Market Overview

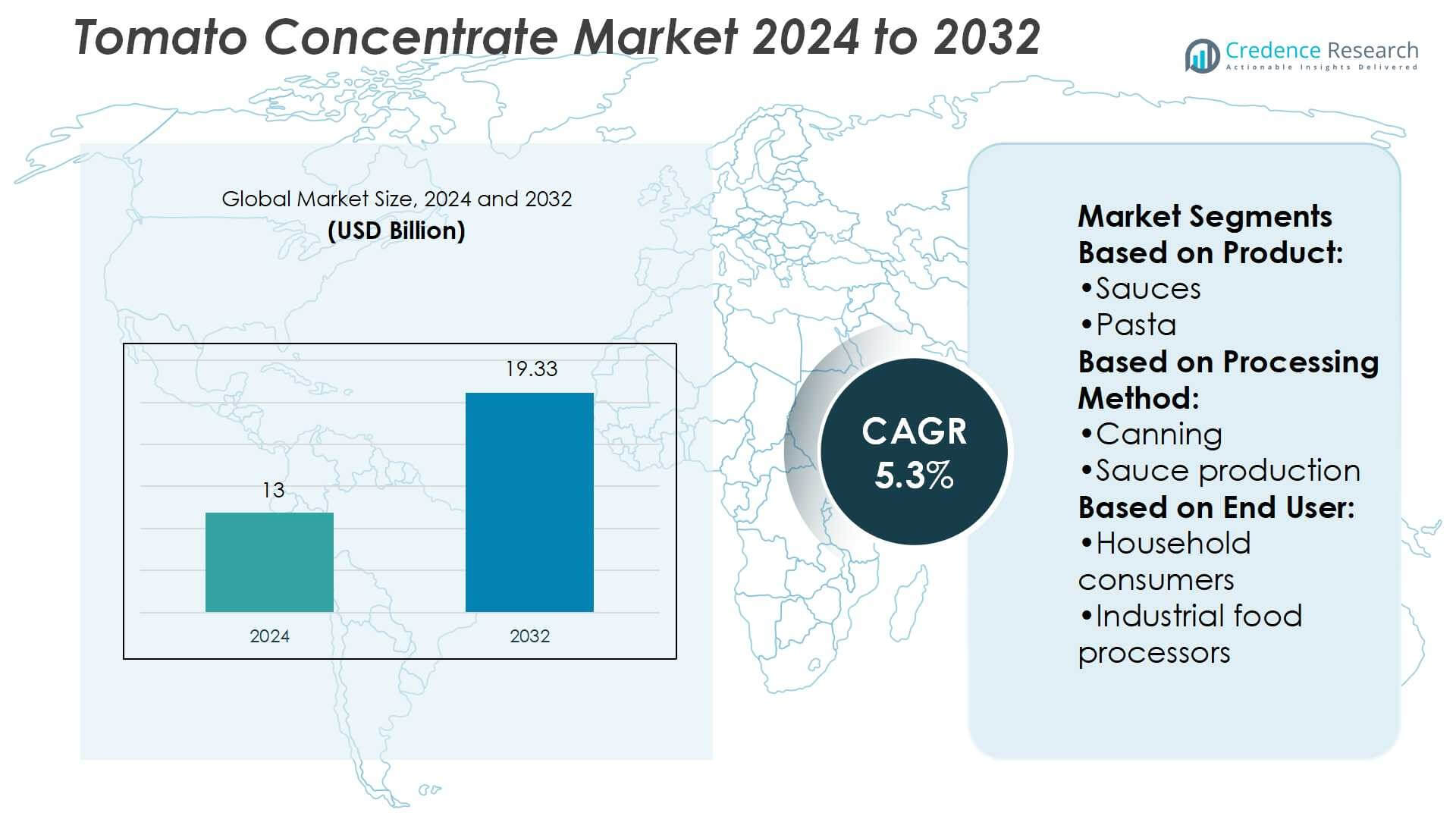

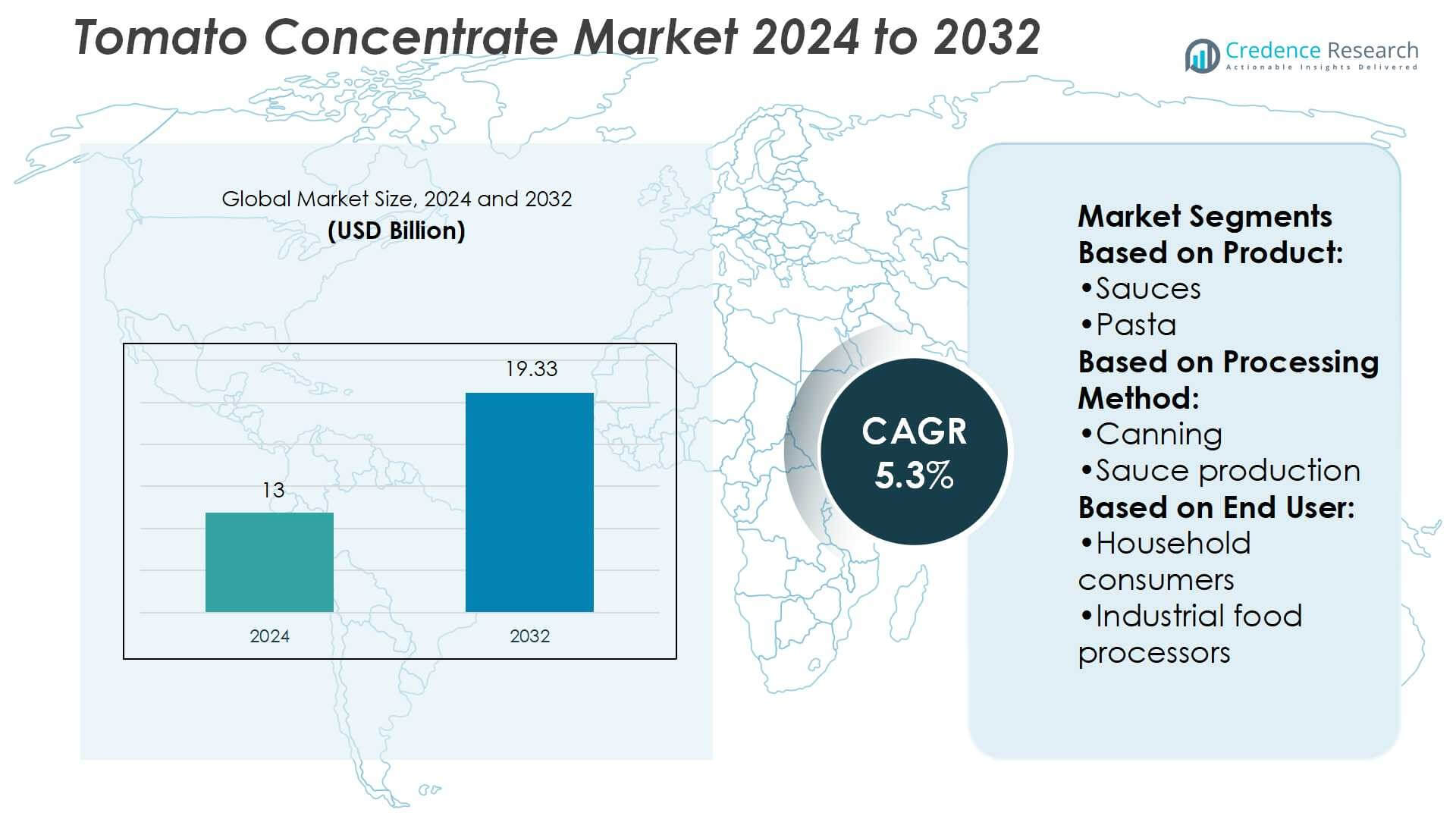

Tomato Concentrate Market size was valued USD 13 billion in 2024 and is anticipated to reach USD 19.33 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Tomato Concentrate Market Size 2024 |

USD 13 Billion |

| Tomato Concentrate Market, CAGR |

5.3% |

| Tomato Concentrate Market Size 2032 |

USD 19.33 Billion |

The Tomato Concentrate Market features strong competition among global and regional players such as Del Monte Foods, Inc., JBT Corporation, Kagome Co., Ltd., Food & Biotech Engineers (India) Pvt. Ltd., J.G. Boswell Tomato Company, Los Gatos Tomato Products, ConAgra Brands, Inc., CONESA Group, CFT Group, and Campbell Soup Company. These companies focus on capacity expansion, product innovation, and sustainable sourcing to strengthen their market positions. Asia-Pacific leads the global tomato concentrate market with a 34% share, supported by high tomato production, rising consumption of packaged foods, and rapid urbanization. This regional dominance reflects both supply strength and growing demand across industrial and household segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The tomato concentrate market was valued at USD 13 billion in 2024 and is expected to reach USD 19.33 billion by 2032, registering a CAGR of 5.3%.

- Rising demand for processed and convenience foods, along with the growing use of tomato-based products in sauces, ketchup, and beverages, is a major driver boosting global consumption.

- Clean-label and organic product preferences are shaping key trends, with manufacturers investing in advanced processing technologies to enhance quality and sustainability.

- Intense competition from global and regional players, along with raw tomato price volatility, remains a significant restraint impacting profitability and supply stability.

- Asia-Pacific leads with a 34% market share, driven by strong tomato production and urban demand, while sauces dominate the product segment with a 28% share, reflecting their widespread use in both household and industrial applications.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

Within the tomato concentrate market, sauces hold the dominant position with a 28% share. Their leadership stems from widespread consumption in both household and commercial cooking, driven by convenience and versatility. The demand for ready-to-cook meals, coupled with rising urban lifestyles, fuels this segment’s growth. Pasta and ketchup also show steady expansion, supported by international cuisine adoption and quick-service restaurants. Meanwhile, canned tomatoes and puree cater to long shelf-life needs, while diced and chopped forms meet culinary customization. Juice, powder, and other products serve niche beverage and industrial uses, expanding the overall product portfolio.

- For instance, JBT Marel’s TREIF dicers offer a range of capacities to suit different needs, from the entry-level FELIX, which processes up to 800 kg/hour, to higher-performance models like the ARGON+ (up to 2 tonnes/hour) and the TWISTER (up to 3.5 tonnes/hour).

By Processing Method

Concentration represents the largest sub-segment, accounting for 32% of market share. This dominance is due to its critical role in creating purees, pastes, and industrial inputs with high shelf stability. Concentrated forms allow cost-effective transportation and large-scale usage in packaged foods and sauces. Sauce production and canning follow closely, driven by rising demand from restaurants and households seeking convenience. Juice extraction caters to beverage markets, while drying and freezing expand applications in processed food manufacturing. Fermentation, though smaller in scale, is gaining relevance in specialty foods and health-oriented tomato derivatives.

- For instance, in integrating Ingomar (USA), Kagome now processes 1.55 million metric tons of processing tomatoes annually at Ingomar’s facility into paste and diced tomato products.

By End User

Industrial food processors lead this category, holding a 40% share of demand in the tomato concentrate market. Their dominance arises from consistent use in ready meals, condiments, and packaged food production. The household consumer segment remains strong, supported by urbanization and at-home cooking trends. Beverage industries utilize tomato juice and concentrates for health-focused products, while the pharmaceutical industry explores lycopene-rich extracts for supplements. Other applications, including foodservice and institutional buyers, also support steady demand. The industrial segment’s reliance on bulk supply and standardized quality continues to anchor overall market stability and growth.

Key Growth Drivers

Rising Demand for Processed and Convenience Foods

The increasing global preference for processed and convenience foods is a major driver in the tomato concentrate market. Busy lifestyles and urbanization are boosting the consumption of ready-to-eat meals, sauces, and packaged products that rely heavily on tomato-based ingredients. Foodservice outlets and quick-service restaurants also drive bulk demand for ketchup, sauces, and puree. The versatility of tomato concentrates across cuisines makes them indispensable in both household and industrial applications, supporting continuous market expansion and product innovation in various packaged food segments.

- For instance, Boswell does own significant acreage in the San Joaquin Valley, with specific figures reported around 132,000 acres in Kings County, 3,700 acres in Tulare County, and 23,000 acres in Kern County.

Expanding Applications in Beverage and Nutraceuticals

Tomato concentrates are gaining traction in the beverage and nutraceutical industries, driven by rising consumer interest in health-oriented products. Lycopene-rich tomato juice and extracts are widely recognized for their antioxidant and cardiovascular health benefits. Beverage producers are introducing fortified juices and blends targeting health-conscious consumers. The pharmaceutical and nutraceutical industries increasingly utilize tomato extracts for dietary supplements and functional foods. This expanding use beyond traditional culinary applications is creating sustained demand and diversifying revenue streams for manufacturers in the global tomato concentrate market.

- For instance, A cross-functional team successfully reduced tomato yield loss by 1.8% year-over-year. This translated to recovering 6,900 tons of tomatoes over 115 days.

Strong Growth in Emerging Economies

Emerging economies are fueling market growth due to rapid urbanization, rising disposable incomes, and changing dietary preferences. Countries in Asia-Pacific, Latin America, and Africa are witnessing increased demand for packaged foods, sauces, and tomato-based products. Expanding retail infrastructure and greater availability of international cuisines further accelerate adoption. Industrial food processors in these regions are scaling up operations to meet growing domestic and export demand. This trend, supported by government initiatives for food processing industries, positions emerging markets as crucial growth engines for the tomato concentrate sector.

Key Trends & Opportunities

Shift Toward Organic and Clean-Label Products

Consumers are increasingly demanding organic and clean-label tomato concentrates free from artificial preservatives and additives. This trend is driven by rising awareness of health and sustainability. Manufacturers are expanding portfolios with certified organic puree, juice, and sauces to cater to premium health-focused segments. The clean-label movement also encourages shorter ingredient lists and natural processing methods. As consumers seek transparency and healthier food choices, the organic tomato concentrate segment presents significant growth opportunities for producers willing to invest in certification and sustainable sourcing practices.

- For instance, CFT ART3MIS Long Run MVR™ evaporator installed at Empresas Carozzi uses a descending circulation design allowing the unit to raise tomato concentrate from about 8.5 °Brix to 14-16 °Brix, removing over 80% of the water content.

Innovation in Processing Technologies

Advancements in processing technologies are creating new opportunities for efficiency and product differentiation. Techniques like cold concentration, aseptic packaging, and advanced drying methods help preserve flavor, nutrition, and shelf life. These innovations improve supply chain efficiency by reducing waste and transportation costs while meeting consumer demand for high-quality products. Manufacturers adopting modern technologies also achieve better scalability for industrial clients. Investment in such solutions strengthens competitiveness, supports sustainability goals, and enables companies to deliver innovative tomato-based products tailored to evolving consumer preferences.

- For instance, Campbell conducted a water-energy nexus assessment at one of its California tomato processing plants that quantified recovery of about 70 million gallons of process water per season, enabling reduced electricity and thermal energy use through hot-water reuse and improved steam system efficiency.

Key Challenges

Price Volatility of Raw Tomatoes

The tomato concentrate market faces a major challenge from fluctuations in raw tomato prices. Seasonal variations, crop diseases, and climate-related disruptions significantly affect supply stability. Price volatility increases production costs for manufacturers, impacting profitability and pricing strategies. Dependence on agricultural cycles also creates risks for processors tied to regional sourcing. Unpredictable input costs force companies to implement hedging strategies or diversify sourcing, but the inherent uncertainty in tomato supply continues to present a persistent barrier to stable market operations and long-term planning.

High Competition and Product Substitution

Intense competition among global and regional players poses a challenge in sustaining margins. The availability of substitutes such as synthetic flavorings, alternative sauces, and vegetable concentrates also limits growth potential in some segments. Companies must differentiate through quality, branding, and value-added innovations like organic or fortified products. Private-label brands in retail further increase competitive pressure on established players. Maintaining product consistency, brand loyalty, and cost competitiveness are key hurdles. Without continuous innovation, businesses may struggle to sustain growth in this highly competitive and price-sensitive market.

Regional Analysis

North America

North America holds a 27% share of the tomato concentrate market, driven by strong consumption of sauces, ketchup, and processed foods. The U.S. leads with high demand from fast-food chains, packaged food producers, and beverage manufacturers. Rising health awareness also boosts demand for lycopene-rich juices and nutraceutical applications. Canada supports steady growth with increasing adoption of organic and clean-label products. Industrial food processors dominate demand, while household consumption remains consistent. Investment in advanced processing and distribution channels further strengthens the region’s position, ensuring stable supply and expanding product availability across diverse consumer categories.

Europe

Europe accounts for 24% of the global tomato concentrate market, supported by established food processing industries and high per capita consumption of sauces and pasta products. Italy, Spain, and France lead production and consumption, benefiting from strong agricultural output and culinary traditions. Demand for organic, clean-label, and sustainably sourced tomato products is particularly strong in Western Europe. Industrial processors and household consumers both contribute significantly, while Eastern Europe shows rising growth potential. Stringent food safety standards and investments in advanced processing technologies enhance product quality, helping maintain Europe’s competitive share in the global market.

Asia-Pacific

Asia-Pacific dominates the tomato concentrate market with a 34% share, driven by rapid urbanization, rising disposable incomes, and growing demand for packaged foods. China and India are major growth engines, supported by increasing adoption of international cuisines and expansion of quick-service restaurants. Japan and South Korea contribute through demand for beverages and nutraceutical applications. Industrial food processors represent the largest consumers, while household adoption rises with lifestyle changes. Expanding retail infrastructure and government support for food processing industries further strengthen the region’s dominance, positioning Asia-Pacific as the fastest-growing market for tomato concentrates globally.

Latin America

Latin America captures a 9% market share, supported by strong tomato production in countries like Brazil and Mexico. The region benefits from both domestic consumption and export opportunities, particularly to North America and Europe. Processed food demand is rising due to changing urban lifestyles and greater acceptance of packaged sauces, purees, and juices. Brazil leads industrial processing, while Mexico supports beverage and foodservice demand. Household consumption remains steady, with growing interest in convenience foods. Expansion of local processing facilities and increasing participation in global trade channels strengthen Latin America’s role in the tomato concentrate industry.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the global tomato concentrate market, supported by growing urban populations and rising demand for affordable packaged foods. Countries like Saudi Arabia, UAE, and South Africa are key consumers, with sauces and ketchup dominating applications. Industrial processors and foodservice sectors drive imports, while domestic production remains limited in many parts of the region. Increasing demand for convenience products and beverages is creating growth opportunities. However, reliance on imports makes the region vulnerable to price fluctuations. Expanding retail networks and rising middle-class consumption fuel gradual market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product:

By Processing Method:

By End User:

- Household consumers

- Industrial food processors

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

- Africa

- South Africa

- Egypt

- Rest of Africa

Competitive Landscape

The competitive landscape of The Tomato Concentrate Market players including Del Monte Foods, Inc., JBT Corporation, Kagome Co., Ltd., Food & Biotech Engineers (India) Pvt. Ltd., J.G. Boswell Tomato Company, Los Gatos Tomato Products, ConAgra Brands, Inc., CONESA Group, CFT Group, and Campbell Soup Company. The tomato concentrate market is highly competitive, characterized by a mix of multinational brands and regional processors focusing on efficiency, innovation, and product diversification. Companies are investing in advanced processing technologies such as aseptic packaging, cold concentration, and drying methods to enhance quality, extend shelf life, and optimize supply chains. Growing consumer demand for organic, clean-label, and nutraceutical-grade products is pushing manufacturers to adopt sustainable practices and pursue certifications that ensure transparency. Competition is further intensified by private-label brands and local suppliers offering cost-effective solutions. Strategic collaborations, capacity expansions, and global distribution networks remain key strategies to strengthen market presence.

Key Player Analysis

- Del Monte Foods, Inc

- JBT Corporation

- Kagome Co., Ltd.

- Food & Biotech Engineers (India) Pvt. Ltd.

- G. Boswell Tomato Company

- Los Gatos Tomato Products

- ConAgra Brands, Inc

- CONESA Group

- CFT Group

- Campbell Soup Company

Recent Developments

- In August 2024, Langer’s released a new line of Agua Fresca drink in three flavors. Strawberry Hibiscus, Mango Lime, and Cucumber Lime. These beverages aim to deliver refreshing and vibrant taste profiles inspired by traditional Latin American beverages.

- In February 2024, Austria Juice showcased its range of organic juice concentrates at BioFach 2023, introducing innovative products such as a pomegranate berry mix and a lime guava drink. The company emphasizes the use of organic fruits, particularly red fruits and apples, in response to the growing demand for organic beverages.

- In September 2023, Conagra Brands Canada unveiled new state-of-the-art upgrades to its tomato processing plant in Dresden, Ontario. The multi-million-dollar investment underscored Conagra’s commitment to delivering high-quality, locally sourced food to consumers in Canada, enhancing production capabilities for tomato-based products.

- In September 2023, Heinz introduced a special edition Heinz Tomato Ketchup Pasta Sauce, blending the iconic taste of Heinz Tomato Ketchup with a tomato sauce made from sun-ripened Italian tomatoes. This launch targeted Heinz enthusiasts who enjoy ketchup on pasta, tapping into a niche preference among 24% of BriTons.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for processed and convenience foods.

- Emerging economies will drive growth through urbanization and lifestyle changes.

- Health-focused products using lycopene-rich concentrates will gain wider acceptance.

- Organic and clean-label tomato concentrates will see strong consumer preference.

- Advanced processing technologies will improve product quality and supply efficiency.

- Industrial food processors will remain the largest end-user segment.

- Beverage applications will grow with the introduction of fortified juice products.

- Strategic mergers and partnerships will enhance global distribution networks.

- Retail and foodservice sectors will increase demand for packaged sauces and purees.

- Sustainability initiatives will shape production practices and strengthen brand positioning.

Market Segmentation Analysis:

Market Segmentation Analysis: