1. Introduction

1.1. Report Description

1.2. Purpose of the Report

1.3. USP & Key Offerings

1.4. Key Benefits for Stakeholders

1.5. Target Audience

1.6. Report Scope

1.7. Regional Scope

2. Scope and Methodology

2.1. Objectives of the Study

2.2. Stakeholders

2.3. Data Sources

2.3.1. Primary Sources

2.3.2. Secondary Sources

2.4. Market Estimation

2.4.1. Bottom-Up Approach

2.4.2. Top-Down Approach

2.5. Forecasting Methodology

3. Executive Summary

4. Introduction

4.1. Overview

4.2. Key Industry Trends

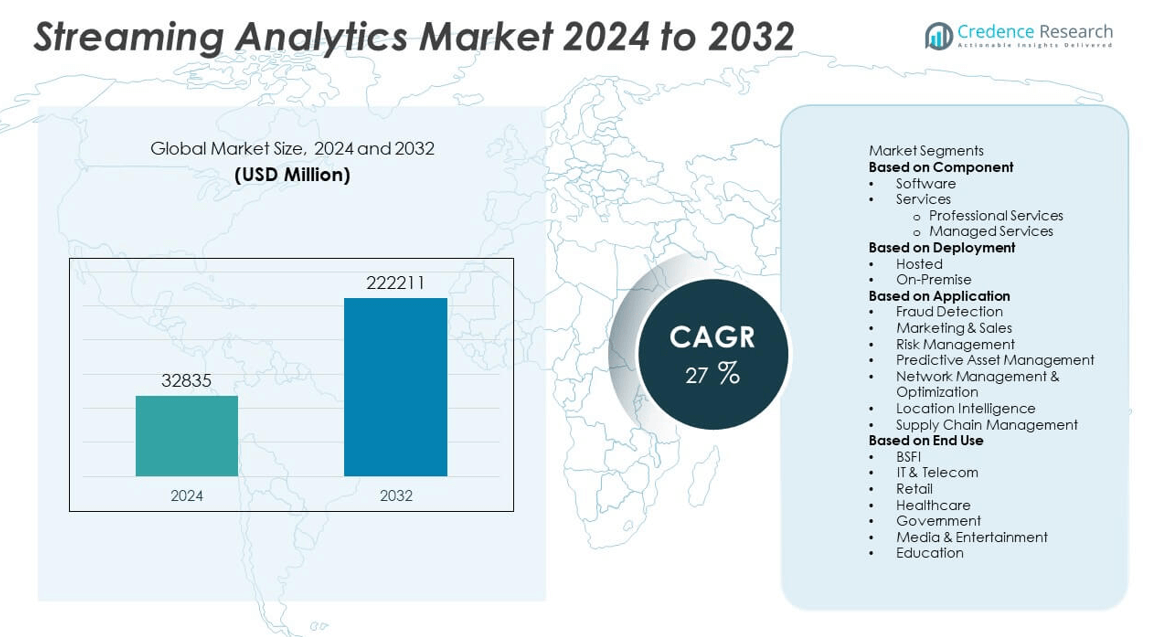

5. Global Streaming Analytics Market

5.1. Market Overview

5.2. Market Performance

5.3. Impact of COVID-19

5.4. Market Forecast

6. Market Breakup By Component

6.1. Software

6.1.1. Market Trends

6.1.2. Market Forecast

6.1.3. Revenue Share

6.1.4. Revenue Growth Opportunity

6.2. Services

6.2.1. Professional Services

6.2.1.1. Market Trends

6.2.1.2. Market Forecast

6.2.1.3. Revenue Share

6.2.1.4. Revenue Growth Opportunity

6.2.2. Managed Services

6.2.2.1. Market Trends

6.2.2.2. Market Forecast

6.2.2.3. Revenue Share

6.2.2.4. Revenue Growth Opportunity

7. Market Breakup By Deployment

7.1. Hosted

7.1.1. Market Trends

7.1.2. Market Forecast

7.1.3. Revenue Share

7.1.4. Revenue Growth Opportunity

7.2. On-Premise

7.2.1. Market Trends

7.2.2. Market Forecast

7.2.3. Revenue Share

7.2.4. Revenue Growth Opportunity

8. Market Breakup By Application

8.1. Fraud Detection

8.1.1. Market Trends

8.1.2. Market Forecast

8.1.3. Revenue Share

8.1.4. Revenue Growth Opportunity

8.2. Marketing & Sales

8.2.1. Market Trends

8.2.2. Market Forecast

8.2.3. Revenue Share

8.2.4. Revenue Growth Opportunity

8.3. Risk Management

8.3.1. Market Trends

8.3.2. Market Forecast

8.3.3. Revenue Share

8.3.4. Revenue Growth Opportunity

8.4. Predictive Asset Management

8.4.1. Market Trends

8.4.2. Market Forecast

8.4.3. Revenue Share

8.4.4. Revenue Growth Opportunity

8.5. Network Management & Optimization

8.5.1. Market Trends

8.5.2. Market Forecast

8.5.3. Revenue Share

8.5.4. Revenue Growth Opportunity

8.6. Location Intelligence

8.6.1. Market Trends

8.6.2. Market Forecast

8.6.3. Revenue Share

8.6.4. Revenue Growth Opportunity

8.7. Supply Chain Management

8.7.1. Market Trends

8.7.2. Market Forecast

8.7.3. Revenue Share

8.7.4. Revenue Growth Opportunity

9. Market Breakup By End Use

9.1. BFSI

9.1.1. Market Trends

9.1.2. Market Forecast

9.1.3. Revenue Share

9.1.4. Revenue Growth Opportunity

9.2. IT & Telecom

9.2.1. Market Trends

9.2.2. Market Forecast

9.2.3. Revenue Share

9.2.4. Revenue Growth Opportunity

9.3. Retail

9.3.1. Market Trends

9.3.2. Market Forecast

9.3.3. Revenue Share

9.3.4. Revenue Growth Opportunity

9.4. Healthcare

9.4.1. Market Trends

9.4.2. Market Forecast

9.4.3. Revenue Share

9.4.4. Revenue Growth Opportunity

9.5. Government

9.5.1. Market Trends

9.5.2. Market Forecast

9.5.3. Revenue Share

9.5.4. Revenue Growth Opportunity

9.6. Media & Entertainment

9.6.1. Market Trends

9.6.2. Market Forecast

9.6.3. Revenue Share

9.6.4. Revenue Growth Opportunity

9.7. Education

9.7.1. Market Trends

9.7.2. Market Forecast

9.7.3. Revenue Share

9.7.4. Revenue Growth Opportunity

10. Market Breakup by Region

10.1. North America

10.1.1. United States

10.1.1.1. Market Trends

10.1.1.2. Market Forecast

10.1.2. Canada

10.1.2.1. Market Trends

10.1.2.2. Market Forecast

10.2. Asia-Pacific

10.2.1. China

10.2.2. Japan

10.2.3. India

10.2.4. South Korea

10.2.5. Australia

10.2.6. Indonesia

10.2.7. Others

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. United Kingdom

10.3.4. Italy

10.3.5. Spain

10.3.6. Russia

10.3.7. Others

10.4. Latin America

10.4.1. Brazil

10.4.2. Mexico

10.4.3. Others

10.5. Middle East and Africa

10.5.1. Market Trends

10.5.2. Market Breakup by Country

10.5.3. Market Forecast

11. SWOT Analysis

11.1. Overview

11.2. Strengths

11.3. Weaknesses

11.4. Opportunities

11.5. Threats

12. Value Chain Analysis

13. Porter’s Five Forces Analysis

13.1. Overview

13.2. Bargaining Power of Buyers

13.3. Bargaining Power of Suppliers

13.4. Degree of Competition

13.5. Threat of New Entrants

13.6. Threat of Substitutes

14. Price Analysis

15. Competitive Landscape

15.1. Market Structure

15.2. Key Players

15.3. Profiles of Key Players

15.3.1. Striim

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financials

15.3.1.4. SWOT Analysis

15.3.2. Microsoft

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financials

15.3.2.4. SWOT Analysis

15.3.3. Software AG

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financials

15.3.3.4. SWOT Analysis

15.3.4. SAS Institute Inc.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financials

15.3.4.4. SWOT Analysis

15.3.5. Cloud Software Group, Inc.

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financials

15.3.5.4. SWOT Analysis

15.3.6. IBM

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financials

15.3.6.4. SWOT Analysis

15.3.7. Oracle

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financials

15.3.7.4. SWOT Analysis

15.3.8. SAP SE

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financials

15.3.8.4. SWOT Analysis

15.3.9. Informatica Inc.

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financials

15.3.9.4. SWOT Analysis

16. Research Methodology

1. Introduction

1.1. Report Description

1.2. Purpose of the Report

1.3. USP & Key Offerings

1.4. Key Benefits for Stakeholders

1.5. Target Audience

1.6. Report Scope

1.7. Regional Scope

2. Scope and Methodology

2.1. Objectives of the Study

2.2. Stakeholders

2.3. Data Sources

2.3.1. Primary Sources

2.3.2. Secondary Sources

2.4. Market Estimation

2.4.1. Bottom-Up Approach

2.4.2. Top-Down Approach

2.5. Forecasting Methodology

3. Executive Summary

4. Introduction

4.1. Overview

4.2. Key Industry Trends

5. Global Streaming Analytics Market

5.1. Market Overview

5.2. Market Performance

5.3. Impact of COVID-19

5.4. Market Forecast

6. Market Breakup By Component

6.1. Software

6.1.1. Market Trends

6.1.2. Market Forecast

6.1.3. Revenue Share

6.1.4. Revenue Growth Opportunity

6.2. Services

6.2.1. Professional Services

6.2.1.1. Market Trends

6.2.1.2. Market Forecast

6.2.1.3. Revenue Share

6.2.1.4. Revenue Growth Opportunity

6.2.2. Managed Services

6.2.2.1. Market Trends

6.2.2.2. Market Forecast

6.2.2.3. Revenue Share

6.2.2.4. Revenue Growth Opportunity

7. Market Breakup By Deployment

7.1. Hosted

7.1.1. Market Trends

7.1.2. Market Forecast

7.1.3. Revenue Share

7.1.4. Revenue Growth Opportunity

7.2. On-Premise

7.2.1. Market Trends

7.2.2. Market Forecast

7.2.3. Revenue Share

7.2.4. Revenue Growth Opportunity

8. Market Breakup By Application

8.1. Fraud Detection

8.1.1. Market Trends

8.1.2. Market Forecast

8.1.3. Revenue Share

8.1.4. Revenue Growth Opportunity

8.2. Marketing & Sales

8.2.1. Market Trends

8.2.2. Market Forecast

8.2.3. Revenue Share

8.2.4. Revenue Growth Opportunity

8.3. Risk Management

8.3.1. Market Trends

8.3.2. Market Forecast

8.3.3. Revenue Share

8.3.4. Revenue Growth Opportunity

8.4. Predictive Asset Management

8.4.1. Market Trends

8.4.2. Market Forecast

8.4.3. Revenue Share

8.4.4. Revenue Growth Opportunity

8.5. Network Management & Optimization

8.5.1. Market Trends

8.5.2. Market Forecast

8.5.3. Revenue Share

8.5.4. Revenue Growth Opportunity

8.6. Location Intelligence

8.6.1. Market Trends

8.6.2. Market Forecast

8.6.3. Revenue Share

8.6.4. Revenue Growth Opportunity

8.7. Supply Chain Management

8.7.1. Market Trends

8.7.2. Market Forecast

8.7.3. Revenue Share

8.7.4. Revenue Growth Opportunity

9. Market Breakup By End Use

9.1. BFSI

9.1.1. Market Trends

9.1.2. Market Forecast

9.1.3. Revenue Share

9.1.4. Revenue Growth Opportunity

9.2. IT & Telecom

9.2.1. Market Trends

9.2.2. Market Forecast

9.2.3. Revenue Share

9.2.4. Revenue Growth Opportunity

9.3. Retail

9.3.1. Market Trends

9.3.2. Market Forecast

9.3.3. Revenue Share

9.3.4. Revenue Growth Opportunity

9.4. Healthcare

9.4.1. Market Trends

9.4.2. Market Forecast

9.4.3. Revenue Share

9.4.4. Revenue Growth Opportunity

9.5. Government

9.5.1. Market Trends

9.5.2. Market Forecast

9.5.3. Revenue Share

9.5.4. Revenue Growth Opportunity

9.6. Media & Entertainment

9.6.1. Market Trends

9.6.2. Market Forecast

9.6.3. Revenue Share

9.6.4. Revenue Growth Opportunity

9.7. Education

9.7.1. Market Trends

9.7.2. Market Forecast

9.7.3. Revenue Share

9.7.4. Revenue Growth Opportunity

10. Market Breakup by Region

10.1. North America

10.1.1. United States

10.1.1.1. Market Trends

10.1.1.2. Market Forecast

10.1.2. Canada

10.1.2.1. Market Trends

10.1.2.2. Market Forecast

10.2. Asia-Pacific

10.2.1. China

10.2.2. Japan

10.2.3. India

10.2.4. South Korea

10.2.5. Australia

10.2.6. Indonesia

10.2.7. Others

10.3. Europe

10.3.1. Germany

10.3.2. France

10.3.3. United Kingdom

10.3.4. Italy

10.3.5. Spain

10.3.6. Russia

10.3.7. Others

10.4. Latin America

10.4.1. Brazil

10.4.2. Mexico

10.4.3. Others

10.5. Middle East and Africa

10.5.1. Market Trends

10.5.2. Market Breakup by Country

10.5.3. Market Forecast

11. SWOT Analysis

11.1. Overview

11.2. Strengths

11.3. Weaknesses

11.4. Opportunities

11.5. Threats

12. Value Chain Analysis

13. Porter’s Five Forces Analysis

13.1. Overview

13.2. Bargaining Power of Buyers

13.3. Bargaining Power of Suppliers

13.4. Degree of Competition

13.5. Threat of New Entrants

13.6. Threat of Substitutes

14. Price Analysis

15. Competitive Landscape

15.1. Market Structure

15.2. Key Players

15.3. Profiles of Key Players

15.3.1. Striim

15.3.1.1. Company Overview

15.3.1.2. Product Portfolio

15.3.1.3. Financials

15.3.1.4. SWOT Analysis

15.3.2. Microsoft

15.3.2.1. Company Overview

15.3.2.2. Product Portfolio

15.3.2.3. Financials

15.3.2.4. SWOT Analysis

15.3.3. Software AG

15.3.3.1. Company Overview

15.3.3.2. Product Portfolio

15.3.3.3. Financials

15.3.3.4. SWOT Analysis

15.3.4. SAS Institute Inc.

15.3.4.1. Company Overview

15.3.4.2. Product Portfolio

15.3.4.3. Financials

15.3.4.4. SWOT Analysis

15.3.5. Cloud Software Group, Inc.

15.3.5.1. Company Overview

15.3.5.2. Product Portfolio

15.3.5.3. Financials

15.3.5.4. SWOT Analysis

15.3.6. IBM

15.3.6.1. Company Overview

15.3.6.2. Product Portfolio

15.3.6.3. Financials

15.3.6.4. SWOT Analysis

15.3.7. Oracle

15.3.7.1. Company Overview

15.3.7.2. Product Portfolio

15.3.7.3. Financials

15.3.7.4. SWOT Analysis

15.3.8. SAP SE

15.3.8.1. Company Overview

15.3.8.2. Product Portfolio

15.3.8.3. Financials

15.3.8.4. SWOT Analysis

15.3.9. Informatica Inc.

15.3.9.1. Company Overview

15.3.9.2. Product Portfolio

15.3.9.3. Financials

15.3.9.4. SWOT Analysis

16. Research Methodology