Market Overview

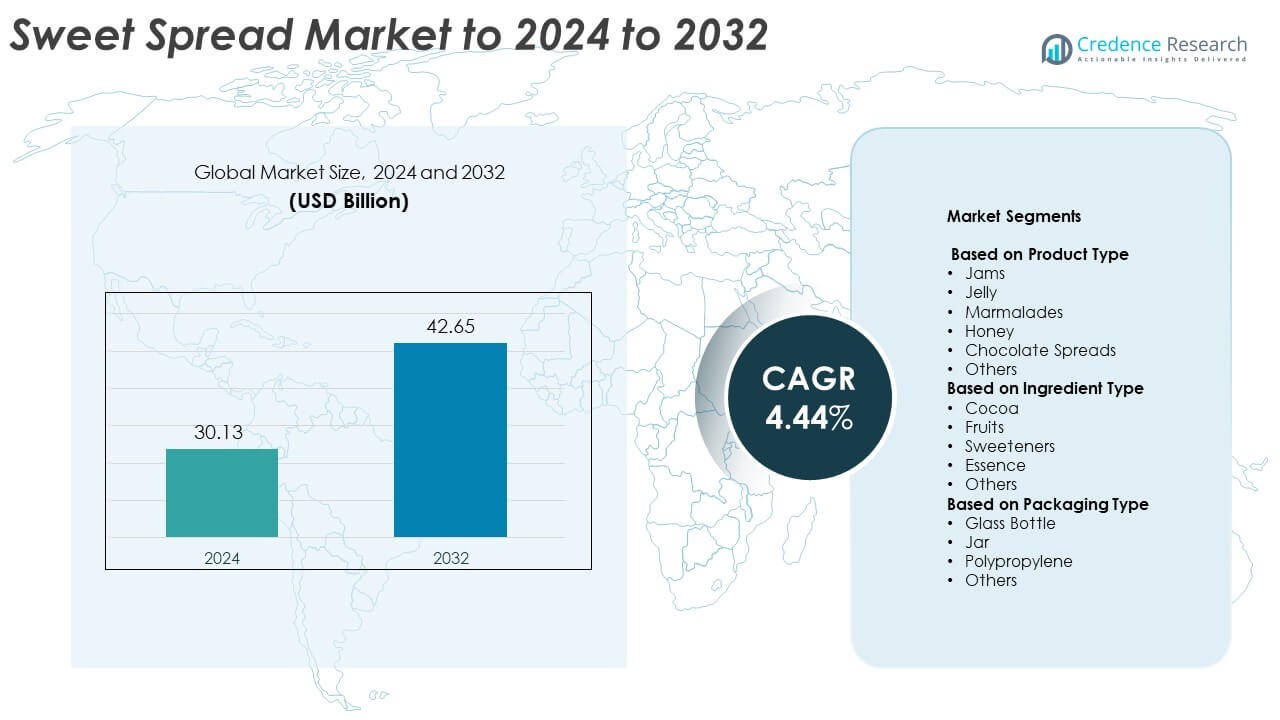

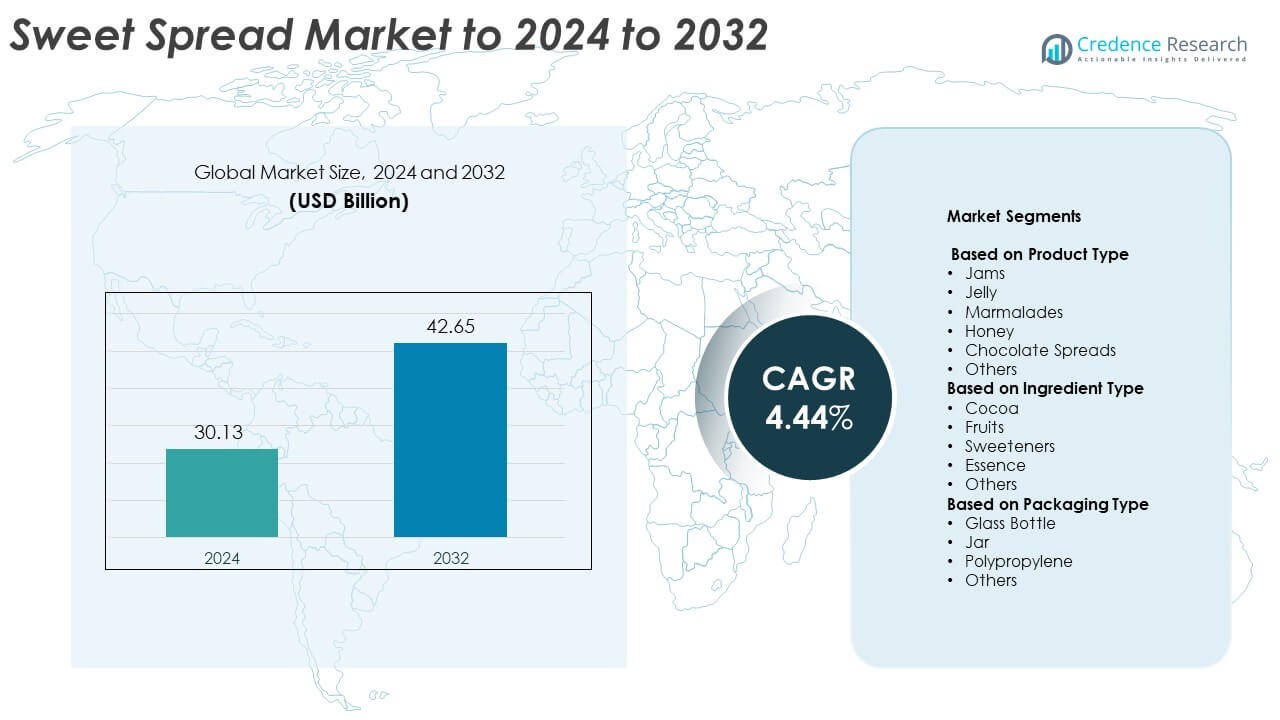

The Sweet Spread Market size was valued at USD 30.13 billion in 2024 and is anticipated to reach USD 42.65 billion by 2032, at a CAGR of 4.44% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Sweet Spread Market Size 2024 |

USD 30.13 Billion |

| Sweet Spread Market, CAGR |

4.44% |

| Sweet Spread Market Size 2032 |

USD 42.65 Billion |

The sweet spread market is highly competitive, led by major players such as The Kraft Heinz Company, Unilever, Ferrero, Mondelez International, and The J.M. Smucker Company. These companies focus on expanding product portfolios with innovative, health-oriented formulations and sustainable packaging. Strategic investments in flavor diversification and digital retail expansion strengthen their global reach. Europe dominated the market in 2024 with a 34.1% share, driven by strong consumer preference for premium and organic spreads. North America followed closely, supported by growing demand for natural and low-sugar products, while Asia-Pacific emerged as the fastest-growing regional segment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Sweet Spread Market was valued at USD 30.13 billion in 2024 and is projected to reach USD 42.65 billion by 2032, growing at a CAGR of 4.44%.

• Rising consumer preference for natural, organic, and low-sugar spreads is driving market expansion globally.

• Innovation in flavors, sustainable packaging, and functional formulations such as fortified or vegan spreads are key emerging trends.

• Leading players are focusing on clean-label products, strategic acquisitions, and retail partnerships to strengthen competitiveness.

• Europe held the largest 34.1% share in 2024, followed by North America at 31.6%, while the honey segment led product categories with a 34.2% share.

Market Segmentation Analysis:

By Product Type

The honey segment dominated the sweet spread market in 2024, capturing a 34.2% share. Its leadership is driven by rising consumer preference for natural and chemical-free sweeteners. Honey’s nutritional benefits and use in both culinary and health applications strengthen its demand across demographics. The growth of organic and raw honey varieties further supports its dominance. Producers focus on sustainable sourcing and innovative packaging to attract health-conscious consumers seeking clean-label alternatives, ensuring steady market expansion in both developed and emerging regions.

- For instance, Dabur Honey has an estimated 40–45% share of India’s branded honey market.

By Ingredient Type

The fruits segment accounted for the largest 38.6% share of the sweet spread market in 2024. Fruit-based spreads such as jams, jellies, and marmalades remain popular due to their natural flavor and nutritional content. Increasing demand for reduced-sugar and high-fruit-content formulations boosts growth in this category. Manufacturers are introducing exotic fruit blends and locally sourced ingredients to appeal to changing taste preferences. The segment also benefits from growing use in bakery and confectionery applications, enhancing its market presence worldwide.

- For instance, the Hero Group reported an overall organic growth of 9.7% for the year 2024, with Net Sales reaching CHF 1.25 billion.

By Packaging Type

The jar segment led the sweet spread market in 2024, holding a 51.7% share. Consumers favor jars for their durability, resealability, and ability to preserve freshness. Their transparent design enhances product visibility, influencing purchase decisions in retail stores. Manufacturers are transitioning toward recyclable glass and lightweight PET jars to meet sustainability goals. The segment’s strength also stems from rising demand for premium and personalized packaging designs that cater to modern, convenience-oriented lifestyles, making jars the preferred format for sweet spread produ

Key Growth Drivers

Rising Demand for Natural and Organic Ingredients

Consumers are increasingly seeking natural and organic sweet spreads made without artificial additives or preservatives. The shift toward healthier eating habits supports the growth of honey, fruit-based jams, and nut spreads. Brands are expanding organic-certified product lines and highlighting clean-label claims to appeal to health-conscious buyers. Growing awareness of sustainable sourcing and allergen-free ingredients also drives this demand. The trend is especially strong in Europe and North America, where premium natural spreads command higher retail margins.

- For instance, Rigoni di Asiago’s Nocciolata Bianca lists 30% less sugar than the classic version and is fully organic-certified.

Expansion of Retail and E-commerce Channels

The growing availability of sweet spreads across supermarkets, convenience stores, and online platforms fuels market growth. Retail chains offer greater visibility through dedicated product shelves and promotional displays, while e-commerce enables direct access to niche and artisanal brands. Rising smartphone use and digital payments are expanding online grocery sales, particularly in emerging markets. Subscription-based and direct-to-consumer models also enhance brand loyalty, enabling producers to reach wider audiences efficiently and boost recurring sales.

- For instance, J.M. Smucker said Uncrustables added over 4 million new U.S. households in one year, driven by new channels and marketing.

Product Innovation and Flavor Diversification

Innovation in flavor profiles and ingredient combinations has become a core growth driver for the sweet spread market. Manufacturers are introducing new blends using exotic fruits, nuts, and plant-based ingredients to attract modern consumers. The development of low-sugar, fortified, and vegan spreads meets evolving dietary preferences. Premium packaging and limited-edition seasonal products further enhance brand differentiation. This focus on innovation allows both global and regional brands to sustain engagement and capture expanding consumer segments.

Key Trends and Opportunities

Growth of Functional and Fortified Spreads

Consumers are showing strong interest in functional spreads enriched with vitamins, proteins, or probiotics. These products align with the global shift toward wellness-oriented food consumption. Brands are developing fortified options such as protein-rich nut spreads or honey infused with herbal extracts. The trend bridges indulgence and nutrition, appealing to fitness-focused and busy consumers seeking convenient yet health-beneficial products. This opportunity encourages manufacturers to explore new formulations that combine taste with functional value.

- For instance, Jam Packd spreads provide 8 g collagen protein, 6–7 g prebiotic fiber, and 21 added plant-based nutrients per serving (about 10% DV).

Adoption of Sustainable Packaging Solutions

Sustainability has emerged as a major trend shaping the sweet spread market. Manufacturers are adopting recyclable glass jars, biodegradable films, and lightweight plastic alternatives to reduce environmental impact. Eco-conscious packaging aligns with global efforts to minimize waste and supports positive brand image. Consumers increasingly favor brands demonstrating environmental responsibility through packaging innovation. Government policies promoting circular economy models further accelerate this transition, creating opportunities for packaging material suppliers and sustainable product developers.

- For instance, in a July 2025 update, O-I Glass confirmed that its average recycled content for glass packaging globally was 41% in 2024. The company also announced a new, more ambitious target to increase this figure to an average of 60% by 2030.

Key Challenges

Fluctuating Raw Material Prices

Volatile prices of key ingredients such as sugar, cocoa, and fruit concentrates pose a major challenge to manufacturers. Weather conditions, crop yield variations, and supply chain disruptions affect production costs. These fluctuations can pressure profit margins, especially for small and mid-sized producers with limited pricing flexibility. To mitigate risks, companies are investing in long-term supplier partnerships and regional sourcing. However, maintaining stable product pricing remains difficult in a competitive market environment.

Rising Competition from Substitutes

The increasing availability of alternative spreads such as nut butters, protein spreads, and plant-based pastes challenges traditional sweet spread categories. Consumers seeking high-protein or low-sugar options are shifting away from conventional jam or chocolate spreads. This competitive pressure forces established brands to diversify portfolios and reposition their products through health-focused innovation. Sustaining consumer loyalty amid rapidly changing dietary preferences remains a key concern, particularly in markets with high product saturation.

Regional Analysis

North America

North America held a 31.6% share of the sweet spread market in 2024. The region’s growth is supported by high consumption of honey, chocolate spreads, and fruit-based jams. Consumers increasingly prefer clean-label and organic formulations, driving product diversification. Strong retail infrastructure and online grocery expansion further enhance accessibility. The United States remains the largest market, with established brands investing in flavor innovation and sustainable packaging. Rising awareness of plant-based and low-sugar alternatives continues to shape market dynamics, supporting steady regional growth.

Europe

Europe accounted for a 34.1% share of the global sweet spread market in 2024, making it the leading regional segment. The region’s dominance stems from long-standing consumption of jams, marmalades, and honey as staple breakfast items. High demand for premium, artisanal, and organic spreads sustains growth. Countries such as Germany, France, and the United Kingdom drive innovation through clean-label and locally sourced products. Regulatory support for sustainable and low-sugar formulations strengthens market performance across the European retail and online sectors.

Asia-Pacific

Asia-Pacific captured a 23.8% share of the sweet spread market in 2024, emerging as the fastest-growing region. Expanding middle-class populations and changing breakfast habits are fueling demand for convenient and nutritious spreads. Countries like China, India, and Japan are witnessing increased adoption of fruit-based and honey products. Rapid growth in e-commerce platforms and retail chains is improving product accessibility. Local manufacturers are focusing on affordable and regionally inspired flavors, catering to diverse taste preferences and driving sustained market expansion across developing economies.

Latin America

Latin America held an 8.2% share of the global sweet spread market in 2024. The region benefits from increasing consumption of fruit-based jams and chocolate spreads. Brazil and Mexico dominate demand due to urbanization and higher disposable incomes. Local producers are expanding exports of tropical fruit spreads and honey-based products. Growing awareness of natural ingredients and improved retail distribution support market development. However, price-sensitive consumers and fluctuating raw material costs pose minor challenges to consistent regional growth.

Middle East and Africa

The Middle East and Africa accounted for a 6.3% share of the sweet spread market in 2024. Rising consumer awareness about natural sweeteners such as honey and date-based spreads supports regional expansion. Urbanization and increasing penetration of modern retail formats are enhancing product availability. Countries including Saudi Arabia, South Africa, and the UAE show strong demand for premium and imported varieties. Manufacturers are introducing affordable, locally sourced options to strengthen market presence, contributing to gradual but consistent growth across this region.

Market Segmentations:

By Product Type

- Jams

- Jelly

- Marmalades

- Honey

- Chocolate Spreads

- Others

By Ingredient Type

- Cocoa

- Fruits

- Sweeteners

- Essence

- Others

By Packaging Type

- Glass Bottle

- Jar

- Polypropylene

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the sweet spread market features prominent companies such as The Kraft Heinz Company, Unilever, Ferrero, Mondelez International, The J.M. Smucker Company, Andros Foods, and others. The market is characterized by product diversification, strong brand portfolios, and continuous innovation in flavors and formulations. Leading manufacturers are prioritizing clean-label, organic, and reduced-sugar offerings to align with evolving consumer preferences. Investment in sustainable packaging, digital marketing, and direct-to-consumer channels is expanding market reach globally. Companies are also leveraging advanced processing technologies to enhance product quality and shelf life. Strategic mergers, partnerships, and regional expansions remain central to gaining a competitive edge. The growing focus on traceability and ingredient transparency further drives consumer trust, while regional brands compete through locally inspired flavor innovations. Overall, the industry remains highly dynamic, with innovation, sustainability, and health-focused development shaping future competition in the sweet spread market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- The Kraft Heinz Company (U.S.)

- Unilever (U.K.)

- Ferrero (Italy)

- Mondelez International (U.S.)

- The J.M. Smucker Company (U.S.)

- Andros Foods (France)

- Hormel Foods Corporation (U.S.)

- Dabur India Limited (India)

- Marico (India)

- Conagra Brands, Inc. (U.S.)

- Duerr & Sons Ltd (U.K.)

- Glanbia PLC (Ireland)

- Bonne Maman (France)

- August Oetker Nahrungsmittel KG (Germany)

- Premium Vegetable Oils Sdn Bhd (Malaysia)

- The Hershey Company (U.S.)

- Pioneer Food Group (South Africa)

Recent Developments

- In 2024, Ferrero (Italy) expanded its sweet spread and confectionery portfolio by launching Nutella Ice Cream, the brand’s first packaged ice cream product.

- In 2023, Bonne Maman launched its Hazelnut Chocolate Spread in the U.S. market.

- In 2022, Marico Limited expanded its Saffola brand by introducing Saffola Mayonnaise and Saffola Peanut Butter, marking its entry into the healthy spreads category.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Ingredient Type, Packaging Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding due to rising demand for natural and organic spreads.

- Manufacturers will focus on low-sugar and clean-label formulations to attract health-conscious consumers.

- Innovation in flavor combinations and fortified spreads will enhance product diversity.

- Sustainable and recyclable packaging will become a key focus area for leading brands.

- E-commerce and direct-to-consumer channels will drive higher product accessibility and visibility.

- Premium and artisanal spreads will gain traction among urban and younger consumers.

- Local sourcing and traceable ingredient supply chains will strengthen brand credibility.

- Plant-based and vegan spread alternatives will experience rapid adoption across markets.

- Strategic collaborations between manufacturers and retailers will improve distribution efficiency.

- Asia-Pacific will emerge as a major growth hub due to rising disposable incomes and westernized food habits.