Market Overview:

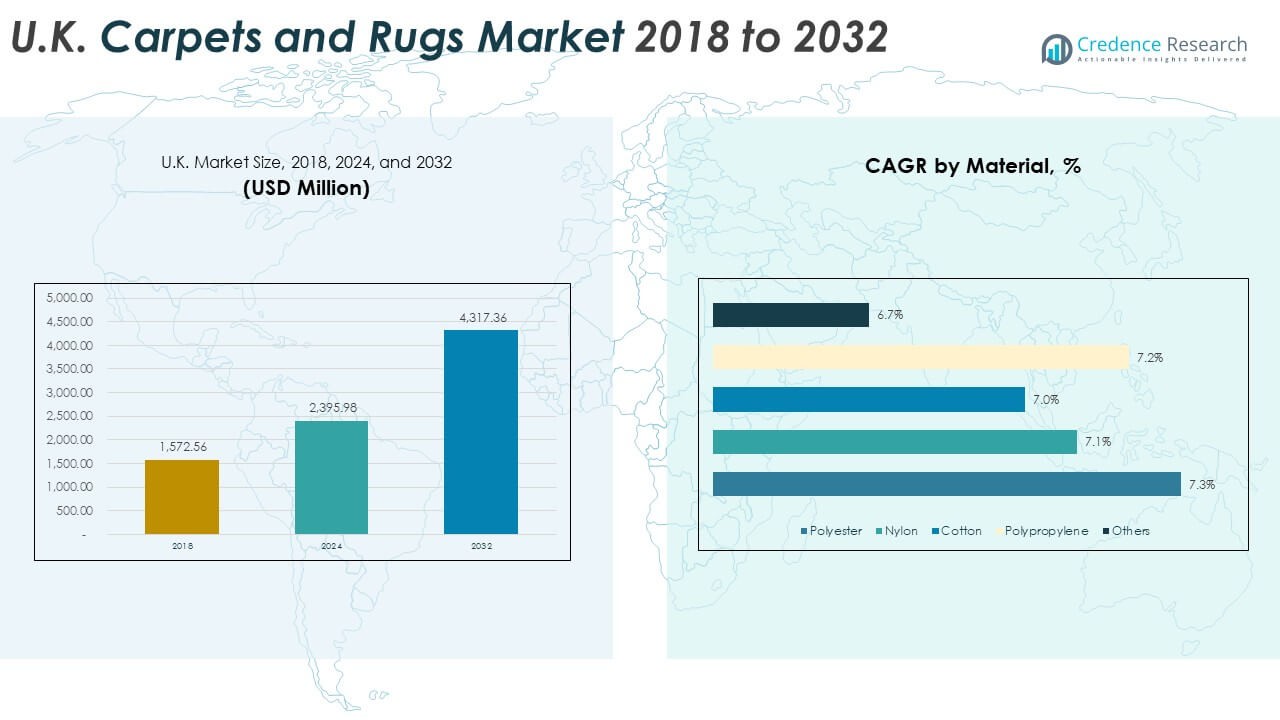

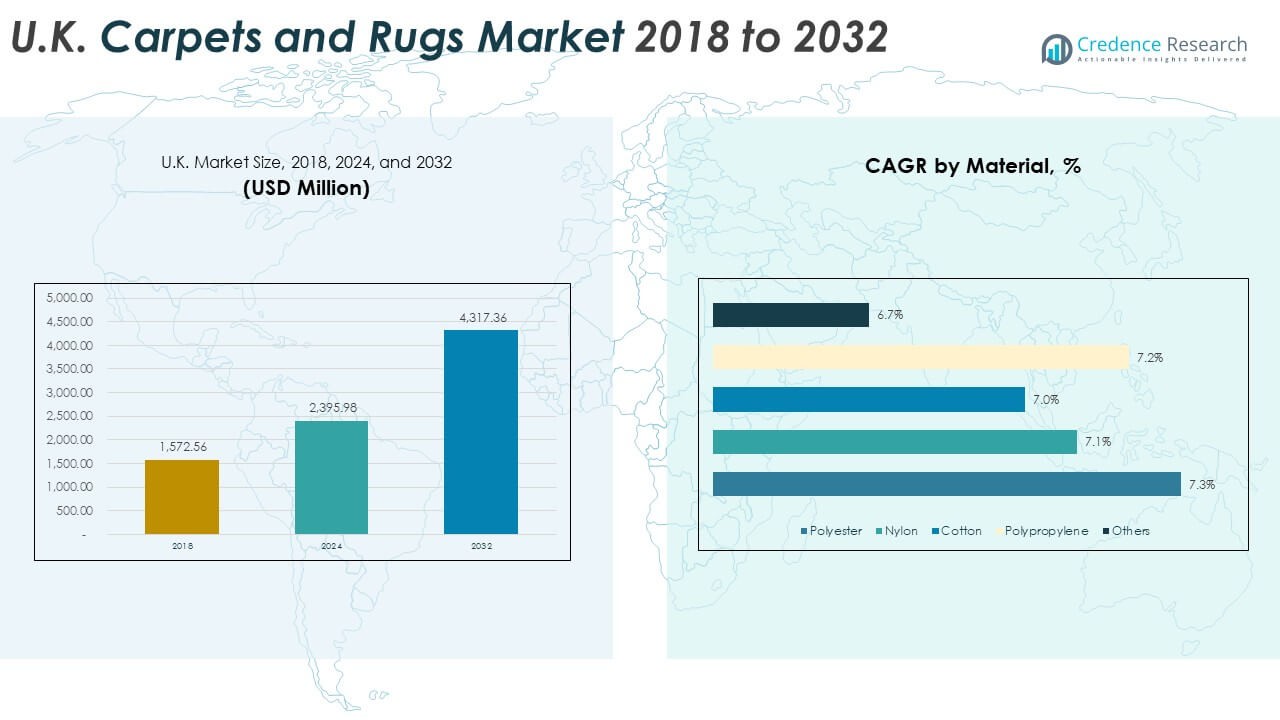

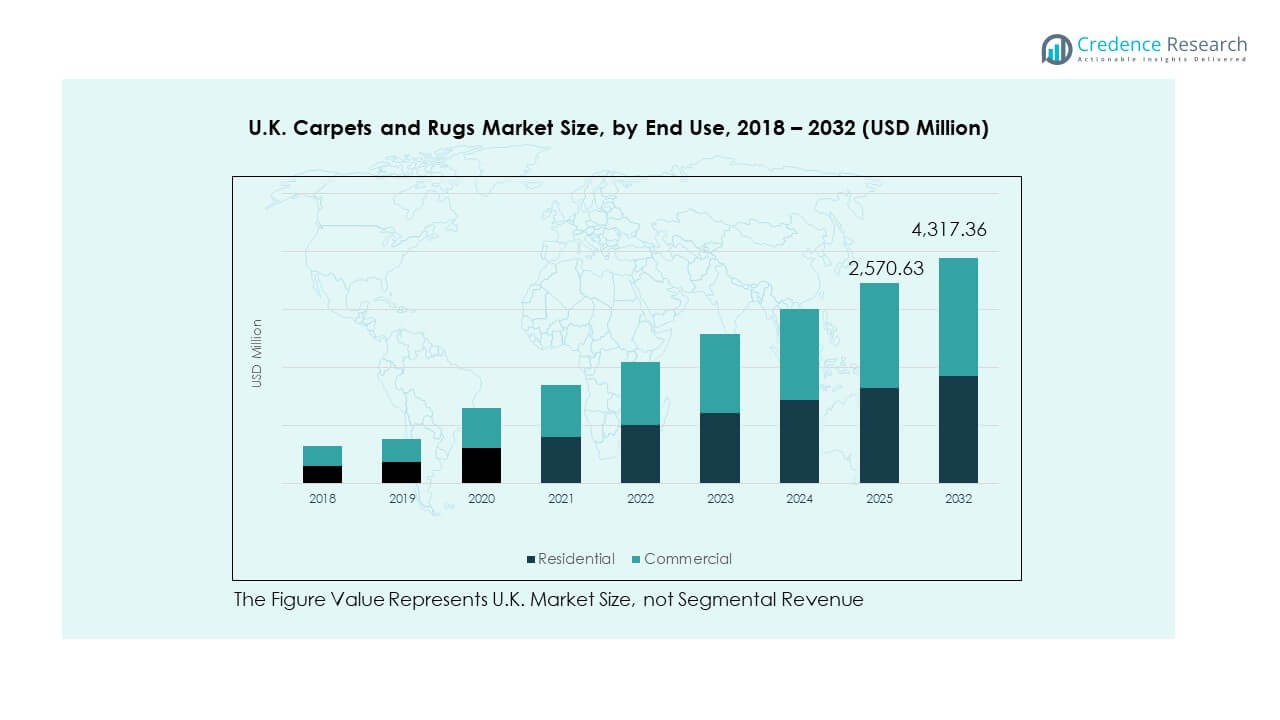

The U.K. Carpets and Rugs Market size was valued at USD 1,572.56 million in 2018, to USD 2,395.98 million in 2024 and is anticipated to reach USD 4,317.36 million by 2032, at a CAGR of 7.57% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Carpets and Rugs Market Size 2024 |

USD 2,395.98 Million |

| U.K. Carpets and Rugs Market, CAGR |

7.57% |

| U.K. Carpets and Rugs Market Size 2032 |

USD 4,317.36 Million |

The market is driven by the increasing demand for flooring solutions that offer both aesthetic appeal and functional benefits. Factors such as rising home renovation activities, the growing popularity of sustainable products, and increasing disposable income contribute significantly to market growth. Additionally, the demand for customized and premium-quality carpets and rugs, especially for residential and commercial spaces, continues to rise, further driving market dynamics.

Geographically, the U.K. remains one of the leading regions in the European Carpets and Rugs Market. The growth in demand is supported by the increasing number of residential and commercial construction projects. Emerging markets within the U.K., particularly in urban areas, show significant demand for both luxury and eco-friendly carpet solutions. The region is expected to maintain dominance, with increased investments in home improvement driving continued demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.K. Carpets and Rugs Market was valued at USD 1,572.56 million in 2018, USD 2,395.98 million in 2024, and is projected to reach USD 4,317.36 million by 2032, growing at a CAGR of 7.57% during the forecast period.

- England leads the U.K. market, capturing approximately 72% of the market share due to its large urban population and high demand for residential and commercial carpets. Scotland follows with strong growth, while Wales contributes with a smaller share but continues to expand.

- The fastest-growing region is Scotland, experiencing higher-than-average growth due to an increase in residential development and commercial projects, driven by ongoing urbanization and infrastructure investment.

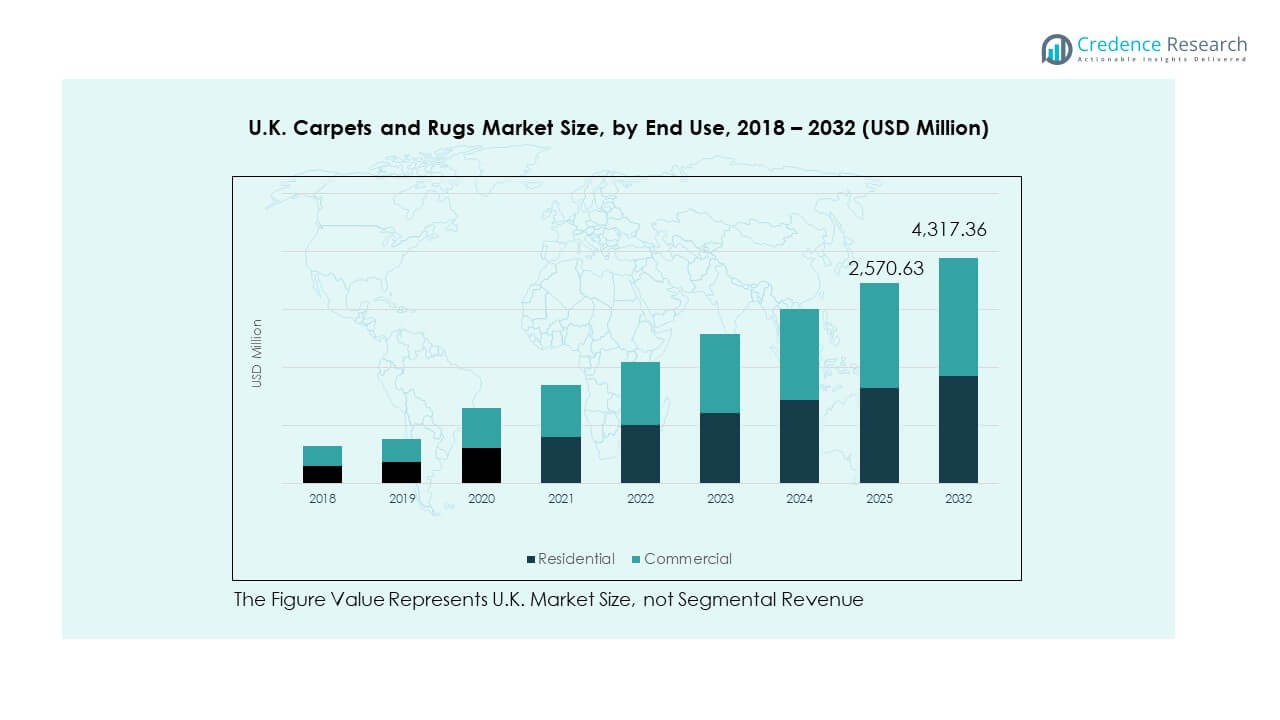

- Residential carpets dominate the market with a significant share, contributing over 60% of the total market size. Commercial carpets hold a smaller but steady share, driven by demand from businesses and public institutions.

- By 2032, the residential segment is projected to generate USD 2,570.63 million, while the commercial segment is expected to reach USD 1,746.73 million, reflecting continued demand in both sectors.

Market Drivers:

Increasing Demand for Sustainable Products

Sustainability has become a crucial factor influencing the U.K. Carpets and Rugs Market. Consumers are increasingly opting for eco-friendly materials such as recycled fibers and biodegradable products. This demand is further supported by the growing awareness of environmental issues and the need for sustainable home décor options. The U.K. market has seen a rise in manufacturers offering green alternatives, addressing the concerns of eco-conscious consumers. It reflects a shift toward environmentally responsible practices in the interior design industry. The increasing popularity of sustainable carpets and rugs is expected to contribute significantly to market growth in the coming years.

- For instance, Shaw Industries Group has, for many years, produced commercial carpet tiles using its high-performance EcoSolution Q100™ nylon 6 fiber, which contains 100% post-industrial recycled content and is 100% recyclable. This established initiative, along with a long-standing commitment to reclaiming and recycling used carpet, allows the company to significantly reduce its environmental footprint and respond to growing consumer demand for sustainable products.

Growth of Residential and Commercial Construction

The expansion of both residential and commercial sectors continues to drive demand for carpets and rugs in the U.K. The steady growth in home renovation projects and new construction is fueling the need for diverse flooring options. Carpets and rugs remain a preferred choice due to their aesthetic appeal, comfort, and practicality. With rising disposable income, homeowners are willing to invest in high-quality flooring solutions that enhance the appearance and functionality of their spaces. Commercial establishments such as offices, hotels, and retail stores also contribute to the growing demand for carpets, driving the U.K. Carpets and Rugs Market forward.

- For instance, Victoria plc has experienced a significant decline in demand for its carpets due to a broader downturn in the flooring sector and macroeconomic headwinds impacting consumer spending. Carpets and rugs remain a relevant choice due to their aesthetic appeal, comfort, and practicality, and commercial establishments such as offices, hotels, and retail stores continue to contribute to the overall market for flooring products.

Preference for Customization and Luxury Products

Customization is a growing trend in the U.K. Carpets and Rugs Market, as consumers seek unique designs that align with their personal preferences. High-end, luxury carpets are in demand, especially for high-end residential properties and upscale commercial spaces. Consumers are increasingly drawn to bespoke, handcrafted rugs that offer superior quality, materials, and unique patterns. This trend reflects a desire for exclusive, tailored products that offer long-term value. As disposable incomes rise, a shift toward premium and luxury carpets and rugs is becoming a major driver in the market, attracting both individuals and businesses alike.

Technological Advancements in Manufacturing

Technological innovations are enhancing the production processes in the U.K. Carpets and Rugs Market, enabling manufacturers to offer superior quality and more diverse designs. The adoption of advanced machinery has led to the creation of more intricate patterns and textures, expanding the range of available products. Automated manufacturing techniques help to reduce production costs, ensuring competitive pricing for both high-end and budget-friendly products. These advancements improve the efficiency of the manufacturing process and make it easier for manufacturers to meet evolving consumer demands. With improved design flexibility, technology plays a key role in driving growth in the U.K. market.

Market Trends:

Rise of Smart Carpets and Rugs

The integration of technology into carpets and rugs is an emerging trend in the U.K. market. Smart carpets equipped with sensors for monitoring health, temperature, and even air quality are gaining popularity. These innovative products are becoming a part of smart homes, offering convenience and improved functionality. The growing trend of connected homes is further boosting the demand for carpets that can interact with other smart devices. The U.K. Carpets and Rugs Market is seeing new entrants who are developing these high-tech products to cater to the tech-savvy consumer. As more people embrace smart home solutions, the adoption of smart carpets is expected to rise.

- For instance, companies like TEKTELIC offer smart room sensors, such as the Breeze CO₂ Smart Room Sensor, which is an Internet of Things (IoT) device that can track CO₂ levels, temperature, and humidity in real-time within a smart home ecosystem. While dedicated sensors like these monitor environmental conditions, other innovative home products, such as the Tarkett Desso AirMaster carpet collection, physically improve air quality by trapping fine dust more effectively than traditional flooring.

Growth of Online Sales Channels

The U.K. Carpets and Rugs Market is witnessing a significant shift towards online shopping. Consumers increasingly prefer to browse and purchase carpets and rugs from the comfort of their homes. E-commerce platforms are providing a wide range of options, from budget to luxury products, making it easier for consumers to compare prices, read reviews, and select the ideal product. Online retailers are offering custom sizes, styles, and free delivery, further enhancing customer convenience. The growing preference for online shopping, fueled by the COVID-19 pandemic and changing consumer habits, is expected to continue shaping the future of the market.

- For instance, the general trend in retail shows significant growth in online sales for many e-commerce-focused companies during 2023, as consumers increasingly value convenience and variety. E-commerce platforms are providing a wide range of options, from budget to luxury products, making it easier for consumers to compare prices, read reviews, and select the ideal product.

Popularity of Eco-Friendly and Recycled Materials

The increasing demand for eco-friendly products continues to shape trends in the U.K. Carpets and Rugs Market. Consumers are now prioritizing products made from recycled or renewable materials, such as bamboo, wool, and PET fibers. This trend reflects a broader societal shift toward sustainability, as more people seek products that align with their environmental values. Manufacturers are adapting to these consumer preferences by incorporating recycled materials into their carpet and rug designs. The focus on sustainability not only caters to eco-conscious consumers but also helps companies align with industry regulations promoting greener practices.

Minimalistic and Neutral Designs

Minimalistic and neutral-colored designs are gaining traction in the U.K. Carpets and Rugs Market, as consumers opt for versatile, timeless pieces that complement various home styles. Simple patterns, light colors, and subtle textures are in high demand for residential spaces and commercial establishments alike. These designs create a sense of openness and calm, making them ideal for modern living spaces. The trend reflects a shift toward understated elegance, where functionality and aesthetics merge seamlessly. As minimalism continues to rise in popularity, the U.K. market is seeing more brands focusing on offering these sleek, modern designs.

Market Challenges Analysis:

Fluctuating Raw Material Prices

One of the key challenges facing the U.K. Carpets and Rugs Market is the volatility of raw material prices. The cost of materials like wool, nylon, and polyester fluctuates due to factors such as changes in global supply and demand, environmental conditions, and trade tariffs. These price variations can have a significant impact on the overall cost structure of carpet and rug manufacturers. Rising material costs often lead to higher retail prices, which can deter price-sensitive consumers. To maintain profitability, manufacturers need to balance raw material costs with product pricing strategies, while also managing their supply chains effectively.

Intense Competition and Price Sensitivity

The U.K. Carpets and Rugs Market is highly competitive, with numerous domestic and international players vying for market share. This intense competition results in downward pressure on prices, forcing manufacturers to constantly innovate and offer attractive pricing. As consumers become more price-sensitive, there is a growing demand for budget-friendly options without compromising on quality. Manufacturers must balance quality, pricing, and innovation to stay competitive. Smaller players may struggle to compete with larger companies that benefit from economies of scale, further intensifying the competitive environment in the market.

Market Opportunities:

Growing Demand for Customizable Products

The increasing desire for personalized home décor provides significant opportunities for the U.K. Carpets and Rugs Market. Consumers are increasingly seeking customizable options that reflect their individual tastes and home styles. From custom-sized rugs to unique patterns, the demand for bespoke products is on the rise. Companies that offer customization services can tap into this lucrative market, catering to a growing segment of homeowners and businesses seeking personalized solutions. As this trend grows, the U.K. market presents an opportunity for brands to differentiate themselves by offering tailored, high-quality products.

Expansion of Eco-Friendly Product Lines

The shift towards sustainability offers a substantial growth opportunity for the U.K. Carpets and Rugs Market. Manufacturers who invest in eco-friendly materials and sustainable production processes can appeal to the growing base of environmentally conscious consumers. By offering products made from recycled, biodegradable, or renewable materials, companies can attract a dedicated customer segment that values sustainability. As awareness of environmental issues continues to rise, the demand for eco-friendly carpets and rugs will likely expand, providing ample opportunities for market players to innovate and capture this niche.

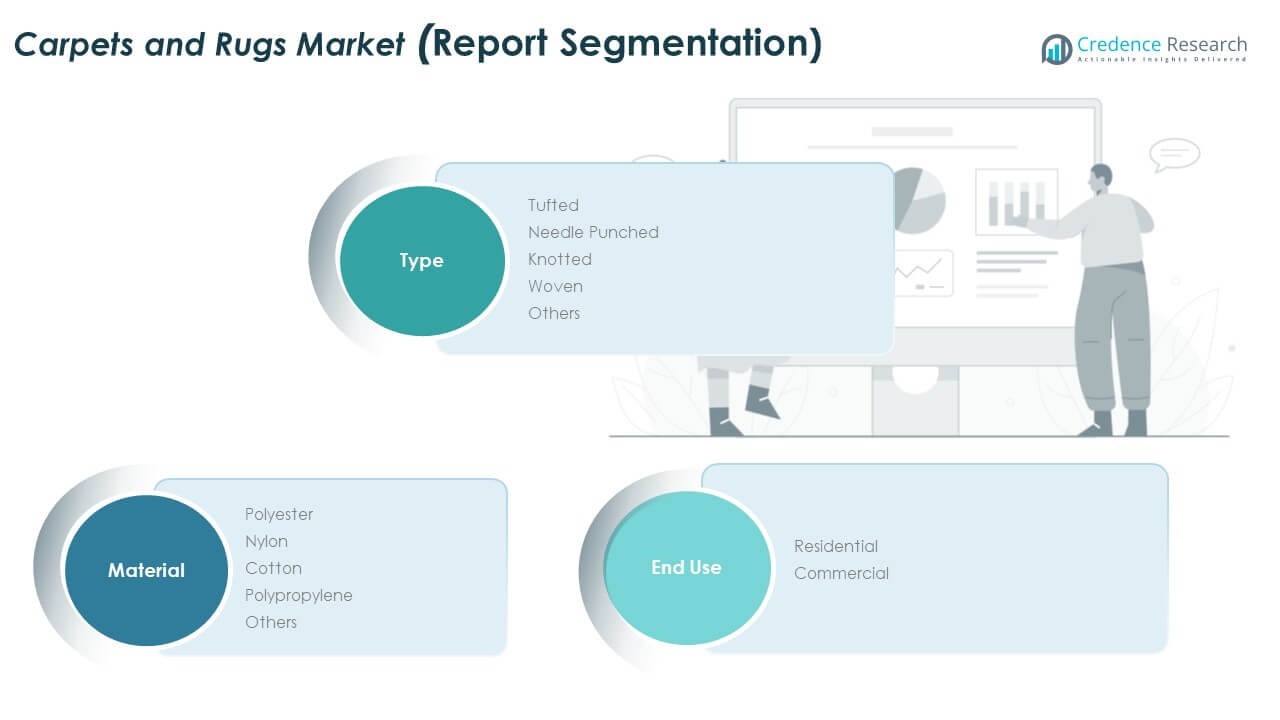

Market Segmentation Analysis:

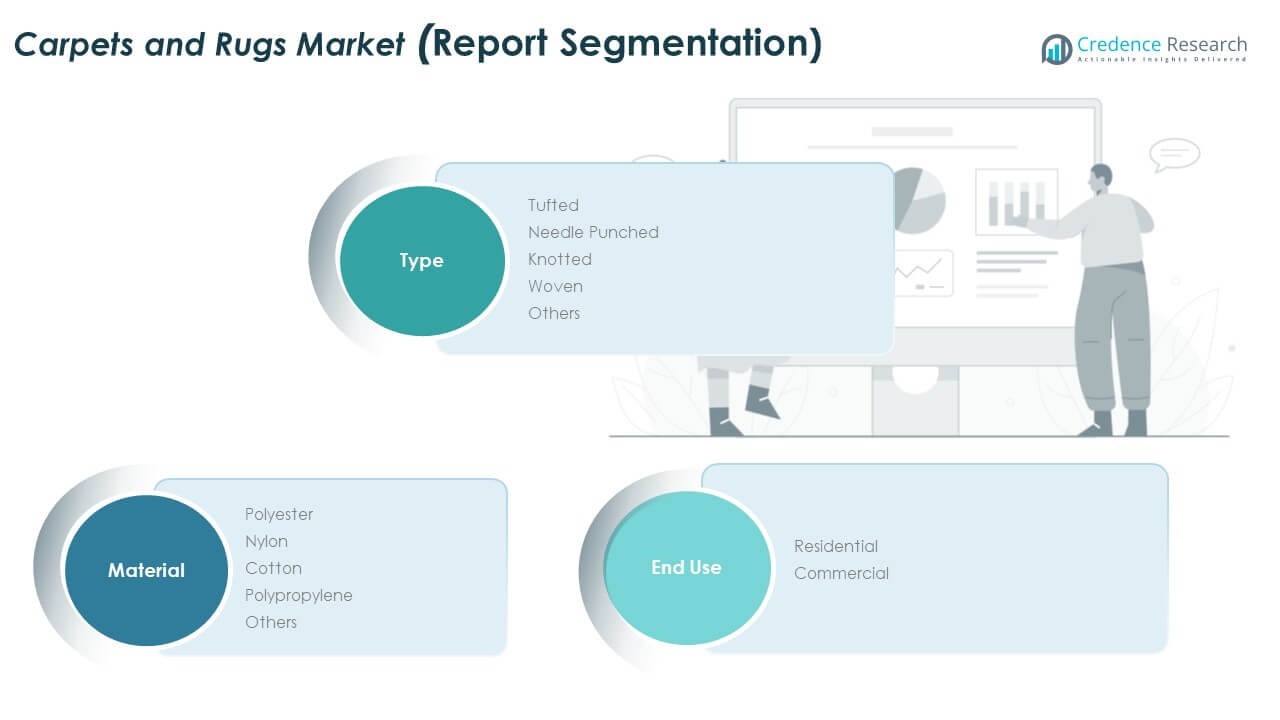

By Type Segment Analysis

The U.K. Carpets and Rugs Market is divided into several types, including tufted, needle punched, knotted, woven, and others. Tufted carpets dominate the market due to their cost-effectiveness and ease of production. Needle-punched carpets are widely used in industrial and high-traffic areas due to their durability. Knotted carpets cater to the premium segment, offering high-quality craftsmanship and intricate designs. Woven carpets are valued for their long-lasting durability and aesthetic appeal, often found in luxury settings. Other types, including customized carpets, are catering to niche market demands.

- For instance, Shaw Industries Group produces a wide range of tufted carpets that are both affordable and versatile, allowing for greater market penetration. Needle-punched carpets are widely used in industrial and high-traffic areas due to their durability. Brockway Carpets Ltd has successfully integrated needle-punched carpets in large-scale commercial projects, offering a robust solution for public buildings and transportation hubs.

By Material Segment Analysis

The material segment in the U.K. Carpets and Rugs Market consists of polyester, nylon, cotton, polypropylene, and others. Polyester holds a strong position due to its affordability and ease of maintenance. Nylon, known for its strength and resilience, is commonly used in both residential and commercial carpets. Cotton, though less durable, is favored for its softness and eco-friendly nature. Polypropylene carpets offer high stain resistance and are widely used in both residential and commercial spaces. Other materials, such as wool and recycled fibers, are gaining traction due to their sustainability and premium appeal.

- For example, Halbmond manufactures a popular line of polyester-based carpets that combine cost-effectiveness with a wide array of design options. Nylon, known for its strength and resilience, is commonly used in both residential and commercial carpets. Tarkett offers nylon carpets designed for commercial spaces, focusing on durability and performance in high-traffic environments

By End Use Segment Analysis

The U.K. Carpets and Rugs Market is segmented into residential and commercial end-use. The residential sector continues to drive the majority of demand, as homeowners seek comfort, style, and durability in their carpets and rugs. Commercial use, including offices, hotels, and retail spaces, contributes significantly, as businesses focus on functionality and aesthetic value. Both sectors exhibit increasing demand for eco-friendly and customizable options, with a growing preference for products that offer both sustainability and quality.

Segmentation:

By Type Segment Analysis

- Tufted

- Needle Punched

- Knotted

- Woven

- Others

By Material Segment Analysis

- Polyester

- Nylon

- Cotton

- Polypropylene

- Others

By End Use Segment Analysis

Regional Analysis:

United Kingdom Core Market – England, Scotland & Wales

The U.K. region commands the largest share of the U.K. Carpets and Rugs Market, with England alone capturing approximately 72 % of revenue in 2024. It drives demand via strong residential renovation activity and commercial fit‑outs across major urban centres. Scotland and Wales contribute the remaining share and exhibit faster growth rates though from smaller bases. It benefits from mature retail networks and a broad consumer base seeking quality flooring. Manufacturers and retailers focus on England for bulk volume and on Scotland for growth potential. Supply‑chain logistics and distribution hubs are centred in England, which further strengthens its dominance.

Rest of Europe Spill‑over – EU Neighbours & Trade Flows

Germany holds about 18.7 % of the European carpets and rugs market, a relevant benchmark for the U.K. sector. The U.K. market draws indirect influence from cross‑border trade flows and imports from Germany and other EU nations. It sources raw materials and finished goods from European manufacturing hubs, affecting cost and pricing dynamics. Regional trade dynamics and regulatory alignment play roles in cost competitiveness. The U.K. market remains linked to European consumption trends while retaining independent trade policy. Proximity to the EU manufacturing base offers both advantages in sourcing and challenges in currency or tariff volatility.

Emerging Markets & Overseas Export Linkages

Though primarily domestic, the U.K. Carpets and Rugs Market also engages with emerging export destinations in Asia and the Middle East, which account for smaller share segments but high growth potential. Firms based in the U.K. are increasingly using export channels to expand beyond saturated domestic demand. It faces competition from low‑cost producers but captures value via premium, sustainable and designer‑label products. Emerging markets generate new demand for bespoke carpets and rugs, offering U.K. manufacturers opportunities to scale. Export linkages thus play a strategic role in extending market reach and balancing domestic saturation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Brockway Carpets Ltd

- Kymo

- Shaw Industries Group

- Object Carpet

- Victoria plc

- Cormar Carpets

- Halbmond

- The Dixie Group

- Fletco Carpets

- Other Key Players

Competitive Analysis:

The U.K. Carpets and Rugs Market remains highly competitive, with several prominent players vying for market share. Established brands such as Brockway Carpets Ltd, Shaw Industries Group, and Victoria plc dominate the landscape, offering a diverse range of products across different price points. These companies continue to innovate, particularly by adopting sustainable materials and eco-friendly production processes to cater to the increasing demand for environmentally responsible flooring options. Smaller players also contribute by focusing on niche markets, such as customized and high-end rugs, allowing them to carve out a space in this crowded market. Market dynamics are shaped by continuous product developments and strategic collaborations, allowing companies to stay competitive and meet the evolving demands of consumers.

Recent Developments:

- Brockway Carpets Ltd was granted the Royal Warrant of Appointment as Carpet Manufacturer to His Majesty King Charles III in May 2025. This recognition from the Royal Warrant office underscores Brockway’s commitment to maintaining the highest standards of service, quality, craftsmanship and environmental standards. The company, a family-owned business that has been designing and manufacturing high-quality hand-finished carpets in the traditional carpet town of Kidderminster since 1964, views this accolade as testament to the hard work and commitment of its entire team and reinforces its belief in British design and craftsmanship.

- The Dixie Group reported improved financial performance in Q2 2025, with net income of $1.2 million compared to $600,000 in the same period of the prior year. The company announced a 10-year sublease agreement for warehouse space in 2025, which is expected to generate $1.8 million in annual income. Despite facing challenging market conditions, the company continues to focus on cost-saving initiatives, new product launches, and manufacturing efficiencies to improve overall performance.

- Fletco Carpets achieved recognition with its Stellar LockTiles® collection winning the prestigious iF DESIGN AWARD 2024 in the Product discipline within the Textiles/Walls/Floor category. This award-winning carpet tile collection is manufactured from regenerated Econyl® yarn without the use of bitumen, latex, PVC or PFAS, and utilizes Fletco’s patented LockTiles® concept for seamless installation. Additionally, Fletco launched a new Rugs & Shapes Collection of area rugs in January 2025, expanding its product portfolio to serve residential and commercial markets.

Report Coverage:

The research report offers an in-depth analysis based on type, material, and end use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increased demand for eco-friendly and sustainable products will drive market growth.

- Technological advancements in manufacturing processes will enhance product quality and variety.

- Customization and personalized carpets will continue to gain popularity in the residential sector.

- The commercial sector will see an increased focus on durability and functionality in flooring options.

- Online sales channels will grow, expanding market reach and consumer accessibility.

- The shift toward smart homes will lead to the development of smart carpets with integrated technology.

- Rising disposable incomes will boost demand for luxury and high-end carpets and rugs.

- Urbanization will contribute to the expansion of residential and commercial spaces, increasing flooring demand.

- Growing awareness of environmental impact will lead to stricter regulations in carpet manufacturing.

- Companies will increasingly focus on international markets to offset domestic saturation and explore new growth opportunities.