Market Overview

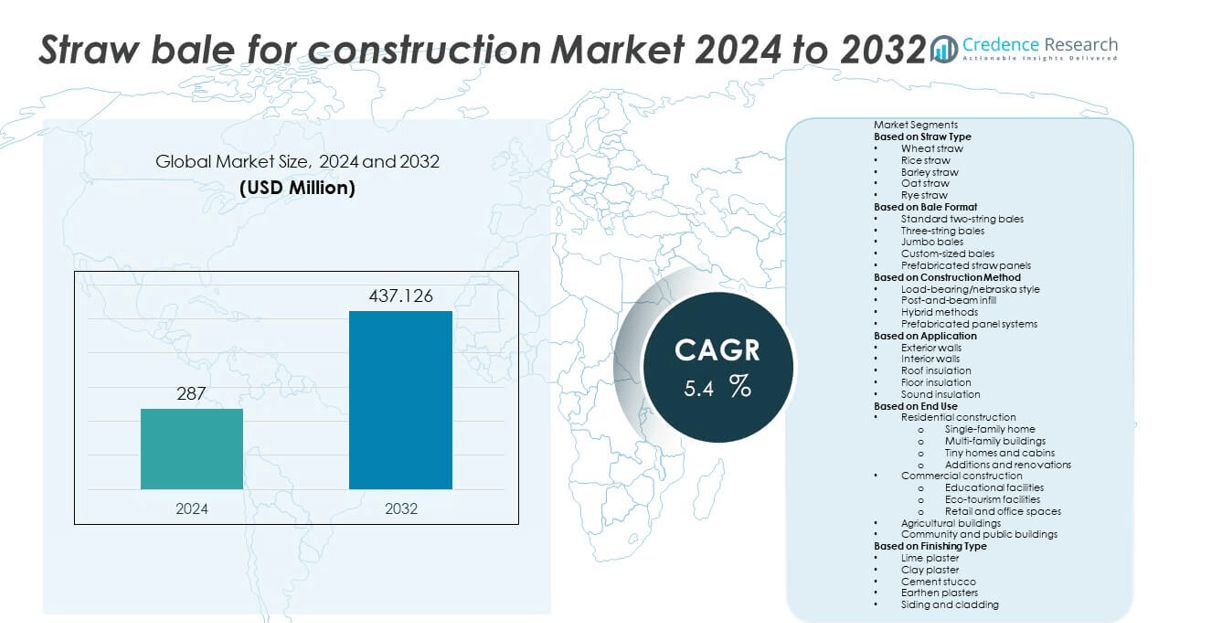

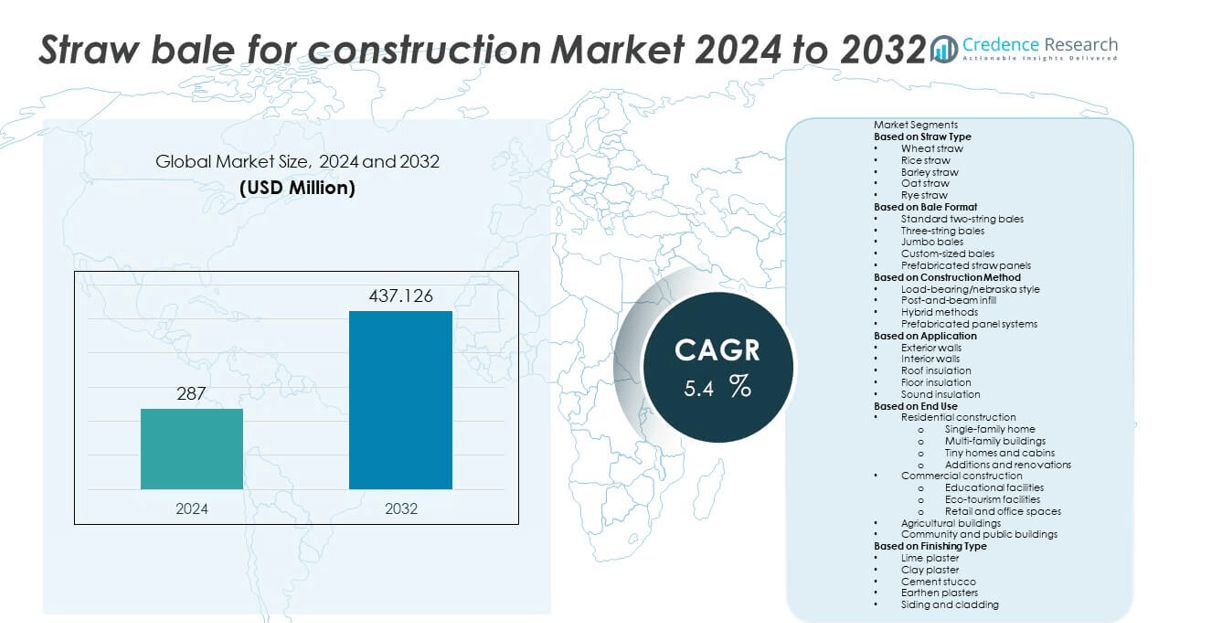

The Straw Bale for Construction Market was valued at USD 287 million in 2024 and is anticipated to reach USD 437.126 million by 2032, growing at a Compound Annual Growth Rate (CAGR) of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Straw Bale for Construction Market Size 2024 |

USD 287 million |

| Straw Bale for Construction Market, CAGR |

5.4% |

| Straw Bale for Construction Market Size 2032 |

USD 437.126 million |

The Straw Bale for Construction Market is gaining momentum due to increasing demand for sustainable and energy-efficient building materials. Rising awareness of carbon-neutral construction methods and the need to reduce greenhouse gas emissions drive the market forward. The affordability and high insulation value of straw bales make them attractive for residential and commercial structures.

The geographical landscape of the Straw Bale for Construction Market is shaped by growing adoption in Europe, North America, and select regions of Africa and Asia-Pacific. Europe leads the market with strong emphasis on eco-friendly construction and well-established sustainable building regulations, particularly in countries like Germany, Poland, and the United Kingdom. North America follows closely, with increasing acceptance of straw bale structures in rural and semi-urban areas due to their insulation benefits and affordability. In Africa and Asia-Pacific, the market is emerging as developers and governments seek cost-effective and low-carbon building solutions. Prominent players driving innovation and adoption in the market include EcoCocon, known for prefabricated straw panel systems; Agile Property & Homes Ltd, promoting sustainable housing in the UK; and StrawSIPS, which integrates straw bale insulation with structural insulated panels

Market Insights

- The Straw Bale for Construction Market was valued at USD 287 million in 2024 and is projected to reach USD 437.126 million by 2034, growing at a CAGR of 5.4 % during the forecast period.

- The market is gaining traction due to rising demand for sustainable, low-carbon building materials that offer excellent insulation properties and reduced environmental impact. Straw bales, being agricultural by-products, support circular economy goals while helping achieve energy efficiency standards in both residential and commercial construction.

- Increasing adoption of prefabricated straw bale wall systems, such as Straw Structural Insulated Panels (S-SIPs), is a key trend. These solutions provide enhanced thermal resistance (up to R-45), reduced labor requirements, and faster construction timelines, contributing to wider adoption in urban eco-housing projects.

- Key players in the market include EcoCocon, ModCell, Strawcture Eco, Endeavour Centre, and Straw-Bale Building UK. These companies focus on product standardization, moisture control, fire resistance, and hybrid building systems to ensure performance compliance with international green building codes.

- However, regulatory challenges, such as limited code acceptance, permit complexities, and insurance hurdles, remain significant barriers. Straw bale structures also face durability concerns in regions with high humidity or pest exposure, requiring innovations in sealing and structural design.

- Regionally, North America leads the market with strong growth in the U.S., driven by state-level incentives for eco-building and abundant straw availability. Europe follows closely, with supportive policy frameworks and growing interest in carbon-neutral construction. Emerging opportunities are visible in Asia-Pacific and Latin America, where straw bale housing offers cost-effective and climate-adaptive solutions for rural and peri-urban areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Sustainable Building Materials Accelerates Market Expansion

The Straw Bale for Construction Market is experiencing strong growth due to the global push toward sustainable and eco-friendly building practices. Straw bales are renewable, biodegradable, and available in abundance, making them attractive for environmentally conscious construction. Regulatory support for green buildings, including incentives and certification programs such as LEED and BREEAM, is driving interest in alternative construction materials. Architects and builders are increasingly adopting straw bale methods for their high insulation properties and low environmental impact. The carbon-sequestering ability of straw bales adds to their environmental appeal, positioning them favorably in markets aiming for carbon neutrality. It is gaining momentum across residential and community-scale developments that prioritize sustainable design.

- For instance, according to Oak Ridge National Laboratory testing, a plastered, two-string straw bale wall with 18-inch bales achieved an R-value of approximately R-27.5 (equivalent to R‑1.45 per inch).

Energy Efficiency and Thermal Performance Fuel Material Preference

Energy efficiency remains a critical factor influencing construction material selection. Straw bale walls offer high thermal resistance, reducing energy consumption for heating and cooling in buildings. This performance aligns with stringent energy codes and evolving building performance standards globally. It is particularly relevant in regions with extreme climates, where insulating materials directly impact energy costs. The material’s natural insulating characteristics reduce reliance on mechanical HVAC systems. The Straw Bale for Construction Market benefits from increasing interest in passive building design, where thermal performance is a core objective.

- For instance, Nebraska-based Strawbale Farms collaborated on a residential project where the straw bale structure achieved an R-value of 33 for exterior walls, significantly exceeding standard frame wall performance which averages around R-13 to R-21.

Cost-Effective Alternative to Conventional Construction Materials

Straw bales provide a cost-effective construction solution, especially in rural and agricultural regions where straw is readily available. The relatively low cost of raw material and minimal processing requirements reduce overall building costs. Labor costs can also be optimized through training and community-based building models that support self-building or cooperative construction. It presents a viable option for affordable housing initiatives, particularly in developing countries. The material’s affordability, combined with good structural and insulating performance, supports its use in a broad range of projects. The Straw Bale for Construction Market continues to appeal to builders looking for economical yet sustainable alternatives.

Increased Research, Innovation, and Technical Standardization Support Market Growth

Ongoing research and institutional support are improving the structural integrity and acceptance of straw bale construction in mainstream markets. Universities and construction laboratories have conducted extensive testing on load-bearing capacity, fire resistance, and moisture management. These efforts have led to the development of building codes and standards in countries such as the United States, Canada, and Germany. It encourages wider adoption among architects, contractors, and regulatory bodies. The integration of straw bale techniques into architectural education and sustainable construction programs further drives awareness and technical expertise. The Straw Bale for Construction Market is benefiting from a growing network of certified professionals and training programs supporting best practices.

Market Trends

Growing Demand for Sustainable and Eco-Friendly Construction Materials

The Straw Bale for Construction Market is experiencing increased demand due to the global emphasis on environmentally responsible building practices. Developers and consumers are actively seeking renewable, biodegradable, and low-carbon materials to reduce ecological impact. Straw bales meet these criteria and provide superior insulation, making them a preferred option in green construction. The market reflects a shift in consumer mindset toward materials that support long-term environmental goals. It also supports zero-waste and low-embodied energy initiatives, which align with evolving building codes and certifications. Regulatory frameworks that reward sustainable practices continue to push adoption rates upward.

- For instance, ModCell, a UK-based company, reported that their straw bale panels achieved a U-value of 0.13 W/m²K, significantly exceeding the UK’s standard minimum building insulation requirement of 0.30 W/m²K, thereby contributing to energy-efficient housing projects.

Integration with Modern Green Building Design and Architecture

Modern architects are exploring straw bale as a viable component in innovative and energy-efficient building designs. Straw bales are now part of contemporary construction projects that combine traditional materials with advanced structural and thermal techniques. The market is witnessing wider experimentation in residential and commercial sectors, especially in energy-conscious regions. Design flexibility, coupled with moisture-resistant coatings and improved construction methods, enhances their commercial viability. This trend reflects a broader architectural shift toward passive design and minimal energy usage. Building professionals are using digital tools to optimize bale placement and performance metrics in different climates.

- For instance, ModCell’s BaleHaus at Bath achieved an airtightness reading of 0.86 m³/h/m² at 50 Pa, over ten times tighter than prevailing UK standards, while delivering a wall U‑value of 0.19 W/m²·K in a real-world test environment.

Adoption in Low-Cost and Rural Housing Projects Worldwide

The Straw Bale for Construction Market shows strong traction in rural and low-cost housing sectors due to its affordability and local material availability. Governments and non-profits are supporting pilot programs and community housing schemes using straw bale structures to address housing shortages. These projects benefit from reduced material and transportation costs, making them ideal for remote and resource-scarce regions. Organizations are also integrating training programs to upskill local labor in straw bale construction techniques. The ease of on-site assembly and thermal insulation properties make it suitable for a range of climates. Its adaptability supports both temporary and permanent structures.

Growing Academic and Institutional Interest in Natural Building Materials

Universities, research institutions, and eco-focused organizations are increasingly exploring the properties of straw bale in construction. The market benefits from studies highlighting its fire resistance, thermal performance, and load-bearing capabilities. These findings contribute to updated codes, manuals, and guidelines that support safe straw bale use in mainstream construction. Education programs now include modules on alternative building methods, generating a new generation of professionals familiar with natural materials. The knowledge ecosystem around straw bale continues to expand, helping reduce resistance in regulatory and construction communities. These developments encourage manufacturers to invest in standardized bale production and testing.

Market Challenges Analysis

Lack of Skilled Labor and Awareness Limits Market Expansion

he Straw Bale for Construction Market faces significant challenges due to a lack of skilled labor familiar with straw bale techniques. Many contractors and builders are not adequately trained in this method, leading to errors in implementation and concerns over structural integrity. Limited formal education or certification programs for straw bale construction further restrict knowledge transfer across the building sector. The market also suffers from low public awareness regarding the benefits of straw bale, which affects demand from potential homeowners and developers. It requires consistent promotion and education to change long-standing perceptions about alternative construction methods. Without widespread understanding, the market struggles to gain momentum beyond niche eco-conscious segments.

Building Codes, Fire Safety, and Regulatory Obstacles Impede Growth

ompliance with modern building codes poses another critical challenge in the Straw Bale for Construction Market. Straw bale structures often face hurdles in obtaining approvals due to concerns about fire safety, moisture control, and long-term durability. Regulatory frameworks in many countries do not yet recognize straw bale as a mainstream construction material, which creates delays and complications in securing permits. It increases the cost and time involved in planning and executing projects, deterring potential investors. Insurance companies also hesitate to underwrite straw bale buildings due to the perceived risks, limiting financial accessibility for developers. These regulatory and institutional barriers hinder scalability and broader adoption in the mainstream construction industry.

Market Opportunities

Rising Demand for Sustainable and Energy-Efficient Building Solutions

The Straw Bale for Construction Market has strong growth potential driven by the increasing global demand for sustainable building practices. Governments and environmental bodies are encouraging low-carbon construction methods, which creates favorable ground for straw bale solutions. Straw is an abundant agricultural byproduct with low embodied energy, making it an ideal material for eco-conscious developers. The superior thermal insulation properties of straw bale walls support energy-efficient building designs, helping reduce long-term heating and cooling costs. Consumers and builders are showing growing interest in renewable materials that align with green certification standards. The market benefits from this shift in consumer behavior toward environmental responsibility.

Expansion in Rural and Low-Income Housing Projects Across Regions

Emerging economies and rural regions present significant opportunities for the Straw Bale for Construction Market. It offers an affordable alternative to traditional construction materials, especially in areas where straw is locally available. Public and private sector initiatives focused on cost-effective housing can integrate straw bale technologies to meet sustainability and budget goals. The material’s low transportation and processing needs further support its viability in underserved regions. NGOs and community-based organizations exploring resilient and climate-responsive housing solutions are increasingly considering straw bale methods. The market can capitalize on these growing interests to expand its footprint in regions facing housing shortages.

Market Segmentation Analysis:

By Straw Type

The Straw Bale for Construction Market segments by straw type into wheat straw, rice straw, barley straw, oat straw, and others. Wheat straw holds a leading position due to its structural integrity, availability, and ease of baling. It offers consistent quality and is widely preferred in residential and commercial structures. Rice straw also shows growing adoption in regions with high paddy cultivation, especially in parts of Asia and North America. Barley and oat straw are less common but serve as suitable alternatives in regions where wheat and rice are not abundant. The selection of straw type depends on regional crop production patterns and local sourcing strategies.

- For instance, the California-based company EcoStraw Builders has constructed over 160 straw bale homes using certified wheat straw bales, sourced within a 200 km radius, ensuring structural integrity and sustainability in alignment with local agricultural cycles.

By Bale Format

Based on bale format, the market includes rectangular bales and round bales. Rectangular bales dominate the segment due to their ease of stacking, handling, and compatibility with conventional construction techniques. Builders prefer rectangular bales for their uniformity and tight packing, which improves wall stability and insulation performance. Round bales, though used in some large-scale projects, pose challenges in alignment and structural integration. The rectangular format supports modular designs and minimizes construction waste, making it more suitable for standardized applications. It remains the preferred choice in both small-scale self-build projects and professional green building initiatives.

- For instance, ModCell’s Core straw bale panels measure 427 mm depth and achieve a U‑value of 0.13 W/m²·K, with airtightness testing delivering 0.86 m³/hr/m² at 50 Pa in their BaleHaus@Bath project—far exceeding UK regulatory requirements.

By Construction Method

The construction method segment includes load-bearing and non-load-bearing methods. Load-bearing construction is popular among traditional and rural builders due to its simplicity and lower material requirement. It eliminates the need for internal framing, allowing the straw bales themselves to support roof loads. Non-load-bearing or infill construction is gaining traction in urban and commercial projects, where timber or steel frames provide the primary structure. This method allows greater design flexibility and compliance with modern building codes. The Straw Bale for Construction Market leverages both approaches to serve a broad customer base across DIY builders, eco-developers, and institutional housing projects. Each method caters to specific structural needs and regulatory standards.

Segments:

Based on Straw Type

- Wheat straw

- Rice straw

- Barley straw

- Oat straw

- Rye straw

Based on Bale Format

- Standard two-string bales

- Three-string bales

- Jumbo bales

- Custom-sized bales

- Prefabricated straw panels

Based on Construction Method

- Load-bearing/nebraska style

- Post-and-beam infill

- Hybrid methods

- Prefabricated panel systems

Based on Application

- Exterior walls

- Interior walls

- Roof insulation

- Floor insulation

- Sound insulation

Based on End Use

- Residential construction

- Single-family homes

- Multi-family buildings

- Tiny homes and cabins

- Additions and renovations

- Commercial construction

- Educational facilities

- Eco-tourism facilities

- Retail and office spaces

- Agricultural buildings

- Community and public buildings

Based on Finishing Type

- Lime plaster

- Clay plaster

- Cement stucco

- Earthen plasters

- Siding and cladding

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for the largest market share of approximately 34.2% in the global Straw Bale for Construction Market in 2024. The region benefits from strong environmental awareness, supportive green building regulations, and a growing demand for sustainable housing solutions. The United States leads the regional market, driven by the presence of eco-conscious consumers and initiatives promoting carbon-neutral building practices. Many rural and suburban areas in the U.S. and Canada have adopted straw bale construction for energy-efficient homes and off-grid structures. Rising interest in low-impact materials among architects and the do-it-yourself community continues to stimulate market expansion. In Canada, climate-focused policies and interest in passive housing are further contributing to the popularity of straw bale materials. The region’s extensive agricultural output provides easy access to wheat and barley straw, keeping raw material costs low and supply stable.

Europe

Europe held a market share of around 29.6% in 2024. The region has long supported sustainable construction through stringent environmental policies and incentives for green infrastructure. Countries like Germany, France, and the United Kingdom have pioneered straw bale construction for both residential and public buildings. In Germany, passive house standards and energy efficiency regulations support the adoption of high-insulation materials such as straw. France has integrated straw bale construction into school buildings, offices, and low-income housing, supported by regional programs and sustainable urban planning. The UK has also witnessed growth in eco-village developments and alternative housing movements using straw bales. The European market benefits from robust regulatory support, skilled labor in eco-construction, and rising public awareness of the carbon footprint associated with conventional construction.

Asia Pacific

Asia Pacific captured approximately 21.8% of the global market share in 2024. The region shows significant potential, particularly in countries with high rice and wheat production like China, India, and Southeast Asian nations. These areas generate abundant straw waste, which presents an opportunity for sustainable reuse in construction. India has initiated straw bale housing pilot projects in rural areas as part of affordable and eco-friendly housing initiatives. China is exploring sustainable construction practices as part of its larger carbon neutrality goals, which includes alternative materials like straw. However, challenges such as lack of awareness, traditional construction preferences, and limited regulatory frameworks continue to hinder large-scale adoption. Growth in the region will likely depend on governmental support, demonstration projects, and greater integration of sustainable practices in urban development policies.

Latin America

Latin America represented a market share of about 8.7% in 2024. The region is still in the early stages of adopting straw bale construction, though interest is gradually increasing. Countries like Brazil, Argentina, and Chile have large agricultural sectors, providing access to necessary raw materials. In rural areas, straw bale construction is seen as a cost-effective, thermally efficient solution for housing. Non-governmental organizations and community-based projects are spearheading the use of straw bales in social housing initiatives. Although the market remains small, growing awareness of eco-friendly construction and cost-saving benefits may drive regional expansion in the coming years.

Middle East & Africa

The Middle East & Africa region accounted for the smallest share of the market at approximately 5.7% in 2024. Adoption remains limited due to climatic extremes, underdeveloped infrastructure, and low public awareness of straw bale construction methods. However, some pilot initiatives in North African countries such as Egypt and Morocco show potential for future growth. In regions where heat insulation is critical and building materials are expensive, straw bales offer a sustainable and affordable alternative. The market is expected to grow moderately with international cooperation, knowledge transfer, and small-scale community projects focused on low-income housing.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- ISO-STROH

- Ilanga LLC

- Spacebale

- Agile Property & Homes Ltd

- StrawSIPS

- Ortech Industries

- EcoCocon

- NIDUS Home

- Ekopanely Boards

Competitive Analysis

The Straw Bale for Construction Market features prominent players such as EcoCocon, ModCell, Strawcture Eco, Endeavour Centre, and Straw-Bale Building UK. These companies are leading the market by offering innovative prefabricated straw bale solutions, promoting energy-efficient and sustainable building practices. They focus on developing systems that meet modern building codes, including fire resistance, thermal insulation, and structural integrity. Companies like EcoCocon and ModCell are recognized for their passive house-certified panels and scalable modular solutions, while Strawcture Eco is gaining traction in emerging markets with cost-effective alternatives. Endeavour Centre and Straw-Bale Building UK contribute significantly to knowledge dissemination and technical training. These players strengthen their market position by leveraging local material availability, promoting eco-certification, and collaborating with architects, governments, and construction firms to facilitate broader adoption of straw bale technology. Their commitment to sustainability, compliance, and design innovation drives competitive differentiation in a niche but expanding market.

Recent Developments

- In April 2025, ISO-STROH in Germany launched a new straw blow-in insulation system called ISO straw, made entirely from locally sourced, untreated wheat straw. The product boasts a sound insulation rating of RW 42 dB, as independently tested under EN ISO 717-1, and holds a European Technical Assessment (ETA-17/0559) for building compliance

- In 2023, ISO-STROH introduced a new straw bale plaster designed to boost the durability and fire resistance of straw bale walls, showcasing ongoing innovation in sustainable building materials.This development signifies a move towards meeting evolving building standards and further realizing the potential of straw bale construction for eco-friendly structures.

Market Concentration & Characteristics

The Straw Bale for Construction Market is moderately concentrated, with a small number of specialized players dominating key regions due to the niche nature of the product and limited industrial scalability. It is characterized by a strong emphasis on sustainability, low embodied energy, and compatibility with eco-conscious building practices. Market participants focus on regional manufacturing, locally sourced straw, and prefabricated panel systems to meet regulatory and environmental standards. Demand is largely driven by green building certifications, climate-resilient construction, and low-carbon architecture trends. The market shows high regional fragmentation, with North America and Europe leading in adoption due to advanced environmental policies and growing support for alternative construction materials. Entry barriers remain moderately high because of code compliance challenges, lack of awareness among mainstream builders, and limited mechanized production. The market’s pace of innovation relies on collaboration with research institutions and public bodies promoting sustainable construction. It continues to evolve with growing investor interest in circular economy solutions

Report Coverage

The research report offers an in-depth analysis based on Straw Type, Bale format, Construction Method, Application, End use, Finishing Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness rising demand due to increasing emphasis on sustainable and carbon-neutral building practices.

- Governments and green building councils will likely support straw bale construction through incentives and regulatory approvals.

- Advancements in modular and prefabricated straw bale panels will improve construction efficiency and scalability.

- Growing adoption of eco-friendly construction materials in residential and small commercial sectors will boost market expansion.

- Builders and architects will increasingly include straw bale solutions to meet energy efficiency and insulation standards.

- Market players will focus on developing code-compliant and fire-resistant straw bale systems to expand urban acceptance.

- Educational campaigns and training programs will drive awareness and adoption among construction professionals.

- Regional players will strengthen their presence through localized production and material sourcing strategies.

- Innovation in moisture control and structural reinforcement will enhance the durability and appeal of straw bale buildings.

- The market will gain traction in climate-resilient infrastructure planning, particularly in Europe and North America.