| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Thailand Medical Tourism Market Size 2024 |

USD 433.81 Million |

| Thailand Medical Tourism Market, CAGR |

15.24% |

| Thailand Medical Tourism Market Size 2032 |

USD 1,349.10 Million |

Market Overview

Thailand Medical Tourism Market size was valued at USD 433.81 million in 2024 and is anticipated to reach USD 1,349.10 million by 2032, at a CAGR of 15.24% during the forecast period (2024-2032).

The Thailand medical tourism market is driven by affordable yet high-quality healthcare services, internationally accredited hospitals, and skilled medical professionals. Government initiatives, such as visa facilitation and promotional campaigns, further enhance the country’s appeal to international patients. The availability of advanced treatments, including cosmetic surgery, dental care, and specialized procedures, attracts a diverse patient base. Rising healthcare costs in Western countries and long waiting times push patients toward Thailand’s cost-effective medical solutions. Additionally, the growing adoption of digital health services, telemedicine, and AI-driven diagnostics enhances patient experience and operational efficiency. Trends indicate an increasing preference for wellness tourism, integrating holistic treatments with conventional healthcare. The market also benefits from strategic collaborations between hospitals, travel agencies, and insurance providers, ensuring seamless medical travel experiences. With continuous investment in healthcare infrastructure and technology, Thailand is poised to strengthen its position as a global medical tourism hub in the coming years.

Thailand’s medical tourism industry is geographically diverse, with key regions such as Bangkok, the Eastern Economic Corridor (EEC), Chiang Mai, and Southern Thailand serving as major healthcare hubs. Bangkok remains the primary destination, offering world-class hospitals and specialized treatments. The EEC is emerging as a medical innovation hub, focusing on regenerative medicine and high-tech healthcare solutions. Chiang Mai attracts medical tourists seeking integrative healthcare, combining modern treatments with traditional Thai medicine, while Southern Thailand is popular for wellness and recovery tourism, particularly in Phuket and Koh Samui. Several key players contribute to Thailand’s medical tourism growth, including Bumrungrad International Hospital, Siam Fertility Clinic, Bangkok Smile Dental Group, and Thai Medical Vacation. These institutions provide high-quality treatments and personalized patient care, attracting international patients. Additionally, companies like Bookimed Limited facilitate medical travel by offering consultation and coordination services. Thailand’s advanced medical infrastructure and internationally accredited healthcare facilities continue to drive its position as a leading medical tourism destination.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Thailand medical tourism market was valued at USD 433.81 million in 2024 and is expected to reach USD 1,349.10 million by 2032, growing at a CAGR of 15.24% from 2024 to 2032.

- Increasing demand for affordable yet high-quality medical treatments attracts international patients, particularly for cosmetic, dental, and cardiovascular procedures.

- Technological advancements, including AI-driven diagnostics and telemedicine, enhance patient experience and improve accessibility to healthcare services.

- Intense competition from emerging medical tourism destinations such as India, Malaysia, and Singapore poses a challenge to Thailand’s market growth.

- Regulatory hurdles, including visa policies and insurance limitations for medical tourists, can impact the ease of access for international patients.

- Bangkok remains the leading medical tourism hub, followed by the Eastern Economic Corridor (EEC), Chiang Mai, and Southern Thailand, each catering to different patient needs.

- Key players such as Bumrungrad International Hospital, Bangkok Smile Dental Group, and Thai Medical Vacation drive market expansion through high-quality treatments and strategic partnerships.

Report Scope

This report segments the Thailand Medical Tourism Market as follows:

Market Drivers

Affordable and High-Quality Healthcare Services

Thailand’s medical tourism market thrives due to the availability of affordable yet world-class healthcare services. The country offers treatments at significantly lower costs than Western nations, making it a preferred destination for patients seeking cost-effective medical procedures. For instance, coronary angioplasty in Thailand costs between $4,500 and $10,600, compared to $55,000 to $57,000 in the U.S. Despite lower costs, hospitals in Thailand maintain high standards of care, employing internationally trained doctors and utilizing state-of-the-art medical technologies. Many healthcare facilities hold accreditations from global organizations such as the Joint Commission International (JCI), ensuring compliance with international healthcare standards. This cost-quality advantage attracts patients from developed nations where medical expenses are considerably high, as well as from neighboring Asian countries seeking specialized treatments. The ability to provide superior healthcare services at a fraction of the cost contributes significantly to the growth of Thailand’s medical tourism sector.

Government Support and Strategic Initiatives

The Thai government plays a pivotal role in promoting medical tourism through policies and initiatives designed to enhance the country’s healthcare sector. For instance, the introduction of specialized medical visas, such as the extended medical visa program, simplifies the process for international patients seeking treatment in Thailand. Additionally, the government actively collaborates with private hospitals to position the country as a leading medical tourism destination. Promotional campaigns highlight Thailand’s advanced medical capabilities, attracting patients from regions like the Middle East, Europe, and North America. Investment in healthcare infrastructure, tax incentives for medical institutions, and support for research and development further bolster the market. Such government-backed initiatives create a favorable ecosystem for the growth of medical tourism, ensuring sustained demand in the coming years.

Wide Range of Specialized Treatments and Advanced Technology

Thailand’s medical tourism sector benefits from its ability to offer a diverse range of medical treatments, including cosmetic surgery, dental care, fertility treatments, cardiology, orthopedics, and wellness therapies. The country is especially known for its expertise in aesthetic and reconstructive surgery, drawing thousands of international patients seeking high-quality procedures at competitive prices. Furthermore, the adoption of cutting-edge medical technologies, including robotic-assisted surgery, AI-driven diagnostics, and minimally invasive procedures, enhances treatment accuracy and patient outcomes. Thailand’s hospitals continually invest in research and innovation, ensuring that medical tourists have access to the latest advancements in healthcare. This commitment to technological excellence strengthens Thailand’s reputation as a global hub for specialized medical treatments.

Growing Demand for Wellness and Integrative Healthcare

The increasing popularity of wellness tourism further fuels Thailand’s medical tourism market. Many international patients seek a combination of medical treatment and holistic wellness experiences, such as spa therapies, traditional Thai medicine, and alternative healing practices. Thailand’s renowned wellness retreats and integrative healthcare centers attract visitors looking for post-treatment recovery programs and preventive healthcare solutions. The growing awareness of holistic well-being, coupled with Thailand’s expertise in both modern and traditional medicine, positions the country as an attractive destination for medical travelers. With rising global demand for wellness-focused healthcare, Thailand continues to expand its offerings in this segment, solidifying its status as a comprehensive medical and wellness tourism hub.

Market Trends

Rising Demand for Specialized and Elective Procedures

Thailand is witnessing a growing preference for specialized medical procedures, particularly in cosmetic surgery, dental care, fertility treatments, and orthopedic surgeries. For instance, Thailand is renowned for its aesthetic and reconstructive procedures, with hospitals like Yanhee International Hospital offering state-of-the-art facilities and highly skilled surgeons. Patients from Western countries, the Middle East, and Asia seek these treatments due to their affordability and high success rates in Thailand. The country is especially renowned for aesthetic and reconstructive procedures, with internationally accredited hospitals offering state-of-the-art facilities and highly skilled surgeons. Additionally, advancements in fertility treatments, such as in-vitro fertilization (IVF), attract couples from countries with restrictive regulations or high costs associated with such services. This rising demand for elective procedures continues to strengthen Thailand’s position as a premier medical tourism destination.

Integration of Digital Health and Telemedicine

The adoption of digital health solutions is transforming Thailand’s medical tourism landscape by enhancing patient experience and streamlining healthcare services. For instance, hospitals like Samitivej Hospital in Bangkok leverage telemedicine platforms to provide pre-consultations, post-operative care, and remote diagnostics, allowing international patients to engage with specialists before and after their medical visits. AI-driven diagnostics and robotic-assisted surgeries are also gaining traction, improving treatment accuracy and reducing recovery times. The integration of digital health technologies ensures seamless communication between medical professionals and patients, making healthcare more accessible and efficient. As Thailand continues to invest in smart healthcare solutions, digitalization will play a crucial role in attracting medical tourists.

Growing Popularity of Wellness and Alternative Medicine

Thailand is expanding beyond conventional medical tourism by integrating wellness tourism into its healthcare offerings. International travelers increasingly seek holistic healthcare solutions, including traditional Thai medicine, spa therapies, detox programs, and mindfulness retreats. Many hospitals and wellness centers now offer personalized recovery programs that combine medical treatments with rejuvenation therapies. The country’s serene landscapes, coupled with its expertise in alternative medicine, make it an attractive destination for post-treatment recovery and preventive healthcare. With growing global awareness of integrative medicine, Thailand’s wellness-focused approach continues to drive its medical tourism sector.

Expansion of Healthcare Infrastructure and International Collaborations

Thailand’s continuous investment in healthcare infrastructure and global partnerships significantly contributes to its medical tourism growth. Leading private hospitals are expanding their facilities, incorporating cutting-edge medical equipment, and enhancing patient-centric services to cater to the increasing influx of international patients. Collaborations with international healthcare providers, insurance companies, and travel agencies streamline medical travel, ensuring hassle-free experiences for patients. Additionally, initiatives to attract highly skilled medical professionals and researchers further elevate the country’s healthcare standards. These strategic developments strengthen Thailand’s reputation as a global medical tourism hub and reinforce its long-term growth potential in the industry.

Market Challenges Analysis

Intense Competition from Emerging Medical Tourism Destinations

Thailand faces growing competition from emerging medical tourism hubs such as India, Malaysia, Singapore, and South Korea. For instance, India provides cost-effective treatments with internationally accredited hospitals like Apollo Hospitals, while Singapore is known for its cutting-edge medical technology and premium healthcare services at institutions like Mount Elizabeth Hospital. Malaysia has also positioned itself as a strong contender in the medical tourism sector by offering high-quality care at affordable rates. This increasing competition puts pressure on Thailand to continuously innovate, upgrade its healthcare infrastructure, and enhance patient services to maintain its market dominance. Additionally, some patients may opt for destinations closer to their home countries to reduce travel costs and logistical challenges, further intensifying the competitive landscape.

Regulatory and Logistical Challenges in Medical Travel

Despite Thailand’s strong reputation in medical tourism, regulatory and logistical challenges pose significant hurdles to market growth. Visa restrictions, varying insurance coverage for medical tourists, and complex cross-border healthcare regulations can create barriers for international patients. While Thailand has introduced medical visas to facilitate patient inflow, bureaucratic processes and policy changes may still impact ease of access. Additionally, language barriers and cultural differences can sometimes lead to miscommunication between patients and healthcare providers, affecting overall patient satisfaction. Another critical challenge is ensuring consistent quality standards across all medical facilities, as variations in service quality may impact Thailand’s global reputation. Addressing these regulatory and operational obstacles through policy improvements, international partnerships, and enhanced patient support services will be essential in sustaining Thailand’s leadership in the medical tourism industry.

Market Opportunities

Thailand’s medical tourism market presents significant opportunities for growth, driven by the increasing demand for high-quality yet affordable healthcare services. Expanding specialized treatments, such as cosmetic surgery, fertility treatments, and advanced orthopedic procedures, allows Thailand to attract a broader patient base from regions like Europe, the Middle East, and Asia. Additionally, leveraging digital health technologies, including telemedicine and AI-driven diagnostics, enhances patient engagement and streamlines the treatment process. By investing in smart healthcare solutions, Thailand can offer seamless pre- and post-treatment consultations, making medical travel more convenient for international patients. Strengthening partnerships with global insurance providers and healthcare facilitators can further improve accessibility, ensuring that patients from diverse regions can receive treatment with minimal financial and logistical challenges.

Another key opportunity lies in integrating wellness tourism with medical services. Thailand is already a global leader in wellness tourism, offering holistic therapies, spa treatments, and alternative medicine such as traditional Thai healing practices. By combining conventional medical treatments with wellness programs, the country can position itself as a comprehensive healthcare destination that caters to both curative and preventive healthcare needs. Developing specialized recovery centers that blend post-surgical rehabilitation with wellness retreats can appeal to international patients seeking a holistic healing experience. Furthermore, ongoing investments in healthcare infrastructure, accreditation programs, and international collaborations will strengthen Thailand’s reputation as a top-tier medical tourism hub. By capitalizing on these opportunities, Thailand can further expand its medical tourism market and reinforce its position as a preferred destination for world-class healthcare.

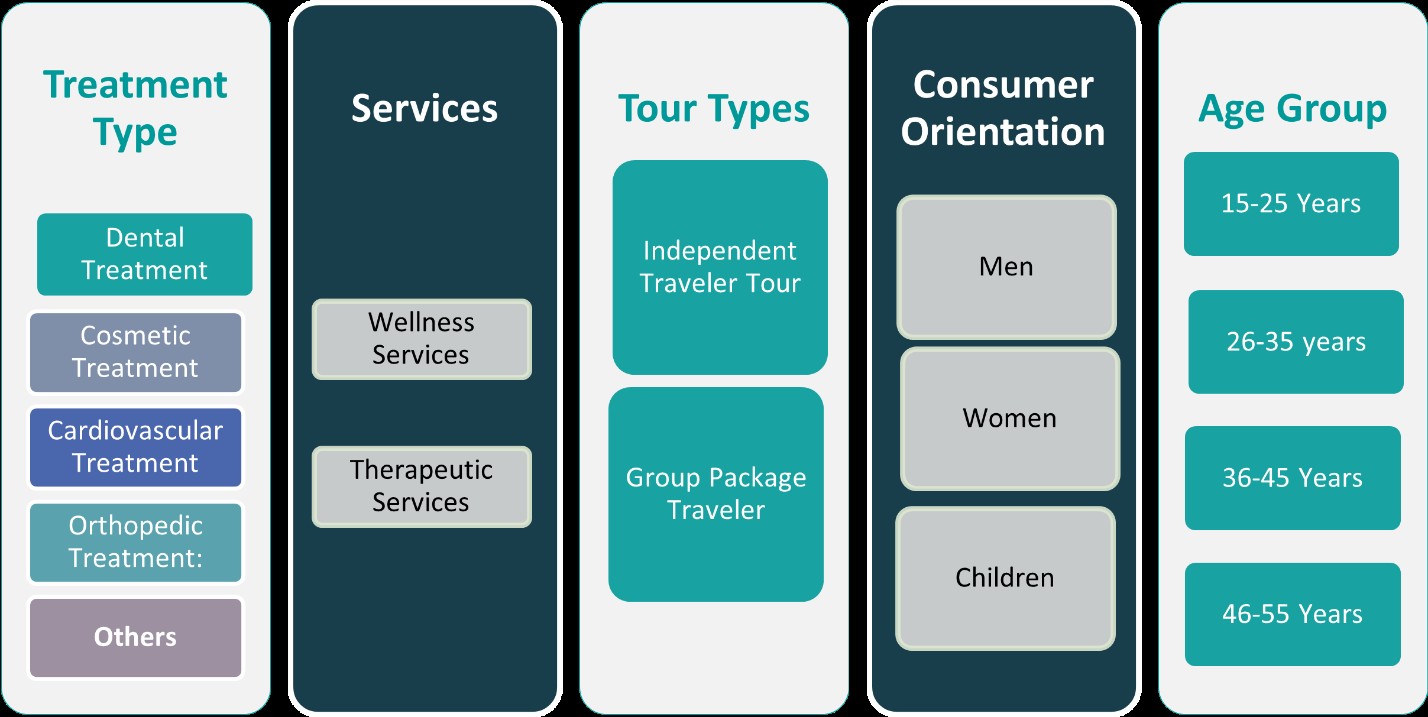

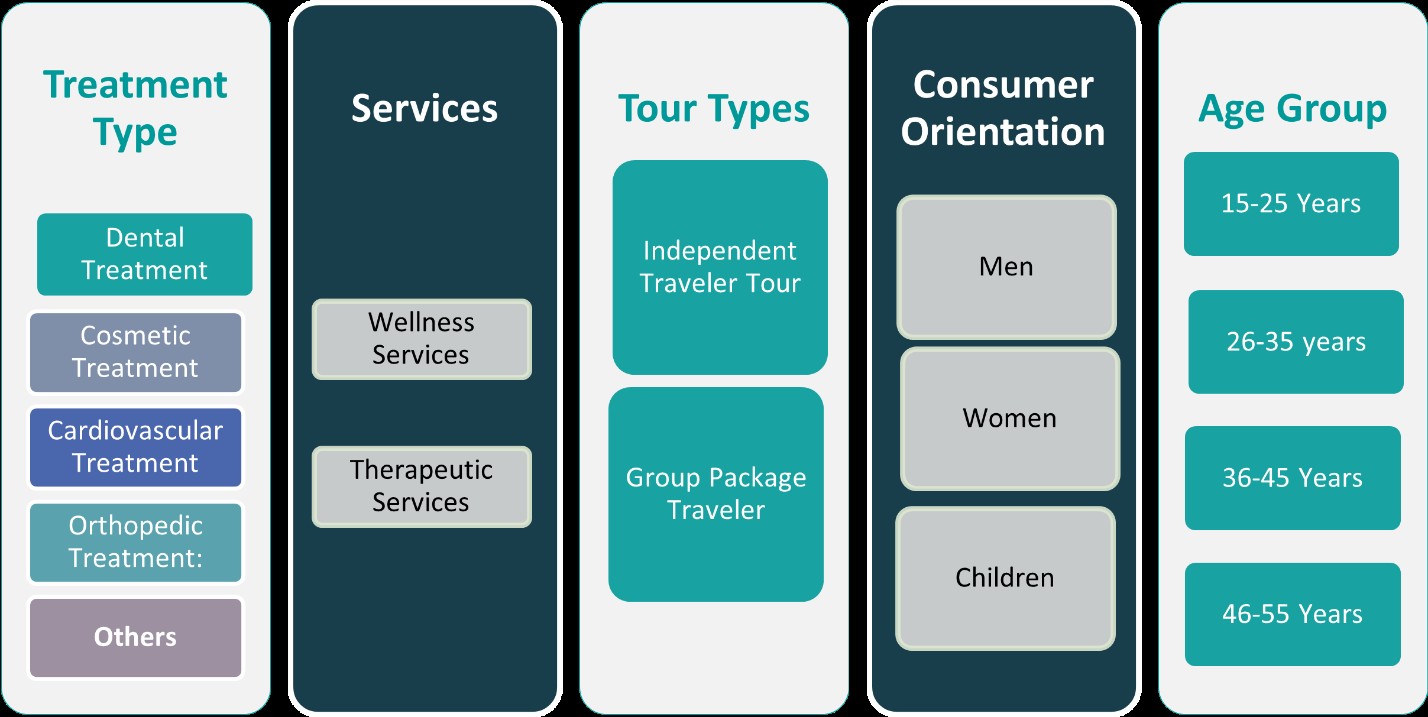

Market Segmentation Analysis:

By Treatment:

The Thailand medical tourism market is segmented based on treatment types, including dental treatment, cosmetic treatment, cardiovascular treatment, orthopedic treatment, and others. Dental treatment remains one of the most sought-after services, attracting international patients due to its affordability and high-quality procedures such as implants, veneers, and orthodontics. Cosmetic treatment also holds a significant share, with Thailand being a global hub for aesthetic surgeries, including rhinoplasty, liposuction, and facelifts, performed at internationally accredited hospitals. The demand for cardiovascular treatment is rising as advanced procedures such as heart bypass surgery and angioplasty become more accessible at competitive prices. Orthopedic treatment is another key segment, with patients seeking joint replacements, spinal surgeries, and sports injury treatments from highly skilled specialists. Other medical services, such as fertility treatments, oncology, and neurology, also contribute to market growth as Thailand continues to enhance its medical infrastructure and technology. The availability of specialized treatments across various medical disciplines strengthens Thailand’s position as a preferred destination for medical tourists worldwide.

By Services:

The market is also categorized based on services, including wellness services and therapeutic services, both of which play a vital role in attracting international patients. Wellness services encompass holistic healthcare solutions such as spa therapies, traditional Thai healing practices, detox programs, and rehabilitation services. These services appeal to medical tourists seeking not only curative treatments but also preventive healthcare and post-treatment recovery. The integration of medical and wellness tourism enhances patient experience and promotes long-term health benefits. Therapeutic services, on the other hand, cover specialized medical treatments and procedures across various disciplines. With world-class hospitals offering personalized healthcare plans, Thailand provides a seamless experience for patients seeking surgical and non-surgical treatments. Additionally, the growing trend of combining therapeutic and wellness services allows patients to recover in a stress-free environment, further positioning Thailand as a leading destination for comprehensive medical care. The increasing focus on patient-centric services continues to drive Thailand’s medical tourism industry forward.

Segments:

Based on Treatment:

- Dental Treatment

- Cosmetic Treatment

- Cardiovascular Treatment

- Orthopedic Treatment

- Others

Based on Services:

- Wellness Services

- Therapeutic Services

Based on Tour Type:

- Independent Traveler Tour

- Group Package Traveler

Based on Consumer Orientation:

Based on the Geography:

- Bangkok

- Eastern Economic Corridor (EEC)

- Chiang Mai

- Southern Thailand

Regional Analysis

Bangkok

Bangkok holds the largest share of Thailand’s medical tourism market, accounting for approximately 55% of the total market. As the capital city and primary healthcare hub, Bangkok is home to some of the country’s most prestigious hospitals and medical centers, including internationally accredited institutions such as Bumrungrad International Hospital and Bangkok Hospital. These facilities attract a large influx of international patients seeking advanced medical treatments, including cosmetic surgery, cardiovascular procedures, and orthopedic care. The city’s well-developed infrastructure, availability of English-speaking medical professionals, and seamless travel connectivity make it the top choice for medical tourists. Additionally, Bangkok offers luxury accommodations and medical wellness packages, further enhancing the patient experience.

Eastern Economic Corridor (EEC)

The Eastern Economic Corridor (EEC) contributes around 20% of the medical tourism market, benefiting from the Thai government’s initiative to develop the region into a high-tech medical hub. Comprising provinces such as Chonburi, Rayong, and Chachoengsao, the EEC features emerging healthcare facilities catering to both expatriates and international medical tourists. The region is particularly known for specialized treatments such as regenerative medicine, anti-aging therapies, and rehabilitation services. Moreover, the Thai government has invested in medical research, biotechnology, and digital health solutions within the EEC, further strengthening its position in the medical tourism sector. Proximity to major industrial zones and international airports also facilitates patient inflow from neighboring countries.

Chiang Mai

Chiang Mai accounts for approximately 15% of Thailand’s medical tourism market, emerging as a preferred destination for wellness tourism and integrative healthcare. The region is well known for combining modern medical treatments with traditional Thai healing practices, such as herbal medicine, acupuncture, and holistic therapies. Chiang Mai’s private hospitals offer high-quality treatments in areas such as dentistry, dermatology, and alternative medicine, attracting patients from Western countries, China, and neighboring ASEAN nations. Additionally, the city’s serene environment and lower cost of living compared to Bangkok make it an attractive option for long-term medical stays and post-treatment recovery programs. Chiang Mai continues to gain recognition as a key player in Thailand’s medical tourism industry, with investments in healthcare infrastructure further boosting its growth.

Southern Thailand

Southern Thailand holds an estimated 10% market share, driven by its appeal as a wellness and recovery destination. The region, which includes Phuket, Krabi, and Koh Samui, is popular for medical tourists seeking post-surgical rehabilitation, spa treatments, and specialized wellness programs. Phuket, in particular, has established itself as a key location for cosmetic surgery, dental procedures, and wellness retreats, offering high-quality care with scenic coastal backdrops. Additionally, the presence of international hospitals and clinics catering to expatriates and tourists strengthens Southern Thailand’s role in the medical tourism sector. The region’s luxury resorts and health retreats provide medical tourists with a relaxing environment for recovery, making it an ideal choice for wellness-focused healthcare.

Key Player Analysis

- Bumrungrad International Hospital

- Siam Fertility Clinic

- Bangkok Smile Dental Group

- Thai Medical Vacation

- Bookimed Limited

Competitive Analysis

Thailand’s medical tourism market is highly competitive, with leading players such as Bumrungrad International Hospital, Siam Fertility Clinic, Bangkok Smile Dental Group, Thai Medical Vacation, and Bookimed Limited driving industry growth. These institutions offer world-class medical services, internationally accredited healthcare facilities, and personalized patient care, attracting medical tourists from across the globe. Bumrungrad International Hospital stands out as a premier multi-specialty hospital, renowned for advanced treatments, cutting-edge technology, and a high influx of international patients. Siam Fertility Clinic specializes in reproductive healthcare, providing innovative fertility treatments for international couples. Bangkok Smile Dental Group has established itself as a leading dental care provider, offering high-quality services at competitive prices. Thai Medical Vacation and Bookimed Limited play a crucial role in facilitating medical travel, offering consultation, travel assistance, and hospital coordination. These key players focus on technological advancements, strategic partnerships, and service diversification to maintain Thailand’s position as a leading destination for medical tourism.

Recent Developments

- In March 2025, Raffles Medical Group signed a strategic collaboration agreement with Shanghai Renji Hospital to establish a “dual circulation” service system. This partnership aims to promote cross-border healthcare services and position Shanghai as a hub for international medical tourism.

- In March 2025, MOHW Hengchun Tourism Hospital was highlighted as a key player in the global medical tourism market in a report projecting significant growth for the industry. The hospital continues to play a pivotal role in expanding medical tourism opportunities, particularly in Asia.

- In February 2025, Apollo Hospitals emphasized the need for a liberal visa policy to enhance India’s medical tourism sector. The hospital is collaborating with the Indian government on the “Heal in India” initiative to attract international patients and streamline medical visa processes.

- In January 2025, Mount Elizabeth Hospitals unveiled new facilities under “Project Renaissance,” which included expanded wards, upgraded critical care units, and additional single-bedded and negative pressure rooms. This expansion added 62 beds to its capacity and enhanced patient care infrastructure.

Market Concentration & Characteristics

The Thailand medical tourism market exhibits a moderate to high market concentration, with a few leading hospitals and specialized clinics dominating the industry. Renowned institutions such as Bumrungrad International Hospital, Bangkok Hospital, and Samitivej Hospital hold a significant share due to their international accreditation, advanced medical technology, and strong reputation among foreign patients. The market is characterized by high service quality, affordability, and specialized treatments, particularly in cosmetic surgery, dental care, cardiovascular procedures, and fertility treatments. Thailand’s healthcare facilities attract patients from Asia, the Middle East, and Western countries due to their cost-effective yet world-class medical services. Additionally, the industry benefits from government support, strategic collaborations with insurance providers, and well-established medical travel agencies that streamline the patient journey. As competition grows, healthcare providers continue to invest in digital health solutions, wellness integration, and infrastructure improvements to enhance Thailand’s position as a leading medical tourism destination.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Treatment, Services, Tour Type, Consumer Orientation and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Thailand’s medical tourism industry is expected to witness sustained growth due to increasing demand for high-quality yet affordable healthcare services.

- Investments in advanced medical technologies, including AI-driven diagnostics and robotic-assisted surgeries, will enhance treatment efficiency and patient outcomes.

- Expansion of specialized healthcare services such as fertility treatments, regenerative medicine, and minimally invasive surgeries will attract more international patients.

- Integration of wellness tourism with medical treatments will strengthen Thailand’s position as a holistic healthcare destination.

- Government initiatives and policy support will improve infrastructure, streamline visa processes, and promote international collaborations.

- Rising competition from other medical tourism destinations will drive Thai healthcare providers to innovate and enhance service quality.

- Strengthening partnerships with global insurance providers will increase accessibility for international patients and boost market penetration.

- Digital health solutions, including telemedicine and AI-powered patient management, will improve the overall medical tourism experience.

- Sustainable healthcare practices and eco-friendly hospital infrastructure will gain importance in attracting environmentally conscious patients.

- Continuous investments in research and development will drive medical advancements and reinforce Thailand’s reputation as a global healthcare hub.