Market Overview:

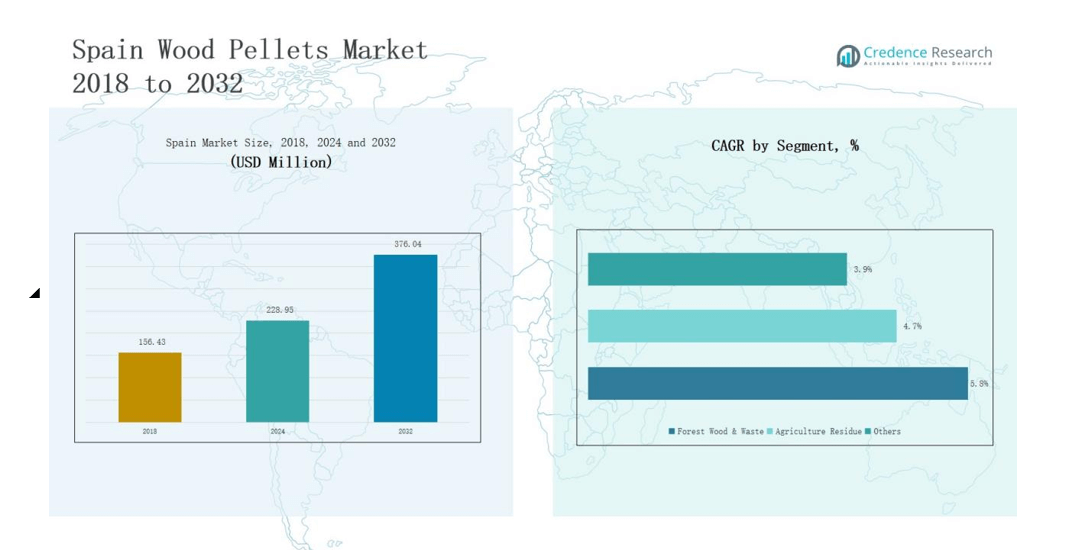

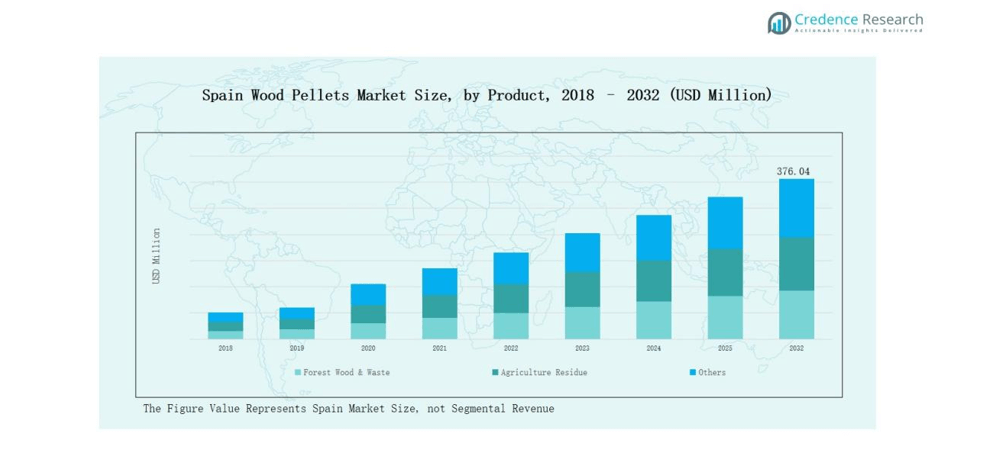

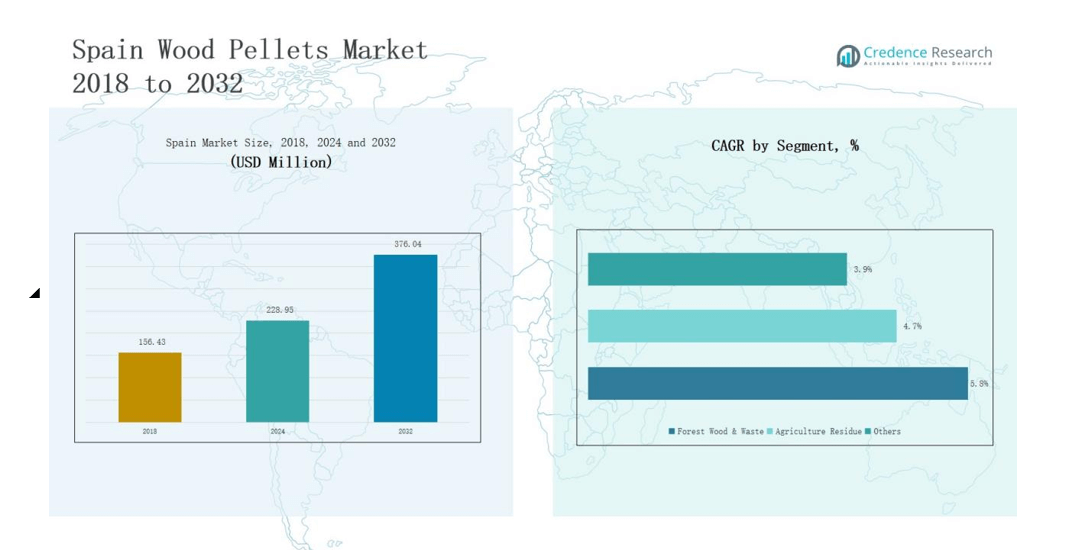

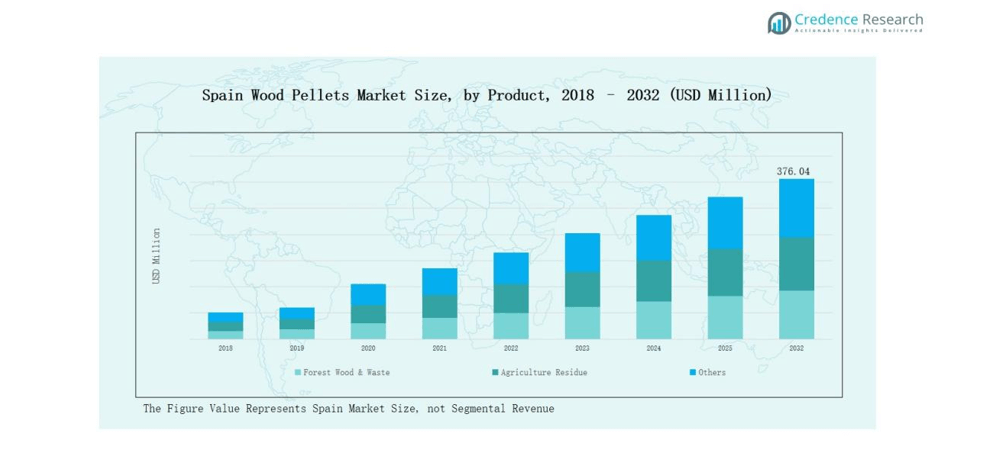

Spain Wood Pellets Market size was valued at USD 156.43 million in 2018 to USD 228.95 million in 2024 and is anticipated to reach USD 376.04 million by 2032, at a CAGR of 5.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Wood Pellets Market Size 2024 |

USD 228.95 million |

| Spain Wood Pellets Market, CAGR |

5.96% |

| Spain Wood Pellets Market Size 2032 |

USD 376.04 million |

The Spain Wood Pellets Market features a competitive mix of established producers and regional suppliers, with key companies including Forest Bioenergy, Biomasa Forestal, Aserbiom Energia, Pellets España, KWB Spain, Maderas Arce, Ecopellets, and Energia Renovable. These players strengthen their positions through ENplus-certified products, strong contracts with utilities, and investments in production capacity. Larger firms focus on supplying industrial CHP and export markets, while smaller producers cater to residential and commercial heating demand, often leveraging agricultural residues. Among regions, Northern Spain leads the market with 42% share in 2024, supported by dense forestry resources, advanced processing facilities, and well-developed district heating infrastructure, making it the dominant hub for production and distribution.

Market Insights

- The Spain Wood Pellets Market grew from USD 156.43 million in 2018 to USD 228.95 million in 2024, and is projected to reach USD 376.04 million by 2032, expanding at a CAGR of 96%.

- Forest Wood & Waste dominates with 71% share in 2024, supported by abundant forestry resources and ENplus certification, while Agriculture Residue holds 21% and Others account for 8%.

- By application, Industrial Pellet for CHP/District Heating leads with 48% share in 2024, followed by Residential and Commercial Heating at 32%, Industrial Co-Firing at 14%, and Others at 6%.

- Northern Spain leads regionally with 42% share in 2024, supported by advanced facilities and district heating projects, followed by Central Spain at 28%, Southern Spain at 19%, and Eastern Spain at 11%.

- Key companies include Forest Bioenergy, Biomasa Forestal, Aserbiom Energia, Pellets España, KWB Spain, Maderas Arce, Ecopellets, and Energia Renovable, competing through certified products, strong contracts, and capacity expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

The Forest Wood & Waste segment dominates the Spain wood pellets market with nearly 71% share in 2024. Its position is supported by rich forestry resources, advanced pellet processing facilities, and strong compliance with ENplus certification standards. Agriculture Residue follows with about 21% share, fueled by biomass from olive pits and crop residues, though logistical constraints limit expansion. The Others category holds 8% share, mainly from recycled wood, serving niche regional demand despite quality and regulatory challenges.

- For instance, in Andalusia, olive pits from the olive oil industry are processed into pellets and briquettes, utilized by local district heating projects, as documented by the Andalusian Energy Agency in 2023.

By Application

Industrial Pellet for CHP/District Heating leads with approximately 48% share in 2024, driven by Spain’s renewable energy goals and expanding district heating projects. Residential and Commercial Heating pellets account for 32% share, reflecting strong demand for stoves and boilers in homes and small businesses. Industrial Co-Firing contributes 14% share, providing a transitional pathway for coal plants reducing emissions. The Others segment captures 6% share, covering uses such as animal bedding and small-scale institutional heating.

- For instance, Drax Power Station in the UK, once fully coal-fired, now co-fires biomass pellets with coal, and has converted four of its six units entirely to sustainable biomass.

Market Overview

Rising Renewable Energy Targets

Spain’s wood pellets market benefits from strong government policies promoting renewable energy adoption. The EU’s decarbonization agenda, alongside Spain’s National Energy and Climate Plan, supports greater use of biomass in heating and power generation. Industrial demand for pellets in combined heat and power (CHP) plants is growing steadily, as pellets provide a cost-effective and sustainable alternative to fossil fuels. This shift positions wood pellets as a central resource in achieving emission reduction goals, reinforcing long-term market expansion.

- For instance, the Biomasa Forestal plant in Galicia produces over 70,000 tons of ENplus®-certified wood pellets annually, supplying both residential heating and industrial CHP systems.

Abundant Forestry and Agricultural Resources

Spain’s vast forest cover and large agricultural base provide reliable biomass feedstock for pellet production. Forestry residues, olive pits, vineyard prunings, and cereal straw ensure a steady supply of raw materials, reducing dependence on imports. Producers leverage these resources to expand production capacity while supporting circular economy goals. The availability of sustainable raw material sources strengthens cost competitiveness and ensures supply security. This resource advantage supports both large-scale industrial applications and small-scale residential heating adoption.

- For instance, Ence Energía y Celulosa runs dedicated biomass power plants that use olive pits and orchard prunings from Andalusia, demonstrating large-scale industrial uptake.

Expanding District Heating and CHP Projects

The rapid expansion of district heating and CHP networks drives significant pellet demand in Spain. Municipal and industrial projects are increasingly investing in biomass-based heating solutions, supported by EU and national subsidies. Pellets are favored for their energy efficiency, low emissions, and ability to integrate seamlessly into existing heating systems. Growing collaboration between energy utilities and pellet producers further boosts demand certainty. This integration of pellets into urban and industrial energy infrastructure remains a primary driver of market growth.

Key Trends & Opportunities

Growing Residential and Commercial Adoption

Spain is experiencing rising demand for pellet stoves and boilers in residential and commercial buildings. Consumers are shifting towards eco-friendly heating solutions, supported by favorable policies, cost savings, and pellet availability. The adoption trend is particularly visible in rural and colder regions, where traditional heating systems are being replaced by pellet-based technologies. This trend creates strong growth opportunities for distributors, equipment suppliers, and pellet producers, positioning residential and small-scale heating as a high-potential segment.

- For instance, Ecoforest, a Galicia-based manufacturer and the first European company to develop pellet stoves in 1993, now exports to over 30 countries while continuing to expand installations across Spain.

Rising Export Opportunities

Spanish producers are increasingly exploring exports to meet demand in nearby European markets. Countries with limited biomass resources but high pellet consumption, such as Italy and France, present attractive opportunities. Spain’s geographical proximity and strong logistics networks support efficient cross-border trade. Export expansion allows producers to diversify revenue streams while balancing seasonal fluctuations in domestic demand. This growing focus on international markets represents a key opportunity for Spain’s pellet industry to strengthen its presence in the broader European biomass energy supply chain.

- For instance, Spanish producer Grupo ENCE has supplied industrial wood pellets for co-firing at French utilities, leveraging its Andalusian ports for shipment efficiency.

Key Challenges

Supply Chain and Logistics Costs

While Spain benefits from abundant resources, transporting biomass from dispersed rural areas to pellet plants adds cost pressure. Inconsistent logistics infrastructure increases expenses and reduces competitiveness against imported pellets. Seasonal fluctuations in supply also create inefficiencies in storage and transportation. These supply chain challenges limit scalability and reduce the profitability of smaller producers. Addressing transportation costs and infrastructure limitations remains critical for ensuring sustainable growth in the market.

Competition from Alternative Renewable Sources

Spain’s strong focus on solar and wind energy creates competitive pressure on biomass adoption. Large-scale renewable projects attract more investment, often overshadowing pellet-based initiatives. Government incentives are also heavily directed towards solar PV and wind, reducing financial support for biomass. This competitive landscape restricts the relative share of wood pellets in the overall renewable mix. The challenge lies in positioning pellets as a complementary solution, particularly for heating and CHP applications where alternatives are less practical.

Regulatory and Quality Compliance

Compliance with EU sustainability directives and ENplus certification standards adds complexity and cost to pellet production. Producers must maintain stringent quality controls to access both domestic and export markets. Smaller producers face difficulties meeting certification requirements, limiting their ability to scale. Frequent regulatory updates at EU and national levels further complicate long-term planning. These compliance challenges act as barriers for new entrants and increase operational risks for existing players in Spain’s wood pellets market.

Regional Analysis

Northern Spain

Northern Spain leads the Spain Wood Pellets Market with a 42% share in 2024. The region benefits from dense forest resources, advanced pellet processing facilities, and well-established district heating networks. Strong industrial demand supports large-scale consumption, while proximity to export routes enhances trade opportunities. Policies favoring renewable energy adoption strengthen biomass integration in industrial and residential heating. It remains the key hub for production and distribution, securing its leadership within the national market.

Central Spain

Central Spain accounts for 28% share in 2024, supported by rising adoption of pellets in residential and commercial heating. Urban centers and mid-sized towns increasingly rely on pellet stoves and boilers to replace traditional heating systems. Availability of agricultural residues, including cereal straw and vineyard prunings, provides steady feedstock for pellet plants. The region also benefits from growing interest in biomass-based CHP projects. It shows balanced demand from households and industrial users, reinforcing its position in the national market.

Southern Spain

Southern Spain holds 19% share in 2024, primarily driven by agricultural residue-based pellet production. Olive pits, almond shells, and crop residues form the core raw materials in this region. Demand is supported by both residential and small-scale commercial heating, especially in rural communities. Warmer climates limit consumption compared to northern regions, but resource availability ensures steady production. It plays a growing role in diversifying the raw material base for the national pellet industry.

Eastern Spain

Eastern Spain contributes 11% share in 2024, focusing on localized production and niche applications. The region relies on smaller producers that supply pellets for domestic consumption and regional trade. Demand is led by households and small businesses adopting pellet-based heating solutions. Limited forest cover restricts large-scale industrial projects, but agricultural residues support niche production. It remains a modest yet stable contributor to the Spain Wood Pellets Market.

Market Segmentations:

By Product

- Forest Wood & Waste

- Agriculture Residue

- Others

By Application

- Industrial Pellet for CHP/District Heating

- Industrial Pellet for Co-Firing

- Pellet for Heating Residential/Commercial

- Others

By Region

- Northern Spain

- Central Spain

- Southern Spain

- Eastern Spain

Competitive Landscape

The Spain Wood Pellets Market is moderately fragmented, with a mix of established producers and regional suppliers competing for market share. Leading companies such as Forest Bioenergy, Biomasa Forestal, Aserbiom Energia, Pellets España, KWB Spain, Maderas Arce, Ecopellets, and Energia Renovable play a central role in meeting industrial and residential demand. These firms strengthen their positions through ENplus-certified products, strategic contracts with utilities, and investments in production capacity. Regional suppliers contribute to localized distribution and often focus on agricultural residue-based pellets, supporting rural economies. Competition is driven by sustainability commitments, pricing efficiency, and the ability to secure long-term biomass feedstock. Larger companies focus on industrial-scale CHP and export opportunities, while smaller firms serve residential heating markets. It is characterized by increasing partnerships, capacity expansions, and technological improvements that enhance product quality and energy efficiency, ensuring sustained competitiveness within Spain and across the wider European biomass sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Forest Bioenergy

- Biomasa Forestal

- Aserbiom Energia

- Pellets Espaňa

- KWB Spain

- Maderas Arce

- Ecopellets

- Energia Renovable

- Others

Recent Developments

- In June 2025, Green Alliance acquired BioEnergy Europe – Pellet and Fire, a Sicily-based biomass distributor, to strengthen its presence in Italy’s wood pellets market.

- On May 19, 2025, Italy’s Guardia di Finanza seized over 400 tonnes of wood pellets near Legnago (VR). The action targeted fraud, misleading labeling, and unauthorized use of the ENplus® trademark.

- In August 2025, ENSO secured €165 million financing to develop two biomass-based energy plants in Spain. The facilities, located in Olmedo and Torrelavega, will supply both thermal and electrical energy to ACOR and Solvay.

- In November 2024, the ENplus® certification program launched a mobile app. The app allows professionals and end-users to scan and verify pellet certification, or report fraud. The move supports transparency and trust across Europe, with Spain ranking among the top producers of ENplus® pellets

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will increase from combined heat and power projects supported by renewable energy policies.

- Residential pellet stove adoption will grow as consumers seek eco-friendly and cost-efficient heating.

- Agricultural residues like olive pits and straw will gain importance as raw material sources.

- Export opportunities will expand to nearby European countries with high pellet demand.

- Investments in pellet processing facilities will strengthen production capacity and supply reliability.

- Partnerships between energy utilities and pellet producers will drive long-term market stability.

- Quality certification requirements will push producers to adopt higher standards and technologies.

- Logistics and distribution improvements will reduce costs and expand pellet access to remote areas.

- Competition with solar and wind energy will require pellets to position as a complementary solution.

- Sustainability initiatives will reinforce biomass use in both industrial and residential heating sectors.