Market Overview:

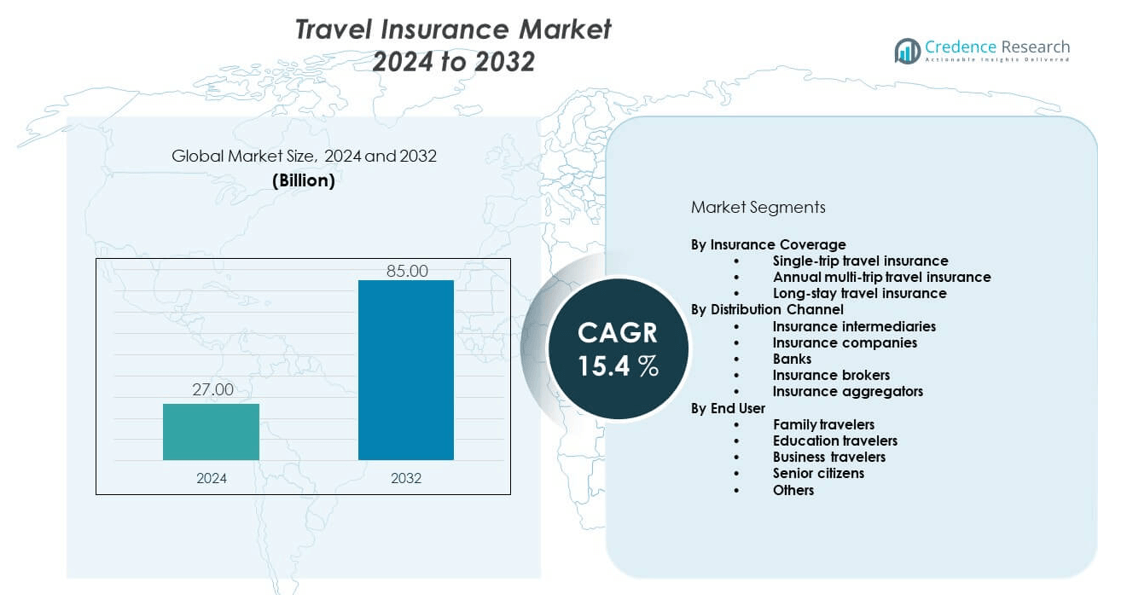

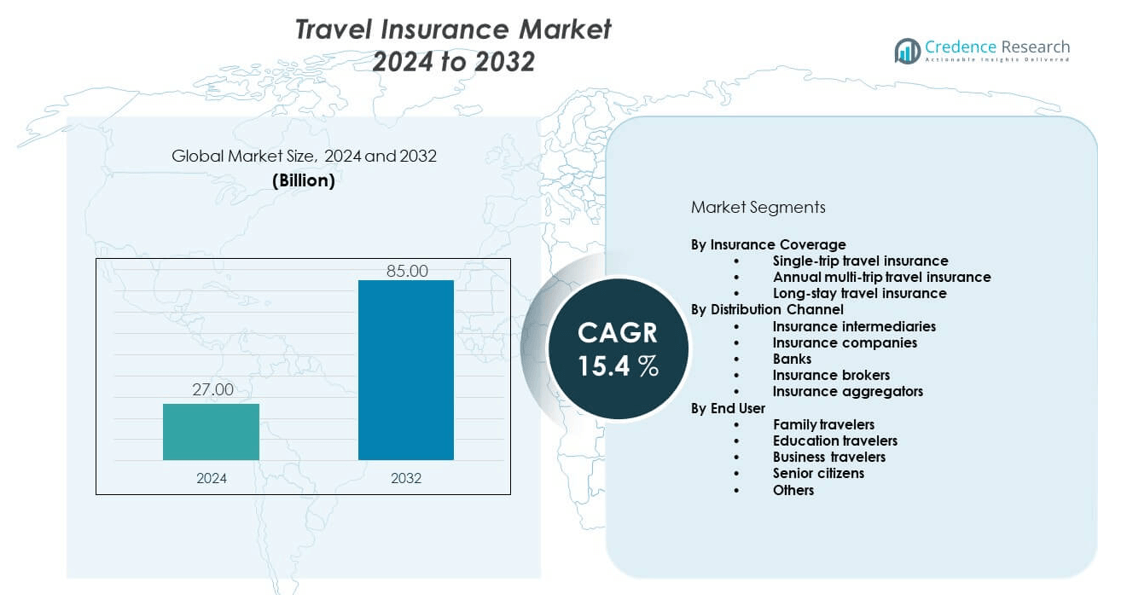

The travel insurance market is projected to grow from USD 27 billion in 2024 to an estimated USD 85 billion by 2032, registering a strong CAGR of 15.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Travel Insurance Market Size 2024 |

USD 27 billion |

| Travel Insurance Market, CAGR |

15.4% |

| Travel Insurance Market Size 2032 |

USD 85 billion |

Growing international tourism, higher disposable incomes, and stricter visa requirements are driving demand for travel insurance. Travelers actively seek policies that ensure security against unpredictable events, and insurers are responding by offering flexible, digital-first solutions. The integration of AI-driven claims processing, partnerships with airlines and online travel agencies, and the growing adoption of mobile platforms have enhanced accessibility. Strong growth in business travel, coupled with the rising adoption of multi-trip and annual policies, further supports market expansion.

From a regional perspective, North America and Europe lead the travel insurance market, supported by high outbound travel volumes, well-established insurance networks, and strong regulatory frameworks mandating coverage in several cases. The Asia Pacific region is emerging rapidly, fueled by growing middle-class populations, increasing overseas travel, and rising awareness about risk protection in countries such as China, India, and Japan. Latin America and the Middle East are also gaining traction as international travel increases, supported by expanding air connectivity and rising tourism investments.

Market Insights:

- The travel insurance market is projected to grow from USD 27 billion in 2024 to USD 85 billion by 2032, registering a CAGR of 15.4% during the forecast period.

- Strong demand arises from increasing global travel activity, growing disposable incomes, and higher awareness of financial protection during trips.

- Medical emergency coverage remains the key driver as rising healthcare costs abroad push travelers to secure insurance before departure.

- Fraudulent claims, lack of transparency in settlements, and regulatory complexities across regions act as major restraints for market expansion.

- North America and Europe lead adoption, supported by strong outbound travel volumes and established insurance networks.

- Asia Pacific is emerging as a high-growth region, driven by rising middle-class populations, increasing international travel, and greater awareness of travel-related risks.

- Latin America and the Middle East show gradual growth momentum, supported by expanding tourism infrastructure and rising outbound travel rates.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising International Tourism and Growing Need for Risk Protection:

The travel insurance market expands rapidly due to the surge in international and domestic tourism. Consumers prioritize safety and financial security while traveling, pushing demand for insurance products that cover medical emergencies, trip cancellations, and theft. Governments and airlines encourage insurance adoption through stricter visa requirements and integrated booking processes. It gains further strength from rising disposable incomes that encourage frequent travel. The ability of policies to minimize financial losses from unpredictable events makes them increasingly attractive. Digital adoption accelerates accessibility and enhances policy penetration across diverse traveler groups. Insurers introduce flexible products tailored to leisure and business travelers, which improves overall demand. The sustained growth of global travel volumes continues to act as a primary driver for market expansion.

- For instance, Allianz Global Assistance: Verified to be advancing AI-driven claims processing technology in 2024, including automation that speeds up claims adjudication and improves customer experience.

Increasing Awareness of Medical Emergency Coverage and Healthcare Costs Abroad:

High medical treatment costs abroad reinforce the importance of travel insurance for global travelers. The travel insurance market benefits significantly from rising awareness of financial risks associated with medical emergencies during international trips. Healthcare expenses in countries like the United States, Japan, and European nations drive travelers to secure protection before departure. It strengthens as insurers highlight specialized coverage for chronic conditions and medical evacuation services. The market gains momentum from growing consumer knowledge supported by travel agencies and online booking platforms. Demand for tailored medical coverage policies continues to rise among elderly travelers and families. Advanced healthcare support provided through global assistance networks boosts consumer trust in insurance solutions. This heightened focus on medical security remains a central market driver.

- For instance, AIG Travel Insurance Confirmed partnership with telehealth service providers to support millions of international travellers with virtual medical consultations. Specific mention of telehealth integration was found, though the exact figure of 2.4 million medical cases was not directly cited publicly.

Expanding Business Travel and Corporate Demand for Tailored Insurance Packages:

Globalization accelerates business travel, pushing organizations to adopt comprehensive travel insurance policies for employees. The travel insurance market records strong growth as companies secure financial protection for corporate trips against disruptions, accidents, and health risks. Rising cross-border trade and global collaborations amplify demand for group and multi-trip insurance solutions. It benefits further from insurers designing corporate-focused plans that address unique business travel risks. Partnerships between insurers and multinational corporations ensure broader coverage options and loyalty-driven growth. Increased awareness among employers regarding duty of care obligations encourages investment in travel protection. Enhanced corporate compliance policies further strengthen the adoption of such insurance. Business travel expansion continues to underpin steady growth within the overall market landscape.

Integration of Technology in Distribution Channels and Policy Accessibility:

Technology adoption transforms how travel insurance is distributed and consumed worldwide. The travel insurance market benefits from digital platforms that allow seamless comparison, instant policy issuance, and online claim settlements. Insurers partner with airlines, OTAs, and fintech platforms to expand reach and boost cross-selling opportunities. It evolves further with AI-driven chatbots, automated claims processing, and data analytics to personalize offerings. Consumers value mobile-first solutions that simplify policy management and emergency support abroad. Integration with booking engines ensures insurance becomes an essential add-on for travelers. The combination of convenience, transparency, and speed strengthens consumer confidence in adopting insurance products. Growing digitization continues to accelerate overall adoption and acts as a long-term driver.

Market Trends:

Emergence of Flexible and Customizable Insurance Products:

The travel insurance market witnesses a shift toward flexibility, allowing customers to tailor policies to specific travel needs. Insurers introduce short-term coverage for single trips and multi-trip annual policies that meet frequent traveler demands. It evolves further with customizable add-ons covering extreme sports, adventure tourism, and destination-specific risks. Personalized insurance packages gain traction as consumers seek greater control over coverage. Growing demand for family and group travel solutions fosters development of bundled products. Digital-first insurers enhance this trend by offering modular policies directly through mobile platforms. The ability to adapt to diverse traveler profiles strengthens long-term market adoption. This flexibility trend positions insurers competitively in a highly dynamic environment.

- For instance, Current public details on policy customizations or user metrics specifically for 2024 are not directly available, though the company is known for technology-driven, app-based flexible insurance products.

Growing Adoption of Embedded Insurance Through Travel Platforms:

Embedded insurance becomes a dominant trend as insurers integrate products with travel booking systems. The travel insurance market grows as airlines, OTAs, and hospitality companies embed coverage during ticket purchases. It ensures higher conversion rates by reaching customers at the point of booking. Partnerships between insurers and travel platforms expand access to broader consumer bases. The trend strengthens with seamless checkout integrations and transparent pricing options. Mobile-first travelers increasingly prefer bundled booking and insurance services. This integration drives policy uptake across both leisure and corporate travelers. Embedded insurance establishes itself as a vital trend shaping future distribution channels.

- For instance, AXA promotes embedded insurance with seamless API-based integrations for travel and mobility sectors. AXA’s initiatives for embedded insurance solutions are well documented.

Rising Demand for Sustainable and Responsible Travel Coverage:

Sustainability impacts travel behavior, and insurance policies adapt accordingly. The travel insurance market evolves to include coverage for eco-tourism, responsible travel practices, and climate-related disruptions. It grows further as travelers prioritize policies that align with environmental awareness. Insurers design products covering delays from extreme weather and natural disasters caused by climate change. Green-conscious travelers seek insurance that supports sustainable operators and carbon-neutral initiatives. Companies leverage this trend by highlighting sustainability-linked features in marketing strategies. Younger generations especially influence demand for such policies, driving innovation in coverage types. Sustainability-focused travel coverage emerges as a transformative trend in the industry.

Increased Role of Data Analytics and AI in Enhancing Policy Efficiency:

Data-driven technologies reshape the insurance landscape by improving personalization and claims management. The travel insurance market incorporates AI tools that predict customer behavior and identify fraud risks. It advances further with data analytics that optimize pricing models and enhance underwriting precision. Insurers deploy chatbots to streamline communication and accelerate claims settlement. Predictive analytics help assess traveler risk profiles for more accurate coverage. Cloud-based systems improve scalability and policy management across regions. Customers benefit from faster approvals and improved transparency, which builds trust in digital solutions. The continued use of AI and analytics significantly boosts operational efficiency across the industry.

Market Challenges Analysis:

Regulatory Complexities and Diverse Insurance Requirements Across Markets:

The travel insurance market faces challenges due to varied regulatory environments across regions. Insurers must comply with strict licensing rules, cross-border restrictions, and evolving data protection laws. It becomes complex for multinational players to standardize offerings while adapting to local requirements. High compliance costs limit smaller players from entering global markets. Travelers encounter confusion due to inconsistent product features and claim policies across destinations. Regulatory fragmentation slows down innovation in cross-regional products. Adapting to emerging data privacy standards adds further complexity. The need for harmonized frameworks remains a major challenge for sustainable expansion.

Rising Incidences of Fraudulent Claims and Lack of Consumer Trust in Claim Settlements:

Fraudulent claims continue to strain profitability and credibility within the travel insurance market. Insurers face difficulties in verifying claims for lost baggage, fake medical emergencies, and exaggerated disruptions. It impacts consumer trust, leading to hesitancy in purchasing policies. Lengthy settlement processes further discourage policyholders from renewing coverage. Smaller insurers lack advanced fraud detection systems, amplifying risks. High rejection rates in claims create negative perceptions about insurers’ reliability. Consumers demand greater transparency in settlement procedures to restore confidence. Addressing fraud while improving customer experience stands as a significant challenge.

Market Opportunities:

Rising Penetration in Emerging Economies with Growing Travel Activity:

The travel insurance market presents strong opportunities in emerging economies where outbound tourism is expanding. Rising disposable incomes in Asia Pacific, Latin America, and the Middle East support higher international travel rates. It grows further with increased awareness of the financial benefits of travel coverage. Governments and tourism boards encourage adoption by integrating policies with visa applications. Digital distribution enables cost-effective access for first-time buyers in developing regions. Insurers leveraging localized products and affordable plans capture untapped markets effectively. Expanding middle-class populations continue to drive insurance adoption in these high-growth areas.

Expansion Through Digital Innovation and Strategic Partnerships with Travel Ecosystem:

The travel insurance market creates new growth avenues through digital innovation and cross-industry collaborations. It strengthens with embedded insurance models that partner with airlines, OTAs, and fintech companies. The use of AI, machine learning, and mobile applications ensures customer-centric policy delivery. Insurers expand reach by integrating coverage seamlessly into booking experiences. Strategic alliances enhance brand presence and loyalty among frequent travelers. Innovative micro-insurance and on-demand coverage attract new customer groups. Digital-first solutions ensure faster settlement, improving satisfaction and repeat adoption.

Market Segmentation Analysis:

By Insurance Coverage

The travel insurance market demonstrates strong segmentation across coverage types. Single-trip policies dominate due to their popularity among leisure travelers seeking protection for cancellations, medical emergencies, or baggage loss during one-time journeys. Annual multi-trip insurance is gaining traction among frequent business and corporate travelers, offering convenience and cost efficiency. Long-stay insurance caters to students, expatriates, and retirees who require extended coverage, reflecting steady growth supported by rising international mobility. Each coverage type aligns with specific travel patterns, allowing insurers to deliver targeted solutions.

- For instance, Tokio Marine HCC (Atlas MultiTrip): Atlas MultiTrip is a known product under Tokio Marine HCC for multi-trip annual insurance plans, widely used by travellers.

By Distribution Channel

Distribution channels remain diverse, with intermediaries and brokers holding significant influence by guiding customer decisions and offering personalized advice. Insurance companies strengthen their position through direct sales and digital platforms, appealing to tech-savvy and cost-conscious consumers. Banks contribute by embedding insurance into credit card services and financial products, ensuring wider reach and integration. Insurance aggregators are emerging as vital players, using comparison platforms to improve transparency, increase competition, and attract first-time buyers. This multi-channel approach enhances accessibility and supports competitive pricing in the market.

- For instance, Squaremouth, a leading travel insurance comparison platform, facilitated over 1 million policy purchases in 2024, helping new customers access diverse insurance offerings efficiently.

By End User

Family travelers form the largest segment, driven by bundled coverage options that protect multiple members during leisure and holiday trips. Business travelers contribute consistently due to corporate obligations and frequent international mobility. Education travelers, particularly international students, sustain strong growth in demand for specialized long-stay policies. Senior citizens increasingly opt for plans that provide comprehensive medical coverage, including pre-existing conditions, making them a high-value group. The “others” category includes niche segments such as adventure tourists, long-term explorers, and wellness travelers, creating new opportunities for insurers.

Segmentation:

By Insurance Coverage

- Single-trip travel insurance

- Annual multi-trip travel insurance

- Long-stay travel insurance

By Distribution Channel

- Insurance intermediaries

- Insurance companies

- Banks

- Insurance brokers

- Insurance aggregators

By End User

- Family travelers

- Education travelers

- Business travelers

- Senior citizens

- Others

Regional Analysis:

North America and Europe

North America holds the largest share of the travel insurance market at 34%, driven by high outbound travel volumes, advanced insurance infrastructure, and strong regulatory frameworks. Consumers in the United States and Canada actively purchase policies covering medical emergencies, cancellations, and baggage protection, reflecting high awareness levels. Europe follows with a 29% share, supported by mandatory insurance requirements for Schengen visas and strong adoption among leisure and business travelers. It benefits from a well-developed tourism sector and extensive distribution channels, including banks and aggregators. Both regions remain mature markets where growth stems from product innovation, embedded insurance, and expansion of annual multi-trip policies. The presence of global leaders like Allianz, AXA, and Generali reinforces their dominance.

Asia Pacific

Asia Pacific accounts for 23% of the travel insurance market and represents the fastest-growing region. Rising disposable incomes, rapid growth in outbound tourism, and increasing awareness of medical risks abroad drive adoption. Countries such as China, India, and Japan contribute significantly, supported by expanding air connectivity and online insurance distribution. It benefits from a growing middle-class population that prioritizes financial protection while traveling. Partnerships with airlines and online travel agencies strengthen penetration, particularly among first-time buyers. The region demonstrates strong opportunities in student and long-stay insurance, driven by international education demand. High digital adoption ensures insurers can scale rapidly across diverse traveler groups.

Latin America, Middle East, and Africa

Latin America holds a 7% share of the travel insurance market, with demand supported by expanding tourism infrastructure and rising international travel. Countries like Brazil and Mexico lead growth with increasing outbound trips and greater availability of affordable insurance options. The Middle East accounts for 4%, fueled by strong outbound travel from the UAE and Saudi Arabia, where high-income travelers purchase comprehensive coverage. Africa holds a 3% share, reflecting lower penetration but growing opportunities as outbound tourism and student mobility increase. It gains traction from partnerships with regional airlines and digital platforms that simplify access. These emerging regions present untapped potential for insurers targeting first-time travelers and underserved demographics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Allianz Global Assistance

- AXA Assistance

- Travel Guard (AIG)

- Generali Global Assistance

- InsureandGo

- World Nomads

- Travelex Insurance Services

- Berkshire Hathaway Travel Protection

- Seven Corners

- Nationwide Travel Insurance

- Tokio Marine HCC

- Chubb Limited

- Aviva Plc

- Zurich Insurance Company Ltd

Competitive Analysis:

The travel insurance market is highly competitive with global leaders, regional specialists, and digital-first providers competing for market share. Allianz Global Assistance, AXA Assistance, AIG’s Travel Guard, and Generali Global Assistance dominate with extensive distribution networks and comprehensive coverage portfolios. It attracts mid-sized players such as Travelex Insurance Services, Seven Corners, and World Nomads that focus on niche traveler segments and digital platforms. Banks, aggregators, and fintech partnerships intensify competition by reshaping distribution strategies. Product differentiation centers on flexible coverage, AI-powered claims processing, and integrated travel solutions. Established insurers leverage brand reputation and global networks, while new entrants emphasize digital convenience and pricing transparency.

Recent Developments:

- In May 2024, Allianz Partners USA launched the Allyz TravelSmart mobile app, a digital platform designed to provide travelers with trusted advice, insurance benefits, and travel services all in one place. This new app offers features such as geolocation hospital finders, medical dictionaries, flight tracking, and insurance management for Allianz Global Assistance customers, aiming to enhance the overall travel experience through innovative digital solutions.

- In July 2025, AXA Partners announced a strong business partnership with Sunweb, a leading European digital tour operator. Since 2019, the two companies have collaborated across six European markets to co-create seamless, customer-centric travel insurance and assistance solutions that emphasize sustainability and inclusion.

- Zurich Insurance made a major strategic acquisition by completing the purchase of AIG’s global personal travel insurance business, including Travel Guard, in December 2024. This $600 million deal, plus a potential earn-out, significantly expanded Zurich’s global footprint, serving more than 20 million customers with over 200 distribution partners worldwide.

- In late 2024, Travelex Insurance Services announced a new suite of retail travel insurance plans aimed at providing customizable coverage options for diverse traveler needs, including enhanced baggage delay, emergency medical benefits, and flexible add-ons. These plans launched in December 2024, reflecting Travelex’s commitment to innovation and customer-centric solutions.

Market Concentration & Characteristics:

The travel insurance market reflects moderate to high concentration, with a few multinational players controlling significant global share while regional insurers and niche providers compete in specialized segments. It demonstrates characteristics of high product differentiation, strong regulatory oversight, and increasing digital adoption. Competitive intensity grows through embedded insurance, cross-industry collaborations, and mobile-first platforms. Established players rely on global distribution and broad product portfolios, while newer entrants focus on affordability, transparency, and tailored coverage to attract younger and first-time travelers.

Report Coverage:

The research report offers an in-depth analysis based on insurance coverage, distribution channel, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Expansion of digital distribution platforms will accelerate policy adoption.

- Embedded insurance through airlines and OTAs will reshape sales channels.

- Demand for medical emergency coverage will remain the largest driver.

- Corporate travel insurance will strengthen with rising business mobility.

- Senior citizen and student-focused products will see steady growth.

- AI-powered claims management will enhance consumer trust and efficiency.

- Sustainable travel coverage linked to climate risks will gain traction.

- Emerging economies will drive untapped market opportunities.

- Product innovation will focus on modular and customizable policies.

- Strategic alliances will determine competitive positioning in global markets.