Market Overview:

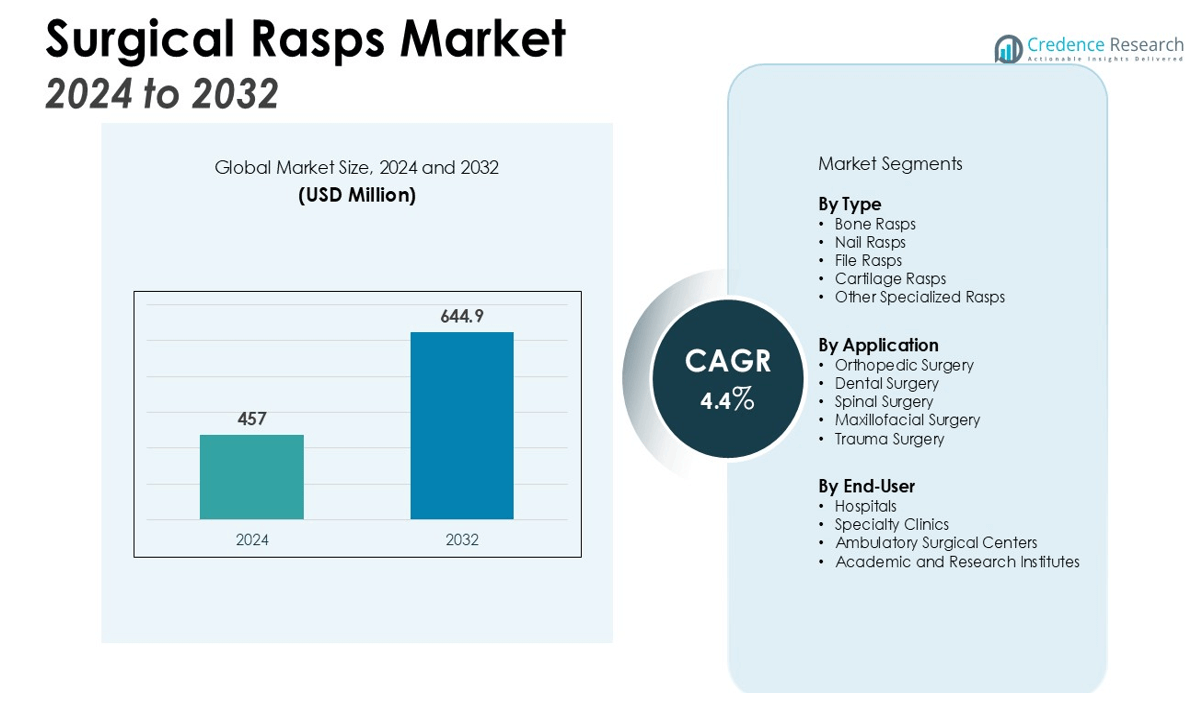

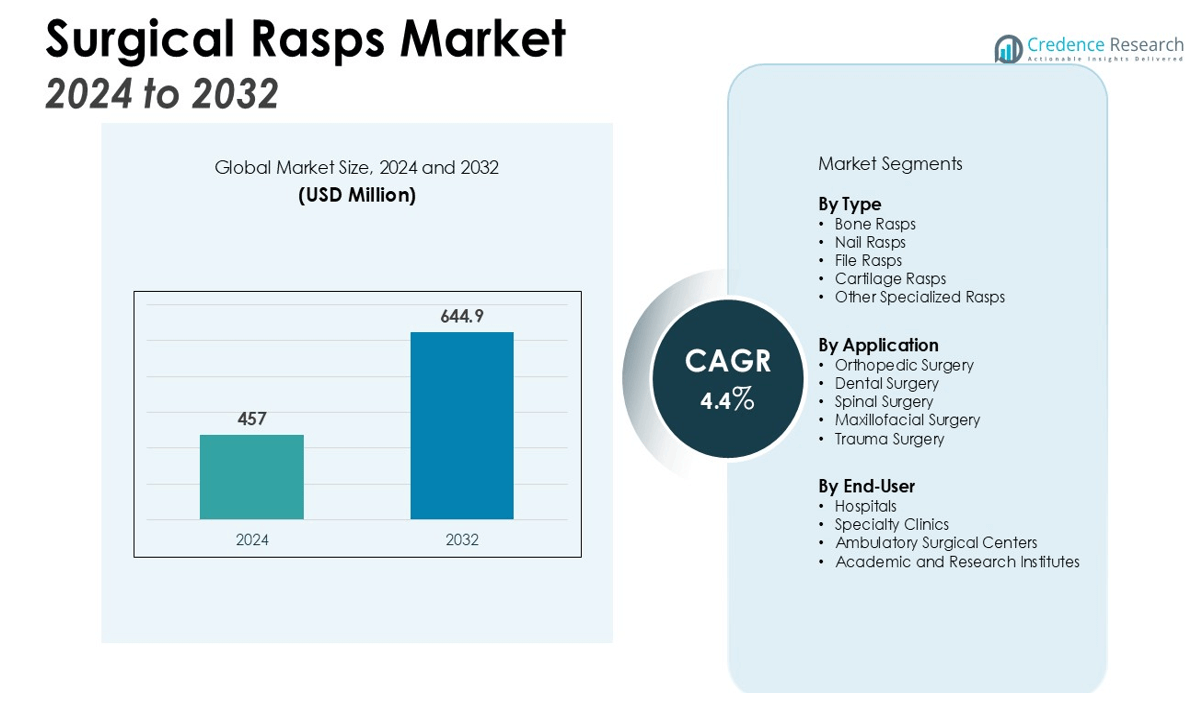

The Surgical Rasps Market size was valued at USD 457 million in 2024 and is anticipated to reach USD 644.9 million by 2032, at a CAGR of 4.4% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Surgical Rasps Market Size 2024 |

USD 457 million |

| Surgical Rasps Market, CAGR |

4.4% |

| Surgical Rasps Market Size 2032 |

USD 644.9 million |

Key drivers fueling the growth of the Surgical Rasps Market include the increasing prevalence of musculoskeletal disorders, trauma injuries, and age-related orthopedic conditions. Continuous innovation in rasp design, material improvements—such as the shift to titanium and high-grade stainless steel—and the growing emphasis on surgical precision and patient outcomes are further supporting market expansion. Rising procedural volumes in dental and spinal surgeries, combined with expanding access to specialized surgical care, are also contributing to market growth. The growing adoption of advanced surgical tools by hospitals and specialty clinics is reinforcing the market’s momentum and ensuring consistent demand for high-performance rasps.

Regionally, North America accounts for the largest share of the Surgical Rasps Market, supported by robust healthcare infrastructure and a high rate of elective orthopedic procedures. Europe follows closely, benefiting from advanced medical technology and an aging population. The Asia Pacific region is experiencing the fastest growth, fueled by increased healthcare investments, expanding insurance coverage, and a large patient base requiring orthopedic interventions.

Market Insights:

- The Surgical Rasps Market was valued at USD 457 million in 2024 and is forecast to reach USD 644.9 million by 2032, with a CAGR of 4.4%.

- Musculoskeletal disorders, trauma injuries, and age-related orthopedic conditions remain key drivers, fueling ongoing demand for surgical rasps.

- Continuous innovation in rasp design and the adoption of titanium and high-grade stainless steel enhance product durability and clinical outcomes.

- Increasing volumes of dental and spinal surgeries, alongside a trend toward minimally invasive techniques, strengthen market growth.

- North America holds a 37% market share, followed by Europe at 29%, while Asia Pacific is the fastest-growing region with a 23% share.

- Challenges include stringent regulatory requirements, product approval delays, and intense price competition among manufacturers.

- Expanding access to specialized surgical care and investments in healthcare infrastructure support broader adoption of advanced surgical rasps worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Prevalence of Musculoskeletal Disorders Drives Demand

The Surgical Rasps Market is witnessing growth due to the increasing incidence of musculoskeletal disorders globally. Factors such as sedentary lifestyles, aging populations, and higher rates of injuries contribute to a surge in orthopedic cases requiring surgical intervention. The market benefits from a steady rise in procedures involving joint reconstruction, bone reshaping, and trauma management. It continues to gain traction as healthcare providers focus on delivering improved patient outcomes for musculoskeletal conditions.

- For instance, DePuy Synthes, a leader in orthopedics, showcases a significant technological achievement with its VELYS™ Robotic-Assisted Solution.

Innovation in Rasp Design and Material Advancements

Continuous advancements in rasp technology and materials represent a crucial growth driver for the Surgical Rasps Market. Manufacturers are focusing on developing ergonomic designs that enhance surgeon control and minimize tissue trauma. The adoption of high-grade stainless steel, titanium, and coated alloys is increasing product durability and reducing the risk of infection. It responds to surgeon preferences for precision instruments that ensure efficiency and safety in a wide range of orthopedic and dental procedures.

- For instance, DePuy Synthes developed GRIPTION TF, a material for surgical implants made from commercially pure titanium that provides a coefficient of friction of 0.82, allowing for an impressive initial scratch fit during procedures.

Expanding Surgical Volumes in Dental and Spinal Procedures

Growth in dental and spinal surgeries is positively influencing the Surgical Rasps Market. A rise in dental implantology, corrective jaw surgeries, and spine interventions demands reliable surgical rasps for accurate bone preparation. The market is expanding as more healthcare facilities integrate advanced instruments to accommodate these complex procedures. It continues to benefit from the trend towards minimally invasive techniques, which require specialized rasps for optimal results.

Improved Access to Specialized Surgical Care

Wider access to specialized surgical care in both developed and emerging regions supports the expansion of the Surgical Rasps Market. Investments in healthcare infrastructure, greater availability of skilled surgeons, and insurance coverage improvements are increasing procedure volumes. The market is supported by government and private sector initiatives aimed at strengthening orthopedic and dental care. It remains a priority for hospitals and clinics seeking to upgrade surgical capabilities and patient care standards.

Market Trends:

Growing Adoption of Advanced Materials and Precision Engineering

The Surgical Rasps Market is witnessing a notable shift toward advanced materials and enhanced manufacturing processes. Manufacturers are prioritizing the use of biocompatible metals such as titanium and high-grade stainless steel, ensuring improved durability and reduced risk of post-operative complications. Precision engineering enables the creation of ergonomic designs that deliver superior control and minimal tissue damage during procedures. The market is also seeing an increase in single-use rasps, driven by infection control protocols and hospital preference for sterile, disposable instruments. These trends reflect the industry’s focus on elevating both clinical performance and patient safety. It continues to respond to surgeon demand for instruments that support minimally invasive and complex orthopedic interventions.

- For instance, ultrasonic surgical scalpels marketed by Johnson & Johnson MedTech operate at a resonant frequency of 55,000 Hz to achieve precise cutting and coagulation in minimally invasive procedures.

Integration of Digital Technologies and Customization Solutions

A prominent trend in the Surgical Rasps Market is the integration of digital technologies and the expansion of product customization. Digital imaging and computer-aided design tools are enabling the development of patient-specific rasps tailored for unique anatomical requirements. This approach improves surgical accuracy and reduces procedure time, offering tangible benefits to both surgeons and patients. The market is embracing innovative features such as color coding, modular handle systems, and textured grips to enhance usability and procedural efficiency. Strong collaboration between medical device companies and healthcare providers accelerates product innovation and broadens the range of available solutions. It remains committed to supporting advancements that align with evolving surgical standards and the demand for personalized care.

- For instance, a retrospective review of 114 total knee arthroplasty cases using patient-specific Vanguard cutting guides reported a 13-minute reduction in surgical time per procedure, improving operating room efficiency.

Market Challenges Analysis:

Stringent Regulatory Requirements and Product Approval Delays

The Surgical Rasps Market faces significant challenges from complex regulatory frameworks and lengthy product approval processes. Manufacturers must comply with diverse quality standards and safety protocols, which can increase development costs and prolong market entry timelines. Regulatory agencies in major regions enforce strict evaluation criteria for material safety, device performance, and clinical efficacy. The market is impacted by the time and resources required for documentation, certification, and post-market surveillance. It must consistently adapt to evolving compliance requirements while maintaining competitive pricing and product innovation.

Intense Price Competition and Limited Reimbursement Policies

Intense price competition among manufacturers poses another challenge for the Surgical Rasps Market. The presence of numerous regional and global players creates pricing pressure, affecting profit margins and limiting investment capacity for research and development. Hospitals and healthcare facilities often seek cost-effective options, further driving price sensitivity across markets. Limited reimbursement policies for surgical instruments in several countries restrict purchasing power and hinder market penetration. It must address these barriers by emphasizing product differentiation, value-added features, and strong after-sales support to sustain long-term growth.

Market Opportunities:

Expansion into Emerging Markets and Untapped Geographies

The Surgical Rasps Market holds substantial growth opportunities through expansion into emerging economies and untapped geographies. Rapid improvements in healthcare infrastructure, rising disposable incomes, and increasing awareness of advanced surgical procedures are driving demand in regions such as Asia Pacific, Latin America, and the Middle East. The market can leverage these trends by forming strategic partnerships with local distributors and investing in targeted marketing initiatives. Governments and private healthcare providers are allocating resources to upgrade hospital facilities and train medical personnel, creating a favorable environment for market entry. It benefits from addressing unmet needs in orthopedic and dental care across these high-potential regions.

Adoption of Technological Advancements and Product Customization

Embracing technological advancements presents significant opportunities for the Surgical Rasps Market to expand its product portfolio and market share. The integration of digital planning tools, computer-aided manufacturing, and advanced material science enables manufacturers to develop highly specialized and customizable rasps. It can capitalize on growing surgeon preference for precision instruments tailored to specific procedural requirements. The demand for minimally invasive and patient-specific surgical solutions is prompting innovation in design, usability, and sterilization features. Collaborations with research institutes and healthcare providers will further drive adoption of next-generation surgical rasps, strengthening the market’s competitive position.

Market Segmentation Analysis:

By Type

The Surgical Rasps Market features a diverse range of product types, including bone rasps, nail rasps, and file rasps, each tailored to specific surgical requirements. Bone rasps lead the segment, driven by their widespread use in orthopedic and reconstructive procedures. Nail rasps are gaining traction in podiatric and hand surgeries, where precise bone contouring is essential. File rasps serve niche applications, particularly in dental and maxillofacial surgery, contributing to the market’s comprehensive product offering. The segment’s growth reflects the ongoing innovation and material advancements that support evolving clinical needs.

- For instance, the Rectangular Bone Rasp by Freelance Surgical measures exactly 210 mm in overall length.

By Application

The Surgical Rasps Market addresses a wide array of applications such as orthopedic surgery, dental surgery, and spinal procedures. Orthopedic surgery dominates, fueled by the rising prevalence of musculoskeletal disorders and trauma cases. Dental surgery is expanding rapidly, with a growing number of implantology and reconstructive cases requiring precision instruments. Spinal procedures also account for a significant share, supported by the demand for minimally invasive techniques and the need for accurate bone preparation. The segment’s diversity enables healthcare providers to optimize surgical outcomes across multiple disciplines.

- For instance, Medtronic’s METRx® System employs tubular retractors as small as 14 mm in diameter, requiring only a 14 mm incision for access, thereby preserving paraspinous musculature and reducing recovery times.

By End-User

Hospitals, specialty clinics, and ambulatory surgical centers represent the primary end-users in the Surgical Rasps Market. Hospitals maintain the largest share, driven by their access to advanced surgical infrastructure and high procedural volumes. Specialty clinics are adopting surgical rasps to enhance specialized care in orthopedics, dentistry, and podiatry. Ambulatory surgical centers contribute to market expansion by offering cost-effective, outpatient solutions for a variety of surgical interventions. The segment’s structure ensures broad accessibility and supports continued market penetration in both established and emerging healthcare settings.

Segmentations:

By Type

- Bone Rasps

- Nail Rasps

- File Rasps

- Cartilage Rasps

- Other Specialized Rasps

By Application

- Orthopedic Surgery

- Dental Surgery

- Spinal Surgery

- Maxillofacial Surgery

- Trauma Surgery

By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Academic and Research Institutes

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Dominates with Highest Market Share

The Surgical Rasps Market holds a market share of 37% in North America, positioning the region as the primary revenue contributor. The United States dominates this segment, backed by early adoption of surgical innovation and a large base of skilled healthcare professionals. High healthcare expenditure, comprehensive insurance coverage, and the presence of leading medical device companies contribute to sustained market growth. The market benefits from ongoing investments in surgical training and the expansion of specialized medical centers. It continues to witness robust demand as hospitals prioritize efficiency, safety, and patient outcomes.

Europe Secures Significant Share with Strong Healthcare Systems

Europe commands a market share of 29% in the Surgical Rasps Market, supported by advanced medical infrastructure and a growing elderly population requiring orthopedic care. Germany, the United Kingdom, and France drive regional growth through a focus on quality standards and regulatory compliance. The market gains traction from the adoption of minimally invasive procedures and strong collaboration between healthcare providers and device manufacturers. Government support for medical innovation and heightened awareness of bone health issues stimulate demand. It maintains steady adoption rates across both public and private healthcare sectors.

Asia Pacific Achieves Fastest Growth with Expanding Demand

Asia Pacific accounts for a 23% share in the Surgical Rasps Market, representing the fastest-growing regional segment. China, India, and Japan are at the forefront, benefiting from government initiatives aimed at improving access to advanced medical treatments and expanding insurance coverage. The market leverages an increasing number of orthopedic and dental procedures, supported by hospital modernization and skilled personnel training. Rising healthcare spending and awareness of surgical solutions are unlocking new opportunities for growth. It continues to attract global manufacturers seeking to capitalize on expanding demand and favorable market conditions.\

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Aesculap

- Braun Melsungen

- Medtronic

- KLS Martin

- MediGus

- Ethicon

- Smith and Nephew

- Zimmer Biomet

- Stryker

- Richard Wolf

- Clampett Industries

- ConMed

- Nouvag

- Karl Storz

- Johnson and Johnson

Competitive Analysis:

The Surgical Rasps Market demonstrates intense competition among leading global and regional manufacturers, each striving to expand their product portfolios and market reach. It features established companies with a reputation for high-quality, precision-engineered instruments, as well as emerging players introducing cost-effective solutions. Key market participants focus on product innovation, advanced material adoption, and ergonomic designs to address surgeon preferences and evolving surgical standards. Strategic collaborations with healthcare providers, investments in R&D, and a strong distribution network further strengthen competitive positioning. The market experiences pricing pressure due to the presence of numerous suppliers, which compels companies to differentiate through technology, durability, and after-sales support. It continues to reward firms that align product offerings with clinical needs, regulatory requirements, and customer service excellence.

Recent Developments:

- In May 2025, Aesculap and Ascendco Health extend their strategic partnership for another ten years to expand surgical instrument tracking across 200+ U.S. health systems.

- In June 2025, Johnson & Johnson launches the ETHICON™ 4000 Stapler, featuring 3D Reloads and Gripping Surface Technology for improved staple-line integrity and leak prevention.

- In June 2025, Smith & Nephew and Standard Health partner to develop the UK’s first orthopaedic ambulatory surgery centre in Poole, Dorset, enhancing access to joint repair and replacement services for NHS and private patients.

Market Concentration & Characteristics:

The Surgical Rasps Market displays moderate concentration, with several established multinational manufacturers holding significant market shares alongside a competitive landscape of regional players. It features a wide range of products tailored for orthopedic, dental, and reconstructive procedures, reflecting ongoing advancements in design and material science. The market prioritizes high standards for product quality, regulatory compliance, and clinical performance to meet the demands of healthcare providers. It adapts quickly to shifts in surgical trends, such as the move toward minimally invasive procedures and the need for patient-specific solutions. Consistent innovation, strategic partnerships, and strong distribution channels define the market’s competitive characteristics.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Surgical Rasps Market will see continued growth driven by rising orthopedic and dental procedures worldwide.

- Advancements in material science and ergonomic designs will improve product durability and user comfort.

- Increasing adoption of minimally invasive surgeries will boost demand for specialized and precision-engineered rasps.

- Hospitals and specialty clinics will expand investments in high-performance surgical tools to enhance patient outcomes.

- The market will benefit from growing healthcare infrastructure and expanded insurance coverage in emerging economies.

- Manufacturers will intensify research and development efforts to introduce innovative, patient-specific solutions.

- Stringent regulatory requirements will challenge market players to maintain high standards for safety and compliance.

- Strong competition among established and emerging companies will drive product differentiation and service quality.

- Strategic collaborations and partnerships will accelerate product development and broaden distribution networks.

- The market will adapt to shifting surgical trends, technological advancements, and evolving clinical requirements to sustain long-term growth.