Market Overview

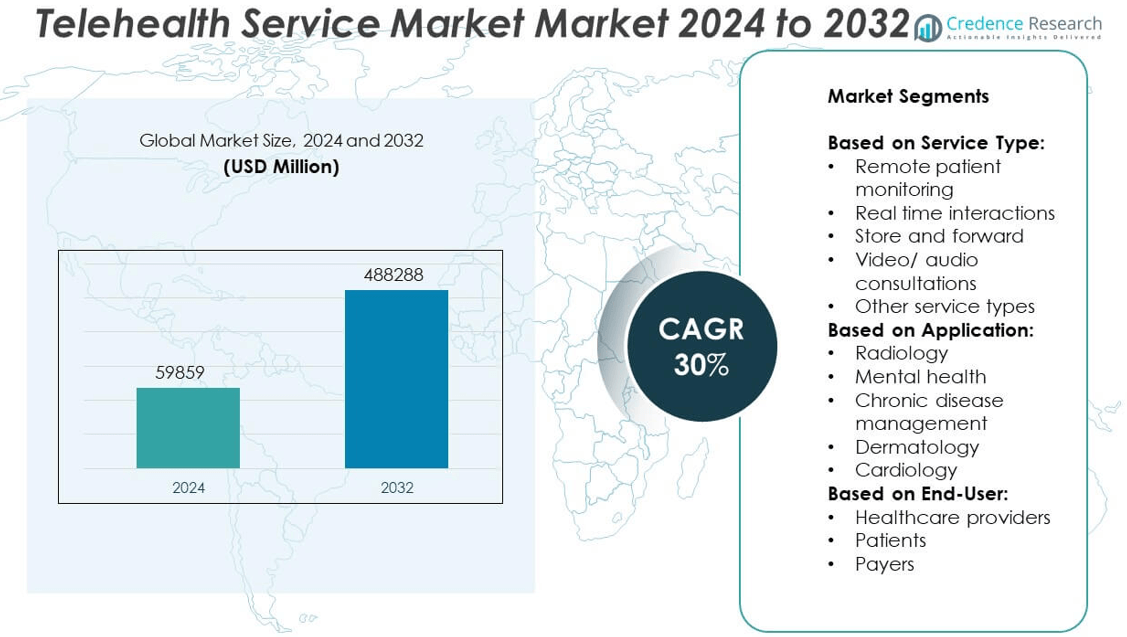

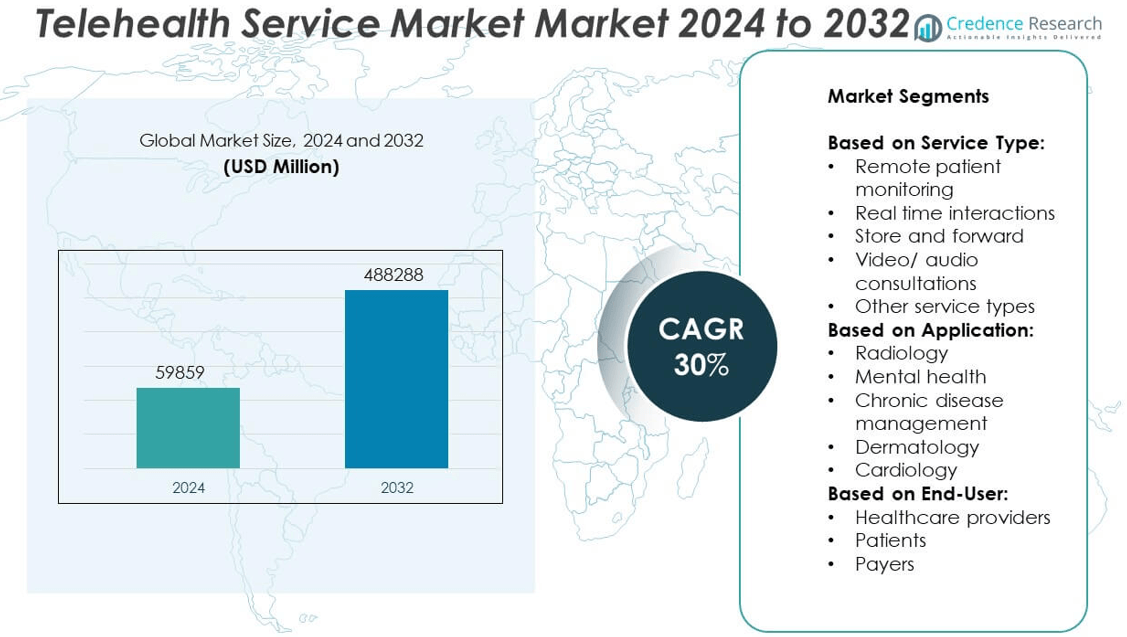

The Telehealth Service Market was valued at USD 59,859 million in 2024 and is projected to reach USD 488,288 million by 2032, expanding at a CAGR of 30% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Telehealth Service Market Size 2024 |

USD 59,859 million |

| Telehealth Service Market, CAGR |

30% |

| Telehealth Service Market Size 2032 |

USD 488,288 million |

The Telehealth Service market is driven by increasing demand for remote healthcare access, rising chronic disease prevalence, and growing adoption of digital health technologies. Governments and insurers are supporting virtual care models to reduce healthcare costs and improve service reach. Advancements in AI, wearable devices, and secure communication platforms enhance the efficiency and accuracy of remote consultations Trends acceptance of virtual behavioral health services are reshaping the delivery of care across global healthcare systems.

The Telehealth Service market demonstrates strong geographical presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America leads in technological adoption and infrastructure readiness, supported by favorable policies and widespread use of digital health platforms. Europe follows with growing integration of telehealth into national healthcare systems and increased investment in virtual care solutions. Asia Pacific shows high growth potential due to its large population base, rising healthcare demand, and, known for integrating advanced diagnostic tools into virtual care.These companies plays significant role in shaping global telehealth capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Telehealth Service market was valued at USD 59,859 million in 2024 and is projected to reach USD 488,288 million by 2032, growing at a CAGR of 30% during the forecast period.

- Increasing demand for remote healthcare access, rising chronic disease prevalence, and growing acceptance of digital health platforms are driving the market forward.

- Trends such as the integration of AI in diagnostics, expansion of behavioral telehealth, and growing use of remote patient monitoring are transforming healthcare delivery.

- The market is moderately concentrated, with leading players like American Well, Koninklijke Philips, Medtronic, and Apollo TeleHealth competing on innovation, reach, and service diversity.

- Key restraints include inconsistent regulatory standards, limited reimbursement models, and unequal access to digital infrastructure across regions.

- North America leads the market due to advanced infrastructure and favorable policies, while Europe follows with national digital health programs and Asia Pacific shows high growth potential driven by population and mobile access.

- Market dynamics will continue to evolve with hybrid care models, increased investments in infrastructure, and strategic partnerships shaping the competitive landscape

Market Drivers

Rising Demand for Remote Healthcare Access in Underserved and Rural Regions

The growing need to improve healthcare access in remote and underserved areas significantly drives the Telehealth Service market. Patients in rural communities often face limited availability of specialists and healthcare infrastructure, prompting a shift toward virtual consultations. Government bodies and health organizations support this transition through funding initiatives and infrastructure investments. It helps bridge geographic gaps in healthcare delivery while minimizing patient travel time and related costs. Healthcare providers are also adopting telehealth to expand their reach and deliver timely medical advice. The Telehealth Service offers a reliable solution for ensuring equitable care across regions with limited resources.

- For instance,The RHS estimates as of 31 March, 2022, has revealed that each sub center (SC) catered to an average of 5691 people, each Primary Health Centers (PHC) to 36049 people and each Community Health Centers (CHC) to 164027 people.

Strong Integration of Digital Technologies and Smart Devices Across Healthcare Systems

Rapid integration of smart devices, cloud computing, and AI-based solutions within healthcare systems supports the expansion of the Telehealth Service market. Devices such as smartwatches, glucose monitors, and wearable ECGs enable real-time health monitoring and seamless patient-provider communication. It enhances clinical decision-making and supports early diagnosis, reducing hospital visits and improving patient outcomes. Healthcare systems are leveraging digital platforms to manage electronic health records and automate care workflows. These innovations ensure higher operational efficiency while supporting large-scale remote care models. The Telehealth Service benefits from these technological improvements, reinforcing its utility in modern healthcare.

- For instance, Worldwide, digital devices are improving every stage of the patient care pathway. For one, sensors are being used to monitor patient metrics 24/7, permitting swift diagnosis and interventions.

Growing Focus on Cost Containment and Healthcare System Efficiency

The global push to reduce healthcare expenditure without compromising care quality propels the demand for the Telehealth Service. Virtual consultations help minimize costs associated with in-person visits, hospital stays, and emergency services. It supports preventive care approaches that identify issues early and reduce the need for expensive interventions. Insurance companies are also recognizing its cost-saving potential by expanding reimbursement for teleconsultations. Employers increasingly offer telehealth as part of corporate wellness programs to reduce absenteeism and productivity loss. The Telehealth Service aligns with broader health policy goals focused on sustainable and efficient care delivery.

Widening Acceptance of Telemedicine Among Providers and Patients

Acceptance of telemedicine by both healthcare professionals and patients plays a pivotal role in market growth for the Telehealth Service. Providers acknowledge its effectiveness in managing chronic conditions, mental health care, and post-operative follow-ups. It has become a preferred method for routine consultations, offering flexibility and faster access to care. Patients value convenience and reduced exposure to hospital environments. Regulatory bodies are also easing restrictions and enabling licensure portability across states and regions. The Telehealth Service continues to gain traction as confidence and familiarity with digital health tools increase across demographics.

Market Trends

Expansion of Virtual Care Models Beyond Primary Consultations

Healthcare systems are expanding virtual care beyond basic consultations to include specialized services such as dermatology, cardiology, and mental health. The shift reflects growing confidence in digital platforms to support diverse clinical needs. It helps streamline follow-ups, manage chronic diseases, and improve specialist access. Hospitals and clinics are designing integrated telehealth departments to meet growing patient expectations for convenience. This broad application boosts the value proposition of the Telehealth Service in daily healthcare operations. Providers are restructuring workflows to embed virtual care as a standard offering.

- For instance, Teladoc Health reported delivering over 1.2 million virtual mental health visits in 2023 alone, and expanded its services to include chronic condition management for diabetes, hypertension, and musculoskeletal issues across more than 40,000 client organizations worldwide.

Increased Investment in AI-Powered Diagnostic and Monitoring Tools

AI technologies are being integrated into telehealth platforms to enhance diagnostic accuracy and patient monitoring. These tools assist in image analysis, voice-based symptom tracking, and predictive risk modeling. It enables healthcare professionals to make faster and more informed decisions remotely. Startups and established tech companies are driving innovation by offering AI-powered add-ons to existing telehealth platforms. The Telehealth Service is evolving from a communication tool into a decision-support system. AI also enhances patient engagement through automated reminders and tailored health tips.

- For instance, May 10, 2025, it revealed that India has registered 1.48 lakh radiology devices, with Maharashtra (20,590), Tamil Nadu (15,267), and Uttar Pradesh (12,236) leading the charge.

Integration of Remote Patient Monitoring with Chronic Disease Management

Remote patient monitoring is gaining traction in chronic disease management programs, supported by connected devices and mobile apps. Providers use real-time health data to personalize care plans and adjust treatment without requiring clinic visits. It helps reduce hospital readmissions and supports better long-term outcomes. This trend is especially relevant in managing conditions such as hypertension, diabetes, and COPD. The Telehealth Service plays a critical role in connecting patients with care teams through continuous monitoring. Data integration into electronic health records ensures seamless care coordination.

Wider Implementation of Telehealth in Behavioral and Mental Health Services

The use of telehealth for behavioral health is increasing, with a surge in demand for therapy, counseling, and psychiatric services delivered remotely. Patients prefer the privacy and accessibility offered by virtual mental health care. It removes stigma and logistical barriers associated with in-person appointments. Employers and insurers are expanding mental health benefits that include teletherapy. The Telehealth Service is helping to close gaps in mental health access, particularly among adolescents and rural populations. This trend is expected to continue with rising mental health awareness and digital engagement.

Market Challenges Analysis

Lack of Universal Regulatory Standards and Reimbursement Policies

The absence of consistent regulations and reimbursement frameworks across regions poses a major challenge to the Telehealth Service market. Health systems often face confusion regarding licensure requirements, cross-border practice limitations, and privacy compliance. It creates barriers for providers who aim to scale telehealth services across multiple states or countries. Inconsistent insurance coverage and limited reimbursement rates discourage healthcare providers from fully adopting virtual care. Governments and insurers have yet to establish long-term policies that align with the evolving digital care landscape. The Telehealth Service remains constrained by fragmented policy environments that hinder seamless implementation.

Technological Gaps and Unequal Access to Digital Infrastructure

Limited internet access and insufficient digital literacy in certain populations reduce the effectiveness of virtual care delivery. Rural areas and low-income communities often lack reliable connectivity or devices needed for telehealth visits. It creates disparities in access, especially among elderly patients or those with chronic conditions. Healthcare systems must invest in infrastructure, training, and community outreach to bridge this divide. Technical issues such as poor video quality, platform incompatibility, and cybersecurity threats further challenge user experience. The Telehealth Service must overcome these infrastructure-related obstacles to achieve widespread and equitable adoption.

Market Opportunities

Expansion into Home-Based and Preventive Healthcare Models

The shift toward home-based care presents a strong opportunity for growth in the Telehealth Service market. Patients increasingly seek medical support that minimizes hospital visits and promotes comfort, safety, and convenience. It supports preventive healthcare by enabling early detection and continuous monitoring of chronic conditions through wearable devices and mobile applications. Providers can deliver regular assessments, medication management, and lifestyle coaching remotely, reducing pressure on in-clinic resources. This model aligns with value-based care strategies and improves long-term health outcomes. The Telehealth Service can lead this transformation by integrating remote care into daily life.

Untapped Potential in Emerging Economies and Global Health Programs

Emerging markets with limited healthcare infrastructure offer significant growth prospects for the Telehealth Service. These regions often experience shortages of medical professionals and inadequate hospital access, creating a strong case for scalable digital health platforms. It allows providers to deliver consultations, diagnostic services, and patient education across vast geographic areas. Global health initiatives and public-private partnerships can accelerate adoption by funding infrastructure and training. Governments in these markets are showing interest in telemedicine to expand reach without major capital investments. The Telehealth Service can support national health goals by closing service gaps and improving care accessibility.

Market Segmentation Analysis:

By Service Type:

The remote patient monitoring leads due to growing demand for home-based care and chronic disease management. Devices that track vital signs, blood glucose, and cardiac data help clinicians intervene early and reduce hospital readmissions. Real-time interactions are also widely adopted, allowing instant communication between patients and providers for acute care and follow-up visits. Store and forward services enable secure transmission of medical data such as images and reports, especially useful in radiology and dermatology. Video/audio consultations continue to gain traction as broadband and mobile device usage increases. The Telehealth Service includes a range of other service types, such as e-prescriptions and mobile health alerts, supporting comprehensive virtual care ecosystems.

- For instance, Philips’ remote patient monitoring platform supported over 300 U.S. hospitals and tracked more than 5 million patients remotely in 2023, using connected devices to capture vital signs like SpO₂, heart rate, and temperature, and enabling early intervention through automated alerts and AI-assisted analytics.

By Application:

The radiology dominates due to the compatibility of imaging with digital platforms. It allows radiologists to analyze and report from any location, accelerating diagnostic processes. Mental health services have seen sharp growth, driven by the convenience, privacy, and accessibility of teletherapy sessions. Chronic disease management is another major segment, where continuous virtual engagement improves medication adherence and reduces emergency visits. Dermatology benefits from store-and-forward capabilities, enabling remote image evaluation for skin conditions. Cardiology applications are expanding through remote ECG monitoring and virtual consultations, improving access to specialty care.

- For instance, 40 countries in the WHO EuropeanRegion either have a national telehealth strategy or include telehealth in a broader digital health strategy – with teleradiology, telemedicine and telepsychiatry being the most used telehealth services across the Region, a new study finds.

By End-User:

The healthcare providers represent the largest share, leveraging telehealth to streamline operations, extend service reach, and manage patient load efficiently. Patients increasingly prefer virtual consultations for convenience, lower costs, and faster access to care. Payers, including insurers and employers, support telehealth adoption by offering reimbursement and coverage benefits to control healthcare expenditure. The Telehealth Service addresses the needs of all three groups by enhancing care delivery, accessibility, and cost efficiency across the healthcare spectrum.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Service Type:

- Remote patient monitoring

- Real time interactions

- Store and forward

- Video/ audio consultations

- Other service types

Based on Application:

- Radiology

- Mental health

- Chronic disease management

- Dermatology

- Cardiology

Based on End-User:

- Healthcare providers

- Patients

- Payers

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest market share, accounting for approximately 42% of the global Telehealth Service market in 2024. The region’s leadership is supported by robust healthcare infrastructure, high levels of digital adoption, and favorable reimbursement frameworks. The United States plays a pivotal role, with strong integration of telehealth platforms across hospitals, clinics, and specialty care practices. Providers benefit from regulatory flexibility, such as interstate licensure compacts and expanded Medicare coverage, which facilitate telehealth expansion. Companies like American Well, Access TeleCare, and McKesson Medical-Surgical are driving innovation through AI-enabled diagnostics and remote monitoring technologies. Telehealth adoption is widespread in chronic disease management, behavioral health, and post-acute care, with strong support from employers and insurers. The region continues to witness rising demand for hybrid care models that combine virtual and in-person visits.

Europe

Europe accounts for approximately 26% of the global Telehealth Service market in 2024. Countries across the region are actively integrating telehealth into public healthcare systems to enhance access and operational efficiency. Government-supported digital health initiatives, particularly in the United Kingdom, France, Germany, and the Nordics, are key growth drivers. The COVID-19 pandemic accelerated digital adoption, especially for mental health and chronic care services. Companies such as Koninklijke Philips and local service providers offer advanced remote consultation and diagnostics platforms tailored to national regulations. Cross-border healthcare and e-prescription solutions are gradually gaining traction under EU policy frameworks. While reimbursement and compliance vary across countries, coordinated efforts continue to improve telehealth adoption and infrastructure. Europe is expected to maintain steady growth with increased focus on sustainable, patient-centered care.

Asia Pacific

Asia Pacific holds a 19% share of the global Telehealth Service market in 2024. The region presents significant growth potential due to its large population, rising chronic disease burden, and increasing smartphone penetration. Countries like China, India, Japan, and South Korea are implementing national telemedicine guidelines and investing in digital health platforms. Apollo TeleHealth and other key players are expanding services to reach remote and underserved populations. Japan and South Korea show strong adoption among elderly populations through tech-driven care models. Health ministries in Southeast Asia are also leveraging mobile health solutions to improve rural access. However, infrastructure gaps and uneven internet access remain obstacles in some countries. Continued public-private partnerships and investment in digital literacy are critical for long-term market expansion in the region.

Latin America

Latin America represents around 7% of the global Telehealth Service market in 2024. The region is gradually embracing telemedicine to address physician shortages and healthcare accessibility challenges. Brazil, Mexico, and Colombia are introducing policy reforms to support virtual consultations, especially in public healthcare settings. Telehealth adoption is growing in mental health, dermatology, and chronic care services. Mobile health apps and platforms are becoming more prevalent among tech-savvy urban populations. Regional players are partnering with hospitals and insurers to scale remote care services. However, challenges such as limited infrastructure, data privacy concerns, and uneven digital inclusion continue to limit penetration. Long-term success will depend on regulatory harmonization and investment in digital ecosystems.

The Middle East & Africa

The Middle East & Africa (MEA) region holds the smallest share, accounting for about 6% of the global Telehealth Service market in 2024. Despite its modest share, the region is showing growing interest in telemedicine as a tool to improve access and quality of care. In the Gulf Cooperation Council (GCC) countries, governments are integrating digital health into national transformation programs, with teleconsultations being actively promoted. Countries like the UAE and Saudi Arabia have developed robust platforms to facilitate remote diagnostics and chronic care support. In Sub-Saharan Africa, healthcare access gaps are prompting international organizations and NGOs to implement mobile-based telehealth programs for maternal and infectious disease care. While barriers such as poor internet coverage and funding constraints persist, ongoing digital health investments indicate a gradual but steady market shift. MEA’s telehealth trajectory will depend on policy alignment, regional collaborations, and infrastructure advancement.

Key Player Analysis

- Medtronic

- American Well

- Omnia TeleHealth

- athenahealth

- McKesson Medical-Surgical

- Eagle Telemedicine

- Cisco Systems

- Access TeleCare

- Koninklijke Philips

- Apollo TeleHealth

- Health Catalyst

Competitive Analysis

The leading players in the Telehealth Service market include American Well, Access TeleCare, Apollo TeleHealth, athenahealth, Cisco Systems, Eagle Telemedicine, Health Catalyst, Koninklijke Philips, McKesson Medical-Surgical, Medtronic, and Omnia TeleHealth. These companies compete through advanced technology integration, diverse service offerings, and strong provider partnerships. American Well focuses on comprehensive virtual care platforms and has secured key collaborations with major insurers and health systems. Access teleCare specializes in real-time specialty consultations, strengthening hospital capabilities in critical care. Telehealth models in underserved regions, combining consultations with diagnostic and pharmacy access. Cisco Systems supports secure, high-performance infrastructure vital for telehealth deployment. Medtronic enhances chronic disease care through remote patient monitoring devices. Philips integrates AI into diagnostic tools, offering seamless virtual care solutions. TeleHealth deliver remote staffing models tailored for hospitals, while McKesson and athenahealth provide logistical and software support. Competitive strategies focus on innovation, geographic expansion, and service efficiency.

Recent Developments

- In May 2025, Medtronic revealed plans to divest its Diabetes business unit, intending to form a standalone entity through a series of capital markets transactions expected to be completed in 18 months, likely via an initial public offering (IPO).

- In May 2025, McKesson announced its intention to spin off its Medical-Surgical Solutions segment into a separate, independent company. This decision is part of McKesson’s strategy to optimize its portfolio and focus on core business areas with higher growth potential, such as specialty drug distribution and oncology services

- In August 2022, Medtronic announced a strategic partnership with BioIntelliSense for the exclusive U.S. hospital and 30-day post-acute hospital-to-home distribution of BioIntelliSense’s BioButton multi-parameter wearable device for continuous remote patient monitoring.

Market Concentration & Characteristics

The Telehealth Service market demonstrates a moderately concentrated landscape, with a mix of established healthcare technology firms, specialized telemedicine providers, and emerging digital health startups. Leading players hold significant influence due to their advanced infrastructure, strong provider networks, and broad service portfolios. It features rapid technological innovation, with integration of artificial intelligence, electronic health records, and remote monitoring tools becoming standard practice. The market is characterized by high regulatory oversight, varying across regions, which impacts service delivery models and expansion strategies. Demand for flexible, scalable, and secure platforms has driven competition around interoperability, user experience, and clinical accuracy. The Telehealth Service supports a diverse range of applications, including chronic disease management, mental health, post-operative care, and primary consultations, appealing to healthcare providers, payers, and patients alike. Market entry barriers remain moderate due to rising demand and digital accessibility, though long-term competitiveness depends on data security, platform reliability, and integration with existing healthcare systems

Report Coverage

The research report offers an in-depth analysis based on Service Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding with increasing demand for remote healthcare across urban and rural regions.

- Telehealth platforms will integrate more AI-powered tools to enhance diagnostics and clinical decision-making.

- Remote patient monitoring will become a standard feature in chronic disease management programs.

- Mental health services will see wider adoption through secure and user-friendly teleconsultation platforms.

- Regulatory frameworks will evolve to support cross-border telemedicine and standardize reimbursement policies.

- Healthcare providers will invest in hybrid care models that combine virtual and in-person services.

- The market will attract more investment from public and private sectors to scale infrastructure and access.

- Telehealth adoption in emerging markets will grow with improved internet connectivity and mobile penetration.

- Data security and compliance will remain key priorities in platform development and deployment.

- Partnerships between technology firms and healthcare systems will drive innovation and service delivery.