| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thailand Industrial Fasteners Market Size 2024 |

USD 353.79 Million |

| Thailand Industrial Fasteners Market, CAGR |

6.61% |

| Thailand Industrial Fasteners Market Size 2032 |

USD 590.35 Million |

Market Overview:

The Thailand Industrial Fasteners Market is projected to grow from USD 353.79 million in 2024 to an estimated USD 590.35 million by 2032, with a compound annual growth rate (CAGR) of 6.61% from 2024 to 2032.

The growth of Thailand’s industrial fasteners market is primarily fueled by expanding construction, manufacturing, and automotive sectors. A surge in infrastructure projects and machinery production has elevated the need for reliable fastening solutions. Government initiatives to modernize public infrastructure, including transportation and utilities, have further boosted demand. In addition, the automotive and aerospace industries are increasingly adopting high-performance fasteners to enhance structural integrity and product durability. The rise in electric vehicle production and the push toward lightweight, efficient manufacturing are also creating opportunities for advanced fastening technologies, particularly in precision engineering and specialized applications. Rising demand for customized fastening solutions tailored to specific industrial needs is further accelerating market growth. Additionally, the increasing focus on quality standards and certification requirements is driving manufacturers to innovate and enhance product performance.

Thailand holds a strategic position within the broader Asia-Pacific industrial landscape, benefiting from its strong manufacturing base and export-driven economy. The country’s industrial fasteners market is supported by regional trade agreements and proximity to major production hubs, facilitating easy access to raw materials and distribution networks. Demand is particularly strong in areas with concentrated industrial activity, such as the Eastern Economic Corridor, where investments in manufacturing, automotive, and aerospace projects continue to rise. Additionally, Thailand’s role as a key supplier within ASEAN strengthens its importance in regional supply chains, offering significant potential for both domestic and cross-border market expansion. Strong government support for industrial modernization and infrastructure development further reinforces Thailand’s competitive position within the regional and global markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Thailand Industrial Fasteners Market is projected to grow from USD 353.79 million in 2024 to USD 590.35 million by 2032, reflecting a robust CAGR of 6.61% during the forecast period.

- The Global Industrial Fasteners Market is projected to grow from USD 98,826 million in 2024 to USD 158,987.23 million by 2032, registering a robust CAGR of 6.12%.

- Expanding construction, manufacturing, and automotive sectors, along with government infrastructure initiatives, are the primary drivers accelerating market growth.

- Thailand’s Eastern Economic Corridor (EEC) dominates the market, supported by concentrated investments in automotive, aerospace, and electronics manufacturing.

- Technological advancements, including precision engineering and smart fastening solutions, are driving innovation across machinery, electronics, and heavy equipment industries.

- Volatility in raw material prices and intense competition from low-cost imports remain significant challenges for domestic manufacturers.

- Rising demand for customized, lightweight, and high-performance fasteners tailored to specific industrial applications is creating new growth opportunities.

- Strong government support under initiatives like Thailand 4.0 and integration into regional trade agreements continue to strengthen Thailand’s position as a key industrial fasteners hub within the Asia-Pacific region.

Market Drivers:

Expansion of the Construction and Infrastructure Sector

The rapid development of Thailand’s construction and infrastructure sector significantly drives demand for industrial fasteners. Major government initiatives focused on building transportation networks, including railways, airports, and highways, have heightened the need for high-performance fastening solutions. Construction activities involving large-scale residential, commercial, and industrial projects require a wide range of fasteners for structural stability and durability. For example, the EEC’s high-speed rail project connecting Bangkok to eastern cities is estimated to require millions of fasteners for rail tracks, stations, and associated infrastructure. This expansion not only increases domestic consumption but also strengthens the role of fasteners in ensuring the safety and longevity of vital infrastructure projects across the country.

Growth of the Automotive and Aerospace Industries

Thailand’s position as a major automotive production hub in Southeast Asia has fueled consistent growth in the demand for industrial fasteners. Automobile manufacturers require fasteners that meet stringent quality, safety, and performance standards for use in engine components, body assemblies, and interiors. The shift toward electric vehicles further amplify the need for lightweight, corrosion-resistant fasteners to optimize vehicle efficiency. Similarly, the aerospace sector, which emphasizes high-strength and lightweight fastening solutions, contributes to steady market expansion. Increasing investments by global manufacturers in Thailand’s automotive and aerospace industries continue to create substantial opportunities for fastener suppliers.

Advancements in Manufacturing Technologies

Technological advancements within the manufacturing sector have positively impacted the industrial fasteners market in Thailand. The adoption of automation, precision engineering, and advanced materials has led to the production of specialized fasteners tailored for complex applications. For example, companies like ATS Global provide smart manufacturing solutions, including the ATS Bus industrial IoT service bus, which connects machines and IT systems for real-time decision-making and reduced downtime. Industries such as electronics, machinery, and heavy equipment manufacturing increasingly demand fasteners that can withstand extreme conditions, ensuring product reliability and extended lifecycle. These evolving requirements drive innovation among fastener manufacturers, encouraging the development of high-quality, customized fastening solutions that align with the specific needs of different industries.

Government Support and Favorable Trade Environment

Government policies promoting industrial growth and foreign direct investment have created a favorable environment for the expansion of the industrial fasteners market. Thailand’s strategic focus on becoming a regional manufacturing and logistics hub under initiatives like Thailand 4.0 enhances infrastructure development and strengthens industrial output. Moreover, the country’s integration into regional trade agreements, such as the ASEAN Economic Community (AEC) and free trade agreements with key global partners, facilitates the flow of raw materials and finished products. This open trade environment encourages collaboration, boosts manufacturing competitiveness, and supports the broader adoption of advanced fastener technologies across Thailand’s key industries.

Market Trends:

Rising Demand for Lightweight and Corrosion-Resistant Materials

A notable trend in Thailand’s industrial fasteners market is the growing shift toward lightweight and corrosion-resistant materials such as aluminum, titanium, and engineered plastics. As industries seek to enhance product durability while minimizing weight, manufacturers are increasingly developing fasteners that meet these advanced material specifications. For instance, in the aerospace sector, titanium fasteners are widely adopted due to their high strength-to-weight ratio and resistance to corrosion and extreme temperatures. The automotive and aerospace sectors, in particular, are driving this trend by prioritizing components that improve fuel efficiency and operational performance. In addition, the construction industry’s adoption of lightweight structural solutions is expanding the application of non-traditional fastener materials, encouraging suppliers to diversify their product portfolios.

Increased Adoption of Smart Fasteners and IoT Integration

Technological innovation is shaping the evolution of industrial fasteners in Thailand, with a growing emphasis on smart fasteners integrated with Internet of Things (IoT) capabilities. Industries such as automotive manufacturing, heavy machinery, and industrial equipment assembly are adopting fasteners equipped with sensors that monitor load, stress, and vibration in real time. These smart fasteners improve maintenance scheduling, enhance safety, and minimize operational downtime. As Thailand advances its digital infrastructure under initiatives like Thailand 4.0, the integration of smart technologies into industrial processes is expected to gain momentum, further boosting demand for intelligent fastening solutions.

Growth of Customized and Application-Specific Fasteners

Another emerging trend is the rising preference for customized and application-specific fasteners across various industries. Sectors like electronics, renewable energy, and medical device manufacturing require fastening solutions that meet strict dimensional, mechanical, and aesthetic specifications. In response, manufacturers are investing in research and development to create fasteners tailored to unique operational environments, such as high-temperature, high-vibration, or chemically aggressive conditions. For example, original equipment manufacturers (OEMs) in the automotive, electrical, and machinery sectors frequently require fasteners that meet unique dimensional, mechanical, or environmental specifications. This focus on customization is driving innovation in design, materials, and manufacturing processes, enabling Thailand’s fastener producers to offer specialized solutions that enhance competitiveness in both domestic and international markets.

Sustainability and Eco-Friendly Manufacturing Practices

Sustainability has become an increasingly important trend in Thailand’s industrial fasteners market. Companies are adopting eco-friendly manufacturing practices, such as using recyclable materials, reducing production waste, and implementing energy-efficient processes. For instance, companies like Kasem International are leading the way by using sustainable materials such as bioplastics, recycled plastics, and biodegradable plastics in their manufacturing processes. End-user industries are placing greater emphasis on sourcing components that align with global environmental standards and certifications. As sustainability regulations tighten and consumer awareness grows, fastener manufacturers are responding by developing greener product lines and optimizing their supply chains for reduced environmental impact. This shift not only meets regulatory requirements but also offers a competitive advantage in attracting environmentally conscious customers.

Market Challenges Analysis:

Volatility in Raw Material Prices

Fluctuations in the prices of raw materials such as steel, aluminum, and specialty alloys pose a significant restraint on the Thailand industrial fasteners market. Fastener production heavily relies on the stable availability and pricing of these materials, and sudden increases directly impact manufacturing costs. Small and medium-sized fastener manufacturers, in particular, face pressure to maintain competitive pricing while managing shrinking profit margins. As a result, market participants must navigate raw material volatility carefully to sustain operations and meet customer expectations for both quality and affordability.

Intense Competition from Low-Cost Imports

Thailand’s industrial fasteners market faces stiff competition from low-cost imports, particularly from countries with large-scale manufacturing capabilities. Imported fasteners, often priced lower than domestically produced alternatives, challenge local manufacturers to differentiate through quality, customization, or after-sales services. This intense price competition can lead to reduced market share for smaller players and creates barriers for new entrants. To counter this, domestic manufacturers must invest in technological upgrades, product innovation, and strategic partnerships to enhance their value proposition.

Technological Adaptation Challenges

While advanced fastening solutions, such as smart fasteners and customized designs, present growth opportunities, adapting to new technologies remains a challenge for many local manufacturers. Integrating digital tools, precision manufacturing techniques, and IoT-enabled products demands significant capital investment and technical expertise. Smaller firms often struggle to meet these requirements, limiting their ability to compete effectively in a rapidly evolving market landscape. For instance, industry experts from companies like Bosch Thailand and ABB have highlighted that the skills gap and the need for government incentives, such as tax benefits and technical training, are critical issues that must be addressed to accelerate technological adoption and ensure long-term competitiveness in the sector. Bridging this technology gap will be critical for ensuring long-term competitiveness and market relevance in Thailand’s industrial fasteners sector.

Market Opportunities:

The Thailand industrial fasteners market presents significant opportunities driven by the country’s expanding role as a regional manufacturing hub. As industries such as automotive, electronics, aerospace, and construction continue to grow, the demand for advanced fastening solutions is expected to rise steadily. The government’s ongoing infrastructure development programs, combined with increased foreign direct investment under initiatives like Thailand 4.0, are creating a favorable environment for industrial expansion. Fastener manufacturers that focus on providing high-strength, lightweight, and corrosion-resistant products can capitalize on the rising demand for technologically advanced and specialized components. Furthermore, the trend toward electric vehicles and renewable energy projects is opening new avenues for fastener applications requiring precision and enhanced material performance.

Another promising opportunity lies in the growing shift toward customization and sustainability. End-user industries increasingly seek fastening solutions tailored to specific operational needs, including high-vibration, high-temperature, and environmentally sensitive environments. Manufacturers that invest in research and development to offer application-specific and eco-friendly fasteners will be well-positioned to capture emerging market segments. In addition, Thailand’s strategic location within ASEAN and its strong export capabilities enable fastener producers to access broader regional and global markets. Companies that leverage technological innovation, expand their product offerings, and align with global sustainability standards are likely to secure a competitive advantage and achieve long-term growth in the evolving Thailand industrial fasteners landscape.

Market Segmentation Analysis:

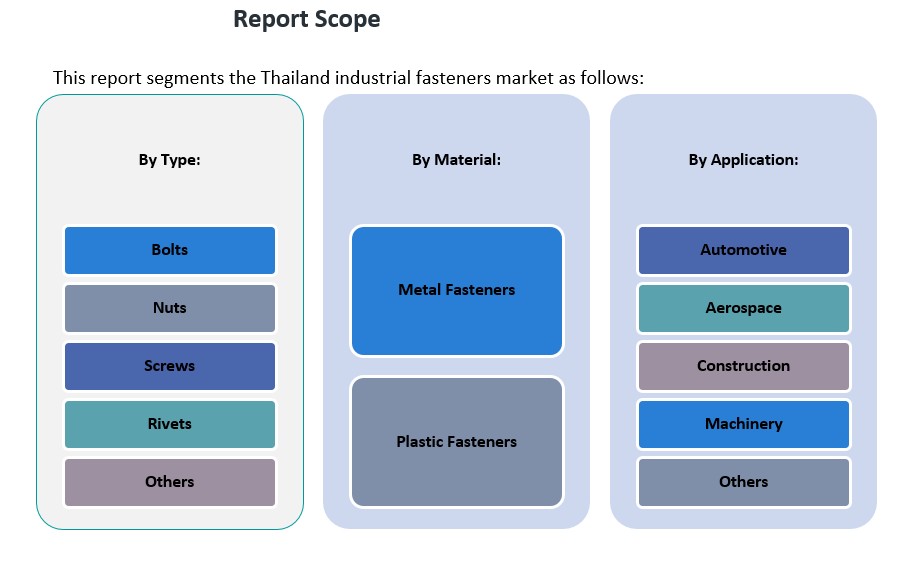

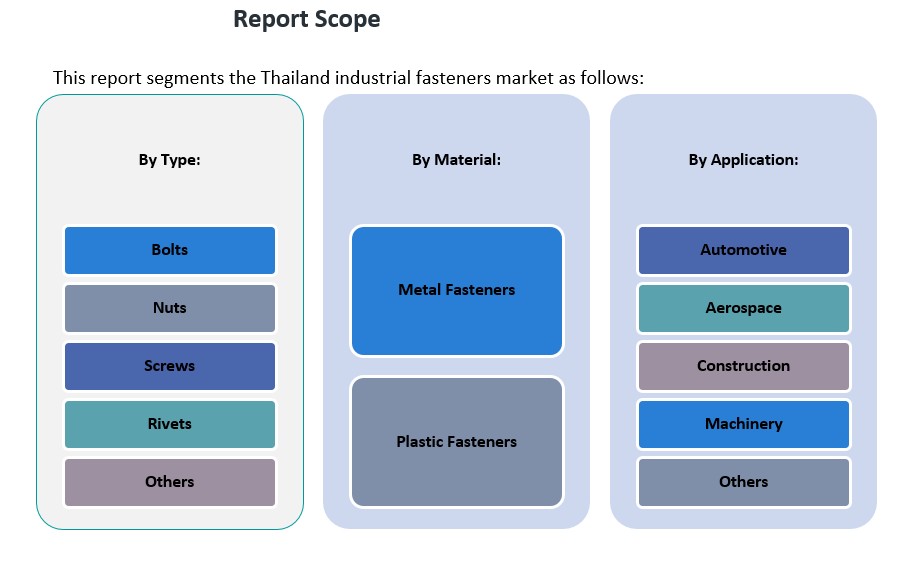

The Thailand industrial fasteners market is segmented by type, application, and material, reflecting the diverse demand across end-user industries.

By type, bolts hold a substantial share due to their widespread use in construction, automotive, and heavy machinery industries for structural and assembly purposes. Nuts and screws closely follow, supported by their versatility across different mechanical and engineering applications. Rivets are increasingly utilized in aerospace and automotive manufacturing, where permanent fastening is critical. The “Others” category, which includes washers, pins, and anchors, also contributes to market growth as specialized industrial needs expand.

By application, the automotive segment dominates the market, driven by Thailand’s established position as a leading vehicle production hub in Southeast Asia. Construction also represents a key application area, with ongoing infrastructure projects boosting the demand for heavy-duty and durable fasteners. The machinery sector is witnessing growing adoption of advanced fastening solutions to support manufacturing activities across industrial equipment and robotics. Aerospace, although a smaller segment, is growing steadily with the increased focus on precision and lightweight fasteners. Other sectors, including electronics and renewable energy, are also creating new opportunities for fastener manufacturers.

By material, metal fasteners continue to account for the majority of market demand, favored for their strength, durability, and wide industrial application. However, plastic fasteners are emerging as a fast-growing segment due to their lightweight properties, corrosion resistance, and suitability for applications where weight reduction and non-conductivity are crucial. This shift is particularly noticeable in automotive interiors, electronics, and renewable energy installations.

Segmentation:

By Type Segment:

- Bolts

- Nuts

- Screws

- Rivets

- Others

By Application Segment:

- Automotive

- Aerospace

- Construction

- Machinery

- Others

By Material Segment:

- Metal Fasteners

- Plastic Fasteners

Regional Analysis:

The Thailand industrial fasteners market exhibits a diverse regional distribution, with key areas contributing significantly to the industry’s growth. The Eastern region, particularly the Eastern Economic Corridor (EEC), stands out as the primary hub, accounting for approximately 45% of the market share. This dominance is attributed to the concentration of automotive, aerospace, and electronics manufacturing facilities, bolstered by government initiatives aimed at transforming the EEC into a leading economic zone. Provinces such as Chonburi, Rayong, and Chachoengsao are pivotal, hosting numerous industrial estates and benefiting from substantial foreign direct investments.

The Central region, encompassing Bangkok and its surrounding provinces, contributes around 30% to the market. This area’s significance stems from its well-established infrastructure, including transportation networks and logistics facilities, which support a wide range of industries from construction to machinery manufacturing. The presence of numerous small and medium-sized enterprises (SMEs) further amplifies the demand for industrial fasteners in this region.

In the Northern and Northeastern regions, the market share is approximately 15%. These areas are witnessing gradual industrial development, with a focus on agro-industrial activities and light manufacturing. Government efforts to decentralize industrial growth and promote regional development are expected to enhance the demand for fasteners in these regions over time.

The Southern region accounts for the remaining 10% of the market. Its contribution is primarily driven by the shipbuilding industry, oil and gas sectors, and emerging renewable energy projects. The region’s strategic coastal location facilitates maritime activities, which, in turn, necessitate specialized fasteners resistant to corrosion and suitable for marine applications.

Key Player Analysis:

- Nifco Inc.

- Shanghai Prime Machinery Co. Ltd.

- Meidoh Co. Ltd.

- Sundram Fasteners Limited

- Agrati Group

- HIL Ltd.

- Bhansali Fasteners

- Zhejiang Huantai Fastener Co., Ltd.

- Kyocera Corporation

Competitive Analysis:

The Thailand industrial fasteners market is highly competitive, characterized by the presence of both international and domestic manufacturers. Leading players focus on product innovation, quality enhancement, and strategic partnerships to strengthen their market position. Global companies leverage advanced technologies and strong distribution networks to cater to the rising demand for specialized fasteners across automotive, construction, and aerospace industries. Meanwhile, local manufacturers emphasize cost competitiveness and customization to meet specific client requirements. The market also witnesses increasing investments in research and development aimed at producing lightweight, corrosion-resistant, and high-strength fasteners. Companies are adopting strategies such as capacity expansions, mergers, and acquisitions to enhance their regional presence. Furthermore, adherence to international quality standards and certifications has become critical for maintaining competitiveness, especially as customers increasingly prioritize product reliability and performance. This dynamic competitive environment continues to drive innovation and operational efficiency across the Thailand industrial fasteners landscape.

Recent Developments:

- In October 2024, Nifco launched a biodegradable plastic fastener (Brush clip) that will be featured in Takenaka Corporation’s “Foresting Architecture” pavilion at the 2025 Osaka-Kansai Japan Expo. These brush clips are made from a blend of cellulose derived from inedible plants and cellulose acetate, resulting in lower CO₂ emissions during production and full biodegradability after use. The product demonstrates Nifco’s focus on sustainability and advanced material technology, aligning with global trends in environmentally friendly manufacturing.

- On February 25, 2025, Miller Electric Mfg. LLC, a wholly-owned subsidiary of Illinois Tool Works (ITW), announced a strategic partnership with Novarc Technologies. This collaboration focuses on developing AI-powered welding solutions under the Miller® Copilot™ line, aiming to enhance productivity, address labor shortages, and improve precision in industries such as shipbuilding and heavy equipment manufacturing.

- In January 2023, Hilti North America announced the addition of more than 30 new cordless tools to its Nuron battery-powered platform, expanding its portfolio to over 100 tools. This expansion, showcased at the World of Concrete event, includes advanced tools such as a diamond core rig, rotating lasers, and cut-off saws, reinforcing Hilti’s leadership in cordless jobsite solutions

Market Concentration & Characteristics:

The Thailand industrial fasteners market is characterized by moderate concentration, featuring a mix of large multinational corporations and numerous small to medium-sized enterprises (SMEs). This structure fosters a competitive environment where global players leverage advanced technologies and extensive distribution networks, while local manufacturers focus on cost-effectiveness and customization to meet specific client needs. The market’s competitiveness is further intensified by the presence of imported fasteners from countries with large-scale manufacturing capabilities, challenging domestic producers to differentiate through quality and innovation. Additionally, fluctuations in raw material prices, particularly for metals and specialty alloys, impact manufacturing costs and profit margins, prompting companies to adopt strategies such as backward and forward integration to stabilize operations. Overall, the market’s dynamic nature, driven by diverse industrial demands and evolving technological advancements, necessitates continuous innovation and strategic agility among participants to maintain and enhance their market positions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application and Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for advanced, lightweight fasteners is expected to grow with the expansion of electric vehicle production.

- Government infrastructure projects will continue to drive substantial demand across the construction sector.

- Rising investments in aerospace manufacturing will increase the need for high-performance fastening solutions.

- Growth in renewable energy installations will create new opportunities for corrosion-resistant and specialized fasteners.

- Adoption of smart fasteners integrated with IoT technologies will gain traction across industrial applications.

- Local manufacturers are likely to increase focus on R&D to meet evolving international quality standards.

- Strategic partnerships and mergers are anticipated to strengthen supply chains and enhance market competitiveness.

- Expansion of Thailand’s export capacity within ASEAN will open new regional markets for domestic producers.

- Growing emphasis on eco-friendly manufacturing will drive innovations in recyclable and sustainable fastener materials.

- Technological advancements in precision engineering will support the development of highly customized fastening solutions.