Market Overview

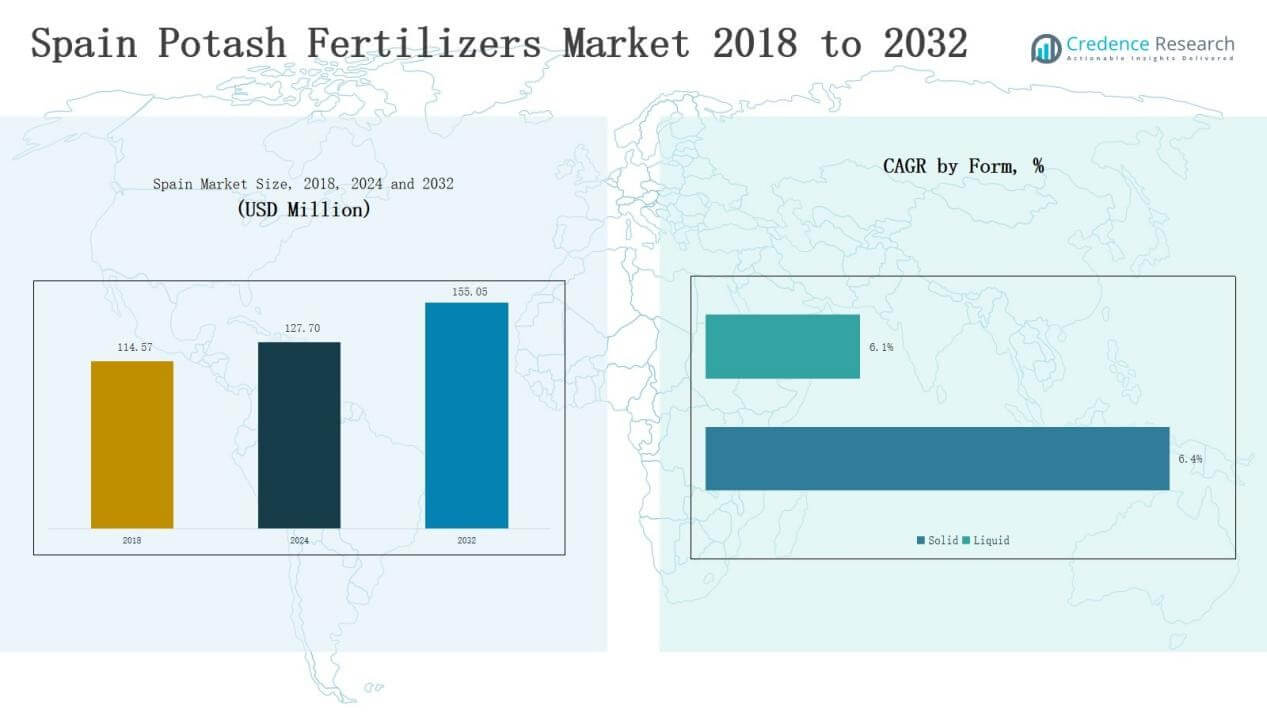

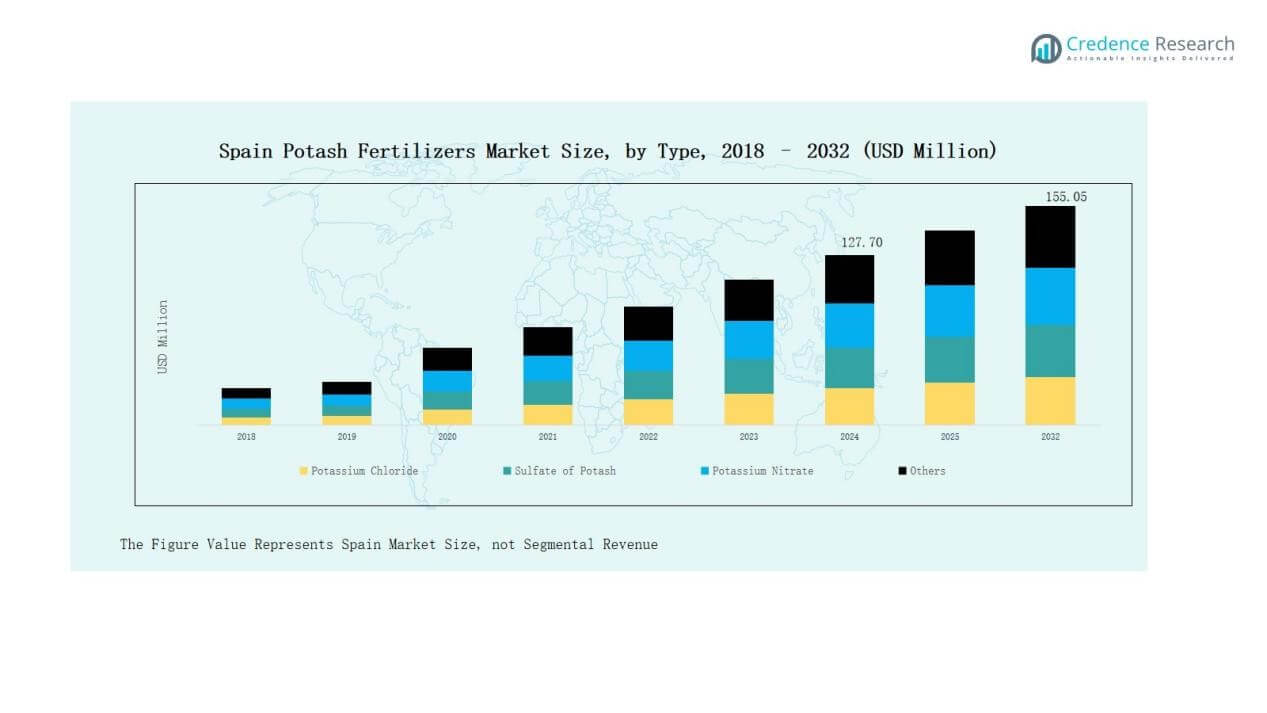

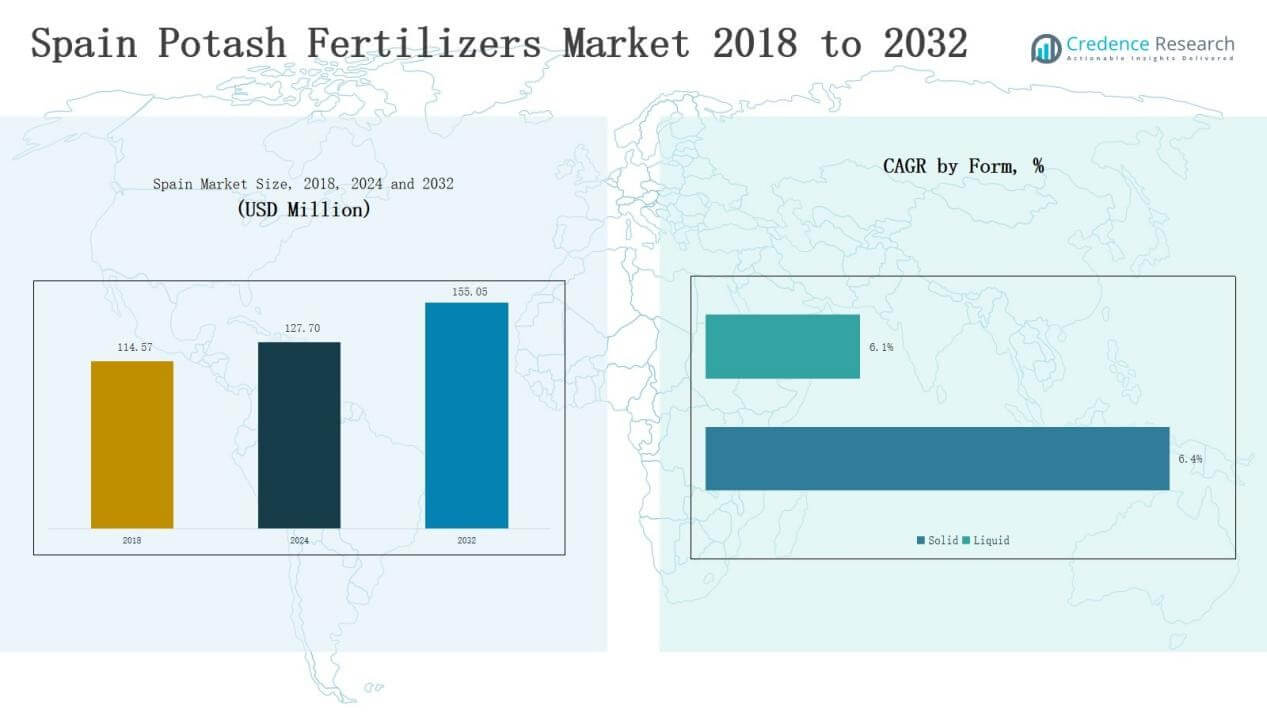

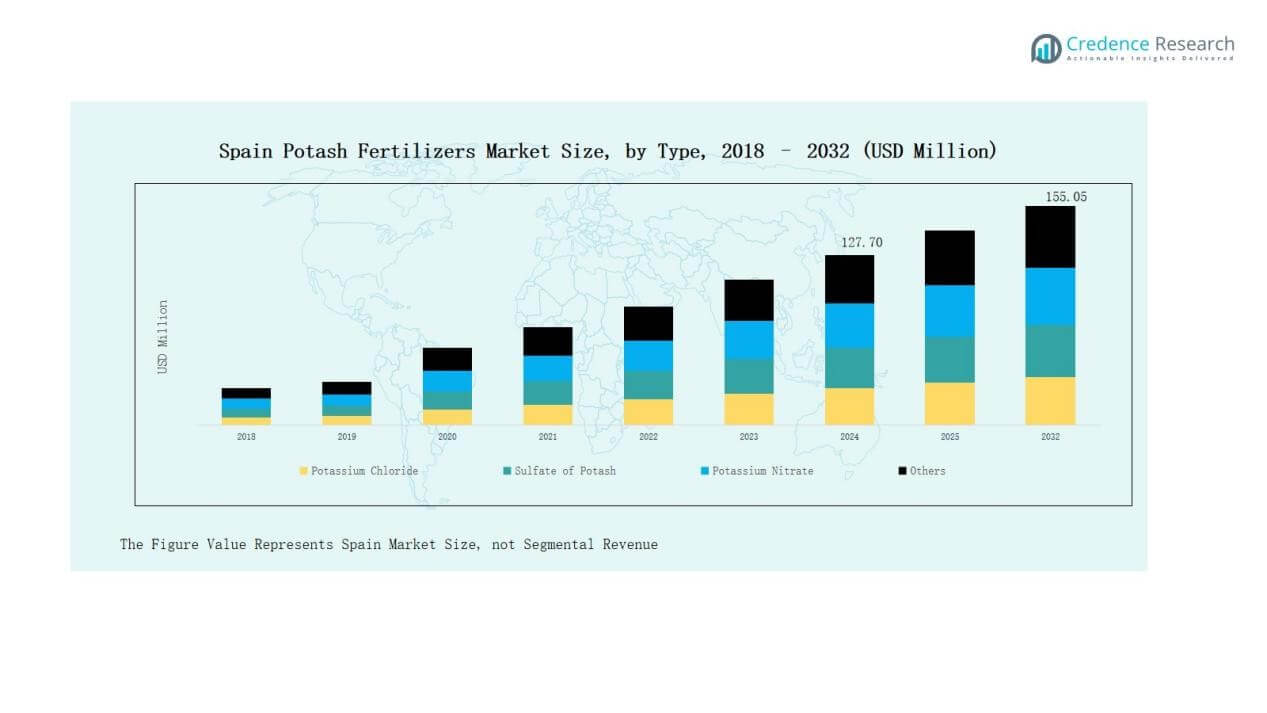

Spain Potash Fertilizers Market size was valued at USD 114.57 million in 2018 to USD 127.70 million in 2024 and is anticipated to reach USD 155.05 million by 2032, at a CAGR of 2.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Potash Fertilizers Market Size 2024 |

USD 127.70 Million |

| Spain Potash Fertilizers Market, CAGR |

2.46% |

| Spain Potash Fertilizers Market Size 2032 |

USD 155.05 Million |

The Spain Potash Fertilizers Market is characterized by the presence of leading global and regional players, including Yara International, The Mosaic Company, K+S Aktiengesellschaft, JSC Belaruskali, Helm, CF Industries, and ICL. These companies focus on expanding product portfolios with chloride-free formulations, strengthening distribution networks, and supporting sustainable agricultural practices tailored to Spain’s diverse crop needs. Northern Spain emerged as the leading region, commanding 34% share in 2024, driven by extensive cereal and grain cultivation, modern mechanized farming, and strong fertilizer adoption across vineyards and orchards.

Market Insights

- Spain Potash Fertilizers Market grew from USD 114.57 million in 2018 to USD 127.70 million in 2024 and is expected to reach USD 155.05 million by 2032.

- Potassium Chloride led by type with 51% share in 2024, driven by affordability and strong demand from cereal and grain cultivation across the country.

- Broadcasting dominated application methods with 47% share in 2024, supported by simplicity, cost efficiency, and widespread use in large-scale cereal farming practices.

- Solid fertilizers held 66% share in 2024, reflecting long shelf life, cost benefits, and extensive use in cereals, while liquid formulations gained ground in greenhouses.

- Northern Spain led regionally with 34% share in 2024, driven by mechanized farming, cereal and grain output, and strong fertilizer demand in vineyards and orchards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

Potassium Chloride dominated the Spain Potash Fertilizers Market with a 51% share in 2024, reflecting its affordability and strong suitability for cereal and grain crops, which form a large part of Spain’s agricultural output. Sulphate of Potash held a notable share, favored in vineyards and vegetable farming due to its chloride-free nature, which protects crop quality. Potassium Nitrate gained traction in high-value horticulture for delivering both potassium and nitrogen efficiently. Other niche formulations contributed only marginally, serving specific localized applications.

For instance, K+S Minerals and Agriculture GmbH expanded sales of sulphate of potash to Spanish vineyards, highlighting its increased use in chloride-sensitive crops such as grapes.

By Application Method

Broadcasting accounted for a 47% share in 2024, making it the leading application method due to its simplicity, lower labor requirement, and extensive use in cereal farming across Spain’s large cultivation areas. Fertigation demonstrated increasing adoption, supported by the country’s expanding greenhouse production and modern irrigation systems. Foliar application also gained momentum in vineyards and fruit farms, offering precise nutrient delivery with visible crop quality benefits. Other application methods remained limited, typically applied in smaller or specialized farming systems.

By Form

Solid fertilizers represented a 66% share in 2024, driven by their wide availability, lower storage cost, and high adoption in field-scale farming for cereals and grains. Their long shelf life and ease of application made them the preferred choice for most traditional farmers. Liquid fertilizers, though smaller in share, showed steady growth in modern farming systems, particularly in fertigation and foliar uses. Their fast absorption and uniform nutrient delivery make them essential in vineyards, orchards, and greenhouse-based cultivation, supporting Spain’s shift toward intensive horticulture practices.

For instance, Nutrien expanded its production of liquid urea ammonium nitrate (UAN) solutions in North America, highlighting demand for liquid fertilizers in high-value horticultural crops.

Key Growth Drivers

Key Growth Drivers

Rising Demand for High-Value Crops

Spain’s strong position in fruits, vegetables, and vineyards drives consistent demand for potash fertilizers. Farmers increasingly use chloride-free fertilizers such as sulphate of potash and potassium nitrate to protect crop quality and improve yield. Export-oriented horticulture and wine production further strengthen this demand. The growth of organic and sustainable farming practices also accelerates fertilizer adoption. With high-value crops contributing significantly to Spain’s agricultural exports, potash fertilizers remain critical for meeting both domestic and international quality standards.

For instance, ICL Group reported strong sales of its potassium nitrate (PeKacid® and Nova PeKacid®) fertilizers in Spain’s fruit and vegetable sector, highlighting their role in enhancing water-use efficiency in drip irrigation systems.

Expanding Greenhouse and Irrigation Systems

The expansion of modern greenhouse cultivation and advanced irrigation systems is a major driver for fertilizer demand in Spain. Farmers are adopting fertigation and foliar methods to improve nutrient efficiency and reduce wastage. This shift supports higher productivity in controlled environments, particularly for vegetables and specialty fruits. Government-backed initiatives promoting water-efficient farming encourage farmers to invest in these technologies. As more growers modernize operations, the demand for soluble and liquid potash fertilizers strengthens, ensuring consistent nutrient supply across multiple crop cycles.

For instance, Fertiberia partnered with Almería greenhouse growers to supply water‑soluble fertilizers as part of sustainable fertigation trials, aiming to enhance tomato and pepper yields.

Government Support and Precision Agriculture Adoption

Government policies promoting sustainable farming practices and improved soil health directly support potash fertilizer usage. Farmers are encouraged to adopt balanced nutrient management, which positions potash fertilizers as essential inputs. The integration of precision agriculture, including GPS-based soil testing and nutrient monitoring, enhances efficiency and reduces overuse. Adoption of these technologies allows farmers to optimize fertilizer application, reducing costs while maximizing yield. Incentives, training programs, and subsidies in precision farming are expected to further expand the adoption of specialized potash fertilizers across Spain.

Key Trends & Opportunities

Key Trends & Opportunities

Shift Toward Chloride-Free Fertilizers

A notable trend in Spain is the shift toward chloride-free formulations such as sulphate of potash and potassium nitrate. These products are gaining preference in vineyards, fruit orchards, and greenhouse cultivation where crop sensitivity to chloride is high. Rising consumer demand for premium fruits, vegetables, and wine enhances this trend. Export markets also demand higher-quality produce, fueling adoption. This creates strong opportunities for fertilizer producers to expand product lines and strengthen supply chains focused on chloride-free solutions tailored for high-value crops.

For instance, ICL Group expanded its Solinure GT line in Europe with chloride-free water-soluble fertilizers, specifically developed for vineyards and fruit cultivation.

Digitalization and Smart Farming Practices

Spain’s farmers are increasingly adopting digital agriculture tools, including soil sensors, automated irrigation, and data-driven nutrient management platforms. These innovations enable precise application of potash fertilizers, improving crop yield and reducing input wastage. Companies offering integrated digital solutions combined with fertilizer products can gain a competitive edge. This shift creates opportunities for suppliers to collaborate with technology providers, promoting customized nutrient solutions for specific crops. Digitalization supports long-term efficiency, sustainability, and profitability in Spain’s agricultural sector, opening new growth avenues for fertilizer companies.

For instance, Corteva Agriscience launched its Granular Link digital platform in Spain, enabling farmers to integrate satellite imagery with fertilizer use planning to optimize nutrient efficiency.

Key Challenges

Soil Salinity and Environmental Concerns

Soil salinity poses a significant challenge in Spain’s agricultural regions, especially where irrigation water quality is poor. Excessive or imbalanced use of potash fertilizers can worsen salinity, reducing soil productivity over time. Environmental regulations are becoming stricter, requiring careful nutrient management to avoid runoff and groundwater contamination. Farmers must balance productivity with sustainability, creating pressure on them to adopt more precise application methods. This challenge requires innovation in fertilizer formulations and sustainable practices to maintain long-term agricultural viability.

Price Volatility and Supply Chain Risks

Spain relies heavily on imports for potash fertilizers, exposing the market to global supply fluctuations and price volatility. Geopolitical tensions, trade restrictions, and disruptions in global supply chains often cause unpredictable price swings, directly impacting farming costs. Small and medium-sized farmers are most affected, as they face tighter margins. The lack of local production capacity limits Spain’s ability to stabilize prices, forcing reliance on external suppliers. Developing alternative sources and stronger supply chain integration will be essential to mitigate this challenge.

Farmer Awareness and Adoption Barriers

While modern application methods such as fertigation and foliar feeding are gaining traction, many farmers still rely on traditional broadcasting practices. Limited awareness, lack of training, and higher upfront investment in advanced systems slow adoption. Smallholder farmers in particular face challenges accessing modern technologies and finance. Without broader educational efforts and government-backed initiatives, uptake of precision farming and chloride-free fertilizers will remain restricted. Bridging this gap is necessary to unlock the full potential of potash fertilizers in Spain’s agricultural landscape.

Regional Analysis

Northern Spain

Northern Spain accounted for 34% share in 2024, making it the leading region in the Spain Potash Fertilizers Market. The dominance stems from extensive cereal and grain cultivation supported by fertile soils and large-scale mechanized farming. Vineyards and fruit orchards in areas like La Rioja also contribute significantly to fertilizer demand. Farmers in this region favor potassium chloride for cereals, while chloride-free formulations are widely used in vineyards. Strong irrigation systems and modern farming techniques further support adoption. It continues to serve as a central hub for large-scale agricultural production.

Central Spain

Central Spain held a 28% share in 2024, driven by wheat, barley, and sunflower cultivation across the Meseta plateau. The region benefits from expansive farmland and consistent fertilizer usage in staple crop production. Broadcasting dominates application methods due to the wide coverage it provides at lower cost. However, fertigation is gradually gaining ground in irrigated areas where farmers cultivate fruits and vegetables. Potassium chloride remains the preferred fertilizer type for broad-acre crops, supported by cost-effectiveness and accessibility. It plays a vital role in sustaining national grain output.

Southern Spain

Southern Spain captured a 25% share in 2024, supported by high-value horticulture and greenhouse farming in Andalusia and Murcia. The region is a leader in citrus, vegetables, and olive production, driving demand for sulphate of potash and potassium nitrate. Farmers emphasize chloride-free formulations to ensure crop quality for export markets. Advanced irrigation infrastructure supports fertigation practices, enabling efficient fertilizer application. Greenhouse clusters in Almería have further accelerated liquid fertilizer adoption. It represents a key growth engine for specialty and export-oriented crops within Spain.

Eastern Spain

Eastern Spain represented a 13% share in 2024, with demand largely concentrated in fruit orchards, vineyards, and vegetable cultivation along the Mediterranean coast. The region’s mild climate and fertile soils support intensive farming of high-value crops. Fertigation and foliar applications are widely used, reflecting the dominance of horticultural systems over cereals. Sulphate of potash and potassium nitrate are the most preferred fertilizer types due to crop sensitivity to chloride. Although smaller in size compared to other regions, it holds significant growth potential through specialty crop expansion.

Market Segmentations:

Market Segmentations:

By Type

- Potassium Chloride

- Sulphate of Potash

- Potassium Nitrate

- Others

By Application Method

- Broadcasting

- Foliar

- Fertigation

- Others

By Form

By Crop Type

- Cereals and Grains

- Pulses and Oilseeds

- Fruits and Vegetables

- Others

By Region

- North Spain

- Central Spain

- Southern Spain

- Eastern Spain

Competitive Landscape

The Spain Potash Fertilizers Market is shaped by the presence of global leaders and regional suppliers competing to strengthen their positions through product innovation, supply chain integration, and distribution expansion. Key players include Yara International, The Mosaic Company, K+S Aktiengesellschaft, JSC Belaruskali, Helm, CF Industries, and ICL, each focusing on improving access to chloride-free fertilizers and sustainable formulations tailored for Spain’s diverse crop needs. Companies actively collaborate with local distributors to expand reach in cereals, fruits, vegetables, and vineyards. Strategic investments in precision farming solutions and water-efficient fertilizer products help them align with Spain’s growing emphasis on sustainable agriculture. Firms also compete by diversifying portfolios across solid and liquid forms, catering to both large-scale grain farming and modern greenhouse cultivation. The market remains moderately concentrated, with established brands holding significant share, while regional players continue to focus on price competitiveness and customized solutions for niche crop segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In August 2024, ICL signed a five-year agreement with AMP Holdings Group Co. Ltd., valued at about USD 170 million, aiming to expand its Growing Solutions product offerings, which positions the company for regional growth in major markets including Spain.

- In January 2025, Vodafone Spain, in collaboration with Geoalcali, announced the deployment of a private 5G network at the Muga sylvinite potash mine to enhance operations.

- In July 2024, Highfield Resources signed a non-binding letter of intent with Yankuang Energy Group and investors to raise US$220 million for Phase 1 of the Muga Potash Project in Spain, while also acquiring the Southey potash project in Canada.

Report Coverage

The research report offers an in-depth analysis based on Type, Application Method, Form, Crop Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for chloride-free fertilizers will increase with expanding fruit and vegetable production.

- Greenhouse farming will drive stronger adoption of liquid and soluble potash fertilizers.

- Precision agriculture will enhance efficiency and optimize fertilizer application across regions.

- Government support for sustainable farming will boost balanced nutrient management practices.

- Rising export demand for wine and citrus will strengthen specialty fertilizer consumption.

- Local distributors will expand partnerships with global producers to improve supply reach.

- Adoption of fertigation methods will grow in irrigation-intensive southern and eastern Spain.

- Innovation in eco-friendly formulations will create new opportunities for international suppliers.

- Soil testing and digital farming tools will accelerate customized nutrient solutions.

- Regional diversification of crops will widen demand beyond cereals and traditional farming.

Key Growth Drivers

Key Growth Drivers Key Trends & Opportunities

Key Trends & Opportunities Market Segmentations:

Market Segmentations: