Market Overview

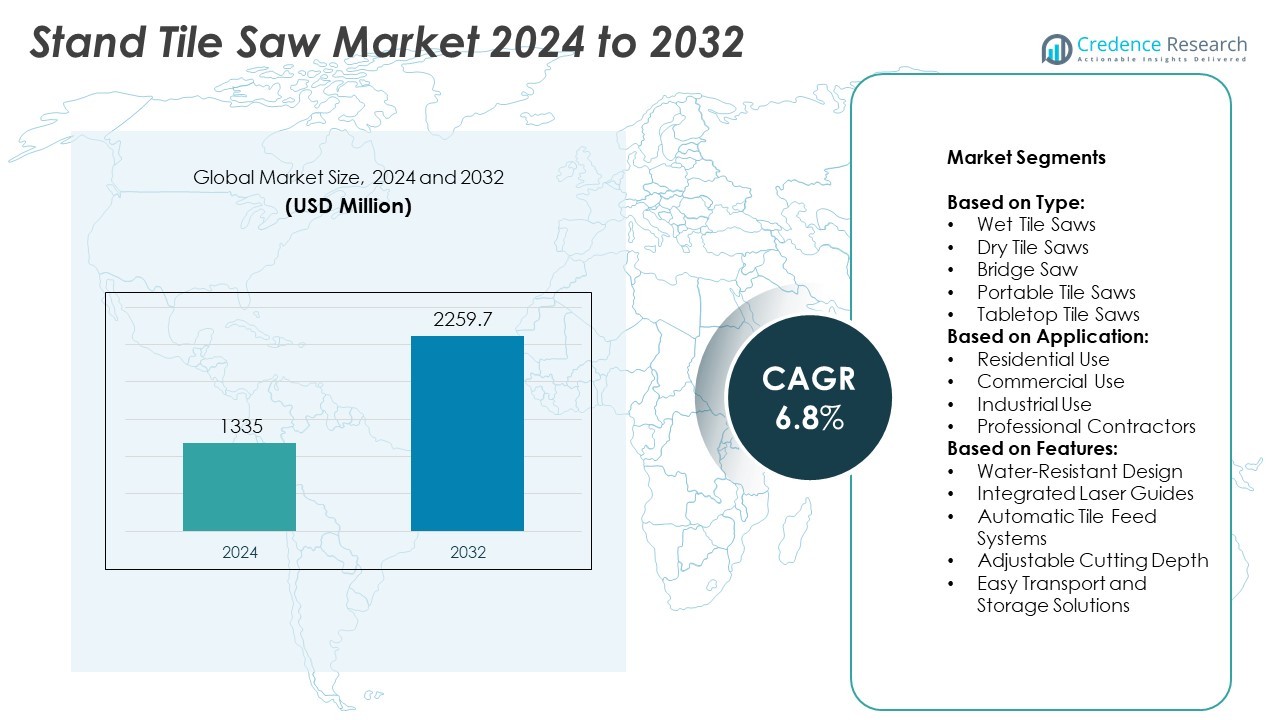

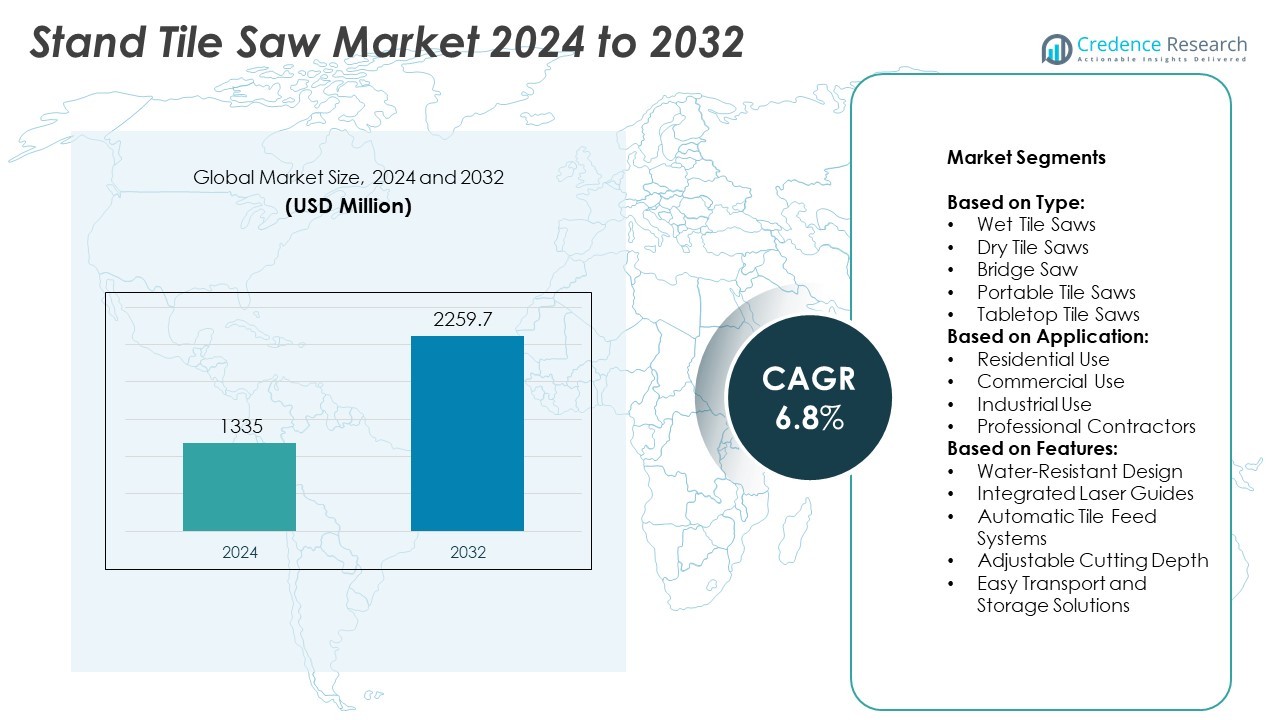

Stand Tile Saw Market size was valued at USD 1335 million in 2024 and is anticipated to reach USD 2259.7 million by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Stand Tile Saw Market Size 2024 |

USD 1335 Million |

| Stand Tile Saw Market, CAGR |

6.8% |

| Stand Tile Saw Market Size 2032 |

USD 2259.7 Million |

The Stand Tile Saw market grows steadily due to rising demand from residential remodeling, commercial flooring projects, and large-format tile installations. Contractors and DIY users prefer these tools for their cutting precision, portability, and compatibility with various materials. The market benefits from increased investment in infrastructure, urban housing, and interior upgrades. Manufacturers focus on developing ergonomic designs, water-efficient systems, and laser-guided controls to enhance user performance. Trends such as cordless mobility, dust control, and digital adjustment features shape product innovation.

North America leads the Stand Tile Saw market due to strong residential renovation trends and widespread professional tool adoption. Europe follows with demand from precision-focused commercial and hospitality projects. Asia Pacific shows rapid growth driven by urban development and rising construction activity in China and India. Latin America and the Middle East & Africa present emerging opportunities with expanding infrastructure. Key players shaping the market include DEWALT, Robert Bosch Tool, Makita Corporation, and GERMANS BOADA, each offering advanced cutting solutions and strong regional presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Stand Tile Saw market was valued at USD 1335 million in 2024 and is projected to reach USD 2259.7 million by 2032, growing at a CAGR of 6.8%.

- Rising demand for residential remodeling, infrastructure expansion, and precision tile cutting tools continues to drive market growth.

- Key trends include the integration of laser guides, water recycling systems, and compact portable designs for improved performance and mobility.

- Competitive players focus on product innovation, ergonomic features, and strong distribution channels to maintain market leadership.

- High equipment costs, operational complexity for new users, and limited access in cost-sensitive regions act as growth restraints.

- North America leads due to strong home improvement culture and construction activity, while Asia Pacific grows rapidly with urban development.

- Leading companies such as DEWALT, Bosch, Makita, and GERMANS BOADA invest in cordless tools, digital controls, and durable blade systems to expand market presence.

Market Drivers

Growing Construction Activities Across Residential and Commercial Sectors

Rapid urbanization and infrastructure development have accelerated demand for precise tile cutting equipment across construction sites. New residential projects and commercial complexes require efficient tools for installing ceramic, porcelain, and stone tiles. Contractors prefer stand tile saws for their stability, accuracy, and ability to handle high-volume cutting tasks. The Stand Tile Saw market benefits from government-supported housing initiatives and real estate investments, especially in emerging economies. It plays a crucial role in reducing material waste and installation errors during tile placement. Demand strengthens where large-format and premium tiles are gaining popularity in interior design.

- For instance, DeWALT’s D24000S Wet Tile Saw features a 1.5 HP motor and can cut tiles up to 610 mm in length diagonally, enabling precise mechanized cutting with less than 0.5 mm deviation, a key metric in professional construction environments.

Rising Preference for Mechanized Tools Over Manual Cutting Equipment

The transition from manual cutters to powered tile saws contributes significantly to market growth. Manual tools are increasingly seen as inefficient for large-scale or high-precision work. Stand tile saws offer better control, smoother finishes, and reduced operator fatigue, which is critical in professional applications. This shift aligns with the growing expectations for quality workmanship in high-end residential and hospitality sectors. The Stand Tile Saw market gains momentum from user preferences for automation and speed in cutting operations. It ensures productivity without compromising on accuracy.

- For instance, Battipav’s Elite 80 tile saw features a closed-loop water system with a 16-liter tank that recycles water during operation, reducing water usage by up to 40% compared to conventional wet saws.

Technological Advancements Improving Blade Efficiency and Motor Durability

Manufacturers continue to integrate advanced features into tile saws, such as laser guides, water-cooled diamond blades, and brushless motors. These innovations extend tool lifespan and improve cut quality across dense and fragile tile materials. Enhanced portability and ease of maintenance are becoming essential design priorities for professional users. It helps reduce downtime and tool replacement costs in long-term construction projects. The Stand Tile Saw market reflects these developments by adopting ergonomic designs and digital interfaces for enhanced user control. It supports both precision and safety in demanding on-site environments.

Expansion of DIY and Home Improvement Culture Driving Consumer Sales

Homeowners and DIY enthusiasts increasingly invest in professional-grade tools for personal renovation projects. Stand tile saws appeal to this audience due to their ease of use and compatibility with diverse tile materials. Social media and online tutorials fuel consumer interest in home improvement, indirectly increasing demand for reliable cutting tools. It enables users to achieve professional results without outsourcing. The Stand Tile Saw market gains traction in retail and e-commerce channels, where compact and user-friendly models perform well. It supports weekend projects and small-scale remodeling with high precision and minimal learning curve.

Market Trends

Integration of Water Recycling and Dust Control Features

Manufacturers are introducing stand tile saws with advanced water management systems to enhance user safety and comply with regulatory standards. These systems help minimize airborne silica dust while simultaneously cooling the cutting blade for longer operational life. Water recycling mechanisms reduce water consumption, appealing to environmentally conscious users and contractors. The Stand Tile Saw market adopts these innovations to meet demand for cleaner and safer work environments. It reflects industry priorities around sustainable construction practices. Contractors now evaluate tools based on environmental performance alongside cutting efficiency.

- For instance, Raimondi’s ZOE ADV 150 tile saw integrates a digital display for cutting depth and angle control, accurate to 0.1 mm, supporting high-precision architectural tile layouts.

Surge in Demand for Lightweight and Portable Equipment

There is a growing trend toward compact, foldable stand tile saws that are easy to transport between job sites. Construction teams value mobility and fast setup without sacrificing precision. New models feature collapsible stands, adjustable tables, and quick-lock mechanisms, catering to professionals operating across multiple locations. The Stand Tile Saw market benefits from this shift by targeting small contractors and independent installers. It enables efficient work in constrained urban spaces or multi-floor construction projects. Manufacturers differentiate offerings through ergonomic design and transportability.

- For instance, the RUBI TZ‑1300 manual cutter weighs approximately 72.6 lb (32.9 kg) and supports rip-cutting tiles up to 51 3/16 in (1300 mm) in length, combining portability with capacity for larger-format tiles

Adoption of Digital Guidance and Smart Control Features

Technological enhancements such as laser alignment, digital depth gauges, and variable speed controls are becoming standard in high-end tile saws. These features improve cutting accuracy and allow adjustments based on tile type and thickness. Users gain better control over complex cutting angles and material density, reducing errors and material wastage. The Stand Tile Saw market incorporates smart controls that simplify operation for both professionals and advanced DIY users. It supports integration with digital measuring tools and layout planning software. Precision-focused applications drive preference for these innovations.

Growth in E-Commerce Sales and Direct-to-Consumer Distribution

Online platforms are expanding their presence in the power tool segment, including tile saws, due to changing consumer buying behavior. Buyers seek detailed product specifications, reviews, and video demonstrations before purchasing. The Stand Tile Saw market aligns with this trend by increasing brand visibility and customer engagement across digital channels. It allows manufacturers to offer exclusive online models, bundled accessories, and extended warranties. Direct-to-consumer strategies reduce dependency on retail intermediaries and improve pricing transparency. E-commerce continues to shape buyer expectations and product availability.

Market Challenges Analysis

High Cost of Ownership and Limited Access in Price-Sensitive Regions

The upfront cost of stand tile saws, particularly professional-grade models, poses a challenge for small contractors and individual users. Many construction firms in developing regions prioritize cost over performance, opting for manual cutters or low-cost alternatives. Ongoing expenses related to blade replacement, motor maintenance, and water handling further increase total ownership cost. The Stand Tile Saw market faces limited penetration where budget constraints and lack of financing options restrict tool adoption. It must balance product durability and affordability to expand into cost-sensitive areas. Manufacturers need pricing strategies and after-sales support tailored to smaller businesses.

Operational Complexity and Training Requirements for First-Time Users

Professional tile saws often require specific setup knowledge, alignment skills, and familiarity with various tile materials. Inexperienced users may find operation challenging, leading to breakage, inaccurate cuts, or tool damage. Commercial projects cannot afford delays due to improper tool handling or lack of technical support. The Stand Tile Saw market encounters resistance from first-time buyers hesitant to invest in equipment that demands a steep learning curve. It limits adoption among DIY users and new entrants in the construction sector. Training content, user-friendly manuals, and customer service remain critical to overcoming this barrier.

Market Opportunities

Expansion of Smart Cities and Infrastructure Modernization Projects

Governments worldwide continue to invest in smart city initiatives and large-scale urban redevelopment. These projects require high-quality finishing tools for residential towers, commercial buildings, and public infrastructure. Stand tile saws serve critical roles in precise tile installation across high-traffic areas such as transit hubs, hospitals, and government buildings. The Stand Tile Saw market gains long-term opportunity from public-private partnerships and infrastructure-focused spending. It supports tiling efficiency in modular construction and prefabricated segments where speed and precision are critical. Manufacturers can position their offerings for large contractors involved in government-funded development.

Customization Demand in High-End Interior Renovation Projects

Rising consumer interest in personalized interior design drives demand for unique tile patterns, materials, and finishes. Stand tile saws provide the precision required to cut irregular shapes, bevels, and mosaics that enhance architectural aesthetics. Luxury real estate and hospitality sectors rely on advanced cutting equipment to achieve design flexibility without compromising material integrity. The Stand Tile Saw market finds opportunity in serving premium renovation projects that demand accuracy and efficiency. It meets the needs of architects, designers, and high-end contractors executing detailed tile layouts. This trend opens pathways for innovation in specialized blades, precision control features, and compact professional models.

Market Segmentation Analysis:

By Type:

The Stand Tile Saw market includes wet tile saws, dry tile saws, bridge saws, portable tile saws, and tabletop tile saws. Wet tile saws hold strong demand due to their ability to minimize dust and maintain blade temperature, making them suitable for continuous use in commercial settings. Dry tile saws offer flexibility in locations without water access but are less favored in enclosed environments due to dust output. Bridge saws serve large-scale applications with precision cutting over wide surfaces, often used in industrial projects. Portable tile saws gain traction among mobile contractors who require quick setup at multiple sites. Tabletop tile saws appeal to residential users and small-scale professionals due to their compact design and lower cost.

- For instance, Sigma offers the Sigma 4CN series cutter with a cutting length of 620 mm, a weight of just 7.4 kg, and a built-in carrying handle, making it ideal for mobile contractors working on compact job sites

By Application:

Residential use dominates in volume due to rising DIY trends and home renovation projects. Consumers seek compact, easy-to-use models suitable for occasional use and small-scale tiling. Commercial use drives demand for durable and high-capacity equipment to support repetitive tile installations across large areas. Industrial use often requires bridge or wet saws to manage tough materials like stone or porcelain in continuous operations. The Stand Tile Saw market finds a key segment in professional contractors, who prioritize equipment reliability, cutting precision, and productivity to meet job site demands.

- For instance, Montolit’s Flash Line 3 system incorporates digital guides and telescopic measuring scales with a maximum length of 340 cm, helping contractors execute long, accurate cuts on large-format tiles with minimal manual calibration.

By Features:

Water-resistant design remains critical for wet saw models and ensures tool longevity in moisture-prone environments. Integrated laser guides enhance cutting accuracy, especially when dealing with detailed tile patterns or large volumes. Automatic tile feed systems reduce manual effort and increase output, making them ideal for commercial and industrial settings. Adjustable cutting depth enables users to work with different tile thicknesses, adding versatility across materials. Easy transport and storage solutions support job site mobility and appeal strongly to contractors and DIY users needing convenience without compromising tool capability.

Segments:

Based on Type:

- Wet Tile Saws

- Dry Tile Saws

- Bridge Saw

- Portable Tile Saws

- Tabletop Tile Saws

Based on Application:

- Residential Use

- Commercial Use

- Industrial Use

- Professional Contractors

Based on Features:

- Water-Resistant Design

- Integrated Laser Guides

- Automatic Tile Feed Systems

- Adjustable Cutting Depth

- Easy Transport and Storage Solutions

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for 32.4% of the global Stand Tile Saw market share in 2024, driven by sustained residential and commercial construction across the United States and Canada. The region benefits from mature infrastructure, high adoption of power tools, and strong presence of key market players. Home renovation projects, particularly in the U.S., have increased due to rising home equity and a growing DIY culture. Professionals and hobbyists alike favor advanced tile saws with features like laser guides and dust control. The demand is further boosted by government-backed infrastructure modernization plans and investment in public facilities. Canada contributes steadily with urban housing developments and tile-intensive interior finishes in high-rise buildings. The regional market reflects consistent replacement cycles and premium tool purchases among contractors.

Europe

Europe held a market share of 24.1% in 2024, supported by regulations promoting energy-efficient construction and high-quality finishing standards. Countries like Germany, France, and the UK are key contributors, with strong demand from commercial and hospitality sectors. Renovation activities in historical structures require precision tile cutting tools, which accelerates sales of stand tile saws across restoration projects. European buyers prioritize safety, dust reduction, and ergonomic features in their tool selections. The Stand Tile Saw market in Europe also benefits from sustainability mandates that encourage clean job site operations and waste reduction. Professional contractors lead adoption, followed by a growing number of individual users purchasing compact units for home improvement tasks.

Asia Pacific

Asia Pacific represented 28.7% of the Stand Tile Saw market in 2024, with rapid growth fueled by urban development, rising disposable income, and expansion of middle-class housing. China, India, and Southeast Asian countries are leading contributors to new residential construction and commercial infrastructure. The shift from manual to powered tools is accelerating across the region due to growing awareness of efficiency and safety benefits. Government infrastructure programs such as Smart Cities in India and Belt and Road in China are expanding tile usage in public and commercial spaces. Regional manufacturers introduce cost-effective models to serve local preferences while expanding exports. The increasing presence of international brands and e-commerce distribution also supports market penetration.

Latin America

Latin America captured 7.6% of the global market share in 2024, supported by recovery in construction post-pandemic and demand for affordable housing in Brazil, Mexico, and Colombia. Regional builders rely on durable, mid-range tile saws for consistent project delivery across residential and small commercial segments. Growth is hindered slightly by price sensitivity and limited access to premium models. However, rising investments in commercial real estate and urban infrastructure create favorable conditions. The Stand Tile Saw market in Latin America benefits from distributor expansion, tool rental services, and DIY trends, especially in urban areas.

Middle East & Africa

The Middle East & Africa region held 7.2% of the market share in 2024, driven by large-scale infrastructure projects in the Gulf countries and gradual growth in residential sectors across Africa. The UAE and Saudi Arabia invest heavily in commercial complexes, retail developments, and luxury housing that require precise tile installations. Professional contractors adopt stand tile saws for speed and quality in large-format tiling. Africa presents a growing but underpenetrated market where rising urbanization and improved access to construction tools support future demand. The region requires affordable, durable saws that can handle variable power conditions and dense materials common in local construction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Powermatic

- DEWALT

- GERMANS BOADA SA

- Altendorf GmbH

- Hitachi Ltd

- Stanley Black & Decker, Inc.

- Nanxing Machinery Co., Ltd.

- MAKITA CORPORATION

- General International Power Products LLC

- Robert Bosch GmbH

Competitive Analysis

The Stand Tile Saw market features strong competition among leading players such as Powermatic, DEWALT, GERMANS BOADA SA, Altendorf GmbH, Hitachi Ltd, Stanley Black & Decker, Inc., Nanxing Machinery Co., Ltd., MAKITA CORPORATION, General International Power Products LLC, and Robert Bosch GmbH. These companies focus on innovation, product differentiation, and regional expansion to maintain competitive advantage. They invest in advanced cutting technologies, including laser alignment systems, water recycling features, and high-efficiency motors to meet the evolving needs of both professional and DIY users. Manufacturers enhance user experience through ergonomic design, precision control, and dust management features. Strong distribution networks, e-commerce strategies, and after-sales support contribute to their market reach. Several players emphasize compact and portable models to tap into urban construction and small contractor segments. The market also witnesses strategic collaborations, tool rental partnerships, and geographic diversification to strengthen their presence in emerging economies. Competitive intensity remains high as companies balance cost, performance, and durability in their offerings.

Recent Developments

- In 2025 ,Bosch announced it will launch more than 15 new products, primarily in its 18V cordless category, and showcase them in the World of Concrete event in Las Vegas

- In Jan 2025 , Makita released a new 40V MAX XGT® Belt Sander along with two new 40V MAX XGT® Impact Wrenches

- In August 2024 ,Marshalltown Announced a major $27 million investment in a new 200,000-square-foot distribution center in Kansas City, designed to bolster logistics efficiency for supplying Lowe’s, Home Depot, and existing facilities in Iowa and Arkansas

Market Concentration & Characteristics

The Stand Tile Saw market displays moderate concentration, with a mix of global power tool brands and specialized manufacturers competing across professional and consumer segments. Leading players such as Bosch, DEWALT, Makita, and GERMANS BOADA focus on performance-driven innovations, ergonomic designs, and multi-material compatibility. The market favors companies with strong distribution networks, product reliability, and technical support services. It features a blend of corded and cordless offerings, with wet tile saws dominating demand due to their precision and dust control benefits. Buyers include contractors, renovators, and DIY users, each requiring different levels of cutting capacity, portability, and maintenance. The Stand Tile Saw market adapts to shifting construction trends, with product differentiation based on blade technology, cooling mechanisms, and safety features. It remains responsive to both volume-driven sales in developing regions and value-added innovation in mature economies.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Features and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise due to increased residential remodeling and urban housing construction.

- Manufacturers will focus on lightweight, foldable designs to improve mobility and job site efficiency.

- Wet tile saws will continue to dominate due to their precision and dust suppression benefits.

- Integration of laser guides and digital depth control will enhance cutting accuracy.

- E-commerce platforms will expand market access, especially for DIY and small contractors.

- Emerging markets in Asia and Latin America will drive volume growth through cost-effective models.

- Professional contractors will demand longer-lasting blades and water management features.

- Environmental concerns will influence the adoption of energy-efficient and low-dust tools.

- Competition will increase with new entrants offering affordable, compact solutions.

- Strategic partnerships and after-sales service networks will become key for market retention.