Market overview

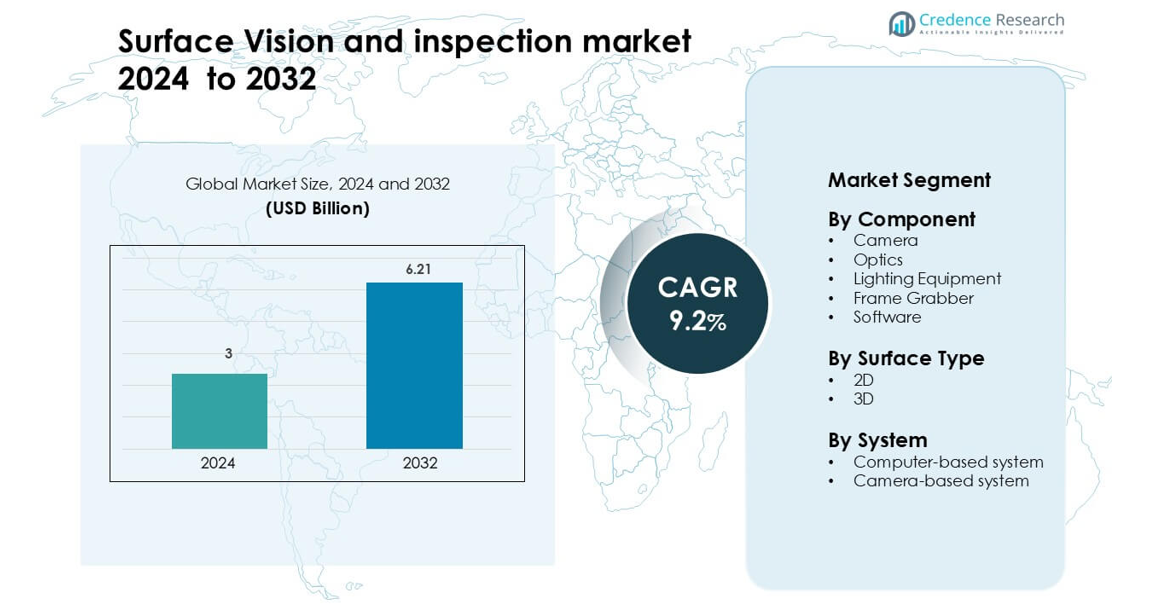

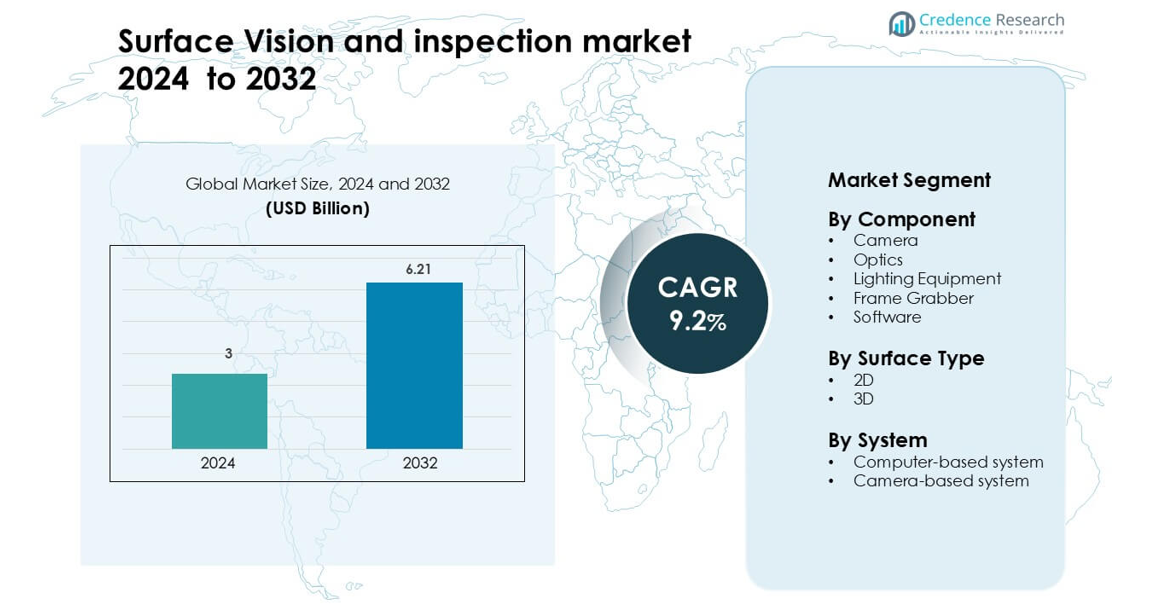

Surface Vision and inspection market was valued at USD 3 billion in 2024 and is anticipated to reach USD 6.21 billion by 2032, growing at a CAGR of 9.2 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Surface Vision and Inspection Market Size 2024 |

USD 3 billion |

| Surface Vision and Inspection Market, CAGR |

9.2% |

| Surface Vision and Inspection Market Size 2032 |

USD 6.21 billion |

The Surface Vision and Inspection Market is shaped by leading companies such as KITOV Systems Ltd., IMS Messsysteme GmbH, KEYENCE CORPORATION, Cognex Corporation, AMETEK Inc., Industrial Vision Systems Ltd., Baumer Inspection GmbH, OMRON Corporation, Edmund Optics, and ISRA VISION GmbH. These firms compete through high-resolution imaging systems, advanced 3D inspection platforms, deep-learning analytics, and precision optics designed for zero-defect manufacturing. Their solutions support electronics, automotive, metals, packaging, and semiconductor production. Asia-Pacific stands as the leading region with a 37% market share, driven by large-scale manufacturing, rapid automation, and strong semiconductor and electronics output across China, Japan, South Korea, and Taiwan.

Market Insights

- The Surface Vision and Inspection Market is valued at USD 3 billion in 2024 and is projected to reach USD 6.21 billion by 2032, growing at a CAGR of 9.2%.

- Demand rises as manufacturers adopt automated quality control to reduce defects, improve production yield, and support zero-error output across electronics, automotive, packaging, and metal processing sectors.

- AI-enabled 2D and 3D vision systems, deep-learning inspection models, and robotics integration shape major trends, especially in semiconductor and battery manufacturing lines.

- Competition strengthens as KITOV Systems, KEYENCE, Cognex, AMETEK, ISRA VISION, and Baumer enhance high-resolution cameras, intelligent lighting, and 3D profiling tools to differentiate in high-precision segments; 2D systems lead with a 67% share.

- Asia-Pacific dominates with a 37% share due to strong electronics and semiconductor output, followed by North America at 34% and Europe at 29%, supported by strict quality standards and rapid automation adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

Camera leads this segment with a 38% share due to its central role in capturing high-resolution images for inspection tasks. Demand grows as manufacturers adopt advanced CMOS sensors and higher frame-rate modules for faster defect detection on production lines. Optics and lighting equipment also gain traction because modern setups require better illumination control to enhance contrast and surface clarity. Software sees strong growth as AI-powered analytics improve accuracy and cut inspection time. Frame grabbers remain important in systems that need real-time image transfer for continuous quality checks.

- For instance, Cognex’s VisionPro Deep Learning platform VPDL is PC-based software and is compatible with hundreds of industrial cameras, including the Cognex CIC camera line, through its acquisition technology that supports various interfaces, including GigE.

By Surface Type

2D surface vision dominates this segment with a 67% share because it supports most standard inspection tasks, including label checks, pattern verification, and defect spotting on flat surfaces. Adoption rises in electronics, packaging, and automotive parts where high-speed 2D cameras offer reliable and cost-efficient output. Demand for 3D surface vision grows in metal fabrication, semiconductor packaging, and precision engineering as industries require depth measurement, surface profiling, and complex geometry assessment. The shift toward automation encourages wider use of hybrid 2D+3D setups for better defect identification.

- For instance, InspecVision’s Planar 2D system can capture up to 40 million ultra-high-resolution measurements in just 0.1 seconds using a fixed camera, enabling hundreds of thousands or even millions of measurements per part depending on its size and complexity.

By System

Computer-based systems hold a 59% share and lead this segment because they support complex algorithms, multi-camera setups, and high-volume inspection tasks. Industries prefer these systems for their strong processing power, flexible integration options, and ability to handle AI-driven defect classification. Camera-based systems grow quickly in smaller facilities where compact units help reduce setup cost and space needs. Their plug-and-play design attracts users wanting faster deployment and minimal calibration effort. Rising industrial digitalization boosts demand for both system types across electronics, food, and automotive sectors.

Key Growth Drivers

Rising Automation in Manufacturing

Rising automation in manufacturing acts as a major growth driver for the Surface Vision and Inspection Market. Industries shift toward automated inspection to improve consistency, cut defects, and reduce labor dependence. Automated lines need precise vision systems that detect micro-level irregularities at high speed, which increases adoption across electronics, automotive, and packaging units. Manufacturers also deploy automated inspection to support lean production and meet global quality norms. Higher throughput requirements push companies to integrate advanced cameras, fast processors, and AI-enabled tools. This trend strengthens market expansion because automated facilities demand continuous, real-time inspection to prevent costly failures and increase yield.

- For instance, Basler ace 2 Pro series uses fourth-generation Sony Pregius S sensors, such as the IMX540, IMX541, and IMX542, offering high resolution and global shutter technology.

Growing Demand for Zero-Defect Production

Growing demand for zero-defect production drives strong market growth as companies prioritize error-free output. Industries adopt vision systems to meet strict tolerance levels, especially in semiconductors, pharmaceuticals, and high-precision engineering. Zero-defect goals push factories to invest in high-resolution sensors, 3D profiling tools, and predictive inspection software that eliminates manual variability. Customers expect flawless products, which forces manufacturers to increase inspection points across the production cycle. Quality audits and regulatory requirements also intensify pressure on industries to validate every surface feature. This creates high demand for reliable inspection platforms that support continuous monitoring and early defect prevention.

- For instance, Alicona InfiniteFocus 3D optical measurement solutions achieve vertical resolution of 10 nanometers, allowing precise surface roughness and edge-sharpness evalation for high-precision manufacturing.

Adoption of AI and Deep Learning in Inspection

Adoption of AI and deep learning forms a major driver because advanced algorithms improve detection accuracy and enable classification of complex defects that were previously difficult to detect with rule-based systems. Deep-learning systems learn from large image datasets to adapt to variations in color, texture, and shape, allowing more flexible inspection. Industries such as electronics, battery manufacturing, and precision machining rely on AI to handle fast line speeds and diverse defect patterns. AI-driven tools also reduce false rejects and improve process optimization. This shift encourages companies to upgrade older systems to intelligent inspection platforms.

Key Trends and Opportunities

Expansion of 3D Surface Inspection Solutions

3D inspection emerges as a key trend as industries require depth, contour, and volume measurements that 2D systems cannot provide. Adoption rises in metal processing, additive manufacturing, semiconductor packaging, and automotive components where depth accuracy matters for structural integrity. 3D systems help detect dents, warpage, micro-scratches, and dimensional errors that affect product reliability. The rise of electric vehicles, battery production, and miniaturized components further pushes demand for 3D imaging. Companies explore structured light, laser triangulation, and stereo vision to enhance inspection detail. This creates opportunities for vendors offering advanced 3D sensing hardware and analytics platforms.

- For instance, Cognex’s L68 3D laser displacement sensor achieves up to 163 million points per second in its 3D point acquisition and has a vertical resolution between 0.9–1.4 μm, allowing detection of very fine surface irregularities.

Shift Toward Cloud-Based and Edge Inspection Platforms

Shift toward cloud-based and edge inspection platforms represents a major opportunity. Manufacturers use cloud tools to store image datasets, train deep-learning models, and manage multi-site inspection networks. Edge processing reduces latency by analyzing defects directly on the production line, enabling faster decisions. This approach supports high-speed production and reduces data-transfer loads. Industries adopt hybrid cloud-edge models to balance accuracy, speed, and security. The trend encourages vendors to develop connected vision systems with remote updates, predictive analytics, and cross-facility performance tracking. Growth in smart factories accelerates adoption across global manufacturing clusters.

- For instance, NVIDIA Jetson AGX Orin delivers 275 TOPS of AI performance, allowing real-time inspection models to run directly on robotic arms or smart cameras in high-speed production.

Rising Integration of Vision Systems with Robotics

Integration of surface vision with robotics becomes a strong trend as industries adopt robotic arms, pick-and-place systems, and automated handling units. Vision-guided robots support intelligent assembly, precise positioning, and dynamic defect detection in real time. This integration reduces downtime, improves alignment accuracy, and boosts throughput in electronics, packaging, and metal processing plants. Collaborative robots (cobots) also expand use cases for small and mid-sized manufacturers. The trend opens opportunities for vendors to supply compact vision modules, embedded sensors, and AI-driven robot-vision software.

Key Challenges

High System Integration and Deployment Costs

High system integration and deployment costs form a major challenge, especially for small and medium manufacturers. Advanced vision systems require costly cameras, lighting, optics, processors, and AI software, increasing upfront investment. Custom integration, calibration, and testing further raise expenses. Many industries face budget limitations when shifting from manual inspection to automated systems. Additionally, high-resolution 3D cameras and deep-learning tools demand powerful computing hardware, making full adoption difficult. These cost barriers slow adoption in low-margin industries and cause delays in modernization plans across emerging markets.

Shortage of Skilled Technical Workforce

Shortage of skilled technical workforce poses another challenge as industries struggle to operate, maintain, and optimize advanced inspection systems. Vision platforms require knowledge of optics, image processing, AI model training, and system calibration. Many factories lack technicians who can manage complex failure scenarios or adjust inspection algorithms for new product variations. This gap increases dependence on external support and raises operational downtime. Training programs remain limited in many regions, slowing the shift toward intelligent inspection. The skills shortage restricts adoption of advanced systems and affects long-term performance across automated manufacturing units.

Regional Analysis

North America

North America holds a 34% share of the Surface Vision and Inspection Market due to strong adoption of automation across electronics, automotive, and packaging industries. Manufacturers invest heavily in AI-based inspection tools and high-resolution imaging to meet strict quality standards. The region benefits from advanced industrial infrastructure and early use of 3D inspection systems in semiconductor fabrication. U.S. firms accelerate adoption through modernization of production lines, while Canada expands usage in food and material processing. Continuous innovation and strong R&D activity help North America maintain a leading position in high-performance inspection technologies.

Europe

Europe commands a 29% share driven by strict regulatory requirements and strong manufacturing bases in Germany, Italy, and France. Automotive and precision engineering industries use advanced surface inspection to ensure compliance with quality norms. The region sees rapid use of 3D cameras, structured-light systems, and high-speed optical tools in metalworking, electronics, and packaging. Expansion of Industry 4.0 strengthens demand for integrated AI-based inspection platforms. Companies upgrade legacy systems to meet zero-defect goals, and widespread digital transformation positions Europe as a key innovator in advanced inspection solutions.

Asia-Pacific

Asia-Pacific leads with a 37% share, supported by large-scale production in China, Japan, South Korea, and Taiwan. Electronics, semiconductor, automotive, and battery manufacturing facilities rely heavily on automated surface inspection to manage high output volumes. APAC benefits from strong investments in smart factories, robotics, and deep-learning inspection tools. Rapid expansion of EV production and PCB manufacturing further boosts demand for precise 2D and 3D inspection systems. Growing industrial automation and rising OEM activity keep Asia-Pacific the fastest-growing regional market with strong long-term potential.

Latin America

Latin America holds a smaller yet growing share of 5%, driven by automation upgrades in automotive, food processing, and packaging sectors. Brazil and Mexico lead adoption as industries replace manual inspection with automated camera-based systems to improve throughput and reduce defects. Expanding local manufacturing and foreign investments support the need for reliable inspection platforms. Companies adopt AI-enabled vision tools to strengthen quality control and reduce waste. While adoption is slower than major regions, rising modernization and competitive pressures push steady growth in advanced surface inspection technologies.

Middle East & Africa (MEA)

Middle East & Africa account for a 3% share, supported by gradual adoption of automated inspection in oil & gas equipment, construction materials, and packaging industries. The UAE and Saudi Arabia lead growth with investments in industrial modernization and smart manufacturing initiatives. Demand increases for surface inspection tools that enhance safety, reduce equipment errors, and support quality consistency. Emerging manufacturing zones in South Africa further push the need for cost-efficient vision systems. Although MEA remains an early-stage market, rising industrial diversification supports long-term opportunities.

Market Segmentations:

By Component

- Camera

- Optics

- Lighting Equipment

- Frame Grabber

- Software

By Surface Type

By System

- Computer-based system

- Camera-based system

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Surface Vision and Inspection Market features strong participation from global and regional technology providers offering advanced imaging hardware, AI-driven analytics, and integrated inspection platforms. Companies focus on high-resolution cameras, precision optics, intelligent lighting, and 2D/3D vision systems to support diverse industrial applications. Vendors compete by expanding deep-learning capabilities, enhancing processing speed, and improving accuracy for micro-defect detection across electronics, semiconductor, metal fabrication, and automotive sectors. Many players invest in edge-computing solutions and cloud-based model training to deliver faster, scalable inspection. Strategic partnerships with automation firms and robotics manufacturers strengthen product integration. Continuous innovation in structured-light sensors, hyperspectral imaging, and advanced algorithms helps companies maintain differentiation. Growing demand for zero-defect manufacturing and smart factory modernization drives firms to upgrade product portfolios, expand service networks, and support multi-industry deployments

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- KITOV Systems Ltd.

- IMS Messsysteme GmbH

- KEYENCE CORPORATION

- Cognex Corporation

- AMETEK, Inc.

- Industrial Vision Systems Ltd.

- Baumer Inspection GmbH

- OMRON Corporation

- Edmund Optics

- ISRA VISION GmbH

Recent Developments

- In July 2025, Kitov AI released its Version 2.9 software, featuring a multi-sensor workflow that integrates a second inspection tool for deeper evaluation of surface roughness and dimensions.

- In July 2024, KEYENCE CORPORATION Introduced the LJ-S8000 Series 3D laser snapshot sensor for high-speed non-contact inspection including surface scanning

Report Coverage

The research report offers an in-depth analysis based on Component, Surface Type, System and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as factories increase automation and adopt AI-driven inspection.

- 3D surface analysis will gain wider use in semiconductor, battery, and metal processing lines.

- Deep-learning models will replace rule-based inspection for complex defect classification.

- Edge processing will grow as manufacturers need faster, low-latency inspection decisions.

- Vision-guided robotics will integrate more deeply into assembly, sorting, and precision handling.

- Cloud-based inspection platforms will rise for multi-site data training and model updates.

- Miniaturized, high-speed cameras will support next-generation electronics and micro-component checks.

- Demand for zero-defect production will push companies to deploy multi-camera hybrid systems.

- Vendors will focus on plug-and-play systems to support small and mid-scale manufacturers.

- Growth in smart factories across Asia-Pacific will continue to shape global adoption trends