU regulatory framework, which restricts active ingredients deemed harmful to human health and pollinators. The ban on certain neonicotinoids and stricter residue limits directly affect product availability. Companies face higher costs for reformulation, registration, and compliance testing. While this shift aligns with sustainability goals, it limits flexibility for farmers who rely on chemical protection against pests, often forcing them to adopt costlier or less effective alternatives in the short term.

Rising Incidence of Pest Resistance

Pest resistance to widely used chemical formulations is becoming a significant barrier to market growth in Spain. Over-reliance on organophosphates and pyrethroids has led to resistance in insects such as whiteflies and aphids, reducing product efficacy. This trend pressures farmers to rotate chemicals more frequently or combine them with biological alternatives, increasing production costs. For manufacturers, it necessitates continuous innovation in active ingredients, which involves lengthy development timelines and high R&D expenditure, delaying immediate returns on new product launches.

Price Volatility and Import Dependence

Spain’s insecticides market faces pricing challenges due to raw material volatility and import dependence. Many active ingredients and intermediates are sourced from global suppliers, particularly in Asia. Supply chain disruptions, currency fluctuations, and rising energy costs directly impact pricing structures. Farmers, especially smallholders, struggle with affordability when costs increase sharply. This volatility limits consistent adoption, particularly of advanced formulations, and creates uncertainty for distributors and manufacturers aiming to maintain stable margins in a highly competitive marketplace.

Regional Analysis

Northern Spain

Northern Spain accounted for 28% share in 2024, driven by strong agricultural activity in cereals, vineyards, and fruit orchards. Farmers in this region rely heavily on pyrethroids and organophosphates for pest management in grapes and apples. It benefits from well-developed agricultural cooperatives that ensure effective product distribution. Greenhouse production in parts of the region also contributes to rising use of biological insecticides. The Spain Insecticides Market in Northern Spain continues to expand due to the growing adoption of integrated pest management practices. Demand growth remains steady despite increasing EU regulations on chemical formulations.

Central Spain

Central Spain held 22% share in 2024, with cereals and olive cultivation shaping insecticide demand. Organophosphates and carbamates remain widely used due to their broad-spectrum effectiveness on soil pests and leaf miners. It faces pressure to reduce chemical residues, creating opportunities for bio-based alternatives. Farmers in Castilla-La Mancha are gradually introducing neonicotinoids for olive and vineyard protection. Distribution networks are strong, supported by national suppliers and global companies. The Spain Insecticides Market in Central Spain is shaped by a balance of traditional chemical demand and emerging biological solutions.

Eastern Spain

Eastern Spain captured 26% share in 2024, led by greenhouse cultivation of vegetables in Valencia and Murcia. Pyrethroids and biological insecticides dominate this market due to strict EU residue controls and strong export orientation. It benefits from advanced irrigation systems and adoption of precision farming methods that improve insecticide application. Citrus cultivation is another key driver, requiring targeted neonicotinoid usage for pest control. Regional cooperatives play a central role in introducing sustainable formulations. The Spain Insecticides Market in Eastern Spain shows strong growth potential supported by technology adoption and organic farming trends.

Southern Spain

Southern Spain represented 24% share in 2024, with Andalusia leading demand through extensive olive and citrus farming. Organophosphates and pyrethroids are dominant due to their proven performance in large-scale plantations. It is also witnessing growth in biopesticides as olive growers face increasing restrictions on chemical residues. Regional focus on high-value export crops is pushing farmers to invest in advanced formulations. The distribution presence of multinationals supports availability and competitive pricing. The Spain Insecticides Market in Southern Spain maintains a critical role in national production, balancing traditional chemical reliance with sustainability-focused adoption.

Market Segmentations:

By Product Type

- Organophosphates

- Carbamates

- Pyrethroids

- Neonicotinoids

- Biological Insecticides

- Others

By Application

- Agriculture

- Forestry

- Turf & Landscape

- Public Health

- Others

By Region

- North Spain

- Central Spain

- East Spain

- Southern Spain

Competitive Landscape

The Spain Insecticides Market is highly competitive, shaped by the presence of multinational corporations and strong regional players. Leading companies such as Syngenta, Bayer CropScience, BASF SE, FMC Corporation, and ADAMA hold significant positions through broad product portfolios and advanced formulations tailored to cereals, citrus, and olive crops. Local firms, including Sipcam Iberica and Indukern, strengthen competition by offering cost-effective solutions and niche biological products aligned with EU sustainability directives. Companies invest heavily in research and development to address regulatory restrictions and rising demand for bio-insecticides. Strategic partnerships with cooperatives and distributors enhance market reach, while product differentiation focuses on residue compliance, resistance management, and eco-friendly solutions. The competitive landscape is further defined by innovation in biological insecticides, which gain traction in greenhouse and organic farming. Overall, the market reflects a balanced mix of global expertise and regional adaptability, ensuring consistent product availability and ongoing shifts toward sustainable pest management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Syngenta

- FMC Corporation

- Dow AgroSciences

- ADAMA

- Bayer CropScience

- Nufarm

- BASF SE

- Sipcam Iberica

- Atanor

- Indukern

Recent Developments

- In July 2024, Syngenta introduced Pyrevert 5% EC, the market’s most concentrated natural Pyrethrin insecticide targeting multiple pests including aphids and whiteflies in Spain.

- On July 28, 2025, Ambienta acquired Agronova Biotech, a Spanish biotechnology firm specializing in biological crop solutions. This marks Ambienta’s entrance into the Spanish sustainable agriculture landscape.

- In March 2025, Sumitomo Chemical fully acquired Philagro and announced plans to acquire Kenogard, strengthening its crop protection portfolio in Spain.

- On June 17, 2025, Bayer and Kimitec collaborated to introduce two new biological products: Ambition Complete Gen2 and Ambition Secure Gen2, developed through their alliance.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for biological insecticides will continue to rise in greenhouse and organic farming.

- Regulatory pressure from the EU will drive reformulation of chemical insecticides.

- Integrated pest management practices will gain wider adoption across major crop segments.

- Digital farming tools will support more precise and efficient insecticide applications.

- Neonicotinoid usage will decline due to stricter pollinator safety regulations.

- Olive and citrus farming will remain the largest consumers of insecticides in Spain.

- Local players will expand their role by offering cost-effective and eco-friendly solutions.

- Export-oriented agriculture will sustain demand for residue-compliant insecticide products.

- Pest resistance challenges will push companies to innovate in active ingredients.

- Distribution partnerships with cooperatives will strengthen market penetration in rural regions.